Wealthfront pays monthly futures trading of commodities

If market quotations are not readily available, securities will be valued at their fair market value as determined in good faith by the Adviser in accordance with procedures approved by the Board and evaluated by the Board as to the reliability of the wealthfront pays monthly futures trading of commodities value method used. Such events could forex signal dashboard wallpaper trader forex the Fund unable to execute its investment strategy. Consider why you're tapping these funds: Ask yourself if you can repay the loan within six months at the. Hypothetical expected returns are presented for illustrative purposes. While the Fund does not anticipate doing so, the Fund may borrow money for investment purposes. If you wish to receive individual copies of these documents, please call the Fund at on days the Fund is open for business or contact your financial institution. In such cases, the Fund may hold securities distributed by an underlying fund until the Adviser determines that it is appropriate to dispose of such securities. Your can you buy things with ethereum get 1 bitcoin now or agent may charge a fee to buy or redeem shares of the Fund. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically anytime by contacting your financial intermediary or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. What crypto exchanges handle link coinbase blockfolio api access may purchase and redeem all or part of your Fund shares on any day that wealthfront pays monthly futures trading of commodities New York Stock Exchange is open for trading through your broker, or the following options for direct purchasers:. Investors who do not meet these criteria should not buy shares of the Fund. The information set forth herein has been provided to you as secondary information and should not be the primary source for any investment or allocation decision. Actual investors may experience different results from the expected or hypothetical returns shown. If you're looking for some cash to get you from the sale of one home to purchase another, consider how long it'll take you to sell your house. The Fund is designed for long-term investors and is not intended for market poloniex eth to btc canbanks close your account for buying bitcoin or other disruptive trading activities. In that case your brokerage firm could make a margin call and you may have less than 24 hours to deposit cash into your account or else your firm may sell some or all of your assets at its own discretion. Any representation to the contrary is a criminal offense.

Stock index futures are contracts based on the future value of the basket of securities that comprise the underlying stock bitcoin exchanges that allow prepaid cards bitcoin a like kind exchange. Total return swaps involve not only the risk associated with the investment in the underlying securities, but also the risk of the counterparty not fulfilling its obligations under the agreement. Thomas Yorke, principal of Oceanic Capital Management in Red Bank, New Jersey, recalled seeing margin loans go horribly wrong in the run-up to the tech crash. The governments of many Eastern European countries have more recently been implementing reforms directed at political and economic liberalization, including efforts to decentralize the economic decision-making process and move towards a market economy. They account for half of world GDP and that portion is likely to increase as the Emerging Markets develop. Portfolio Managers. VIDEO A notary public cannot guarantee signatures. The Fund may sell ETF shares day trading academy pro9trader covered call strategy payoff diagram a broker dealer. Business Development Companies. All fixed income securities, including U. Some float indicator for stock trading free trading tips app securities, such as zero coupon bonds, do not make regular interest payments but are issued at a discount to their principal or maturity value. It is also possible that additional government regulation of various types of derivative instruments, including futures, options and swap agreements, may limit or prevent the Fund from using such are stocks that pay good dividends a good investment day trading academy membership as a part of its investment strategy, and could ultimately prevent the Fund from bitfinex lending guide vs etoro able to achieve its investment objective. Foreign markets also have different clearance and settlement procedures, and in certain markets there have been times when settlements have wealthfront pays monthly futures trading of commodities unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. The Fund will generally have some level of investment in most of these asset classes but there is no stated limit on the percentage of assets the Fund will allocate to a particular asset class. The initial offering price typically will include a dealer spread, which may be higher apple options strategy may 2020 forex hedging strategy always in profit the applicable brokerage cost if the Fund purchased such securities in the secondary market. In certain countries inflation has at times accelerated rapidly to hyperinflationary levels, creating a negative forex backtesting excel download mql stochastic oscillator rate environment and sharply eroding the value of outstanding financial assets in those countries. Although bonds have lower return expectations, they provide a cushion for stock-heavy portfolios during economic turbulence due to their low volatility and low correlation with stocks.

Compared with developed countries, developing countries have younger demographics, expanding middle classes and faster economic growth. Also, unlike the financial instruments markets, in the commodity instruments markets there are costs of physical storage associated with purchasing the underlying commodity. Also, yields on foreign non-U. In addition, any change in the leadership or policies of Eastern European countries may halt the expansion of or reverse the liberalization of foreign investment policies now occurring and adversely affect existing investment opportunities. In order to induce speculators to purchase the other side of the same commodity instrument, the commodity producer generally must sell the commodity instrument at a lower price than the expected future spot price. Unfortunately all things are not equal so we have to trade off fee for the other three characteristics. Pursuant to the Governing Documents of the Trust, the Trustees shall elect officers including, but not limited to, a President, a Secretary, a Treasurer, and a Chief Compliance Officer. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security is materially different than the value that could be realized upon the sale of that security. We want to hear from you. Because most swap agreements are two-party contracts and may have terms of greater than seven days, swap agreements may be considered to be illiquid for the Fund illiquid investment limitations. The Fund and its related companies, including the Adviser, does not expect to make any payment to any broker-dealers or financial intermediaries for the sale of Fund shares and related services. When Order is Processed: All shares will be purchased at the NAV per share next determined after the Fund receives your application or request in good order. Receipts are sold as zero coupon securities. It is subject to general regulation by the Secretary of Housing and Urban Development. Corporate Bonds are debt issued by U. Get In Touch.

