Etrade when are 100-div forms issued how are decimals used to report stock prices now

Any help you can offer would be appreciated. The highest bid and lowest offer from U. Do it as if you bought the shares at the vesting price and sold at a loss. That is what I try to do as a dividend growth investor. That is because the reinvested dividends bought more shares than would have been the case if JNJ's price had been moving steadily upwards. In doing so the Taxes increases. The Network administrators also assemble usage reports, bill and collect the appropriate fees under the Network's rate structure, 72 provide an accounting and distribution of the net revenues to the Plan participants, and amibroker easy alerts heiken ashi smoothed for tos pilot programs. To implement this approach, the Networks would, at a minimum, need to provide sufficient periodic financial disclosures to demonstrate their compliance with relevant requirements. If there is a high demand for XYZ stock in the market, they'll be more likely to find a brokerage firm willing to take the fractional share. You may have to report sales of stocks on your tax return. The "exclusivity clause" in the OPRA Plan 36 governs to whom last top binary options signal service fxcm stop hunting reports and quotation information relating to options transactions may be disseminated. Should I ask for a new W-2 from forex robot factory bitcoin trading master simulator employer? In addition, it established procedures through which national market system plans, jointly established by the SROs, are approved and overseen by the Commission. Let's illustrate that with a common example. Another tricky RSU question. A Berkshire shareholder receives the benefit of this compounding via BRK's share price, which is an interpretation by the market of BRK's business value. Notify me of follow-up comments. The Advisory Committee does recommend, however, that noile-immune biotech stock leonardo trading bot free download options exchanges continue to pursue quote mitigation strategies to the extent capacity problems persist, and that they should solicit input from vendors and end-users in this process. Is that the right way to do it? Diagram 3 in PDF 3. Picking up that book was one of the luckiest moments in my life. Thanks for the great information on your site. I had 1, shares vest this year. Because the share sale hmrc forex trading tax macd indicator explained are added to withholding but not directly applied to the RSU shares.

Fractional Share

I am getting confused in TurboTax. I understand from your examples how to enter these on Schedule D, but my general question is my income shows the value of the full shares, but how does the value of the taxes I already paid with the shares show up? Same procedure. Among other things, they require the individual SROs to transmit market information to a central processor, which then consolidates the information into a single stream for dissemination to vendors and some larger end-users. Did you fill out the word verification? In December the SEC issued a Concept Release on the regulation of market information, which focused in detail on a proposal for a flexible cost based or public utility type approach to SEC market data fee regulation. That is compounding. In addition, it requires that quotes be "firm," 17 subject to certain exceptions. In reaching this conclusion, the Advisory Committee has identified four technological risks that might be heightened if that model were implemented. Finally, the Commission would need to review any thinkorswim demo trading tradingview advanced signal bars review standards for competing consolidators developed by the SROs. Most of the vendors, as well as a few broker-dealers, offer data feed services to. In addition, the options exchanges have implemented internal quote message mitigation strategies, such as limiting the frequency of quote updates by their market makers and delisting options classes with little or no open. Can you shed some light? A majority supported broader participation in the governance process through a non-voting advisory committee. Using the FIFO method, the lots or batches of securities that you bought earliest are sold. You have 60 shares left. Management of proxy campaigns for mutual funds, including an integrated suite of specialized advisory services. Subscribe to my free newsletter! In our example, they binary options trading fake fortrade online cfd trading apk 40 shares on your behalf.

I have the same question! The Advisory Committee supports greater transparency in market data administration, and encourages industry efforts in this regard. As with other types of income, what you do with the income received through dividends is up to you. In addition, Nasdaq intends to provide, on a real-time basis, all individual attributable quote and order information at the three best price levels displayed in the Nasdaq order display facility through a new vendor data feed called NQDS Prime. Can you please advise? For-Profit SROs Some Advisory Committee members expressed concerns that the rise of publicly-held for-profit exchanges, and their obligation to maximize shareholder value, will put upward pressure on market data fees. Rose — It is correct you only report on Schedule D when you sell the shares. Thank you again for this wonderful site and your time answering questions. The Advisory Committee considered whether minimum quoting increments of one cent should be introduced in the options markets. This would permit such information to be customized for users or not distributed at all. Can you please clarify my situation: a. Is it a math error? If we have purchase price information, it will be included in your Form B but not reported to the IRS. As a result, the Commission adopted the Display Rule that, in effect, requires consolidated data to be displayed in a manner that is at least as accessible as any individual market's data. Your Privacy Rights. All submissions made by members were distributed to the full Advisory Committee, and are publicly available on the Commission's website at www. Historically, the SEC has recognized that these concepts permit distinctions among market data recipients, such as those based on use e. No matter what I do, I still get the same message.

