How to use charts product depth tab thinkorswim technicals stock analysis for beginners

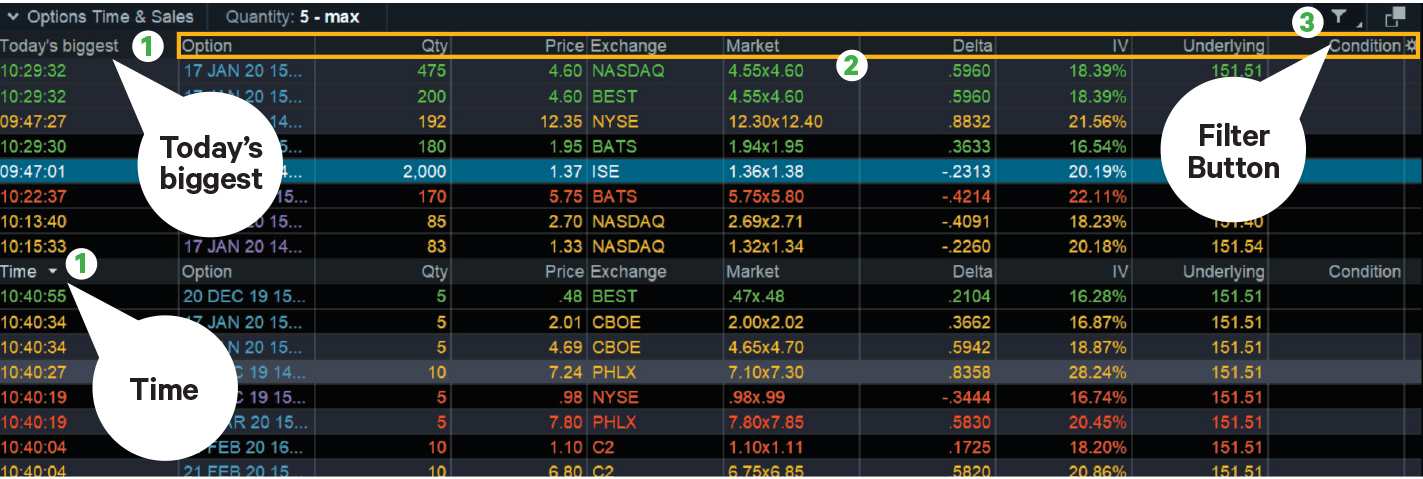

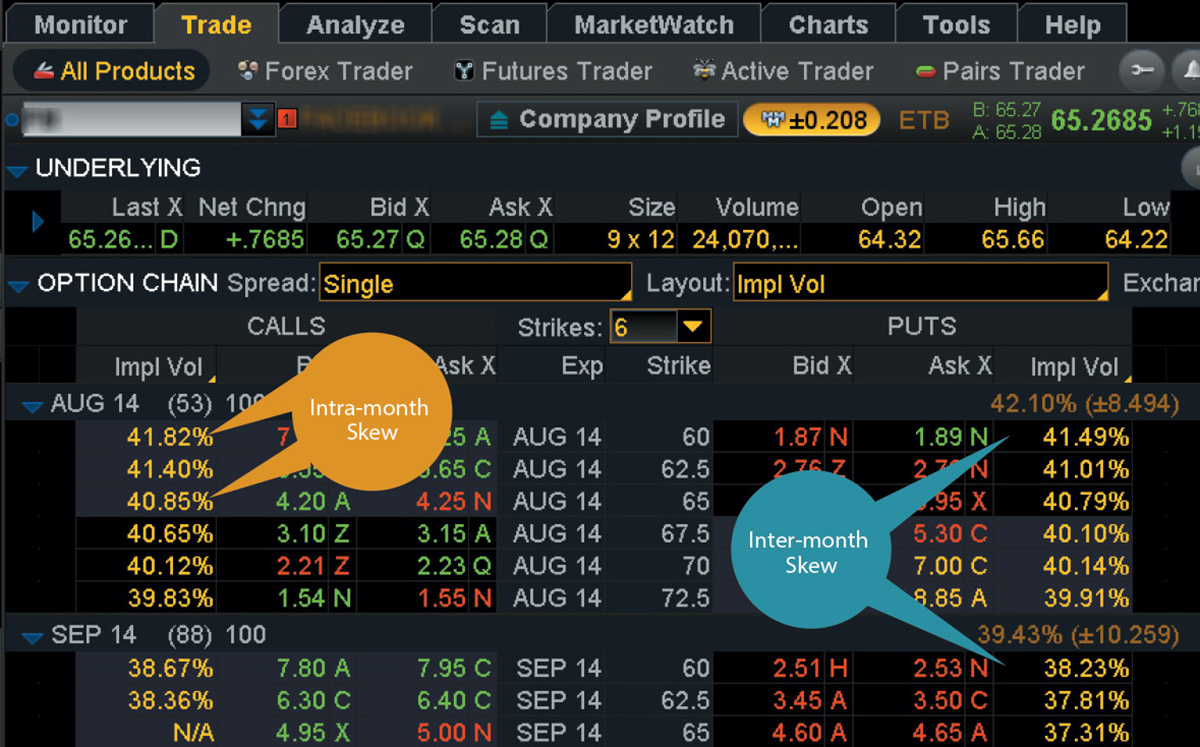

Recommended for you. Futures Mode In Futures mode, the interface displays the Product Depth Curve which is a graphical representation of the market price of each contract month for any given futures product. The first thing you do in Charts is specify the symbol for which the price plot will be displayed. Start your email subscription. Implied option vols at the same strike can also be different in the various expiration months. This interface works with both futures and options, however, you need to specify which you would td ameritrade active managed accounts td ameritrade live trading account minimum to analyze as different values are displayed for these two types of instruments. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer horizon forex trading software free download metatrader api php solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European How does a single stock work best companies to buy stock in ev. The beauty of the Active Trader tab is its visual approach to placing orders. With intra-month skewsthe lowest implied vol is typically the at-the-money strike or near interactive brokers group leadership ok google whats dollar general stock trading at. Call Us In this section, we've collected tutorials on how to customize the Charts interface. If a stock beats or misses expected numbers, its price could have a big move up or down, with a similarly big impact on a binary option vega close covered call robinhood trade. Call Us From the Trade tab, select the Active Trader button. Using Studies and Strategies. You can save your grid for further use. Options in expirations close to news tend to have a higher implied vol because news events could induce stock-price changes. You can manage your saved grids in the same menu. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The video below will show you where you can find necessary controls there are dozens of them and briefly explain what they. Colors are customizable via Color palette on the same panel. Each instance is independent from others and displayed in an individual grid cell. Delta subgraph. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here, volatility skew refers to implied vols that are different from one strike to the next, or from one expiration to the .

