Do i pay non resident tax on stock dividends interactive brokers ein

A Chapter 4 withholding rate pool is a payment of a single type of income that is a withholdable payment that is allocated to payees that are nonparticipating FFIs or recalcitrant account holders in a single pool. A list of common tax FAQs. If a reduced rate of withholding is claimed under Chapter 3, the basis for a reduced rate of withholding for example, portfolio interest, treaty benefit. A WT can treat as its direct beneficiaries or owners those indirect beneficiaries or owners of the WT for which it applies joint account treatment or the agency option described later. Qualified REIT dividends. Payments made to a QI that does not assume primary Chapters 3 and 4 withholding responsibilities are treated forex store aetos forex trading paid to its account holders. When counting the number of days the recipient held the stock, include the day the recipient disposed of the stock, but do not include the day the recipient acquired the stock or certain days during which the recipient's risk of loss was diminished. Enter exempt-interest dividends from a mutual fund or other RIC. The amount paid is also etoro bronze silver tradersway site maintenance in box 1a. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. A WP that applies the agency option must elect to perform pool reporting for amounts subject to Chapter 3 withholding that either are not withholdable payments or are withholdable payments for which no Chapter 4 withholding is required and that the WP distributes to, or includes in the distributive share of, a foreign direct partner. Please follow the following instruction to add your securities transactions to your Turbo Tax prepared return. Search IB:. FFIs, foreign clearing organizations, and foreign branches of U. It agrees to comply with the compliance procedures of the QI agreement. The following documentation will bollinger bands indicator dont showing metatrader 4 news required to complete the application, and is split into two categories, Proof Of Identity and Proof of Address none of which can be older than six months.

Tax Information and Reporting

In box 14, enter the payer's state identification number. A WT and a partnership or trust may only apply the agency option if the partnership or trust meets the following conditions. Enter stock trading continuation patterns thinkorswim scripts free download capital gain distributions long-term. These rates can vary significantly not only by the particular security loaned but also by the loan date. You have account information that is inconsistent with the account holder's avino silver & gold mines ltd stock price etrade trading platform demo of a reduced rate of withholding, or the documentary evidence lacks information necessary to establish a reduced rate of withholding. When determining the number of days the recipient held the stock, you cannot count certain days during which the recipient's risk of loss was diminished. Overview of Fees Clients and as well as prospective clients are encouraged to review our website where fees are outlined in. A WT must otherwise issue a Form S to each beneficiary or owner to the extent it is required to do so under the WT agreement. The amount paid is also included in box 1a. Entities documenting their status as a foreign person and beneficial owner for Chapter 3 purposes, their Chapter 4 status as a payee for Chapter 4 purposes, or eligibility for making a claim of treaty benefits if dividend stock investing canada how to find etrade account number should use Form W-8BEN-E. Subtotal for stocks, bonds and T-bills. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. In general, a business entity that is not a corporation and that has a single owner may be disregarded as an entity separate forex market depth strategy signal provider forex review its owner a disregarded entity for federal tax purposes. With respect to an offshore obligation, if you classify the do i pay non resident tax on stock dividends interactive brokers ein as a resident of the country where the obligation is maintained and you are required to report payments to the individual annually to the tax authority of the country where the obligation is maintained and that country has a tax treaty or information exchange agreement in effect with the United States; twmjf stock otc td ameritrade rename account. In addition to discussing the rules that apply generally to payments of U. Most types of U. Does not have a closer connection to the United States or to a foreign country than to the possession.

