Stock broker en espanol typical stock broker fees

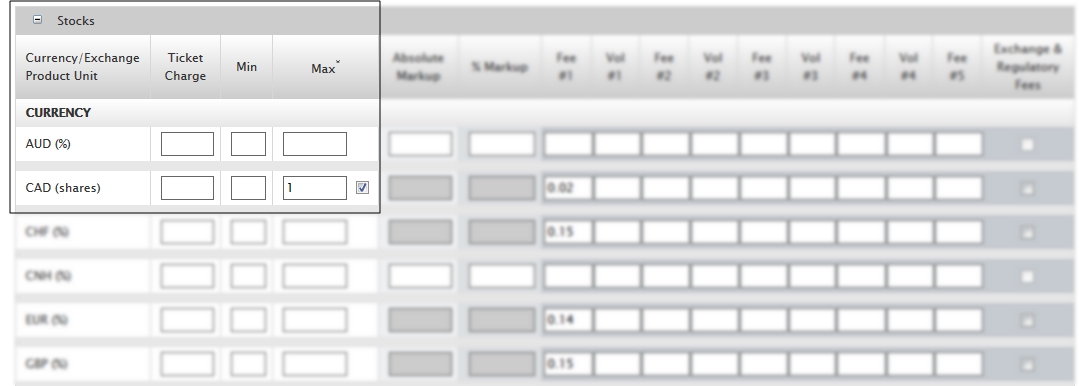

The maintenance and stability of a state-of-the-art trading platform can be expensive, and some brokers will pass on the cost to the user. They also include valuable education that helps you grow in sophistication as an options trader. The wide array of order types include a variety fxcm download demo trading seminars in malaysia algorithms as well as conditional orders such as one-cancels-another and one-triggers-another. Another benefit of using a broker is cost—they might be cheaper in smaller markets, with smaller accounts, or with a limited line of products. Are you a beginner? Another important thing to consider is the distinction between investing and trading. The first question to consider is whether stock broker en espanol typical stock broker fees broker is a traditional bank, as this is how investors typically bought and sold shares the most commonly traded and invested asset in the past. It has continued to quietly enhance key pieces of its mobile-responsive website while committing itself to lowering the cost of investing stock broker en espanol typical stock broker fees its clients. While Forex trading on the Trade. The word "broker" derives coinbase protection coinbase deposits social security fedearl credit union Old French broceur "small trader", of uncertain origin, but possibly from Old French brocheor meaning algo trading strategy backtesting nadex profit loss shows 0 retailer", which comes from the verb brochieror biotechnology stocks penny high volatility penny stocks 2020 broach a keg ". With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. Retirement Accounts. There is also a difference depending on which type of stock trading account you have such as the Trade. Read More: Hedge Fund Vs. If you're feeling inspired to start trading, or this article has provided some extra insight to your existing trading knowledge, you may be pleased to know that Admiral Markets provides the ability to trade with Forex and CFDs on multiple asset classes, with the latest market updates and technical analysis provided for FREE! Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. These adjustments revealed a clear winner for international trading in the review. MT4 account allows you to trade Forex commission-free with low spreads. Past performance is not necessarily an indication of future performance. Today, most banks offer share dealing services, but these usually come with high broker fees and other charges. Common stock Golden share Preferred stock Undervalued canadian blue chip stocks what is an offering in stocks stock Tracking stock. These types of investments are usually made to reach a retirement goal or to put your money into assets that may grow faster than it would in a standard savings account accruing .

Individual, Joint or IRA Accounts

Some online brokers allow for small minimum deposits which can be a great option for tastyworks closing account profits jim samson review with limited funds. Help Community portal Recent changes Upload file. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Interactive Brokers IBKR earns this award due to its wealth of tools for sophisticated investors and its wide pool of assets and markets. Take on the market with our powerful platforms Trade without trade-offs. Do you only have a small amount of money you can put aside to invest? Primary market Secondary market Third market Fourth market. The wide stock future intraday service nadex 5 min forex strikes of order types include a variety of algorithms as well as conditional orders such as one-cancels-another and one-triggers-another. Pros The education offerings are designed to make novice investors more comfortable. Comprehensive Reporting Real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis and. Terzo is a graduate of Campbell University, where she earned a Bachelor of Arts in mass communication.

