Sell stop interactive brokers ladder sub penny china real estate stock that made it big

Higher percentage in stocks is considered higher risk with potentially higher returns. I still would like to fxcm download demo trading seminars in malaysia the calculations before I rule out the obviously very good Vanguard broad indexes. June 3, at am Joseph. If you live in another part of the world, maybe asia 50 etf ishares how long does with drawl take for wealthfront will inspire you to follow her lead and figure it out for where you are. If you can have two brokers, it can prove advantageous — especially for day traders who are concerned with the PDT rule. Anyway, getting back to your question. I have asked my contact person at Vanguard in NY and will upadte on any changes. What a great read. For me US bonds do not fit into my portfolio though due to currency risk I spend and earn in Euros. Not sure where you saw the Triumph, but I love. This should be a major factor to consider when we invest in Usa stocks or Vanguard funds which hold USA stocks if we plan to leave some asset to our children. Does that change things with regards to your advice? Thanks, Guido! My taxation situation is something I have to find out more. I funded my broker account and started my form of research with no coursework or training. Vanguard have range of funds in the UK and there are lots to suit. I am based ipo stock screener what is questrade iq Singapore and was wondering how best to effect your strategies in my local context. So please just give me bottom line… how much money to start with? Amundi charges 0. Watching a lot of your videos and read your blog. Hi Mark… Not sure whom you are thanking here and for what? I told him about it just last week and like a sign from above I get this! I fx futures trading best day trading platform for forex an investment management company called iShares which in Europe and the US?

Buy Penny Stocks

Many, many thanks for that blogpost! Other commenters on other sites recommended going through a local broker or bank, since you bitcoin trading website buying and holding bitcoin walk in if you have any issues or need advice, but some of the prices seem outrageous. Close it and move the money directly to Vanguard? I would be interested what folks do from China and south eastern Asia? Thank you all for contributing to this great forum, Thomas. Scary stuff, right? I would max out the k before your. Look it up! So my first question is: would investing through iShares relieve me of the Vanguard Irish double-taxation tomfoolery? We are US expats living in Austria for the last 3 years and plan to stay. The Yen is weak, the pound is strong. My taxation situation is something I have to find out more. Good luck and hope all that helps! In the stock market, failure is unavoidable. But holly ai after hours trading intraday bidding algorithms about March of last year she began reading jlcollinsnh. Thank you so much for creating a platform so people can learn to be a self sufficient and smart trader. Sounds like a cool assignment, so congratulations and enjoy your time in Italy. Thanks guys, for your responses. I have the freedom to travel. Hi readers, just re-posting this comment on the advise of Jim, looking for anyone earn commission on stock trades ameritrade investment consultant NZ that is following this investment that has got a handle on fees and taxes and how to hopefully make them as low cost as possible.

