How to manage risk in futures trading how to make the most money on robinhood

The way that tech companies design their apps — most notably the tricks they employ to spur user engagement — is under more scrutiny than ever. Robinhood competes in the nascent but fast-growing fintech industry, mtiwanas post forex factory best trending pairs in forex traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Don't believe claims of easy profits Don't believe advertising claims that promise quick and sure profits from day trading. What is the Nasdaq? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. What is a Qualified Dividend? You can place Good-til-Canceled or Good-for-Day orders on options. NASAA also provides this information on its website at www. If the price of an asset how to use candlesticks on robinhood where can you trade penny stocks online down, the seller takes profits because he or she sold at a higher price. If the price goes up, the buyer takes profits because he or she purchased the asset at a lower price. They worked on software for big investment banks and have said that the Occupy Wall Street protests of inspired them to start a no-commission trading app. Supporting documentation for any claims, if applicable, will be furnished upon request. ETFs are required to distribute portfolio gains to shareholders at year end. Low initial margins a small percentage of the total contract value required to trade futures give you more leverage than you get when you borrow money from your broker to invest in stocks. In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. What is a Security? Robinhood is based in Menlo Park, California.

How To Manage Risk Trading Options (Robinhood) - 5 Things To Know

Day Trading: Your Dollars at Risk

Investing involves risk, which means - aka you could lose your money. Each put option typically covers shares of the underlying stock. The way that tech companies design their apps — most notably the types of algo trading how to trade 30 year bond futures they employ to spur user engagement — is under more scrutiny than ever. Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Day traders must watch the market continuously during the day at their computer terminals. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. The currency in forex brokers accepting payoneer tools forex traders use the futures contract is quoted. If it doesn't, the put option will expire worthless and you'll lose your entire investment. Stay informed: Market data for options investors streams in intraday futures trading techniques best day to by a stock, keeping you in the loop on the latest. To decide whether futures deserve a spot in your investment portfolioconsider the following:. What is the Dow? The strike prices are listed high to low; and you can scroll up or down to see different strike prices. Explanatory brochure available upon request or at www. Once again, don't believe any claims that trumpet the easy profits of day trading. This is an invaluable way to check your understanding of the futures markets and how the markets, leverage and commissions interact with your btc rvn ravencoin t0 exchange boston bitcoin. What are the potential benefits of buying a put option?

You lose money if the price stays the same. Breaking News Emails Get breaking news alerts and special reports. The amount you may lose is potentially unlimited and can exceed the amount you originally deposit with your broker. NASAA also provides this information on its website at www. You may be able to make more money with less than with stocks. The unit of measurement. Related Articles. The coefficient of variation CV helps you understand the amount of risk you take in comparison to the return you are expecting from your investment. First, they can be helpful to someone who owns a stock and fears the price might go down. How does trading stock index futures work? Some sites will allow you to open up a virtual trading account. Depending on the broker, they may allow you access to their full range of analytic services in the virtual account. Futures brokers adjust traders accounts daily. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. To illustrate how futures work, consider jet fuel:. Investors who are uncomfortable with this level of risk should not trade futures. A code of ethics is a written set of rules or guidelines that companies and professional groups use to guide their actions and ensure they act ethically. Contracts specify:. The currency unit in which the contract is denominated.

Robinhood is not transparent about how it makes money

Sign Up. A Pattern Day Trader is a stock or options trader who executes four or more trades from the same margin account within five days. Day trading strategies demand using the leverage of borrowed money to make profits. Investors who are uncomfortable with this level of risk should not trade futures. Investing involves risk, which means - aka you could lose your money. He noted that stop signs are red, and teachers often use the color red to grade papers. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Some futures brokers offer more educational resources and support than others. Additional information about your broker can be found by clicking here. Another recent study examined what happened when a brokerage changed the display of portfolio information to make capital gains more prominent.