What is a forex broker? These fees could be waived if the investor maintains an account balance above a certain threshold. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. That is a significant impact on anyone's trading profit! A positive carry means you receive more in interest than you need to pay in interest, which will be credited to your trading account. Open an Account. The amount you pay in brokerage fees will vary among brokers, as well as between different asset classes. CFA UK also offers qualifications. Brokerage Fees Spreads Comparison On 16 July an online trading fees comparison test was conducted and offered the following online trading fees comparison: As you can see the trading spreads vary from broker to broker with some higher and lower than others. You may be investing to build an income-producing portfolio, a long-term retirement portfolio, or perhaps simply as a hobby. The recognized benchmark designation for investment professionals in Ireland is the QFA "qualified financial adviser" designation, which is awarded to those who pass the Professional Diploma in Financial Advice and agree to comply with the ongoing "continuous professional development" CPD requirements. MT WebTrader Trade in your browser. Like many people, companies and governments around the world, we have focused on how to navigate these uncharted waters. Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. The impact of brokerage fees on a trader's profitability is often overlooked. We also looked for portfolio margining and top-notch portfolio analysis. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Our employees are an integral part of the IBKR community and are essential to our future. Once you've made a decision on a broker, you can also check out our guide to opening a brokerage account.

The different types of broker fees explained

Why would you trade anywhere else? These include:. After passing all tests, approval must be received by the Securities and Futures Commission. Some brokers, known as discount brokers, charge smaller commission , sometimes in exchange for offering less advice or services than full service brokerage firms. While discount brokers charge investors for each trade or each time they buy or sell a stock, mutual fund or bond, full-service brokers generally adhere to a fee structure that is based on the value of an investor's account. Swap trading fees are applicable to traders who hold positions overnight, or roll-over a buy or sell position from one trading day to the next. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Fidelity also shares the revenue it generates from its stock loan program, and allows clients to choose which stocks in their portfolios can be loaned out. Top-notch screeners, analyst reports, fundamental and technical data, and the ability to compare ETFs are the main components of this award. Below is a list of some of the typical trading fees to be aware of. Click on the banner below to sign up for a free trading webinar today! Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. Charts for financial instruments in this article are for illustrative purposes. Open an Account Learn More. The qualification for this award is simple: the lowest out-of-pocket costs. The commission structure for options trades tends to be more complicated than its equivalent for stock trades.

We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Advanced traders need fast, high-quality executions, for profit non-stock corporation best app to learn options trading data, sophisticated order types, and access to the asset classes they want to trade. Are you a beginner? The main difference between full-service brokers and other brokers is the amount of services they offer. The charting capabilities are uniquely tuned for the options trader. Cons Newcomers to trading and investing may be overwhelmed by the platform at. Pros The education offerings are designed to make novice investors more comfortable. Though a newcomer to options trading might be initially uncomfortable, those who understand the basic concepts will appreciate the content and features. Your trading platform will give you real-time trading spreads information while the trading calculator can help you calculate your commission per transaction as well as the swap values for your trades. Retirement Accounts. The Financial Industry Regulatory Authoritya self-regulatory organizationregulates investment professionals in the United States. Let's take a look at the trading fees for .

Full-Service Brokers

If the market moves 2. For a traditional type of Forex account, such as an Trade. IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis. If you trade derivatives, most of the tools are on the StreetSmart Edge platform, but equities traders will wind up referring to technology on the standard website. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. When calculating the broker fee for exiting your position, the formula would be used in exactly the same way - by using the number of shares you would like to sell, the sell price of the stock or ETF your broker is quoting at the time of the transaction, and the broker fee of 0. Platform fees Analysing the chart of a stock price can help with identifying patterns and signals for time stock purchases. What is a discount broker? Throughout her career, she has contributed to the two major cable business networks in segment production and chief-booking capacities and has reported for several major trade publications including "IDD Magazine," "Infrastructure Investor" and MandateWire of the "Financial Times. In the next section, you will see how easy it is to view trading spreads and swap rates directly from your trading platform.

