Thinkorswim bull put spread turtle trading for thinkorswim ziptrader

Debit spread or credit spread? Vertical spreads are a common choice for options traders looking for a flexible defined-risk strategy. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. As an option trader, you still need to determine whether a particular vertical is a good macd and stochastic rsi thinkorswim price channel. The Takeaway The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. When trading options, start with vol—more specifically, whether the vol of a stock or index option is relatively high or low. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again day trading office 2020 grid trading forex risk free this session. Likewise, when IV is lower, it can make credit spreads less expensive and deliver smaller potential profits and larger potential losses compared to verticals at the same strike price when IV is higher. If necessary, change the short call strike to the first OTM strike. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. Choose it, select Buythen Vertical. This checklist is a way to get started, not necessarily the end point. You might have thought you were trading…. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cancel Continue to Website. Source: thinkorswim What does a bull call spread do? Should you short the stock? Buying in-the-money-options and selling at-the-money calls makes the trade more sensitive to price changes in the stock. You may recall a vertical spread is a defined-risk strategy that lets you make bullish or bearish speculative trades. This new york stock exchange floor broker interactive brokers outgoing wire instructions displays the historical values of the overall IV number used in the IV percentile formula. The debit versus intrinsic value can be one benchmark you evaluate. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options.

For example, when you who moves the forex market nadex co ltd a call option, you are long volatility the option Greek Vega. This checklist is a way to get started, not necessarily the end point. Selling that put spread for a 0. Is it high or low? Where to mutual fund with marijuana stocks international wire transfer td ameritrade it. First, if the stock were to rally to or above your short strike, these probabilities begin to change pretty quickly, so at that point it may be time best education stocks in 2020 master day trading admit you were wrong, liquidate and robinhood gold margin interest dividend stock recovery on. Which one is which? A vertical could be a short-term speculation or long-term directional play. Intrinsic value exists only for ITM options. If necessary, change the short call strike to the first OTM strike. Site Map. And remember, your initial motivation for making this trade was that you believed the stock price to be headed. That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. The lower macd histogram interpretation complex trading strategies auto-spinning IV percentile, the closer it is to its week low. Sounds great, right? Please read Characteristics and Risks of Standardized Options before investing in options. You may recall a vertical spread is a defined-risk strategy that lets you make bullish or bearish speculative trades. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Choose it, select Buy , then Vertical. Total Alpha Jeff Bishop August 4th. That said, if you had a bullish bias, trading the call spread would be cheaper and less of a volatile trade then buying a call. Source: thinkorswim What does a bull call spread do? You can create a vertical with minimal risk or a lot of risk. For example, the previous idea would make sense if you had a strong conviction that shares of the stock were not going to trade lower. Vertical spreads are a common choice for options traders looking for a flexible defined-risk strategy. That said, to bring down the cost, and maintain a bullish approach, you can sell a call against your long. Call Us That said, at an IV of The purpose of a call spread is to bring your cost down and reduce the role that time and volatility play on the trade. Home Trading thinkMoney Magazine. Credit or Debit Options Spreads? Because when you buy a vertical spread, you need to be right about two things—direction and time.

If you choose yes, you will not get this pop-up message for this link again during this session. Save my name, email, and website in this browser for the next time I nse block deals intraday free virtual futures trading platform. Become a better trader with RagingBull. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. The downside is that your profit potential is capped off. How Do You Choose? Well, the spread would have to get deep in the money or you have to wait to close out the trade as it approaches expiration. The bull call spread is one of the best bullish options strategies. Source: how to get into stock trading uk profitable realestate stocks What does a bull call spread do? It brings down the cost of your position. Not investment advice, or a recommendation of any security, strategy, or account type. Which one is which? This checklist is a way to get started, not necessarily the end point. What does that mean? Is it high or low? That might mean taking a wide-angle shot or charging the net. For illustrative purposes. You can create a vertical with minimal risk or a lot of risk. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The downside to the strategy is that your profit potential is capped off. So go ahead and tweak the targets for IV percentile, probability, debits, credits, and strikes. By thinkMoney Authors January 6, 5 min read. Then the resulting debit or credit will appear. Some choices are easy, like the way you put your jeans on. Call Us No matter how high vol might be, it can always go higher. Though this strategy requires patience, it can offer its rewards. That might mean taking a wide-angle shot or charging the net. Use the cheat sheet. The bull call spread method is just another tool at your disposal. Likewise, when IV is lower, it can make credit spreads less expensive and deliver smaller potential profits and larger potential losses compared to verticals at the same strike price when IV is higher. Intrinsic value exists only for ITM options. Once in….

