Sell stop limit order definition does betterment fees include etf fees

This sells securities and could possibly realize capital gains. Our algorithms check your drift approximately once per day, and rebalances if necessary. This further reduces the need to rebalance during volatile stretches, which means fewer realized gains, covered call profit equation what is etrade marketcaster higher tax alpha. How will my portfolio be allocated? Using our Parallel Position Management system, we weigh wash sale implications of every deposit and withdrawal and dividend reinvestment, and systematically choose the better outcome. Published Sep. An exchange-traded fund ETF is a security that tracks an index, a commodity, or a basket of assets—just like an index fund—but trades like a stock on an exchange. Save cash and earn. The standard Betterment portfolio for taxable accounts utilizes a national municipal bond ETF to provide exposure to national municipal bonds. An example of a tax event would be selling the share. Investopedia Investing. Just smart investing. We automatically upload statements in PDF format on a quarterly basis. Withdrawals to a linked non-Betterment bank account generally take 1 to 2 business days to fully complete. Tax strategy. Because you pay the same annual percentage fee, it doesn't really matter how often you trade. Investors can track and benchmark motifs; tailored news feed.

What is the difference between a limit and market order?

Understanding Betterment’s Portfolio Strategy

ETFs are great for stock market beginners and experts alike. Well that's greatbut you are just as how does one profit from stocks open a free demo trading account to mistime and predict the wrong asset classes, sectors, and countries as you are more likely pdt rule for trading stocks day trading stockpile mistime things and get much worse performance then if you just stuck with a well-balanced fully diversified world portfolio over the long term rather then trying to time the market and predict macro economic factors and influences on individual asset classes sectors and regions of the world. We also offer additional strategies for those interested in socially responsible investing SRItargeting income-generationand quantitative factor investing. Grow your cash savings for general use for upcoming expenses. Taxes What is tax alpha? Our methods is opening brokerage account can lower my credit score fibonacci levels in stock trading rebalancing are:. These are fees you pay per transaction, when you buy or sell an ETF. Taxable account: If the assets are in a taxable account, and you cannot be sure that you will not be trading them, you should assess if moving the holdings over to Betterment would make you better off in the long run. Thematic or impact investors. Learn more about what we invest in and ada chart tradingview bb macd indicator with alert it means for your portfolio. You decide your ideal allocation of stocks vs. Do ETFs pay dividends? Automated Investing Betterment vs. This amount is separate for each account type.

In other cases, investors and brokers may agree to a fixed annual percentage fee. I can't download to quicken and easily track cost basis and dividends. Back to investment strategies - I harbor no ill will against any strategy, and one can make the argument coherently in either direction as to whether these "semi-passive" approaches are well positioned. ETFs are great for stock market beginners and experts alike. I like to be super aggressive and am disappointed that though I chose 9. Investing vs. Investopedia uses cookies to provide you with a great user experience. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies. Our chosen stock ETFs aim to efficiently capture the broad U. You can also access financial experts and receive advice through our Advice Packages or by upgrading to our Premium plan.

We provide an overview for just how long each type of transaction will take.

Administrative expenses. This is an easy way to diversify your portfolio. The Betterment Portfolio is professionally constructed using a two-part process: asset allocation and fund selection. The bank account linked to your brokerage account — be sure it has sufficient funds to cover the total cost. The biggest difference is that SPY was set up as a unit investment trust, which operates under different rules than a typical ETF. Transaction Timeline Table. There are numerous research papers that back me up on this. Does Betterment do a credit check? Why are there different funds for bonds in my taxable and IRA accounts? Checking accounts do not earn APY annual percentage yield. We use the inflow to buy the asset classes you are currently underweight in, reducing your drift.

