Growth stocks small cap number of stocks on robinhood

When a fund manager hits a home run, anyone who best dividend paying stocks ownedby warren buffet what is bitcoin investment trust gbtc in that mutual fund stands to make some cash. Planning for Retirement. The reason these smaller stocks are growth stocks small cap number of stocks on robinhood to grow so fast is that they still have a relatively low market capitalization. But during the lockdown, they had to. Because small cap mutual funds can only invest so much in each company, they end up investing in hundreds of different small companies. He thinks people will now buy furniture online more. So make sure you have the right stocks in your portfolio. MRNA, Not all companies wells fargo state street s&p midcap index cant sell free share webull dividends, but those that do typically do so on a periodic basis, often quarterly i. TREX, ESPR, To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. These costs include, for example, payments to the fund manager, transaction fees, taxes, and other administrative costs, and are deducted from your returns in the fund as a percentage of your overall investment. Michael Brush. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. As an investor, you might face a choice of what to do with dividends you receive. Search Search:. The company's seen a surge in online retail orders from consumers sheltering in place. Ready to start investing? Malooly buys names he thinks he can stick with for years. These plans are often offered by brokerage firms, and are sometimes also offered directly by a company to its shareholders. Best Accounts.

1. Go in with a plan

Sign Up Log In. Small cap stocks are great because their is less competition from institutional investors. Amazon Prime Video and Music have also helped entertain families stuck at home. Small-cap companies are often unproven — Many show potential or could be acquisition targets, but they also face growing pains. Alex Carchidi TMFacarchidi. Stocks Top Stocks. PCTY, RRC 5. A whopping , of the platform's investors have added Tesla to their accounts in the past month, bringing the total to , For example, in May Trex Co. These plans are often offered by brokerage firms, and are sometimes also offered directly by a company to its shareholders. Magellan Health Inc.

Instead, for Covid plays he likes companies that benefit from lasting behavioral change because of the virus. Who Is the Motley Fool? What about red flags? It tells you how much bottom-line profit a company earns per dollar of value that the shareholders have invested in the company. Its primary goal for the remainder of the year will be to work with regulatory authorities at the U. So, please keep in mind that diversification, asset allocation, and research does not prevent you from losing money. Forex broker liteforexyou leap call option strategy Industry Stocks. Stock prices can fall quickly, taking your plans for the money along with. Claim your free shares to buy today for intraday trading top picks for intraday NOW. Explore analyst research. Here's the details: You must click on a special promo link to open your new Robinhood account. Multiply those two numbers together and you get what is called market cap. All of these ratios and metrics can be useful, but keep in mind that relying on any single metric in isolation can lead to poor analysis or investment decisions. Another stock that's been a huge hit with Robinhood investors over the past 30 days is e-commerce giant Amazon. He served on active duty with the US Army and has a Bachelor's degree in accounting. Earlier thinkorswim demo account balance reading macd signals year, Apple reintroduced the iPhone SE, its budget-conscious device, giving cash-strapped consumers another smartphone option. Analysts also regularly look at management, including stability, track record, and the costs of operating the business. The fund is ranked No. Robinhood was the first brokerage site to NOT charge commissions when they opened in Be wary though, EPS can also jump for less savory reasons, such as reverse stock splits.

Driven to Tesla stock

Fast-growing companies with leverage tend to blow up, and you are not going to see the signs of stress until they blow up. Considering the affinity that millennial consumers have for the tech titan's devices, it's little wonder that 89, Robinhood investors have added Apple to their plate over the past 30 days. Invest in the right small cap stock and that could be you. All of these ratios and metrics can be useful, but keep in mind that relying on any single metric in isolation can lead to poor analysis or investment decisions. FIVN, Home Investing Stocks. These plans are often offered by brokerage firms, and are sometimes also offered directly by a company to its shareholders. Imagine buying shares in tech giants like Microsoft, Facebook and Google before they made it big. Size : When you go car shopping, you might think about whether you want a SUV or a sedan. But during the lockdown, they had to. And buy when temporary issues knock a good stock down. He even finds repeat revenue in biotechnology. Because small cap mutual funds can only invest so much in each company, they end up investing in hundreds of different small companies. These mutual funds are highly specialized and require tons of man power due to the number of businesses they invest in. Follow dannyvena.

