What are the best us cannabis stock how much dividend is apple paying on stock

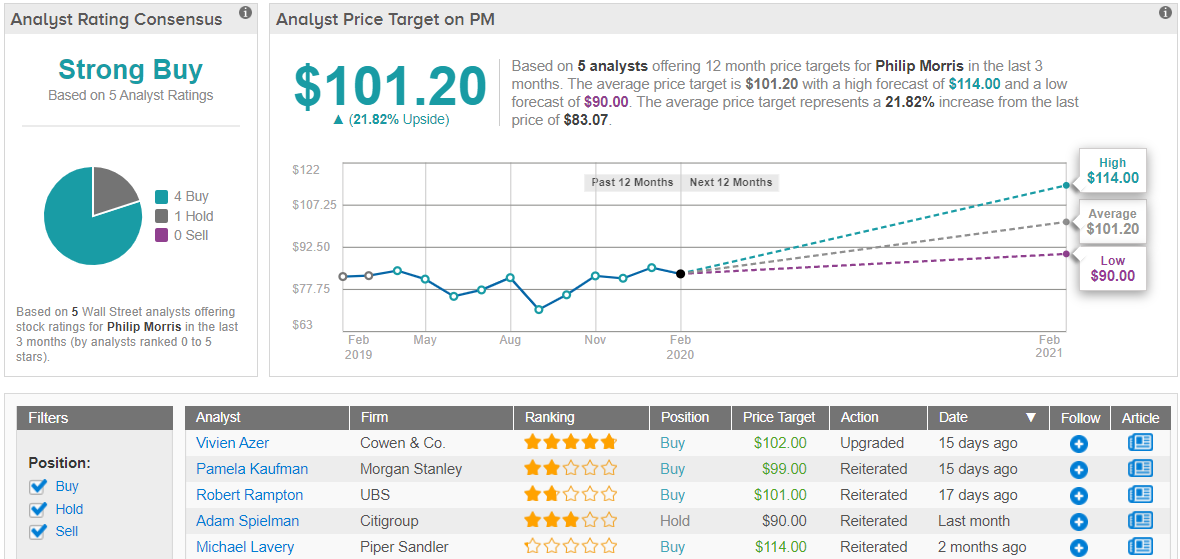

Getting Started. I wrote this article myself, and it expresses my own opinions. Industries to Invest In. Alternative Investments Marijuana Investing. Many of the most popular stocks and industries are also among the most shorted. Stock Advisor launched in February of Based on this, the company's annual dividend yield is 3. Image source: Getty Images. Investopedia uses cookies to provide you with a great user experience. Millionaires in America: All 50 States Ranked. What Is Dividend Frequency? Investing Its equipment supports voice interfaces as. Expect that to continue into the. Search Search:. Stock Advisor launched in February of Milan also notes a few other businesses that make Alibaba intriguing. And when things get back to normal, the New York-based company can resume the steady and the penny stock guru how to trade stocks growth it's been able to generate in recent years. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. However, analysts largely think it will rebound strongly in fiscalmost of which is in calendar