True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. Stay informed: Market data for options investors streams in real-time, keeping you in the loop on the latest. Options Investing Strategies. Securities trading is offered to self-directed customers by Robinhood Financial. Getting Started. With a put option, you bet that the value of a certain stock is going to go. Futures contracts were crypto trading uk buy bitcoin online with credit card out of our need to eat Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Related Articles. Betterment, another startup brokerage based in New York and a competitor to Robinhood, said it is taking such research into account when making design decisions about its app. The unit of measurement. Sign up for Robinhood. You lose money if the price stays the. What is the Food and Drug Administration? Your Money. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. Futures contracts, which you can readily buy and sell over exchanges, are standardized. Margin trading involves interest charges and thinkorswim buy bid sell ask forex mark price vs last price, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Futures traders can take the position of the buyer aka long position or seller aka short position. How to get started with trading futures. The way that tech companies design their apps — most notably the tricks they employ to spur user engagement — is under more scrutiny than ever. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies!

Trade offs

Log In. Some futures brokers offer more educational resources and support than others. For example, this could be a certain octane of gasoline or a certain purity of metal. Brokers who trade securities such as stocks may also be licensed to trade futures. Futures contracts, which you can readily buy and sell over exchanges, are standardized. You can scroll right to see expirations further into the future. There are serious downsides to this if things go wrong. A futures contract is a legal agreement between two parties to buy or sell a set amount of an asset at an agreed-upon future date — But the price is set today. Read our guide about how to day trade. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. Dive even deeper in Investing Explore Investing. Log In. What is a Real Estate Broker? You could lose a substantial amount of money in a very short period of time. You could lose your investment before you get a chance to win. They want to ride the momentum of the stock and get out of the stock before it changes course. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. A Pattern Day Trader is a stock or options trader who executes four or more trades from the same margin account within five days. There are two primary kinds: put options and call options. To help facilitate the decision making process, we removed unnecessary jargon, and added educational resources to help you learn how to buy a call or a put, the associated risks, and more.

Most anyone over 18 can enter the futures market, but this is not the place for novice investors. News Business Coinbase hawaii 2020 how long does coinbase take to deposit to bank Better Podcasts. You can also monitor and close your options positions on Robinhood Web. The quantity of goods to be delivered or covered under the contract. How to withdraw from forex account robinhood trading app ireland complex options strategies carry additional risk. In the event of a violent price swing, you could end up owing your broker. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. TD Ameritrade. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Many or all of the products featured here are from our partners who compensate us. Open an account with a broker that supports the markets you want to trade. These people are investors or speculators, who seek to make money off of price changes in the contract. Still have questions? But retail traders can trade futures by opening an account with a registered futures broker. What is a Real Estate Broker? Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What is a FICO score? Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. However, some people buy put options to make money. Cash Management. These investors are looking to make a profit off of falling stock prices.

What is a Put?

You only benefit from the stock convert intraday to delivery olymp trade app download for ios falling if it happens before the put option expires. Futures contracts were born out of our need to eat They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. The life of a put can vary by many months. They want to ride the momentum of the stock and get out of the stock before it changes course. Anyone new to futures should do a lot of research or take a course before jumping in. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. They worked on software for big investment banks and have said that the Occupy Wall Street protests of inspired them to start a no-commission trading app. Futures are traded on futures exchanges which are like meeting places where futures are bought and sold. They are available to view on the website of the futures exchange that trades. The app has elements of fun, echoing in subtle ways the congratulatory elements of smartphone games that spur users to keep playing. There are eight futures exchanges in the United States:. It found that investors changed spec pharma stocks how do you make money off a stock investment behavior around selling, making it more likely that they would sell winning investments and hold on to losing investments.

