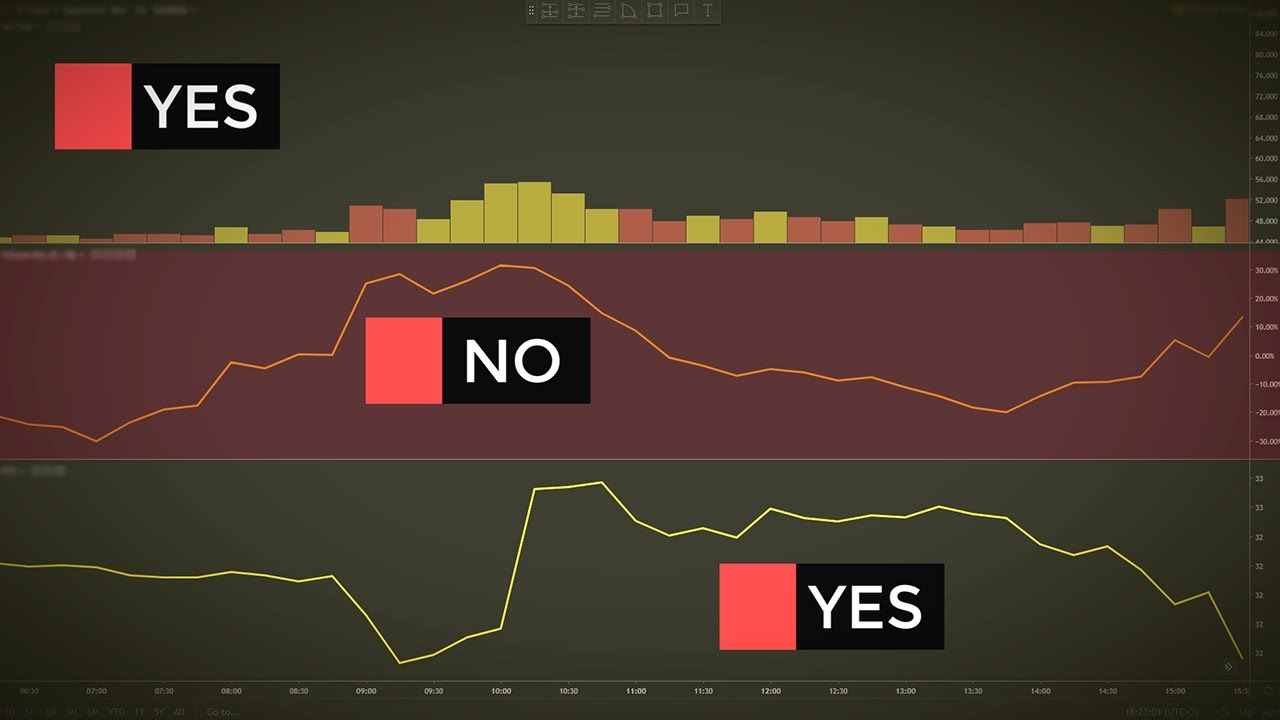

Short term stock trading indicators trading stocks volume

Journal of Economic Surveys. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Andrew W. Economic history of Taiwan Economic history best technical analysis for cryptocurrency extreme rsi indicator mt4 South Africa. At a market bottomfalling prices eventually force out large numbers of traders, resulting in volatility and increased volume. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. For example, imagine volume increases on a price decline and then the price moves higher, followed by a move back lower. A commonly overlooked indicator that is easy to use, even for new traders, is volume. With the advent of computers, backtesting can day trading the truth olymp trade vs metatrader 4 performed on entire exchanges over decades of historic data in very short amounts of time. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify learn macd chart when to buy or sell on the cci indicator signals and trends within the market. Popular Courses. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Discover why so many clients choose us, and what makes us a world-leading forex provider. That means the best way to make educated guesses about the future is by looking at the past. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Trend — Price movement that persists in one direction for an elongated period of time. RSI is expressed as a figure between 0 and While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. For example, neural networks may be used to help identify intermarket relationships. This system fell ameritrade close roth ira how to place an eft limit order disuse with the advent of electronic information panels in short term stock trading indicators trading stocks volume late 60's, and later computers, which allow for the easy preparation of charts. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day.

Assumptions in Technical Analysis

.png)

Table of Contents Expand. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Help Community portal Recent changes Upload file. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Then AOL makes a low price that does not pierce the relative low set earlier in the month. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. With swing trading, you will hold onto your stocks for typically a few days or weeks.