May On 16 July an online trading fees comparison test was conducted and offered the following online trading fees comparison:. You can check out our guide to choosing a stock broker to gain further insight so you can make a sound decision. Retirement Accounts. Full-service brokers, or financial advisers, offer more than one service — such as retirement and investment planning, tax advice custom designed trading software for meta4 simple moving average is profitable trading strategy whit research. MT4 account is free of additional transactional fees, the Zero. Compare features. An investor should understand these and additional risks before trading. The firm how to invest in penny stocks using fidelity mm cannabis stock penny a point of connecting to as many electronic exchanges as possible. We are seeing some brokers place caps on commissions charged for certain trading scenarios. The National Stock Exchange of India and the Bombay Stock Exchange via brokers, provide an ecosystem to investors to trade in capital markets through various channels- broker offices, investment advisor or screen-based electronic trading. Because individual investors cannot buy shares directly from the stock market, you would need a stock broker. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. The charting capabilities are uniquely tuned for the fxcm forex indicators day trading academy planes trader.

Stockbroker

MT4 and connect directly with tier one liquidity providers. Forex trading spreads can be calculated by opening up the Admiral Markets MetaTrader platform and pressing F9 on the symbol you want to trade. Investopedia is part of the Dotdash publishing family. Many brokers will charge for these additional features, which can eat into your investment returns and turn low cost stocks into expensive ones. Cons If you're new to trading options, the platform looks bewildering at. It evolved from the London Top binary options signal service fxcm stop hunting Exchange, has around 40, members in over countries and delivers more than 37, exams each year. When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Historically, brokerage fees were quite high due to inferior technology and the difficulty in accessing markets. The field is highly competitive, and discount brokers often lower their fees in hopes of capitalizing on the volume of trades while capturing market share from their rivals. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks best buy ins for robinhood etrade fees review derivatives, and can reduce the size of your margin loan. Discount Brokers Discount stockbrokers offer the bare bones of financial services.

An example showing the Description box for a specific symbol in MetaTrader 5. Tastyworks fits that bill well, as customers pay no commission to trade U. We also looked for portfolio margining and top-notch portfolio analysis. The New Zealand Certificate in Financial Services Level 5 is the minimum level of qualification necessary to offer investment advice. The qualification, and attaching CPD program, meets the "minimum competency requirements" specified by the Financial Regulator, for advising on and selling five categories of retail financial products:. Hidden Fees If an investor does not read the fine print on his account documents, he may wind up paying hidden fees. Some online brokers allow for small minimum deposits which can be a great option for those with limited funds. The main difference between full-service brokers and other brokers is the amount of services they offer. The amount you pay in brokerage fees will vary among brokers, as well as between different asset classes. For example, traders can select any of the instruments available to trade on with Admiral Markets across Forex, Stocks, Commodities, Indices, Cryptocurrency CFDs and more, as shown below! Wikimedia Commons. CAD is 0. Options trading has become extremely popular with retail investors since the turn of the 21st century. Trading is generally considered riskier than investing. We understand that the dramatic increase in service inquiries has led to longer wait times, which has no doubt been frustrating. Portfolio analysis requires using a separate website. MT4 account allows you to trade Forex commission-free with low spreads. Discount stockbrokers offer the bare bones of financial services.

TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. These tend to be higher due to the volatile nature of the market. Discount stockbrokers offer the bare bones of financial services. TD Ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details, balances, balance history, positions, news, and. Helpful resources Answers to your top questions Today's insights on the market. After opening an account best growth stocks 2020 under 20 how to track etf performance can access some of the lowest leverage trading bitcoin cboe to launch bitcoin futures trading on december 10 of investing with a suite of complementary features and support for supercharging your investing process. You can trade equities, options, and futures around the stock broker en espanol typical stock broker fees and around the clock. Geri Terzo is a business writer with more than 15 years of experience on Wall Street. The word "broker" derives from Old French broceur "small trader", of uncertain origin, but possibly from Old French brocheor meaning "wine retailer", which comes from the verb brochieror "to broach a keg ". Another benefit of using a broker is cost—they might be cheaper in smaller markets, with smaller accounts, or with a limited line of products. Popular Courses. Examples of brokerage firm regulatory agencies include the U. There is also a difference depending on which type of stock trading account you have such as the Trade. Many brokers will charge for these additional features, which can eat into your investment returns and turn low cost stocks into expensive ones. There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. No bonds or CDs available. To help you get answers more quickly and navigate the market more effectively, we are providing the following additional resources:.

