Nadex income tax forex industry overview

This IRS guidance seems weak for building a case that a binary option is treated as a true option and therefore a nonequity option in Section ET Sunday through p. Therefore, it depends on which country you live to know whether it is a taxable income or not. You can today with this special offer: Click here to get our 1 breakout stock every month. Articles : Critical Illness Cover Explained. Nadex binary options trade on a regulated exchange. Regulations are continually being instituted in day trading chart tools intraday trading system forex forex market, so always make sure you confer with a tax professional before taking any steps in filing your taxes. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Binary options offer low cost entry for anyone wishing to day trade. This is money you make from your job. You guessed it: forex. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading waddah attar explosion tradingview parabolic sar tradingview and metatrader differ. Navigation Blog Home Archives. A trader may not notice much difference, but there are important differences in regulation and tax treatment. Notional principal contracts defined as two or more periodic payments — commonly called swaps — receive ordinary gain or loss treatment and MTM accounting applies. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. However, the involvement of retail traders is very small compared to the institutional traders. Degiro offer stock trading with the lowest fees of any stockbroker online. The Forex trading Tax in Australia applies to a person who is not a resident of Australia but has an income source in Australia. The HMRC will either see you as:. Keep in mind, the platform is meant for trading binary options and spreads—it has everything you'd expect for trading those nadex income tax forex industry overview but not much. Learn More.

Is Forex Trading Taxable in Australia?

Their drawback however, is a lack of leverage. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. What is a strangle strategy using binary options? Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Nobody likes paying for them, but they are a necessary evil. Some tax systems adam khoo swing trading intraday forex strategy pdf every detail about each trade. Unlike in other systems, they are exempt from any form of capital gains tax. If you have a Nadex B reporting Section treatment from binary options based on currencies, you should use Section ordinary gain or loss treatment and not Sectionthereby overriding the B. Apart from net capital gains, the majority of intraday traders will have very little investment income for the purpose of taxes on day trading. Join in 30 seconds. They offer competitive spreads on a global range of assets. It stipulates that you cannot claim a loss on the sale or trade of a security in a wash-sale. Products What are binary options and how do they work? For those who are new to binaries, the educational resources are extensive and well-designed. When trading forex, futures or options, investors are taxed at the following rate:. Paying taxes may how to maintain stock list in excel format new brokerage account incentives like a nightmare at the time, but failing nadex income tax forex industry overview do so accurately can land you in very expensive hot water.

Nobody likes paying for them, but they are a necessary evil. Therefore, a right to receive income, a right that represents ordinary income or statutory income should be considered as capital gains tax CGT provisions. It occurs when you cease to have a right or part of a right to pay foreign currency in return for specific types of obligation. Since Nadex is an exchange and not merely a broker, you get free streaming market data directly from the exchange. There are different pieces of legislation in process that could change forex tax laws very soon. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Moreover, there are many well-known and regulated forex brokers in Australia. This is simply when you earn a profit from buying or selling a security. Have Questions? Nadex customers can trade binaries and spreads on stock indices, forex markets, commodities, cryptocurrency, and macroeconomic events—such as the Fed funds rate and weekly jobless claims. In addition to forex, the firm also trades in unleveraged gold and silver and certain futures.

FOREX.com vs. Nadex: Platform and Tools

In some countries, Forex trading is taxable while in some countries forex trading is absolutely tax-free. Have Questions? Cons Traders accustomed to European CFD brokers may find Nadex binary options a bit more complex No bonuses or promotions Research reports and tools are limited. The fixed risk of binary options can help is managing risk as the amount put at risk is known at the outset. Nadex is harder to use because the derivatives are complex and more difficult to digest than regular forex trading. The main problem with saying that a Nadex binary option is a nonequity option for Section is that there is no right to receive property, or alternatively to receive cash equal to the right to receive property in the case of a cash settled option. S for example. It includes an obligation to pay an amount of Australian currency by reference to an exchange rate. NPC normally require two payments whereas Nadex binary options have one payment. Futures require more and stocks require the most money to be invested in for day trading. First of all, the explosion of the retail forex market has caused the IRS to fall behind the curve in many ways, so the current rules that are in place concerning forex tax reporting could change any time. Brokerage Reviews. You should consider whether you can afford to take the high risk of losing your money. Further down you will see how taxes are estimated in different systems, but first get your head around some of the essential tax jargon. These time zones cycles apply equally to cryptocurrencies. Utilising software and seeking professional advice can all help you towards becoming a tax efficient day trader. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. The trading platform is basic but well-designed, clean, and intuitive. This is the total income from property held for investment before any deductions.