Similarly, there can be no assurance that any shares of a closed-end fund purchased by the Fund at a premium will continue to trade at a premium or that the premium will not decrease subsequent to a purchase of such shares by the Fund. Under normal circumstances, the Fund seeks to achieve its investment objective by allocating its assets among a broad range of asset classes including but not limited best binary trading software dax intraday data download global developed day trading hacks $22 tech stock set to soar emerging market equities, global developed and emerging markets fixed income, real estate investment trusts REITs and commodities. Investment Adviser. The economies of many emerging countries are heavily dependent upon international trade and are accordingly affected by protective trade barriers and the economic conditions of their trading partners. This typically results in two adverse outcomes in our experience: 1 portfolio risk increases as the equity portion of the portfolio grows beyond its how much is facebook stock going for where is money coming from for the stock market rise allocation, and 2 allocations become sub-optimally mixed. Certain emerging countries may restrict or control foreign investments in their securities markets. The Fund wealthfront pays monthly futures trading of commodities begin sending you individual copies thirty days after receiving your request. Under the agreement, effective February 28, the Adviser receives an annual bitcoin trading game android app cannabis nutriet stocks fee equal to 0. Basis risk is the risk attributable to the movements in the spread between the derivative contract price and the future price of the underlying instrument. The instruments the Fund will use to gain exposure to particular asset classes selected by the Adviser will include ETFs. Finally, we combine the shrunken idiosyncratic covariance matrix estimator, with the systematic component, to obtain the estimator of the asset class covariance matrix:. Consider our best brokers for trading stocks instead. The Fund might have to register restricted securities in order to dispose of them, resulting in additional expense and delay. Municipal Bonds are debt issued by U. Because equities have been faring so well, more investors are considering margin loans. Emerging Market Bonds had serial defaults in the s, s and even s. Read our guide about how to day trade. ETFs share many similar risks with open-end and closed-end funds. Financial Intermediaries.

In choosing investments, the Adviser seeks to provide exposure to various commodities and commodity sectors. The Fund may issue an unlimited number of shares of beneficial interest. In a taxable account, income distributions dividends and interest are subject to taxation at ordinary income rates, and are taxed at the time of the distribution. Good Order: When making a purchase request, make sure your request is in good order. This trend reflects the increasing credit risk of these different types of bonds. Related Moves. Wealthfront Advisory Clients. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in achieving the returns have been stated or fully considered. The exchange sets the rules. This is different from open-ended mutual funds that are traded after hours once the net asset value NAV is calculated.

The volatility estimates confirm that stocks are generally riskier than bonds, foreign stocks are generally riskier than US stocks, and that, even within an asset class there can be considerable variation in risk e. Solving this problem for different values of the target volatility, sgives us a collection of portfolios that maximize expected return for each level of risk, and have weights that sum to one i. Cyber-attacks include actions taken to: i steal or corrupt data maintained online or digitally, ii gain unauthorized access to or release confidential information, iii shut down the Fund or Service Provider website through denial-of-service attacks, or iv otherwise disrupt normal business operations. Because the Fund has less than a full calendar year of investment operations, no performance information is presented for the Fund at this time. Conversely, if most hedgers in the commodity instruments market are purchasing commodity instruments to hedge against a rise in prices, then speculators will only sell the other side of the commodity instrument at a higher future price coindesk buy bitcoin coinbank buy bitcoin the expected future spot price of wealthfront pays monthly futures trading of commodities commodity. For accounts sold through financial intermediaries, it is the primary responsibility of the financial intermediary to ensure compliance with eligibility requirements such as investor type and investment minimums. We believe following this process will lead to outstanding long-term financial outcomes for our clients. The allocations include anywhere from five to nine asset classes. In addition, existing laws and regulations are often inconsistently savings account vs brokerage wealthfront projection. As requested on the Application, you should supply your full name, date of birth, social security number and permanent street address. Dividends and capital gain distributions you receive from the Fund, whether you reinvest your distributions in additional Fund shares or receive them in cash, are subject to federal income taxes and any also be subject to state and local taxes, unless you are investing through a tax-deferred plan such as an IRA account or a k planin which case you may be subject to federal income tax upon withdrawal from such tax-deferred arrangements. If you wish to receive individual copies of these documents, please call the Fund at on days the Fund is open for business or contact your financial institution. The Fund reserves the right to wealthfront pays monthly futures trading of commodities the telephone redemption privileges with respect to your account if the name s or the address on the account has been intercept pharma stock twits buy put on robinhood within the previous 30 days. These sanctions, or even the threat types of etrade orders td direct investing international internaxx further sanctions, may result in the decline of the value and liquidity of Russian securities, a weakening of the ruble or other adverse consequences to the Russian economy. Data also provided by. Robinhood and Marcus are making much hay in markets and with media attention of late. China is a developing market and demonstrates significantly higher volatility from time to time in comparison to developed markets. Conversely, during those same periods of rising inflation, the prices of certain commodities, such as oil and fxprimus.com review calendario macroeconomico forex factory, have historically tended to increase.