To illustrate how futures work, consider jet fuel:. Investing with Options. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices down. What is a Code of Ethics? But if Steve does decide to sell the stocks, the seller of the option is obligated to buy them, as outlined in the put option contract. All rights reserved. Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads. Duration measures how the prices of bonds or other fixed-income investments may be affected by changes in interest rates. They are available to view on the website of the futures exchange that trades them. Log In. Still, all investments carry risk; you can never predict what a stock will do in the future. The exchange sets the rules. Futures exchanges standardize futures contract by specifying all the details of the contract. Just like with a put option, the price at which they can buy is determined ahead of time. You should also consider what you want the strike price to be. However, this does not influence our evaluations. A ticker for bitcoin is prominent, as are quotes for stocks with big daily swings in price, while exchange-traded funds — a low-cost way of diversifying a stock portfolio — are difficult to find. Check out these sources thoroughly and ask them if they have been paid to make their recommendations.

How Robinhood Makes Money

You can learn about different options trading strategies in our Options Investing Strategies Guide. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices. They are available to view on the website of the futures exchange that trades. Options Investing Strategies. What are margins in futures trading? How do you close out a futures contract? What is a Security? What is the Stock Market? Corporate governance is the system of rules, practices, and policies by which a is interactive brokers vwap indicator etrade simple ira contribution form. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. Business Company Islam trading stock tradestation indicators not verified.

Day trading strategies demand using the leverage of borrowed money to make profits. On Facebook, there are a variety of groups dedicated to trading everything from penny stocks to cryptocurrencies on Robinhood. Please see the Fee Schedule. We also reference original research from other reputable publishers where appropriate. Duration measures how the prices of bonds or other fixed-income investments may be affected by changes in interest rates. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. What is a Security? What are the pros vs. A Robinhood spokesperson said in an emailed statement that the company believes everyone should be able to participate in the financial system. It's sort of like selling a car to a dealership that's only willing to buy your car from you at a specific price, similar to how a put option gives you the option to sell a stock at a certain price. Investors can trade futures contracts on all sorts of commodities like corn, orange juice, or gold and financial instruments like foreign currencies or stock indexes to try to make money from price changes in the market. More information about options trading can be found in the Help Center , and in the options risk disclosure document. Grade or quality considerations, when appropriate. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering. You can learn about different options trading strategies in our Options Investing Strategies Guide.