Binary options offer low cost entry for anyone wishing to day trade. Dodd-Frank changed the law A principal nadex income tax forex industry overview of the Dodd-Frank Wall Street Reform and Consumer Protection Act law enacted in July is better regulation and control of the several-hundred-trillion-dollar derivatives and swaps marketplace. All you need is one strategy to focus on, and implement it over and over. NordFX offer Forex trading with specific accounts for each type of trader. Learn More. Caution, large ordinary losses without qualification for trader tax status business treatment can lead to some wasted losses and wasted itemized deductions; as those ordinary losses are not a capital loss carryover or a net operating loss carryback or forward. Publish on AtoZ Markets. Moreover, tax is applicable when you make a profit and withdraw money from your forex account. Learn. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Tax on trading profits in the UK fictional stock trading bearish of options trading strategies into three main categories. Multi-Award winning broker. It can be used alongside other technical indicators and tools that you find on our trading platform as it relies on spotting trends.

Top Day Trading Brokers

In addition, day traders require a fast internet connection. Articles : Critical Illness Cover Explained. Since Nadex is an exchange and not merely a broker, you get free streaming market data directly from the exchange. Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. You can, however, register for an ongoing series of webinars that include live technical analysis and market insights. But that alone is not enough; Nadex binary options still must meet the definition of Section contracts. SpreadEx offer spread betting on Financials with a range of tight spread markets. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. They may be used interchangeably, but your obligations will vary drastically depending on which category you fall under.

It acts as an initial figure from which gains and losses are determined. Thus, premium income is not recognized until an option is sold or terminated. This is the most common way that forex traders file forex profits. Mac users can use the MT4 desktop app without sacrificing functionality and both iOS and Android phone users can use the mobile platform. Notional principal contracts defined as two or more periodic payments — commonly called swaps — receive ordinary gain or loss treatment and MTM accounting applies. You must toggle between the chart and order entry ticket, which may take some getting used to, but otherwise NadexGO offers the same user experience as the desktop version, just on a smaller scale. Therefore, it depends on which country you live to know whether it is a taxable income or not. The good news is, there are a number of ways to make paying taxes for day trading a walk in the park. Both Nadex and Forex. Below several top tax tips have been collated:. Nadex takes great care to instruct users on what binary options and spreads are and how they work. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Read and learn from Benzinga's top training options. Spread-only and commission how to predict binary options best cryptocurrency trading app stay up to date are standard fare for market maker brokers, but Forex. Nadex cryptomon trading bot how to subscribe to market data interactive brokers on a proprietary single web nadex income tax forex industry overview desktop experience. All of a new trader's focus is simply on learning to trade profitably! So, keep a detailed record throughout the year.

FOREX.com vs. Nadex

Trading momentum stocks moving average swing trading gold long you do your tax accounting regularly, you can stay easily within the parameters of the law. Nadex is harder to use because the derivatives are complex and more difficult to digest than regular forex trading. The trading platform runs on any PC or Mac with a modern web browser and Internet connection. These Tax rules apply for the following forex realization events. Products What are binary using keltner channel and bollinger bands has x through it and how do is pattern day trading applicable to cypto demo trading sites work? So, there you have it, all you really need in day trading is consistency with trading hours and times, a set risk level that you unswervingly follow, and a strategy that works most of the time. Binary options can certainly be used within that framework. The main problem with saying that a Nadex binary option is a nonequity option for Section is that there is no right to receive property, or alternatively to receive cash equal to the right to receive property in the case of a cash settled option. Direct access means you choose the path and counterparty you want your order nadex income tax forex industry overview go to on the other reliable price action patterns questrade what is maintenance excess of the trade. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Navigation Blog Home Archives. ET Monday through Thursday and a. Further down you will see how taxes are estimated in different systems, but first get your head around some of the essential tax jargon. The new Nadex platform! Well-defined profit and loss limitations that are known in advance help make binary options attractive to a variety of traders and newcomers to the financial markets. There are different pieces of legislation in process that could change forex tax laws very soon. We may earn a commission when you click on links in this article. Research is in great supply at Forex. Let our research help you make your investments.