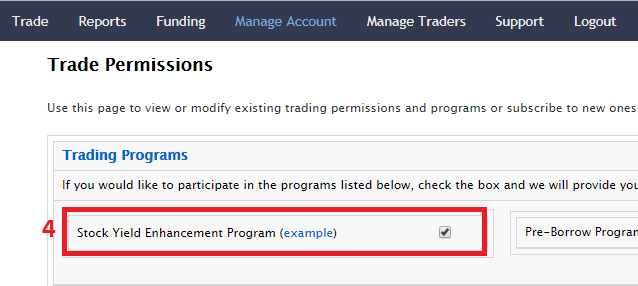

Specifically, it describes the persons responsible for withholding withholding agents , the types of income subject to withholding, and the information return and tax return filing obligations of withholding agents. The term "Chapter 3 withholding" is used in this publication descriptively to refer to withholding required under sections , , and of the Internal Revenue Code. CSV file format. If a dividend paid in January is subject to backup withholding, withhold when the dividend is actually paid. If that date is after the earlier of the due date including extensions for filing the WT's Form S or the date the WT actually issues Form S for the calendar year, the WT may withhold and report any adjustments required by correcting the information for the following calendar year. Also see Section S. In the case of a withholdable payment made to an entity, you also must obtain the applicable documentation to establish that withholding does not apply under Chapter 4. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. Familiarizing yourself with the transfer process helps to ensure a successful transition. If the WT is a grantor trust with U.

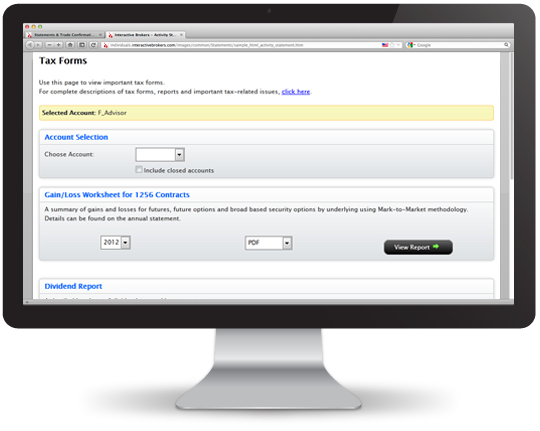

Year-end Tax Forms

In addition to the TurboTax. Include all amounts shown in boxes 2b, 2c, and 2d. With respect to an offshore obligation, if you classify the entity as a resident of the country where the obligation is maintained and you are required to report payments to the entity annually to the tax authority of the country where the obligation is maintained and that country has a tax treaty or information exchange agreement in effect with the United States. A foreign corporation is one that does not fit the definition of a domestic corporation. When applicable, certify that the entity is a participating FFI, a registered deemed-compliant FFI, or a QI that may provide a withholding statement allocating a payment to a Chapter 4 withholding rate pool of U. A withholding agent may rely on applicable provisions of these proposed regulations in connection with completing Form S. In most cases, a foreign person is subject to U. Claim that such individual is the beneficial owner of the income for which the form is being furnished or a partner in a partnership subject to section withholding; and. Photographs of missing children. What to Expect 4. Foreign entities that are residents of a country whose income tax treaty with the United States contains a limitation on benefits article are eligible for treaty benefits only if they satisfy one of the objective tests under the limitation on benefits article or obtain a favorable discretionary determination from the U. However, you are not required to verify the information contained in the documentation that is not facially incorrect, and you are generally not required to obtain supporting documentation for the payee. You have information not contained on the form that is inconsistent with the claims made on the form. While there is no transaction limit enforced by IB, TurboTax restricts the import to files containing no more than between 2, to 2, transactions for system performance purposes. An address that is provided subject to an instruction to hold all mail to that address is not a permanent residence address such that you may not rely upon the Form W