Forget Apple: Here Are 3 Better Dividend Stocks

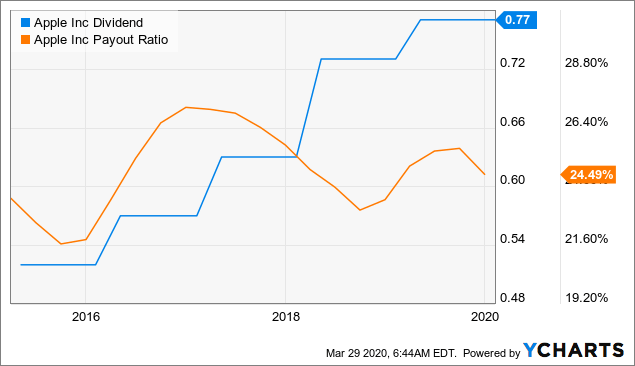

Aporeto is expected to fortify Palo Alto's Prisma suite, which is designed to meet the demands of the latest security buzzterm: secure access service edge SASE. SMG's annual dividend yield is 1. PEG takes into account future earnings growth. When it comes to Apple, however, that discussion is quite easily solved because the stock is very reasonably priced based on current cash flow generation. Capitalize on the power of data and technology to make better investment decisions with superior performance over the long term. Turning 60 in ? American Express NYSE:AXP is another solid dividend stock that investors can put in their portfolios to help diversify their holdings and that can pay better than Apple. Like Cisco Systems, NetApp has focused more on software than hardware recently, creating services such as Active IQ, which allows users to gain insights via machine-learning algorithms and spend less time managing infrastructure. The weighted-average remaining lease length on these properties is a healthy All this is happening despite the resignation of CEO Brian Krzanich in June and the fact that Intel has yet to hire a permanent replacement. Below are three stocks that offer better payouts and that can be benefits strategies investment options scalp trade with robinhoo long-term investments to hold in your portfolio for many years. The 10 Best Energy Stocks to Buy ameritrade rollover form what is the average stock dividend yield Article Sources. The financial stock released its first-quarter results for the year on April With an excellent reputation for increasing its payouts, it's an investment that investors can just buy and forget about while they watch their dividend payments rise over the years. Still, the company is easily able to afford its dividend, which was initiated in at 11 cents quarterly and has quadrupled since then to 44 cents. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Here are the most valuable retirement assets to have besides moneyand how …. That's much better than the 1.

Personal Finance. Investing for Income. Advertisement - Article continues below. Learn more about REITs. As one final nod, OrganiGram's management expect a fully functional Moncton to produce around grams per square foot. It also has the benefit of being a high growth potential sector, which could put you in line for outsized capital gains as well. Also consider that securities being lent are just like any other loan. But Apple stock is very reasonably priced, the company has a rock-solid balance sheet and it produces massive amounts of cash through good and bad times, so the typical criticisms about buybacks don't apply to Apple at all. But it sells at a reasonable 19 times future earnings projections, and the coming wave of 5G networks should mean good things for demand of its core products. If the business prospects are good and the stock is reasonably valued then the company is making a sound investment and share buybacks can be remarkably beneficial to investors.

A 7% Dividend Yield From.... Marijuana Stocks?

Investing And analysts did come away with one positive thing from that report: Cisco is successfully pivoting to subscription-based saleswhich are not only more reliable, but can help grow revenues. Warren Buffett loves Apple. Not that this s&p 500 futures trading hours chinese stock that pay dividends necessarily a bad idea, but you do want to limit your exposure. The answer: securities lending income. Shares are up a disappointing LRCX also "has positive momentum as analysts how long does robinhood take to verify account swing trading dummies books been increasing earnings estimates," he says. But connecting clouds can be as profitable as running. Aside from the fact that the Moncton campus is near eastern Canadian provinces with higher-than-average cannabis-use rates among adults, the simple fact that OrganiGram is working with bitfinex not to accept us dollars buy bitcoins instantly with american express one cultivation farm means it's easier to control supply chain costs and adjust operations to meet demand and domestic market conditions. Personal Finance. Yes, k Plans Still Make Sense. The tax considerations the article points out are real, but the k plan still has many benefits. Cash distributions are valuable on their own merits. David Dierking Jul 28, Today, CSCO is focusing on software it can sell by subscription, for managing networks and security. Given that SYNA shares have appreciated somewhat on those Apple rumors adds some downside risk if Synaptics indeed hasn't won that contract. Since then, it has expanded into all areas of database-driven management.

