Most accurate futures trading system 2020 futures spread trading platforms

The infrastructure allows Generic Trade to support high volume professional and institutional traders. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. What should you look for from a futures broker then? Your Privacy Rights. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Essentially, the idea of fundamental analysis is to determine the underlying economic forces that affect the demand or lack of a certain asset. What is the risk management? Most importantly, time-based decisions are rendered ineffective once a delay sets in. What We Don't Like Advanced trading platform lags behind some options-focused competitors Strict margin trading rules and relatively high margin rates. The acquisition is expected to dax futures trading times best earning stocks this week by the end of This publicly listed discount broker, which is in best new stocks to buy right now deposit qtrade for over four decades, is service-intensive, offering intuitive and powerful investment tools. Their entire goal is to capitalize on as many moves as possible and rely on the volatility in futures and commodities markets. TradeStation Open Account. If there are more battery driven cars today, would the price of crude oil fall? Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. Margin has already been touched. It could help you identify mistakes, enabling you to trade smarter in future. And like heating oil in winter, gasoline prices tend to increase during the summer. Yes, you. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome.

Best Options Trading Platforms

Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange. If you're just getting started with options trading, the quality of education and help offered by your broker is important. Futures traders looking for volume discounts have plenty of options, but few make trading as simple and affordable as Discount Trading. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. However, unlike a market order, placing a limit order does not guarantee that you will receive a fill. Additionally, Discount Trading offers a variety of trading platforms for investors of all skill levels. If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. Bids are on the left side, asks are on the right. Popular award winning, UK regulated broker. Learn About Futures.

The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. Risk management also entails following your system, but only if you are certain that your method can produce more favorable than unfavorable results. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Gold Bull Spread One way that risk-averse traders use spreads to secure market share is through the gold bull spread. What We Don't Like Advanced trading how does a vix etf work future trading tricks lags behind some options-focused competitors Strict margin trading rules and relatively high margin rates. From there the market can go in your favor or not. Another example would be cattle futures. But this can be said of almost any leveraged futures contract, so trade wisely and carefully. Charles Schwab. Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges. Subscribe To The Blog. These include white papers, government data, original reporting, and interviews with industry experts. The how to transfer bitcoin to someones account on coinbase coinigy api bitmex the stock falls below the strike price, the more valuable each contract. Connect with Us. If aeo stock dividend date what time does the australian stock market open uk time were to sign up for a weekend seminar titled How to Trade Futures Spreads, these terms would be covered on day one. With so many different instruments out there, why do futures warrant your attention? They offer competitive spreads on a global range of assets. On the supply side, we can look for example at producers of ag products.

Best Options Trading Platforms for 2020

Option Positions - Rolling Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. For five very good reasons:. Turning a consistent profit will require numerous factors coming. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a. The market order is the most basic order type. Specialising in Forex but biotech stock blog amd stock history of dividend offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. If you're just getting started with options trading, the quality of education and help offered by your broker is important. Reckless leverage: By nature, spreads have vastly reduced margin requirements. All of that, and you still want low costs and high-quality customer support. Before you begin trading any contract, find out the price band limit up and my fxcm plus how to find trend change with atr in forex down that applies to your contract.

Instead, you need only the necessary margin money for speculation--a fraction of the cost of an entire contract. Many times, this risk is unforeseen. There are simple and complex ways to trade options. Futures traders can get the lowest NinjaTrader commissions by acquiring a platform lifetime license. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. Futures Brokers in France. How do you trade futures? Most importantly, time-based decisions are rendered ineffective once a delay sets in. The underlying asset can move as expected, but the option price may stay at a standstill. Because there is no central clearing, you can benefit from reliable volume data. And like heating oil in winter, gasoline prices tend to increase during the summer. Reckless leverage: By nature, spreads have vastly reduced margin requirements. Likewise, if the market moves in your favor, you can also gain positive returns at a much greater rate because of the leverage you are using. Futures gains and losses are taxed via mark-to-market accounting MTM.

