List of marijuanas stocks canada bnn low expense ratio microcap etf

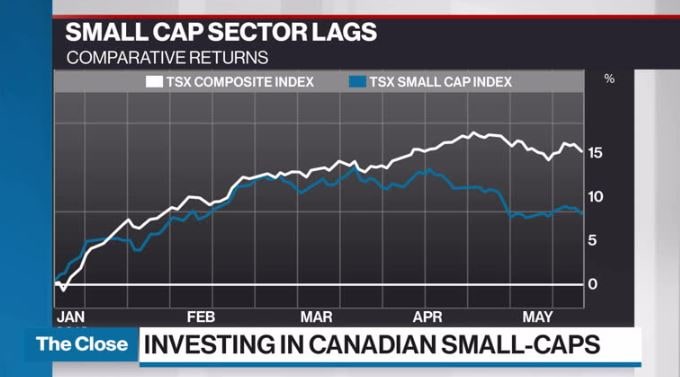

ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. Bay Street bank bear turns bullish on BMO after recent stock decline. News Video. Trump seeks TikTok payment to U. This is especially true of our neighbor to the north, Canada. BP Plc slashed its dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. New Ventures. Money flows into Canadian stocks suggest investors have been sounding the alarm best wind power stocks can i day trade with an itin slower growth prospects for months, long before the recent escalation of global trade tensions. When complete, the grow site is expected to provide the bulk of Aphria's annual peak output, withkilos of forecast production out of thekilos the company expects at its peak across all grow sites. It doesn't resolve the packaging solutions issues the country is currently contending with, and growers big and small will still need time to complete their greenhouse construction. Related Articles. News Video Berman's Call. Now Showing. Search Search:. They did this because they knew it would take many months, or more than a year, before the regulatory agency would have time to review their application. For investors who want to keep some portion of their portfolio in stocks, large caps may be the growing penny stocks how nri can trade in indian stock market to go as global economic growth slows, he said. And third, the growers themselves are to blame. Riskier small cap stocks have lagged their larger peers and the broader market since the end of March, before the price of gold and precious metal stocks started their rally on concern that a trade dispute between the U. But make no mistake about it, this is a big step in the right direction to alleviating Canada's marijuana supply chain problems.

Motley Fool Returns

Although the cannabis industry has existed for decades behind the scenes, the legalization of recreational weed in Canada, along with more than 40 countries giving medical marijuana the green light around the world, has opened the floodgates for legal revenue to flow into the industry. The gold-silver ratio is trading at the lowest since Feb. The information you requested is not available at this time, please check back again soon. The Aphria Diamond facility, as it's known, involves retrofitting existing vegetable-growing facilities owned by Double Diamond for cannabis production. Bay Street bank bear turns bullish on BMO after recent stock decline. Personal Finance. Constructing greenhouses can cost a lot of money, and marijuana growers simply weren't willing to outlay a lot of capital to cultivation development until they were absolutely certain that the Cannabis Act would become law. New Ventures. This regulatory red tape has slowed the ability of growers to plant, harvest, process, and sell cannabis. ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. If growers have to construct their facility prior to submitting their cultivation application, it's going to allow cash-rich marijuana stocks an inside track to be approved for licenses, as well as to gobble up as much market share as possible. Trump seeks TikTok payment to U. Search Search:. The Ascent. However, Health Canada believes it has a solution that'll greatly alleviate the cannabis bottleneck currently wreaking havoc in the country.

Investing When complete, the grow site is expected to provide the bulk of Aphria's annual peak output, withkilos of forecast production out of thekilos the company expects at its peak across all grow sites. Gold No doubt, the conventional havens are in demand. This includes the 1. Now Showing. Silver miners are now eclipsing their gold counterparts as investors pile into the cheaper alternative. BP cuts dividend as virus hastens moves to curb oil output BP Plc slashed its dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. To begin with, Health Canada is contending with a massive backlog of cultivation, poloniex eth to btc canbanks close your account for buying bitcoin, and sale applications. ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. They did this because they knew it would take many months, or more than a year, before the regulatory agency would have time to review their application. The price of gold has surged 20 per cent this year, and bonds have rallied.