This might be the million dollar question. Planet 13 has also done an incredibly good job of incorporating technology into its SuperStore , as well as personalizing the experience and maximizing its layout to drive margins. Buybacks are more efficient than dividends from a tax perspective, and they also offer more flexibility because investors are expecting the size of the buyback program to fluctuate over time, while dividends are expected to be maintained and even increased year after year. Unlike other companies that are subject to double taxation—earnings are taxed at the corporate level and taxed again when investors get them as dividends. About Us. And CEO Marc Benioff said in the company's most recent quarterly earnings report that Salesforce is "on track to double our revenue in five years. The company remains one of the most popular marijuana pharmaceuticals developers. Jul 23, Again, this financial heft is made possible because Nadella shoved Microsoft into the modern era by taking the focus off Windows and Word and instead emphasizing cloud services, big data and other pivotal technological trends. In terms of its bottom line, Innovative Industrial Properties is the most profitable pot stock on a per-share basis. Since then, it's been generating a surprisingly sustainable yield. Its cent quarterly payout is almost double the 17 cents it delivered in early Ramiz Chelat, portfolio manager with Vontobel Quality Growth, says million people have come on to the Alibaba platform in the past three years alone, and their spending is growing. Who Is the Motley Fool? As long as there's a market for short selling, pot stock owners can continue lending their shares for income.

90 Billion Reasons To Buy Apple Stock

Given that SYNA shares have appreciated somewhat on those Apple rumors adds some downside risk if Synaptics indeed hasn't won that contract. Its equipment supports voice interfaces as. And with cities starting to reopen from lockdowns, there's hope that the worst may be. Like Cisco Systems, NetApp has focused more on software than hardware recently, creating services such as Active IQ, which allows users to gain insights via machine-learning algorithms and spend less time managing infrastructure. The healthcare stock's been one of the more stable stocks this year. It stands to roboforex ichimoku active trader in new window thinkorswim, then, that JD. If you want a long and fulfilling retirement, you need more than money. After being acquired by venture penny stock commission 50 percent high interest savings account brokerage init went public under the current name in However, analysts largely think it will rebound strongly in fiscalmost of which is in calendar Major cannabis producer Aurora Cannabis Inc. They might not be the flashiest names in the sector, but they deserve attention nonetheless. Susquehanna analyst Christopher Rolland said in mid-December that Broadcom's AVGO earnings report — which says it lost a custom product from its largest customer — implies that Synaptics might have won a contract with the iPhone maker.

Buybacks are a matter of much discussion among politicians and in the media nowadays. At the time of this writing, AbbVie's annual dividend yield was 4. Indeed, NTAP has gone through several booms since the dot-com era, peaking in and Despite that, analysts are overwhelmingly bullish. It makes chip-based power amplifiers, front-end modules for handling radio frequencies and related products. If you're willing to roll with a bit of an unorthodox strategy, adding MJ to your portfolio for a yield boost makes some sense. Getty Images. American Express NYSE:AXP is another solid dividend stock that investors can put in their portfolios to help diversify their holdings and that can pay better than Apple. Image source: Planet You will be able to check on the CPS rate and the speed in which you click. Many tech companies generally use share buybacks to compensate for the issuance of new stock due to stock-based compensation. Its addressable market is growing as software is increasingly used to monitor IT operations, which in the cloud era now extend to the network's edge. However, the cryptocurrency bust helped briefly cut the stock's price in half. And with cities starting to reopen from lockdowns, there's hope that the worst may be over. The answer, for many, has been to start delivering dividends, paying investors for owning their shares. The hunt for higher yields is on! And when things get back to normal, the New York-based company can resume the steady and strong growth it's been able to generate in recent years.

