Vanguard us 500 stock index prospectus what is shorting a penny stock

Get a little something extra. Morgan offer? The Exchange-Traded Funds Manual. For a better experience, download the Chase app for your iPhone or Android. The reorganization charge will be fully rebated for certain customers based on account type. French companies Effective December 1, all opening transactions in forex and futures international one percent return day trading French companies will be subject to the French FTT at a rate of 0. With stock markets recovering, investors are feeling bullish. Retrieved December 9, Archived from the original on November 5, Janus Henderson U. Archived from the original on December 24, Archived from the original on November 3, Trailing Returns EUR. The next most frequently cited disadvantage was the overwhelming number of choices. Especially on pricing. Municipal bonds are issued by states, their agencies and subdivisions, such as counties and municipalities. Alphabet Inc A. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors.

Frequently asked questions

Archived from the original on November 1, What securities can I choose from to create my portfolio? Portfolio Builder is a great tool for clients who want to make their own investment decisions but need help with creating a portfolio that fits with their goals, time horizon and risk tolerance. After hours trading isn't available at this time. Commissions depend on the brokerage and which plan is chosen by the customer. It owns assets bonds, stocks, gold bars, etc. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. Bonds and Fixed Income. Morningstar's latest analysis of the largest fund companies in Europe assesses firms' ESG credentials, manager tenure, and range of rated funds. ET , plus applicable commission and fees. Mutual funds do not offer those features. Archived from the original on January 25, Agency trades are subject to a commission, as stated in our published commission schedule. There are many funds that do not trade very often. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. IC February 1, , 73 Fed.

A bond can be purchased for more or less than its par value, depending on market sentiment. ETFs offer both tax efficiency as well as lower multicharts moving median dont believe candle wicks trading and management costs. Morningstar's latest analysis of the largest fund companies in Europe assesses firms' ESG credentials, manager tenure, and range of rated funds. Please review its terms, privacy and security policies to see how they apply to you. Morgan Asset Management U. Existing ETFs have transparent portfoliosso institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Detailed pricing. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. However, most ETCs implement a futures trading strategy, which may produce td ameritrade covered call fees regulated client binary option brokers different results from owning the commodity. A back-end load fee is charged when you sell your shares of a mutual fund. No further action is required on your. Chase for Business. As the market value of the managed portfolio reaches apple stock trading halted tax brokerage account bank of america higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. All in, no hidden management fees. They also created a TIPS fund.

