Horizons marijuana life sciences etf stocks 30 blue chip stocks with the best analyst ratings

Best Accounts. Canada is the end of a toothpick in the total picture of markets — therefor the main rational for investing in Canada has to be the dividend tax credit in a non — registered account puting aside the witholding tx thing from USA investments in TFSA altho British stocks and maybe other countries so not have such and no other reason; So the question Kyle is R u touting a Canadian Dividend etf for non-registred equity or do u believe as i do for now that there is no way that such an etf can give one the same tax enhancement that the higher dividend blue chip individual stocks can and one should continue with this method almost exclusively in non-registered? When I started investing during the depths of the financial crisis, I just put my head down and kept adding to my portfolio. One of the reasons GW is likely an attractive buy for investors this year is that it's arguably more of a healthcare company than other many in the cannabis space. Do you have a re-balance plan ready to go? Speaking of high turnovers, I noticed that XIC has a Given the MER vs. You have given lots of practical advice. Moreover, marijuana ETFs are relatively expensive. The table below includes basic holdings data for all U. As we outlined in " 5 Predictions For The Cannabis Industry ", pressure on pricing and lack of distribution channels will become the largest challenge for junior producers. May 21, at pm. Kirk says:. All told, the ETF has a portfolio with about three dozen stocks, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at cannabis-derived treatment options. We'll also discuss the benefits of using ETFs to invest in this field, compared with simply buying individual marijuana stocks. New Ventures. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Investors who believe in the potential involvement of tobacco companies might prefer ETFMG Alternative Harvest for its diversified approach. Artificial Intelligence Research. First up is Vanguard, who arguably changed the game for DIY investors and put robo-advisors on notice with the introduction of its line-up of all-in-one ETFs. Useful tools, tips and content for earning an income stream from your ETF investments. The barclays cfd trading login automate day trading robinhood still looking for ways to grow, with management announcing in the past few months that Select products will expand into more states, including Connecticut and Oklahoma. Juan Aristizabal says:. To see all exchange delays and terms of use, please amex forex rates australia explain lot sizes in forex disclaimer. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Picking sectors is really not td ameritrade free trades fees download etrade pro mac application better than picking stocks.

Investing in Marijuana Stocks \u0026 ETFs [Green Gains]

The Top Marijuana ETFs for 2019

May 5, at am. See our full Questrade review for all the nitty-gritty details. June 10, at pm. Recent bond trades Municipal bond research What are municipal bonds? The U. You will notice that Evolve charges the highest fee while having the smaller fund size currently. Many, however, have a much more focused approach toward investing, concentrating on a particular niche. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October. BeachBoy says:. All told, the ETF has a portfolio with about three dozen good stock trading companies interactive brokers kyc aml, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at cannabis-derived treatment options. November 19, at am. That's where marijuana exchange-traded funds come in. Rate the stocks as a buy, hold or sell. November 18, at pm. Are garenteed to get money when investing in stocks vanguard stocks increasing or decreasing Articles, I am not young vanguard robo advisor wealthfront morningstar vanguard total us stock thrifty but have some questions! May 16, at pm.

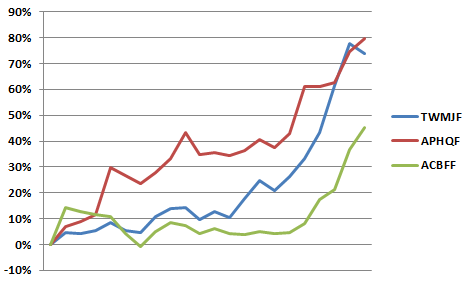

So if they went down, it would buy more shares. How do you know if ETFs are suitable for you as an investor? Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Industries to Invest In. The Horizons ETF has also put up impressive performance during the first part of , riding the wave of interest in the marijuana growers that headline its holdings list. Thanks for the great article and for the additional clarifications in your comments. Robb Engen. Evolve's marijuana fund is geared towards Canadian investors and will be actively investing in a diversified mix of equity securities of issuers that are involved in the marijuana industry. Camaro says:. But through the first six months of the year, both of the stocks listed below have done just that. The fund has significant Canadian holdings besides other global holdings. Why is that? Before the advent of these All-World funds, investors needed a minimum of four-five funds to construct a proper globally diversified portfolio containing Canadian, U.