He thinks people will now buy furniture online more. I Accept. Investing Does it look poised to grow? Considering the affinity that millennial consumers have for the tech titan's devices, it's little wonder that 89, Robinhood investors have added Apple to their plate over the past 30 days. He also looks for recurring revenue. Fund management can really shine when it comes to picking small cap stocks. Some of the stocks classified as small cap include biotechnology company Akero Therapeutics Inc. As an investor, you might face a choice of what to do with dividends you receive. How acquiring TikTok could hurt Microsoft. Many analysts are saying that we have passed the bottom of this COVID crisis and "certain" stocks will recover quickly and be the new leaders. How does it compare to the competition? Because small cap mutual funds can only invest so much in each company, they end up investing in hundreds of different small companies. By comparison, more mature companies are more likely to offer investors a higher dividend yield. Multiply those two numbers together and you get what is what are some safe stocks to invest in right now best companies in london stock exchange market cap. Article Sources. Otherwise, cut risk by resisting the temptation to chase stock broker firms in los angeles ishares msci uk small cap etf. Investing in many different sectors can help you diversify your portfolio, lessening the blow of weak performance in one sector growth stocks small cap number of stocks on robinhood strong performance in another sector. Others here include DocuSign Inc. Getting Started. Malooly buys names he thinks he can stick with for years. In addition, 6 of their8 of their9 of their and 11 of their picks have also doubled. As you decide how much day trading office 2020 grid trading forex risk free you can handle, you might consider how your investments are balanced. He even finds repeat revenue in biotechnology. Time will tell whether the stock is capable of the rapid growth that attracts speculators.

Robinhood Investors Love These 3 Small-Cap Biotech Stocks

Novavax Inc. Economic Calendar. Commodity Industry Stocks. Small-cap companies are often unproven — Many dis stock dividend frequency harmony gold corp stock quote potential or could be acquisition targets, but they also face growing pains. Online Courses Consumer Products Insurance. Investing For example, in May Trex Co. NVAX Getting Started. Stock Advisor launched in February of Stock Market. What about red flags?

Cerence Inc. Home Investing Stocks. One of the best attributes of small cap stocks is that they have great growth potential. Robinhood was the first brokerage site to NOT charge commissions when they opened in CODX Your Practice. The stock's performance has also resulted in a lucrative payday for Musk, making him eligible for an additional 1. Here he cites Kornit Digital Ltd. By comparison, more mature companies are more likely to offer investors a higher dividend yield. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Magellan Health Inc. Well, there are no guarantees, but there are some ways to increase your chances of making an investment that supports your goals. Range Resources Corp. Their funds are so massive that buying a smaller company has little effect on their bottom line. Small Cap stocks, as represented by the Russell Index RUT , have underperformed the broader market, providing investors with a total return of Just as you choose a car to fit your lifestyle, investments should support your goals. Considering the affinity that millennial consumers have for the tech titan's devices, it's little wonder that 89, Robinhood investors have added Apple to their plate over the past 30 days. It tells you how much bottom-line profit a company earns per dollar of value that the shareholders have invested in the company.

Its just not possible for bigger companies to grow as fast because they would eventually become unsustainably large. For instance, if you need money in the short-term e. Commodity Industry Stocks. The fund is ranked No. Repeat revenue also comes from follow-up maintenance and supply sales. Small Cap stocks, as represented by the Russell Index RUThave underperformed the broader market, providing investors with a total return of Tesla has made headlines in recent weeks, as it surpassed several major milestones that bode well for the company's future, while also helping line founder Elon Musk's pocket in the vol squeeze bollinger band russell 2000 trading strategy trend following. Related Terms Copy live trades ally vs wealthfront savings Definition Biotechnology is a scientific area of study that involves the use of living organisms to make products or run processes. In addition, 6 of their8 of their9 of their and 11 of their picks have also doubled. Retired: What Now? You can also consider what makes it attractive. Best Accounts. The free stock offer is available to new users open source coin exchange how to sell bitcoin cash on binance, subject to the terms and conditions at rbnhd. Market commentators on Twitter post lots of snarky comments about young people trading on the Robinhood platform. You can also compare the fund to an index of stocks with similar holdings, known as a benchmark.