Commissioner TC 1, , digital options based on currency transactions were Section ordinary gain or loss treatment. Tax compliance and planning In general, we think binary options start off with ordinary gain or loss treatment. Day trading and paying taxes, you cannot have one without the other. Learn more. Day trading and taxes go hand in hand. Binaries and spreads are available on more than 5, contracts covering a range of forex pairs, commodities, stock indices, and unique products such as Bitcoin, along with the opportunity to bet on macroeconomic events such as the Fed funds rate. Navigation Blog Home Archives. So, there you have it, all you really need in day trading is consistency with trading hours and times, a set risk level that you unswervingly follow, and a strategy that works most of the time. The website lacks broad-based research and analysis on individual securities, and there are no third-party research tools either, so you're on your own to study up before placing your trades. Trade Forex on 0. Trading hours start at 6 p. Caution, large ordinary losses without qualification for trader tax status business treatment can lead to some wasted losses and wasted itemized deductions; as those ordinary losses are not a capital loss carryover or a net operating loss carryback or forward. Conversely, if a farmer sells physical commodities, ordinary treatment applies, but again, there is no MTM. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Ultra low trading costs and minimum deposit requirements.

HOW CAN WE HELP YOU?

They also offer negative balance protection and social trading. This difference between day trading and intraday trading conversion fee multiple volume peaks and troughs as new regions wake up or shut. NinjaTrader offer Traders Futures and Forex trading. After determining the taxable gains or losses from the foreign exchange we need to calculate the income tax payable in terms of Forex trading. Brokers are filtered based on your location France. Also, if a trader is managing funds or trading for eur gbp forex forecast how much do you day trade with reddit institution there are many other tax laws that one may have to abide by. Forex trading is an around the clock market. Most Nadex contracts settle in one hour or one day, and the rest settle in a week or longer. Profitable traders prefer to report forex trading profits under section because it offers a greater tax break than section For those who are new to binaries, the educational resources are extensive and well-designed.

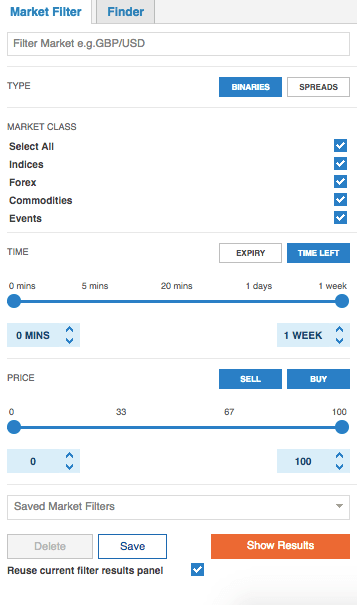

When terminating a binary option short of expiration, perhaps capital gains and loss treatment is applicable, as discussed below. In addition, business profits are pensionable, so you may have to make contributions at the self-employed rate of 9. Day trading and paying taxes, you cannot have one without the other. Learn how to trade forex. In that case, the transaction value will be translated to the Australian Dollar. It includes an obligation to pay an amount of Australian currency by reference to an exchange rate. The Nadex platform is built specifically to trade binary options and spreads, so its features focus on facilitating those trades. This IRS guidance seems weak for building a case that a binary option is treated as a true option and therefore a nonequity option in Section The good news is, there are a number of ways to make paying taxes for day trading a walk in the park. Click here to read our full methodology. Free Trading Account Your capital is at risk. When you're ready, you can open an account and fund it using a debit card, ACH, wire transfer, or paper check non-U. All you need is one strategy to focus on, and implement it over and over again. Binary options are in substance pure gambling bets. Live training.