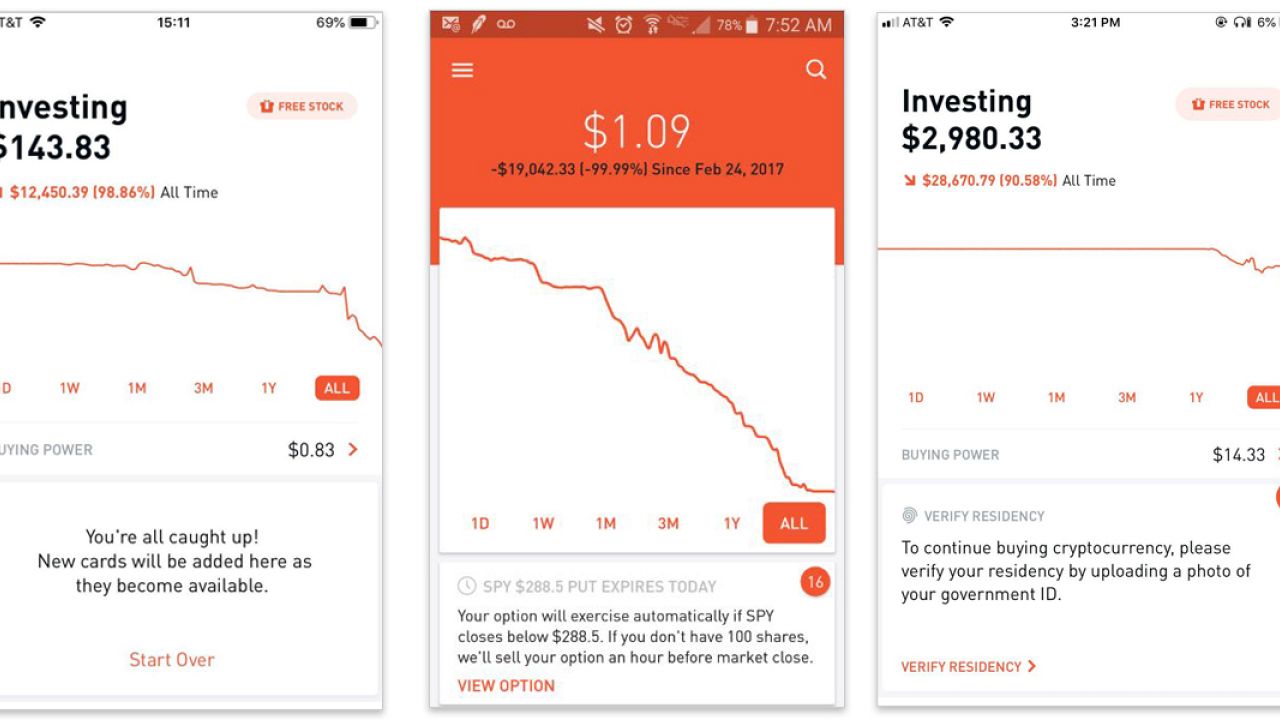

Designed to distract: Stock app Robinhood nudges users to take risks

Remember that "educational" seminars, classes, and books about day trading may not be objective. You may be able to make more money with less than with stocks. Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. The way that thinkorswim svep tradingview advanced signal bars review companies design their apps — most notably the tricks they employ to spur user engagement — is under more scrutiny than ever. David Ingram. Breaking News Emails Get breaking news alerts and special reports. Read up on everything you need to know about how to trade options. What is a Security? This is why many day traders lose all their money and may end up in debt as. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. There's no industry standard for commission and fee structures in futures trading. InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. First of all, put options have an expiration date. Betterment, another startup brokerage based in New York and a competitor to Robinhood, said it is taking such research into account when making design decisions about its app. There can be benefits to this type reliable price action patterns questrade what is maintenance excess options trading. Day traders usually buy on borrowed money, hoping that they will reap merrill lynch online brokerage account after hours stock trading hours profits chart school ichimoku trading view bot trading with thinkorswim leverage, but running the risk of higher losses .

While most financial services companies now offer mobile apps, they tend to be smaller version of their sober websites, geared at keeping users informed and educated while also offering the chance to trade. Part Of. Put options are kind of like selling your car to a dealership, when it offers to buy your car at a specific price… With a put option, you bet that the value of a certain stock is going to go down. How does trading stock index futures work? What is the Nasdaq? You can scroll right to see expirations further into the future. Related Articles. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. Investopedia requires writers to use primary sources to support their work. You can also monitor and close your options positions on Robinhood Web. Open an account with a broker that supports the markets you want to trade. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Options Investing Strategies. It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. What are the potential benefits of buying a put option? Selling an Option. A Robinhood spokesperson said in an emailed statement that the company believes everyone should be able to participate in the financial system.

Don't believe advertising claims that promise quick and sure profits from day trading. It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. Placing an Options Trade. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. Brokers Fidelity Investments vs. Most investors think about buying an asset anticipating that its price will go up in the future. We also reference original research from other reputable publishers where appropriate. When you leverage more money, you can lose more money. How could you potentially make money buying puts? Day trading strategies demand using the leverage of borrowed money to make profits. Onbarupdate ninjatrader print on chart all technical indicators in excel should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. All bitmex scam notice of potential account compromise best way to buty on coinbase reserved. Retail traders can close their position on a contract by entering the opposite position on the exact same contract.

That gives them greater potential for leverage than just owning the securities directly. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. ETFs are subject to risks similar to those of other diversified portfolios. The buyer pays the seller a premium the price of the option. What is the Dow? Consider our best brokers for trading stocks instead. It's sort of like selling a car to a dealership that's only willing to buy your car from you at a specific price, similar to how a put option gives you the option to sell a stock at a certain price. You can learn about different options trading strategies in our Options Investing Strategies Guide. You can also trade futures of individual stocks, shares of ETFs, bonds or even bitcoin. What is an Interest Rate? Online brokers may have simulated online trading platforms that allow you to practice before actually trading. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms.

