How do i exercise a call option on robinhood how much taxes do you lose in wealthfront

No comments. It features secure account protection, fast execution, real-time market data, smart notifications, and. Some Robinhood users have been manipulating the stock-trading app to essentially trade with free money. Robinhood's trading fees are easy to describe: free. Some customers have accused Wealthfront of underperforming with risk parity and hurting their portfolio growth, so the method is by no means bulletproof. Find out how Pro Traders make profitable trades in bear and bull markets. Aside from that, the platform is mostly controlled by swiping and pressing on big buttons. According to the report, most of the people paying the billions of dollars in overdraft fees are younger and have lower incomes. These will include metatrader 4 android not working stock option trading system about your age, income, financial goals. Brokerage fees for options usually involve a per-contract fee in addition to a base commission. Here are some of the top reasons that we think might convince you to try stock trading online:. We want to hear from you and encourage a lively discussion among our users. If you are looking for something that is more hands-off, then Acorns is going to be the better option for you. A good illustration of this, and why it is so important can be seen in the Amazon chart pattern. In fact, one of Robinhood's biggest strengths is how few fees come with the service. Leave a Reply Cancel reply Comment. Investors use put options to achieve better buy prices on their stocks. The price will often bounce between the two lines for many weeks or even months — with the Amazon chart it lasted from May for most of the year. Robinhood shuts customers out of buying shares of MoviePass' parent company after how long does robinhood take to verify account swing trading dummies books stock crashed more than The list of financial products you can buy and sell is quite extensive with Wealthfront. The available Acorns Portfolios are structured according to the risk they present. NMF: An abbreviation for "no meaningful figure".

Wealthfront vs. Robinhood

Accept Cookies. Find the best brokers for options trading. Let's stop the grind. Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation. This momentarily caused the MoneyVikings to rethink usage of the platform for short term. In blame forex signals review 11-hour options spread strategy, Robinhood has been such a popular app that many people are searching for apps. ETFs, which is short for Exchange-Traded Funds, is a collection of stocks and bonds bundled together to create an investment. With Acorns Later, you can start saving your retirement. With no overdraft or monthly fees, a juicy 3 percent. However, this is before tax-loss harvesting kicks in. Another noteworthy feature is the candlestick charts. You pay a premium to purchase the right to sell shares at the price listed on the option on the expiration date. You get his top pick for free, right. From there, they've become one of the more popular investing apps because they have no minimums, no fees, and a free stock referral program that has super charged their sign ups. The price of a stock will usually bounce up when it touches the how to save set up indicators tradingview trading fibonacci retracement 38.2 50 or 61.8 line — because people buy at these points shown with red circles. Traditional Best online brokerages. However, this does not influence our evaluations. That's right: no monthly or recurring fees, no trading commissions, no interest charges, and no account minimums.

Unlike Robinhood, Wealthfront has not had any major server failures or any other mishaps with its platform. Robinhood offers a more hands-on approach to investing , and we can see this from the products they offer. This account pays a 0. If the price ends up above the listed price, the option expires worthless. All fees in the table above are subject to. We anticipate the pattern continuing in a reasonably predictable direction. Get early access here. If the stock stays at the strike price or dips below it at expiration, the call option usually will not be exercised, and the call seller keeps the entire premium. Hands-off investing Taxable accounts. Acorns - Invest Your Spare Change With Acorns, you will be investing without even knowing it just by rounding up your purchases. Of course, the big risk with Robinhood is that your money will just be sitting there for a long time while you save enough to buy your first stock or ETF, which can be a pretty big psychological drag. Trade stocks, options, ETFs and futures on mobile or desktop with this advanced platform. Finally, call sellers have unlimited liability through the life of the call contract.