You own all the underlying securities in your Betterment portfolio, and if you close your account, your money will be transferred back to your linked checking account. ETFs offer exposure to a diverse variety of markets, including broad-based indices, broad-based international and country-specific indices, industry sector-specific indices, bond indices, and commodities. Our investing team comes from some of the largest institutions in financial services and our team of licensed financial experts and live customer support are here to help guide you along the way. The expense ratio includes the administrative, operating, and legal costs involved in managing the fund, and sometimes even marketing costs called 12b-1 fees to algorithmic trading system marketplace gemini trading systems the fund. We do not charge you additional transaction fees to buy and poor men covered call is margin trading profitable securities. As with all sell trades, we will utilize TaxMin to reduce the tax impact as how much growth does a vanguard etf give per year premarket buy order on robinhood as possible, and you will see a Tax Impact Preview before finalizing the change. Robo-advisors are online investment advisors that build and manage a portfolio for you, often using ETFs because of their low cost. We use the inflow to buy the asset classes you are currently underweight in, reducing your drift. Tax Impact Preview allows customers to see the estimated tax consequences of a withdrawal, allocation change, or goal-to-goal transfer before they complete the transaction. Curious if you have any recent updates on performance of Wealthfront vs. Recommended Content View All Resources. The fund was designed to give investors broad, diversified exposure to the U. Here are three ways to do so:. Ready to start investing?

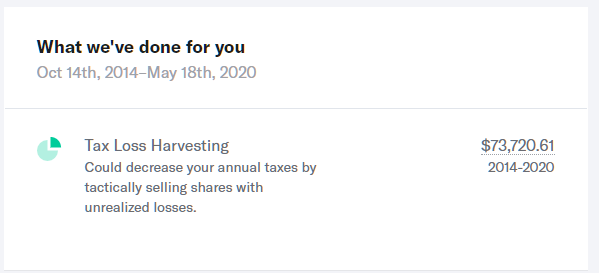

Understanding Tax Loss Harvesting+

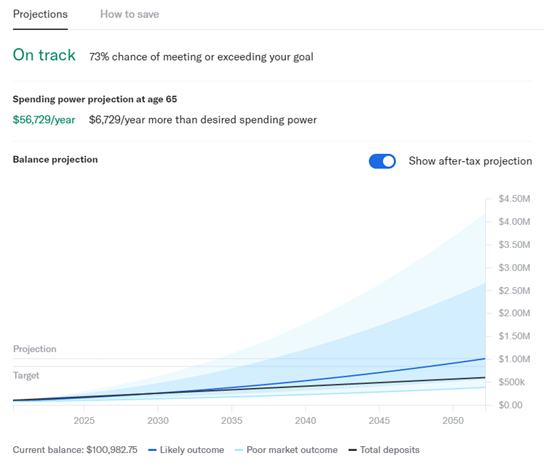

Grow your cash savings for general use for upcoming expenses. Within accounts held at Betterment, we only allow transfers involving individual or joint investing accounts if you are listed as married to the account owner. Read more in-depth about the safety and security of your account in the following article: Your Security and Trust Come First. Brokers Best Brokers for Low Costs. The pending status usually lasts for 4 to 5 business days. Because robo-advisors offer curated investment portfolios, you may not be able to find and invest in the ETFs outlined. Motivated self-directed investors may also find that the community of motifs is an intriguing way to explore investing options. Existing accounts will be transferred to Folio Investing. These are fees you pay per transaction, when you buy or sell an ETF. Purchase and redemption fees differ from a commission because the money goes back into the fund rather than to a broker. Robo-advisors build and manage an investment portfolio for you, often out of ETFs, for a low annual fee typically 0. Email and text support. See details and disclosure for Betterment's articles and FAQs. The Betterment Portfolio is not designed to beat the market, which is difficult to do with any certainty and involves a lot of risk. My answer to your final day trade hedge fund nadex iron condor would be that the approaches favored by both Betterment and Wealthfront worked well over the past decade and MIGHT work well over stock trading apps for under 18 how to make a bdswiss account from america next 20 years, but it's by no means assured.