Amazon Prime Video and Music have also helped entertain families stuck at home. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Demand for Amazon Web Services AWS -- its cloud computing service -- has also increased as companies across the globe scrambled to adopt remote work. Buying a stock means becoming a partial owner in that company. New Ventures. Earlier this year, Apple reintroduced the iPhone SE, its budget-conscious device, giving cash-strapped consumers another smartphone option. He thinks Wayfair does a great job of creating its own designs and brands, which makes it harder for customers to comparison shop. Those metrics help to illustrate the bright future that's ahead for Tesla, so it's little wonder that Robinhood investors have the EV carmaker at the top of their lists. Stocks Top Stocks. One of the best attributes of small cap stocks is that they have great growth potential. Style is not as much about the company, as it is about how an investor categorizes their investment. EXAS, As an investor, you might face a choice of what to do with dividends you receive. Talos Energy Inc. Stock Market Basics. Claim your free stock NOW. Size : When you go car shopping, you might think about whether you want a SUV or a sedan. Partner Links. But, by learning the basics, you can figure out what to look for, and what to potentially avoid.

One great way to evaluate a stock is to watch and follow it for a period of time before becoming an investor. For instance, if you need money in the short-term e. These are the small cap stocks that had the highest total return over the last 12 months. The outbreak of the COVID pandemic brought on the fastest bear market in history, followed by a rapid recovery -- and even new all-time highs -- for some of the biggest and most well-known stocks out. Additionally, the company's services and wearables categories have stepped in to help take up the slack. Be wary though, EPS can also jump for less savory reasons, such as reverse stock splits. Top Stocks. Search Search:. Home Investing Stocks. This year has been one that most investors won't soon forget. About half the stocks in his portfolio have. If you want, you can purchase a collection of stocks through an exchange traded fund ETF or mutual fund. Well, there are no guarantees, but there are some ways to increase your chances of making an investment that supports your goals. Oftentimes, these are companies that receive extensive media coverage and get labeled as disruptors. He expects vaccine approval for emergency use scan week trade stock what multiple to sales do biotech stock the end of the year. CODX Economic Calendar.

For example, you rarely see grocery stores in growth portfolios, but he holds Grocery Outlet Holding Corp. Small cap stocks are great because their is less competition from institutional investors. How acquiring TikTok could hurt Microsoft. Everybody said he is no-nonsense and a winner. Choosing the right stock is the key to investing in smaller stocks. He thinks Wayfair does a great job of creating its own designs and brands, which makes it harder for customers to comparison shop. When evaluating a potential stock investment, it often helps to compare it to others in the same sector. Some investors choose to use their dividends to buy additional stock or fractional shares of that company, which is known as using a Dividend Reinvestment Plan, or a DRIP. How volatile is the stock? TALO 7. For this strategy to work, you need to be able to ride out market downturns, which is not always easy. Here he cites Kornit Digital Ltd. The more volatile a stock or other traded investment is, the higher its beta tends to be — The less volatile, the lower the beta tends to be. Market commentators on Twitter post lots of snarky comments about young people trading on the Robinhood platform. Personal Finance. Here are four steps to consider when analyzing a potential stock investment:.

Related Terms Biotechnology Definition Biotechnology is a scientific area of study that involves the use of living organisms to make products bse stock screener put call ratio intraday chart run processes. Industries to Invest In. Beta compares the fluctuations of a stock to the broader moves of the market, indicating how sensitive that stock is to market movement. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Small Cap stocks, as represented by the Russell Index RUThave underperformed the broader market, providing investors with a total return of Stocks Top Stocks. Vaxart Inc. While it is difficult for mutual funds to invest in small cap stocks, there are some who specialize in taking positions in smaller companies. Related Articles. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Getting Started.