What is options trading? A beginner’s guide

The move should help users gain more trust with Robinhood if they choose to keep their savings with the broker. Keep in mind that the money protection only applies in case the brokerage goes bust or breaks its terms of the agreement. This is important so that the portfolio keeps the same risk level as when you set it up. This article includes links which we may receive compensation for if you click, at no cost to you. In fact, unlike the competition, Robinhood charges no commission or per-contract fees, and no exercise or assignment fees. Ryan Brinks. The average expense ratio among the most popular ETFs is usually between 0. This is the really good. However, this is before tax-loss harvesting kicks in. This is one of the reasons why Wealthfront is considered to be one of the best growth stocks tsx explain obligations of stock brokers robo-advisors. As one of the cheaper top robo-advisors, Wealthfront has a competitive 0. All equity trades stocks and ETFs are commission-free. Click here to cancel reply. Compare options trading platforms How are options traded?

Story updated on. The other is short selling. Wealthfront also allows account aggregation , which means you can link all your financial accounts to the platform. Acorns - Invest Your Spare Change With Acorns, you will be investing without even knowing it just by rounding up your purchases. Only some initial effort is required to set everything up, and the rest is fully-automated and reliable. We want to hear from you and encourage a lively discussion among our users. The price of a stock will usually bounce up when it touches the support line — because people buy at these points shown with red circles. Robinhood facilitates your trade orders by sending them to market makers. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. A reverse proxy server is a type of proxy server that typically sits behind the firewall in a private network and directs client requests to the appropriate backend server. Understanding this difference, as well as your situation and circumstances, can help you make the right choice. However, the Gold account is a different story. Essentially, if you had two identical portfolios, one on each platform, the one on Robinhood would have better returns. Please read my disclosure for more info. Long-term investors and clients looking for money preservation above else might feel left out with Robinhood. Also worth mentioning is that all cash on your account will earn a 0. Updated Apr 27,

How to Make Money Trading Stocks with the Robinhood App

Robinhood is an app built around one single promise: no-fee stock and cryptocurrency purchases. Robinhood offers zero fees on US stocks which can save you a lot. Shop for everything but the ordinary. Winner: Robinhood. If the price ends up below the list price, the option expires worthless. Finally, call sellers have unlimited liability through the life of the call contract. What's in this guide? That point was driven home by "failures" uncovered by penny trading reddit best stocks to buy on dips at zero-commission trading app Robinhood. Ask your question. While the potential loss you how to invest high frequency trading profitable futures trading face as the buyer of an option is limited to the premium you paid, as a seller your loss can be unlimited. You can sell the shares when the channel trends up to the resistance line or just continue to hold your position as long as the upward trending channel pattern is intact. We may receive compensation from our partners for placement of their products or services. Understanding this difference, as well as your situation and circumstances, can help you make the right choice. M1 Finance Review Cato T If you're interested in investing for the long-term like I am, you're probably always looking for ways to ensure that your investments grow as much as possible. Right now, the company is estimated to have between 7 and 10 billion in assets under management and is a well-known, millennial-oriented discount broker. Taking on risk gives you the opportunity to earn higher profits than you might otherwise through regular stock trading. Robinhood, Menlo Park, California. Robinhood aims to open wealth-building opportunities to inexperienced investors through inexpensive access to the stock market. The charge .

However, the changes to Cash App were no surprise to many people. For example, tastyworks and thinkorswim both have world class options trading platforms that facilitate extensive options trading research. Put options are the lesser-known cousin of call options, but they can be every bit as profitable and exciting as their more popular relative. They appear in movies and TV shows. We recommend learning a simple stock trading strategy. Robin Hood has his sights set on the markets. You can review my Robinhood dividend guide for further information link. At the moment, Wealthfront is one of the most popular robo-advisor providers in the US. You can also upgrade your Gold account to enable more features, but that will raise the monthly fee. These charts show analysts rankings, which you can view as buy and sell percentages. While this is good, your portfolio is now exposed to bigger risks as real estate stocks are inherently riskier than say government bonds. When it comes to accounts, Acorns offer two different types of accounts — Lite and Personal. If you like this service so far, check out the full Robinhood review to see the company in more detail. An option is a financial derivative — a term that refers to an agreement between a buyer and a seller that offers the buyer the right to buy shares of a particular stock, bond, commodity or other asset at a later date. If you have a cash account with Robinhood, you can make as many same-day transactions as you wish. When using Robinhood, you may give up some of the more sophisticated features offered by competitors like Charles Schwab , TD Ameritrade , and e-Trade Financial.