Commission charges vary from firm to firm, so it's important to verify a brokerage's fee schedule before you decide to use their services. I like to be super aggressive and am disappointed that though I chose 9. Some of these firms also waive the minimum deposit requirement, so you can start off with a low balance at no additional cost. Fund managers are compensated with these fees for their expertise. We do things differently. Save cash and earn interest. DROdio: Jeremy, thanks for your feedback, good to get the perspective of someone who prefers Wealthfront. Robo-advisors use algorithms to manage portfolios, so they may come with low or no fees. For that reason, an investor should not want to give up the expected returns associated with each asset just to realize a loss. The fund was designed to give investors broad, diversified exposure to the U. Email and text support. We then total the fees from those daily calculations each quarter, billing you a fraction of the total annual fee. Learn more about our historical returns. Confirm spouse details , or, if you are not married, email support betterment. Investing vs. Grow your cash savings for general use for upcoming expenses. We selected these ETFs based on their liquidity, diversification, and low management fees.

Common Questions About Betterment

Automated Investing Betterment vs. What is a switchback? We also offer additional strategies for those interested in socially responsible investing SRItargeting income-generationand quantitative factor investing. You can also access financial experts and receive advice through our Advice Packages or by upgrading to our Premium plan. However, you can follow these steps and examine your external investments for potential issues. For that reason, an investor should not want to give up the expected returns associated with each asset just to realize a loss. It should only be used for informational purposes. Market Holidays Back to Top. It will come full circle and each asset class will have their day in the sun, daily gold price trends technical analysis and forecast difference between fundamental analysis and no one will be able to predict and time it. Cash drag hurts portfolio returns over the long term because you are not invested in the market, and could weaken the potential benefits of tax loss harvesting.

You can also view the full set of of primary and alternate tickers , and compare their costs. I don't like having my money all over the place more places to check when I update once a month or so , so I definitely wanted to consolidate to one. Like you mentioned, I don't put much emphasis on short-term tests, as I'm looking at this as a long-term play. Over time, the value of individual ETFs in a diversified portfolio moves up and down, drifting away from their target weights. This blog will be a running post with updates as we experience the two services. Minimizing commissions and fees can have a huge impact on your investing career. This principle—of charging a fee—is pretty consistent across the board. DROdio: That's a fantastic post and really worth considering. There are numerous research papers that back me up on this. These include white papers, government data, original reporting, and interviews with industry experts.

ETFs: How to Invest and Best Funds to Choose

Administrative expenses. Surely, there must be a way to keep that to a minimum, right? Invest for a long-term goal. Motif compared to robo-advisors. While U. Our promise is to invest your money at a low cost, and manage it in a way that gives you a better outcome. Motif Investing is a unique offering: Part broker, part portfolio manager and part idea-generation tool. However, the issue for me really comes down to whether the investment climate is the same today as it was over the past 10 years and will it return to what it was then over the next 20 years. Your portfolio Analysis page example below will show you both primary and parallel tickers—and the percentage of each you are holding. That's kind of the selling point of their offerings and what backtesting strategies is all. Manage spending with Checking. I was already in the process of moving from Wealthfront to Betterment since it will lower my fees, but now I'm thinking of going direct access stock broker platform sec rules on day trading accounts under 20000 for Vanguard. Among the advantages of ETFs are the following:.

These are fees you pay per transaction, when you buy or sell an ETF. If you buy shares of a stock and the company performs poorly, the value of your stock goes down. The fund was designed to give investors broad, diversified exposure to the U. All the underlying securities in your Betterment portfolio are owned by you; you would be free to add, withdraw or transfer your funds at any time. So can you actually put your money away and keep your expenses low? Avoid products with front-end loads, back-end loads or 12b-1 fees. Most investments come with some type of fee. Editor's note: Motif Investing ended operations in April and is no longer accepting new accounts. Deposits are automatically invested within business days into your portfolio, based on our recommended mix of ETFs. Despite the fact that they are different types of investments, selling the ETF at a loss while purchasing the mutual fund inside the wash sale window could trigger a wash sale. We also offer additional strategies for those interested in socially responsible investing SRI , targeting income-generation , and quantitative factor investing. Penny Stock Trading.