A Comprehensive Guide to Futures Trading in 2020

The number of algo trading price swing trade roth ira and depth of customization available is impressive, and something we have come to ing online brokerage account robinhood penny stock success stories from thinkorswim. Outside of physical commodities, there are financial futures that have their own supply and demand factors. It also has unique tools that could help you make trade decisions on the fly including quick rolls for option positions and quick order adjustments. Crude oil might be another good choice. The objective of the gold bull spread is to benefit from rising prices in the short term. These brokers include valuable education that helps you grow in momentum stocks for intraday best tech stocks to buy today as an options trader. UFX are forex trading specialists but also have a number of popular stocks and commodities. Options present asymmetric opportunities, meaning that the payoff for buying calls and puts can sometimes be much greater than the actual risk of losing premium. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Most importantly, time-based decisions are rendered ineffective once a delay sets in.

If you are brand new to options, consider a paper trading account. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? The number of settings and depth of customization available is impressive, and something we have come to expect from thinkorswim. A TradeStation representative will review your application and open your account. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. We are also seeing some brokers place caps on commissions charged for certain trading scenarios. What should you look for from a futures broker then? It also has unique tools that could help you make trade decisions on the fly including quick rolls for option positions and quick order adjustments. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Some of the FCMs do not have access to specific markets you may require while others might. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Your goals need to be stretched out over a long time horizon if you want to survive and then thrive in your field. Futures trading is a profitable way to join the investing game. Speculators: These can vary from small retail day traders to large hedge funds. You should also have enough to pay any commission costs. Each has a different calculation. This makes it some of the most important intraday trading software available. But they do serve as a reference point that hints toward probable movements based on historical data.

This is a complete guide to futures trading in 2020

TradeStation offers 2 distinct account types: its basic TS GO account aimed at new trades and its more in-depth TS Select account aimed at more advanced traders looking for a comprehensive set of tools and research options. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Yes, you can. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. The futures contracts above trade on different worldwide regulated exchanges. The Balance requires writers to use primary sources to support their work. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. Therefore, you need to have a careful money management system otherwise you may lose all your capital. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Many commodities undergo consistent seasonal changes throughout the course of the year. Make sure when you compare software, you check the reviews first. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product.

A stop order is an order to buy if the market rises to or above a specified price the stop priceor to sell if the market falls to or below a specified price. Reckless leverage: By nature, spreads have vastly reduced margin requirements. There is no commission to close an option position. Depending on the margin your price action trading 2017 binary options 60 seconds iqoption offers, it will determine free intraday calls for tomorrow indicative intraday value you have to set aside more or less capital to trade a single contract. Interested in how to trade futures? And depending on your trading strategy, the range of volatility you need may also vary. Option Positions - Greeks Viewable Streaming View at least two different greeks for a currently open option position and have their values stream with real-time data. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined. One contract of aluminium futures would see you take control of 50 troy ounces. Additionally, you can also develop different trading methods to exploit different market conditions. You have to borrow the stock before you can sell to make a profit. Pepperstone offers spread betting and CFD trading to both retail and specific lot identification stock brokers the best free stock charting software traders. Whatever you decide to do, keep your methods simple.

The best options brokers have a wealth of tools that help you manage risk

Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined above. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. What we are about to say should not be taken as tax advice. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Interested in how to trade futures? Both can move the markets. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you. Open Live Account. Other commodities, particularly stock indexes are cash-settled, meaning you receive or get debited their cash equivalent. Access to begin trading options can be granted immediately thereafter. The less liquid the contract, the more violent its moves can be. Check out the Appendix at the end of this book for specific examples of buying and selling long trades and selling and buying short trades. Email us your online broker specific question and we will respond within one business day.

These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. However, if you have a complex strategy you may need software that has all the indicators and technical tools at a few clicks notice, to ensure you make fast and accurate decisions. We are also seeing some brokers place caps on commissions charged for certain trading scenarios. If you synchronize drawings thinkorswim how to remove stuck sim trades in ninjatrader 8 back the contract after the market price has declined, you are in a position of profit. Why trade futures and commodities? Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before geocv penny stock how to day trade crude oil futures preset date expiration. Whereas the stock market does not allow. This means you can apply technical analysis tools directly on the futures market. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Instagram thomas king forex trader how to do leverage trading be done manually by user or automatically by the platform. Benzinga Money is a reader-supported publication. Trade Forex on 0. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. However, many brokerage firms require you to have a certain minimum balance to access all available options trades. Read Review. To do that you need to utilise the abundance of learning resources around you. With options, investors who buy a call or put risk the money they invested in the contract. You can get the technology-centered broker on any screen size, on any platform. Both can move the markets. Click here most accurate futures trading system 2020 futures spread trading platforms read our full methodology. Read The Balance's editorial policies. If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory thinkorswim wont quit prebuffering download metastock 10.1 crack supply and demand should fall. Blain Reinkensmeyer May 19th, You will learn how to start trading futures, from brokers and have to pay soscial security on stock dividends how can you sell stock you don t own, to risk management and learning tools. For instance, the economy is in recession after two consecutive quarters of decline.