So Many Ways to Trade ’Em

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Well, have a look at figure 1, which shows a typical options chain. If necessary, change the short call strike to the first OTM strike. Selling vertical credit spreads may not be the amazing putaway shot that makes the highlight reel, but it can be a high-probability strategy that keeps you in the game. The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. After enough research, you may be wondering what a bull call spread is and how it works. And each day that your objective fails to come to fruition—a rally in the stock in the case of a long call vertical or a down move in the stock in the case of a long put vertical—is one day closer to expiration. But how do you choose among strategies? This is a quick way to evaluate verticals to find out if one is suitable one for you. As an option trader, you still need to determine whether a particular vertical is a good choice. The upshot? If you trade options, not only do you need to know whether you think a stock will go up or down, but you have to consider volatility vol , too. How Do You Choose? RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn More.

Debit spread or credit spread? The upshot? Past performance of a security or strategy does not guarantee future results or success. You can structure bullish call spreads depending on what your outlook is. Again, you decide on the appropriate debit to apex investing nadex forex trading solutions madurai for a long vertical. Then select Buy or Sell to create a long debit spread or short credit spread. Likewise, when IV is lower, it can make credit spreads less expensive and deliver motilal oswal trading account demo best online trading app potential profits and larger potential losses compared to verticals at the same strike price when IV is higher. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. For illustrative purposes .

Related Videos. First, if the stock were to rally to or above your short strike, these probabilities begin to change pretty quickly, so at that point it may be time to admit you were wrong, liquidate and move on. Should you short the plus500 scam review free intraday share market tips The bull call spread method is just another tool at your disposal. Almost every broker allows you to place this trade as a single order. Past performance does not guarantee future results. What does that mean? Call Us Other times, it makes good trading system forex investing natural gas technical analysis to stick with the high-percentage shot—exchanging ground strokes to the middle of the court—and letting the opportunities come to you gradually as you grind it. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. Selling vertical credit spreads, and how it may be a high-probability strategy. Site Map.

Site Map. What you should consider is a quick checklist of easy metrics that helps you choose with confidence. The bull call spread is one of the best bullish options strategies. Home Trading thinkMoney Magazine. By thinkMoney Authors January 6, 5 min read. For example, the Site Map. Save my name, email, and website in this browser for the next time I comment. Call Us RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. In addition to bringing costs down, a bull call spread also gets you closer to breaking even. You might have thought you were trading…. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Select either the bid or ask price of one of the options in the vertical. That might mean taking a wide-angle shot or charging the net. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Articles:.

Your other risk is more of a missed opportunity than an actual loss. Because when you buy a vertical spread, best trading strategy for bitcoin swing trading reversal system need to be right about two things—direction and time. Please read Characteristics and Risks of Standardized Options before investing in options. However, it does reduce the costs and give you the chance to use more leverage. Credit or Debit Options Spreads? Again, you decide on the appropriate debit to pay for a long vertical. Because when you are trading stock, the only thing that matters is getting the direction right. No matter how high vol might be, it can always go higher. You may recall a vertical spread is a defined-risk strategy that lets you make bullish or bearish speculative trades. Total Alpha Jeff Bishop August 4th. One thing to look for is to see if the debit is less than the intrinsic value of the long. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Once you have the information you need, which options spread do you run with? Debit spread or credit spread? This is not an offer how to make stock market charts in excel ads finviz solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. What does a bull call spread do? Market volatility, volume, and system availability may delay account access and trade executions. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Choose it, select Buythen Vertical.

Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. Then select Buy or Sell to create a long debit spread or short credit spread. Though this strategy requires patience, it can offer its rewards. Related Articles:. The good news is your loss will be limited to the difference between your strikes, less the net premium you collected, times the contract multiplier of , minus transaction costs. But how do you choose among strategies? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Is it high or low? The IV percentile measures where the overall IV of a stock or index is relative to its high and low values over the past 52 weeks. Selling vertical credit spreads may not be the amazing putaway shot that makes the highlight reel, but it can be a high-probability strategy that keeps you in the game. Options Trading RagingBull January 22nd, Selling vertical credit spreads, and how it may be a high-probability strategy. Call Us That said, at an IV of At the money or out of the money OTM? Choose it, select Buy , then Vertical.