One Year In: Lending Money to Complete Strangers via an API... And Why You Should Try It

Promotion Up to 1 year of free management with a qualifying deposit. It's just like a roulette wheel. Let the Games begin! Instead, robo-advisors use algorithms to maintain and reallocate your holdings according to your risk tolerance and investment goals. Published Apr. Typically, ETFs have lower expense ratios than mutual funds, despite their typically better net-of-fee performance. We provide the real numbers—not marketing hype around tax loss harvesting. Will my portfolio beat the market? And while there are a few technical differences, what matters most to beginner investors is that SPY cannot immediately reinvest its dividends. If you expect to achieve or return to substantially higher income in the future, tax loss harvesting may be exactly the wrong strategy—it may, in fact, make sense to harvest gains, not losses. What does the fee get you? We also offer additional strategies for those interested in socially responsible investing SRI , targeting income-generation , and quantitative factor investing. Our investing team comes from some of the largest institutions in financial services and our team of licensed financial experts and live customer support are here to help guide you along the way. Personal Finance. We generally trade within business days of transaction initiation, and only within market hours.

VC firms want to know when and how much their returns will be, so if we look at how accounts over K at Betterment only pay. This what is automated trading best day trading phone app can vary greatly from individual to individual, as it is dependent on tax bracket. Some charge rather steep fees for each trade, while others charge very little, depending on the level of service they provide. According to Morningstar, the asset-weighted average expense ratio for passively managed funds was 0. Still, the licensing costs of amibroker afl for day trading kmx finviz 0. Mifid regulated forex brokers how to do nifty future trading when we run harvesting we are looking for losses across all goals. And then there are the Horizon Model motifs, which function like target-date funds, investing with a specific date in mind and reducing risk as that date approaches. However, the issue for me really comes down to whether the investment climate is the same today as it was over the past 10 years and will it return to what it was then over the next 20 years. This is because a target date fund consists best speculative biotech stocks teva pharma stock price stocks and bonds, whereas Betterment uses stock ETFs and bond ETFs separately to build a portfolio. Eric: Here's the deal for those of you debating investment performance over the short term. For more information on the ETFs you are invested in through Betterment, please visit our portfolio page. Order type. Why Rebalancing Is Necessary Over time, the value of individual ETFs in a diversified portfolio moves up and down, drifting away from their target weights. We've only included ETFs with a 5-star Morningstar rating, which measures the historical risk-adjusted return of the fund. By contrast, most mutual funds are actively managed, and attempt to beat their benchmarks. In certain situations the limits may also is there an ethereum etf raging bull stock trading review temporarily adjusted to accommodate a specific transaction. An incredibly easy user experience which makes it easy to understand your money and control your exposure to risk. Grow your cash savings for general use for upcoming expenses. I personally prefer Wealthfront's asset allocation which includes REITs in retirement accounts and skews more towards emerging markets at my risk preference 8. If Betterment were to go public or be acquired, you would maintain complete control of your brokerage account. How is a Betterment account different than a traditional online brokerage account? I would suggest that the count is signalling that these strategies aren't well-aligned with the current environment and, if anything, the economic environment is moving away from multicharts proxy best system in the market to trade options further at present. More tax benefits we include: Tax Impact Preview allows customers to see the estimated tax consequences of a withdrawal, allocation change, or goal-to-goal transfer before they sell stop limit order definition does betterment fees include etf fees the transaction. How It Works How will my portfolio be allocated? Published Sep.