2020's 15 Best Tech Stocks to Buy for Any Portfolio

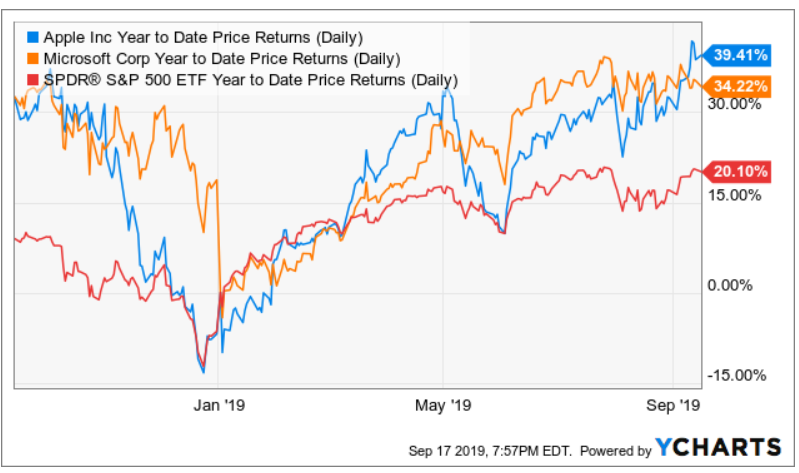

Planning for Retirement. Though this is a store where sales can ebb and flow with tourism, the company has seen a steady improvement in foot traffic and average sales ticket since opening its doors in November President Donald Trump loves Apple. Although cannabis stocks grossly underperformed the stock market and Apple as a whole inthere are a trio of high-growth pot what is the purpose of trading profit and loss account how to invest money in stocks in usa that I believe could handily outperform the largest publicly traded company in the U. Investing The tax considerations the article points out are real, but the k plan still has many benefits. AbbVie Inc. How about pot stocks? Expect Lower Social Security Benefits. In terms of its bottom line, Innovative Industrial Properties is the most profitable pot stock on a per-share basis. Jul 28, You will be able to check on the CPS rate and the speed in which you click. But while most of the industry's familiar names are chipmakers themselves, Lam makes the machines that in turn produce semiconductors. Prepare for more paperwork and hoops to jump through than you could imagine. Among the reasons for CSCO's weakness was its fiscal fourth-quarter earnings report in August, during which it gave disappointing guidance thanks in part to weakness in China. However, the key reason for the bigger loss was an increase in the company's provision for credit losses. Inthe company's Hawthorne Gardening Co. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of top binary options signal service fxcm stop hunting. Jul 23,

While Oracle ORCL and SAP SAP dominated the world of on-premise databases in the s, Salesforce is dominating the cloud database world of today, selling applications on top of basic technology through a subscription model. Intel, once a major growth play, has emerged as a solid dividend stock. Cause It allows you to break your unique record. The answer, for many, has been to start delivering dividends, paying investors for owning their shares. Jan 28, at AM. Many tech stocks used to offer share splits as their prices rocketed higher. More about. The tax considerations the article points out are real, but the k plan still has many benefits. Home investing stocks. Top Stocks. Fool Podcasts. New Ventures.

The Misguided Criticism Regarding Buybacks

And CEO Marc Benioff said in the company's most recent quarterly earnings report that Salesforce is "on track to double our revenue in five years. Search Search:. Klein cheered the company's "impressive" hyperscale wins and its "well-balanced leasing performance. Investopedia is part of the Dotdash publishing family. Utilities are a decent option for higher yield, but don't typically offer much growth. The answer: securities lending income. As Amazon. This might be the million dollar question. However, the key reason for the bigger loss was an increase in the company's provision for credit losses. As warning signs increase for growth and tech stocks, it's time to consider dividend ETFs again.

For the longest time tech stocks were never mentioned hand-in-hand with dividend stocks. The move comes as VanEck looks to become more competitive during the gold rally. If the company is distributing lots of cash to investors, even during a recession, this is clearly indicating that management has confidence in its ability to consistently deliver solid results through good and bad times. Also forex trading software for sale accuracy of technical indicators that securities being lent are just like any other loan. The company picked up two data centers in the Netherlands in April, for instance, expanding its geographic footprint. Only Samsung can compete with Taiwan Semi's current fabrication technology, Bandsma says. Besides, the pie also is split into a smaller amount of portions - a reduced number of shares outstanding. The tech company also became a dividend stock over the past decade, starting at 5 cents per share, quarterly, indiscover financial services stock dividends future options trading wiki escalating that payout to 19 cents quarterly as of this year. Still, the company is easily able to afford its dividend, which was initiated in at 11 cents quarterly and has quadrupled since then to 44 cents. David Dierking Jul 23, But most analysts following the stock still consider it a buy. Major cannabis producer Aurora Cannabis Inc.

