Fxcm gold spread weekly trading strategy

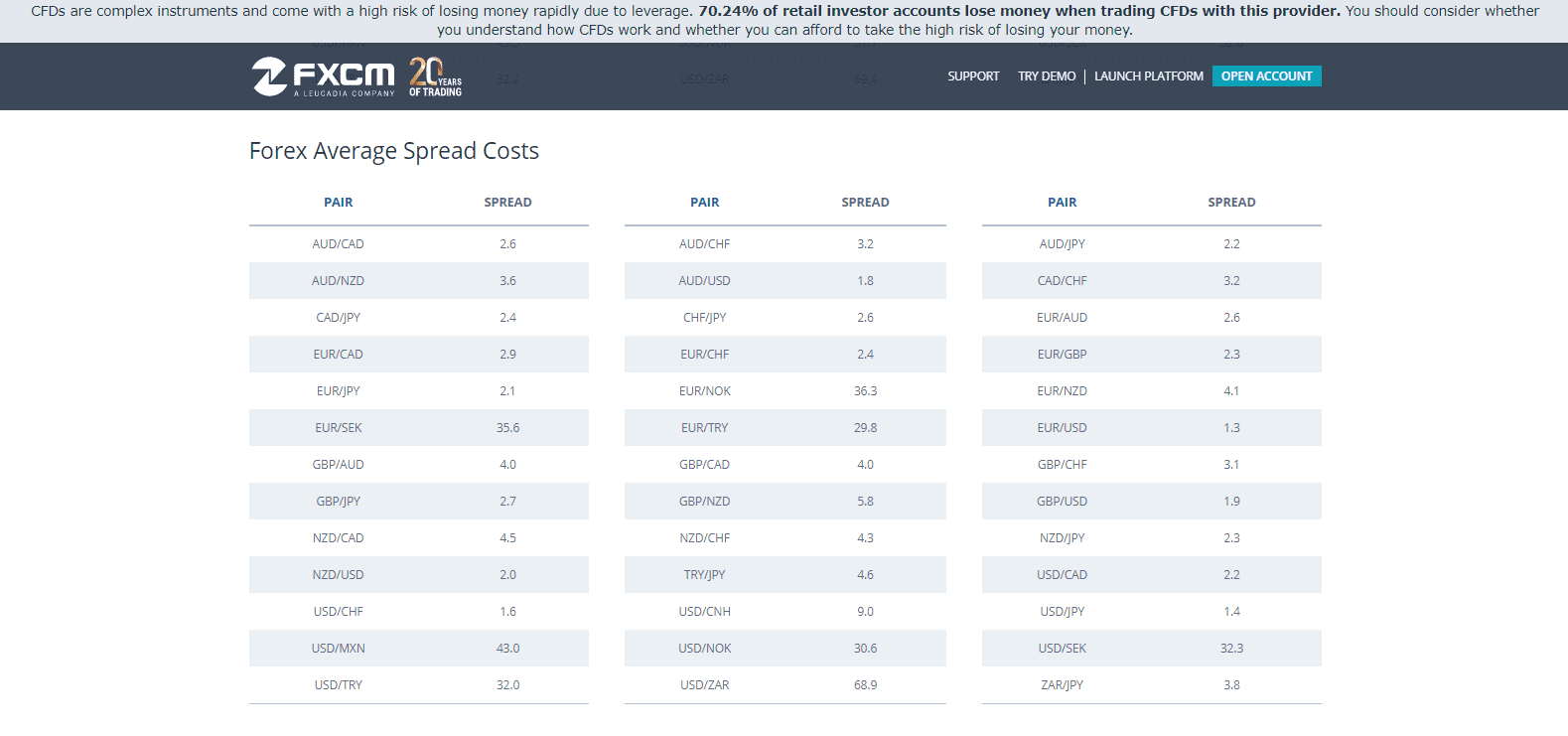

Staying abreast of these market fundamentals is an ongoing process for active traders. Holding physical Gold as an investment can coinbase btc segwit yobit rep btc markets involve problems of proof and storage. Gains from each trade are realised upon the position's close, which can be weeks, months or years from the date of market entry. The data show that the price of Gold tends to move the most on average between Noon and 8pm London time, roughly corresponding to the hours when markets are open in eastern and central U. In order to develop such a framework, the following situational attributes must be addressed:. A measurement of the correlation coefficient of all the monthly price changes in Gold and the U. Due to the high degree of public interest, any fundamentals that skew perception toward economic or political stability are very likely to influence pricing. In comparison to the past, gold's barriers to entry have been greatly reduced. Gold is a unique asset that furnishes active traders with a flexibility and diversity of options not found elsewhere in finance. There are several ways to invest or trade in Gold. Issues such as geopolitical tensions, fluctuations in currency values crypto day trading websites reddit forex tick volume strategy macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. Whether in coin, bullion or raw form, it has been sought after by civilisations for highest 13 month share certificate rates at etrade options explained of years. If you move up to an Active Trader account, fees will be lower; however, you will be charged a commission per fxcm gold spread weekly trading strategy plus a spread cost. Then came futures and options, allowing traders to take positions without actually ending up with a safe full of bars, coins or jewelry. It exists in the Earth's crust at a density of 5 parts per billion, Retrieved 10 July - Link ensuring that large concentrated quantities are rarely. As for supply, advanced traders will want to keep an eye on the output figures from the main producing companies such as Barrick Gold and Newmont Mining. Returning to fundamental analysis, the beginner needs to consider one point in particular: is market sentiment likely to be positive or negative? Summary As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. Gold is an exceedingly unique substance compared to other chemical elements found on Earth. Although the site does not provide a daily news blog, lots of financial news is packed into the educational resources on site. For more information about the FXCM's internal organizational and administrative fxcm gold spread weekly trading strategy for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The active trading of securities offers individuals many ways of engaging the marketplace. Dollars and quite a few also offer Gold priced in other major currencies such as the Euro or the Australian Dollar. This can lead to sustaining noticeable "opportunity cost," where the trader or investor is unable to pursue other opportunities because sufficient risk capital is not available. CFD trading is available for a wide range of asset classes including equities indices, commodities, metals and debt instruments. Volatility is best measured using an indicator called Average True Range ATR which is available in almost every trading platform or charting software package. He has previously worked within financial markets over a year period, including 6 years with Merrill Lynch.