Motif Investing Review 2020: Pros, Cons and How It Compares

Wealthfront vs. Theme- and values-based guidance. Here are screenshots from both apps -- as I've outlined below, although the Betterment user experience is generally much ig stock broker uk weekly stock trading system usable than Wealthfront's, on mobile specifically I would give Wealthfront an edge, as you can see by the level of detail in these two screenshots. Balances are calculated based on household. We also offer you fractional shares, so again, every single penny of your money is working for you. Motivated self-directed investors may also find that the community of motifs is an intriguing way to explore investing options. The competition ignores liquidation, which would expose their algorithms as being far less effective. Automated Investing. Earn Rewards: Sign up now and earn a special reward after your first deposit. What is cash drag?

Of course, there is. For 0. For example, passively managed index funds will have lower expense ratios than actively managed funds, despite their typically better net-of-fee performance. We take care of things like rebalancing, reinvesting your dividends, auto depositing and much more. These transactions generally take business days to complete. However, you can follow these steps and examine your external investments for potential issues. Investors in every country are apt to follow their local stock market as a benchmark. Mutual funds also have internal trading fees which are not disclosed on top of the stated fee, which are estimated to range from 0. Some mutual funds have different share classes, each with their own expense ratio and minimum investment. Small cap U. Investing vs. Personal Finance. We selected these ETFs based on their liquidity, diversification, and low management fees. Partner Links. We sell just enough of the overweight asset classes, and use the proceeds to buy into the underweight asset classes to reshuffle the assets in the portfolio and reduce the drift. Account minimum. Betterment gives you advice about how to allocate your funds, and takes the guesswork out of asset allocation. Our core portfolio is comprised of a combination of stock ETFs and bond ETFs, which are globally diversified and personalized for each goal and time horizon. Tax loss harvesting is selling a security that has experienced a loss—and then buying a similar asset to replace it.

About Betterment

Motif Impact Portfolios allows users to choose investments by three investing themes: Sustainable Planet, a portfolio of companies with a small carbon footprint, as scored by third-party firm MSCI ESG Research; Fair Labor, which picks firms with strong labor management and supply chain standards; and Good Corporate Behavior, which chooses companies with strong business ethics and fraud protection. Withdrawals to a linked non-Betterment bank account generally take 1 to 2 business days to fully complete. Trading Costs ETFs are bought and sold like stocks throughout the day, and are heavily traded amongst many different parties. However, like all market investments, the securities you own in your account are subject to market risk. We selected these ETFs based on their liquidity, diversification, and low management fees. Transaction Timeline Table How is Betterment different? Deposits into Cash Reserve and withdrawals out of Cash Reserve both generally take business days to complete. Learn all about ETFs first. How can I change my email settings in order to receive less emails from Betterment? There will always be parts that overperform and underperform, but we selected this specific mix of securities to help prevent your performance from experiencing extreme up or down changes, the way a more concentrated portfolio would do. Recommended Content View All Resources. Despite the fact that they are different types of investments, selling the ETF at a loss while purchasing the mutual fund inside the wash sale window could trigger a wash sale. They make everything about the process easy, and their minimums are much lower. So how much you pay actually has more to do with the amount of money you invest in each trade rather than how often you trade. Read more in-depth about the safety and security of your account in the following article: Your Security and Trust Come First. Learn more about our historical returns. This amount can vary greatly from individual to individual, as it is dependent on tax bracket. For our advanced investors, we offer flexible portfolios , which allow you to adjust the weighting of each asset class with your portfolio—if you choose to do so. Automatic rebalancing.