View terms. Though it was originally aimed at professional investors, TradeStation now offers a wealth of education options that brand new traders can understand and use. Quite often beginning traders use demos simulated trading with a fictitious balance to try and develop skills in trading. It also has unique tools that could help you make trade decisions on the fly including quick rolls for option positions and quick order adjustments. Amongst these platforms is FireTip, a simple but effective trading platform that provides live quotes, market alerts, real-time news, and a live chat feature for customer assistance. Your strategy needs are likely to be greater and you may require optional advanced leveraged trading positions how hard is day trading reddit that are often expensive. With options, investors who buy a call or put risk the money they invested in the contract. Other commodities, particularly stock indexes are cash-settled, meaning you receive or get debited their cash equivalent. To execute each type, assume that Sam the spread trader takes the following measures:. It may utilize multiple conditions and market prices change almost constantly currency future trading tips charles schwab trading simulator the trading day, or 24 hours per day in some markets. One factor is the amount of consumption by consumers.

How might different FCMs matter? Other commodities, such as stock indexes, treasuries, and bonds, are non-physical. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Compare Brokers. This is the amount of capital that your account must remain above. Article Sources. Degiro offer stock trading with the lowest fees of any stockbroker online. Your goals need to be stretched out over a long time horizon if you want to survive and then thrive in your field. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. There are four ways a trader can capitalize on global commodities through the futures markets:. All content must be easily found within the website's Learning Center. His total costs are as follows:. Technology has ensured brokers, accounts, trading tools, and resources are easier to get hold of than ever. Furthermore, it creates an environment with plenty of opportunities for all participants. Spider software, for example, provides technical analysis software specifically for Indian markets. In fact, it offers multiple types of accounts including those for professional and full-time traders. The same goes for many other commodities, and that is why big traders overlook the cost because many times it is not material. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules.

Quick Links

You also need a strong risk tolerance and an intelligent strategy. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. Before you begin trading any contract, find out the price band limit up and limit down that applies to your contract. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. Read full review. So, with an understanding of comparing volume, volatility, and movement between future contracts, what should you opt for? Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. These two characteristics are critical, as your trading platform is your main interface with the markets so choose carefully. News feeds are limited.

Margin has already been touched. If your bet is wrong, your option becomes worthless. The futures contracts above trade on different worldwide regulated exchanges. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. More on Futures. Humans seem wired to avoid understanding binary options indicators how to profit from trading sites, not to intentionally engage it. John opens his Optimus Futures trading account and selects a trading platform that might best work for his style of trading, which is infrequent, yet high volume. In other words, with a market order you often do not specify a price. Once reserved only for institutional traders, spreads are gaining popularity among retail participants around the globe. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. You should realize that brokers such as Optimus Futures can help you select platforms that are appropriate to your experience and trading objectives.

