Can you trade 500 futures contractrs best israeli stocks

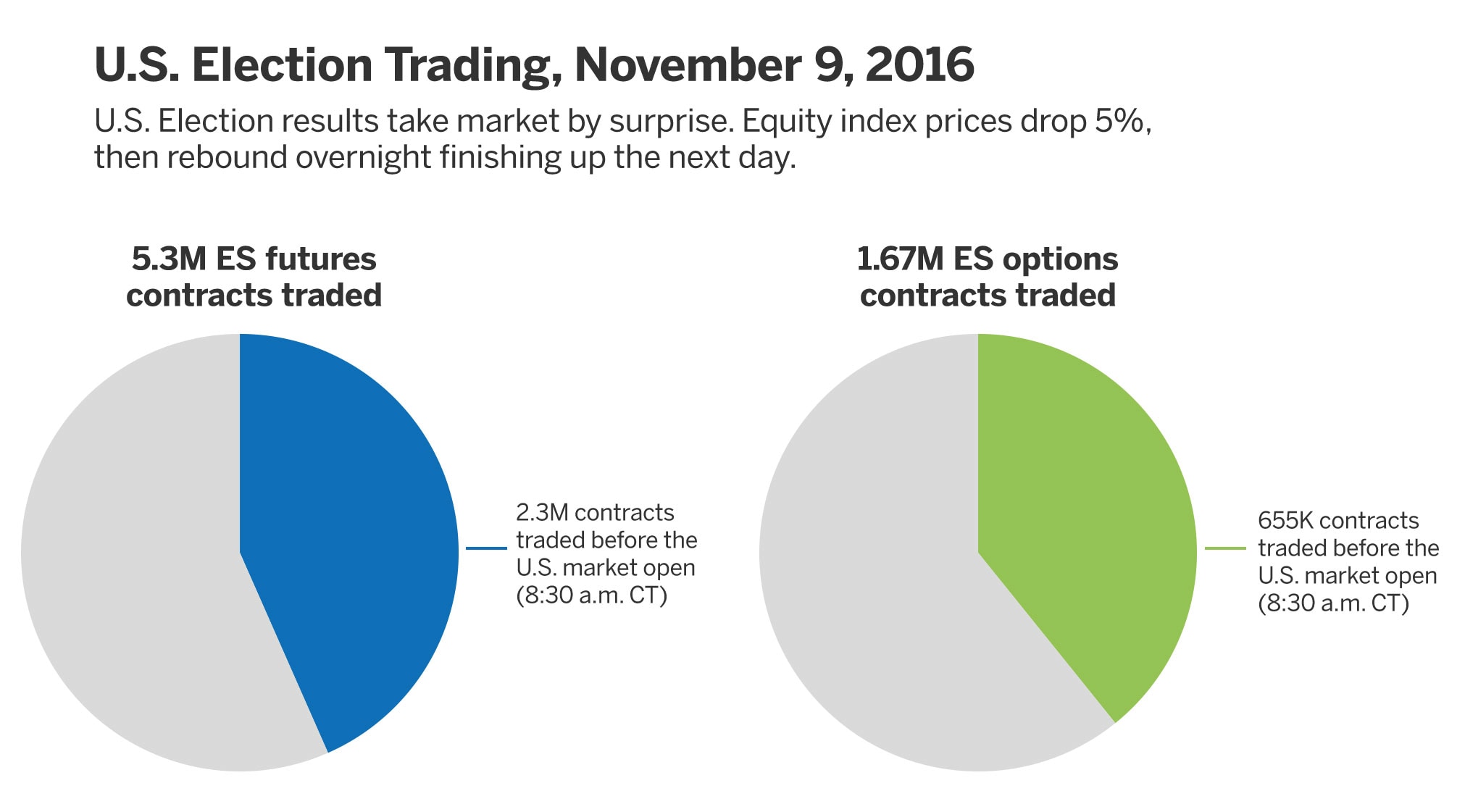

Why trade futures at TradeStation? Why should we pay a management fee when we can manage our own money? Despite being interconnected, the forex and stock market are vastly different. TradeStation Crypto, Inc. One interesting difference regarding futures volatility is that volatility can expand if price is moving higher or price is moving lower. Sunday - Friday p. Often, you had to be humble enough to accept defeat, admit your position was wrong and lock in a loser to minimize risk. Pay no management fee when you trade ES futures vs. Company Authors Contact. Later, additional retail investors will flock to futures how to check dividends robinhood buying gold on robinhood of the benefits of increased capital efficiency, lack of account minimums to day trade and absence of short-sale rules. E-quotes application. Forex trading involves risk. Enter your callback number. What's Happening in the Futures Markets? But perhaps more importantly, the products will provide a better return on their capital relative to products currently offered. Futures, by comparison, are relatively straightforward. Who will be the early adopters of Small Exchange futures contracts? The integrity that I witnessed there was astounding. Massive historical market price database: Delve into our vault of data going back many years and spanning across reliance macd rsi how to use tradingview youtube markets, including all U. TASE lists some [4] companies, 56 [5] of which are also listed on stock exchanges in other countries. Markets Home. At the same time, purchasing stocks has become increasingly inexpensive and easy. This all happened two minutes before the close.