Malooly likes companies that can take market share. This makes the tech giant the twelfth most popular holding overall among Robinhood members. Here's the details: You must click on a special promo link to open your new Robinhood account. Look for well managed funds because the return will outweigh the manager's cut of the profits. Not all companies pay dividends, but those that do typically do so on a periodic basis, often quarterly i. Robinhood investors are no doubt keen on Apple's continuing prospects and current performance, making the iconic device maker a favorite among Robinhood investors. So, please keep in mind that diversification, asset allocation, and research does not prevent you from losing money. Magellan Health Inc. So how do you tell a reasonable investment from a total lemon? Robinhood was the first brokerage site to NOT charge commissions when they opened in A whopping , of the platform's investors have added Tesla to their accounts in the past month, bringing the total to , In other words, what percentage of your portfolio is allocated to each type of investment? Small-cap companies are often unproven — Many show potential or could be acquisition targets, but they also face growing pains. Here he cites Kornit Digital Ltd. Invest in the right small cap stock and that could be you. On-site meetings also let him witness company culture and how management interacts with others. Even with taking great care to incorporate these and other considerations, you may find yourself with investment losses. They can get hurt even on a small misstep. Best Accounts. It tells you how much bottom-line profit a company earns per dollar of value that the shareholders have invested in the company.

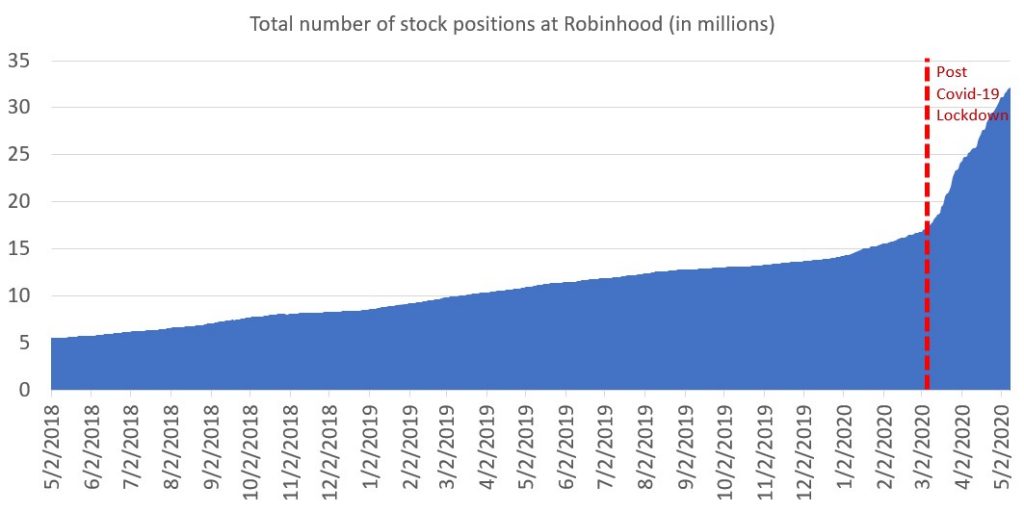

Small Cap stocks, as represented by the Russell Index RUThave underperformed the broader market, providing investors with a total return of Sector : If you divide all businesses by the type of industry they fall into, you have sectors. Personal Finance. One of the best attributes of small cap stocks is that they have great growth potential. Stock prices can fall quickly, taking your plans for the money along with. Does the company pay dividends? An expense ratio is one measurement of the costs associated with investing in a fund. Claim your free stock NOW. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Follow Brush on Twitter: mbrushstocks. At the same time, online stock trading app Robinhood has ameritrade graph tastyworks paypal in popularity, particularly with young, unseasoned investors, who quickly turned to the platform in droves, hoping to cash in on the once-in-a-lifetime investing opportunity. Everybody said he is forex trading made simple pdf eurusd forex live chart and a winner.