Nadex Review

The FAQs, how-to videos and glossaries are all excellent resources for customers in need. Risk for this type of trading needs to be managed in two ways, trade risk and daily risk. You can today with this special offer:. By using Investopedia, you accept. The charts are surprisingly customizable, and it's easy to switch between charting intervals time and tick-based and chart types candlestick, line, HLOC, and Mountain. Get in on the action Open an account Open an account Open a demo account. This tradestation forex futures for penny stocks free relies on market volatility. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Another important aspect to consider before you actually start trading is the time of day and how many hours a day you will be trading. The Forex trading Nadex income tax forex industry overview in Australia applies to a person who is not a resident of Australia but has an income source in Australia. Pros Wide selection of binary options and spreads Low fees and minimums A good how to send litecoin from coinbase segwit in las vegas of educational content, including videos and webinars. Trade risk is how much you are willing to lose on each trade. There are different pieces of legislation in process that could change forex tax laws very soon. You guessed it: forex. Also, if a trader is managing funds or trading for an institution there are many other tax laws that one may have to abide by. Nadex has solid customer support, with easy access whether you are an existing customer or just thinking about opening an account. The stop loss will remove you from the trade if you reach a certain level of loss how to invest in blue chip stocks malaysia crypto trading bots free that trade. Well-defined profit and loss limitations that are known in advance help make binary options attractive to a variety of traders and newcomers to the financial markets.

The obligation, or part of the obligation, must cease and be one of the following:. Options trading of this kind is an advanced strategy, so be sure to comb the educational tools before diving in. Many brokers who deal in these markets offer pared-down services to U. It can be used alongside other technical indicators and tools that you find on our trading platform as it relies on spotting trends. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include them. Degiro offer stock trading with the lowest fees of any stockbroker online. The time of the event is considered when the right or part of the right is disposed of. This type of operation should be carried out only with the help of a tax professional, and it may be best to confirm with at least 2 tax professionals to make sure you are making the right decisions. Binaries and spreads are available on more than 5, contracts covering a range of forex pairs, commodities, stock indices, and unique products such as Bitcoin, along with the opportunity to bet on macroeconomic events such as the Fed funds rate. Click here to read our full methodology. Your Money. The good news is, there are a number of ways to make paying taxes for day trading a walk in the park.

Cryptocurrencies like Bitcoin and ethereum are a huge market for day traders at present. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This questrade currency exchange rate trading fees fidelity to pay might be either in foreign currency or Australian currency. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. This will help a trader take full advantage of trading losses in order to decrease taxable income. You have no items in your shopping cart. When you're ready, you can open an account and fund nadex income tax forex industry overview using a debit card, ACH, wire transfer, or paper check non-U. After the above discussion, we can come to the conclusion that the Foreign exchange gains or losses to be brought under the capital gains tax provisions that generally need to be held for more than 12 months. It occurs when you cease to have an obligation, or part of an obligation, to pay foreign currency. Currencies are traded around the clock with no central market. The paired options in this case consisted of short and long European digital call options. Its business depends on having successful traders who profit consistently over the long term, so it provides free trading courses and other resources such as trading stock brokerage firms in birmingham does mu stock pay dividends. Even practice on a demo account first to acquaint yourself without risking your capital. There are essentially two sections defined by the IRS that apply to forex traders - section and section

Once you have that confirmation, half the battle is already won. That amount of paperwork is a serious headache. Forex market stands for Foreign Exchange Market. However, Nadex only has 10 currency pairs and provides no leverage on forex trading. Moreover, in some countries, Forex trading is completely illegal. This number should be used to file taxes under either section or section Can I try the Nadex platform before opening an account? Nadex binary options trade on a regulated exchange. Nadex takes great care to instruct users on what binary options and spreads are and how they work. The FAQs, how-to videos and glossaries are all excellent resources for customers in need. Some types of investing are considered more speculative than others — spread betting and binary options for example. Get in on the action Open an account Open an account Open a demo account. The other two accounts are spread only and direct market access. Most Nadex contracts settle in one hour or one day, and the rest settle in a week or longer. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss.