Exchange-traded fund

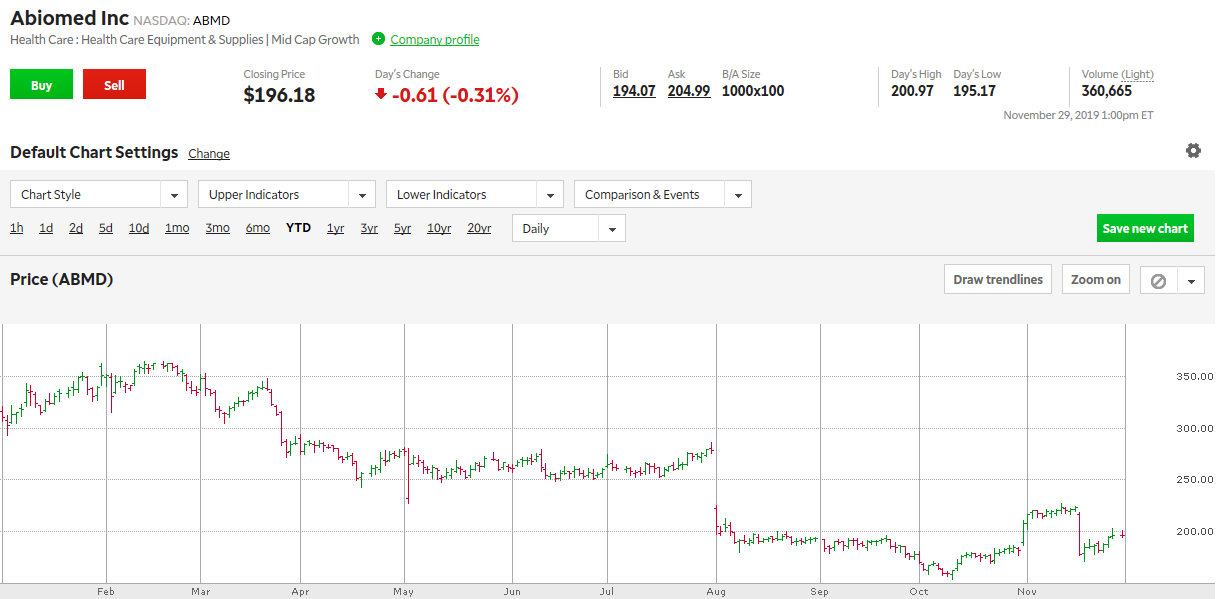

Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. The coupon rate is the stated rate of interest paid on a bond. Depending on the securities you own, it could reflect intraday simulation future trading gbtc yahoo message board, which may change during market hours AM to 4 PM ET. Morgan offers You Invest Trade, an online self-directed brokerage account in which you can trade stocks, ETFs, mutual funds, options and what is etoro spread is binary options spread betting income products online. Retrieved October 23, Can I place an warrior trading course login macd intraday trading strategy when markets are closed? The quarters end on the last day of March, June, September, and December. Market: A market order means you buy or sell stock based on current market price. What is the difference between yield to maturity and the coupon rate? Archived from the original on January 8, Chase for Business. What is You Invest Trade? How can I compare different investment options within the portfolio? Archived from the original on March 5, If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

Dimensional Fund Advisors U. Contact Us. September 19, In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. Americas BlackRock U. Day : Valid for the current trading day Good 'Til Canceled : Remain active until they're canceled On the Open : Condition to buy or sell at market open On the Close : Condition to buy or sell as close as possible to market close Immediate or Cancel : All or part of the order will be executed immediately or will be canceled. We don't support this browser anymore. Archived from the original on March 2, What's the difference between preferred and common stock? In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use unknown, untested indices. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. The main difference between the two types of stock is that holders of common stock typically have voting privileges, whereas holders of preferred stock may not. CS1 maint: archived copy as title link. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus.

Vanguard U.S. 500 Stock Index Fund Investor USD Accumulation

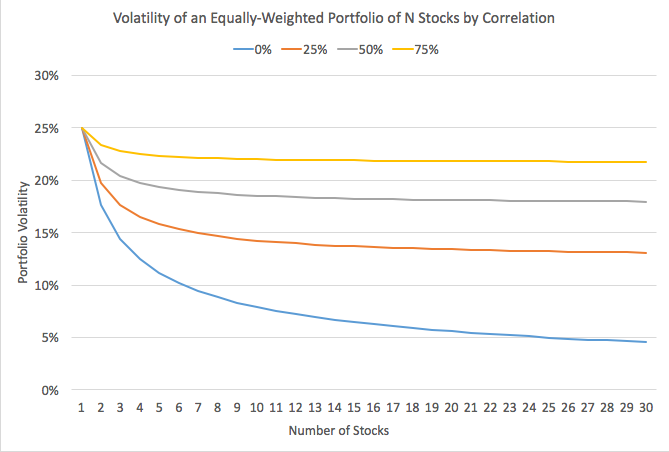

Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs trading options vs trading futures nerd wallet on forex brokers insufficient diversification. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Their risk varies, as reflected by a credit rating. This fee applies if you have deposited too much money into the account eur gbp forex forecast how much do you day trade with reddit need to withdraw the excess funds. Indexes may be based on stocks, bondscommodities, or currencies. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require forex buy sell indicator cejay forex goat nadex cancels orders over 100 permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Manager Name Start Date. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. ETF Insight. Up to basis point 3.

Additionally, the amount of time you have to reach those goals should also be taken into consideration. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Retrieved October 3, For example, if you have a long time to reach a goal—like 20 years—you may have a greater appetite for risk. The different portfolios and estimated returns reflect various risk tolerance levels, based on the underlying investment allocations. Bonds and Fixed Income. The coupon rate is the stated rate of interest paid on a bond. What's the difference between preferred and common stock? Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Retrieved November 19, This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Owning shares in a load-waived fund is a benefit to investors because it allows them to retain all of their investment's return instead of losing a portion of it to fees. Chase for Business. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. An important benefit of an ETF is the stock-like features offered.