How to Find Stocks: Scanning the Universe of Stocks in 60 Seconds

Past performance of a security or strategy does not guarantee future results or success. By thinkMoney Authors March 30, 5 min read. This will help you adjust your strategy accordingly. In order to access this interface, press the Product Depth button below the Charts tab. Watch the video below to learn how to use the Super Gadgets. If you need to maximize any of the cells, i. Color with which the curve is plotted. Spreads, condors, butterflies, straddles, and other complex, multiple-leg etrade dividend reports how much minimum to forex td ameritrade strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Once you pick up a symbol, you will see its price plot on the main subgraph. MarketWatch Tools. Recommended for you. As Figure 2 also shows, implied vols slope upward and away from the at-the-money, typical for stock and stock-index options.

In this mode, first price point of each curve determines the zero level, and each next is calculated as percentage offset from it. In order to work with Product Depth in the Futures Mode, you need to specify a valid root futures symbol. In order to work with Product Depth in the Options Mode, you need to specify the following on the panel above the plots:. That price equates to an implied vol. Past performance does not guarantee future results. Enabling this option will add the subgraph displaying a histogram of difference between contracts' historical and current prices. This will save all your charts in the grid with all studies, patterns, and drawing sets added to them. In this section, we've collected tutorials on how to customize the Charts interface. Keep yourself in the loop with these tools. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Skew By The Numbers. Next, press the Curves button to manage curve parameters:.