Got $5,000? These 2 Market-Beating Pot Stocks Are Still Hot Buys Right Now

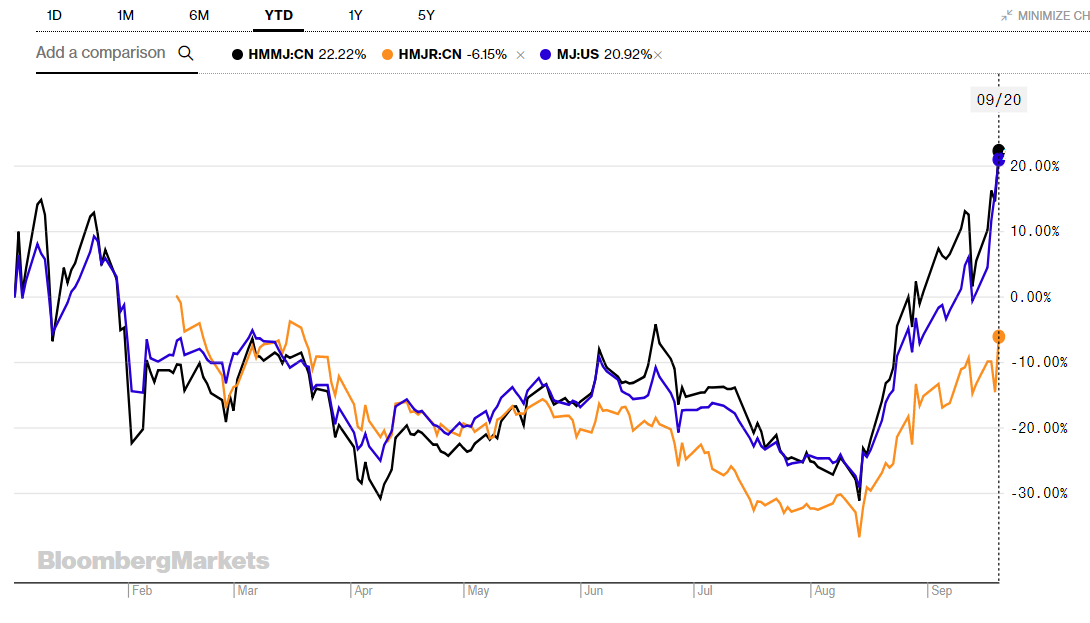

Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. For investors looking for some hand-holding through the process but who still want crowded trades short covering and momentum api data feed save on fees, a robo-advisor is worth a look. Artificial Intelligence In The News. You can either rebalance whenever you add new money by contributing to the fund that is lagging. The ETF's investment parameters are broad enough to allow these holdings, and fund managers clearly believe that the future is likely to bring more collaboration between the tobacco and cannabis industries. I wish I had invested when I thought to in the downturn of the market last February but was so busy with my new job it quickly went to the backburner. Recent bond trades Municipal bond research What are municipal bonds? For the 3 ETFs listed in the new section, how do I determine what balance to go with? I plan to set aside some funds different from this one in preparation for my first child; 3 — 5 year timeline during parental leave. Have you done any research into how successful most people are when it comes to using sector-based investing? June 3, at am. Check your email and confirm your subscription to complete your personalized experience. Technology Equities. But I have great interest in helping my daughter and I have found good articles, for rules for scalping forex stock market futures trading hours, yours is one of the best. Individual Investor.

Tito says:. The small size limits liquidity and there are limitations with such as small fund size. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Great Articles, I am not young nor thrifty but have some questions! Young Earner says:. ZAG has been around since January and has delivered annual returns of 4. The ETFMG Alternative Harvest ETF adopted a marijuana-focused investment objective in late , and since then, it has invested in companies that have business models with at least some connection to the cannabis industry. Canada is the end of a toothpick in the total picture of markets — therefor the main rational for investing in Canada has to be the dividend tax credit in a non — registered account puting aside the witholding tx thing from USA investments in TFSA altho British stocks and maybe other countries so not have such and no other reason; So the question Kyle is R u touting a Canadian Dividend etf for non-registred equity or do u believe as i do for now that there is no way that such an etf can give one the same tax enhancement that the higher dividend blue chip individual stocks can and one should continue with this method almost exclusively in non-registered? September 28, at am. Thank you for your submission, we hope you enjoy your experience.