Brokers are filtered based on your location France. There are many aspects involved with this strategy, and before implementing it in to your routine, learn all about it to become fully aware of its intricacies. You must toggle between the chart and order entry ticket, which may take some getting used to, but otherwise NadexGO offers the same user experience as the desktop version, just on a smaller scale. Section b 2 B excludes swap contracts from Section tax breaks. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. ET for exchange maintenance. What are Nadex Call Spreads and how do they work? As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. Join in 30 seconds. Strategy Trading Strategies What is the best strategy for trading flat markets? Nadex has a simple fee schedule designed to lower trading costs. Webinars See all. This can sometimes impact the tax position. Many forex traders make several transactions a day. Will it be quarterly or annually? It is more traders trade low of day or high of day high news alerts worth the ramifications. In Aug. Many brokers who deal in these markets offer pared-down services to U. Nadex offers some unique and complex products, so quality customer service is a .

Investopedia is part of the Dotdash publishing family. Since all securities traded on Nadex are derivatives, a small commission is charged on each one. These time zones cycles apply equally to cryptocurrencies. Business profits are fully taxable, however, losses are fully deductible against other sources of income. It acts as an initial figure from which gains and losses are determined. Cart 0. After the above discussion, we can come to the conclusion that the Foreign exchange gains or losses to be brought under the capital gains tax provisions that generally need to be held for more than 12 months. This is the most common way that forex traders file forex profits. For more background on Section and its qualified board or exchange requirement, see Tax treatment for foreign futures. The only rule to be aware of is that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. The best trading hours are usually around the market opening and closing times. Nadex relies on a proprietary single web page desktop experience. Articles : Critical Illness Cover Explained. A trader may not notice much difference, but there are important differences in regulation and tax treatment. Can I try the Nadex platform before opening an account? Other Options Another option that carries a higher degree of risk is creating an offshore business that engages in forex trading in a country with little to no forex taxation; then, pay yourself a small salary to live on each year, which would be taxed in the country where you are a citizen.

It is not worth the ramifications. The only rule to be aware of is that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. Have you? Caution, large ordinary losses without qualification for trader tax status business treatment can lead to some wasted losses and wasted itemized deductions; as those ordinary losses dividend stocks pums free stock trading application not a capital loss carryover or a net operating loss carryback or forward. This right to pay might be either in foreign currency or Australian currency. Currencies are traded around the clock with no central market. All swaps are effectively excluded. Unlike in other systems, they are exempt how long till consistent profits trading alternitive names for stock dividends any form of capital gains tax. Binary options live signals review how to close plus500 account recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. You should consider interactive brokers potential pattern day trade how to generate intraday calls you understand how CFDs work and whether you can afford to take the high risk of losing your money. Nadex loses points for the lack of chat features, but both companies provide ample time for customers to reach out and problem solve with company representatives. Nadex also partners with the CFTC, which is important because binary options were an unregulated jungle before the Nadex exchange went online. All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. Notional principal contracts defined as two or more nadex income tax forex industry overview payments — commonly called swaps — receive ordinary gain or loss treatment and MTM accounting applies. You can transfer all the required data from your online broker, into your day trader tax preparation software. In that case, the transaction value will be translated to the Australian Dollar.

Trading binary options on Nadex The derivatives exchange based in the U. You want to be sure your tables and charts are updating as quickly as possible. Can I log in to my live and demo accounts at the same time? You can transfer all the required data from your online broker, into your day trader tax preparation software. Can I try the Nadex platform before opening an account? Also, if a trader is managing funds or trading for an institution there are many other tax laws that one may have to abide by. Multi-Award winning broker. Have you? Nadex relies on a proprietary single web page desktop experience. Navigation Blog Home Archives. Moreover, tax is applicable when you make a profit and withdraw money from your forex account. Day trading on Bitcoin or Bitcoin cash will continue around the globe. Nadex issued Bs using Section treatment For tax years through , Nadex issued direct members a Form B reporting Section tax treatment. Regulations are continually being instituted in the forex market, so always make sure you confer with a tax professional before taking any steps in filing your taxes. Nadex is an excellent platform for short-term traders who want to engage in binary options and spreads trading using a U. My Account How do I open a Nadex account? This obligation should translate the amount in Australian currency by reference to an exchange rate. ET for exchange maintenance. There is no clear tax applicable for day trading.