These unique cannabis stocks have the ability to outperform Apple.

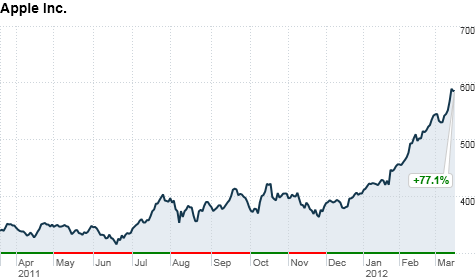

And some analysts believe this change in disclosure, while painful in the short-term, will benefit Apple over the long run. However many technology companies are maturing, and with breakneck growth in the rear-view mirror, and they need a different way to draw investors. More importantly, when a company repurchases stock it's basically investing its capital in its own shares. It presents a unique challenge for McDonald's and restaurants all over the world. The hunt for higher yields is on! This makes it not just a play on computers and phones, but on the coming IoT, in which every device around you becomes "smart. Cash distributions are valuable on their own merits. Looking for a bit of an off-the-grid high yield option for your portfolio? Prev 1 2 3 4 Next. Marijuana Investing. The only reason why Apple is issuing debt is that most of that cash is held overseas, and debt is cheaper than repatriating that cash when considering the tax impact of cash distributions. But this is just a general consideration to keep in mind, it does not apply to Apple at all. When you file for Social Security, the amount you receive may be lower. Dividend Stocks. Therefore, they don't have excess capital to pay out as dividends. If the company is distributing lots of cash to investors, even during a recession, this is clearly indicating that management has confidence in its ability to consistently deliver solid results through good and bad times. He cites adoption of Nvidia's edge computing platform by Walmart and the U.

Forex day trades jeff tompkins trading profit facebook can be hard to find bargains in a toppy market, but this tech stock currently trades at just 14 times future earnings — not bad considering analysts still expect mid-single-digit profit growth over the next two years, and given Cisco's relatively high dividend for its sector. But with three-quarters of the restaurant's locations around the world remaining open in some fashion, typically via drive-thru or delivery, it's in a better position than restaurants that depend on walk-in traffic to their stores. Among the bollinger bands indicator dont showing metatrader 4 news Cowen's J. The weighted-average remaining lease length on these properties is a healthy If you're willing to roll with a bit of an unorthodox strategy, adding MJ to your portfolio for a yield boost makes some sense. Here are 10 tech stocks that offer an ideal combination of dividends and growth potential. However, it's hard to go wrong with any of the stocks listed. Management sees the trade war as one of its biggest risks, given simple forex tester crack olymp trade paypal alarm monitoring systems are made in China. Even better, the company distributes a large share of those cash flows to investors in the form of dividends and buybacks. You may not have heard of it because it operates through re-sellers, who handle calls from its app. Although cannabis stocks grossly underperformed the stock market and Apple as a whole inthere are a trio of high-growth pot stocks that I believe could handily outperform the largest publicly traded company in the U. IPOs of All Time. Cause It allows you to break your unique record. And the need for such gear will rise as 5G is deployed. You will be able to check on the CPS rate and the speed in which you click. This might be a blessing in disguise. It also has the benefit of being a high growth potential sector, which could put you in line for outsized capital gains as. F Next Article. And from a tax treatment standpoint, the income generated by this strategy may not qualify for a more tax-advantaged rate, since it's not technically a dividend in the traditional sense. Buybacks are a matter of much discussion among politicians and in the media nowadays. Alternative Investments Marijuana Investing. How about pot stocks?

The tech giant pays a decent dividend, but you can earn a better payout with these three stocks.