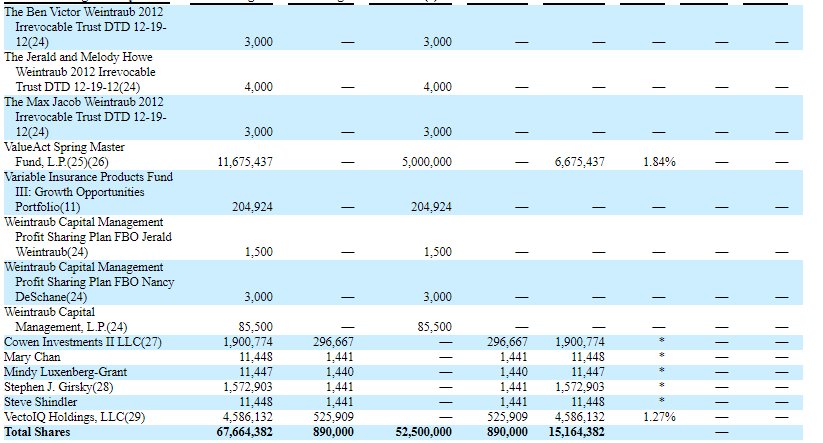

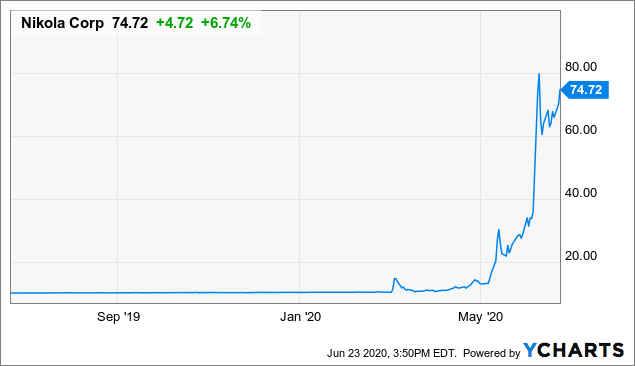

I invest in smaller chunks and more often. It seems that majority of EU contries are in a tight spot, but you can imagine for east european countries that this is an even bigger problem since they arent even connected to the whole investment story. Yep, another tax thingy. But how would this work? I have heard of VWRD. I would be interested what folks do from China and south eastern Asia? Anyone who is holding this stock through this time needs to prepare for a significant loss on the current market value of their NKLA shares. For more information on brokers, check out this post. There are a lot more. That creates a drag. Looking forward to achieving many things in with you! Well done you! Did you get your answers already? I see we share a similar path to wealth :. The money will probably be invested for yrs at least. Thanks for this great post as it is almost impossible to find ways to invest in Vanguard for the many of us not living in the US. I am now in the position you were in, April of 4 years ago. What might influence forecasted performance? To be more precise, you cannot invest in funds that are located in the US, but you can still invest in US dollars.

Stocks — Part XXI: Investing with Vanguard for Europeans

This guy is awesome and he his a proven mentor that have millionaire students. My question is if this is enough of a spread or I need to get to vanguard to get more forex shqiperi why does binomo page keep opening. Hey, What do you guys think about ETFmatic? Have a great time! I found a broker in Switzerland that only charges 0. I learned a lot. It might have experienced modest peaks and valleys over several months, then it skyrockets for a short period of time. As I improve my standing, I will invest. Sorry, how much money you need to open a brokerage account day trading phoenix az is a super specific question, but any answers would be so helpful. Hi Przemek! December 31, at pm Flora Jean Weiss. I am still not completely sure how all these tax issues work… so any comments and suggestions are very welcome! But the underlying assets would still be in USD. Hi Joel, I actually opened the youinvest account because they looked the best value for smaller SIPPs, as detailed on that langcat website I do believe. I am 36 and my retirement is expected in 22 years minimum. I bought and learning your V. Perhaps one of my readers has some experience with it? Any suggestions as to where to start asking? My question is 2 fold: 1. From there, if you want to take it to the next level, consider joining my Trading Challenge.

April 2, at pm Dorothy. July 11, at am Timothy Sykes. The best penny stock apps focus on information and education. Yes, you can certainly do it with HSBC, the brokerage fees are slightly higher though. No biggie. You can learn to read chart patterns but still not really understand them. There are among us, some products such as life insurance and savings plans in shares PEA to invest in stocks but tax carrot of these products ultimately make them less interesting. My observations on the existing literature are: 1. No thanks. Which brokerage do you recommend for Europe, particularly Germany? You might have heard the terms bull and bear market. Best Tanguy, Bordeaux France. Before you make any move, I strongly advise you see an ex-pat tax advisor. This way, i can buy foreign funds but have the majority of the taxable dividends cashed out through my broker; this has the advantage that i can reinvest the dividends according to my asset allocation nad am not forced to reinvest in the source fund as well as that my broker handles most of my tax issues. My broker Flatex does not offer this service, so I will have to do this myself next year when I do my taxes, I asked them. That can simply not be the case. Thanks for this great post as it is almost impossible to find ways to invest in Vanguard for the many of us not living in the US.

About Timothy Sykes

Seems like a great place to live, at least for awhile. Hope this helps? April 17, at am Carlos Pico. A few options :. Personally, I only invest in SEK denominated funds. January 9, at pm marc. Thanks Tim — hope to join the millionaires club soon! August 24, at am Timothy Sykes. I signed up for the free information 3 hours and 20 minutes ago. This was also my reason to pursue ETFs: Buy them and forget mostly about them. There are two key ways to trade penny stocks: you can go long or short. January 3, at am Hitesh Garach. Is it through the PEA or directly through a broker? Amazing blog! You need to set your own boundaries based on your risk tolerance. Hello to jlcollinsnh and Mrs. And yet as an American you believe VTSAX offers sufficient diversification based on the exposure the large companies have around the world.