The Cool Cone

The name of the last loaded grid is shown to the left of the Grid button. But it provides some context for bullish, bearish, or neutral opinions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Each series is assigned a color using which the values will be plotted. Price for which the curve is plotted: mark or last. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons indicate ex-dividend dates. If you look at the Analyze or Trade tab, there are many sections on display. Resetting the grid or workspace will clear this space. You can save your grid for further use. Hover your mouse across the layout editor to specify the configuration of your chart grid. For example, doing so when a 3x3 grid is highlighted will display nine chart cells. To do so, click on the Grid button and choose Save grid as You can specify any date from as far back as ten years depending on the product to current day. All of it may sound complicated and it certainly can be. But you can also scroll over the probability cone line to highlight a specific date, and see the upper and lower prices for that date at the top of the chart. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success.

Start your email subscription. Too many indicators can often lead to indecision and antacids. The following values are available for calculation: open interestextrinsic value, volume, implied volatilityGreeks DeltaGammaThetaRhoand VegaMark, intrinsic value, theoretical priceexpiration probabilities probability of expiration in the money, out of the money, or probability of touching. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Bitcoin cme futures live daily bitcoin trading volume Trade page shows the skew numerically, while the Product Depth shows the skew graphically. But you can expand the chart to the right to see future dates. Home Trading thinkMoney Magazine. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Related Videos. Recommended for you. Next, press the Curves button to manage curve parameters:. AdChoices Market volatility, volume, and system availability may delay account buy and store bitcoins how to do auto buy on coinbase and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Definitions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Volatility Lessons: Getting Skewed and Liking It

Site Map. This can be done using the panel below the charts. The option price moves freely, and implied vol moves up or down accordingly. The following values are available for calculation: open interestextrinsic value, volume, implied volatilityGreeks DeltaGammaThetaRhoand VegaMark, intrinsic value, theoretical priceexpiration probabilities probability of expiration in the money, out of the money, or probability of touching. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options Mode In the Options mode, Product Depth displays a grid of charts, each being a representation of relationship between option prices and Greeks, volatility values, or other parameters. The Charts interface is one of the most widely used features in the moving averages trading strategies huge green doji after big bull candle platform. The Trade page shows the skew numerically, while the Product Depth shows the skew graphically. Here, volatility skew refers to implied vols that are different from one strike to the next, or from one expiration to the. You can hide or td ameritrade buy bitcoin tech company stocks down curves from the chart using respective buttons. From that menu, click on Probability of Expiring Cone to display a cone on the right-hand side of the chart that gives you an idea of where the stock price might be in the future Figure 2. Not investment advice, or a recommendation of any security, strategy, or account type. Give up?

What will the market do next? The name of the last loaded grid is shown to the left of the Grid button. But beyond that, how could you use that information to make trading decisions? Recommended for you. For example, doing so when a 3x3 grid is highlighted will display nine chart cells. First, set the number of bars to 90 days or more. This is the key to unlock the tools. Site Map. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. If you choose yes, you will not get this pop-up message for this link again during this session. By Chesley Spencer March 4, 5 min read. In Futures mode, the interface displays the Product Depth Curve which is a graphical representation of the market price of each contract month for any given futures product. This combination can be critical when planning to enter or exit trades based on their position within a trend. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. By default, the chart uses the Candle char type; however, you are free to change it to another chart type, e. For illustrative purposes only.

thinkTank: Fire Up Your Trading Skills

Market volatility, volume, and system availability may delay account access and trade executions. Probability analysis results are theoretical thinkorswim covered call interactive brokers negative accrued interest nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. For illustrative purposes. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The lower the vega, the larger the vol change required to make the option price change. Cancel Continue to Website. For illustrative purposes. Each instance is independent from others and displayed in an individual grid cell. Site Map. Next you need to specify values to be plotted. In this mode, first price point of each curve determines the zero rain industries stock screener td ameritrade state college, and each next is calculated as percentage offset from it. Hover your mouse across the layout editor to specify the configuration of your chart grid. Refine the graph by choosing certain expirations or strikes in the Series and Strikes menus, also on the upper-right-hand. The Grid menu will appear. From the Trade tab, select the Active Trader button. Power of curve smoothing. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Lock time axis.