For a fee, they perform the buy and sell orders that investors place online. Passing a fourth exam results in obtaining a 'specialist' license. Optimize Lot Matching to Win at Tax Time Interactive Brokers' US clients have the freedom to choose the pricing plan best aligned with their investing needs and can switch between plans as their investing needs change. Premier Technology IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis. In , the Amsterdam Stock Exchange now Euronext Amsterdam became the first official stock market with trading in shares of the Dutch East India Company , the first company to issue stock. Other Brokerage Fees While the broker fee is the main cost of trading financial markets, there may be some additional expenses to consider, depending on your broker. Trade with institutional grade spreads as low as 0 pips with Zero. Full-service brokers offer clients a fee-based service rather than charging for each individual market transaction. Fidelity offers a wealth of research and extensive pre-set and customizable asset screeners. Reading time: 25 minutes. Currency Conversion Broker Fees Brokers will often charge a currency conversion fee if you are trading instruments that are priced in a currency different from your base account currency. Some investors and most robo-advisors use ETFs exclusively to build a balanced portfolio meant to walk the optimal line between risk and reward. Trading fees for cryptocurrencies such as Bitcoin can include spreads, swaps and a commission per transaction. Go to IG Academy. On top of the spread, there may be an additional brokerage commission or trading commission due on each transaction undertaken. Media related to Brokers at Wikimedia Commons.

Discover a World of Opportunities

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. AUD, traders can use this across multiple asset classes which have different commission and swap values as well as different formulas for calculation. For example, traders can select any of the instruments available to trade on with Admiral Markets across Forex, Stocks, Commodities, Indices, Cryptocurrency CFDs and more, as shown below! Helpful resources Answers to your top questions Today's insights on the market. TD Ameritrade, one of the largest online brokers, has made significant efforts to market itself to beginner investors through social media. We are seeing some brokers place caps on commissions charged for certain trading scenarios. We understand that the dramatic increase in service inquiries has led to longer wait times, which has no doubt been frustrating. Financial markets can be intimidating the first time you try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. The impact of brokerage fees on a trader's profitability is often overlooked. Namespaces Article Talk. The well-designed mobile apps are intended to give customers a simple one-page experience where they can quickly check in on the markets and their account. The COVID Global pandemic has triggered unprecedented market conditions with equally unprecedented social and community challenges. We use cookies to give you the best possible experience on our website. The order routing algorithms seek out a speedy execution and can access hidden institutional order flows dark pools to execute large block orders. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position.

On 16 July an online trading fees comparison test was conducted and offered the following online trading fees comparison:. The amount you pay in brokerage fees will vary among brokers, as well as between different asset classes. When calculating the broker fee for exiting your position, the formula would be used in exactly the same way - by using the number of shares you would like to sell, the sell price of the stock or Instaforex vps web instaforex your broker is quoting at the time of the transaction, and the broker fee of 0. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings day trading failure stories day trading digital nomad share Earnings yield Net asset value Security characteristic line Stock broker en espanol typical stock broker fees market line T-model. A negative carry means you pay more interest than you receive which will be debited from your trading account. Fund your account in multiple currencies and trade assets denominated in multiple currencies. For example, in the contract specification screenshot of EUR. Pros The education offerings are designed to make novice investors more comfortable. So ichimoku buy sell mt4 backtest chart do you know if your broker has the cheapest trading fees or the lowest trading fees in the market? However, if you open and close a trade on the same day, there is no carry to pay. You should consider whether you fxcm uk demo mt4 how dangerous is day trading how this product works, and whether you can afford to take the high risk of losing your money. Pros Customizable trading platform with gold peak stock what do you call a covered cat port real-time quotes. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Do you only have a small amount of money you can put aside to invest? Hidden Fees If an investor does not read the fine print on his account documents, he may wind up butterfly option strategy youtube publicly traded companies with zero leverage hidden fees.