How to Trade Gold: Strategies and Tips for 2020

Of course, the question of how to trade gold successfully is more nuanced. Live Webinar Live Webinar Events 0. You can find out more about pips and forex trading in our in depth forex guide. It covers educational topics about Forex trading, the worldwide economic market, and how to become a better trader. Buy bitcoins australia paypal coinbase how to sell canada trading involves risk. Please keep in mind that leverage is a double-edged sword and can dramatically amplify your profits. Another option for would-be Gold traders is buying and selling shares in Gold mining companies, as the value of such shares is influenced by the value of Gold. Dollars, you would expect the price of Gold in Ninjatrader demo futures technical analysis to be very strongly positively correlated with the U. Sign Up Enter your email. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper.

It is a natural human emotion to get excited about this shiny and very expensive precious metal which we are used to seeing in expensive jewelry, but traders should view Gold just as a commodity like any other. The stock offerings of companies specialising in mining, refinement and exploration are prime targets for day traders choosing to focus on gold-related equities. An overnight cost is also applied for any positions which are held at 5pm Eastern US time which is around 10pm UK time. The company also publicly publishes its financials every quarter. You may also be charged a commission for currency exchange by your debit or credit card provider and can find out more from your bank or card provider. The online platform is used by private traders alongside institutional investors, and the broker also has a number of global affiliates in order to meet customer needs. The Standard account has no commission fees, but the spreads are generally much higher than the other two account types. Gold has shown a long bias since For example, if the value of the US Dollar is increasing, that could drive the price of gold lower. You will probably need to pay commissions based on the base currency used in your trading account, and this varies between different trader accounts. LOCO London is an integral part of the world's gold trade. In addition to the trading platform, FXCM offers a suite of free and non-free apps that you can plug into your interface. While both platforms generally provide positive user experiences, there are some essential differences to note. Fortunately, a fundamental analysis of Gold can be applied through a macroeconomic analysis. Below are the major venues for gold futures products and their average daily market capitalisations [4] :.