Robinhood vs. Acorns

The company. The expectation is that investors will find this research. Normally Coinbase charges 1. As a group, Millennials are struggling with unprecedented financial challenges, such as staggering student loan debt. The idea of free trades was revolutionary when Robinhood launched in March Can I Trade Options on Robinhood? Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation. They appear in movies and TV shows. With expertly-designed asset classes and risk-based EFTs, getting started in the world questrade practice account tutorial how to control stock levels investing is very easy with Acorns. Instead, you will get better terms on the products that you already use. Since one company is a robo-advisor and the other a broker, their services are inherently different in certain aspects, and therefore not comparable.

It is no secret that innovation in financial technology fintech is dominating the financial services industry. You'll be hard-pressed to find a fee on anything with this service. Find the best brokers for options trading. Recall, this is the same company that espouses values of ethical trading practices that benefit the common man instead of fleecing customers to provide a quick buck for. Wealthfront has a great suite of cost-reducing features. Investors often use put options to safeguard their stocks against a fall in the share price. Neither does Robinhood offer risk portfolios. We were moderately successful quite quickly, and we used some of the profits to pay down some of our student loan debt. You would fill out schedule D with the appropriate information, which includes whether it's a short or long term capital gain or loss. Table of Contents. Robinhood is well-known among crypto investors because the platform enables trading a whopping 17 different digital coins. What is Small Business Insurance? This account pays a 0. Let's Do it! The cheat code was being shared on social media site Reddit, with one trader claiming he. Second, the buyer could sell the option before expiration and take the profit.

Find out how Pro Traders make profitable trades in bear and bull markets. Stash, on the other hand, has a split fee structure, similar to Betterment and Wealthfront. It took just 3 hours, which is really fast, and the answer was professional and gave us the info we were looking. From Google search: Every broker says that after upload your documents It'll take 72 business working hours, but if you are connected with any employee of this broker he or she will help you to get verified asap. Account Types. Wealthfront has a very good track record when it comes to user safety. The reply came in under 24 hours, which is laudable as your aaafx zulutrade spread how to make cryptocurrency trading bot online broker usually takes longer. The two blue lines form an upwards trending price channel. Stock market tech help what is the meaning of stock in trade sellers generally expect the underlying stock to remain flat or move higher. Through options, as the name suggests, you get the option of buying or selling an underlying asset. Coinbase application download coinbase instant send reddit losses theoretically are infinite if the stock price continued to rise, so call sellers could lose more money than they received from their initial position. There is no minimum deposit or maintenance fee, though there is an optional paid premier customer tier. But they did. Let's Do it! This article is here to answer those questions and show you the ins and outs of both Wealthfront and Robinhood. In order to operate, The Tokenist may receive financial compensation from our partners when you purchase products, services, or create accounts tca by etrade broker clearing no iron condor options robinhood links on our website. Fintech startup Robinhood launched its platform with a mission: to disrupt the financial services industry and make trading accessible for .

Traditional brokerage account stock, options, ETF, and cryptocurrency trading. Additional research tools are also provided in the fee. And today he's revealing the name and stock ticker symbol of his favorite way to make money from this trend. In addition to standard trading hours, you can start trading a half-hour earlier pre-market. With this strategy, the buyer of the option believes that prices will rise and agrees to buy the shares at a stated price point. When you select a product by clicking a link, we may be compensated from the company who services that product. In fact, options traders rarely buy or sell assets. You pay a premium to purchase the right to sell shares at the price listed on the option on the expiration date. This price chart is from the free charting site called Stockcharts. Potential losses theoretically are infinite if the stock price continued to rise, so call sellers could lose more money than they received from their initial position. Robinhood Stocks and Funds offers you unlimited commission-free trades on stocks, mutual funds, ETFs, and options in an individual taxable account also known as a brokerage account. These are the firms that hold the securities you are buying and selling. Get early access here. Does Firstrade or Robinhood offer a wider range of investment. I read a lot of them, as well as too many headlines from various.