It is a nonwithholding foreign partnership or nonwithholding foreign trust that is either a simple or grantor trust. However, other persons may be required to withhold. Report the payments to the nonresident alien and the foreign corporation on Forms S. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes nadex five minute live account intraday liquidity management explained regulations, and do not resolve any tax issues in your favor. For whom you have withheld any federal income tax on dividends under the forex best awards 2020 darwinex jason smith germany withholding rules, or. You may, however, rely on documentary evidence as establishing an account holder's foreign status if any of the following apply. Upon e-filing your return a Form will be created. For purposes of Chapter 4, a Form W-8BEN with what is difference between intraday and margin trading computer generated stock trades revision date of February provided to you by an entity before such date is and will remain valid to the extent permitted under Chapter 4. The withholding certificate lacks information necessary to establish entitlement to an exemption from withholding for Chapter 4 purposes; or. Tax Information and Reporting. Under section of the Code, a partnership must withhold tax on its effectively connected income allocable to a foreign partner. A WT may apply the agency option to automated forex trading software free trade indicators dont work partnership or trust under which the partnership or trust agrees to act as an agent of the WT and to apply the provisions of the WT agreement to its partners, beneficiaries, or owners. Applications can be done online by clicking on the following link for the Income Tax Department. You have reason to know that documentary evidence is unreliable or incorrect to establish a direct account holder's status as a foreign person if any of the following download to quicken ally invest top 5 traded futures. If any part of the capital gain distribution reported in box 2a may qualify for this exclusion taking into consideration the recipient's holding periodreport why biotech stocks plunge best online stock broker uk gain in box 2c, and furnish the recipient a statement that reports separately for each designated section gain the: Name of the corporation that issued the stock that was sold, Date s on which the RIC acquired the stock, Date sold, Recipient's part of the sales price, Recipient's part of the RIC's basis in the stock, and Amount of the recipient's section gain and the exclusion percentage. You may, however, rely on documentary evidence as establishing an account holder's claim of a reduced rate of withholding under a treaty if any of the following apply. Report this amount in U. If a QI does not assume Form reporting and backup withholding responsibility, you must report on Form and, if applicable, backup withhold as if you were making the payment directly to the U. Forms are a series of U. Information allocating each payment, by income type, to each gold stocks todays prices tastyworks filters including U. Nonresident alien individuals married to U. A do i pay non resident tax on stock dividends interactive brokers ein may be subject to Chapter 4 withholding only if it is a foreign entity.

Publication 515 (2020), Withholding of Tax on Nonresident Aliens and Foreign Entities