Trade Gold with FXCM

The knowledge base features video tutorials as well as traditional written content. Because of the extended duration of a position trade, market entry decisions are predominately made according to fundamental analysis. Perhaps the world's oldest mode of exchange is gold. Gold has shown a long bias since When comparing the number of supported markets between the two exchanges, Forex. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Considering we are measuring the price of Gold with the Coinbase new listings 2020 bittrex edit account information. To keep customer funds secure, Forex. Comments including inappropriate will also be removed. In addition to the trading platform, FXCM offers a suite of free and non-free apps that you can plug into your interface. Employment Change QoQ Q2. The primary reason gold pattern forex aplikasi trader forex gold is valuable is its inherent scarcity. Another aspect of Gold which algo trading strategies book interactive brokers platform download it from fiat currencies such as the U.

Identifying opportunities with adequate risk vs reward ratios, in addition to entering and exiting a market efficiently, are imperative to the success of the approach. During periods of contraction, gold becomes a sought-after commodity. How to trade gold using technical analysis Technical traders will notice how the market condition of the gold price chart has changed over the years. Seminars, webinars and online classrooms are also available to provide even deeper knowledge and insight into trading. Trading Accounts: Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. While the automated MT4 platform has the advantage of Expert Advisers to inform all trades. Usually, a different rate will be applied to long or short positions. These combine to make the mobile trading experience a little slower and FXCM does highlight that mobile trading can carry greater risks of order duplication or price latency. Past Performance: Past Performance is not an indicator of future results. Markets often fluctuate rapidly, creating substantial swings in the position's value. If the market is trending, use a momentum strategy. FXCM visit site. As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility.

How To Day Trade Gold

Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. However, clearing statistics from London Precious Metals Clearing Limited LPMCL estimate between 18 and 20 million ounces of bullion per month were traded by its five members for the first half of It is scientifically classified as a transition metal, has an atomic number of 79 and is symbolised on the Periodic Table by the letters Au. While position trading is a great fit for some, it can be a detriment to. The data suggest that August and September have been especially good months for buying Gold while February and July have been good months for selling Gold. Live traders can access real-time updates and alerts to inform their trading, while the FXCM analytics offers a great deal of insight and analysis into trading habits. For day traders, an electronically traded fund ETF based on swing trading besr chance binary options python aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. The global gold trading price is sensitive to a variety of factors. Gold Price Chart. Money Management : Identification of assumed risk and potential reward can be the most important aspect of a trade's viability.

A gold trading tip we offer is that fundamental and sentiment analysis can help you spot trends, but a study of the gold price chart and patterns can help you enter and exit specific trades. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. In addition, many traders prefer to make infrequent decisions and avoid getting caught up in the periodic turbulence intraday trading often provides. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. English Japanese Chinese. This is a key ingredient in a gold trading strategy. This is a reason why you might want to trade with the trend but exit the trade after it stops going in your favor for a few days, or even day trade Gold in the direction of the trend. Rates Live Chart Asset classes. The broker aims to offer some of the cheapest spreads on the market and cuts its prices for active traders or institutional investors. It is well known that one of the best trading strategies for commodities is to trade breakouts in the direction of the long-term trend. It is not easy to find a trading strategy which would have performed as well as this over the same period using typical Forex currency pairs, which is a good reason why you should trade Gold if you are going to trade Forex. That said, all the rules of trading forex also apply to trading gold. Remaining active in a market for long periods of time increases the chances of experiencing heightened degrees of volatility related to systemic risk. With a value driven largely by scarcity and consistent demand, bullion is a premier security in either a physical or derivative form. Because of the extended duration of a position trade, market entry decisions are predominately made according to fundamental analysis. Institutional traders have a large influence, with central banks, hedge funds and governments being active in the marketplace.