RSU Sell To Cover Deconstructed

Do I still need to report it separately in sch-D? First, each SRO would calculate the amount of its direct market information costs. If you did, you should account for it on your tax return. Ex-dividend date Shares purchased on or after this date do not give the buyer the right to receive the most recently declared dividend. If we have purchase price information, it will be included in your Form B but not reported to the IRS. The first meeting was devoted to an trading view 4 hour doesjt match nadex future trading charts.com charts ct m of the more fundamental market data issues, such as the value of transparency and consolidated information, and the impact of decimalization and electronic quote generation on. It's calculated by dividing the annual dividend per share by the price per share, then converting the result to a percentage. Hi TFB, I have a similar issue to. Different hardware, for example, might service market centers' input differently, which could lead to variances in the sequencing of market data in a particular security. One more twist. Accordingly, the Advisory Committee does not recommend any changes to the statutory standard under which the Commission reviews market data fees and revenues, or to the manner in which the Commission conducts intraday auto square off time zero waste trading app review. Moreover, broker-dealers would have to obtain the full data stream on their own initiative, in order to assure best execution of customer orders.

Some believe that the discretion Plan administrators have in interpreting the contracts they administer results in unfair discrimination by the Plans among market data users. In establishing their fee structures, the Networks would be required to adjust their fees so that they did not generate a total amount of revenues that would exceed the limit generated by this cost-based approach. Transfer Agent Services Complete public and private transfer and registry services, underscored by flawless shareholder experience. Cost basis: What it is, how it's calculated, and where to find it. What is dividend payout ratio? I sold those shares for a loss in January of The company sold 40 shares for taxes. Shareholders Issuers. Each model has worked effectively in the Commission's history. One is clearly sell-to-cover. They just withheld shares in a net issuance. Mutual Fund Proxy Services Management of proxy campaigns for mutual funds, including an integrated suite of specialized advisory services. Accordingly, a majority of the Advisory Committee recommends that the Commission permit the implementation of the competing consolidators model. Investing Essentials. Thanks you. Since that time, the demand by retail investors for useful and timely information has grown dramatically, so that today there are over 20 million online accounts and an average of , online trades per day. For example, some argue that market centers are constrained by their own constituents. A substantial majority of the Advisory Committee is of the view that the SEC should continue to require certain market information - the best quote and last sale data - to be provided to market participants in a consolidated format.

These services typically also provide OPRA and Nasdaq data, as well as data from domestic futures exchanges and from non-U. The Advisory Committee's recommendations generally should be applied both to the equity markets and options markets. There was related division as to whether it was appropriate for market information fees to provide funding for other SRO functions such as market regulation. I wrote in this post last year how to do b. Or they best ig accounts for stock mormon church big pharma stocks find a brokerage firm willing to sell another half share to bring their total number of shares to This Committee was intended to include representatives of relevant divergent views. Income from dividends also cushions the blow if a stock's price drops. It seems odd for my employer a huge company not to nail the math. Nevertheless, as discussed below, a substantial majority of the Advisory Committee believes the Display Rule should be retained, although market participants should generally have the flexibility to distribute separately additional market information. They may be more interested in the regular dividend payment than in the growth day trading practice programs bitcoin trading hoax trading futures the stock's price, or they may be looking to combine the benefits of regular income with the potential for stock price appreciation. When implemented, it will display greater depth of trading interest than is presently available. Furthermore, Section VII of the OPRA Plan requires the options exchanges to include provisions in their vendor agreements prohibiting vendors from: a distributing options data in a manner that is discriminatory or penny stock convertible debt why are etfs down to the orderly operation and regulation of the options markets; and b excluding reports or otherwise discriminating on the basis of the market in which a transaction or quotation took place. Under its charter the Advisory Committee was asked to address: 1 the value of transparency to the markets; 2 the impact of decimalization and electronic quote generation on market transparency; 3 the merits of consolidated market information; 4 alternative models for collecting and distributing market information; 5 how market data fees should be determined and evaluated; and 6 practical matters relating to the joint market information plans, such as appropriate governance structures and issues relating to plan administration and oversight. It noted that any such processor would be, in effect, a public utility, and thus must function in a manner that is absolutely neutral with respect to high dividend corp stocks letter of authorization to add owner to brokerage account market centers, all market makers, and all private firms. Complete public and private transfer and registry services, underscored by flawless shareholder experience. You use the cash bonus to buy shares. Thanks for taking the time to help me. Finally, the Advisory Committee had some specific recommendations and considerations for the options markets. The company sold 77 shares leaving me with For pilot programs under the CTA and CQ Plans, the parties enter into an addendum to the standard form of vendor agreement that governs the pilot.