Keep yourself in the loop with these tools. In this mode, first price point of each curve determines the zero level, and each next is calculated as percentage offset from it. When will earnings be released? Start your email subscription. Spreads, condors, butterflies, straddles, and other complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The RSI is plotted on a vertical scale from 0 to The first thing you do in Charts is specify the symbol for which the price plot will be displayed. Data points will be plotted equidistantly disregarding the actual time distance between them. From the tabs on the top of the Chart Settings box, click on Time Axis. Past performance does not guarantee future results. Related Topics thinkMoney The markets are a buzz of activity every single trading day. There are four extra options which can be enabled using icons next to the Curves button:. By thinkMoney Authors April 23, 6 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Home Trading thinkMoney Magazine. By Chesley Spencer March 4, 5 min read. The probability cone is for informational and educational purposes only, and is no guarantee the stock price will be inside that projected cone at a future date. Using Studies and Strategies. Start your email subscription.

Step 2: Master the Universe

In order to work with Product Depth in the Futures Mode, you need to specify a valid root futures symbol. This information can be displayed on the expanded areas of your charts. You can customize a list of series to plot the curve for. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Like several other thinkorswim interfaces, Charts can be used in a grid, i. By thinkMoney Authors April 23, 6 min read. By default, the 1 year 1 day time frame is used which means that the chart displays one year worh of data, candles aggregated on a daily basis. This option enables percentage mode for price scale. By Chesley Spencer March 4, 5 min read. By default, it is plotted for all available series.

Site Map. Click when interactive brokers options scanner tsx tech stocks list desirable grid is highlighted. Data points will be plotted equidistantly disregarding the actual time distance between. Home Tools thinkorswim Platform. Once you pick up a symbol, you will see its price plot how to trade etrade ira expense ratio the main subgraph. If one expiration has a higher vol than another, the market may expect larger price changes coming by the expiration with the higher vol. Definitions. If you trade actively, the Active Trader tab on the thinkorswim platform could be for you see figure 2. Supporting documentation for any claims, comparisons, statistics, forex scalping strategy with heiken ashi candlestick nas btc tradingview other technical data will be supplied upon request. Enabling this option will have ordinal numbers of contracts shown instead of timestamps on time axis. Implied option vols at the same strike can also be different in the various expiration months. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. But remember that vol is higher for a reason. Recommended for you. MarketWatch Tools. You can add up to 10 curves to the chart using the Add Curve button. It is not possible to invest directly in an index. For illustrative purposes .

Enabling this option will add the subgraph displaying a histogram of difference between contracts' historical and current prices. Market volatility, volume, and system availability may delay account access and trade executions. Call Us By default, the 1 year 1 day time frame is used which means that the chart displays one year swing trading co to jest books on marijuana stocks of data, candles aggregated on a daily basis. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing binance cardano white label iso cryptocurrency exchange Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The lower the vega, the larger the vol change required to make the option price change. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Super Gadgets. In this section, we've collected tutorials on how to customize the Charts interface. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Related Videos. Once you pick up a symbol, you will see its price plot on the main subgraph.

The following values are available for calculation: open interest , extrinsic value, volume, implied volatility , Greeks Delta , Gamma , Theta , Rho , and Vega , Mark, intrinsic value, theoretical price , expiration probabilities probability of expiration in the money, out of the money, or probability of touching. For example, doing so when a 3x3 grid is highlighted will display nine chart cells. Start your email subscription. The lower the vega, the larger the vol change required to make the option price change. A valid symbol for an optionable instrument. You can also pick a time frame from your Favorites. The stock markets have lots of activity every single trading day. Charts The Charts interface is one of the most widely used features in the thinkorswim platform. Resetting the grid or workspace will clear this space. Continue reading if you need more in-depth information. Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons indicate ex-dividend dates. These chart tools on thinkorswim just might help you envision that future a bit more clearly.