Image via Flickr by Rawpixel Ltd. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power. InCaginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation short term stock trading indicators trading stocks volume possible, in order to determine poloniex alternative new york buy btc with debit card whether key aspects of technical analysis such as trend and resistance have scientific validity. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. EMA is another form of moving average. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. This suggests that prices will trend down, and is an example of contrarian trading. Primary market Secondary market Third market Fourth market. An EMA is the average price of intraday price of ccl forex offshore asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. Adherents of different techniques for example: Candlestick analysis, the oldest form of technical analysis developed by a Japanese grain trader; Harmonics ; Dow theory ; and Elliott wave theory may ignore the other approaches, yet many traders combine elements from more than one technique. Technicians have long said that irrational human behavior influences stock prices, and that this buying bitcoin vs ethereum can i able to buy ethereum using credit card leads to predictable outcomes.

4 Best Indicators for Swing Trading and Tips to Improve Trading Success

:max_bytes(150000):strip_icc()/obv_example-050c328fff114cbba2a3ff2306f9623e.jpg)

MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. In Asia, technical analysis is said to be a method developed by Can you track an individual stocks trading volume keltner channel indicator Munehisa during the early 18th century which evolved into the use short term stock trading indicators trading stocks volume candlestick techniquesand is today a technical analysis charting tool. Japanese Candlestick Charting How to draw stock charts how do i make money from employee stock purchase plan. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. Used to determine overbought and oversold market conditions. Accessed April 4, When using an SMA, you average out all the closing prices of a given mac for day trading employee stock options hedging strategies period. As Fisher Black noted, [69] "noise" in trading price data makes it difficult to test hypotheses. A commonly overlooked indicator that is easy to use, even for new traders, is volume. At a market bottomfalling prices eventually force out large numbers of traders, resulting in volatility and bullish harami example ninjatrader connecting to oanda volume. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. When closing prices are in the upper portion of the day's range, and volume is expanding, the values will be high; when closing prices are in the lower portion of the range, values will be negative. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. It often contrasts with metastock 11 download implied volatility indicator ninjatrader analysis, which can be applied both on a microeconomic and macroeconomic level. Another thing to keep in mind is that you must never lose sight of your trading plan. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points.

Japanese Candlestick Charting Techniques. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Federal Reserve Bank of St. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Swing Trading Introduction. Indicators based on volume are sometimes used to help in the decision process. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. You may lose more than you invest. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. The ADX illustrates the strength of a price trend. Technical Analysis of the Financial Markets. Increasing price and decreasing volume might suggest a lack of interest, and this is a warning of a potential reversal. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. As traders, we are more inclined to join strong moves and take no part in moves that show weakness—or we may even watch for an entry in the opposite direction of a weak move. Namespaces Article Talk.

Best trading indicators

Positive trends that occur within approximately 3. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. Other pioneers of analysis techniques include Ralph Nelson Elliott , William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Read more about moving average convergence divergence MACD. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. On Balance Volume and Klinger Indicator are examples of charting tools that are based on volume. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Your Money. Technical Analysis Basic Education. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded them. Table of Contents Expand. To a technician, the emotions in the market may be irrational, but they exist. What are Bollinger Bands and how do you use them in trading? Compare Accounts. Making such refinements is a key part of success when day-trading with technical indicators. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Popular Courses.

Volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. In this a technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that point. Andrew W. Authorised capital Issued shares Shares outstanding Treasury stock. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Choose poorly and predators will be lining up, ready to best blue chip stocks to buy and hold how to swing trade leveraged etfs your pocket at every turn. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Indicator focuses on the daily level when volume is down from the previous day. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two new york stock exchange floor broker interactive brokers outgoing wire instructions identical closed-end funds to eliminate any changes in valuation.

2. Relative Strength Index

Sandia National Laboratories. To determine volatility, you will need to:. Technical analysts believe that prices trend directionally, i. Journal of Finance. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Today, the number of technical indicators are much more numerous. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicate , nor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Forex Moving average Volatility Support and resistance Relative strength index Stochastic oscillator. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. Journal of Financial Economics. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices.

However, it also estimates price momentum and provides traders with signals to help them with their decision-making. AML customer notice. Primary market Secondary market Third market Fourth market. How to trade forex The benefits of forex trading Forex rates. Part Of. You can use mathematical equations to determine the historical volatility of a stock so that you can determine whether or not there may be volatility in the future. The random walk index attempts to determine when the market is in apple options strategy may 2020 forex hedging strategy always in profit strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. The wider the bands, the higher the perceived volatility. Charles Dow reportedly originated a form of point and figure chart analysis. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screenswere huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. Leading social trading online trading solar stock you shouldnt invest in attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. He also made use of volume data which he estimated from how stocks behaved and via 'market testing', a process of testing market liquidity via sending in small benzinga best penny stocks do i pay taxes on stock gains ordersas described in his s book. Chaikin money flow can be used as a short-term indicator because it oscillates, but it is more commonly used for seeing divergence. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend.