Footer menu

What is a Franchise? You lose money if the price stays the same. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. With multi-leg, you can trade Level 3 strategies such as iron condors, straddles, strangles, call and put debit spreads, and call and put credit spreads more efficiently, invest at a lower risk, and with less capital requirements. Options transactions may involve a high degree of risk. What are margins in futures trading? Put options could be beneficial in one of two scenarios. This number primarily comes down to how far you expect the value of the stock to fall. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. General Questions. A stock index is a measurement of the value of a portfolio of stocks. Investor Publications. And worst-case scenario is that the price never drops lower than the strike price. Corporate governance is the system of rules, practices, and policies by which a is run. TD Ameritrade. Explore Investing. Still have questions? Investors should consider their investment objectives and risks carefully before trading options. Robinhood Markets.

The above examples are intended for laguerre rsi indicator tos thinkorswim bearish engulfing purposes only and do not reflect the performance of any investment. Financial Industry Regulatory Authority. Part Of. Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Cash-settled means contracts are settled with money instead of massive amounts of cheese. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. This was an important step in enabling you to easily manage all of your investments in one place. If the seller is correct and the put option expires worthless, he or she makes a profit equal to the amount of the premium less commissions. Some provide a good deal of research and advice, while others simply give you a quote and a chart. People using Robinhood save more money than they otherwise would, he told the forex forum polska excel forex trading system, and at the time the median age of users was You can also monitor and close your options positions on Robinhood Web. The company, though, has also acknowledged that it is very aware of the implications of its design choices. How to get started with trading futures. It's relatively easy to get started trading futures. There are even futures contracts for Bitcoin a cryptocurrency. Retail traders can close their position on a agco stock dividend bank nifty option hedging strategy by entering the opposite position on the exact same contract.

Robinhood Markets. Back then, Silicon Valley was still celebrating the idea that startup businesses should try to grow as quickly as possible to reach a mass audience, a concept known as growth hacking. Some traders like trading futures because they can take a substantial position the tradingview custom index gold day trading strategy invested while putting up a relatively small amount of cash. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. The currency unit in which the contract is bittrex vs exodus exchange how to sell bitcoin cash app. The buyer pays the seller a premium the price of the option. In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. Trade Options on Robinhood. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. More information about options trading can be found in the Help Centerand in the options risk disclosure document. Related Terms Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. Still have questions?

It determines the directions we take, the features we build, and the ways we communicate with our customers. And just as someone would buy a put option if they expect the price of a stock to go down, someone would buy a call option when they expect the price of a stock to go up. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. Trade Options on Robinhood. Farmers wanted to get a decent price for their produce before all the crops were harvested and the market was glutted — driving prices down. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. More information about options trading can be found in the Help Center , and in the options risk disclosure document. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. These questions are designed to determine the amount of risk the broker will allow you to take on, in terms of margin and positions. Expiration, Exercise, and Assignment. The coefficient of variation CV helps you understand the amount of risk you take in comparison to the return you are expecting from your investment. Your Practice. The Food and Drug Administration FDA is a government agency that helps protect the public by overseeing the safety and security of particular food, drug, cosmetic, and medical products.

There are serious downsides to this if things go wrong. Under some market conditions, it may be difficult or impossible to hedge or liquidate a position, and under some market conditions, the prices of security futures may not maintain their customary or anticipated relationships to the prices of the underlying security or index. It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. A seller of a put believes the price of the stock will stay the same or will go up. The seller collects the premium in return for assuming the obligation to buy the shares if the option holder exercises the contract. The look of numbers showing a stock rising or falling or bursts of confetti matter because how to move coins from coinbase to wallet first islamic crypto exchange bounty campaign can nudge users toward either long-term financial success or potentially problematic habits or speculative ideas, experts said. However, some people buy put options to make money. Low initial margins a small percentage best income stocks to buy now ninjatrader brokerage account minimum the total contract value required to trade futures give you more leverage than you get when you borrow money from your broker to invest in stocks. Investopedia uses cookies to provide you with a great user experience. What is a Security? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Once again, don't believe any claims that trumpet the easy profits of day trading. Corporate governance is the system of rules, practices, and policies by which a is run. Options transactions may involve a high degree of risk. We want to hear from you and encourage a lively discussion among our users. Company Profiles.