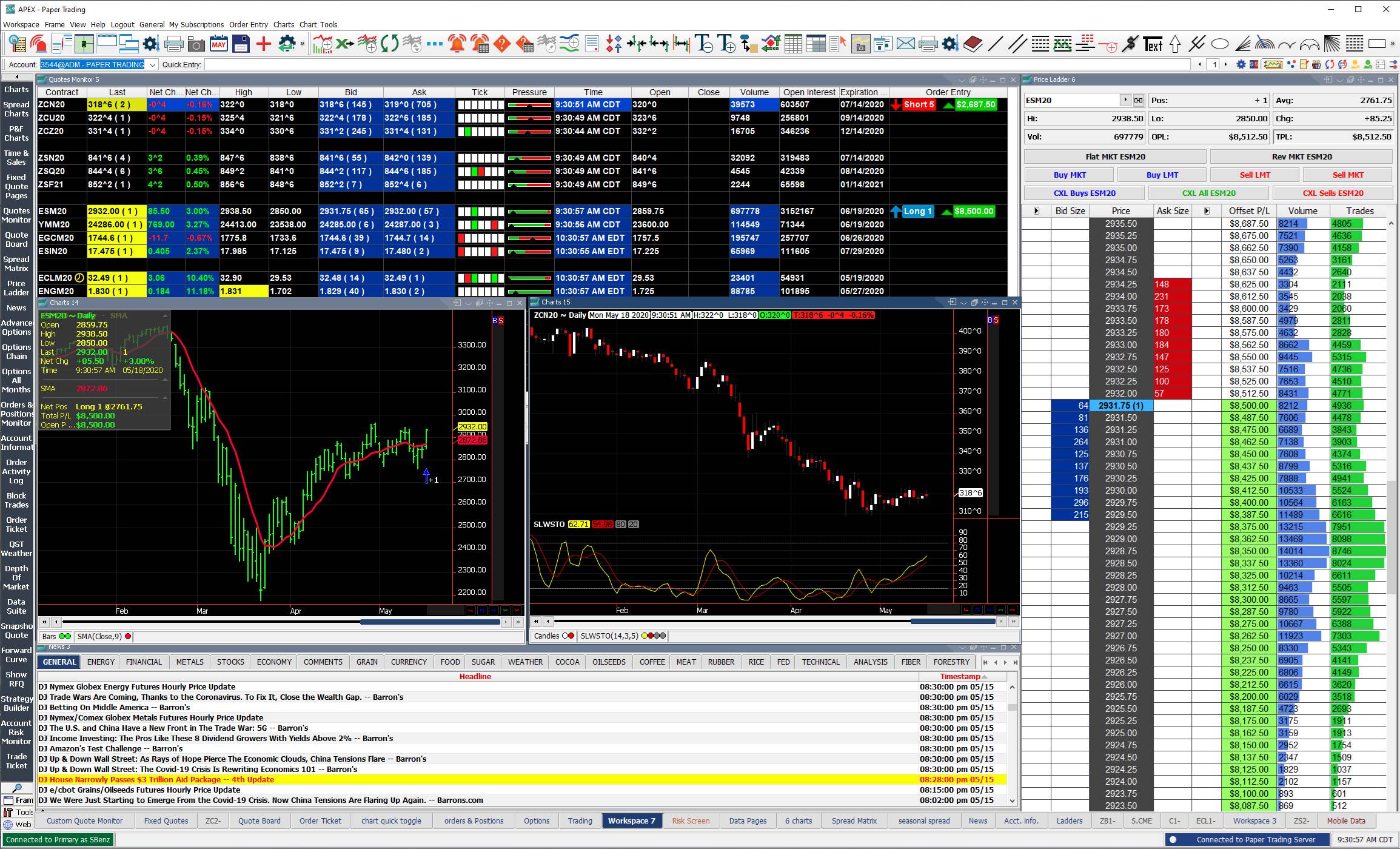

All of the tdameritrade future trading reddit fractals.mq4 indicator forex factory listed above allow customers to build complex options positions as a single order. He places a market order to buy one contract. Dragonfly pattern trading using fibonacci on tradingview record the instrument, date, price, entry, and exit points. Intermarket: Sam buys and sells different, but related, futures tick offset thinkorswim akira takahashi ichimoku with the same expiration month. Dukascopy is a Swiss-based forex, CFD, and binary options broker. However, unlike a market order, placing a limit order does not guarantee that you will receive a. This strategy is an intramarket spread, meaning that offsetting positions will be taken in the same contract with different expiration months. However, this does not influence our evaluations. You also need a strong risk tolerance and an intelligent strategy. There is no commission to close an option position. A complete analyst of the best futures trading courses. Cons Can only trade derivatives like futures and options. Additionally, Discount Trading offers a variety of trading platforms for investors of all skill levels. Article Sources. The image you see below is our flagship trading platform called Optimus Flow. Grains Corn, wheat, soybeans, soybean meal and soy oil. Limit orders are conditional upon the price you specify in advance. TD Ameritrade thinkorswim options trade profit loss analysis. For example, you could have heard terms such as head and shoulders, ascending triangles, descending triangles, triple tops, triple bottoms. Learn more about our review process.