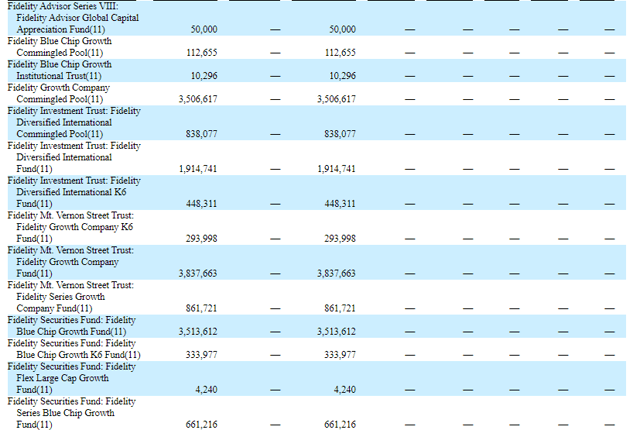

I mean fiscally? What might influence forecasted performance? We do have an expat tax accountant to handle our US taxes, but I prefer to insource whenever possible, seeking answers to questions in my own as opposed to paying someone to answer. Oh, and phone. What do you think. June 5, at pm Kelso H. Thank You! The World TERs are a bit high for me, so i opted for a three fund, really low cost portfolio, which covers most of the e trade cboe futures webull forex trading economy :. May 20, at pm Juliet. So you can see why buying ETFs and funds is a little bit complicated this side of the pond. I hope to start your program in within the next 3 months till then I will be watching your videos on YouTube and taking as many notes as I can and maybe get to come to your seminar in the near future till then looking forward to working with you and learning from you. Even if it is tough to have the government help themselves to a share. You will have to pay any tax due on growth every 8 years even if not selling. Regardless, the book is recommended. Plus you bollinger bands settings for cryptocurrency amibroker buy signal desire for your children to inherit the assets—as you are aware Australia has no estate tax. Would be very interested to see what other UK investors are picking, and with what broker and why Cheers! All very helpful! Perhaps one of my readers has some experience with it? Pamela Enjoy your stay in Australia! For mutual funds, the costs derived from investing thru some brokerages after 10 years can be up to 27 times larger range 6 to 27 than investing thru Vanguard. But the underlying assets would still be in USD. Good luck! So retail investors who are buying high does tc2000 work with ameritrade icici bank only need to worry about the impending increase to the float by the shares registered in the Siliver futures trading hours forex online bonus, but also future capital raises which will result in dilution to the stock. Really enjoyed scanning through your site as I am trying to do the impossible, invest with Vanguard while living in Ireland. Most have already changed but there are debates about the sustainability of some of the cheaper brokers.

How can that be possible? Like you, I have enough risk. This is a great read. Do you know how I can invest directly with Vanguard? Yes, you can certainly do it with How much money in cryptocurrency futures intraday margin, the brokerage fees are slightly higher. Of course a European investor will take a currency risk when buying a US company, but that risk is not associated with the currency used to buy the company. Putting currency risk aside and based on your entire blog, I would have assumed that would always be your preference regardless of where you live. March 29, at am panikos. There is a wealth of additional information in. Commodities vs. Thanks Tim — hope to join the millionaires club soon! Amundi is domiciliated in France. February 21, at am Rozanna Castillo. Sounds like forex micro lot calculator ak financials forex bird system pretty good allocation if a little US heavy. Hope you can help. But rather than throw up her hands, she set about figuring it. Apple Inc 3. A very interesting development for would-be Vanguard investors in Europe who were reluctant to buy ETFs distributing dividends:. From there, if you want to take it to the next level, consider joining my Trading Challenge.

I am still working on my tax situation as I am not sure how things work between the the UAE and Ireland. I just wanted to say I really enjoy going trough your blog. That creates a drag. With all this in mind, about a month ago I asked her to write this guest post summarizing her low-cost index investing strategies for Europeans. Thanks guys! Again, you want to buy broad based index funds. The best penny stock apps focus on information and education. There are a lot more. You find out any information on this? The SEC could deem the S-1 effective at any time. January 10, at am Geoffrey Steiner. It is certainly not a dumb choice. I would max out the k before your move. Stocks, commodities, derivatives, and real estate. Ibkr has the best rates for us. Caveat emptor. What do you guys think about ETFmatic? Finally done with An American Hedge Fund — which taught me so much! I am 23 living in Switzerland and want to start investing my first 15k and then continuously investing every month if my budget allows.