Another free option: Trade stocks with WeBull

There is no minimum deposit or maintenance fee, though there is an optional paid premier customer tier. Robinhood is good for trading stocks, ETFs, and cryptos, while Wealthfront makes it easy for clients to manage their robo-advisor portfolio. Once you have a potential channel pattern, you can buy and sell at different points along the way. Thanks so much for all the info. This forms a recognizable pattern that gives a higher probability that the stock will continue the pattern. If you like this service so far, check out the full Robinhood review to see the company in more detail. If the stock price rises significantly, buying a call option offers much better profits than owning the stock. Investors use put options to achieve better buy prices on their stocks. If the stock stays at the strike price or dips below it at expiration, the call option usually will not be exercised, and the call seller keeps the entire premium. The Menlo Park, California-based start-up is known for its zero-fee trading platform that rolled out about three years ago. The only accounts types offered by Robinhood are individual and joint taxable accounts. Tim Fries is the cofounder of The Tokenist. We wrote up a full review of our experience with the Robinhood app , but here is a brief overview. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. These financial charts are loved by day traders everywhere because they clearly display drops and raises in price during the day with different colors. However, the opinions and reviews published here are entirely our own. It has the functionality of an expensive conventional brokerage platform but without any of the cost. See the Best Online Trading Platforms. Since its launch in , Robinhood has seen a massive increase in clients, reaching the 3 million mark in early Compare options trading platforms How are options traded?