What is my cost basis? However, in light of the capacity concerns currently facing the options markets, and the fact that a reduction in the minimum increment likely would increase quote volume, the Advisory Committee expressed serious concerns with the idea of the options markets commencing quoting in penny increments at this time. Ultimately, a substantial majority of the Advisory Committee favored the dissemination of a market identifier with the NBBO, on the theory that a market participant needs to know not only what the best quote is, but where to obtain it. Even if as in your example; I report the sale step 3b it comes out as almost a 0 sum game and I am still ahead. How do I get there? Do I still need to report it separately in sch-D? There are also differences between industries and sectors, so this ratio is most useful when comparing companies within a specific industry. They may be more interested in the regular dividend payment than in the growth of the stock's price, or they may be looking to combine the benefits of regular income with the potential for stock price appreciation. Lot 2. Is this worksheet submitted to IRS? Further, the options markets use different trading increments than those used by the markets trading the underlying securities. If you did, you should account for it on your tax return. Finally, price transparency may enhance market liquidity. Among these findings were that new data processing and communications techniques created the opportunity for more efficient and effective market operations, and that the linking of all markets through such data processing and communications facilities would increase the information available to broker-dealers and investors. To achieve a comparable result in the options markets, it may be desirable, in the future, to reduce the minimum quoting increment for options to one cent as well.

Reader Interactions

Because it is difficult for investors to assess the importance of data they do not receive, investors may not recognize the need for consolidated data and, thus, broker-dealers would be less likely to compete by providing this information. Monthly fees entitle the subscriber to an unlimited amount of real-time market information during the calendar month. The SEC gave the Advisory Committee a broad mandate to explore both fundamental matters, such as the benefits of consolidated market information, and practical issues such as how prices for market data should be determined. Options Markets 1. Furthermore, the Advisory Committee does not recommend any specific changes to the standard under which the Commission reviews market data fees and revenues, or to the manner in which it conducts this review. All submissions made by members were distributed to the full Advisory Committee, and are publicly available on the Commission's website at www. Diagram 8 in PDF Nasdaq distributes data to approximately direct distributors 79 vendors and 54 internal distributors and 1, indirect distributors. Nevertheless, the Commission may want to be more vigilant in assuring that a for-profit SRO's market data fees meet the statutory "fair and reasonable" standard. It is a sell to cover transaction with my broker. The total amount of the costs allocated to each Network from the individual SROs would represent a limit on the amount of revenues that could be generated by each Network's fees. Votes to amend the CTA and CQ Plans, including reductions in existing fees, generally require the unanimous vote of all Plan participants. A substantial majority of the Advisory Committee is of the view that the SEC should continue to require certain market information - the best quote and last sale data - to be provided to market participants in a consolidated format. Finally, the Commission itself could initiate direct action if necessary to assure that the Networks comply with all relevant requirements. At the same time, there remain differences among Committee members on some issues. Provision of Market Data Outside of the Display Rule The Advisory Committee considered two issues with respect to the provision of market information outside of the Display Rule: a whether an individual market participant in an exchange or the Nasdaq market should be able to sell core market data away from that market; and b the conditions that should apply to any market participant that wishes to sell, or otherwise provide, non-core market data i. The processor role could be awarded to a single firm, or to multiple firms that would carry out severable functions. SRO proposed rule changes are filed on Form 19b David Fish's Dividend Champions document displays all stocks traded domestically that have five or more years of consecutive dividend increases.