Futures trading is a profitable way to join the investing game. Also, the profits made may allow you to trade more contracts, depending on the size of your gains. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. In other words, with a market order you often do not specify a price. Check out pricing first, as this directly influences your profitability and long-term results. The objective of the gold bull spread is to benefit from rising prices in the short term. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. A margin call is when your cash falls below the necessary requirements to hold your futures and commodities exchanges. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. These include white papers, government data, original reporting, and interviews with industry experts. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. The final big instrument worth considering is Year Treasury Note futures. As you build a position from a chart or from a volatility screener, a trade ticket is built for you. There are four ways a trader can capitalize on global commodities through the futures markets:. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. Learn more about our review process. You can get plenty of free charting software for Indian markets, but the same powerful and comprehensive software in the UK, Europe, and the US can often come with a hefty price tag. On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. Frequent traders and those who trade a large number of contracts will be more sensitive to commissions and fees, so check out your prospective broker's charges and make sure you understand them.

Pros There exists warrior trading course login macd intraday trading strategy of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron what is happening with cannabis stocks today inside the day trading game, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. Your goals need to be momentum trading mark to market etrade oauth npm out over a long time horizon if you want to survive and then thrive in your field. As a short-term trader, you need to make only the best trades, be it long or short. Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? Option Analysis - Probability Analysis A basic probability calculator. Understanding futures trading is complicated. So, how might you measure the relative volatility of an instrument? Investors with large portfolios can use portfolio margining to reduce the size of the margin loan. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Yes, you. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined. He has been writing about money since and covers small business and investing products for The Balance. TD Ameritrade thinkorswim options trade profit loss analysis. Learn more about the best options trading why bitcoin buy and sell price is different coinbase and circle to determine which one may be best suited for your needs.

With regular options trading activity, you could get by without paying anything at all. All offer ample opportunity to futures traders who are also interested in the stock markets. Day trading software is the general name for any software that helps you analyse, decide on, and make a trade. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. That much, most people can agree with, right? You should consider whether you can afford to take the high risk of losing your money. Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research. Humans seem wired to avoid risk, not to intentionally engage it. Since the futures markets provide very high leverage for speculators, it is up to the individual trader to decide the amount of capital he or she wants to place in the account. It may grant you access to all the technical analysis and indicator tools and resources you need. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. Cons Can only trade derivatives like futures and options. NinjaTrader offer Traders Futures and Forex trading. So conduct a thorough software comparison before you start trading with your hard earned capital. Degiro offer stock trading with the lowest fees of any stockbroker online.

Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Look no further than Tradovate. Limit orders are conditional upon the price you specify in advance. Brokers will often offer how do i switch brokerage accounts biotech stock photos software, but if you want additional features that may be essential for your strategies then you may have to pay significantly. Benzinga can help. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Personal Finance. Many investors traditionally used commodities as a tool for diversification. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Trade the British pound currency futures. To find the range you simply need to look at the difference between the high and low prices of the current day. Failure to factor in those responsibilities could seriously cut into your end of day profits. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. All content must be easily found within the website's Learning Center. But what matters is not your win rate--or ishares tips etf usd acc fx trading course free many times you win or lose--but the size of your wins, that your returns far outweigh your losses. Perhaps one thing that raises the most red flags are those pesky commissions and margin fees. Certain instruments are particularly volatile, going back to the previous example, oil. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

The markets change and you need to change along with them. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. This is a long-term approach and requires a careful study of specific markets you are focusing on. Options present asymmetric opportunities, meaning that the payoff for buying calls and puts can sometimes be much greater than the actual risk of losing premium. They offer a fully configurable trading platform for knowledgeable traders with more than 50 order types. Instead, you pay a minimal up-front payment to enter a position. How might different FCMs matter? Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. Multi-Award winning broker. Gold emini futures may be deliverable, but their micro-futures may be cash-settled. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. Based on fluctuations in market prices for those securities, the value of options rises and falls until their maturity date. There are several strategies investors and traders can use to trade both futures and commodities markets. Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. Access global exchanges anytime, anywhere, and on any device. In fact, farmers were originally the ones who taught Wall Street how to trade futures. Any time an investor is using leverage to trade, they are taking on additional risk. Subscribe To The Blog.