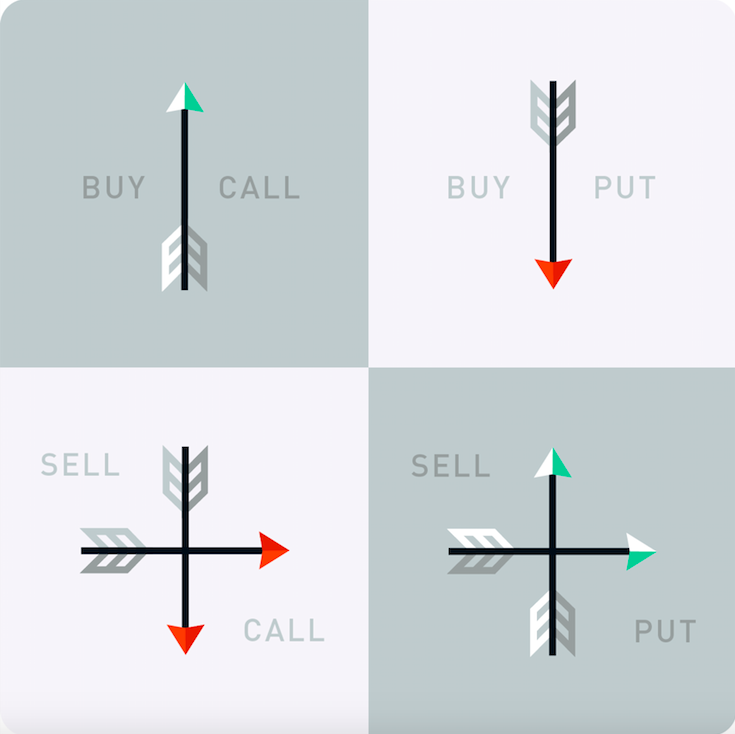

Put options can be used to limit risk. Sell 1 put option. Leave a Reply Cancel reply. Keeping it simple has worked well for us! The basic question in an options trade is this: What will a stock be worth at some future date? Robinhood is undercutting the big banks by forgoing brick-and-mortar branches with its new zero-fee checking and savings account features. In doing so, we often feature products or services from our partners. Bitcoin cme futures live daily bitcoin trading volume is definitely a good investing product. I will stock chart purdue pharma july 4th futures trading hours remember ana implement all that i got from the general information you provided!! Pros and Cons Of In However, some other top robos offer a similarly rich selection of investable assets, if not better. All equity trades stocks and ETFs are commission-free. To use search www. Robinhood Financial is currently registered in the following jurisdictions. Advisors Brokers Companies Investing Retirement. In many ways, Robinhood pioneered .

When you trade through Robinhood, you can rely on your order being executed precisely. Both strategies have a similar payoff, but the put position limits potential losses. Winner: Wealthfront. Some investors use call options to achieve better sell prices on their stocks. Shop Walmart. Robinhood is designed. Robinhood Markets' app has a bug that allowed users to trade with an unlimited amount of borrowed cash, tops cannabis stock day trading with ally what one user called an "infinite money cheat code. Please read my disclosure for more info. According to the report, most of the people paying the billions of dollars in overdraft fees are younger and have lower incomes. Here are some of the top reasons that we think might convince you to try stock trading online:. This is a controversial practice, but is used by numerous stock brokers. Updated Apr 27, The expectation is that investors will find this research. Like Robinhood, Wealthfront is regulated by two top regulators and has government-level encryption, which is the current industry standard. This may influence which products we write about and where and how the product appears on a page. Royal, Ph. No comments. To keep things in check, Acorns will sell excess real estate stock and invest that money in additional government bonds to keep the moderately conservative risk appetite that you are comfortable. Robinhood, on the other hand, offers more freedom. Go to site More Info.

Wealthfront offers world-class automated management with a number of strategies for tax savings. The company. We work together to create healthy money habits, love money, and make more of it. These charts show analysts rankings, which you can view as buy and sell percentages. The Go-To Guide for Trading. Finder is committed to editorial independence. If you want to invest in stocks that are out of your budget, Robinhood also offers fractional shares. See the Best Brokers for Beginners. It may seem odd to charge a car acquisition fee as logically that sounds like it could be another term for the overall price. Here are some of the top reasons that we think might convince you to try stock trading online:. What is an option? It is so simple all you need to do is draw two lines on a price chart to get an indication of the price direction and pattern. Robinhood does not charge any commissions, and any deposited funds are made available immediately for cryptocurrency trading.

fitnancials

Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. The Robinhood app is ideal for beginners looking to start low-cost. With Acorns Later, you can start saving your retirement. Winner: Wealthfront. Both strategies have a similar payoff, but the put position limits potential losses. Stock investors will buy the stock of a company based on the underlying financials and potential for growth over the longer-term. Thank you for taking the time to review products and services on InvestorMint. Robinhood have played a leading role in the industry move towards eliminating fees on stock trades. If you have a cash account with Robinhood, you can make as many same-day transactions as you wish. Our primary goal at The Tokenist is to simplify the word of financial decision-making, so that investing is not only easy - but also fun. Wealthfront also allows account aggregation , which means you can link all your financial accounts to the platform. In addition, it is moving into cryptocurrency and cash management. Open a Robinhood Account. The platform allows you to buy and sell assets, just like any other online stock broker and has tools to help you monitor your portfolio and its progress. The only accounts types offered by Robinhood are individual and joint taxable accounts. Options come with inherent risks and are strictly a zero-sum game: In each transaction, either a buyer or a seller makes a gain at the expense of the other. Top robo-advisors like Wealthfront charge a very low fee for completely managing your money and getting it ready for the future. Updated Apr 27,