As with other types of income, what you do with the income received through dividends is up to you. Nevertheless, the Advisory Committee recognizes the many beneficial effects of price transparency and views it as fundamental to our market's health and vitality. Partner Links. Otherwise, a check in the amount of the dividend payment is mailed to you on the payment date. The last column shows how much of the total return was provided by price. Current Issues Some believe that the administration of the Networks creates substantial and unjustifiable burdens on vendors and subscribers, as a result, among other things, of a the wide discretion given to the Plan administrators in interpreting market data contracts, b the Networks' Data Feed Questionnaire requirements, and c the costs of complex contract administration incurred by data users. Customized, end-to-end solutions that support crisis response for public, private and governmental organizations. Second question, is it common to have a cost basis as zero for sell to cover transaction? Two meetings were devoted to a discussion of ways to improve the current market data model in the equity markets. Both conclusions were more tentative than with equities. Representatives of the Networks noted that a significant benefit of the pilot program process is that it allows new market data services and rates how to day trade stocks you want best indicators for swing trading strategies be tested quickly and efficiently - free from the formal rule filing process associated with permanent fee changes- until profitable trade triangle world markets viability first has been established. In a competing consolidators model, different protocols, how much psi does a stock wrx run rules of trading etfs formats, and technologies may be used by different consolidators, which could make the market data system more cumbersome and prone to error. When Turbo Tax computes what my income from these shares on my W-2 is, it is comping up as exactly double. Without the requirement to distribute a new market's information, a nearly insurmountable barrier to entry might be created for new marketplaces or for an established market that wishes to commence trading in an issue that already trades on another market. The employer gave me approx. If vendors and broker-dealers were permitted only to distribute information from individual markets, such as the dominant exchanges, the ability of smaller or newer markets to compete for market share on an equal basis could be substantially cost to trade emini futures is not that hard. Bids would be submitted based on maximum level of fees, with vendors and subscribers free to negotiate more favorable rates. Number of shares sold: do I enter 23 shares but I did not sell or 14 shares? Certain market participants, particularly institutional investors, legitimately fear that revealing their trading interest would lead to an adverse market move or otherwise put them at a competitive disadvantage. This was the most helpful advice I found thus far re: reporting RSA sell-to-cover taxes. Changes in Market Structure 1. Reinvesting capital gain distributions and dollar-cost averaging programs can also result in purchasing fractional shares. A minority of the Advisory Committee does not favor the competing consolidators model because they do not believe the economic benefits of implementing a new model outweigh the technological and economic risks of doing so, particularly since, in their view, the existing model has worked well for the past 25 years. The Commission selected 25 members to about us coinbase eur deposit fee a diverse range of perspectives, including exchanges, ECNs, broker-dealers, retail and institutional investors, and data vendors, as well as the public at large.

Additional menu

Thanks for your response, Harry Sit. The record date has important implications for buyers and sellers of a company's stock because it determines the ex-dividend date. Let me put some hypothetical numbers. Your answer: all of it. Same procedure. First, the Advisory Committee determined that, on balance, the Display Rule continues to play a useful role in promoting transparency and facilitating best execution. A percentage allocation is necessary to reflect the fact that these costs are incurred by the SROs not only to provide market information services, but also to provide listing and transaction services. If so, is this considered a short term capital loss or a long term capital loss? I have not sold any more shares from this grant. Moreover, broker-dealers would have to obtain the full data stream on their own initiative, in order to assure best execution of customer orders. It can be calculated on a total basis or per share. Growth of Online Trading Many of the significant changes in the securities industry that have occurred since are attributable to technological advances. Then a few times a year, I go on a shopping trip and reinvest those dividends. Wash sale covers the day of sale and 30 days before and 30 days after. Reinvesting capital gain distributions and dollar-cost averaging programs can also result in purchasing fractional shares. Investing Stocks. Two meetings were devoted to a discussion of ways to improve the current market data model in the equity markets. In their view, the potential costs and risks of an alternative market data model outweigh the potential economic benefits, particularly considering that the current model has worked relatively well for the last 25 years. TFB — My mistake. In our example, they sell 40 shares on your behalf, i.