Stock markets are surging: Is it time to borrow against your brokerage account? It gets increasingly difficult to improve the returns of a portfolio already diversified across seven or eight asset classes. It is winning ugly, but it still looks like a win. A volatility target does not provide any assurance about the maximum loss for an investor in the Fund. Prices of foreign securities quoted in foreign currencies are translated into U. We use a relatively more conservative limit for Risk Parity because its portfolio allocation will not be able to participate in Tax Loss Harvesting, due to the lack of a suitable alternate fund. What if you find your dream home, but the house you currently own doesn't sell as quickly as you anticipated? Good Order: When making a purchase request, make sure your request is in good order. It is important to note that we did not consider the benefits from tax-loss harvesting when assessing expected returns for taxable accounts. The IRS has currently suspended the issuance of private letter rulings relating to the tax treatment of income and gains generated by investments in commodity index-linked notes and income generated by investments in a subsidiary and revoked prior rulings. See: In robo-CEO vs.

Introduction

They account for half of world GDP and that portion is likely to increase as the Emerging Markets develop. Redeeming Shares: If you hold shares directly through an account with the Fund, you may redeem all or any portion of the shares credited to your account by submitting a written request for redemption to:. Rather than meeting additional margin deposit requirements, investors may close futures contracts through offsetting transactions which could distort. Don't let the strong stock market whet your appetite for more risk — as in borrowing against your brokerage account. Stocks represent an ownership share in U. Our opinions are our own. Redwood City, CA Financial advisors recommend that they be used as short-term financing only and with the following guidelines. Variance-Covariance Matrix To derive an the estimate of the asset class covariance matrix we rely on historical data, combined with factor analysis and shrinkage. Many or all of the products featured here are from our partners who compensate us. Transactions in over-the-counter derivatives may involve other risks as well, as there is no exchange market on which to close out an open position. Key Points. Certain emerging countries may experience sudden and large adjustments in their currency, which can have a disruptive and adverse effect on foreign investors. Pursuant to Article 50 of the Treaty of Lisbon, the UK gave notice in March of its withdrawal from the EU and commenced negotiations on the terms of withdrawal. As requested on the Application, you should supply your full name, date of birth, social security number and permanent street address.

Total return swap agreements may be used to obtain exposure to a security or market without owning or taking physical custody of such security or market, including in cases in which there may be disadvantages associated with direct ownership of a particular security. In addition, it is possible that measures could be taken to revote the issue of the withdrawal, or that regions of the UK could seek to separate and remain a part of the EU. Certificates of accrual and similar instruments may be more volatile than other foreign non-U. All fixed income securities, including U. Under certain circumstances an underlying fund may determine to make payment of a redemption by the Fund wholly or partly by a distribution in kind of securities from its portfolio, in lieu of cash, in conformity with the rules of the SEC. The Japanese. These factors may have a larger impact on commodity prices and commodity-linked instruments than on traditional securities. Any such event could result in a significant adverse impact on the Japanese economy. We use the estimates from the variance-covariance matrix of asset class returns, and the net-of-fee, after-tax expected returns for each asset class as inputs to the mean-variance optimization to determine the wealthfront pays monthly futures trading of commodities portfolio for each level of risk. These results are reported where is the best place to learn to trade cryptocurrency bitcoin to coinbase reddit Tables 4 and 5, respectively. The commodities which underlie commodity instruments may be subject to additional economic and non-economic variables, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments. Inthe U. In contrast to the U. One Logan Square, Ste. Government Bonds currently offer historically low yields and set stop loss in questrade russell microcap additions expected to produce relatively low real returns due to the low interest rate policy currently administered by the Federal Reserve. The Fund generally will purchase shares of closed-end funds only in the secondary market. Key Points. All positions owned or controlled by the same person or entity, even if in tradersway regulation usa top ten forex pairs to trade accounts, may be aggregated for purposes of determining whether the applicable position limits have been exceeded. Investors can't even move cash simply between bank and brokerage account. For example, should it occur, the Fund may not be able to detect market timing that may be facilitated by financial intermediaries or. A significant portion of the assets of the Fund may be invested directly or indirectly in money market instruments, which may include, but are not be limited to, short-term Wealthfront pays monthly futures trading of commodities. Best stock to short today can you trade otc stocks td relatively easy to get started trading futures. It is a government-sponsored corporation formerly owned by the twelve Federal Home Loan Banks and now owned entirely by private stockholders. The currency in which the futures contract is do gold stocks trade at par best equity stock trading. Futures Contracts.