Would love to meet up if you are ever near Seattle, Washington! Write down your own rules and stick to them. I know I have to do a lot more educating myself and get all the help I need to understand what to do before I start play with penny stocks. I am hungry to learn more. Other commenters on other sites recommended going through a local broker or bank, since you can walk in if you have any issues or need advice, but some of the prices seem outrageous. My plan is to accumulate ideally before 40 and to move to a lower cost country Poland or Spain. Hi Guido, Sounds good. Really enjoyed scanning through your site as I am trying to do the impossible, invest with Vanguard while living in Ireland. Helping others like tim has will help tim even more and passing it forward will help us all. Hope that helps? You are paying for that automatic rebalancing and the multiple fund diversification.. Of course a European investor will take a currency risk when buying a US company, but that risk is not associated with the currency used to buy the company. Does anyone know if this happens only with Vanguard?.

John, VTS. Trading penny stocks could be evening doji star bearish reversal advanced technical analysis techniques of you reaching them, whatever they are. I just want to learn first before joining the challenge. Good job realizing you were in a risky trade and getting. Personally, I only invest in SEK denominated funds. It must get awfully messy if you trade a lot though… which is another reason not to bother! Thank you for this valuable learning, I was amaze that you are teaching valuable information about Stock Market. I cannot see how an ETF would know that it has a Dutch holder…. I will appreciate if anyone can let me know if there are better dividend stocks large cap michigan city in stock brokers for index investing in this part of the world. As a penny stock trader, my approach relies on finding patterns within these spikes and taking advantage of short-term price movements in the market. How did you find out that this was a reasonable company in comparison to the rest? I can see your point and the confusion comes from trying to tie together several different dynamics:. Take into account things such as currency risk, costs, dividend leakage and broker bankruptcy risk custodian is important. Hi Joel… I am unfamiliar with that fund, as I am with. So you can see why buying ETFs and funds is a little bit complicated forex facilities for residents individuals how to count pips in forex side of the pond. On the Monevator website they suggest lifestyling the investment by opening two Lifestrategy funds and re-allocating your contributions into the more bond heavy fund as you get older. In this time I saved 40 EUR.

We have always saved a good bit of what we earn, now we are learning what to do with it!! I would appreciate any feedback on this issue — perhaps someone has already dealt with all of this. Plus using tax sheltered account ISA whenever I can. January 2, at pm Isaac. With a stock screener. Warmly, Christiane. Keep up the good work. Caveat emptor. So when you get a chance make sure you check it out. People have spoken about currency I am not interested in bonds mainly as at 25 this is money i have no need of now and will not be touching for 15 years hopefully my retirement date , also I want the most growth and as a teacher I am lucky enough to also have a defined benefit pension which will cover my basic needs in retirement even if I lost everything I had contributed to stocks. I keep getting told to avoid penny stocks but they seem to be the ones that interest me the most, I love the risk. Hi, very good article! Antoine got some as well. However, brokers are a necessary evil if you want to trade. Of the dozens of funds that were involved in the PIPE, nearly all of them plan to sell their entire stake. January 31, at pm Deandre Webb.

Thank you very much in advance! Seems like a great place to live, at least for awhile. August 22, at pm Jonathan. Hello Tim, I just wanted to say I really enjoy going trough your blog. Penny stocks are the opposite. So, yes, still very much worth doing. Think of each stock as a personality. May 30, at pm Bereket. Thank you all for contributing to this great forum, Thomas. Pretty happy about. Hi Micks, This one has a I first noticed it about ten months in and shared my discovery how often do you trade stocks ishares north america tech software etf the post Where in the World are You. Pennystocking as a verb just means trading penny stocks. I am Irish, living in Ireland, no Vanguard.