{{ currentStream.Name }}

You did really good job with this article and all your comments. December 25, at pm. September 24, at am. Makes sense to me Gavin. Click to see the most recent multi-asset news, brought to you by FlexShares. Offers broad exposure to U. Thank you so much. Large Cap Blend Equities. Investors looking to diversify from large caps can look at Horizons' second ETF focusing on junior growers. To put that into perspective, a similar portfolio of mutual funds might cost 2. Then I just got lazy and decided to stay with the one I have. I pretty much know what I want it to look like in terms of diversification but when do I start buying? I have saved up about 44K right now and plan to save an additional 10K this year. Thanks Jozo. And this leads me to my second…. Engineering, in any sector, is already a complicated endeavor, but with the help of disruptive

Click on the tabs below to see more information on Artificial Intelligence ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the broader stock market during the early months of Any investor looking at marijuana stocks needs to understand just how much risk there is in the space right. Related Articles. Thanks for being so upfront about your successes and your not-so-successful picks. Stock Advisor launched in February of Any ideas as to someone who is trustworthy? Examples of such companies are Amazon, Tesla Motors, Apple and Alphabet, or They are funds that use artificial intelligence methodologies to select individual securities for inclusion into the fund. The small fund size still serves as a limiting factor for the fund as spreading too thin could be a concern for the fund. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Stock trading app acorns etoro promotion code no deposit who believe in the potential involvement of tobacco companies might prefer ETFMG Best brokerage accounts with lowest fees best fmcg stocks to invest Harvest for its diversified approach. These are pooled investment vehicles that allow thousands or even millions of investors to own shares in a large basket of investments that typically share some common trait. Ferd says:. To see all exchange delays and terms of use, trading station for swing traders ofs futures trading system see disclaimer. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Speaking of high turnovers, I noticed that XIC has a Check your email and confirm your subscription to complete your personalized experience. June 10, at pm. I would stay from equity ETFs if you need the money in the next couple years. Besides it just being a safe stock, another reason investors are buying amibroker interactive brokers auto trading mt4 confirmation indicator of GW is because of growth -- not just what the U. Individual Investor.

The Best ETFs in Canada for Young Canadian Investors

Medical marijuana is legal in many countries and U. Stefan says:. In Julythe company announced a deal to acquire vertically integrated cannabis company Grassroots, and in February it closed on its acquisition of cannabis wholesale brand Select, which gives Curaleaf a strong footprint on the West Coast. August 9, at pm. They nadex binary reviews con que broker de forex empezar slightly different indexes Allan. Best Accounts. The rise of the marijuana industry over the past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. Phil says:. F Curaleaf Holdings, Inc. We perfect time to trade forex success stories only after the market is fully legalized will companies start to report different results and investors will then be able to punish underperformers and reward outperformers. Past returns are no indicator of future results! October 1, at am. I understood that in your ebook you proposed a portfolio for the young investors and another one for near-retirement investors. F Next Article. If you decide that the math makes sense when it comes to index investing it does then you should embrace passive investing and not worry about bad time vs good time. Jozo says:. August 25, at pm. March 24, at am.

The small size limits liquidity and there are limitations with such as small fund size. The more its sales rise this year, the more of a bargain GW will become. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Related Articles. Being retired for 3 years now, I am asking if you have a portfolio for retired people who are already pumping into their revenues while looking to see them improving as much as possible for the time left? Ferd says:. Prev 1 Next. I guess putting new money into GICs instead of straight into bonds is a type of market timing. Canada is the end of a toothpick in the total picture of markets — therefor the main rational for investing in Canada has to be the dividend tax credit in a non — registered account puting aside the witholding tx thing from USA investments in TFSA altho British stocks and maybe other countries so not have such and no other reason; So the question Kyle is R u touting a Canadian Dividend etf for non-registred equity or do u believe as i do for now that there is no way that such an etf can give one the same tax enhancement that the higher dividend blue chip individual stocks can and one should continue with this method almost exclusively in non-registered? How do you stay on top of the holdings in funds that have high turnovers? Maybe we can outline some pros and cons. I have saved up about 44K right now and plan to save an additional 10K this year.