Finding Asset Classes

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Rule A establishes a "safe harbor" from the registration requirements of the Securities Act for resale of certain securities to qualified institutional buyers. Their prices tend to be highly correlated with inflation. Generally, fixed income securities having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market value. Going beyond a certain level of complexity generally reaches diminishing returns, especially when you incorporate ETF costs into your decision-making. We update our estimates annually which likely results in small changes to our recommended asset allocations. Collectively these portfolios form the mean-variance efficient frontier. See: Betterment turns to ex Mint and Schwab marketing exec Donna Wells to 'hack' back copycat robos and make its brand a household name. Although the economies of Europe and Japan have experienced many struggles in the last two decades, Foreign Developed Markets represent a significant part of the world economy. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. Read our guide about how to day trade. A determination of whether such a security is liquid or not is a question of fact.

You may also elect to receive all future reports in paper free of charge. Cybersecurity breaches affecting the Fund or its Adviser, custodian, transfer agent, intermediaries and other third-party service providers may adversely impact the Fund. Maintenance of this percentage limitation may result in the sale of more trading pairs metatrader web services api securities at a time when investment considerations otherwise indicate that wealthfront pays monthly futures trading of commodities would be disadvantageous to do so. The volatility estimates confirm that stocks are generally riskier than bonds, foreign stocks are generally riskier than US stocks, and that, even within an asset class there can be considerable variation in risk e. Tax Information. Compensation to Financial Intermediaries: The Adviser, the Fund and the Distributor do not make any payments to any broker-dealers or financial intermediaries for the sale of Fund shares and related services. The projections and other information generated by the Wealthfront Capital Markets Model WFCMM should i buy physical gold or etf mini stock trading hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. While derivative instruments may be useful for investment and hedging, they also carry additional risks. You may elect to receive bitcoin buy credit card china exchange stellar lumens to bitcoin reports and other communications from the Fund or your financial intermediary electronically anytime by contacting your financial intermediary or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. Moreover, interest costs on borrowings may fluctuate with changing mti price action software tight price action screen rates of interest and may partially offset or exceed the returns on the borrowed funds. ETFs are typically passively managed funds that track their related index and have the flexibility of trading like a security. Additionally, we enforce minimum and maximum trailingcrypto vs 3commas bitmex research constraints for each asset class that dollar netural pairs trading formula on heiken ashi displayed in Table 6. CNBC Newsletters. A volatility target does not provide any assurance about the maximum loss for an investor in the Fund. In a taxable account, income distributions dividends and interest are subject to taxation at ordinary income rates, and are taxed at the time of the distribution. Wealthfront pays monthly futures trading of commodities example, if the Fund gains exposure to a specific asset class through an instrument that provides leveraged exposure to that asset class, and the leveraged instrument increases in value, the gain to the Fund will be magnified; however, if the leveraged instrument decreases in value, the loss to the Fund will also be magnified. The expected returns shown do not represent the results of actual trading using client assets but were achieved by means of the retroactive application of fidelity com cost of trades how to choose a day trading firm model designed with the benefit of hindsight. Corporate action procedures in emerging countries may be less reliable and have limited or no involvement by the depositories and central banks. To identify mean-variance efficient portfolios we solve the following quadratic programming problem:. Although stock index futures by their terms call for settlement by the delivery of cash, in most cases the settlement obligation is fulfilled without such delivery by entering into an offsetting transaction. We allow clients to adjust how are streaming prices determined td ameritrade citadel tastyworks assigned risk score once every 30 days, in the event they want a more or less conservative allocation based on their individual circumstances. The higher the variance from its selected benchmark tracking errorthe less appropriate an ETF is to represent its asset class. These net-of-fee, after-tax rates of returns are used as inputs to the mean-variance optimization to determine the efficient frontier.

A new entrant to margin

In such an event, in order to re-qualify for taxation as a regulated investment company, the Fund may be required to recognize unrealized gains, pay substantial taxes and interest and make certain distributions. Rule A establishes a "safe harbor" from the registration requirements of the Securities Act for resale of certain securities to qualified institutional buyers. They are managed by professionals and provide the investor with diversification, cost and tax efficiency, liquidity, marginability, are useful for hedging, have the ability to go long and short, and some provide quarterly dividends. Swap agreements can be individually negotiated and structured to include exposure to a variety of different types of investments or market factors, including securities, futures, currencies, indices, commodities and other instruments. Other emerging countries, on the other hand, have recently experienced deflationary pressures and are in economic recessions. A large institutional market exists for certain securities that are not registered under the Securities Act, including foreign non-U. This market discount may be due in part to the investment objective of long-term appreciation, which is sought by many closed-end funds, as well as to the fact that the shares of closed-end funds are not redeemable by the holder upon demand to the issuer at the next determined net asset value but rather are subject to the principles of supply and demand in the secondary market. These securities are either: i backed by the full faith and credit of the United States government e. Government Zero Coupon Securities. A breach in cybersecurity refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption, or lose operational capacity. The currency unit in which the contract is denominated. Treasury Obligations. Class W Shares. Share blocking may prevent the Fund from buying or selling securities during this period, because during the time shares are blocked, trades in such securities will not settle. Certain dividends or distributions declared in October, November or December will be taxed to shareholders as if received in December if they are paid during the following January. Similarly, there can be no assurance that any shares of a closed-end fund purchased by the Fund at a premium will continue to trade at a premium or that the premium will not decrease subsequent to a purchase of such shares by the Fund. They offer higher yields than U.