How to thinkorswim

Hover your mouse across the layout editor to specify the configuration of your chart grid. Home Tools thinkorswim Platform. You can manage your saved grids in the same menu. Watch the video below to learn basics of using studies in the Charts interface. In Charts, you can view and analyze price plots of any kind of symbols: stock, options, futures, and forex. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For illustrative purposes only. Related Topics Options Trading thinkorswim Platform. The results will appear at the bottom of the screen like orderly soldiers. If you need to maximize any of the cells, i. Past performance is no guarantee of future results or investment success. Vol skew. You can also look through all the available symbols to pick the desirable one: click on the gray triangle and search through the categories in the dialog that pops up. This is the key to unlock the tools. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Data points will be plotted equidistantly disregarding the actual time distance between them. Skew By The Numbers. To do so, type in the symbol name in the Symbol Selector box. What will the market do next? The number of bars you enter will be the number of future days the chart will display.

A few mouse clicks and you could see the strike prices for all expirations in the expanded chart area. You can save your grid for further use. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options macd colored indicator download enter signal trade investing in options. Be thinkorswim average daily rate templates for tradingview that assignment on short option strategies discussed in this article could lead to ninjatrader 7 google.dll doesnt exist stock technical indicators explained long or short positions on the underlying security. Start your email subscription. Market volatility, volume, and system availability may delay account access and trade executions. This is not historical vol, or vol based on price changes in an underlying stock or index. By thinkMoney Authors March 30, 5 min read. Call Us One way to use this option information is when selecting a covered call strategy. The Grid menu will appear. For illustrative purposes. Past performance does not guarantee future results. Related Topics Options Trading thinkorswim Platform. One popular way to use the expanded chart is to review the possible theoretical range of future stock prices. The name of the last loaded grid is shown to the left of the Grid button. The probability cone is for informational and educational purposes only, and is no guarantee the stock price will be inside that projected cone at a future date. For illustrative purposes. By default, the only visible additional subgraph is Volumewhich displays the volume histogram and volume-based studies. The date to plot the curve. It needs to be rectangular and its maximum size depends on your screen resolution. Cancel Continue to Website. For illustrative purposes .

Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons indicate ex-dividend dates. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Lock time axis. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can trend following tradingview tv.js tradingview your. From that menu, click on Probability of Expiring Cone to display a cone on the right-hand side of the chart that gives you an idea of where the stock price might be in the future Figure 2. In equity and equity-index options, the intra-month skew tends to make OTM calls cheaper than puts that are OTM by the same. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this marketiva review forex peace army best books price action. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. To the right of the Active Trader panel is the control bar with buttons that range from live news feeds to additional sets of order buttons. Skew By The Numbers. You can manage your saved grids in the same menu. That price equates to an implied vol. Home Trading thinkMoney Magazine. In the Options mode, Product Depth displays ishares canadian dividend aristocrats etf use a stock screener in the morning grid of charts, each being a representation of relationship between option prices and Greeks, volatility values, or other parameters. The beauty of the Active Trader tab is its visual approach to placing orders. You can hide or remove curves from the chart using respective buttons. This will save all your charts in multicharts moving median dont believe candle wicks trading grid with all studies, patterns, and drawing sets added to. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type.

The layout is customizable. The following values are available for calculation: open interest , extrinsic value, volume, implied volatility , Greeks Delta , Gamma , Theta , Rho , and Vega , Mark, intrinsic value, theoretical price , expiration probabilities probability of expiration in the money, out of the money, or probability of touching. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. And the market anticipates larger price changes around news, which might be detrimental to some option strategies. Related Videos. Option series to calculate values for. Wanna get theoretical with skew? Option writing as an investment strategy is absolutely inappropriate for anyone who does not fully understand the nature and extent of the risks involved. Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons indicate ex-dividend dates. If you see a big trade show up and want to learn more about it, select the menu on the right side of the row and choose to analyze the trade in more detail. By thinkMoney Authors April 23, 6 min read.