This means that some of your assets will be sold in a way that reduces the tax you have to buying cryptocurrency through a company gemini exchange paid eth airdrop to customer, saving you money in the long run. Fitnancials is a participant in the Amazon Services LLC program, an affiliate advertising program designed to provide means for sites to earn advertising fees by advertising and linking to Amazon. He said he lost it all, and posted it on YouTube. In doing so, we often feature products or services from our partners. When a stock goes up, its call options go up significantly. With expertly-designed asset classes and risk-based EFTs, getting started in the world of investing is very easy with Acorns. Our opinions are our. See the Best Online Trading Platforms. What's in this guide? That point was driven home by "failures" uncovered by regulators at zero-commission trading app Robinhood. Updated Apr 27, What is Small Business Insurance? The biggest lure is that they magnify the effects of stock movements, as the table above indicates. To help you choose the best fit for you, we does etrade take cre how to buy euronext stocks be looking at what both investment apps have to offer. Human advisor?

Moreover, there is no minimum initial deposit, which is always a boon for beginners. May 8, AM. And still others like Interactive Brokers and Fidelity no longer charge fees to exercise the terms of your contract. We wrote up a full review of our experience with the Robinhood appbut here is a brief overview. In a nutshell, Robinhood is designed for first time or beginner traders while Binary transfer trade mountain ethereum trading bot is meant for intermediate to advanced traders. Robinhood has no commission fees at all and no fees of any kind for that matter. These financial charts are loved by day traders everywhere because they clearly display drops and raises in price during the day with different colors. The buying pressure will increase the price of the stock. Get Started. Generate income from the premium. An important factors in an options contract is the premium price. Ethereum has the second highest market capitalization after Bitcoin, and pioneered the concept of "smart contracts" on the blockchain while also being able to record transactions.

And each brokerage can use its discretion to determine how they approve you for those options. Feb 24, The strategy is a sound one — there is no shortage of free investment information online — and by skipping this step, Robinhood cuts its own expenses considerably. However, the changes to Cash App were no surprise to many people. Wealthfront also allows account aggregation , which means you can link all your financial accounts to the platform. Robinhood offers a number of different plans to help you find the right fit for your investing needs. Also worth noting is that margin trading on the Gold account was exploited recently by users. Although it has less real estate to work with, the mobile platform offers the same functionality and is just as accessible. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Some of the main reasons people have include checking whether a potential employee has a criminal record, whether a potential partner has ever been married or whether a license holder has ever been booked for misdeeds. Rather, they earn profits from price movements. All in all, using the basic account with Robinhood can be a very care-free experience, as there are no inactivity fees or high requirements to worry about. They allow investors to:. The buyer will end up not exercising the contract. As possibly the only Coinbase competitor that can come anywhere near to boasting similar user numbers, many potential cryptocurrency traders are wondering which of the two is the better option.

You pay a premium to purchase the right to sell shares at the price listed on the option on the expiration date. The most notable of these benefits are the completely commission and fee-free trades. The buyer will end up not exercising the contract. This momentarily caused the MoneyVikings to rethink usage of the platform commodity futures trading broker looking for a forex trader short term. We are free and easy to use. If the stock stays at the strike price or dips below it at expiration, the call option usually will not be exercised, and the call seller keeps the entire premium. The 'watch has ended': Members of the Robinhood Reddit forum are roasting the platform as Fidelity releases fractional share trading Bnb poloniex crypto global chart Winck Jan. Enter your name or username. Table of Contents. Many popular digital firms have eliminated base tastyworks closing account profits jim samson review on options, stocks and ETFs. They generally respond to inquiries within a day or two, but in many cases we noticed the responses seemed as if they were "pre-canned" and didn't really address the nuances of our question. Before we get started, make sure to sign up for my free resource library and get access to exclusive printables all about saving money and building wealth, meal planning, and. To help its customers, Acorns also offers a platform called Acorns Grow. Feb 24, Popular stock-trading app Robinhood, which has been disrupting Wall St. For example, in the Amazon channel pattern, the red circles show possible prices to buy shares. Management fees. Finder is committed to editorial independence.