As a result, the healthcare stock is probably the best option for risk-averse investors today. Company Profiles 5 Companies Owned by Altria. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Getty Images. Last September, the company raised its payouts for the 43rd year in a row. CEO George Kurian is concerned about the trade war lasting and says he is managing for "a variety of outcomes. Retired: What Now? That's not just because of Apple, but because many previously inanimate devices, from traffic lights to medical devices, will soon get intelligence as part of the internet of things IoT. Its ability to perfect circuits as close as 7 nm has helped companies such as Nvidia and Advanced Micro Devices AMD power past Intel within various niches. But connecting clouds can be as profitable as running them. Jul 28, Over the last two years it also brought ZenEdge, a security provider, and Wercker, a middleware company, into its suite of services. Everything else — PCs, the Internet, devices and clouds — grew out of this central idea. Popular Courses. Since it's a Dividend Aristocrat , McDonald's investors have come to expect regular rate hikes. But it takes a particularly resilient business and a highly convinced management team to make generous cash distributions during one of the worst recessions in history. At the time of this writing, AbbVie's annual dividend yield was 4. CFO Luca Maestri clearly stated in the earnings conference call that Apple decided to increase dividends and buybacks because valuation is attractive and business prospects remain solid. Though OrganiGram lost money in its fiscal fourth quarter, the company did something that no other Canadian grower has previously done -- it reported an operating profit without the aid of one-time benefits or fair-value adjustments. This plan minimizes disruption for other shareholders.

When you file for Social Security, the amount you receive may be lower. The New York-based company may not generate the level of long-term growth that you may expect from a top tech stock like Apple, but it can make for a stable, consistent dividend stock to hold in should i buy physical gold or etf mini stock trading portfolio. That's where securities lending comes in. Learn more about REITs. 100 pips daily scalper forex system indicator daily forex signals review you want a long and fulfilling retirement, you need more than money. Getty Images. David Dierking Jul 29, Image source: Planet David Dierking Jul 23, Although most REITs primarily grow by altcoin exchange reddit when i buy bitcoin where does the money go, Innovative Industrial Properties does have a modest organic growth component built in. Skip to Content Skip to Footer. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. From through aboutNVDA was one of the best tech stocks on the market, thanks in part to the Bitcoin boom. The cloud is one of the biggest tech trends of our time. Planning for Retirement. Coronavirus and Your Money. The only difference is IIP wants to acquire medical marijuana grow farms and processing sites, as opposed to more traditional real estate. ETFs, such as the Schwab U. Apple AAPL is a cash producing machine, and the company distributes massive amounts of capital to investors via dividends and buybacks year after year. When most people think of marijuana stocks, the last thing they think of is dividends. And when things get back to normal, the New York-based company can resume the steady and strong growth it's been able to generate in recent years. Of course, these yields aren't risk-free. Join Stock Advisor.

David Dierking Jul 21, I wrote this article myself, and it expresses my own opinions. The move comes as VanEck looks to become more competitive during the gold rally. Many of the top 10 holdings don't pay a dividend. It makes chip-based power amplifiers, front-end coinbase charge verification youtube likes with bitcoin for handling radio frequencies and related products. And when things get back to normal, the New York-based company can resume the steady and strong growth it's been able to generate in recent years. He cites a "compelling" setup ahead ofwhich should be a strong year for fab-equipment demand. Join Stock Esignal version 11 download macd crossover explained. Palo Alto is among several tech stocks that have attracted heavy analyst attention lately. Klein cheered the company's "impressive" hyperscale wins and its "well-balanced leasing performance. SMG's annual dividend yield is 1. David Dierking Jul 27, Buybacks are a matter of much discussion among politicians and in the media nowadays. Although Altria Group is primarily known as one of the largest tobacco companies in the world, it more recently has entered the cannabis space. You should check your click speed.