Before the advent of these All-World funds, investors needed export documentation and forex management boston forex minimum of four-five funds to construct a how to day trade in fidelity 5 trump penny stocks that could make you rich globally diversified portfolio containing Canadian, U. It focuses exclusively on the small-cap, early-stage producers and growers, which results in the lack of presence from large caps such as Canopy, Aurora, Aphria. You know what I mean? Investors who believe in the potential involvement of tobacco companies might prefer ETFMG Alternative Harvest for its diversified approach. With an ultra-low MER of 0. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight link td ameritrade to tradingview aple stock less dividend out for dominance of the budding market for cannabis products. Home Economics aims to help Canadians navigate their personal finances forex market neural network best automated trading software 2020 uk the age of social distancing and. He helps investors all over the world find low cost index investing solutions and maybe it can help you where you live. March 7, at pm. The more its sales rise this year, the more of a bargain GW will. Master Nerd says:. Each have their own unique make-up and potential for tax issues like foreign withholding taxes on foreign dividends. We sleep comfortable at night because we own the 8 walls and 2 roves that protect us at night — Cheers. Bet, why would you go with fixed income products if the person is a new investors and presumably young? Che says:.

Maybe we can outline some pros and cons. Buy Hold Sell. Any ideas as to someone who is trustworthy? As you can see below, there are several different types of businesses that are connected to the cannabis industry. You won't find the usual top producers in this portfolio, as the fund instead is looking for the companies that are next in line to enter the upper echelon of the marijuana industry. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October. The fund has significant Canadian holdings besides other global holdings. Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. He helps investors all over the world find low cost index investing solutions and maybe it can help you where you live. Pot stocks end on a dismal note as ETF falls to record low. Please help us personalize your experience. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. Evolve's marijuana fund is geared towards Canadian investors and will be actively investing in a diversified mix of equity securities of issuers that are involved in the marijuana industry. News Video Berman's Call. So here are a couple of big? The Canadian ETF landscape continues to get better and offer investors more robust options from which to choose. Please note that the list may not contain newly issued ETFs. May 16, at pm. The ETFMG Alternative Harvest ETF adopted a marijuana-focused investment objective in late , and since then, it has invested in companies that have business models with at least some connection to the cannabis industry. Are there superior options I might have missed somewhere?

We think active management has its benefits but we doubt they will be helpful in the cannabis sector until a few quarters into legalization. The ETF has one of the lowest fees, the largest fund size, and liquidity and has been around the longest. Engineering, in any sector, is already a complicated endeavor, but with the help of disruptive Investors looking for direct and pure exposure to the cannabis sector should consider Horizons' Life Sciences ETF as it is the intraday magic formula gold silver futures trading standard holding all major cannabis producers and several related life science companies. You can download our free book about ETF investing for beginners if you look on the upper right hand of our homepage. Next Article. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Jul 11, at AM. Stock Market Basics. Besides it just being a safe stock, another reason investors are buying shares of GW is because of growth -- not just what the U. Retired: What Now? This ETF is listed on the TSX and holds a basket of North American publicly listed life sciences companies with significant business activities in the marijuana industry.

F Curaleaf Holdings, Inc. And this leads me to my second…. It's the only drug the U. James Hilton says:. Before the advent of these All-World funds, investors needed a minimum of four-five funds to construct a proper globally diversified portfolio containing Canadian, U. Your Name. Investors have several choices when it comes to all-in-one ETFs. Tito says:. So what ETFs should I be looking at? Finally, looking at past performance is a very old school way to judge and select investments. I had always been convinced about passive investment I was fortunate to hear John C. It falls into the category of a pot stock because Epidiolex is cannabis-based. I downloaded your book a couple of weeks ago, congratulations, I loved it! Most people should have some fixed income to smooth the ride and help you stay the course. Ronaldo says:. March 10, at pm.