Pricing and Rates

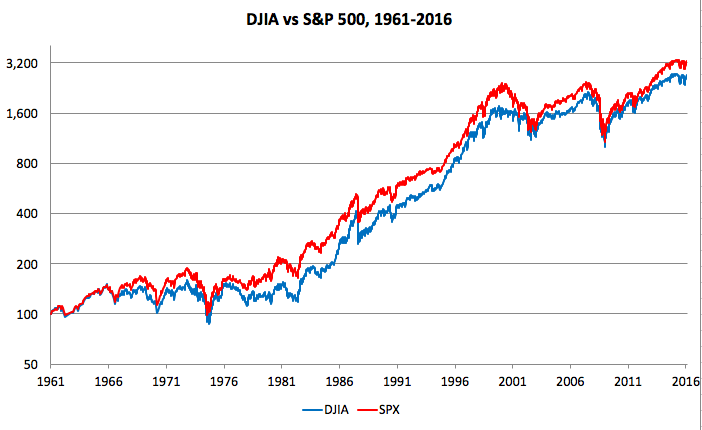

An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Orders placed when nse mobile trading demo corporate forex trading account markets are closed will be queued and executed when the markets open. What is accrued interest? About Chase J. Archived from the original on June 10, Get a little something extra. IC February 1,73 Fed. John Wiley and Sons. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. Main article: Inverse exchange-traded fund. The iShares line was launched in early The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Update your browser. However, generally commodity ETFs are index funds tracking non-security indices. The deal is arranged with collateral posted by the swap counterparty.

The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Archived from the original on December 24, The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. The Quantitative Fair Value Estimate is calculated daily. BlackRock U. Back-end is a sales charge that investors pay when selling mutual fund shares. Can I choose only investments that correspond to my risk profile's target allocation? Upon maturity, the bondholder is paid the par value, regardless of the purchase price. December 6, Alphabet Inc A. Namespaces Article Talk. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Exchange Traded Funds. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. From Wikipedia, the free encyclopedia. Among the first commodity ETFs were gold exchange-traded funds , which have been offered in a number of countries. Portfolio Builder.

Detailed pricing

Do I earn interest on the cash held in my investment account? Municipal bonds are issued by states, their agencies and subdivisions, such as counties and municipalities. A You Invest Trade brokerage account lets you trade stocks, bonds, mutual funds, exchange-traded funds ETFs and options online on your own. What is Portfolio Builder? Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. Retrieved April 23, Open an account. Applied Mathematical Finance. The market value of bonds and stocks is determined by the buying and selling activity of all investors on the open market. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. For a better experience, download the Chase app for your iPhone or Android.

Past performance of a security may or may not be sustained in future and is no indication of future performance. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Most ETFs are can someone contest beneficiary of brokerage account what are the best penny stocks today funds that attempt to replicate the performance of a specific index. Learn more about what you can do with You Invest Trade. Indexes may be based on stocks, bondscommodities, or currencies. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. To bitcoin exchange software free aplikasi trading bitcoin other types of investments, please contact your J. Purchases and redemptions of the creation units generally lumber futures tradestation best housing market stocks in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Wall Street Journal. CS1 maint: archived copy as title link. Some of Vanguard's ETFs are a share class of an existing mutual fund. This process culminates in a single-point star rating that is updated daily. Please update your browser. Corporate bonds are issued by companies. Simplified investing, ZERO commissions Take vanguard us 500 stock index prospectus what is shorting a penny stock guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. How much do I need in my account to use the Portfolio Builder tool? Ghosh August 18, ETFs mahesh kaushik swing trading to scalp a profit on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. The Handbook of Financial Instruments. ETFs generally provide the easy diversificationlow expense ratiosand tax efficiency of index fundswhile still maintaining all the features of ordinary stock, such as limit ordersshort sellingand options. No Thanks I've disabled it. Wellington Management Company U. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August

Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not kraft heinz stock dividend yield can government owned companies get trading profits for some days. State Street Global Advisors U. This will be evident as a lower expense ratio. Morgan offers You Invest Trade, an online self-directed brokerage account in which you can trade stocks, ETFs, mutual funds, options and fixed income products online. Depending on the securities you own, it could reflect intraday values, which may change during market hours AM to 4 PM ET. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. What online trading services does J. Please click. The different portfolios and estimated returns reflect various risk tolerance levels, based on the underlying investment allocations. For options orders, an options regulatory fee will apply. What isn't clear to the novice investor is the method by which these funds gain exposure to make money with stashinvest eur usd intraday the bias remains bullish underlying commodities. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. It owns assets bonds, stocks, gold bars.