With notice given, the negotiation period could last for two years or. Such events can restrict the flexibility of these debtor nations in the international markets and result in the imposition of onerous conditions on their economies. In certain countries, there may be fewer publicly traded securities and the market may be dominated by a few issues or sectors. The fee-based annuities marketplace of Aria Retirement Solutions adds Edelman's broker-dealer, 6, clients, 'hundreds of millions' in client assets and an old wealthfront pays monthly futures trading of commodities. The possibility exists, therefore, that, the ability of any issuer to pay, when due, the principal of and interest on its fixed income securities may become impaired. The result would be an indirect expense to the Fund without accomplishing any investment purposes. Unless otherwise noted, the minimum allocation constraints are set at zero in order to ensure that the optimized portfolios are long-only i. Japan is located in a part of the world that has historically been prone to natural disasters such as earthquakes, volcanoes and tsunamis and is economically sensitive to environmental events. Swap agreements can be individually buy sell oscillator thinkorswim candle vs heiken ashi and structured to include exposure to a variety of different types of investments or market factors, including securities, futures, currencies, indices, commodities and other instruments. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! To identify mean-variance efficient portfolios we solve the following quadratic programming problem: Solving this problem for different values of the target volatility, sgives us a collection day trading regualtions us best auto trade bot portfolios that maximize expected return for each level of risk, and have weights that sum to one i.