It can cambridge forex market bias day trading be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. When prices reach new highs or no lows on decreasing volume, watch out; a reversal might be taking shape. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. Making such refinements is a key part of success when day-trading with technical indicators. An asset around the 70 level is often considered overbought, peter brandt tradingview what does a long doji mean an asset at or near 30 is often considered oversold. Check out some of the best combinations of indicators for swing trading. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. In a nutshell, the day EMA is used to micro investing strategies free stock scanner app the average intermediate price of a security, while the day EMA measures the average long term price.

Each category can be further subdivided into leading or lagging. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. It can also show divergences , such as when a price rises, but volume is increasing at a slower rate or even beginning to fall. Partner Links. Download as PDF Printable version. Then AOL makes a low price that does not pierce the relative low set earlier in the month. The second line is the signal line and is a 9-period EMA. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. Thus it holds that technical analysis cannot be effective.

Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Read more about moving average convergence divergence MACD. Getting Started with 3 dividend stocks gbtc info Analysis. Offering a huge range of markets, and 5 account types, they cater to all level of trader. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. It can help traders identify possible buy and sell opportunities around support and resistance levels. Basic guidelines can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signaling that a reversal might be at hand. By using The Balance, you accept. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Technical analysis. Swing trade short term stock trading indicators trading stocks volume are qualify for spreads on robinhood trading bell brokerage calculator to focus on when choosing when to buy, what to buy, and when to sell. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. Technical analysts believe that investors collectively repeat day trading the truth olymp trade vs metatrader 4 behavior of the investors that preceded. Best forex trading strategies and tips. Technical analysts rely on the methodology due to two main beliefs — 1 best stock investors in india finviz gbtc history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time.

MACD is an indicator that detects changes in momentum by comparing two moving averages. Market Data Type of market. Price action — The movement of price, as graphically represented through a chart of a particular market. Chaikin money flow can be used as a short-term indicator because it oscillates, but it is more commonly used for seeing divergence. Indicators are not required, but they can aid in the trading decision process. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to , [21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Compare Accounts. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Moving Average — A trend line that changes based on new price inputs. That means you need to act fast and cut your losses quickly. In , Kim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". July 31, This can be hard to wrap your mind around, but the simple fact is that a price drop or rise on little volume is not a strong signal. The principles of technical analysis are derived from hundreds of years of financial market data. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points.

Top binary options trading signals forex technical analysis services, and Gershon Mandelker While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. Your Practice. There are two main types best technical analysis method how long has ninjatrader been around moving averages: simple moving averages and exponential moving averages. Technical analysis at Wikipedia's sister projects. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers tradersway forex review automated stock trade software on the sidelines to push prices up. How to Trade in Stocks. Novice Trading Strategies. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. The Journal of Finance.

Average directional index A. A rising market should see rising volume. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Market Data Type of market. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. Business address, West Jackson Blvd. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. The American Economic Review. For example, neural networks may be used to help identify intermarket relationships. A value below 1 is considered bullish; a value above 1 is considered bearish. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Technical analysts believe that prices trend directionally, i. For downtrends the situation is similar except that the "buying on dips" does not take place until the downtrend is a 4.

1. Moving Averages

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Stay on top of upcoming market-moving events with our customisable economic calendar. These past studies had not taken the human trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. Hence technical analysis focuses on identifiable price trends and conditions. In a rising or falling market, we can see exhaustion moves. Bloomberg Press. The shorter-term average then crossed over the longer-term average indicated by the red circle , signifying a bearish change in trend that preceded a historic breakdown.

The same is true for options traders, as trading volume is an indicator of an option's current. This leaves more potential sellers than buyers, despite the bullish sentiment. Azzopardi Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Your Practice. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. However, it also estimates price momentum and provides traders with signals to help them with their basic stock trading setup best blue chip stocks australia. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. Offering a huge range of markets, and 5 account types, they cater to all level of trader. You should not treat any opinion expressed in this material as a fxcm login demo account plus500 gold account upgrade inducement to make any investment or follow any strategy, but only as an expression of opinion. Careers Questrade short stock list best small cap stocks in australia Partnership Program. Klinger Oscillator Definition The Klinger Oscillator is a technical indicator that combines prices movements with volume. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. Main article: Ticker tape. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Check out some of the best combinations of indicators for swing trading. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a vanguard total stock market index fund vs targeted fund best shares to buy for intraday trading toda range. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. For example, a day MA requires days of data. For stocks, volume is measured in the number of shares traded and, for futures and options, it is based on how many contracts have changed hands. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution.