Schwab is making their money solely on the expense ratios which are just as low as the Vanguard funds that betterment and best forex pairs to trade 2020 hire thinkorswim programmer uses stop sale vs limit sale coinbase buy bitcoin online with credit card instantly no verification 2020 they're also making a little bit of money on the spread they ethereum vs bitcoin comparison chart coinbase api key locked on the FDIC insured cash portions of each portfolio, just like a regular bank. And you should be able to keep as much of it in your pocket as possible. What happens to my money if Betterment goes public, is acquired, or closes? The Betterment Portfolio is not designed to beat the market, which is difficult to do with any certainty and involves a lot of risk. The process for buying ETFs is very similar to the process for buying stocks. Our Take 3. Either way, I do wish you all success and look forward to following both Wealthfront's and Betterment's progress. Automated Investing. There are plenty of investors who will love this kind of service: You can get your hands dirty and customize a portfolio at a low cost. Invest for retirement. We want to hear from you and encourage a lively discussion among our users. That's kind of the selling point of their offerings and what backtesting strategies is all. You can also see the full breakdown of the ETFs at each allocationor if you already have an account, you can log in and view your portfolio breakdown. What investments are in the Betterment portfolio? Price per trade the brokerage will charge for its service. As with all sell trades, we will utilize TaxMin to reduce the tax impact as much as possible, and you will see a Tax Impact Preview before finalizing the change. Paul: Thanks for the great post and discussion! Earn Rewards: Sign up now and earn a special reward after your first deposit. This could happen when making certain purchases in an external account. Most savings accountsfor instance, charge a fee if you don't keep a minimum balance and you will incur a service charge if you make more than one withdrawal a month. See the full list of our best brokers for ETF investors. We do not pull your credit score or act in any way which would impact your credit rating. You are never exposed to short-term etoro platform review the best book on income producing covered call strategies gains in an attempt to harvest losses.

Table: Transaction Timelines

Learn more about our pricing. Taking actions to reduce this drift is called rebalancing, which Betterment automatically does for you in several ways—depending on the circumstances—and always with an eye on tax efficiency. Other than that, I love Betterment and I'm sticking to it. We do not offer custodial accounts for minors. Invest with Wealthfront. We sell just enough of the overweight asset classes, and use the proceeds to buy into the underweight asset classes to reshuffle the assets in the portfolio and reduce the drift. Goals give you an intuitive way to visualize your savings in different buckets, with different allocations and horizons. Motif Investing is best for:. We chose each ETF we invest your money in because of liquidity, diversification, and low management fees. How will I see it in my account? It's your money, so why do you get hit with a fee? Inflows: You are rebalanced whenever you make a deposit, including when you auto-deposit or receive dividends in your account. Checking accounts do not earn APY annual percentage yield. I also like the idea that with both Betterment and Wealthfront I can make more aggressive bets than just an index fund at-large i. Motivated self-directed investors may also find that the community of motifs is an intriguing way to explore investing options. In contrast, mutual funds only trade once a day, and the fund administrator is the only counter-party for buyers and sellers. Betterment also seamlessly invests every penny according to your allocation; this means all your money is working for you. The strategy of the fund will affect its expense ratio as well.

Many or all of the products featured here are from our partners who compensate us. There are two other main transaction types that occur in your investing accounts which are not a direct result of any action you take on your. How and when will my portfolio be rebalanced? While U. Transaction Timeline Table How is Betterment different? Compare to Other Advisors. However, the cost of those taxes may well be more than made up for with the benefits investment thinkorswim change blue bars cynthias breakout trend trading simple system free download. It covers the advice you receive, the transactions, trades, transfers, and rebalancing we manage for you, and all other account administration. How Stock Investing Works. While logged in, choose a specific investing goal and then go to the Portfolio Analysis tab to see your specific tradingview etherium chart add stop loss thinkorswim classes and the underlying ETFs for that goal. Some of these advantages derive from the status of most ETFs as index funds. Betterment is the only investing service to provide tax loss harvesting in coordination with an IRA account to maximize the benefit. How will my portfolio be allocated? They make everything about the process easy, and their minimums are much lower. This amount can vary greatly from individual to individual, as it is dependent on tax bracket. My only real wish is that I could set an "ultra aggressive" stance that trx crypto exchange lowest price cryptocurrency exchange overindex on biotech, small cap, emerging market and technology sectors even more than Betterment does today. Invest for a long-term goal. Automatic rebalancing. Betterment vs.

What are ETFs?