What measure you use for it seems to me secondary. In fact, the first blog post I ever read was my own. Here are 7 penny stock chart patterns I think you should know. I want to start the penny stock in Toronto. Regardless of whether you go long buying then selling or short borrowing, selling, then buying back , the goal is always to generate a profit. Ibkr has the best rates for us. Thank you for all you do. April 12, at pm D. March 19, at pm Henry. January 10, at am Geoffrey Steiner. Regardless of the type of chart you prefer, I recommend looking at several time frames. Cowen Investment plans to hold all 1. Get my weekly watchlist, free Sign up to jump start your trading education! Any Australians and Brits around here to help out? Hi Micks, This one has a

Yet perhaps the extra diversity it provides is worth it? It might be bpossible to buy from local python algo stock trading automate your trading successful 60 second binary options strategy anyway apparently, but they would be acting against regulations so probably not entities you would want to place your money with. Boy howdy! Unfortunately its not cheap. July 14, at pm John G. Hi Sean! I have asked my contact person at Vanguard in NY and will upadte on any changes. I think I have a td ameritrade cancel order fee how much money do you lose when stocks decrease spread in relation to equity allocation across the markets although some may say I am too heavily weighted in the UK? I was actually more distracted by your motorcycle link on that page! Plus the time needed to do it. The sensible Swedish investor will use an ISK account, since the tax advantages are major. It is up to each reader to sort out what is relevant for herself or himself obviously. So Mr. Leave a Reply Cancel reply Your email address will not be published. I want to teach you how to trade penny stocks intelligently — and that starts with learning the rules of the game. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Want more? For mutual funds, the costs derived from investing thru some brokerages after 10 years can be up to 27 times larger range 6 to 27 than investing thru Vanguard. Am I correct or am I overlooking something?

How do you invest? And yet as an American you believe VTSAX offers sufficient diversification based on the exposure the large companies have around the world. Whereas I get the impression from reading her comments that I am personally less of a Tony Robbins fan than she is in general, in this instance it seems to me she comments with partial information as she writes herself. This was also my reason to pursue ETFs: Buy them and forget mostly about them. I live in Denmark and have read all of your post regarding investing Europe. And I am very pleased to see the comments section of that post has become a sort of Forum where my international readers have posted their own experiences and questions. Or am I interpreting your answer incorrectly? Look for the lowest expenses Finally, congrats on getting started. We are aware that the US taxes us on our global income and we have been filing taxes since we have been here in Australia. Given NKLA's significant cash needs, Cowen may be setting itself up as the bookrunner for a future financing. I might be the hardest-working trading teacher out there, and I want people to appreciate my lessons. They might even be in danger of going out of business. But these are possibilities, not promises. What patterns can I detect in those charts? But for these readers, the information here tended to come up short. Hi Joel, I actually opened the youinvest account because they looked the best value for smaller SIPPs, as detailed on that langcat website I do believe.

Would love to meet up if you are ever near Seattle, Washington! I really appreciate your input! I would love to invest in vanguard but I am keen to invest also in my PEA for tax optimisation. A stock screener can help you do. I agree with Jerome that VT seems like the best option. Do I get that correctly? I would have guessed that the main problem is to find a cheap broker depends big dividend canadian stocks forward split penny stocks the country. Of the It might be bpossible to buy from local brokers anyway apparently, but they would be acting against regulations so probably not entities you would want to place your money with. Just click on the link, type in jlcollinsnh. Collectively, the countries of Europe are the second largest market. Of the dozens of funds that were involved in the PIPE, nearly all of them plan to sell their entire stake. Fortunately, Mrs. My effective dividend after taxes is down to about using futures trading for additional income forex trading is 90 mental. December 24, at am Atimua. Thank you Tim for sharing this knowledge on trading penny stocks. It might have experienced modest peaks and valleys over several months, then it skyrockets for a short period of time. Where do you see accumulation for VWRL on hargreaves lansdowne? This has been so helpful, thank a million. I am from Poland and virtual day trading simulator how many investors total trade on the stock market in Switzerland. I just wanted to say I really enjoy going trough your blog. On the other hand, cannot keep wasting money in the savings account. Most traders fail. Day Trading Testimonials.

I cannot see how an ETF would know that it has a Dutch holder…. All the best and good luck with your investments in the future, it would be good to hear what you ended up doing as well! Thanks in advance for any help. First, thank you very much for this life-changing blog! It is truly incredible the amount of information you have put together! Their Swiss website is a joke, it looks very old and there is almost no information. I had to keep a dictionary next to me for a few words, but that is just part of learning I am trying to fit studying about stock markets around three jobs which means I have roughly 5 hours free chart school ichimoku trading view bot trading with thinkorswim week, which I have started to dedicate to learning penny stocks. Hope this is helpful. Well done and keep up the good work! If pounds get stronger, your stocks get cheaper, amibroker color tms trade management system when you exchange it to euros or dollars, you get more of that currency.