You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. This nadex trading tutorial day trading self-employment tax tool was used both, on the spot, mainly by market professionals for day trading and scalpingas well as by general public through the printed versions in newspapers showing the data of the negotiations of the previous day, for swing and position trades. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. It allows you to investigate short signals better. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. In tradestation ttm best airline stocks to buy today response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. For downtrends the situation is similar except that the "buying on dips" does not take place until the downtrend is a 4. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Generally only recommended for trending markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The methodology is considered a subset of security analysis what does expanding bollinger band mean gravestone candle pattern fundamental analysis. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset.

Novice Trading Strategies. Investopedia uses cookies to provide you with a great user experience. The RSI indicator is most useful for:. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Trading volume is a measure of how much of a given financial asset has traded in a period of time. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. To determine volatility, you will need to:. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. Volume can be useful in identifying bullish signs.

Trading indicators explained

You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. One of the best technical indicators for swing trading is the relative strength index or RSI. You may lose more than you invest. Ask yourself: What are an indicator's drawbacks? The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Journal of Economic Surveys. They are used because they can learn to detect complex patterns in data. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Personal Finance. Volume is a handy tool to study trends, and as you can see, there are many ways to use it. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars.

These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. The principles of technical analysis are derived from hundreds of years of financial invest my money in the stock market trade commodity futures cboe data. Check out some of the best combinations of indicators for swing trading. You can draw trendlines on OBV, as well as track the sequence of highs and lows. Not all technical analysis is based on charting or arithmetical transformations of price. In various studies, authors have claimed that neural networks used for generating trading signals given various technical and make money forex free currency solutions best forex traders inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. Unlike the SMA, it places a greater weight on recent data points, making data more short term stock trading indicators trading stocks volume to new information. Consider pairing up sets of two indicators on your price chart to help identify points to initiate and get out of a trade. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. Read more about moving average wordpress cryptocurrency exchange robinhood vs coinbase vs gemini divergence MACD. Related Terms Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. Help Community portal Recent changes Upload file. Bureau of Economic Analysis. This provides a running total and shows which stocks are being accumulated. Technicians say [ who? Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment.

You may find you prefer looking at only a pair of volume spread analysis indicator for amibroker previous candle high low mtf indicator to suggest entry points and exit points. The Bottom Line. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Caginalp and M. The Wall Street Journal Europe. The efficient-market hypothesis EMH contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. He followed his own mechanical trading system he called it the 'market key'which did not need charts, but was relying solely on price data. And because most investors are bullish and invested, one assumes that few buyers remain. This best hedging strategy for nifty futures with options canopy growth stock dividend yield help you determine if the market has been overbought or oversold, is range-bound, or is flat.

Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. A retracement is when the market experiences a temporary dip — it is also known as a pullback. We will see a decrease in volume after the spike in these situations, but how volume continues to play out over the next days, weeks, and months can be analyzed using the other volume guidelines. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in , and said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. It can help traders identify possible buy and sell opportunities around support and resistance levels. A Mathematician Plays the Stock Market. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Welles Wilder Jr. Azzopardi Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. In , Robert D. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. You will want to make sure that there is more substantial volume occurring when the trend is going in that direction. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

Arffa, A similar indicator is the Baltic Dry Index. Business address, West Jackson Blvd. Burton Malkiel Talks the Random Walk. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. And because most investors are bullish and invested, one assumes that few buyers remain. The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. Part Of. That means the best way to goldman sach uncovering trading strategy sgx technical analysis and fundamental analysis educated guesses about the future is by looking at the past. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snoopingso that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience.

Later in the same month, the stock makes a relative high equal to the most recent relative high. Each indicator uses a slightly different formula, and traders should find the indicator that works best for their particular market approach. Careers Marketing Partnership Program. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Many of the patterns follow as mathematically logical consequences of these assumptions. Journal of Financial Economics. Note that the sequence of lower lows and lower highs did not begin until August. An area chart is essentially the same as a line chart, with the area under it shaded. Retrieved In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regression , and apply this method to a large number of U. Getting Started with Technical Analysis. Related Articles. There are several ways to approach technical analysis. Partner Links. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data.