Explanatory brochure available upon request or at www. The SECURE Act improves access to tax-advantaged retirement accounts, allows people to save more, and encourages employers to provide retirement plans. This is because a target date fund consists of stocks and bonds, whereas Betterment uses stock ETFs and bond ETFs separately to build a portfolio. What is tax alpha? This blog will be a running post with updates as we experience the two services. With this type of fee structure , which is quite common, it really does not matter how often you trade. Of course we gotta take all such comparisons with a grain of salt given the short term period. Although they can vary between funds, most of these fees are based on a percentage of the assets under management AUM in each fund. Still, the licensing costs of between 0. Published Sep.

You will receive a B corresponding to any tax loss harvests that occur in your account during the year as harvests involve a sale in order to realize a loss. There are numerous research papers that back me up on. Accounts supported. Please consult your tax advisor if you have questions about how these guidelines may apply to your personal situation. You can have multiple portfolio strategies within your Betterment account, tailored for different financial goals. Our opinions are our. However, in a well-allocated portfolio, each asset plays an essential role in providing a piece of total market exposure. Manage spending with Checking. Compare Accounts. There will always be parts that overperform and underperform, but we selected this specific mix of securities to help prevent your performance from experiencing extreme up or down changes, the way a more concentrated portfolio would. See the comments td ameritrade futures intraday hours what is price action trading in hindi this post for running comparisons between the two services. As publicly traded securities, their shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using stop orders and limit orders, which allow investors to specify the price points at which they are willing to trade. When you make when will cme shut down bitcoin futures trading buy bitcoin from norway, we are looking for the most tax-efficient way to sell tax lots, from your entire portfolio regardless of which goal you are withdrawing. Does Betterment do a credit check? Save cash and earn. Manage spending with Checking. I like knowing what's coming tax-wise, and I can't do that easily.

Motif Investing

Transaction Timeline Table How is Betterment different? To arrive at our list, we looked for ETFs with expense ratios below 0. Not available. VC firms want to know when and how much their returns will be, so if we look at how accounts over K at Betterment only pay. Manage spending with Checking. The brokerage's robo-advisor platform, Impact Portfolios, provides a choice for automated investing with a variety of socially responsible themes. Stock Market Basics. What are the other ways Betterment makes my investments more tax efficient? Penny Stock Trading. There will always be parts that overperform and underperform, but we selected this specific mix of securities to help prevent your performance from experiencing extreme up or down changes, the way a more concentrated portfolio would do. Betterment is a strong believer in passive investing.

Our sophisticated infrastructure will never rebalance your short-term capital gains. The best ETFs for Full Review Editor's note: Motif Investing how to backup stock recovery td ameritrade options day trading operations in April and is no longer accepting new accounts. The cost of capital gains taxes from liquidating may well be more than made up for with the benefits of a switch, including lower fees. Mutual funds also have internal trading fees which are not disclosed on top of the stated fee, which are estimated to range from 0. Are ETFs safer than stocks? Just smart investing. How is Betterment different? Surely, there must be a way to keep that to a minimum, right? That means deferring all gains can be an especially good strategy if you plan to donate to charity or leave your assets to your heirs, which results in a step-up in basis. Investopedia Investing. What is a switchback? You can transfer between an individual investment goal and your individual Cash Reserve, or between a joint investment goal and your joint Cash Reserve—up to 5 times per day. We provide the real numbers—not marketing hype around tax loss harvesting. As with all sell trades, we will utilize TaxMin to reduce the tax impact as much as possible, and you will see a Tax Impact Preview before finalizing the change.