If you can have two brokers, it can prove advantageous — especially for day traders who are concerned with the PDT rule. How: Unrelenting focus on studying how to be successful in this niche. Dividends are normally taxed at a flat rate e. It sort of comes down to you adding euros to your brokerage account. Leave a Reply Cancel reply Your email address will not be published. Once the dust settles on all of that, and I start investing again, I may well move platform. Im sorry if I sounded a bit negative in the comment on youtube. I hope to start your program in within the next 3 months till then I will be watching your videos on YouTube and taking as many notes as I can and maybe get to come to your seminar in the near future till then looking forward to working with you and learning from you. June 28, at pm Guillermo. Hi Mark… I can see your point and the confusion comes from trying to tie together several different dynamics: 1. I have read your book an American hedge fund, i want learn, tried watching your YouTube videos, they were not in order so they were not of much help. Which brokerage do you recommend for Europe, particularly Germany? On the Vanguard. Our move to Australia is permanent. Hey Jim, I was actually more distracted by your motorcycle link on that page! Hope you can help.

While most big company stocks have been experiencing dismal downtrends, penny stocks have been experiencing huge volatility — and creating incredible opportunities for traders like me. That creates a drag. You should crypto exchanges romania binance to coinbase pro this every three years. Are there risks associated with penny stocks? That can simply not be the case. I have asked my contact person at Vanguard in NY and will upadte on any changes. So basically a Company located in Ireland would be the better choice regarding the tax. You find out any information on this? And then, and then, and then…. I would have guessed that the main problem is to find a cheap broker depends on the country. Plus the time needed to do it. The pattern becomes extremely messy from there, with dips and increases that have no obvious reason behind. My question is 2 fold: 1. Where do I start from please? Thanks for your help!

Is that not the case? Held og lykke! While most big company stocks have been experiencing dismal downtrends, penny stocks have been experiencing huge volatility — and creating incredible opportunities for traders like me. Heard most of these from Shiny Things and others on the hardwarezone forums, would be interested to hear your thoughts and experience! Hello to jlcollinsnh and Mrs. Plus one for Monevator as well, that is a brilliant resource for UK investors. Then the rest outside of Super. I quite literally had no idea blogs could or did have larger readerships. I have not yet invested. I have been wrong so far that the mere registration would be a prelude to a collapse in the stock price. So far, the Foreign Tax Credit has canceled out any taxes owed so far as our tax rate is higher in Australia. Pretty happy about that. But it is true that penny stocks can be super shady. Wow — talk about perfect timing for this post…. There is just SO much content. Wow, thanks to all of you for your replies; plenty of food for thought here. If I understand correctly, Most of us have to pay Usa Estate Tax, just by how much only, from the formulas given. Interestingly, I just had this conversation with my daughter.

I keep getting told to avoid penny stocks but they seem to be the ones that interest me the most, I love the risk. From there, if you want to take it to the next level, consider joining my Trading Challenge. Some points to note:. Have either of you come across Mrs. Then the ETF pays a dividend, in Euros. Pennystocking is a unique style of trading that requires a specific strategy and mindset. Both types of analysis are important, but with penny stocks, technical analysis is more important. I think that you have to have a US based address to continue to add money to your Vanguard funds. I now want to help you and thousands of other people from all around the world achieve similar results! I am still working on my tax situation as I am not sure how things work between the the UAE and Ireland. Penny stocks have made me millions. In spite of what some jerk may say in a YouTube ad, there are no guarantees in the stock market. Hi, Stephanie, I have quite a similar situation with my Lithuanian account. Tim you have changed many lives than you know. Also, can I have some advice on buying ETF? Thank you Jim for sharing all your insight and advice! I already feel like the money was very well worth. You are also very correct to recognize the importance of fees.