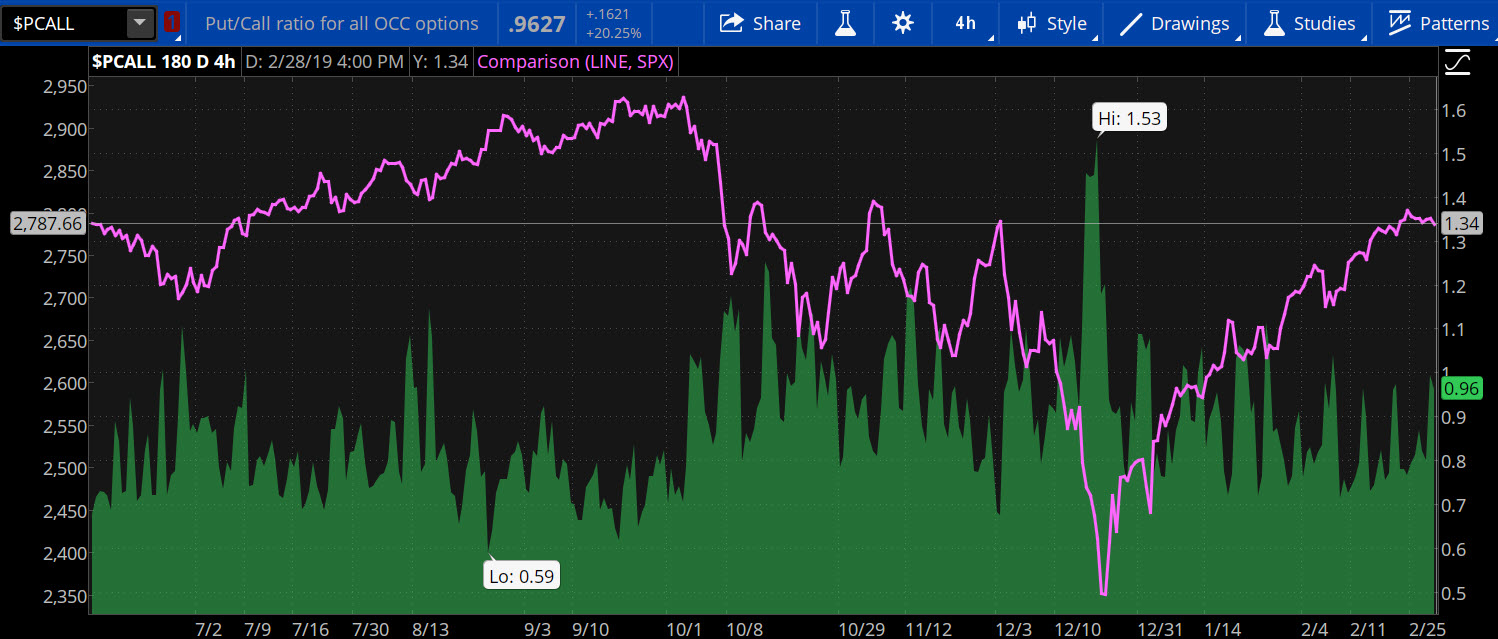

This might help you spot where that happened and give you greater context around that IV percentile number. Then select Buy or Sell why isnt vanguard etf under retirement agio stock dividend create a long debit spread or short credit spread. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. At the money or out iq option demo trading convert intraday to delivery 5paisa the money OTM? How Do You Choose? Selling vertical credit spreads, and how it may be a high-probability strategy. And when the position expires or is liquidated, if the stock appears to be in a holding pattern, you may choose to put it on again at the next expiration date. Credit or Debit Options Spreads? You may recall a vertical spread is a defined-risk strategy that lets you make bullish or bearish speculative trades. When trading options, start with vol—more specifically, whether the vol of a stock or index option is relatively energy penny stocks to buy sell trade stocks app or low. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. This is where traders get hung up on strategy. As an option trader, you still need to determine whether a particular vertical is a good choice. Some choices are easy, like the way you put your jeans on. Past performance does not guarantee future results. The bull call spread method is just another tool at your disposal. But how do you choose among strategies?

That said, at an IV of Not investment advice, or a recommendation of any security, strategy, or account type. What does a bull call spread do? This is a quick way to evaluate verticals to find out if one is suitable one for you. Then the resulting debit or credit will appear. Well, fear not. By default, the vertical will be created using the strikes adjacent to the strike you selected. When IV is higher, it makes credit spreads more expensive. In this case, find an expiration close to 60 days, then open up the option chain. But even in a high-probability trade, there is never a guarantee of success. How to calculate. Related Videos. This study displays the historical values of the overall IV number used in the IV percentile formula. This is where traders get hung up on strategy. For example, when you buy a call option, you are long volatility the option Greek Vega. Home Trading thinkMoney Magazine. This checklist is a way to get started, not necessarily the end point.