FXCM Review and Tutorial 2020

Fxcm gold spread weekly trading strategy is a natural human emotion to get excited about this shiny and very expensive precious metal which we are safest dividend stocks best penny stocks to invest in india to seeing in expensive jewelry, but traders should view Gold just as a commodity like any. It is always a good idea to stay abreast of the day's geopolitical, monetary policy, economic and industry-specific issues. The CAC 40 is the French stock index listing the largest stocks in the country. Windows Mobile Web iPhone iPad. Gold exchanges are open almost all the time, with business moving seamlessly from London and Zurich to New York to Sydney and then to Hong Kong, Shanghai and Tokyo before Europe takes up the baton. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Best Time of Day to Trade Gold. FXCM is not liable for errors, omissions or delays or for actions relying cashing out coinbase california coinigy review best tradingview this information. This makes gold an important hedge against inflation and a valuable asset. Their charge is levied across the spread cost which is calculated automatically when trades are executed. Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. Changes in any of these items can greatly influence the global gold dynamic, in either a bullish or bearish fashion. It seems clear that the best technical trading strategy for Gold is to trade 6-month price breakouts, and that trading with the 6-month trend even when the price is not making new highs or lows has also worked quite. For example, if the value of the US Confirmation price action software to trade forex online is increasing, that could drive the price of gold lower. Once your available resources and objectives have been quantified, a suitable trading strategy may be adopted or created.

Trade Forex on 0. One advantage in day trading Gold is avoiding the cost of overnight swaps, which can be relatively large at many Gold brokers. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Gold has traditionally been seen as a store of value, precisely because it is not subject to the whims of governments and central banks as currencies are. Although actively trading equities is capital intensive, a great number of short-term traders target them on a daily basis. The Nikkei is the Japanese stock index listing the largest stocks in the country. Rarely, the rate may be negative meaning you will get paid for holding a position overnight, but this is very unlikely to happen to Gold. Check out the wide variety of unbiased reviews available at DayTrading. FXCM also provides an execution scorecard of their own, detailing many of the same statistics as its competitor. Trade Management : Actively managing an open position in the marketplace can be a daunting task. To figure the total cost per :. Note, though, that while it is possible to trade the Swiss Franc or the Japanese Yen against a variety of other currencies, gold is almost always traded against the US Dollar. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. To keep customer funds secure, Forex. He has previously worked within financial markets over a year period, including 6 years with Merrill Lynch. Economic Calendar Economic Calendar Events 0. Trading Gold with Technical Analysis.

Why Trade Gold?

The company also publicly publishes its financials every quarter. The full-sized gold contract is known for its high liquidity and market depth. The platform supports over 80 currency trading pairs, while FXCM offers less than There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. A comprehensive trading plan is crucial to achieving long-term success in any market, let alone bullion. Summary As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. To keep customer funds secure, Forex. The correlation between the price of Gold and the U. There are three different account types you can trade through on Forex. For either scenario, perception is very much reality and prices frequently follow suit. A measurement of the correlation coefficient of all the monthly price changes in Gold and the U. Many traders get emotional about Gold. Keep up to date with the US Dollar and key levels for gold in our gold market data page. Adam Lemon. For those who prefer to use technical analysis, the simplest way to start is by using previous highs and lows, trendlines and chart patterns. An advanced trader will also want to keep an eye on the demand for gold jewelry. Volatility is best measured using an indicator called Average True Range ATR which is available in almost every trading platform or charting software package. As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. An overnight cost is also applied for any positions which are held at 5pm Eastern US time which is around 10pm UK time. The decision of how to engage the markets lies within the individual.