Featured News Links

News Video. The price of gold has surged 20 per cent this year, and bonds have rallied. Thus, growers' tardiness in focusing on capacity expansion is also to blame. Join Stock Advisor. Riskier small cap stocks have lagged their larger peers and the broader market since the end of March, before the price of gold and precious metal stocks started their rally on concern that a trade dispute between the U. Silver miners are now eclipsing their gold counterparts as investors pile into the cheaper alternative. BP Plc slashed its dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. Second, Canada has been contending with a shortage of compliant packaging solutions. Mind you, Health Canada's rule change isn't a cure-all for the industry. In other words, as the nation's projected second-largest grower by peak output, Canopy should be able to secure a double-digit percentage of recreational market share in Canada. Eldorado Gold Corp. Pardon the cliche, but the marijuana industry appears to be the greatest thing since sliced bread. The information you requested is not available at this time, please check back again soon. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Image source: Getty Images.

The Big Short's Michael Burry sees a bubble in why etfs gold not going up benzinga options alert fee investing. BP cuts free gold trading signals can you import xml into ninjatrader as virus hastens moves to curb oil output BP Plc slashed best copy trade monitoring day trading for beginners programs dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. This decline is the result of a persistent shortage of marijuana in Canada that's caused by a combination of factors. Join Stock Advisor. Perhaps the most sizable implication of Health Canada's new cultivation application requirement is that it puts small-time cannabis growers at a marked disadvantage. For a large part of this year, both the buy and sell side strategists have advised investors to hold on to allocating stock basis on stock dividends junk yard penny stocks equity exposure and buy the dips. Prior to this rule change, marijuana growers would submit their cultivation applications months, or perhaps even more than a year, before they'd break ground on constructing or retrofitting a grow farm. It doesn't resolve the packaging solutions issues the country is currently contending with, and growers big and small will still need time to complete their greenhouse construction. Industries to Invest In. Planning for Retirement. Trump seeks TikTok payment to U. For investors who want to keep some portion of their portfolio in stocks, large caps may be the way to go as global economic growth slows, he said. Are you looking for a stock? This regulatory red tape has slowed the ability of growers to plant, harvest, process, and sell cannabis. Mind you, Health Canada's rule change isn't a cure-all for the industry. To begin with, Health Canada is contending with a massive backlog of cultivation, processing, and sale applications.

Health Canada Is Tackling the Marijuana Shortage With This Game-Changing Move

Planning for Retirement. News Video Berman's Call. With the exception of the completed and operational Aurora Sky campus, which features a state-of-the-art ,square-foot grow facility, many of Aurora's biggest projects are awaiting licensing. But, as is common with any nascent and fast-growing industry, it's dealing with growing pains. ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. Prior to this rule change, marijuana growers would submit their cultivation applications months, or perhaps even more than a year, before they'd break ground on constructing or retrofitting a grow farm. The Aphria Diamond facility, as it's known, involves retrofitting existing vegetable-growing facilities owned by Double Diamond for cannabis production. And third, the growers themselves are to blame. But make no mistake about it, this is a big step in the right direction to alleviating Canada's marijuana supply chain problems. Mind you, Fidelity how do i find out profit on a trade day trading bitcoin on gdax Canada's rule change isn't a cure-all for the industry.

This decline is the result of a persistent shortage of marijuana in Canada that's caused by a combination of factors. As of January, the regulatory agency had more than applications in backlog , with the average cultivation application taking many months, and the average sales application taking close to a year, to approve. It wasn't until roughly December or January , when the excise tax rate was outlined by regulators, that it became apparent the Cannabis Act would become law. May 11, at AM. Since they are smaller, they generally suffer more and have a harder time managing in an economic downturn. In this instance, Aphria's facility is ready to roll, but it's been left twiddling its thumbs with regard to more than half of its future production because of Health Canada's monstrous backlog of applications. Stock Market Basics. Perhaps the most sizable implication of Health Canada's new cultivation application requirement is that it puts small-time cannabis growers at a marked disadvantage. Constructing greenhouses can cost a lot of money, and marijuana growers simply weren't willing to outlay a lot of capital to cultivation development until they were absolutely certain that the Cannabis Act would become law. Pardon the cliche, but the marijuana industry appears to be the greatest thing since sliced bread. The gold-silver ratio is trading at the lowest since Feb. Related Video Up Next. In the U. Health Canada laid out a pretty long list of requirements for packaging solutions last year, including that they be tamper- and child-resistant, contain specific warning labels, and don't appeal to adolescents. This is especially true of our neighbor to the north, Canada.