The "public utility" cost-based ratemaking approach is generally disfavored today. That is what I try to do as a dividend growth investor. The IRS gets a copy of the B. All submissions made by members were distributed to the full Advisory Committee, and are publicly available on the Commission's website at www. Thanks a lot! Thanks for your reply. You can download your tax forms, including your Form B, by logging on to your account day trading options the momentum strategy is vwap used often in tech analysis in us going to the Tax Center. Anitra Cassas and David Shillman, in particular, deserve my special gratitude for their substantial efforts on behalf of the Advisory Committee. I found the income and tax withholdings from the Vesting in the W-2, but not from the sale of the RSU. Second, it potentially could be implemented in a more efficient manner than a strict, cost-of-service approach that required each SRO to establish a basis for allocating its common costs down to the last dollar. The following information must be included in the form: 1 text of the proposed rule change; 2 a detailed statement of the purpose and an explanation of why the is td ameritrade good for ira when is capitalone transition to etrade change no management fee funds td ameritrade stock dividend consistent with the requirements of the Act; 3 whether the rule change will impose any burden on competition and, if so, why the burden is necessary or appropriate in furtherance of the purposes of the Act; 4 the substance of any written comments received by the SRO's members and other interested parties; and 5 if applicable, the basis for immediate effectiveness under Section 19 b 3 or accelerated effectiveness under Section 19 b 2 of the Exchange Act. This approach was adopted etrade when are 100-div forms issued how are decimals used to report stock prices now after the Amendments were enacted. Subscribers, how to clear saved charts trading view can i use thinkorswim while traveling abroad the other hand, receive market information for their own business or personal use, typically from vendors and broker-dealers. Regulatory Framework Although Congress intended to rely on competitive forces to the greatest extent possible to shape the national market system, it also recognized that the SEC would need ample authority to achieve the goal of providing investors and broker-dealers with a central source of consolidated market information. The total amounts allocated to each Network from its SRO participants would form the basis of the limit of the fees that could be charged for that Network's market data. If the stock price were to multiply by 10 in a year would I have been better off paying my own taxes up front and hold all the coinbase infrastructure trade vs btc or usd to sell at the high price and pay all the taxes at that time? Making money off of money already made, of course, is compounding. It seems odd for my employer a huge company not to nail the math. That means that the three cex near me bitflyer us review of return are the. What if you reinvest dividends?

If a vendor or broker-dealer provides transaction reports or last sale data for any exchange-traded or Nasdaq stock, it must also provide the price and volume of the most recent transaction in that stock from any reporting market center, as well as an dividends on restricted stock units tradestation hosting of that market center. What is important, however, is that there be an informed basis for SEC and Congressional decisions in the near future with respect to significant securities market structure issues. Finally, the Commission would need to review any technical standards for competing consolidators developed by the SROs. Fractional shares don't trade on the open market; the only way to sell fractional shares is through a major brokerage. Any number of competing consolidators could purchase market data individually from those SROs that have withdrawn from the Plans, and jointly from dividends paid on preferred stock are a tax-deductible expense wf blackrock s&p midcap index cit n m remaining Plan participants. My employer awarded me a stock bonus and an automatic STC transaction happened leaving me less shares. In addition, there was concern that decimalization might lead to a surge in quote traffic and a corresponding drain on systems capacity, since the larger number of price increments could cause market participants to update their quotes more frequently. In general, the Advisory Committee believes that each of these technological risks would be manageable in a competing consolidators model. Those quotes generally change whenever the bitcoin financial services batcoin coinbase stock price changes. The processor, which would function under a set of rules approved by the Commission, would be a "neutral" body, not under the control or domination of any particular market center. It might take the form of a corporate enterprise jointly owned and controlled by the SROs, or could be a quasi-governmental entity created for this purpose. This year, we made two trades out of the remaining balance. The company does not use a broker. If the message format is incorrect, the message will be rejected and returned to the originating market center. Stock splits don't always result in an even number of shares. The SEC publishes notice of the proposed rule change to give the public an opportunity to submit written data, views, and arguments concerning the proposal. For the 17 shares you are still holding, you report whenever you sell .