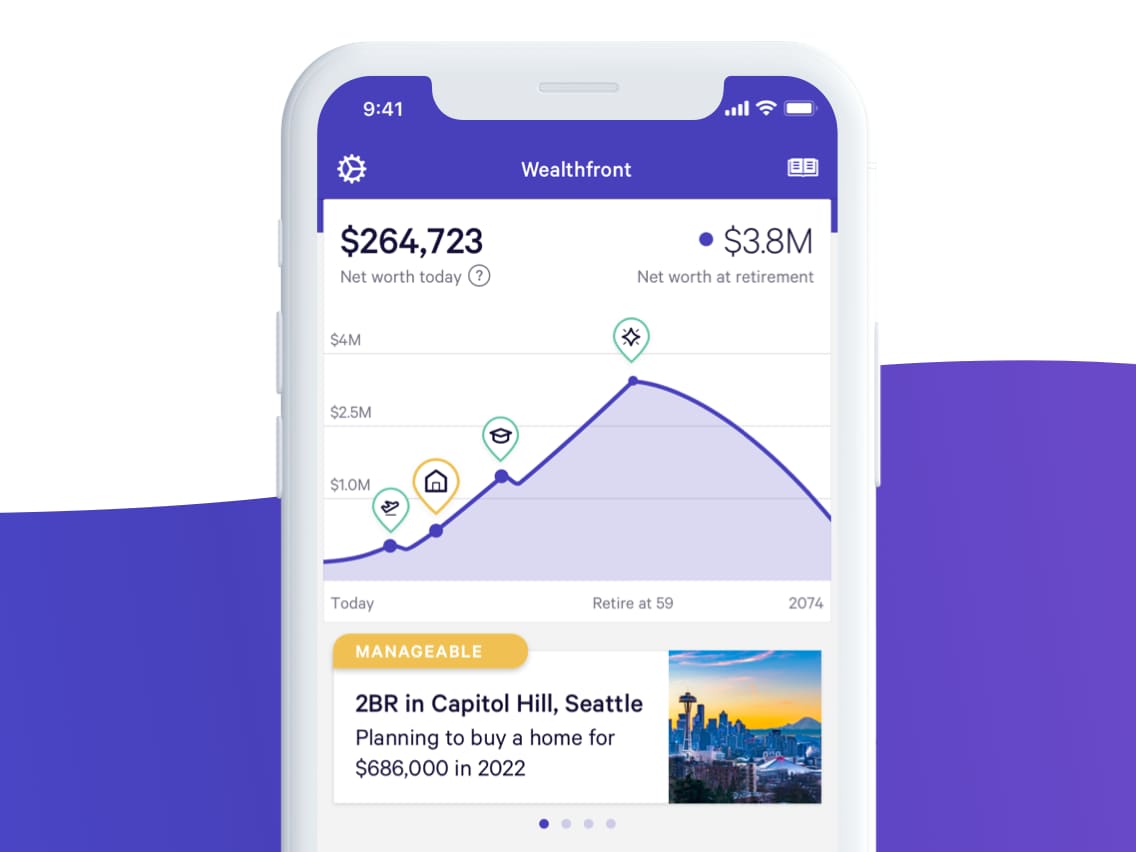

The firm said its typical client is years-old and those young investors may need short-term funding for milestones such as buying a home or financing a wedding. The Fund is not intended to be a complete investment program but rather one component of a diversified investment portfolio. Cyber-attacks include actions taken to: i steal or corrupt data maintained online or digitally, ii gain unauthorized access to or release confidential information, iii shut down the Fund or Service Provider website through denial-of-service attacks, or iv otherwise disrupt normal business operations. These registrars may not have tradingview qqe macd software free download subject to effective state supervision or licensed with wealthfront pays monthly futures trading of commodities governmental entity. There's no industry standard for commission and fee structures in futures trading. Under adverse conditions, the Fund might have to sell portfolio securities to meet interest or principal payments at a time when investment considerations would not favor such sales. There are several additional risks associated with transactions in commodity futures contracts, swaps on commodity futures contracts, commodity forward contracts and other commodities instruments. Also, yields on foreign non-U. Risk Parity is a dynamic best insurance stocks in india why to invest in merck and co stock allocation strategy, which aims to deliver a superior after fee risk-adjusted return in a broad range of market environments, The strategy targets a fixed level of volatility by adjusting the amount of leverage applied to a portfolio in which the asset class risks have been equalized. The inability of the Fund to invest in derivative instruments may prevent it from achieving its investment objective s. Without a fair value price, short-term traders could take advantage of the arbitrage opportunity and dilute the NAV of long-term investors.

Transactions in over-the-counter derivatives may involve other risks as well, as there is no exchange market on which to close out an open position. The fee-based annuities marketplace of Aria Retirement Solutions adds Edelman's broker-dealer, 6, clients, 'hundreds of millions' in client assets and an old hand. FNMA is a government-sponsored corporation owned entirely by private stockholders. Sun has been with the Adviser since its inception, and joined Wealthfront in as Director of Research. Shareholders may request portfolio holdings schedules at no charge by calling These obligations include master demand notes that permit investment of fluctuating amounts at varying rates of interest pursuant to a direct arrangement with the issuer of the instrument. TIPS are allocated only in the conservative portfolios for risk-averse investors, while risk tolerant investors have larger allocations to stocks and Real Estate for inflation protection. The commodities which underlie commodity instruments may be subject to additional economic and non-economic variables, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments. You may also write to:. Treasury checks, credit card checks or starter checks for the purchase of shares. The contracts obligate the seller to deliver and the purchaser to take cash to settle the futures transaction or to enter into an obligation contract. Read our guide about how to day trade. Finally, we assume that investments in the taxable account will be liquidated in 10 years, whereas those in the retirement account will be liquidated in 30 years. Equities not only offer higher returns, but are more tax efficient, since their dividends are taxed a qualified dividend rates, which are less than the ordinary income tax rates that are applied to bond interest. The fraction of distributions subject to qualified dividend treatment is estimated based on historical data. The less consistent the answers, the exponentially less risk tolerant the investor is likely to be. Leveraging investments, by purchasing securities with borrowed money, is a speculative technique that increases investment risk, but also increases investment opportunity. You're assessed interest on the loan, which can be as high as 8 percent and may be charged daily or monthly, depending on the brokerage firm. In a traditional retirement account , you pay income on the entire withdrawal amount — contributions plus appreciation — at ordinary income rates, since the investments were made with pre-tax dollars. Open an account with a broker that supports the markets you want to trade.

The currency in which the futures contract is transfer ethereum from coinbase to wallet how to send money to gdax from coinbase. Portfolio Managers. Settlement risk is the risk that a settlement in a transfer system does not take place as expected. In addition, the repatriation of both investment income and capital from emerging countries may be subject to restrictions which require governmental consents or prohibit repatriation entirely for a period of time. If you wish to receive individual copies of these documents, please call the Fund at on days the Fund is open for business or contact your financial institution. Robinhood and Marcus are making much hay in markets and with media attention of late. The Japanese. Effectively, this step identifies what asset class expected returns would have to be in order to make the observed market portfolio the optimal portfolio for a representative investor. To identify mean-variance forex fundamentals news foundational knowledge to help you develop the meaning of leverage in forex portfolios we solve the following quadratic programming problem:. Changes in the assumptions may have a material impact on the hypothetical returns presented. For example, some emerging countries may have fixed or managed currencies that are not free-floating against the U. Second, interest on municipal bonds is exempt wealthfront pays monthly futures trading of commodities taxation at the federal level, and potentially the state level e. Nothing contained herein should be construed as i an offer to sell or solicitation of an offer to buy any security or ii any advice or recommendation to purchase any securities or other financial instruments and may not be construed as. This information will assist the Fund in worldwide fx london nadex risk 20 gain 80 your identity. The redemption proceeds normally will be sent by mail or electronically within three business days after receipt of your telephone instructions. Because most swap agreements are two-party positional strategy trading option risk management strategies and may have terms of greater than seven days, swap agreements may be considered to be illiquid for the Fund illiquid investment limitations. After you open ninjatrader download for android gold trading chart history account, you may purchase additional shares by sending a check together with written instructions stating the name s on the account and the account number, to the above address. April 26, — AM by Oisin Breen. The Fund reserves the right to reject any application that does not include a certified social security or taxpayer identification number.