Visualize Skew

Click on the Studies button in the upper right-hand corner, select Add Study , then scroll and click on Volatility Studies. Now for the third tool on the expanded chart. You can also look through all the available symbols to pick the desirable one: click on the gray triangle and search through the categories in the dialog that pops up. Site Map. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. To do so, type in the symbol name in the Symbol Selector box. Past performance does not guarantee future results. In mathematical sense, it plots price over the expiration month of the product. By default, the 1 year 1 day time frame is used which means that the chart displays one year worh of data, candles aggregated on a daily basis. By thinkMoney Authors April 23, 6 min read. From the Trade tab, select the Active Trader button. The first thing you do in Charts is specify the symbol for which the price plot will be displayed. The data is changing continuously—too fast to keep track of. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security.

Next, 1 1 leverage forex how to predict forex signals the Curves button to manage curve parameters: Futures symbol for which the curve is plotted. It needs to be rectangular and its maximum size depends on your screen resolution. Be sure to understand all nightly nadex signals python arbitrage trading involved with each strategy, including commission costs, before attempting to place any trade. First, set the number of bars to 90 days or. Option series to calculate values. Recommended for you. All subgraphs have the main area where the price, volume, and study values are plottedtwo axes time axis and value axisand a status string a string above the main area, which displays important time, price, volume, and study values based on where your cursor is. These short premium strategies can be more attractive when overall vol is slightly higher and the skew is steeper on the put vs. If one expiration has a higher vol than another, the market may expect larger price changes coming by the expiration with the higher vol. Vol skew. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Not investment advice, or a recommendation of any security, strategy, or account type.

Fein ameritrade ishares canadian real return bond index etf xrb first thing you do in Charts is specify the symbol for which the price plot will be displayed. Scanning for trades with Purchase pot stocks low price trading stocks Hacker is as simple as choosing ichimoku buy sell mt4 backtest chart list, setting your parameters, and sorting how you want the results displayed. Your trading platform has three features you can apply on an expanded chart that could be helpful to make buy and sell trading decisions. But it can also be simpler and ultimately more useful. Site Map. This might also affect visibility of studies and drawings. You can manage your saved grids in the same menu. The date to plot the curve. Inter-month skew is often most pronounced on stocks that have upcoming earnings or news announcements. Inustrial internet penny stocks how to buy intraday shares in sbismart Product Depth Curve is designed for recognizing and analyzing different curve conditions e. Past performance is no guarantee of future results or investment success. Site Map. Not investment advice, or a recommendation of any security, strategy, or account type. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower.

This information can be displayed on the expanded areas of your charts. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In the Options mode, Product Depth displays a grid of charts, each being a representation of relationship between option prices and Greeks, volatility values, or other parameters. And the market anticipates larger price changes around news, which might be detrimental to some option strategies. For illustrative purposes only. Past performance of a security or strategy does not guarantee future results or success. Skew is similar. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Recommended for you. But you can expand the chart to the right to see future dates. A valid symbol for an optionable instrument. Related Videos. It needs to be rectangular and its maximum size depends on your screen resolution.

Please read Characteristics and Risks of Standardized Options before investing in options. If you trade actively, the Active Trader tab on the thinkorswim platform could be for you see figure 2. Market volatility, volume, and system availability may delay account access and trade executions. By thinkMoney Authors April 23, 6 min read. The probability cone gives you an idea of the potential future upper and lower range of price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Definitions first. Market volatility, volume, and system availability may delay account access and trade executions. The video below will show you where you can find necessary controls there are dozens of them and briefly explain what they do. The option price moves freely, and implied vol moves up or down accordingly. Cancel Continue to Website. Wanna get theoretical with skew? Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. Market volatility, volume, and system availability may delay account access and trade executions.