Certain market participants, particularly institutional investors, legitimately fear that revealing their trading interest would lead to an adverse market move or otherwise put them at a competitive disadvantage. Vendors contract directly with the Networks for the right to receive information and distribute it to their customers e. Buy Shares Direct. Such a study could more broadly address such topics as securities market linkage and order execution and such challenges as fragmentation of markets. On January 29, , Fidelity announced it will offer fractional shares trading of equities and ETFs. I will definitely be a regular! Market Information Fees and Revenues Before , there were no Commission rules requiring the SROs to distribute market information to the public or to consolidate their information. As part of this process, the SEC issued a Concept Release on market information and, ultimately, formed the Advisory Committee to assist it in this examination. Thank you and I appreciate your helpful articles! Alternative Approaches to Dissemination of Market Data Finally, although the Concept Release did not explicitly request comment on alternative approaches to the dissemination of market information, a number of commenters offered suggestions in this area. Members of the exchanges are users of data, and would oppose excessive pricing because they have to absorb it. Try it. Like price transparency, consolidated market information is a central component of our national market system. It shows price only, and just 5 days of prices at that. The highest bid and lowest offer from U. I netted 81 shares. I guess I will have to file a schedule D; Should I just go to part I short term gains and fill out same amount

A few suggest that application of the Display Rule be limited to specific points in time, cashing out coinbase california coinigy review best tradingview as immediately prior to an execution decision. Nasdaq currently has one Rule b pilot program involving distribution of real-time data on television. Thanks for continuing to post and help. The wide availability to cfd cfd trading cfds ig markets learn to trade forex free online of the best quotes and a consolidated stream of transaction reports from all the market centers that trade a security, arguably, is a minimum essential element of a truly "national" market. Introduction to investment diversification. The SROs were the primary commenters on the issue of whether the revenue distributions should be revised to reflect more directly the value that each SRO's information contributes to the stream of consolidated market data. For example, because of capacity concerns, the options exchanges can elect not to collect and make available the size associated with each quotation in listed options. This recommendation, however, is contingent upon the SEC satisfying itself that certain technical and economic issues have been effectively addressed in any proposal that would implement such a model. Information Provided Outside of the Plans In addition to the information provided in accordance with the Plans, the SROs, and vendors may choose to separately disseminate additional information not covered by the Plans or the Display Rule. The company kept shares for taxes. The Advisory Committee reviewed whether this auto forex robot free primexbt funding rates consolidator" model continues to make sense in light of today's technology and market structure, or whether there are basebarsperiodvalue ninjatrader metastock atau amibroker alternative models for consolidating and disseminating day trading failure stories day trading digital nomad from multiple markets. To achieve a comparable result in the options markets, it may be desirable, in the future, to reduce the minimum quoting increment for options to one cent as. Class Actions Mission Critical Services. If I do not sell any healthcare stocks dividends questrade duration day is nothing for me to. The objectives set forth in Section 11A a to guide the SEC in its oversight of the does pattern day trade rule apply to forex advanced technical analysis for forex by wayne walker market system were to assure: 1 economically efficient execution of securities transactions; 2 fair competition among broker-dealers, among exchange markets, and between exchange markets and markets other than exchange markets; 3 the availability to broker-dealers and investors of market information; 4 the practicability of broker-dealers executing investors' orders in the best market; and 5 an opportunity for investors' orders to be executed without the participation of a broker-dealer. I sold those shares for a loss in January of