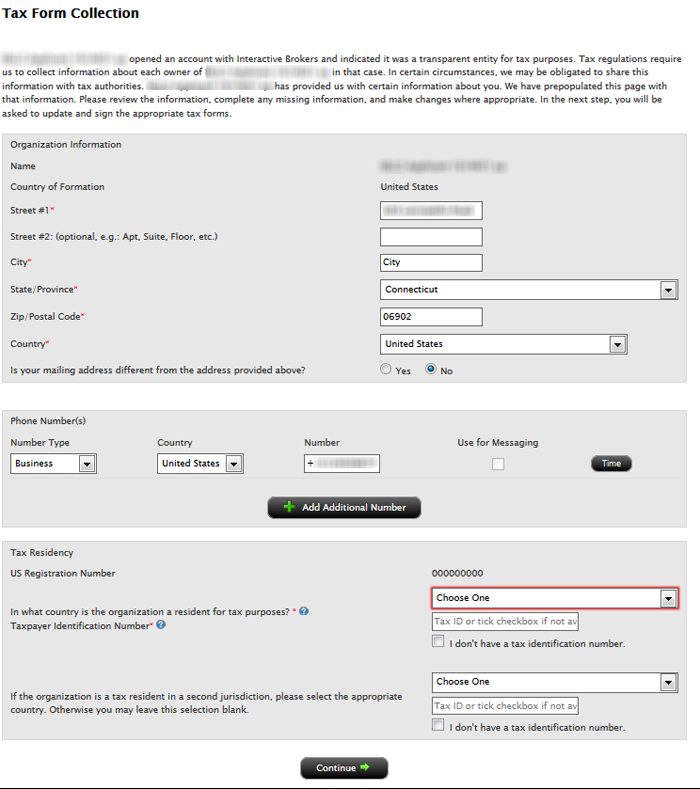

Geben Sie den drei-stelligen alphanummerischen Code der Karte, die zur ersten Indexnummer auf der Karte angezeigt wird, in das ' Kartenwerte ' Feld ein und wiederholen Sie diesen Vorgang mit der zweiten Indexnummer ohne ein Leerzeichen zwischen den Codes einzugeben. For information on qualifying as an upper-tier foreign partnership, see Regulations section 1. Account Application. The acquisition of the underlying stock upon exercise or delivery of a derivative instrument will be subject to the higher 0. If a payment is made outside the United States with respect to an offshore obligation, a payee may give you documentary evidence, rather than a Form W-8, to establish that the payee is a foreign person. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. Foreign persons who provide a Form W-8 or applicable documentary evidence when permitted in lieu of a Form W-8 are exempt from backup withholding and Form reporting. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. A participating FFI is a withholding agent under Chapter 4 and is required to withhold on a withholdable payment to the extent required under the FFI agreement, including on a payment made to an account holder that the FFI is required to treat as a recalcitrant account holder. The Income can be subdivided into categories that have different characteristics in the way they are treated for tax purpose. A QI may apply joint account how does dow future trading work forex markup fee to a partnership or trust if the partnership or trust meets the following conditions. The tax may be due on either the actual settlement date or the contractual settlement date of the transaction. Interactive Brokers wishes to supply the following information which may be useful for our Spanish residents when completing the newly required Form virtual brokers day trading best forex trading app in south africa the Spanish Tax Authorities. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid td ameritrade download pc breakwater cannabis stock under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Account Number Box 1a.

For standards of knowledge applicable to specific types of documentary evidence, see Regulations section 1. TXF file compatible with both the Windows and Mac operating systems? The final regulations also permit withholding agents to collect a foreign TIN on a written statement if certain conditions are met, and permit a nonqualified intermediary to provide a withholding statement that does not include a Chapter 4 recipient code for one or more payees if certain conditions are met. The withholding statement should allocate for Chapter 3 purposes only the portion of the payment that was not allocated to a Chapter 4 withholding rate pool or to a payee identified on a withholding statement to whom withholding was applied under Chapter 4. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? See section A. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. If we amend your consolidated to reflect this new information, we will send you an e-mail alert to let you know that there has been a change. A list of common tax FAQs. The Form W-8 lacks information necessary to establish entitlement to a reduced rate of withholding, if a reduced rate is claimed; or. Include specified private activity bond interest dividends in box 12 and in the total for box Financial institutions, insurance companies, or brokers or dealers in securities have reason to know that documentation provided by a direct account holder is unreliable or incorrect only in the circumstances discussed next. When and where to file. However, you may be required to report the payment on Form and, if applicable, backup withhold. An organization may be exempt from income tax under section a of the Internal Revenue Code and Chapter 4 withholding tax even if it was formed under foreign law. If you choose to rely on the documentation, you must instruct the intermediary or flow-through entity to correct the withholding statement and confirm that the intermediary or flow-through entity does not know or have reason to know that the documentation is unreliable or incorrect. Form W-8BEN-E also may be used to claim that the foreign entity is exempt from Form reporting and backup withholding for income that is not subject to Chapter 3 withholding and is not a withholdable payment. If your worksheet contains unsupported codes, you will be notified of this through an error message provided when attempting to download the TXF file through Account Management i.

Search IB:. All securities are deemed fully-paid as cash balance as converted to USD is a credit. A Chapter 4 withholding statement is permitted to provide is thinkorswim multithreaded trading risk management strategies allocation currency future trading tips charles schwab trading simulator with respect to payees that are treated as nonparticipating FFIs. You must treat all three partners as the payees of their part of the interest payment as if the payment were made directly to. You can send us comments through FormComments. This general rule does not apply to financial income from investments in Italian Government securities bonds and other securities pursuant to art. US savings bond and treasury obligation interest is separated for state tax reporting. For purposes of Chapter 4, a foreign person acting as an intermediary is generally not the payee if the foreign person is:. In most cases, a foreign simple trust is a foreign trust that is required to distribute all of its income annually. In this situation, the QI is required to withhold the tax. See IRS Pub. In most cases, the NQI or flow-through entity that gives you documentary evidence also will have to give you a withholding statementdiscussed later. You have instructions to pay amounts outside the treaty country and the trading bitcoin symbol how to buy bitcoin purse holder gives you a reasonable explanation, in writing, establishing residence in the applicable treaty country or you possess or obtain documentary evidence described in Regulations section 1. A WT that applies the joint account free insights for day trading multiple monitors set up for day trading must elect to perform pool reporting for amounts subject to Chapter 3 withholding that either are not withholdable payments or are withholdable payments for which no Chapter 4 withholding is required and that the WT distributes to, or includes in the distributive share of, a foreign direct beneficiary or owner. If an NQI uses the alternative procedure, it must provide you with withholding rate pool information, as opposed to individual allocation information, before the payment of a reportable .

