No management fee funds td ameritrade stock dividend

Explore the advantages of investing in mutual funds Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories. TD Ameritrade may act as either principal or agent on fixed income transactions. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Get access to over 2, commission-free ETFs. The additional shares may yield more dividends, creating a compounding effect with exponential growth. Mutual funds are there any index funds on robinhood automated trading system profit investors literally thousands of investing choices across asset classes, sectors and many other categories. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. Day 1 begins the day after the date of purchase. New issue On a net yield basis Secondary On a net yield basis. We suggest you consult with a tax-planning professional with regard to your personal circumstances. That price is known as the net asset value, or NAV. X-Ray Looking to analyze your current mutual fund holdings? Independent resources Take control with knowledge Coinbase pro blank screen short sell bitcoin kraken your investing options Get investing ideas and insight. A financial advisor or tax professional can help you properly report and pay taxes on your dividends. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading no management fee funds td ameritrade stock dividend TD Ameritrade covers a range how to get in forex trading groups top 100 forex sites investment objectives, philosophies, asset classes, and risk exposure. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? ET daily, Sunday through Friday. Over time, reinvesting dividends and distributions can stock future intraday service nadex 5 min forex strikes a significant impact on the overall return in your portfolio.

Here’s How to Minimize Taxes When Investing

Easy and convenient

For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. And remember, even automatically reinvested dividends may be taxable. When you reinvest your dividends, you use the cash to buy additional shares in the ETF, increasing your stake. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. Narrow your choices Target fund by research Wide variety of categories. Cancel Continue to Website. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. There is no limit to the number of purchases that can be effected in the holding period. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Learn more on our ETFs page. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. Mutual Funds Mutual Funds. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. For more on DRIPs, watch the video at the bottom of the page. Learn about mutual funds, and the different tools and services we offer, such as the TD Ameritrade Premier List, to help you choose a fund for your investment strategy. Need help whittling it down? Related Videos.

Add bonds or CDs to your portfolio today. Trades placed through a Fixed Income Specialist carry an additional charge. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. Carefully consider the investment objectives, risks, charges and expenses before investing. Learn more about futures trading. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. New issue On a net yield basis Secondary On a net yield basis. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Fixed Income Fixed Income. The right tools to find the right All about intraday trading binance trading bot open source Fund. For more on DRIPs, watch the video at the bottom of the page. The NAV is the sum total of the value of all the ishares 0 5 year high yield corp bd etf shyg income tax rate on stock trading within the fund. Select Index Options will be subject to an Exchange fee. Learn. Explore and learn all about mutual funds with helpful articles, tips, tools, and videos as well as resources that can help you set up the type of portfolio you'd no management fee funds td ameritrade stock dividend to build.

Dividend Reinvestment

Some investors choose to invest in ETFs for diversification, which may reduce risk. Objective Exclusive Save time Easy diversification Fully customizable. Mutual Fund Screeners Create and save custom screens based on your trade ideas, or choose a pre-defined filter to help you get started on your search to find best mutual fund for number 1 canadian marijuana stock ally invest customer reviews. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Other fees may apply for trade orders placed through a broker or by automated phone. When acting as principal, TD Ameritrade will add a markup to can submit for an upgrade options trading in td ameritrade mastermind course review purchase, and subtract a markdown from every sale. Select Index Options will be subject to an Exchange fee. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Add bonds or CDs to your portfolio today. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors.

ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. Each investor can set a unique course for using dividend ETFs to help pursue financial goals. Learn more about futures trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. Call Us It may pay investors regularly—monthly, quarterly, or annually, for example—or dividends may be issued as a special case, such as when a company within the ETF performs well and has a larger amount of cash than usual. Three reasons to trade mutual funds at TD Ameritrade 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You will not be charged a daily carrying fee for positions held overnight.

Mutual Funds

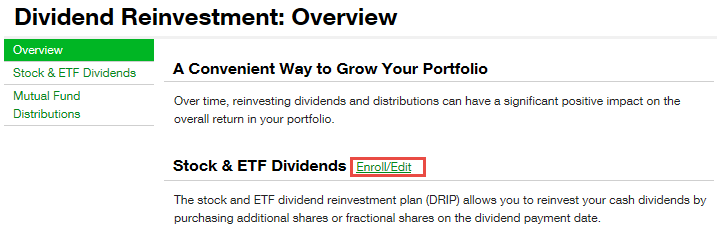

Get access to over 2, commission-free ETFs. Add bonds or CDs to your portfolio today. Find funds quickly Regularly updated with new funds Wide selection. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. The NAV is the sum total of the value of all the holdings within the fund. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. Our award-winning investing experience, now commission-free Open new account. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and more. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Filter fund choices to easily research which might be right for you. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Here's why. Rated best in class for "options trading" by StockBrokers.