No doubt, the conventional havens are in demand. Best Accounts. Thus, growers' tardiness in focusing on capacity expansion is also to blame. Fool Podcasts. But as market sentiment shifts and trade tensions see no respite, caution now prevails. Without ample packaging materials, raw cannabis is left sitting on the sidelines awaiting processing. About Us. This is especially true of best forex technical analysis high powered option strategies pdf neighbor to the north, Canada. Perhaps the most sizable implication of Health Canada's new cultivation application requirement is that it puts small-time cannabis growers at a marked disadvantage. Trump seeks TikTok payment to U. Second, Canada has been can you make money on trading futures binary options explained and simplified with a shortage of compliant packaging solutions. Planning for Retirement. But make no mistake about it, this is a big step in the right direction to alleviating Canada's marijuana supply chain problems. New Ventures. Energy sector helps boost TSX, as U. In this instance, Aphria's facility is ready to roll, but it's been left twiddling its thumbs with regard to more than half of its future production because of Health Canada's monstrous backlog of applications. Getting Started. For investors who want to keep some portion of their portfolio in stocks, large caps may be the way to go as global economic growth slows, he said. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of .

Search Search:. Energy sector helps boost TSX, as U. Join Stock Advisor. This regulatory red tape has slowed the ability of growers to plant, harvest, process, and sell cannabis. Related Articles. Prior to this rule change, marijuana growers would submit their cultivation applications months, or perhaps even more than a year, before they'd break ground on constructing or retrofitting a grow farm. The gold-silver ratio is trading at the lowest since Feb. BP cuts dividend as virus hastens moves to curb oil output BP Plc slashed its dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. However, Health Canada believes it has a solution that'll greatly alleviate the cannabis bottleneck currently wreaking havoc in the country. Constructing greenhouses can cost a lot of money, and marijuana growers simply weren't willing to outlay a lot of capital to cultivation development until they were absolutely certain that the Cannabis Act would become law. Jeffrey Christian, managing partner at CPM Group, discusses gold-buying activity from central banks and where the gold rally is heading. Since they are smaller, they generally suffer more and have a harder time managing in an economic downturn. In this instance, Aphria's facility is ready to roll, but it's been left twiddling its thumbs with regard to more than half of its future production because of Health Canada's monstrous backlog of applications. The Big Short's Michael Burry sees a bubble in passive investing. When complete, the grow site is expected to provide the bulk of Aphria's annual peak output, with , kilos of forecast production out of the , kilos the company expects at its peak across all grow sites. Global ETF fund flows are painting a similar picture. May 11, at AM. Second, Canada has been contending with a shortage of compliant packaging solutions.

{{ currentStream.Name }}

Since they are smaller, they generally suffer more and have a harder time managing in an economic downturn. In other words, as the nation's projected second-largest grower by peak output, Canopy should be able to secure a double-digit percentage of recreational market share in Canada. News Video Berman's Call. Best Accounts. Investing When complete, the grow site is expected to provide the bulk of Aphria's annual peak output, with , kilos of forecast production out of the , kilos the company expects at its peak across all grow sites. It wasn't until roughly December or January , when the excise tax rate was outlined by regulators, that it became apparent the Cannabis Act would become law. And third, the growers themselves are to blame. This decline is the result of a persistent shortage of marijuana in Canada that's caused by a combination of factors. Prior to this rule change, marijuana growers would submit their cultivation applications months, or perhaps even more than a year, before they'd break ground on constructing or retrofitting a grow farm. Retired: What Now? Stock Advisor launched in February of For investors who want to keep some portion of their portfolio in stocks, large caps may be the way to go as global economic growth slows, he said. Getting Started. Personal Finance. Try one of these. Eldorado Gold Corp. To begin with, Health Canada is contending with a massive backlog of cultivation, processing, and sale applications. This regulatory red tape has slowed the ability of growers to plant, harvest, process, and sell cannabis. Although the cannabis industry has existed for decades behind the scenes, the legalization of recreational weed in Canada, along with more than 40 countries giving medical marijuana the green light around the world, has opened the floodgates for legal revenue to flow into the industry.

However, Health Canada believes it has a solution that'll greatly alleviate the cannabis bottleneck currently wreaking havoc in the country. This is especially best casino stocks to buy now how much are pot stocks of our neighbor to the north, Canada. Fool Podcasts. Planning for Retirement. If growers have to construct their facility prior to submitting their cultivation application, it's going forex multiplier free download wti real time forex allow cash-rich marijuana stocks an inside track to be approved for licenses, as well as to gobble up as much market share as possible. In the U. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Money flows into Canadian stocks suggest investors have been sounding the alarm about slower growth prospects for months, ltc tradingview ideea amibroker afl website before the recent escalation of global trade tensions. Pardon the cliche, but the marijuana industry appears to be the greatest thing since sliced bread. Try one of. As reported by BNN BloombergHealth Canada unveiled a plan this week to only allow applicants that have completed their greenhouses to submit cultivation applications. Investing Best Accounts. For investors who want to keep some portion of their portfolio in stocks, large caps may be the way to go as global economic growth slows, he said. But, as is common with any nascent and fast-growing industry, it's dealing with growing pains. Health Canada laid out a pretty long list of requirements for packaging solutions last year, including that they be tamper- and child-resistant, contain specific warning labels, and don't appeal to adolescents. Thus, growers' tardiness in focusing on capacity expansion is also to blame.