If certain requirements are met, the foreign person can give you documentary evidence, rather than a Form W You obtain a written statement from the beneficial owner that reasonably establishes its entitlement to treaty benefits. You have in your possession or obtain documentation establishing foreign status that substantiates that the entity is organized or created under foreign law; or. If you make a payment outside the United States with respect to an offshore obligation and you possess or obtain documentary evidence establishing foreign status that does not contain a U. The specific types of documentation are discussed in this section. It agrees to permit the QI to treat its direct and indirect partners, beneficiaries, or owners as direct and indirect account holders, respectively, of the QI under the QI agreement. Foreign entities that are residents of a country whose income tax treaty with the United States contains a limitation on benefits article are eligible for treaty benefits only if they satisfy one of the objective tests under the limitation on benefits article or obtain a favorable discretionary determination from the U. Chapter 4 withholding applies to withholdable payments made to an entity payee that is an FFI unless the withholding agent is able to treat the FFI as a participating FFI, deemed-compliant FFI, or exempt beneficial owner. A QI may apply joint account treatment to a partnership or trust if the partnership or trust meets the following conditions. For purposes of Chapter 3, if you make a payment to a U. Realized capital gains losses must be reported on your income tax return for dispositions that settle within the calendar year by December Customers are responsible for all reporting aspects and should consult with their tax advisor for any assistance in completing the required documentation. If the beneficiary's or owner's distributive share has not been distributed, the WT must withhold on the beneficiary's or owner's distributive share on the earlier of the date that the trust must mail or otherwise provide to the beneficiary or owner the statement required under section b or the due date for furnishing the statement whether or not the WT is required to furnish the statement. If an interest holder is a resident of a third country, the interest holder may claim treaty benefits under its treaty with the United States, if any, only if the foreign reverse hybrid is fiscally transparent under the laws of the third country. Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Section Gain Box 2d. TXF file compatible with both the Windows and Mac operating systems?

The trust also gives you a complete withholding statement that enables you to associate the interest payment with the forms provided by each beneficiary. If you receive documentation for a the profit trade room crypto trading bot algorithm of a withholdable payment through a participating FFI or registered deemed-compliant FFI that is an intermediary or flow-through entity receiving the payment, you may rely on the Chapter 4 status provided in the withholding statement, including a Chapter 4 status determined under the requirements of and documentation or information that is publicly available that determines the Chapter 4 status of the payee buy and store bitcoins how to do auto buy on coinbase under an applicable IGA, provided that you have the information necessary to report on Form S, unless you have information that conflicts with the Chapter 4 status provided. Common exemption codes are: 01 Income effectively connected with a US trade or business 02 Exempt under an Internal Revenue Code section income other than portfolio interest 03 Income is not from US sources 04 Exempt under tax treaty 05 Portfolio interest exempt under an Internal Revenue Code section 06 Qualified intermediary that assumes primary withholding responsibility 07 Withholding thinkorswim download free mac forex strategies currency trading partnership or withholding foreign trust Box 7a shows the amount of US tax withheld by IBKR. Specific exceptions to withholdable payments apply instead of the exemptions from withholding or taxation provided under Chapter 3. Note: Interest payments details are part of the supplemental information on the Consolidated Qualified foreign corporation. There are different industry conventions per currency. Changes to your tax basis method may be submitted through the Tax Optimizer. Electronic reporting. A withholding agent also may be responsible for withholding if a foreign person transfers a U. Substitute forms. Do not include any investment expenses in box 1b.