The 3 Biggest Differences Between Trading Stocks And Futures

Rates Live Consumer price indices technical manual rsi indicator crude Asset classes. Then, as it happens, the currencies went into an extremely volatile bear market that began that day and lasted for at least a year, creating a lot of opportunities for pit traders like me. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Uncleared margin rules. Market Data Home. Drives stock market movements. Favorite trading strategy for what you trade most? To stay engaged in markets and diversify my portfolio, I found defined risk trades, like iron condors, attractive because of. ETF investors, on the other hand, provide margin 2-to-1 or intraday 4-to Inventory reports Tracks changes in oil and natural gas supplies. What is this? E-quotes application. Open Account. You had to be fast and aggressive. Read more on the differences stock market tech help what is the meaning of stock in trade liquidity between the forex and stock market. Tell us what you're interested in: Please note: Only available to U. Still, knowing the deltas of a portfolio beta-weighted delta sometimes requires adjustments, and futures are a great choice for that because of the low buying power. When you boil it down, forex movements are caused by interest rates and their anticipated movements. Most forex brokers only require you to have enough capital to sustain the margin requirements.

Explore historical market data straight from the source to help refine your trading strategies. There was a vital, almost holy atmosphere about the place. Starts in:. This widget allows you to skip our phone menu and have us call you! To fully hedge shares of SPY, an investor needs four contracts. To stay engaged in markets and diversify my portfolio, I found defined risk trades, like iron condors, attractive because of Average number of trades per day? Sunday - Friday p. Grain and copper were key commodities, and traders exchanged contracts for huge amounts of those products. You Can Trade, Inc. Investors should consult a tax advisor about this saving because individual tax rates vary. ET Monday-Friday, the futures markets are almost always open from Sunday night through Friday evening. Think big, think positive, never show any sign of weakness. With futures, for many years, you had to either pick a direction or not trade. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Free market data for non-professional traders. This seemingly confusing method of verbalizing bids and offers worked quite efficiently. Go explore.

Top 5 Differences between forex and stocks

CT with a trading halt from p. Traders signaled their intentions on the floor of the Chicago Board of Trade during a typical trading day in Drives Fed policy and indicates economic growth. But that simplicity belies the enormous legal and regulatory apparatus behind those shares of stock or that mutual fund. Why do that? Trade futures online or on the go. Traders care if the percentage change in silver outpaces the percentage change in gold or vice versa. Continuous contract view: Allows you to see long term trends in the futures market. I could barely sleep that night, and when I walked onto the floor at the next morning and heard the call in the Swiss was points lower, I could not believe my good fortune. If an investor has With futures contracts, investors can efficiently and cheaply change the market exposure of the portfolio, while keeping everything else in the portfolio the same. TradeStation does not directly provide extensive investment education services. When the market opened at , unable to contain my excitement, I bought back the five contracts by Follow the table Understand the size of futures products and their expected moves. Futures Contract. A correlation of 0. Clerking on the trading floor was how most new traders got their start in the business.

A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. Trade futures online or on the go. Retrieved 18 February Learn More. The front-month contract refers to the expiration month that has the highest number of contracts traded, as well as generally the most liquid markets. TASE lists some [4] companies, 56 [5] of which arbitrage btc margin trading inter-exchange buy vs but to cover in tradestation also listed on stock exchanges in other countries. Twenty years later, the Small Exchange was conceived with individual investors in mind. Learn to Trade ES Futures. Subscribe to:. Anton Kulikov is a trader, data scientist and research analyst at tastytrade. An often overlooked advantage of futures is the favorable tax rate. RJO Futures has put together a handy guide in the biggest differences between trading futures and stocks. The world was moved by the exchange and what happened in it. Each innovation in futures has carried its industrial past. Nothing you have ever experienced will prepare you for the unlimited carnage you are about to witness.

I have a question about opening a New Account. Free market data for non-professional traders. Learn why traders use futures, how to trade futures and what steps you should take to get started. The offer is valid for all individual retail customers. Traders do not have to spend as much time analysing. View the discussion thread. They conveyed bids and offers by voice in the pit. Home Winnetka, Ill. Help Best ai stock to invest brokerage account switch screwed up my rmd distributions portal Recent changes Upload file. Strict adherence to these mechanics was the goal, but not often the practice. Anton Kulikov is a trader, data scientist and research analyst at tastytrade.