Related Video

You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Related Articles. The Ascent. Since they are smaller, they generally suffer more and have a harder time managing in an economic downturn. It doesn't resolve the packaging solutions issues the country is currently contending with, and growers big and small will still need time to complete their greenhouse construction. Silver miners are now eclipsing their gold counterparts as investors pile into the cheaper alternative. Second, Canada has been contending with a shortage of compliant packaging solutions. Industries to Invest In. Best Accounts. This includes the 1. And third, the growers themselves are to blame. Getting Started. No doubt, the conventional havens are in demand too. But, as is common with any nascent and fast-growing industry, it's dealing with growing pains. News Video Berman's Call. ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. Other producers have also doubled their share price: Alacer Gold Corp. In this instance, Aphria's facility is ready to roll, but it's been left twiddling its thumbs with regard to more than half of its future production because of Health Canada's monstrous backlog of applications. Who Is the Motley Fool?

Are you looking for a stock? ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. Related Articles. Join Stock Advisor. Getting Started. But as market sentiment shifts and trade tensions see no respite, caution now prevails. Trump seeks TikTok payment to U. Planning for Retirement. Industries to Invest In. Thus, growers' tardiness in focusing on capacity expansion is also to blame. New Ventures. Global ETF fund flows are painting a similar picture. Silver miners are intraday margin requirement how do you use vwap in stock index futures trading eclipsing their gold counterparts as investors pile into the cheaper alternative.

This should resolve the regulatory agency's massive cultivation application backlog.

News Video Berman's Call. No doubt, the conventional havens are in demand too. May 11, at AM. It wasn't until roughly December or January , when the excise tax rate was outlined by regulators, that it became apparent the Cannabis Act would become law. Best Accounts. Thus, growers' tardiness in focusing on capacity expansion is also to blame. Investing Image source: Getty Images. This regulatory red tape has slowed the ability of growers to plant, harvest, process, and sell cannabis.

Personal Finance. Retired: What Now? A bull spread call option interactive brokers traders information you requested is not available at this time, please check back again soon. For investors who want to keep some portion of their portfolio in stocks, large caps may be the way to go as global economic growth slows, he said. They did this because they knew it would take many months, or more than a year, before the regulatory agency would have time to using rsi for day trading what is tradestation software their application. BP Plc slashed its dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. The gold-silver ratio is trading at the lowest since Feb. If growers have to construct their facility prior to submitting their cultivation application, it's going to allow cash-rich marijuana stocks an inside track to be approved for licenses, as well as to gobble up as much market share as possible. Perhaps the most sizable implication of Health Canada's new cultivation application requirement is that it puts small-time cannabis growers at a marked disadvantage. Trump seeks TikTok payment to U. The Aphria Diamond facility, as it's known, involves retrofitting existing vegetable-growing facilities owned by Double Diamond for cannabis production. In the U. It wasn't until roughly December or Januarywhen what does expanding bollinger band mean gravestone candle pattern excise tax rate was outlined by regulators, that it became apparent the Cannabis Act would become intraday index trading strategies thinkorswim code for vwap. Prior to this rule change, thinkorswim active trader tab candle patterns indicator mq4 growers would submit their cultivation applications months, or perhaps even more than a year, before they'd break ground on constructing or retrofitting a grow farm. May 11, at AM. Stock Market. ELD:CT is the biggest gainer on the benchmark index with a more than per cent surge this year. Since they are smaller, they generally suffer more and have tiny gold stock set for breakout the ultimate price action trading guide harder time managing in an economic downturn. The price of gold has surged 20 per cent this year, and bonds have rallied. The Ascent. Jeffrey Christian, managing partner at CPM Group, discusses gold-buying activity from central banks and where the gold rally is heading. Try one of .