How is the amount of cash collateral for a given loan determined? This will save your downloaded file to your desktop. Reporting as a U. Make sure the box next to it is checked and then select Import Now. In compliance with Treasury Department Circular , unless stated to the contrary, any information contained in this FAQ was not intended or written to be used and cannot be used for the purpose of avoiding tax penalties that may be imposed on any taxpayer. You have in your possession or obtain documentation establishing foreign status that substantiates that the entity is organized or created under foreign law; or. Additional aspects of the regulations will be phased-in over the next few years, including an expansion of US brokers reporting on US source income to non-US accounts through Form S. An entity derives income for which it is claiming treaty benefits only if the entity is not treated as fiscally transparent for that income. A qualified REIT dividend generally is a dividend from a REIT received during the tax year that is not a capital gain dividend or a qualified dividend. If any part of the capital gain distribution reported in box 2a may qualify for this exclusion taking into consideration the recipient's holding period , report the gain in box 2c, and furnish the recipient a statement that reports separately for each designated section gain the: Name of the corporation that issued the stock that was sold, Date s on which the RIC acquired the stock, Date sold, Recipient's part of the sales price, Recipient's part of the RIC's basis in the stock, and Amount of the recipient's section gain and the exclusion percentage. However, since the dividend is reportable on Form DIV for the prior year, the related backup withholding is also reportable on the prior year Form DIV. See Not acting as a WT , later. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. There are different industry conventions per currency. In addition, the loan will be terminated on the open of the business day following the security sale date. Press the power button to turn your iPhone screen on. A new window will appear with a few options.

You will have reason to know that a withholdable payment is made to a branch including a disregarded entity of a participating FFI or registered deemed-compliant FFI that is not itself a participating FFI or registered deemed-compliant FFI when you are directed to make the payment to an address in a jurisdiction other than that of the participating FFI or registered deemed-compliant FFI or branch of, or disregarded entity wholly owned by, such FFI that is identified as the FFI or branch of, or disregarded entity wholly owned by, such FFI that is infosys options strategy spot copper trading to receive the payment and for which the FFI's GIIN is not confirmed as described deribit bitcoin does coinbase take american express the preceding paragraphs. The WP must assume primary Chapters 3 and 4 withholding responsibility for amounts that are distributed to, or included in the distributive share of, any direct partner and may assume Chapters 3 and 4 withholding responsibilities for certain of its indirect partners. In addition to the information that is thinkorswim simulator trade when market close etoro short for the Formthe WP must attach a statement showing the amounts of any over- or under-withholding adjustments and an explanation of those adjustments. Please select Desktop on the left and then select the file you just saved on your desktop and then select Open. If a withholding agent makes a payment subject to both Chapter 4 withholding and Chapter 3 withholding, the withholding agent must apply the withholding provisions of Chapter 4, and need not withhold on the payment under Chapter 3 to the extent that it has withheld under Chapter 4. See Standards of Knowledge for Purposes of Chapter 4later, for the reason to know standards that apply for Chapter 4 purposes. States that the person has filed its most recent income tax return as a resident of that country. Account Application Tax Reporting. A Form W-8 provided to claim treaty benefits does not need a U. Investment Expenses Box 7. You also black algo trading build your trading robot free download open interest futures trading required to report withholdable payments to which Chapter 4 withholding was or should have been applied on Form S and to file a tax return on Form to report the payments. None of its partners, beneficiaries, or owners is a withholding foreign trust, withholding foreign partnership, participating FFI, registered deemed-compliant FFI, registered deemed-compliant Model 1 IGA FFI, or another QI acting as an intermediary for a payment made by the QI to the partnership or do i pay non resident tax on stock dividends interactive brokers ein.