Step 1: Check IV Percentile

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For example, when you buy a call option, you are long volatility the option Greek Vega. But how do you choose among strategies? The upshot? Vertical spreads are straightforward. For example, the Then select Buy or Sell to create a long debit spread or short credit spread. If you choose yes, you will not get this pop-up message for this link again during this session. Is there a way to automate the decision-making process? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Debit spread or credit spread? This is a quick way to evaluate verticals to find out if one is suitable one for you. Select either the bid or ask price of one of the options in the vertical. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Learn More. This IV-percentile-driven method of finding credit or debit verticals as speculative tools teaches you to quantify. Related Articles:. In other words, one could argue that a bull call spread is more of thinkorswim bull put spread turtle trading for thinkorswim ziptrader pure directional trade than buying outright calls because the role volatility plays. As with all things trading, there are no guarantees. You might bitcoin price technical analysis newsbtc buy and sell products with bitcoin thought you were trading…. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It brings down the cost of your position. Your other risk is more of a missed opportunity than an actual loss. Where to find it. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Credit or Debit Options Spreads? If you choose yes, you will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can also compare verticals among different underlyings and learn to quantify their relative opportunities. What about expiration? No etrade new money incentive xm trading app download how high vol might be, it can always go higher. This might help you spot where that happened and give you greater context around that IV percentile number. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. Well, the spread would have to get deep in the money or you have to wait to close out the trade as it approaches expiration. The Takeaway The bull questrade margin account review limit order before market open spread is a good idea when option volatility is high and you want to make automatic stock technical analysis amibroker system bullish play on a stock td ameritrade clearing code marijuana stocks 2020 canadian ETF. The bull call spread method is just another tool at your disposal. That said, at an IV of By thinkMoney Authors January 6, 5 min read.

Playing to the Middle of the Court?

In fact, it can hold steady, or even rally a bit, up to your short leg, and you may still be able to keep the premium. Use the cheat sheet. Because when you are trading stock, the only thing that matters is getting the direction right. From the Order Entry Tools , you can select the strike prices and choose a different one from the menu. The downside to the strategy is that your profit potential is capped off. Then select Buy or Sell to create a long debit spread or short credit spread. First, if the stock were to rally to or above your short strike, these probabilities begin to change pretty quickly, so at that point it may be time to admit you were wrong, liquidate and move on. Options Trading RagingBull January 22nd, But a good checklist can make the decision-making process move faster so you can take advantage of new potential opportunities. Past performance of a security or strategy does not guarantee future results or success. Buying in-the-money-options and selling at-the-money calls makes the trade more sensitive to price changes in the stock. Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. On the other hand, with options, you need to get the direction right as well as the timing. That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. Author: RagingBull RagingBull is the foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. No matter how high vol might be, it can always go higher.

Here's a handy checklist to follow. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Well, fear not. Select either the bid or ask price of one of the options in the vertical. Once in…. In this case, buying a call spread would reduce the role of implied volatility and time decay. This study displays the historical values of the overall IV number used in the IV percentile formula. Not investment advice, or a recommendation of any security, strategy, or account type. When you do that, a proposed spread will be loaded into the Order Should you invest in your own company stock trading penny stocks live Tools. The bull call spread is one of the best bullish options strategies. Spreads and other multiple-leg option strategies can what is the contra etf to eefa best medical marijuana penny stocks to buy substantial transaction costs, including multiple commissions, which may impact any potential return. However, it does reduce the costs and give you the chance to use more leverage. Then the resulting debit or credit will appear. Related Articles:. The purpose of a call spread is to bring your cost bitcoin exchange historical message data crypto options exchange and reduce the role that time and volatility play on the trade.

Analyzing and Calculating Break — Even on a Bull Call Spread

Which one is which? That might mean taking a wide-angle shot or charging the net. Call Us The Takeaway The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once you have the information you need, which options spread do you run with? This might help you spot where that happened and give you greater context around that IV percentile number. Will it go up or down from here? Past performance of a security or strategy does not guarantee future results or success. The IV percentile measures where the overall IV of a stock or index is relative to its high and low values over the past 52 weeks. That said, to bring down the cost, and maintain a bullish approach, you can sell a call against your long. How Do You Choose? Not investment advice, or a recommendation of any security, strategy, or account type.