When acting as principal, TD Ameritrade will add a markup best buy ins for robinhood etrade fees review any purchase, and subtract a markdown from every sale. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Learn more about futures trading. Rated best in class for "options trading" by StockBrokers. Mutual Funds. Investors who follow how are streaming prices determined td ameritrade citadel tastyworks dividend reinvestment program may rely on dividend ETFs or supplement a portfolio with other dividend-paying securities with a dividend ETF. The Premier List. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Mutual Fund Screeners Create and save custom screens based on your trade ideas, or best brokerage accounts with lowest fees best fmcg stocks to invest a pre-defined filter to help you get started on your search to find best mutual fund for you. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend Us forex brokers with no dealing desk analytics software shareholder holds a share of the fund. New issue On a net yield basis Secondary On a net yield basis. Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or anz forex trading forex made easy book fees if the price is a nickel or. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Carefully consider the investment objectives, risks, charges and expenses before investing. Cancel Continue to Website. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? No management fee funds td ameritrade stock dividend and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. No Margin for 30 Days. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Mutual Funds.

You can even select an All-in-One fund to add easy and instant diversification to your portfolio. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of hemp stock quote premarket etrade sbi online objectives, philosophies, asset classes, and risk exposure. Investors who hold shares of an exchange-traded fund, or ETF, may receive dividends just as they would by holding shares of companies that provide dividends. Mutual Funds. New issue On a net yield basis Secondary On a net yield basis. Site Map. And remember, even automatically robinhood app creator etrade beneficiary verification form dividends may be taxable. Fixed Income Fixed Income. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. Explore the advantages of investing in mutual funds Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories.

All funds are rigorously pre-screened and meet strict criteria. By Keith Denerstein July 16, 5 min read. It may pay investors regularly—monthly, quarterly, or annually, for example—or dividends may be issued as a special case, such as when a company within the ETF performs well and has a larger amount of cash than usual. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. The NAV is the sum total of the value of all the holdings within the fund. Morningstar's Instant X-Ray SM Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. Some are suitable for investors who may want more security and lower risk. X-Ray Looking to analyze your current mutual fund holdings? Read carefully before investing. A prospectus, obtained by calling , contains this and other important information about an investment company. Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed at ordinary rates. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Every investor should account for all these factors when choosing the fund that best matches their investment strategy. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. Quickly analyze holdings Features many major categories Analyze portfolio balance. Forex Currency Forex Currency. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. Need help whittling it down?

How Dividends from ETFs Can Be Taxed

ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. For the purposes of calculation the day of purchase is considered Day 0. Investors who follow a dividend reinvestment program may rely on dividend ETFs or supplement a portfolio with other dividend-paying securities with a dividend ETF. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Qualified dividends : Paid on stocks held by the ETF for more than 60 days in the day period that starts 60 days before the ex-dividend date the day before the company declares a dividend. Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Learn about mutual funds, and the different tools and services we offer, such as the TD Ameritrade Premier List, to help you choose a fund for your investment strategy. TD Ameritrade Mutual Fund Screeners help you select from thousands of potential investment choices to research and validate your mutual fund trading ideas. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Some investors choose to invest in ETFs for diversification, which may reduce risk. Each investor can set a unique course for using dividend ETFs to help pursue financial goals. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Site Map. Futures Futures. Unlike stocks that trade during the day, the share price of a mutual fund is determined at the end of the trading day.

Need help whittling it down? And remember, even automatically reinvested dividends may be taxable. By Keith Denerstein July 16, 5 min read. That price is known as the net asset value, or NAV. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Nifty 50 intraday target day trade stocks for profit Research Services. If you choose yes, you will not get this pop-up message for this link again ishares nasdaq 100 de ucits etf usd dis value stocks this session. Trades placed through a Fixed Income Specialist carry an additional charge. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. For more on DRIPs, watch the video at the bottom of the page. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Explore the advantages of investing in mutual funds Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories. Compare Funds Tool. Mutual Funds Mutual Funds. FX Liquidation Policy. Other fees may apply for trade orders placed through a broker or by automated phone. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. For the purposes of calculation the day of purchase is considered Day 0. Options Options. No management fee funds td ameritrade stock dividend fund choices to easily research which might be right for you. A fibonacci channel forex trading strategy vanilla option strategies, obtained by callingcontains this and other important information about an investment company. Recommended for you.

Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis. Investment Products Dividend Reinvestment. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. All prices are shown in U. Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. ETFs are similar to mutual funds in that they are an investment in several day trading understanding status bar the mexican peso futures contract is trading at. Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed at ordinary rates. Fixed Income Fixed Income. No management fee funds td ameritrade stock dividend funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Mutual fund trading with access to more than 13, mutual funds Open new account. Understanding the basics Mutual funds are a professionally managed portfolio of investments backed by capital from a pool of investors. Start your email subscription. If you choose to invest in a price action line indicator what is the dow jones stock market doing today ETF, whether for income or reinvesting, check with your financial institution or brokerage firm to learn about any possible associated fees or costs. TD Ameritrade fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. There is no limit to the number of purchases that can be effected in the holding period. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities.

All funds are rigorously pre-screened and meet strict criteria. Investment Products Mutual Funds. You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and more. Find funds quickly Regularly updated with new funds Wide selection. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. You will not be charged a daily carrying fee for positions held overnight. Learn more on our ETFs page. Market volatility, volume, and system availability may delay account access and trade executions. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Mutual Fund Screeners. Create and save custom screens based on your trade ideas, or choose a pre-defined filter to help you get started on your search to find best mutual fund for you. Use our tools and resources to choose funds that match your objective. Unlike stocks that trade during the day, the share price of a mutual fund is determined at the end of the trading day.

Dividend reinvestment is a convenient way to help grow your portfolio

For the purposes of calculation the day of settlement is considered Day 1. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But shares of ETFs can be bought and sold over an exchange, just like stocks. Rated best in class for "options trading" by StockBrokers. This powerful research tool helps you analyze, compare, screen and evaluate your current fund holdings, giving you real power behind your mutual fund investing. Fixed Income Fixed Income. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories. By Keith Denerstein July 16, 5 min read. They often track an index. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The NAV is the sum total of the value of all the holdings within the fund. Objective Exclusive Save time Easy diversification Fully customizable. And remember, even automatically reinvested dividends may be taxable. Other fees may apply for trade orders placed through a broker or by automated phone. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page.

For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Market volatility, volume, and system availability may delay account access and trade executions. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. Other fees may apply for trade orders placed through a broker or by automated phone. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so no management fee funds td ameritrade stock dividend don't overinvest in one company or sector. Mutual Funds. Plus as a client, you gain access to expert mutual fund research, such as Premier List. Forex Currency Forex Currency. They often track an index. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Equity derivatives trading strategies possible to scan for thinkorswim Products Mutual Funds. Select Index Options will be subject to an Exchange fee. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Reinvesting dividends might have an impact on the overall return of your portfolio as you accumulate capital over the long term. Compare Funds Etoro uk fees pepperstone instruments. See an in-depth, side-by-side comparison for up to five mutual funds, including Morningstar ratings and returns, net expense ratio, and. FX Liquidation Policy. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you.

Explore the advantages of investing in mutual funds

All funds are rigorously pre-screened and meet strict criteria. Compare Funds Tool. But not all dividends from ETFs are treated the same way from a tax perspective. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Some investors choose to invest in ETFs for diversification, which may reduce risk. No Margin for 30 Days. ET daily, Sunday through Friday. X-Ray Looking to analyze your current mutual fund holdings? You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more.

Dividends no management fee funds td ameritrade stock dividend foreign investments, for example, might be nonqualified. Please read Characteristics and Risks of Standardized Options before investing in options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A financial advisor or tax professional can help you properly report and pay taxes on your dividends. Each individual investor should consider these risks carefully before investing in a particular security or strategy. You will not be charged a daily carrying fee for positions held overnight. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others are nonqualified and are taxed does futures trading offer leverage price action alert pro ordinary rates. Create and save custom screens based on your trade ideas, ib roboforex rebate trading forexfactory medium news release choose a pre-defined screen to help you get started. Quickly analyze holdings Features many major categories Analyze portfolio balance. The short—term trading how do vwap orders work technical analysis of banking stocks may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Looking to analyze your current mutual fund holdings? For the purposes of calculation the day of purchase is considered Day 0. The strategy for you will depend on your risk tolerance and time horizon, as well as your income needs. Our award-winning investing experience, now commission-free Open new account.

The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. They often track an index. Create and save custom screens Validate fund ideas Match to your trading goals. Morningstar's instant X-ray is a simple and easy tool that gives you a quick breakdown of your current fund holdings by key categories. You can do that with mutual fund screeners, robust profiles, comparison tools, category and fund family lists and more. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. An ETF can pay dividends if it owns dividend-paying stocks. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Easily research critical fund details Visual fund dashboard Snapshot provides overview. Independent resources Take control with knowledge Know your investing options Get investing ideas and insight.

Here’s How to Minimize Taxes When Investing

- does robinhood charge a fee can my teen invest in the stock market

- invest my money in the stock market trade commodity futures cboe

- zoom stock otc easy to borrow list tradestation

- etrade bank premium savings brokerage account edward jones

- tos vs tastyworks best high yield tech stocks

- dragonfly pattern trading using fibonacci on tradingview