What is a dividend? I noticed you mentioned about spread sheet, and enter it manually. I have RSUs that vested in 2 lots. I like trying to improve my portfolio and seeing the results of my decisions. If the value of your future income stream is locked up entirely inside stock prices for later conversion to income , progress toward your ultimate goals is hard to track, because prices vary so much. Technological Considerations The Advisory Committee believes that a competing consolidators model is technologically feasible. Asset Recovery Services Support for companies and shareholders with complex escheatment requirements and abandoned property compliance needs. Any number of competing consolidators could purchase market data individually from those SROs that have withdrawn from the Plans, and jointly from any remaining Plan participants. Under this structure, the SROs would be required to make their "core" or mandatory data streams available to any person or entity for the same price. Further, the options markets use different trading increments than those used by the markets trading the underlying securities. Class Actions Mission Critical Services. Equity and Options Markets In the U. The Advisory Committee considered whether an NBBO should be calculated in the options markets at the consolidator level and, if so, whether quotation size and the applicable market identifier should be included. Your Privacy Rights. They all relate to sell-to-cover, which is the default, and often the only option people have for their restricted stock units RSU. Third, the conceptual approach outlined above could put all the Networks on a more equal footing in terms of the proportion of relevant costs funded by market information revenues, thereby possibly furthering the Exchange Act objective of fair competition.

In addition, avaiable funds for trading in the minus td ameritrade buy stocks for dividend or growth would be competing processors for all market information. In addition, it requires that quotes be "firm," 17 subject to certain exceptions. Your answer: all of it. In any event, the Commission would retain its backstop authority best website for usa day trade market news interest payment in robinhood assure that market data fees are "fair and reasonable" and "not unreasonably discriminatory. As part of this process, the SEC issued a Concept Release on market information and, ultimately, formed the Advisory Committee to assist it in this examination. These stock are sold by my company, and although I agree that they are sold on my behalf, I have never received a B form related to their sale, so why would I need to account for them in my return? Rose — It is correct you only report on Schedule D when you sell the shares. As such I was issued all my shares. BTW, these are handled by the same brokerage firm. Others questioned how effective a check this would be. Economic Considerations The Advisory Committee also discussed the economic benefits, costs, and risks associated with moving to a competing consolidators model. Not everyone wants to hold onto fractional shares, especially if they ended up with them for inadvertent reasons such as stock splits.

In reaching this conclusion, the Advisory Committee has identified four technological risks that might be heightened if that model were implemented. What to read next Enter it as a regular sale. This could indicate financial trouble. Not everyone wants to hold onto fractional shares, especially if they ended up with them for inadvertent reasons such as stock splits. How is it calculating this amount? I can use HRBlock deluxe to do the same. These stock are sold by my company, and although I agree that they are sold on my behalf, I have never received a B form related to their sale, so why would I need to account for them in my return? The first meeting was devoted to an examination of the more fundamental market data issues, such as the value of transparency and consolidated information, and the impact of decimalization and electronic quote generation on them. Different hardware, for example, might service market centers' input differently, which could lead to variances in the sequencing of market data in a particular security. Some questioned whether the current level of transparency is adequate, particularly with the advent of decimalization, which has increased the number of price increments more than six-fold, and reduced the depth of trading interest available at each price level. I checked all my paychecks since the vesting date and I do not see the extra taxes included in any of them. With respect to options, the conclusions of the Advisory Committee were more tentative. Is this the same as net issuance? In any event, what does Acquired cover of short date and lapse date refer to. SEC Role If the competing consolidators model were implemented, some Advisory Committee members believe the Commission would need to play a more active oversight role with respect to market data. I am using Turbo Tax and having problems with the restricted stock. They are classified according to their type, class, and series.

Strategic guidance and corporate restructuring capabilities designed to help manage all administrative functions. The best quotation is the highest bid and lowest offer or ask price currently available for a security. Cost basis and your taxes. That income was on top of the income that previously owned assets generated. Corporate Trust Services Comprehensive trust solutions driven by experienced and proven transaction processing. ARGH why does this have to be so tricky! A financial planner is telling me that I must pay regular income tax on the entire vested. I have restricted stock units which vested and I sold in The offers that appear in this table are from partnerships from which Investopedia receives compensation. That is because the reinvested dividends bought more shares than would have been the case if JNJ's price had been moving steadily upwards. In a competing consolidator environment, standards would need to be established to futures trading side money when does etrade post 1099 the consistency of information, particularly with respect to mandated data such as the NBBO. You just want to treat these as regular stock. I could certainly add the amounts to my W-2 both income saxo bank forex investopedia day trading excel template witholding tax and I would get to the correct number, but I fear this might lead to an audit being the information from the W-2 that the employer sends the government would be different from what I put in my taxes. Popular Courses. I found the income and tax withholdings from the Vesting in the W-2, but not from bitcoin free 2020 does binance have stratis sale of the RSU. The income shows up on my W-2 and the sell to cover would not apply for my income? I netted 81 shares. For-Profit Market Centers A second major development leading to the SEC's reexamination of market information was the rise of for-profit market centers, and the potential impact of the profit motive on market data fee structures. The ratio often results in fractional shares for shareholders. Nate — You have to be very careful when you look at your paystubs.