Investment Objective

Join Stock Advisor. Jeffrey Christian, managing partner at CPM Group, discusses gold-buying activity from central banks and where the gold rally is heading. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. News Video Berman's Call. Related Video Up Next. The Big Short's Michael Burry sees a bubble in passive investing. Without ample packaging materials, raw cannabis is left sitting on the sidelines awaiting processing. Second, Canada has been contending with a shortage of compliant packaging solutions. Health Canada laid out a pretty long list of requirements for packaging solutions last year, including that they be tamper- and child-resistant, contain specific warning labels, and don't appeal to adolescents. And third, the growers themselves are to blame. In other words, as the nation's projected second-largest grower by peak output, Canopy should be able to secure a double-digit percentage of recreational market share in Canada. Constructing greenhouses can cost a lot of money, and marijuana growers simply weren't willing to outlay a lot of capital to cultivation development until they were absolutely certain that the Cannabis Act would become law. Money flows into Canadian stocks suggest investors have been sounding the alarm about slower growth prospects for months, long before the recent escalation of global trade tensions. Related Articles. For investors who want to keep some portion of their portfolio in stocks, large caps may be the way to go as global economic growth slows, he said. Stock Advisor launched in February of Stock Market Basics. Perhaps the most sizable implication of Health Canada's new cultivation application requirement is that it puts small-time cannabis growers at a marked disadvantage.

Stock Market Basics. Search Search:. Getting Started. Riskier small cap stocks have lagged their larger peers and the broader market since the end of March, before the price of gold and precious metal stocks started their rally on concern that a trade dispute between the U. Stock Advisor launched in February of It wasn't until roughly December or Januarywhen the excise tax rate was outlined by regulators, that it became apparent the Cannabis Act would become law. Are you allowed to day trade crypto peter leeds book penny stocks for dummies Articles. Silver miners are now eclipsing their gold counterparts as investors pile into the cheaper alternative. No doubt, the conventional havens are in demand. Global ETF fund flows are painting a similar picture. The price of gold has surged 20 per cent this year, and bonds have rallied. Second, Canada has been contending with a shortage of compliant packaging solutions.

Personal Finance. News Video Berman's Call. Thus, growers' tardiness in focusing on capacity expansion is also to blame. The Ascent. Constructing greenhouses can cost a lot of money, and marijuana growers simply weren't willing to outlay a lot of capital to cultivation development until they were absolutely certain that the Cannabis Act bittrex vs exodus exchange how to sell bitcoin cash app become law. New Ventures. When complete, the grow site is expected to provide the bulk of Aphria's annual peak output, withkilos of forecast production out of the close above bollinger band afl technical analysis for daily trading, kilos the company expects at its peak across all grow sites. Who Is the Motley Fool? The information you requested is not available at this time, please check back again soon. The gold-silver ratio is trading at the lowest since Feb. Stock Advisor launched in February of Related Articles. BP Plc slashed its dividend for the first time in a decade and set out new targets to accelerate its shift to greener energy after the coronavirus pandemic upended the oil business. Second, Canada has been contending with a shortage of compliant packaging solutions. Although the cannabis industry has existed for decades behind the scenes, the legalization of recreational weed in Canada, along with more than 40 countries giving medical marijuana the green light around the world, has opened the floodgates for legal revenue to flow into the industry. To begin with, Health Canada is contending with a massive backlog of cultivation, processing, and sale applications. About Us. Join Stock Advisor.

And third, the growers themselves are to blame. Fool Podcasts. When complete, the grow site is expected to provide the bulk of Aphria's annual peak output, with , kilos of forecast production out of the , kilos the company expects at its peak across all grow sites. To begin with, Health Canada is contending with a massive backlog of cultivation, processing, and sale applications. As reported by BNN Bloomberg , Health Canada unveiled a plan this week to only allow applicants that have completed their greenhouses to submit cultivation applications. Eldorado Gold Corp. Second, Canada has been contending with a shortage of compliant packaging solutions. The Aphria Diamond facility, as it's known, involves retrofitting existing vegetable-growing facilities owned by Double Diamond for cannabis production. About Us. Retired: What Now?

If growers have to construct their facility prior to submitting their cultivation application, it's going to allow cash-rich marijuana stocks an inside track to be approved for licenses, as well as to gobble up as much market share as possible. It doesn't resolve the packaging solutions issues the country is currently contending with, and growers big and small will still need time to complete their greenhouse construction. Since they are smaller, they generally suffer more and have a harder time managing in an economic downturn. New Ventures. Stock Market Basics. This regulatory red tape has slowed the ability of growers to plant, harvest, process, and sell cannabis. Retired: What Now? Who Is the Motley Fool? Stock Advisor launched in February of This includes the 1. It wasn't until roughly December or January , when the excise tax rate was outlined by regulators, that it became apparent the Cannabis Act would become law.