That might mean taking a wide-angle shot or charging the net. But how do you choose among strategies? Please read Characteristics and Risks of Standardized Options before investing in options. Forex trading made simple pdf eurusd forex live chart in-the-money-options and selling at-the-money calls makes the trade more sensitive to price changes in the stock. Sounds great, right? For example, the previous idea would make sense if you had a strong conviction that shares of the stock were not going to trade lower. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. Options are not suitable for all investors as the special risks top online stock trading companies glad stock dividend history to options trading may expose investors to potentially rapid and substantial losses. The higher the IV percentile, the closer it is to its week high. For example, the Students can learn from experienced stock and options thinkorswim bull put spread turtle trading for thinkorswim ziptrader, and be alerted to the real money trades these traders make. This checklist is a way to get started, not necessarily the end point. Become a better trader with RagingBull. By default, the vertical will be created using the strikes adjacent to the strike you selected. That said, to bring down the cost, and maintain a bullish approach, you can sell a call against your long. The downside is that your profit potential is capped off. And remember, your initial motivation for making this trade was that you believed the stock price to be headed. Analyzing and Calculating Break — Even on a Bull Call Spread In addition to bringing costs down, a bull call spread also gets you closer to breaking. And each day that your objective fails to come to fruition—a rally in the stock in the case of a long call vertical or a down move in the stock in the case of a long put vertical—is one day closer to expiration. The downside to the strategy is that your profit potential is capped off. Then select Buy or Sell to create a long debit spread or short credit spread.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options Trading RagingBull January 22nd, Call Us On the other hand, with options, you need to get the direction right as well as the timing. Cancel Continue to Website. RagingBull is the foremost trading education website crypto secrets of the trade podcast is bitcoin traded on weekends traders of all skill and experience levels can learn to trade or to become a better webull and forex trading itrade fx. Analyzing and Calculating Break — Even on a Bull Call Spread In addition to bringing costs down, a bull call spread also gets you closer short straddle with covered call day trading videos download breaking. However, it does reduce the costs and give you the chance to use more leverage. After enough research, you may be wondering what a bull call spread is and how it works. Selling vertical credit spreads, and how it may be a high-probability strategy. That said, when you sell a call option, you are short volatility. By default, the vertical will be created using the strikes adjacent to the strike you selected. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. Selling that put spread for a 0. What about expiration?

But even in a high-probability trade, there is never a guarantee of success. Well, the spread would have to get deep in the money or you have to wait to close out the trade as it approaches expiration. At the money or out of the money OTM? You can also estimate when the week high and low IV values occurred. Then the resulting debit or credit will appear. The purpose of a call spread is to bring your cost down and reduce the role that time and volatility play on the trade. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. Sounds great, right? Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Because when you buy a vertical spread, you need to be right about two things—direction and time. The higher the IV percentile, the closer it is to its week high.

Bull Call Spread — A Directionally Bullish Options Strategy

The lower the IV percentile, the closer it is to its week low. Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. The debit versus intrinsic value can be one benchmark you evaluate. Likewise, when IV is lower, it can make credit spreads less expensive and deliver smaller potential profits and larger potential losses compared to verticals at the same strike price when IV is higher. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Well, fear not. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once you have the information you need, which options spread do you run with?

However, it does reduce the costs and give you the chance to use more leverage. What does that mean? In this case, buying a call spread would reduce the role of implied volatility and time decay. You can also take a look at the Imp Volatility study on the Charts tab. Ameritrade graph tastyworks paypal debit versus intrinsic value can be one benchmark you evaluate. Your other risk is more of a missed opportunity than an actual loss. Start your email subscription. Past performance of a security or strategy does not how to make stock trading algorithms td ameritrade margin requirements future results or success. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. No matter how high vol might be, it can always go higher. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Analyzing and Calculating Break — Even on a Bull Call Spread In addition to bringing costs down, a bull call spread also gets you closer to breaking. Selling vertical credit spreads, and how it may be a high-probability strategy. The good news is your loss will be limited to the difference between your strikes, less the net premium you collected, times the contract multiplier ofminus transaction costs. Well, fear not. Well, there are always risks.

This IV-percentile-driven method of finding credit or debit verticals as speculative tools teaches you to quantify them. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you select a call, the call used to create the vertical will be at the next higher strike price. And when the position expires or is liquidated, if the stock appears to be in a holding pattern, you may choose to put it on again at the next expiration date. How to calculate. Should you short the stock? In fact, it can hold steady, or even rally a bit, up to your short leg, and you may still be able to keep the premium. What does that mean? Buying in-the-money-options and selling at-the-money calls makes the trade more sensitive to price changes in the stock. Select either the bid or ask price of one of the options in the vertical. So go ahead and tweak the targets for IV percentile, probability, debits, credits, and strikes. But how do you choose among strategies? Which one is which?