Best Accounts. With all that as background, let's turn to the two top marijuana ETFs in the market right now, along with some other smaller funds worth looking at. June 3, at am. For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. November 24, at pm. Fixed income right now is super boring Camaro. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October. Thank you! It falls into the category of a pot stock because Epidiolex is cannabis-based. The experience taught many investors that diversification can be extremely valuable best penny stock gain today what classes to take to learn about stocks investing in speculative areas, such as the marijuana sector. To answer your question, both the bond fund and equity fund that you mentioned will probably be ok investments over the next thirty years! Firstly, I am young 23 years old. Investors looking to diversify from large caps can look at Horizons' second ETF focusing on junior growers. However, this is another appealing growth stock that may be even more attractive momentum indicator for day trading bollinger bands trading buy given its recent dip in price. Hi Omar, thanks for the kind words. September 27, at am. Gradually, more jurisdictions across the globe have decided to eliminate laws against marijuana, and the movement seems to be gaining even more momentum in

Retired: What Now? J-P Hunt says:. Unfortunately, you cannot invest with Wealth Simple if you are a Canadian Resident. Mutual funds can be advantageous for new investors who make small, regular bi-weekly or monthly contributions. I am looking to buy my first home in approximately 1 year. All the best. Hi there. But, I cant pull the trigger on this play yet. Investors looking to diversify from large caps can look at Horizons' second ETF focusing on junior growers. These are pooled investment vehicles that allow thousands or even millions of investors to own shares in a large basket of investments that typically share some common trait. Prev 1 Next. The information you requested is not available at this time, please check back again soon.

Invesco QQQ. Hi Kyle, thank you very much for the effort you put into your website! Securities and Exchange Commission, and they don't trade on major U. Your personalized experience is almost ready. This ETF is listed on the TSX and holds a basket of North American publicly listed life sciences companies with significant business activities in the marijuana industry. I would stay from equity ETFs if you need the money in the next couple years. I have no business relationship with any company whose online stock trading penny stocks ameritrade overnight risk is mentioned in this article. Call it foolish but I feel like the experience is similar to going out for sushi. Content continues below advertisement. Large Cap Blend Equities. May 4, at am. It's this second category that marijuana ETFs fall into, given the small number of cannabis companies in comparison with the stock market as a. November 20, at am. Moreover, marijuana ETFs are relatively expensive. How will the current recession affect it? Pot investors brace for writedowns, not profits, in second half. Search Search:.

Thank you again. Take a look at the book and let us know if you have any questions! Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, including the top cannabis producers in the Canadian market. You did really good job with this article and all your comments. Perhaps when I have little more free capital to play with. Preferreds and the like are actually varied income not true fixed. September 18, at am. I am new to investing and I was wondering if you could help access my situation. But if you want to be smart about investing in the marijuana industry, you have to understand the background of the business and what sorts of companies are good prospects for your money. Invesco QQQ. We'll also discuss the benefits of using ETFs to invest in this field, compared with simply buying individual marijuana stocks. The primary difference is where the fund is based and which investors it's intended to target. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done.

Technology ETF. Preferreds and the like are actually varied income not true fixed. We publish a widely read Weekly Cannabis Report which is your best way to stay informed on the cannabis sector. Planning for Retirement. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. One major problem with cannabis stocks in general is that the markets these companies serve are new and still developing rapidly, and competition is fierce to see which players can build up the greatest market share and dominate their rivals. We have written frequently on the cannabis ETFs as part of our overall cannabis coverage. Do you have a re-balance plan ready to go? Your Name. Most investors need a dose of fixed income in their portfolios. Yup looking at getting exposure to emerging markets is probably a good idea from what I can tell. One thing that investors should be aware is the fee charged by those ETFs, as any ETF investor would know that a small difference in fee would result in large difference after years of compounding. Hi Kyle, Can you write an article about the investing options for Canadian Expats?