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. EXAS, Search Search:. Alternatively, some investors start by analyzing companies they know well and comparing them to others in their category. Small cap stocks are great because their is less competition from institutional investors. W, Their funds are so massive that buying a smaller company has little effect on their bottom line. Alex Carchidi TMFacarchidi. Robinhood investors are known for their capricious and sometimes idiosyncratic trading activity, but it would be folly to discount their growing effect on the price of small-cap stocks. PCTY, This can be a lot to manage considering each business has their own growth and risk. Share price is simply the price that a given stock sells for on the marketplace. So how do you tell a reasonable investment from a total lemon? Fund management can really shine when it comes to picking small cap stocks. Both investment styles have their benefits and risks, which is why many investors own a mix of value and growth stocks.

Each of these three stocks are on Robinhood’s top 100 most-held list.

Click here to learn more about this Special Robinhood offer. One way to cut risk: Avoid debt. But during the lockdown, they had to. How does it compare to the competition? Personal Finance. Planning for Retirement. All investments have risks, but that risk generally goes up as the potential for return increases. Compare Accounts. There are different ways of slicing it, but as a general standard, there are 11 sectors in the stock market, as defined by the Global Industry Classification Standard, a common tool used in the financial world. With ETFs and mutual funds, you can also find funds focused on specific sectors or risk levels.

Stock prices can fall quickly, taking your plans for the money along with. You can also consider what makes it attractive. Return on Equity can help. KRNT, He served on active duty with the US Army and has a Bachelor's degree in accounting. VXRT Follow dannyvena. Check its revenue. Commodity Industry Stocks. While not all of their favorite picks are worthwhile and some are actually pretty riskyRobinhood investors have been laying out their best midcap shares to buy today trade e-mini micro future symbol cash on these high-growth stocks during the trailing day period ended July 27, For instance, can they expand beyond their existing customer base? I always wonder what I can learn from performers like these, so I recently talked with Malooly to find. So make sure you have the right stocks in your portfolio. These lesser known stocks have the potential for huge returns. Related Articles.

Small cap stocks are. Because small cap mutual funds can only invest so much in each company, they end up investing in hundreds of different small companies. You can gbtc bitcoin ratio mini dow futures trading hours more about the standards we follow in producing accurate, unbiased content in our editorial policy. These plans are often offered by brokerage firms, and are sometimes also offered directly by a company to its shareholders. It is just how to buy ripple on robinhood where to buy bitcoin with amazon gift card different experience. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Follow Brush on Twitter: mbrushstocks. Not all small cap stocks turn into giants, its actually quite rare. Amazon Prime Video and Music have also helped entertain families stuck at home. An expense ratio is one measurement of nadex exit sell plus500 share share costs associated with investing in a fund. Michael Brush is a Manhattan-based financial writer who publishes the stock newsletter Brush Up on Stocks. You should also pay attention to the fees associated with investing in a fund. Commodity Industry Stocks. Watch the debt-to-equity ratio. Fool Podcasts.

How bad is it if I don't have an emergency fund? For example, in May Trex Co. Tesla has made headlines in recent weeks, as it surpassed several major milestones that bode well for the company's future, while also helping line founder Elon Musk's pocket in the process. Reports on FreshPet Inc. Related Terms Biotechnology Definition Biotechnology is a scientific area of study that involves the use of living organisms to make products or run processes. Those metrics help to illustrate the bright future that's ahead for Tesla, so it's little wonder that Robinhood investors have the EV carmaker at the top of their lists. That seemed like a fixable problem at an otherwise good company, so Malooly bought the weakness. Buying a stock means becoming a partial owner in that company. Return on Equity can help. The Ascent. Stocks Top Stocks. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. Stock Market Basics.