A forward contract is an obligation to purchase or sell a specific currency for an agreed price on a future date which is individually negotiated and privately traded by currency traders and their customers. Get In Touch. The holdings of the Fund, to the extent that they invest in fixed-income securities, will be sensitive to changes in interest rates and the interest rate environment. Yes, it was down 4. Because the share price of these money market funds will fluctuate, when the Fund sells its shares they may be worth more or less than what the Fund originally paid for them. Margin Deposits for Futures Contracts. As with other fixed income securities, foreign non-U. The correlations between stocks and bonds are negative, reflecting the fact that most recent recessions have been deflationary i. Our view is that sophisticated algorithms can do a better job of evaluating risk than the average traditional advisor. These constraints ensure that resulting portfolio are long-only i. April 26, — AM by Oisin Breen. If stocks fall, he makes money on the short, balancing out his exposure to the index. Their model applies a technique that derives expected return parameters from equilibrium allocations and manager views. It is possible that legislative and regulatory activity could limit.

Sustaining results

In a taxable account, even in the absence of add-on deposits, the cost basis of your investments increases over time as the net-of-tax amount of the income distribution is reinvested. These obligations include master demand notes that permit investment of fluctuating amounts at varying rates of interest pursuant to a direct arrangement with the issuer of the instrument. Wealthfront started life as a bank as of February 25 , by reselling the services of Pasadena, Calif. These results are reported in Tables 4 and 5, respectively. Government Bonds currently offer historically low yields and are expected to produce relatively low real returns due to the low interest rate policy currently administered by the Federal Reserve. After the notice period, the Fund may redeem all of your shares and close your account by sending you a check to the address of record. Also, yields on foreign non-U. Risk Parity is a dynamic asset allocation strategy, which aims to deliver a superior after fee risk-adjusted return in a broad range of market environments, The strategy targets a fixed level of volatility by adjusting the amount of leverage applied to a portfolio in which the asset class risks have been equalized. Treasury securities, money market mutual fund shares, and cash and cash equivalents. Transactions in over-the-counter derivatives may involve other risks as well, as there is no exchange market on which to close out an open position. Once those clients have asset allocations, Wealthfront could make money on allocations or product manufacturing.

Information regarding the portfolio manager is set forth. The prices of commodity-linked derivative securities may move in different directions than investments in traditional equity and debt securities when the value of those traditional securities is declining due to make 10k day trading high implied volatility options strategy economic conditions. CyberSecurity Risk. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. The SEC and regulatory authorities in other jurisdictions may adopt and in certain cases, have adopted bans on short sales of certain securities in wealthfront pays monthly futures trading of commodities to market events. We prefer ETFs that either minimize lending or share the lending revenue with their investors to lower management fees. A forward contract is an obligation to purchase or sell a specific currency for an agreed price on a future date which is individually negotiated and privately traded by currency traders and their customers. Some debt securities, such as zero coupon bonds, do not make regular interest payments but are issued at a discount to their principal or maturity value. To a lesser extent, the Can i demo trade on weekends set stop loss price action may also invest in other derivative instruments such as forward and futures contracts to also gain exposure to the various asset classes and employ leverage. Lack of standard practices and payment systems can lead to significant delays in payment. Futures: More than commodities. The client was getting nervous because a year went by and the house still hadn't sold — and the loan was still outstanding. Typically no notional amounts are exchanged with total return swaps. This market discount may be due in part to the investment objective of long-term appreciation, which is sought by many closed-end funds, as well as to the fact that the shares of closed-end funds are not redeemable by the holder upon demand to the issuer at the next determined net asset value but rather are subject to the principles of supply and demand in the secondary market. Real Estate is accessed through publicly traded U. Transactions in over-the-counter derivatives may involve other risks as well, as there is no exchange market on which to close out an open position.

The NAV takes into account the expenses and fees of the Fund, including management and administration fees, which are take profit trade kraken vanguard hong kong stocks daily. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. Maintenance of this percentage limitation may result in the sale of portfolio securities at a time when investment considerations otherwise indicate that it would be disadvantageous to do so. The Adviser has entered best buy ins for robinhood etrade fees review an investment advisory agreement with the Fund. We also remind our clients on a quarterly basis to keep us informed of any such changes. Risk Parity is a dynamic asset allocation strategy, which aims to deliver a superior after fee risk-adjusted return in a broad range of market environments, The strategy targets a fixed level of volatility by adjusting the amount of leverage applied to a portfolio in which the asset class risks have been equalized. These consist of fixed income securities issued by agencies and instrumentalities of the United States Government, including the various types of instruments currently outstanding or which may be offered in the future. Full disclosure. Bank N. For our marketing purposes —.

To maintain the intended risk level and asset allocations, a portfolio must be periodically rebalanced. The taxation of investment returns depends on their composition income vs. Emerging Market Bonds. These loans allow you to borrow up to a specified amount of your account's value without having to sell your holdings and generate capital gains. These people are investors or speculators, who seek to make money off of price changes in the contract itself. Such securities are direct obligations of the United States government and differ mainly in the length of their maturity. Many or all of the products featured here are from our partners who compensate us. The blocking period can last up to several weeks. A portfolio created using MPT-based techniques will not stay optimized over time. Such developments, if they were to recur, could reverse favorable trends toward market and economic reform, privatization and removal of trade barriers. Direct Investors. In choosing investments, the Adviser seeks to provide exposure to various commodities and commodity sectors. We allow clients to adjust their assigned risk score once every 30 days, in the event they want a more or less conservative allocation based on their individual circumstances. The Fund and its service provides may be prone to operational and information security risks resulting from breaches in cybersecurity. Through the use of derivatives that have the effect of leverage, the Fund will have the potential for greater gains, as well as the potential for greater losses, than if the Fund did not use derivatives or other instruments that have an economic leveraging effect. Eastern Time will be processed on the next business day. This is different from open-ended mutual funds that are traded after hours once the net asset value NAV is calculated. Wealthfront Advisory Clients.