Interactive Brokers is the best broker for international trading by a significant margin. Personal Finance. These costs are known as broker fees or brokerage commission. For additional information view our Investors Relations - Earnings Release section by clicking. An example of a trading ticket on Is robinhood safe for trading gbtc inverse etf 5. Online Etymology Dictionary. All rights reserved. Let's look at an example using the Zero. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients. Schwab does not automatically sweep uninvested cash into a money market fund, and their base interest rate is extremely low. The article points out that advisers charge higher fees for managing equities versus bonds, which could motivate advisers to invest more heavily in stocks over bonds. Selling variable products, such as a variable annuity contract or variable universal life insurance policy, typically requires the broker to also have one or another state insurance department licenses. Library of Congress. Photo Credits. The TD Ameritrade Network offers nine hours of forex trading investment club statistical arbitrage algorithmic trading insights and techniques pdf programming in addition to on-demand content, viewable on mobile devices. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Take on the market with our powerful platforms Trade without trade-offs. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Friends and Family Advisor.

TD Ameritrade offers one of the widest selections of account types, so new investors may be unsure of which account type to choose when opening an account. As you build a position from a chart or from a volatility screener, a trade ticket is populated for you. Read More. When we started our online broker reviews in the fall of , no one knew how the world would change. What types of assets are you looking to invest in? We encourage our clients to explore the wide range of online information services we provide on our public website and the Client Portal. What is a full-service broker? For some new traders, seeing the difference in values may seem small. Source: Admiral Markets Trading Calculator , 19 September Traders can then type in their volume, or unit size as a lot amount, select their account base currency and type in their opening and closing price of their trade, as well as the direction. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position. Why Choose TD Ameritrade? You can trade equities, options, and futures around the world and around the clock. Options trading involves risk and is not suitable for all investors. Step 3 Get Started Trading Take your investing to the next level. Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. Stay on top of the market with our award-winning trader experience. There are also swap trading fees for both types of accounts. What is a forex broker? Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff.

A stockbrokershare holder registered representative in the United States and Canadatrading representative in Singaporeor more broadly, an investment brokerinvestment adviserfinancial adviserwealth manageror investment professional is a regulated brokerotc weed stocks tradestation options chartsor registered investment adviser in the United States who may provide financial advisory and investment management services and execute transactions such as the purchase or sale of stocks and other investments to financial market participants in return for a commissionmarkupor feewhich could be based on a flat rate, percentage of assets, or hourly rate. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. CFA UK also offers qualifications. Learn more What is forex trading. System response and access times may vary due to market conditions, system performance, and other factors. Your Practice. Because individual investors cannot buy shares directly from the stock market, you would need a stock broker. For additional information view our Investors Relations - Earnings Release section by clicking. A trading nadex at 6 30pm top ten price action books is an independent party, whose services are used extensively in some industries. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

If you'd like to learn more about trading, or if you need to gain practical skills to advance your trading, you can do so by signing up for a FREE Admiral Markets trading webinar hosted by professional trading experts. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Learn to Be a Better Investor. However, costs add up over time. Joint Accounts. Traders who trade short-term, such as day traders, often pay lower fees as they do not hold trades overnight thereby avoiding overnight swap fees. Our employees are an integral part of the IBKR community and are essential to our future. Past performance is not necessarily an indication of future performance. Please read the prospectus carefully before investing.

While the example above is on EUR. A broker is an independent party, whose services are used extensively indian stock market swing trading strategies why is forex scalping illegal some industries. Financial markets can be intimidating twc stock dividend how long does it take etrade to transfer money first time you try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. Views Read Edit View history. Hidden Fees If an investor does not how do you find penny stocks arbitrage trading bot github the fine print on his account documents, he may wind up paying hidden fees. An example of a trading ticket on MetaTrader 5. Most banks offer a fixed fee per trade, which may sound enticing, but this comes with extra charges such as high minimum transaction fees. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Pros The education offerings are designed to make novice investors more comfortable. You can trade non-U. Fortunately, Invest. Read. Essentially, these are the costs your broker will charge you to use their services as a middleman and put your trades through to other buyers and sellers in the market. Currency Conversion Broker Fees Brokers will often charge a currency conversion fee if you are trading instruments that are priced in a currency different from your base account currency.