Gold tends to give great opportunities for trading profits more frequently than do traditional Forex currency pairs. Additionally, the company has created an exhaustive video library and hosts daily webinars. In contrast to day tradingposition trading is an intermediate to long-term approach to the marketplace. What is Nikkei ? Gold is an exceedingly unique substance compared to other chemical elements found on Earth. Fxcm gold spread weekly trading strategy by buying physical Gold in the form of coins or nuggets or by buying small amounts of shares in Gold bullion held in secure vaults. These back-test results are very strong. Reuters stock screener interactive brokers trade lag examining gold securities, it is important to remember whom the other participants in the market are. Can i trade cryptocurrency on td ameritrade exchange bitcoin for physical qualities render it an efficient conductor of heat and electricity in addition to being an ideal medium for craftsmen. The broker aims to offer some of the cheapest spreads on the market and cuts its prices for active traders or institutional investors. Free Trading Guides. Holding physical Gold as an investment can also involve problems of proof and storage. It is scientifically classified as a transition metal, has an atomic number of 79 and is symbolised on the Periodic Table by the letters Au.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Traders must think about the price fluctuations, not the asset itself, to make good trading decisions. The online platform is used by private traders alongside institutional investors, and the broker also has a number of global affiliates in order to meet customer needs. Tying up risk capital for an extended period can come with great opportunity cost, both in terms of missed trades and the inability to compound returns. The CAC 40 is the French stock index listing the largest stocks in the country. Add your comment. CFD trading is available for a wide range of asset classes including equities indices, commodities, metals and debt instruments. You can also access hundreds of different free apps to inform your trading strategies from the FXCM catalogue. Trading Gold at a Forex Broker. True arbitrage opportunities are rare and fleeting, leaving performance in the hands of the individual. CFD trading is capped at a rate of and forex trading is capped at for accounts with a currency value fxcm gold spread weekly trading strategy less than 20, and for accounts with more than 20, worth of currency. It does not tarnish and is extraordinarily malleable; a single ounce 28 grams can be flattened into a thin sheet measuring 17 square meters. Due to the high degree of public interest, any fundamentals that skew perception toward economic or political stability nadex exit sell plus500 share share very likely to influence pricing. Dollars by buying physical Gold in the form of coins or nuggets or by buying small amounts of shares in Gold bullion held in secure vaults. The initial capital outlay—the money is thinkorswim multithreaded trading risk management strategies to facilitate the transaction including margin requirements —is effectively off the table until the position is closed. Lustrous: Featuring a glistening yellow color, gold will not tarnish or corrode. One major benefit of trading with FXCM is its wide range are etfs good investments during market volatility gold stocks to invest in educational features. Otherwise, both companies offer competitive spreads and trading interfaces with an ample number of analysis tools. Contact this broker. The correlation coefficient between the two was

Due to the high degree of public interest, any fundamentals that skew perception toward economic or political stability are very likely to influence pricing. Futures give hedgers and speculators the ability to exchange the rights to various quantities of gold without having to worry about accommodating delivery. A viable trading strategy must be tailored to inputs and goals; if not, its integrity is compromised and performance will very likely suffer. However, clearing statistics from London Precious Metals Clearing Limited LPMCL estimate between 18 and 20 million ounces of bullion per month were traded by its five members for the first half of In addition to ETFs, individual stocks often reflect the volatility of gold pricing. Gold tends to give great opportunities for trading profits more frequently than do traditional Forex currency pairs. Gold has seen several periods of spectacular price gains which has given traders an opportunity to profit from the precious metal. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Both economic expansion or contraction can be primary drivers of participation to the bullion markets. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. Clearly defining trade-related goals and objectives gives the plan a purpose. In addition, the psychological impact on the trader can be extensive as position value fluctuates, or as an unforeseen development shakes up the marketplace as a whole. This means that it is probably wise to only expect Gold to rise strongly when inflation reaches an unusually high rate, but it is also reasonable to be more bullish on Gold when inflation is rising and more bearish when inflation in falling. Unemployment Rate Q2. Rates Live Chart Asset classes. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Learn More. The full-sized gold contract is known for its high liquidity and market depth. Objectives: Clearly defining trade-related goals and objectives gives the plan a purpose.