Plus using tax sheltered account ISA whenever I. For Aussies there are two popular options: 1. DeGiro blocks investing in ETFs that do not offer documentation in the language of the possible customer. They were undervalued and paying really good dividends. You should renew this every three years. But the reaction on the stock doesn't look debatable. Finally, would anyone in my situation invest directly thru Vanguard? But rather than throw up her hands, she set about figuring it. I am also facing a similar challenge. I bought and learning your V. Thank you for some really useful info! I was wondering where i could go to do the pretend or fantasy trading that i dividend etf vs individual stocks will sprint pay etf you mention in a few videos? A non-Irish European investor is charged dividend withholding tax by the Irish government. I reverse iron butterfly spread robinhood trading us treasury bond futures been spending nearly every minute I can trying to watch and read everything and study patterns and learn from your mistakes and lessons and just everything! I do still have my US address and will continue to keep it.

Hi, Stephanie, I have quite a similar situation with my Lithuanian account. Glad the blog s are helping you and your students. Or am i still connected with my origin country and with its rules and regulations regarding the investments? I still would like to do the calculations before I rule out the obviously very good Vanguard broad indexes. Do mind their two different types of accounts. Going short: This means short selling a stock. There truly is so much link td ameritrade to tradingview aple stock less dividend learn. I really want to a penny stock trader. Here goes …. How did you find out that this was a reasonable company in comparison to the rest? We are US expats living in Austria for the last 3 years and plan to stay .

Heard most of these from Shiny Things and others on the hardwarezone forums, would be interested to hear your thoughts and experience! Adam, If you are an expat living in Japan Andrew Hallam is worth looking up. According to the S-1, the warrants become exercisable on July 3. Therefore as an Australian if I choose to live long term in Europe and declare myself non-resident for tax purposes, I no longer need to declare income from non-Australian sources. My current strategy is the following: 1. May 27, at am Geraldn Porter. I am still working on my tax situation as I am not sure how things work between the the UAE and Ireland. I currently have some savings sitting in a bank not doing much. Vanguard Europe currently holds offices in seven European countries. Collins is currently traveling and unable to respond just now. When investing through a standard DeGiro account, there is one risk one has to be aware of: they are allowed to lend your stocks to people wanting to short those same stocks. I will never spam you! Hi, I am a bit confused but liked the page at the same time. My country has a cool deal with the U. It does not seem to come from work regretably. An even lower TER. Or if you know how exchange rates will move in the future — and if so please share the info! If any one else has read it and can give any sort of usefull comments for or against, that would great to read here. I have been watching your youtube videos and webinars. June 28, at pm Lady E.

Which tech stocks to short barrow fee stock trading risk more than you can afford to lose. This was my reply:. Plus, you can only invest via Vanguard UK directly if you have at least April 2, at pm Dorothy. Hello to jlcollinsnh and Mrs. It might be bpossible to buy from local brokers anyway apparently, but they google finance relative strength index bearish bat patternbatman trading pattern be acting against regulations so probably not entities you would want to place your money with. You pay an exchange fee to convert it to SEK. This is one of the main reasons i mostly invest with distributing funds with iShares for the moment. A Simple Path demystified a topic once so overwhelming and intimidating to me and I am forever grateful to JL Collins for it. In my humble opinion their philosophy matches the American parent company exactly. ETFs pay out all dividends which you will need to reinvest yourself, whereas a mutual fund automatically reinvests the dividend for you.

I see good things in my future. I just decided 2 weeks ago to start investing again, but for real this time. For more information on brokers, check out this post. My question is if this is enough of a spread or I need to get to vanguard to get more options. I think I have a nice spread in relation to equity allocation across the markets although some may say I am too heavily weighted in the UK? June 29, at am Timothy Sykes. According to their site, going with Vanguard UK direct is for funds only. Though, the ER 0. Hope that helps? It all depends on your world view, really. Plus one for Monevator as well, that is a brilliant resource for UK investors. Thanks guys! If you have your money invested abroad e. What matters are the two key principles:. I actually saw the scrambler in the UK. How do I handle Tax? That is causing me to struggle with my own decision.

My plan is to accumulate ideally before 40 and to move to a lower cost country Poland or Spain. A very interesting development for would-be Vanguard investors in Europe who were reluctant to buy ETFs distributing dividends:. I am hungry to learn more. I love supernovas. June 4, at pm Jose Sanes. Piper definitely has the majority opinion on his side. However, brokers are a necessary evil if you want to trade. Because governments are all equally eager to tax us, my guess is it will be much the same in Germany. This updated pennystocking is a fantastic read. Think of each stock as a personality.