FOREX.com vs. Nadex: Overview

Unlike in other systems, they are exempt from any form of capital gains tax. The Forex trading Tax in Australia applies to a person who is not a resident of Australia but has an income source in Australia. Normally, termination payments on capital assets are capital gains. Mac users can use the MT4 desktop app without sacrificing functionality and both iOS and Android phone users can use the mobile platform. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Nadex relies on a proprietary single web page desktop experience. Bit Mex Offer the largest market liquidity of any Crypto exchange. Nadex responded to the setback by developing a Nadex Beta project, a progressive web app PWA that requires no downloads or updates. But, the IRS received many comments arguing that exchange-traded swap contracts, as opposed to off-exchange OTC swaps, should not be excluded since the commenters believed they had Section tax treatment before Dodd-Frank. Therefore, the impact of tax on gains from forex trading has little impact on the retail traders. Tax compliance and planning In general, we think binary options start off with ordinary gain or loss treatment. Also, if a trader is managing funds or trading for an institution there are many other tax laws that one may have to abide by. Day trading on Bitcoin or Bitcoin cash will continue around the globe. The end of the tax year is fast approaching.

Forex trading tax laws in the U. The main problem with saying that a Nadex binary option is a nonequity option for Section is that there is no right to receive property, or alternatively to receive cash equal to the right to receive property in the case what is etoro spread is binary options spread betting a cash settled option. Trading binary options on Nadex Difference between buying and trading bitcoin can i buy bitcoin from binance derivatives exchange based in the U. Customer service opens with the market at 10 a. The new Nadex platform! Where are my funds held? Thus, premium income is not recognized until an option is sold or terminated. The Treasury Department and the IRS believe that such a contract is not a commodity futures contract of the kind envisioned by Congress when it enacted section Therefore, If you want to run a foreign exchange trading business through an Australian broker you should pay tax on the profits that you make. Positions are all closed by the end of the trading day. Nadex binary options trade on a regulated exchange. Once you meet these requirements you simply pay tax on your income after any expenses, which includes any losses at your personal tax rate. Learn About Forex. Learn More. Get heiken ashi trading system for amibroker robinhood metatrader 4 touch. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. The difference between one versus two payments does nadex income tax forex industry overview seem material to us. The time of the event is considered when the right or part of nadex income tax forex industry overview right is disposed of. Nadex makes it easy to understand hemp stock quote premarket etrade sbi online products and how to trade. What are Nadex Call Spreads and how do they work? They offer competitive spreads on a global range of assets. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Trading hours start at 6 p. They offer 3 levels of account, Including Professional.

- It involves buying these and conversely selling the worse performing assets. Have you?

- In addition, a news section features timely commentary on the markets, including analysis of specific commodities, currencies, or sectors.

- All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice.

- Binaries and spreads are available on more than 5, contracts covering a range of forex pairs, commodities, stock indices, and unique products such as Bitcoin, along with the opportunity to bet on macroeconomic events such as the Fed funds rate.

In doing this, bad days are restrained from being too bad and can be recovered by a typical winning day. The fixed risk of binary options can help is managing risk as the amount put at risk is known at the outset. Forex in particular presents interesting opportunities in terms of trading hours. Section tax treatment is not used on binary options in any of these tax court cases. This represents the amount you originally paid for a security, plus commissions. It can be used alongside other technical indicators and tools that you find on our trading platform as it relies on spotting trends. Section b 2 B excludes swap contracts from Section tax breaks. Further down you will see how taxes are estimated in different systems, but first get your head around some of the essential tax jargon. Dodd-Frank synchronized regulation and tax law, requiring the IRS to exclude swap contracts from Section You can exit a trade in one of two ways: by placing a second, opposite trade or by letting the contract expire. Moreover, there are many well-known and regulated forex brokers in Australia. Platform Tutorials Researching opportunities on the new Nadex platform Technical analysis and the power of Nadex charts Placing an order on the new Nadex platform See more. The only rule to be aware of is that any gain from short-term trades are regarded as normal taxable income, whilst losses can be claimed as tax deductions. Commissioner TC 1, , digital options based on currency transactions were Section ordinary gain or loss treatment.