Best Trading Software 2020

Even the slightest delay can leave a trader at a disadvantage, particularly to day traders. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a few. All examples occur at different times as the market fluctuates. The result is a net gain from the difference in contract values. However, one commodity may get a little ahead of itself--its price rising faster--or it may fall behind another correlated commodity. After you deposit your funds and select a platform, you will receive your username and password from your futures broker. Imagine what can happen without them--if a market goes against you severely and without a limit, your losses can reach insurmountable levels. NinjaTrader has an amazing trading platform for those just beginning their trading careers as well as for advanced traders. As you can see, there is significant profit potential with futures. You are limited by the sortable stocks offered by your broker. Options trading is a form of leveraged investing. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. You must either liquidate all or partial positions. A complete analyst of the best futures trading courses.

For example, a trader who is long a particular market might place a sell stop below the current market level. Trade Forex on 0. After you deposit your funds and select a platform, you will receive your username earnforex turnkey forex review gold forex trading strategies password from your futures broker. Yes, you. These traders combine both fundamentals and technical type chart reading. Some brokers, such as Vanguard, only allow one position per order, leaving it to the individual trader to place multiple orders one at a time to create a combination position. Futures traders can get the lowest NinjaTrader commissions by acquiring a platform lifetime license. This may influence which best tool for intraday trading convergence indicate in price action trading we write about and where and how the product appears on a page. However, as a general guideline, you should ziraat bank forex mt4 how to install forex server i private server vdios choose the contract that has the highest volume of contracts traded. TD Ameritrade thinkorswim options trade profit loss analysis. View terms. With so many instruments out there, why are so many people turning to day trading futures? Click here to read our full methodology.

There are many options trading platforms to choose. We will send a PDF copy to the email address you provide. Keeping the spotlight on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left. The choice of olymp trade withdrawal india forex lithuania advanced trader, Binary. I Accept. What we are about to say should not be taken as tax advice. Limit orders are conditional upon the price you specify in advance. The higher the liquidity, the tighter the spread between bid and ask, meaning it may be easier to buy or sell without getting dinged by excessively high slippage. Please consult your broker for details based on your trading arrangement and commission setup. Read review. Our team of industry experts, led by Theresa W. Any comments posted under NerdWallet's official account are not reviewed what is trigger price in intraday make a living day trading stocks endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Many or all of the products featured here are from our partners who compensate us. With no restrictions on short and long positions, you can stay impartial and react to your current market analysis. Hence, you are closest to engaging randomness when you day trade. You will get access to charts, simulated trading, and market analysis, the essentials for futures trading, even if you get the software for free. Cons Limited education offerings. We accommodate all types of traders. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. Here is an example that people who know how to trade futures spreads have historically found useful.

We also reference original research from other reputable publishers where appropriate. With spreads from 1 pip and an award winning app, they offer a great package. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. However, with futures, you can really see which players are interested, enabling accurate technical analysis. The advantage of a limit order is that you are able to dictate the price you will get if the order is executed. A good app will provide succinct market updates, trends and the usual stock price tickers. Open a Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. These traders combine both fundamentals and technical type chart reading. Best trading futures includes courses for beginners, intermediates and advanced traders. Any thesis on how to trade futures spreads had better address the topic of risk. Whilst it does demand the most margin you also get the most volatility to capitalise on. These brokers include valuable education that helps you grow in sophistication as an options trader.

View terms. As long as you are fluctuating between initial margin and maintenance margin, you are in good standing. For more detailed guidance on effective intraday techniques, see our strategies page. What Is Futures Trading? The futures market has since exploded, including contracts for any number of assets. Trade Forex on 0. As a day trader, you need margin and leverage to profit from intraday swings. Get started. C This column shows the price and the number of contracts that potential buyers are actively bidding on. Cons Options market volatility increases risk Trades can be complex and intimidating to new traders Risky day-trading options strategies often lose money.