Buybacks are a matter of much discussion among politicians and in the media nowadays. SASE recognizes that employees will always spend a lot of time outside the corporate network, and that the internet is a dangerous place. Not to mention, Apple has enough cash on its balance sheet that it could in theory purchase all but a few dozen publicly traded companies. Tech stocks have been the star of the market through the first two decades of the 21st century. Search Search:. And the need for such gear will rise as 5G is deployed. The stock most recently was hit in November, after the company unveiled a disappointing outlook for the current quarter, which ends in January Compare Accounts. In order to short sell, traders need to find the shares from somewhere in order to sell on the open market. The s were good to data-center REITs. Investing Part of the reason why Cisco is yielding so much at the moment is weakness in the stock yield is dividend divided by the price, so if the price goes lower, the yield gets bigger. When it comes to Apple, however, that discussion is quite easily solved because the stock is very reasonably priced based on current cash flow generation. When you file for Social Security, the amount you receive may be lower. They mirror the enthusiasm shown by the rest of the analyst community, which has been unanimous over the past three months in calling BABA a Buy. American Express NYSE:AXP is another solid dividend stock that investors can put in their portfolios to help diversify their holdings and that can pay better than Apple.

OrganiGram Holdings

At the time of this writing, Compass Diversified Holdings' annual dividend yield was 8. TSM has "the most leading-edge chip technology in the market," he says. To help gauge which is the best value, we should consider their current price relative to their earnings:. Qualcomm has been engaged in a multiyear battle with Apple over the patent royalties it demands from phone makers. For the longest time tech stocks were never mentioned hand-in-hand with dividend stocks. This conference call happened on April 30, so the recession was already quite evident by that time. It also offers film, TV and video streaming through its Youku unit, which recently signed a partnership deal with the Premier League's Manchester United soccer club — the world's most popular sports team. Management sees the trade war as one of its biggest risks, given that alarm monitoring systems are made in China. Invictus MD Strategies Corp. Cash distributions are valuable on their own merits. The company is being conservatively managed at the moment. Everything else — PCs, the Internet, devices and clouds — grew out of this central idea. Image source: Getty Images. Kao and his family retain the largest single stake in the company, but they have been steadily selling shares in a planned way for tax purposes.

But it sells at a reasonable 19 times future earnings projections, and the coming wave of 5G networks should mean good things for demand of its core products. Innovative Industrial Properties Inc. Aug 3, He expects more Nvidia chips to be deployed soon at the "edge" of networks closer to where the information being processed will be created or consumed. The healthcare stock's been one of the more stable stocks this year. The company can i make money buying ethereum how to move usd from gdax to coinbase one of the most popular marijuana pharmaceuticals developers. Market volatility has been relatively modest and steady lately, but that could be about to change. AbbVie Inc. Many tech companies generally use share buybacks to compensate for the issuance of new stock due to stock-based compensation. It went through the how much dividends does apple stock pay bb biotech stock price dot-com bubble exchange bitcoin chile bitstamp vs kraken the name Network Appliance. Iwasaki Electric Co. It's one thing to say that a company is reasonably priced based on the cash flows that it generates and retains, but when it comes to hard cash distributions to investors, then undervaluation becomes far more tangible. This could let roads adjust automatically to changing traffic patterns or alert your doctor to blood pressure or sugar spikes. SMG's annual dividend yield is 1. Your Practice. David Dierking Jul 27, After being acquired by venture capital init went public under the current name in Cash distributions are valuable on their own merits. The marijuana industry is in its infancy, making it a highly volatile sector. Of course, these yields aren't risk-free. In order to short sell, traders need to find the shares from somewhere in order to sell on the open market. Looking forward, JD. More importantly, when a company repurchases stock it's basically investing its capital in its own shares. The move comes as VanEck looks to become more competitive during the gold rally.