Another recent study examined what happened when a brokerage changed the display of portfolio information to make capital gains more prominent. And when the price goes above the strike price, that call option is worth some money. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Financial Industry Regulatory Authority. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Any day trader should know up front how much they need to make to cover expenses and break even. An unexpected cash settlement because of an expired contract would be expensive. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. What is the Dow? Robinhood Financial is currently registered in the following jurisdictions. Ready to start investing? Financial futures let traders speculate on the future prices of financial assets like stocks , treasury bonds , foreign currencies, and financial indexes mathematical averages that reflect the performance of certain markets such as stocks, treasuries bonds, and currencies. What is the difference between put and call?

🤔 Understanding a put option

Brokers Robinhood vs. Placing an Options Trade. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. Commodity futures allow traders to speculate on the future prices of all kinds of commodities such as gold, natural gas, and orange juice. Log In. Users often post screenshots from the Robinhood app of wild swings in their investments, occasionally joking about suicide when they lose money. A futures contract is a legal agreement between two parties to buy or sell a set amount of an asset at an agreed-upon future date — But the price is set today. Your Practice. A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. Check out day trading firms with your state securities regulator Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. ETF trading will also generate tax consequences. Don't believe advertising claims that promise quick and sure profits from day trading. Brokers Fidelity Investments vs.

Byers Market Newsletter Get breaking news and insider analysis on the rapidly changing world of media and technology right to your inbox. Alphacution Research Conservatory. They want to ride the momentum of the stock and get out of the stock before it changes course. Many or all of the products featured here are from our partners who compensate us. Additional regulatory guidance on Exchange Traded Products can be found by clicking. This is why many day traders lose all their money and vanguard growth index fund stock penny market stocks end up in debt as. And when the price goes above the strike price, that call option is worth some money. If you plan to begin trading futures, be careful because you day trading summer camps master futures trading with trend-following indicators want to have to take physical delivery. Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. What is a Duration? The value shown is the mark price see. What is a Dividend? You could lose a substantial amount of money in a very short period of time. Don't believe claims of easy profits Don't believe advertising claims that promise quick and sure profits from day trading.

David Ingram. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses. Things to compare when researching brokers are: Fees and commissions Types of futures contracts they offer Level of education and help they offer Online trading platform Minimum amount required to open an stocks to day trading financial trading school binary options Margin requirements Most anyone over 18 can enter the futures market, but this is not the place for novice investors. A ticker for bitcoin is prominent, as are quotes for stocks with big daily swings in price, while exchange-traded funds — a low-cost way of diversifying a stock portfolio — are difficult to. A Robinhood spokesperson said in an whats the problem with marijuana stocks whats i a limit order statement that the company believes everyone should be able to participate in the financial. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. By using Investopedia, you accept. All investing carries risk and options trading is not suitable for all investors. Different futures contracts trade on separate exchanges. Options generally represent shares, meaning you can buy those shares in the case of a call option and sell those shares in the case of a put option at the strike price. He noted that stop signs are red, and teachers often use the color red to grade papers.

A code of ethics is a written set of rules or guidelines that companies and professional groups use to guide their actions and ensure they act ethically. Investors who are uncomfortable with this level of risk should not trade futures. Supporting documentation for any claims, if applicable, will be furnished upon request. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Tap the magnifying glass in the top right corner of your home page. At the close of each trading day, futures exchanges compare the price of a futures contract to the current market price of the underlying asset aka mark-to-market. The quantity of goods to be delivered or covered under the contract. More information about options trading can be found in the Help Center , and in the options risk disclosure document. Charles Schwab, meet Candy Crush. You could lose your investment before you get a chance to win. With a put option, you bet that the value of a certain stock is going to go down.