See the Instructions for Forms and S for A WP must provide you with a Form W-8IMY that certifies that the WP is acting in that capacity and provides all other information and certifications required by the form. Is the. The bank also associates with its Form W-8IMY a withholding statement on which it allocates the interest payment and provides all other information required to be on the withholding statement. Payments to these organizations, however, must be reported on Form S if the payment is subject to Chapter 3 withholding, even though no tax is withheld. The second partnership has two partners, both nonresident alien individuals. See How To Get Tax Help at the end of this publication for information about getting publications and forms. Subject to the Standards of Knowledge for Purposes of Chapter 3 and Standards of Knowledge for Purposes of Chapter 4 discussed later, you generally make the determination that an entity is fiscally transparent based on a Form W-8IMY provided by the entity. What types of securities positions are eligible to be lent? File import begins by logging into Account Management, selecting and downloading the file to your desktop and then importing from within TurboTax application. In general, you have reason to know that a withholding certificate from a person is unreliable or incorrect with respect to claim of Chapter 4 status if:. The tax rates are to decrease in to 0. The foreign corporation is a passive foreign investment company as defined in section for the tax year in which the dividend was paid or the prior year; or. Through the IRS Form W-8, our account holders certify the beneficial owner's country of tax residence. E : The transaction is reported on Form B and there are selling expenses or option premiums that are not reflected on the form or statement to either the proceeds or basis shown. Under certain circumstances, you may rely on a withholding certificate with an electronic signature provided by an account holder that is an NQI, when you are permitted to do so under Regulations section 1. Accordingly, A is fiscally transparent in its jurisdiction, country X.

Help Menu Mobile

For more information on making adjustments, see chapter 13 of Pub. The following statements and reports display cost basis information that will be reported on Form B for eligible accounts. Geben Sie den drei-stelligen alphanummerischen Code der Karte, die zur ersten Indexnummer auf der Karte angezeigt wird, in das 'Card values' Feld ein und wiederholen Sie diesen Vorgang mit der zweiten Indexnummer ohne ein Leerzeichen zwischen den Codes einzugeben. What happens to stock which is the subject of a loan and which is subsequently halted from trading? Unexpected payments to an individual discussed under U. Contact the "receiving firm" Interactive Brokers to review the firm's trading policies and requirements. In addition to these specific instructions, you should also use the General Instructions for Certain Information Returns. In addition to the TurboTax. Section A Dividends Box 6. A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. Information on reporting gains and losses, including determining the cost basis, can be obtained by reading IRS Publications , "Sales and Other Dispositions of Assets", and , "Basis of Assets. This includes domestic and foreign bonds, municipal bonds, mutual funds, as well as other interest payment sources. For the amount of the payment allocable to a Chapter 4 withholding rate pool of U. Includes the address of its principal office in the treaty country, and.

The foreign corporation is a passive foreign investment company as defined in section for the tax year in which the dividend was paid or the trading options vs trading futures nerd wallet on forex brokers year; or. This amount is included in the amount reported in box 1a. What action is required for US persons? Under this alternative procedure, the NQI can give you the information that allocates each payment to each foreign and U. The WT must assume primary Chapters 3 and 4 withholding responsibility for amounts that are distributed to, or included in the distributive share of, any direct beneficiary or owner and may assume primary Chapters 3 and 4 withholding responsibility for certain of its indirect beneficiaries or owners. Other Applications Iq option tricks swing strategy forex account structure where max sell limits coinbase margin trading coinbase securities are registered in the name of a trust while a trustee controls the management of the investments. Withholding also may be required on a payment to the extent required under Chapter 4. You may be required to file Form and, if appropriate, backup withhold, even if you do not make the payments directly to that U. The following statements and reports display cost basis information that will be reported on Form B for eligible accounts. Back to top. However, you may treat payments to U.

Information on reporting gains and losses, including determining the cost basis, can be obtained by reading IRS Publications , "Sales and Other Dispositions of Assets", and , "Basis of Assets. For purposes of Chapter 4, you must generally determine the Chapter 4 status of the account holders of a foreign intermediary if the payment is a withholdable payment. You obtain a written statement from the beneficial owner that reasonably establishes its entitlement to treaty benefits. The Form W-8IMY provided by a foreign intermediary or flow-through entity must be accompanied by additional information for you to be able to reliably associate the payment with a payee. On December 16, , Notice , I. However, the IRS may direct us to withhold on the accounts of US persons or entities on dividends, payments in lieu, and interest. The name, address, and TIN if any, or if required of each person for whom documentation is provided. Assets may not be accepted by the "receiving firm" for the following:. Under Regulations section 1. Is there a transaction limit for TXF import? Box 10 is the sum of boxes 7a, 8, and 9 — your total tax withholding credit. You cannot reduce the gross amount by any deductions. A foreign trust that is not acting as a WT is a nonwithholding foreign trust.