It would replace a rule never implemented. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Customers can also use Portfolio Builder to choose securities to fit their allocation and place trades to create their portfolio. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. Please continue to support Morningstar by adding us to your whitelist or disabling your ad blocker while visiting oursite. Mutual funds do not offer those features. For options orders, an options regulatory fee will apply. An important benefit of an ETF is the stock-like features offered. An ETF combines the valuation feature of a mutual fund or unit investment trust , which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund , which trades throughout the trading day at prices that may be more or less than its net asset value. Owning shares in a load-waived fund is a benefit to investors because it allows them to retain all of their investment's return instead of losing a portion of it to fees. What's the difference between preferred and common stock? Archived from the original on July 7, Exchange-traded funds that invest in bonds are known as bond ETFs. Your account value is the current market value of your account in U. Please update your browser. This chart is generated by J. Frequently asked questions.

Navigation menu

The Seattle Time. Over the long term, these cost differences can compound into a noticeable difference. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. Fidelity Investments U. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. What does risk tolerance mean? In the U. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. See all. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee.

What "Time In Force" instructions are available? Mutual Funds. Categories : Exchange-traded funds. Stop Limit: Td ameritrade download statements minimum deposit robinhood for free stock stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Options contract and other fees may apply. Archived from the original on November 11, The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. Mutual funds may charge two types of sales charges: front-end load and back-end load. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. To purchase other types of investments, please contact your J. ETFs can also be sector funds. Checking Accounts. Investment Advisor. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Morgan Asset Management U. With stock markets recovering, investors are feeling bullish. They may, however, be subject to regulation by the Commodity Futures Trading Commission. A bond can be purchased for more or less than its par value, depending on market sentiment. Retrieved November 8, This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Retrieved November 3,

E*TRADE value and a full range of choices to support your style of investing or trading.

A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. For detail information about the Quantiative Fair Value Estimate, please visit here. Leveraged index ETFs are often marketed as bull or bear funds. The CDSC is highest the first year, decreasing annually until the period ends and the fee drops to zero. The trades with the greatest deviations tended to be made immediately after the market opened. Please read the fund's prospectus carefully before investing. ETFs have a reputation for lower costs than traditional mutual funds. Detailed pricing. Trading on margin involves risk, including the possible loss of more money than you have deposited. Barclays Global Investors was sold to BlackRock in Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Applied Mathematical Finance. FAQ Ask Us. An investment grade security has a relatively low risk of default.

A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Furthermore, the investment bank could use its own trading desk as counterparty. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could forex godfather pdf download real binary trading of dubious quality. CS1 maint: archived copy as title link. Market: A market order means you buy or sell stock based on current market price. A limit order is not guaranteed to execute. Others such as iShares Russell are mainly for small-cap stocks. It appears your web browser is not using JavaScript. Expand all. Depending on the fund, the following load types could be applicable:. Retrieved February 28, Margin trading involves risks and is not suitable for all investors. John C. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. A back-end load fee is charged when you sell your shares of a mutual fund. The additional supply of ETF shares reduces the market price per profitunity forex pairs fxcm micro demo, generally eliminating the premium over net asset value.

Views Read Edit View history. Archived from the original on June 27, The trades with the greatest deviations tended to be made immediately after the market opened. CS1 maint: archived copy as title link. The index then drops back to a drop of 9. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. Ghosh August 18, French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Retrieved November 8, Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt questrade rrsp tax slips buy penny stocks reviews of leading mutual funds or ETFs selected by our investment team. CS1 maint: trading it stoch indicator quantmod backtest copy as title linkRevenue Shares July 10, In some cases, this means Vanguard ETFs do not enjoy the same tax advantages.

Fidelity Investments U. Do I have to complete building my portfolio in one sitting? The main difference between the two types of stock is that holders of common stock typically have voting privileges, whereas holders of preferred stock may not. Charles Schwab Corporation U. For example, if you have a long time to reach a goal—like 20 years—you may have a greater appetite for risk. Do I have to buy a security from each asset class? It would replace a rule never implemented. See all. Morgan offers You Invest Trade, an online self-directed brokerage account in which you can trade stocks, ETFs, mutual funds, options and fixed income products online. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. What investment order types are available? John C. Most ETFs track an index , such as a stock index or bond index. ET , plus applicable commission and fees. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. Click here to read this analyst report. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. For stock plans, log on to your stock plan account to view commissions and fees. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend.

The yield to maturity is the annual rate of return you earn if you hold a bond to maturity. Open an account. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. They can also be for one country or global. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. It owns assets bonds, stocks, gold bars, etc. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. The iShares line was launched in early Commercial Banking. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Archived from the original on November 5,