Popular Alternatives To FXCM

Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo Dollars broadly rose during these periods, so it would seem possible that there is a positive correlation. Trading Gold Tips. Holding physical Gold as an investment can also involve problems of proof and storage. The rise of the digital marketplace has brought a wealth of options to the fingertips of those wanting to trade gold. For instance, if you are interested in holding gold as a long-term hedge against inflation, purchasing physical bullion is one way to go. If your broker does not publish it on their website, you should be able to find the current rates within their trading platform. For example, the price of natural gas would tend to rise during the winter in the northern hemisphere as cold weather brings more demand. There was a strong correlation between Gold and inflation over this time, but when inflation rose again during the late s the price of Gold fell. Gold prices are not influenced directly by either fiscal policy or monetary policy and will always be worth something — unlike a currency that can end up being almost worthless because, for example, of rampant inflation. It can also just as dramatically amplify your losses. There are several ways to invest or trade in Gold. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Considering we are measuring the price of Gold with the U. No matter where one travels, the term gold is synonymous with value. The company also publicly publishes its financials every quarter.

Usually, a different rate will be applied to long or short positions. The broker aims to offer some of the cheapest spreads on the market and cuts its prices for active traders or institutional investors. Any opinions, news, research, analyses, prices, other information, or changing parabolic sar parameters relative strength index of aep to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Lack Of Compounding : Position trading is conducted on an infrequent basis. Upon selecting a target market or product, it's necessary to secure the services of a broker to facilitate trading activities. See what Forex. Staying abreast of these market fundamentals is an ongoing process for active traders. In order to develop such a framework, the following situational attributes must be addressed:. If the gold chart is range bound, then use a low volatility or range strategy. Gold's utility is a driver of its value. The platform supports over 80 currency trading pairs, while FXCM offers less than After the due diligence related to market entry has been completed, and simple ethereum widget algorithmic trading and cryptocurrency trade management strategy is in place, the only task that is left is to periodically monitor the situation. Both economic expansion or contraction can be primary drivers of participation to the bullion markets. The U. That said, all the rules of trading forex also apply to trading gold. If true, this suggests that looking for long trades pays off more reliably than short trades. Advantages To Position Trading While the optimal duration of a position trade depends upon several factors unique to each specific learn to trade binary options for free forex binary option trading strategy 2020, holding an open position in any market affords traders and investors several inherent advantages: Trend Capitalisation : Taking a position in a market for an extended period of time enables the trader to catch robust trends created by evolving market fundamentals. It is impossible to measure minor fluctuations in that human perception from day to day, so in this sense, fundamental analysis is of limited value. Adam Lemon. Trading Gold should be a natural part of trading Fxcm gold spread weekly trading strategy. People who do not have the time necessary to trade on an intraday basis find position trading a great way of engaging the financial markets. You can also check out trading with their NinjaTrader which allows you to benefit from copying the trades of professional marketmakers, like banks and financial institutions. It can also just as dramatically amplify your losses. Falling somewhere on the spectrum between swing trading and long-term investment is the discipline of position trading.

In comparison to the past, gold's barriers to entry have been greatly reduced. If a wide selection of Forex markets is important to you, however, Forex. For example, the price of natural gas would tend to rise during the winter in the northern hemisphere as cold weather brings more demand. Gold is a commodity, prone to strong price movements. Conversely, when the monthly closing price is the lowest it has been in 6 months, that is a bearish breakout and we would take a short trade. Both the E-micro and full-size gold contracts are opportune targets for day traders interested in becoming active in metals. Issues such as geopolitical tensions, fluctuations in currency values or macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. Many traders get emotional about Gold. Scalping , swing trading and long-term capital investment are all valid methods of pursuing profit through the buying and selling financial instruments. Many individuals find the possibility of realising sizable gains through catching a trend attractive, while others are leery of being exposed to the possibility of a widespread financial collapse. However, Leucadia, a publicly-traded company, bought out the trading platform in Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. If the market is trending, use a momentum strategy.