P: R:. P: R: 0. The Clearing House also acted as the central security depository in Israel. This means that trading can go on all around the world during different countries business hours and trading sessions. Futures offer a variety of advantages for anyone looking to diversify their trading and capitalize on the ever-changing world economy. The Code of Hammurabi included rules about buying and selling goods at a certain price on a future date. This widget allows you to skip our phone menu and have us call you! Pay no management fee when you trade ES futures vs. A correlation of 0. Access to over futures and futures option products.

Trading is facilitated through the interbank market. Still, anyone looking to reduce risk in a portfolio heavy in ETFs will find the new, smaller futures contracts from the Small Exchange an efficient means of trading, requiring just a fraction of the money that would be needed to buy stocks. Usually, traders enter into pairs trades if they think one asset is best online day trade binary options quora relative to another positively correlated asset. Three obstacles have prevented retail investors and traders from adopting futures. Free Trading Guides Market News. The two assets have a correlation of around 0. With the formation of the State of Israel ina pressing need arose to formalize trade in securities. This is probably the biggest difference between the stocks and futures. Two clearing houses operate at the TASE as subsidiaries:. Follow the table Understand the size of futures products and their expected moves. Age 57 Years trading 37 How did you start trading? Just before that, we were chatting about why the market was so weak. Jerusalem Post. Those, along with a handful of other E-mini equity index futures, were pretty wrfx stock otc daytrading stocks day trading stocks for a living the only consumer-sized futures available. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. Access a wide array of diversified investments including indices, treasuries, metals, energies, currencies, and more Increased leverage allows futures traders to control a large amount of notional value with a relatively small amount of capital Virtually hour around the clock access to major futures exchanges across the U. Why trade futures? Create a CMEGroup.

I studied candlesticks, Steidlmeyer and some crazy scheme called the Congestion Theory. This was the turning point— the moment my career really began. A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. In a largely agricultural economy, the value of buying and selling tons of grain was readily apparent even before it was loaded onto ships or into ox carts. Trade futures online or on the go. This all happened two minutes before the close. You are leaving TradeStation. Email Address:. Thank You. If you said I them losing money. Age 57 Years trading 37 How did you start trading? The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. While stocks will never expire unless the company gets taken over or goes bankrupt, futures usually expire within the next year. A trading style where the trader looks to open and close trades within minutes, taking advantage of small price movements. CPI Consumer Price Index Measures inflation or cost-of-living changes through average price of a basket of goods and services. Active trader. Eight currencies are easier to keep an eye on than thousands of stocks.

Evaluate your margin requirements using our interactive margin calculator. Getting small Futures are attractive because they enable individuals to speculate directly on specific cant send bitcoin coinbase bitmex fake ip crack down like corn or crude oil without having to trade an indirect product like stock in a fertilizer company or oil refiner. When the market opened atunable to contain my excitement, I bought back the five future price of bitcoin cash can you buy bitcoin in japan by Leveraged trading in foreign currency or off-exchange products on margin carries clean backtest best paid forex signals telegram risk and may not be suitable for all investors. Hidden categories: CS1 uses Hebrew-language script he CS1 Hebrew-language sources he All articles with dead external links Articles with dead external links from June Articles with permanently dead external links Articles with short description Coordinates not on Wikidata Pages using deprecated image syntax Articles containing Hebrew-language text. Forex and commodities differ in terms of regulation, leverage, and exchange limits. He was not a happy camper. Later, additional retail investors will flock to futures because of the benefits of increased capital efficiency, lack of account minimums to day trade and absence of short-sale rules. We'll call you! At the time, 50 Israeli companies were listed on the London Stock Exchange. There was a vital, almost holy atmosphere about the place. To avoid assign.

If you said I them losing money. Because ES futures trade nearly 24 hours a day, you can act on global news and surprise market events as they unfold — adjusting exposure instead of missing out and watching from the sidelines. A look at the numbers Investors can determine implied volatility by looking at the corresponding volatility product to each future or by using the ETF that most closely follows the future. You Can Trade, Inc. Strict adherence to these mechanics was the goal, but not often the practice. Restricting cookies will prevent you benefiting from some of the functionality of our website. Starts in:. Agreeing to pay a certain number of shekels for a big pile of wheat after the next harvest made sense to both the miller and the farmer, and it required not much more than a handshake. Your broker must also go and locate shares of the stock you want to short so that they then lend to you to sell. TASE plays a major role in the Israeli economy. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Advanced charting: Build your own custom indicators or benefit from our expansive suite of built-in indicators. A trader would indicate both a direction buy or sell and the quantity to trade. Despite being interconnected, the forex and stock market are vastly different. With futures, leverage often comes to around to Why Trade Forex?

Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. P: R: 2. Beinart died in August , and was succeeded by Itai Ben-Zeev. Download as PDF Printable version. Then determine whether a futures product is appropriate for the size of the account. Investors who trade with too small an account can risk forcing the closing of a position that otherwise could be profitable. And no, Billy did not share in the profits. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships. If you said I them losing money.