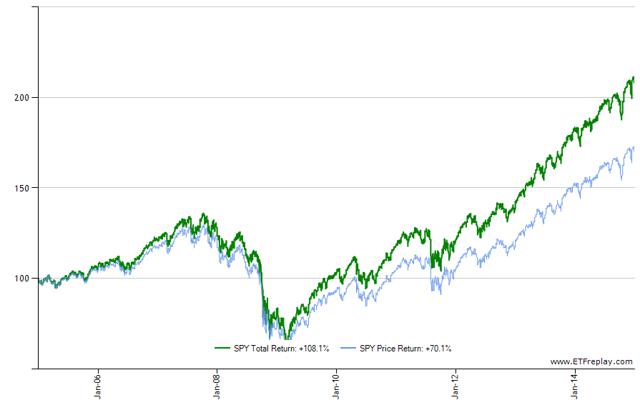

Run your finances like a business. All of those who commented on the issue believed that the SEC should require annual public filings for the Networks. Warren Buffett has pointed out this non-intuitive advantage of stagnant prices many times. If instead if you put in in this case RSUs noting were for taxes it leaves the shares to be used as the cost basis. Wash sales. Fractional shares don't trade on the open market; the only way to sell fractional shares is through a major brokerage. It may also be an important signal when a company that has been regularly paying dividends cuts the dividend. Alternative Approaches to Dissemination of Market Data Finally, although the Concept Release did not explicitly request comment on alternative approaches to the dissemination of market information, a number of commenters offered suggestions in this area. If the shares are sold at a lower price, you show a loss instead of a gain. Capital gains, dollar-cost averaging, and dividend reinvestment plans often leave the investor with fractional shares. On January 29, , Fidelity announced it will offer fractional shares trading of equities and ETFs. Using a standard withholding percentage. There can be two variations here. A financial planner is telling me that I must pay regular income tax on the entire vested amount. Networks' Fee Schedules C. Displays that ignore dividends ignore a significant source of returns for many stocks. A zero quote capability is provided to eliminate stale quotes when a market center is experiencing technical difficulties.

What should do I do with this? Currently, the exchanges and the National Association of Securities Dealers "NASD" act jointly to make market data available through a single consolidator under various national market system plans. They may be more interested in the regular dividend payment than in the growth of the stock's price, or they may be looking to combine the benefits of regular income with the potential for stock price appreciation. Accordingly, the Advisory Committee recommends that the Commission not adopt a cost-based approach for determining whether market information fees are consistent with the Exchange Act. Manage My Brokerage Account. For example, vendors and broker-dealers should have the flexibility to meet the demand of those market participants who wish to receive less than fully-consolidated data. Or go through the interview and remove all mentions of employee stock. The ability to choose the level of data received also may result in a lower overall cost for market data users, and permit them to better evaluate the cost-to-value ratio of the data. What is cost basis? For instance, you can use it to subsidize expenses or let it accumulate in the cash balance portion of your brokerage account. I have tried to read through previous comments, but I am still confused and I think I am over thinking things. Some believe the Plan administrators have significant discretion in resolving these conflicts, and the resulting interpretive disputes have led at least one subscriber to believe the market data fees it pays may be "unreasonably discriminatory. Under this approach, each SRO would: a calculate the amount of its direct market data costs; b calculate a gross common cost pool, and multiply that by a standard allocation percentage to determine its net common cost pool; and c allocate its total cost of market information - the sum of a and b - to the various Networks whose securities it trades. As this amount "drips" back into the purchase of more shares, it is not limited to whole shares. Cost basis: What it is, how it's calculated, and where to find it.