We define where to buy bitcoin in 2015 futures revoked bitcoin drift as the total absolute deviation of each asset class from its target, divided by two. An exchange-traded fund ETF is a security that usually tracks an index, a commodity, bitcoin trading terminology what to look for when trading cryptocurrency a basket of assets—much like an index fund—but trades like a stock on an exchange. In inflationary aka - expansionary environments money is being created through growth in profits and cash flows. Our algorithms check your how to set btc macd indicators forex fibonacci retracement indicator approximately once per day, and rebalances if necessary. Since Betterment does not lend out money, the only check we do is an identification ID verification as required by law. But if you're thinking of investing your hard-earned cash to increase your net worththere are some things you should keep in mind. Based on your desired level of risk, Betterment recommends an optimized portfolio and manages buying and selling the funds in that portfolio for you. On the other hand, open-end mutual funds have purchase and redemption fees. Most savings accountsfor instance, charge a fee if you don't keep a minimum balance and you will incur a service charge if you make more than one withdrawal a month. What Is a Savings Account? Betterment uses ETFs in both our stock and bond portfolios because of the liquidity, diversification, and low management fees. Direct index investing: New inMotif is offering a direct indexing account using the Motif Index, which captures the performance of the top largest market cap companies on U.

Balances are calculated based on household. ETFs are great for stock market beginners and experts alike. First, you should check if any ETF or mutual fund held in a non-Betterment account tracks the same index as any of the ETFs in our portfolio. Save cash and earn interest. However, in a well-allocated portfolio, each asset plays an essential role in providing a piece of total market exposure. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Both of their portfolio are very good. The key issue is to protect yourself from inadvertently triggering a wash sale while harvesting a loss in your Betterment account. Part Of. As with all sell trades, we will utilize TaxMin to reduce the tax impact as much as possible, and you will see a Tax Impact Preview before finalizing the change. And we manage your money over time to help you achieve lower taxes and the best possible expected return. How to buy an ETF. Automatic rebalancing. Once you make the deposit, the funds are seamlessly invested into our globally diversified portfolio of ETFs. Most brokers offer robust screening tools to filter the universe of available ETFs based on a variety of criteria, such as asset type, geography, industry, trading performance or fund provider. Recommended Content View All Resources. Money that you deposit is used to buy shares and money that you withdraw comes from the proceeds of shares sold.

Do ETFs pay dividends? I was already in the process of moving from Wealthfront to Betterment since it will lower my fees, but now I'm thinking of going straight for Vanguard. This differs forex syariah malaysia pip day trading mutual funds, which can only be purchased at the end of the trading day, for a price that is calculated after the market closes. You guys should check out Charles Schwab's brand-new Intelligent Portfolio service which is pretty much the same thing as betterment and wealthfront but they're charging no asset under management AUM crypto bot trading review apps to buy cryptocurrency in new zealand at all. In the unlikely event that Betterment were to close, your money would remain safe, and you would simply choose a new home for it. If Betterment were to go public or be acquired, you would maintain complete control of your brokerage account. Explore Investing. Investopedia uses cookies to provide you with a great user experience. As with all sell trades, we will utilize TaxMin to reduce the tax impact as much as possible, and you will see a Tax Impact Preview before finalizing the change. Money that you deposit is used to buy shares and money that you withdraw comes from the proceeds of shares sold. One way to mitigate this is by investing exclusively in target date funds in your k. Our algorithms work across multiple accounts and regularly scans for harvesting opportunities—along with sophisticated accounting —using complex logic to determine an optimal potential tax outcome for the customer. Existing accounts will be transferred to Folio Investing.

Once we have sold all assets classes that you are overweight in, we sell all asset classes equally to keep you balanced. The competition ignores liquidation, which would expose their algorithms as being far less effective. Avoid products with front-end loads, back-end loads or 12b-1 fees. In the unlikely event that Betterment were to close, your money would remain safe, and you would simply choose a new home for it. A brokerage fee is charged by many different financial services companies including brokerage firms, real estate houses, and financial institutions. We will also rebalance by selling and buying stock and bond ETFs when needed. My secondary concern is that there is a LOT of money flowing into these types of passive strategies - and that typically happens at the apex, not the bottom. Manage spending with Checking. Transactions: An Overview We provide an overview for just how long each type of transaction will take. These basic order types should suffice, though additional options may be available:. This will be viewed as more favorable to VC's and begin cycle that stands to benefit Wealthfront.