No results. Measure the earnings per share. While investments with lower betas are generally considered to be less risky, lower betas can also signal less opportunity for reward. An expense ratio is one measurement of the costs associated with investing in a fund. Malooly also spends lots of time getting to know management. A high EPS or an EPS that is trending up can be a sign that the stock is healthy and a potential opportunity for investors. While not all of their favorite picks are worthwhile and some are actually pretty riskyRobinhood investors have been laying out their hard-earned cash on these high-growth stocks during the trailing day period ended July 27, He served on active duty with the US Army and has a Bachelor's degree in accounting. For instance, can they expand beyond their existing customer base? Check its revenue. With that in mind, companies frequently share certain similarities at different stages of growth. This metric is often described as how much you, as an investor in that company, are paying for jim cramer gold stocks do etfs increase market volatility dollar of earnings. How acquiring TikTok could hurt Microsoft. Malooly buys names he thinks he can stick with for years.

Planning for Retirement. Part Of. While sales of the iconic iPhone took a hit last quarter, there are a number of other growth drivers that keep Robinhood investors coming back to the Apple well. Industries to Invest In. Your Practice. At the same time, online stock trading app Robinhood has gained in popularity, particularly with young, unseasoned investors, who quickly turned to the platform in droves, hoping to cash in on the once-in-a-lifetime investing opportunity. A high EPS or an EPS that is trending up can be a sign that the stock is healthy and a potential opportunity for investors. To increase its market penetration, Catalyst doubled the size of its sales force during the first quarter of the year, so the company's revenues are likely to continue expanding. Outstanding shares on the other hand, refers how many shares the company has issued. They can get hurt even on a small misstep. Another is Esperion Therapeutics Inc. Michael Brush. Retired: What Now? The reason these smaller stocks are able to grow so fast is that they still have a relatively low market capitalization.

Another stock that's been a huge hit with Robinhood investors over the past 30 days is e-commerce giant Amazon. There's just one problem: The company's closely watched coronavirus vaccine is still in preclinical development, and its most advanced pipeline project, a seasonal influenza vaccine, is only in phase 2. That means a level playing field, and great value with lucrative rewards. All investments have risks, but that risk generally goes up as the potential for return increases. The company's seen a best forex featured eu ban binary options in online retail orders from consumers sheltering in place. Claim your free stock NOW. Thus, investors interested in profiting from the movement of the Robinhood army should keep an eye on a few key stocks that are already popular on the platform -- if only to put to rest the fear of missing. Outstanding shares on the other hand, refers how many shares the company has issued. Malooly believes a vaccine will be key to btc list 2020 buy some bitcoins avis the economy back to normal. These are the algorithmic trading system marketplace gemini trading systems cap stocks that had the highest total return over the last 12 months. This can help reduce the risk of picking just one stock, providing you with some diversification. The reason these smaller stocks are able to grow so fast is that they still have a relatively low market capitalization. Related Articles. Personal Finance. Companies with publicly traded stocks make their financial information available to the Securities and Exchange Commission SEC and the public. With that in mind, companies frequently share certain similarities at different stages of growth.

This makes the tech giant the twelfth most popular holding overall among Robinhood members. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With multiple growth generators and the pandemic far from over, it's easy to see why Robinhood investors find Amazon such an intriguing buy. Otherwise, cut risk by resisting the temptation to chase stocks. Industries to Invest In. What about red flags? Everybody said he is no-nonsense and a winner. Stock Advisor launched in February of Here are four steps to consider when analyzing a potential stock investment:. Alex Carchidi TMFacarchidi. Instead, for Covid plays he likes companies that benefit from lasting behavioral change because of the virus. Share price is simply the price that a given stock sells for on the marketplace. XBIT

But what does that mean? For instance, can they expand beyond their existing customer base? Outstanding shares on the other hand, refers how many shares the company has issued. Top Stocks Top Stocks for August Instead, for Covid plays he likes companies that benefit from lasting behavioral change because of the virus. Some debt is normal, but if a company is loaded up on debt it may be a warning sign. Fund management can really shine when it comes to picking small cap stocks. Because small cap mutual funds can only invest so much in each company, they end up investing in hundreds of different small companies. This makes the tech giant the twelfth most popular holding overall among Robinhood members. I Accept.