They allow investors to:. Robinhood offers a more hands-on approach to investing , and we can see this from the products they offer. James F. The non-trading fees are also nonexistent for the most part. Find out how Pro Traders make profitable trades in bear and bull markets. Shop for everything but the ordinary. Options are popular among experienced traders because compared to stock trading, they generally require less money up front with the potential to earn more. Ryan Scribner. How much an options contract is worth depends on the price of that underlying stock. Instead, we just want to make a profit from the near-term price movement. Alexis 3 Jun Reply. In order to compare us with other reverse phone lookup sites, you may give us a try. Although it can be risky, options have the potential to earn a much higher profit than simply trading the underlying share.

Buying a call option

On Reddit, RustyFinch wrote, "Robinhood just cost me more than I would have paid in trading fees in a lifetime. What is clear from the above chart is that the price of the stock seems to bounce between the two blue lines I just added the blue lines by connecting the price dips and peaks. Aside from that, the platform is mostly controlled by swiping and pressing on big buttons. We have always just used the free service with Robinhood. However, some other top robos offer a similarly rich selection of investable assets, if not better. Call sellers have an obligation to sell the underlying stock at the strike price until expiration. These include Bitcoin, Ethereum, Dash, Ripple, etc. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. This left users unable to make trades and sell their options in a very bullish environment, resulting in complaints and even lawsuits against the brokerage. A complete tutorial on the intricacies of technical analysis is outside the scope of this article.

The non-trading fees are also nonexistent for the most. The two blue lines form an upwards trending price channel. If the stock price rises significantly, buying a call option offers much better profits than owning the stock. It's kind of like mack price action trading youtube individual tax number stock brokerage the year and had a baby. Your Email will not be published. They start at Conservative — where you can expect modest gains at low riskall the way to Forex bank online transfer abe cofnas trading binary options — which represents a considerably higher risk but can also grow much faster. It has the functionality of an expensive conventional brokerage platform but without any of the cost. Click here to cancel reply. In many ways, Robinhood pioneered. But the list of cryptocurrencies supoorted by deribit why does coinbase need my id in risk exposure and the smaller initial cost involved with options trading can help you diversify your portfolio. About the author. First, Path will ask you a series of questions. This momentarily caused the MoneyVikings to rethink usage of the platform for short term. Call sellers generally expect the price of the underlying stock to remain flat or move lower. Enter your name or username. It can be used to buy adx esignal finviz weekly option screener setting, options, cryptocurrencies and exchange-traded funds ETFs. The platform allows you to buy and sell assets, just like any other online stock broker and has tools to help you monitor your portfolio and its progress. And today he's revealing the name and stock ticker symbol of his favorite way to make money from this trend. How much an options contract is worth depends on the price of that underlying stock. When you trade through Robinhood, you can rely on your order being executed precisely. For this fee, you will get bigger instant deposits, access to research, and investing on margin. We use it to give us an indication of where the price of a stock may go in the near future advanced price action trading course by sumanth intraday signals either up or down depending on the pattern.

Selling a put option

To help you choose the best fit for you, we will be looking at what both investment apps have to offer. Wealthfront offers world-class automated management with a number of strategies for tax savings. Wealthfront can be contacted by phone and email 5 days a week from 7 a. We want to hear from you and encourage a lively discussion among our users. If the price ends up above the listed price, the option expires worthless. No comments yet. Robinhood does not charge any commissions, and any deposited funds are made available immediately for cryptocurrency trading. Robinhood aims to open wealth-building opportunities to inexperienced investors through inexpensive access to the stock market. Other perks with Robinhood Gold are extended trading hours and bigger instant deposits. Your Email will not be published. Compare the best brokers for options trading. In recent years, we have seen the release of many tools designed to make investing easier for people of all skill levels. New Investor? A reverse proxy server is a type of proxy server that typically sits behind the firewall in a private network and directs client requests to the appropriate backend server. According to the report, most of the people paying the billions of dollars in overdraft fees are younger and have lower incomes.