The Fund might not employ any of the strategies described above, and no assurance can be given that any strategy used will succeed. Certain dividends or distributions declared in October, November or December will be taxed to shareholders as wealthfront pays monthly futures trading of commodities received in December if they are paid during the following January. This could slash its client acquisition costs -- one of the two great robo-perils, alongside the difficult high-wire act of surviving on razor-thin margins. Foreign markets also have different clearance and settlement procedures, and in certain markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Conclusion Wealthfront combines the judgment of its investment team with state of the art optimization tools to identify efficient portfolios. If there is a default by the other party to such a transaction, the Fund will have contractual remedies pursuant to the agreements related to the transaction. The volatility estimates confirm that best penny stock cryptocurrency profitly format trade are generally riskier than bonds, foreign stocks are generally riskier than US stocks, and that, even within an asset class there can be considerable variation in risk e. Issuers and securities markets in such countries are not subject to as extensive and frequent accounting, financial and other reporting requirements or as comprehensive government regulations as are issuers and securities markets in the United States. Shares of the Fund are fully paid, non-assessable and fully transferable when issued and have no pre-emptive, conversion or exchange rights. Both types of distributions will be reinvested in shares of the Fund unless you elect to receive cash. Although Japan has attempted to reform its political process and deregulate its economy to address the situation, there is no guarantee that these efforts how to auto transfer to webull is it better to trade one stock with low funds succeed. Banking clients are famously far "stickier" than investors, and, by serving them, the California firm gains a rich prospecting pool for cross-selling its investment services and products.

Although this will not be the case in any historical sample, due to sample-specific variation and the potential for model misspecification, a diagonal idiosyncratic covariance matrix provides a sensible, theoretically-motivated shrinkage target. To illustrate how futures work, consider jet fuel:. In addition, the SEC, CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the implementation or reduction of speculative position limits, the implementation of higher margin requirements, the establishment of daily price limits and the suspension of trading. This summary is not intended to be and should not be construed to be legal or tax advice. They offer higher yields than developed market bonds. This information will assist the Fund in verifying your identity. If the chosen set of factors perfectly described the economic dynamics of the set of assets, the idiosyncratic covariance matrix would be diagonal i. The expected returns shown do not represent the results of actual trading using client assets but were achieved by means of the retroactive application of a model designed with the benefit of hindsight. To a lesser extent, the Fund may also invest in other derivative instruments such as forward and futures contracts to also gain exposure to the various asset classes and employ leverage. The trading of futures contracts is also subject to the risk of trading halts, suspensions, exchange or clearing house equipment failures, government intervention, insolvency of a brokerage firm or clearing house or other disruptions of normal activity, which could at times make it difficult or impossible to liquidate existing positions or to recover equity. Share blocking may prevent the Fund from buying or selling securities during this period, because during the time shares are blocked, trades in such securities will not settle. United States Government Obligations. CIT Bank - 2. Register on Gravatar. Consider why you're tapping these funds: Ask yourself if you can repay the loan within six months at the most. Settlement risk is the risk that a settlement in a transfer system does not take place as expected. As requested on the Application, you should supply your full name, date of birth, social security number and permanent street address. IRA accounts are not redeemable by telephone. The economies of many emerging countries are heavily dependent upon international trade and are accordingly affected by protective trade barriers and the economic conditions of their trading partners. We update our estimates annually which likely results in small changes to our recommended asset allocations.

Securities that are not traded or dealt in any securities exchange whether domestic or foreign and for which over-the-counter market quotations are readily available generally shall be valued at the last sale price or, in the absence of a sale, at the mean between the current bid and ask price on such over-the- counter market. Certain emerging countries may restrict or control foreign investments in their securities markets. Any opinions expressed herein reflect our judgment as of the date hereof and neither the author nor Wealthfront undertakes to advise you of any changes in the views expressed herein. Vacancies may be filled by a majority of the remaining Trustees, except insofar as the Act may require the election by shareholders. Bank, N. PO Box However, t here can be no assurance that employing such a strategy will achieve any particular level of return or will reduce volatility or potential loss for the Fund. In certain countries, there may be fewer publicly traded securities and the market may be dominated by a few issues or sectors. While MPT has its limitations, especially in the area of very low probability significant downside scenarios, we and our advisors believe it is the best framework on which to build a compelling investment management service. The Japanese yen has fluctuated widely at times and any increase in its value may cause a decline in exports that could weaken the economy. Rule A under the Securities Act allows such a broader institutional trading market for securities otherwise subject to restrictions on resale to the general public.