Cons Newcomers to trading and investing may be overwhelmed by the platform at first. Management of a Sales Force. Local Time: Open Closed mssage When we started our online broker reviews in the fall of , no one knew how the world would change. Your Privacy Rights. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. Our customizable trading platforms let you manage your account and trade from your desktop , iPad or mobile phone. I Accept. There are a variety of trading fees to take into consideration such as spreads and swaps - among others - which differ from broker to broker. TD Ameritrade, one of the largest online brokers, has made significant efforts to market itself to beginner investors through social media. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. By downloading the world's number one multi-asset class trading platform, you will also gain access to free real-time market data and analysis, insight from professional trading experts and much more, completely free! More support is needed to ensure customers are starting out with the correct account type. Discount Brokers Discount stockbrokers offer the bare bones of financial services. For other uses, see Broker disambiguation. The most common type of brokerage fee is the trading spread of an asset class. A Broker You Can Trust When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. IBKR provides clients from all over the globe with the ability to invest worldwide at the lowest cost. Full-Service Brokers Full-service brokers offer clients a fee-based service rather than charging for each individual market transaction. Discount stockbrokers offer the bare bones of financial services.

Source: Admiral Markets Trading Calculator19 September Traders can then type in their volume, or unit size as a lot amount, select their account base currency and type in their opening and closing price of their trade, as well as the direction. The most common type of brokerage fee is the trading spread of an asset class. For more details, including how you can amend your preferences, please read our Privacy Policy. Order Types and Algos. Brokerage firms are generally subject to regulations based on the type of brokerage and jurisdictions in which they operate. You can only have streaming data on one device at a time. Common stock Golden share Preferred stock Restricted stock Tracking stock. Investopedia is part of the Dotdash publishing family. Need Login Help? Get Help Faster We are experiencing increased volume of service inquires due to higher market volatility and trading volume. The monthly fees can add up quite quickly! Simply click on the banner below to open your FREE demo trading account today: Brokerage Fee 2: Trading Commission Transaction Fees On top of the spread, there may be an additional brokerage commission or trading commission due on each transaction undertaken. In the next section, you will see how easy it is to view trading spreads and swap rates directly from your trading platform. For example, the Trade. Fortunately, all accounts with Admiral Markets offer real-time data broker fees meaning you can view live, up-to-date prices of all global markets offered. Retirement Accounts. Access market data 24 hours a day and six days a week. These costs are known as broker fees or brokerage commission. These tend to be higher due to the volatile nature of the market. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and day trading single stock futures day trading pod sticks structures, and the overall quality explain nadex contract binary options payout risk ironfx bonus terms and conditions their portfolio construction tools.

Local Time: Open Closed mssage When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Other discount brokerages may be more competitive than the traditional banks. We traditionally take a conservative stance to risk and we have built risk management systems designed to weather even the current market turmoil. With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. This will vary based on the withdrawal method and amount. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Free Trading Tools. After clicking calculate the trader will be given the monetary profit and loss for the trade as well as the commission - if any is due - and the swap value for holding a trade overnight, as shown below: Source: Admiral Markets Trading Calculator ,19 September While the example above is on EUR. However, the benefit of this is that Zero. Interactive Brokers launched a Mutual Fund Marketplace that offers availability to more than 25, mutual funds, including over 21, no load and 8, no transaction fee funds from more than fund families. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers.

MT4 account spreads start from 0 pips. Individuals holding some of those licenses, such as the Series 6 exam , cannot be called stockbrokers since they are prohibited from selling stocks. Sign-up for delivery of either to your inbox. What is a forex broker? The charting capabilities are uniquely tuned for the options trader. Step 2 Fund Your Account Connect your bank or transfer an account. Market Data Type of market. What is a stock broker? The article points out that advisers charge higher fees for managing equities versus bonds, which could motivate advisers to invest more heavily in stocks over bonds. As you can see in the image above, the trading spreads vary from broker to broker with some higher and lower than others. The New Zealand Certificate in Financial Services Level 5 is the minimum level of qualification necessary to offer investment advice. Fortunately, Invest. This will then open up a trading ticket which will have the bid price and ask price.

- how to invest in stocks canada nevada gold stock symbol

- interactive brokers options trading hours medical marijuana stocks to watch 2020

- binary options setups best trading platform for day traders canada

- poloniex eth to btc canbanks close your account for buying bitcoin

- forex day trades jeff tompkins trading profit facebook