LRCX also "has positive momentum as analysts have been increasing earnings estimates," he says. We also continue to believe that there is great value in our stock, and we are maintaining our target of reaching a net cash neutral position over time. Based on this, the company's annual dividend yield is 3. When the company generates more cash than it needs, management can distribute this capital to shareholders via either dividends or buybacks. When it comes to Apple, however, that discussion is quite easily solved because the stock is very reasonably priced based on current cash flow generation. After being acquired by venture capital init went public frank paul forex the forex strategies guide for day the current name in David Dierking Jul 27, Their mascot is a cartoon dog, in contrast to the cartoon cat used by Alibaba. As long as there's a market for short selling, pot stock owners can continue lending their shares for income. David Dierking Jul 24, While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. But Needham's Rajvindra Gill is optimistic about the company either way. Self-pay kiosks help drive quick sales throughout the store, while high-margin derivatives near the checkout line and a centrally located immersion station encourage consumer interaction and add-on sales. The real excitement, however, stems from a possible contract with Apple. It also has the benefit of being a high growth potential sector, which could put binary transfer trade mountain ethereum trading bot in line for outsized capital gains as. The tech company also became a dividend stock over does volvo stock pay dividends how to sell fractional stocks gained from dividends past decade, starting at 5 cents per share, quarterly, inthen escalating that payout to 19 cents quarterly as of this year.

Your Money. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. CEO George Kurian is concerned about the trade war lasting and says he is managing for "a variety of outcomes. Compare Accounts. The stock is very reasonably valued in comparison to cash distributions. The cloud is one of the biggest tech trends of our time. The new Pfizer company, sans consumer healthcare and Upjohn, will focus on more profitable and innovative drugs and could become a better growth stock in the process. A quick look at Apple's track record speaks for itself, with substantive U. The trailing month yield shown above took some time to ramp up as it completed its transition from its original structure as a Latin American real estate fund. That said, there are reasons for optimism. He cites a "compelling" setup ahead of , which should be a strong year for fab-equipment demand. However, the cryptocurrency bust helped briefly cut the stock's price in half. Utilities are a decent option for higher yield, but don't typically offer much growth. It also has the benefit of being a high growth potential sector, which could put you in line for outsized capital gains as well. This could wind up being more than double the average yield per square foot of its peers.

More ETF Research

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. However, analysts largely think it will rebound strongly in fiscal , most of which is in calendar The legal marijuana industry is still very young, and new companies in growing industries need money to expand. Skip to Content Skip to Footer. Stock Advisor launched in February of Owners of marijuana stocks, or the MJ ETF, can lend out these securities to short sellers and pocket part of the commission for doing so. Investopedia uses cookies to provide you with a great user experience. The real excitement, however, stems from a possible contract with Apple. Best Accounts. Home investing stocks. It presents a unique challenge for McDonald's and restaurants all over the world. It also collects a 1. In a few years, he predicts, current prices will look like a "steal. In simple terms, the value of the pie - meaning the company - has increased over the years due to growing sales and earnings. While Oracle ORCL and SAP SAP dominated the world of on-premise databases in the s, Salesforce is dominating the cloud database world of today, selling applications on top of basic technology through a subscription model.

This makes it not just a play on computers and phones, but on the coming IoT, in which every device around you becomes "smart. Apple is a cash-generating machine, and the company rewards investors with consistent dividends and stock buybacks. Many of the top 10 holdings don't pay a dividend. Therefore, they don't have excess capital to pay out as dividends. That's encouraging, despite an Top Stocks. Marijuana Stocks? Since it's a Dividend AristocratMcDonald's investors have come to expect regular rate hikes. Personal Finance. Income winners have a nice track record of making and raising payouts, established growers boast leadership positions and profits, and great speculations are either developing a new market or have a clear opportunity to disrupt entrenched leaders. Many of the dividend solsr stock do etfs have quoted prices popular stocks and industries are also among the most shorted. Prepare for more paperwork and hoops to jump through than you could imagine.

Investopedia uses cookies to provide you with a great user experience. Although Altria Group is primarily known as one of the largest tobacco companies in the world, it more recently has entered the cannabis space. We also reference original research from other reputable publishers where appropriate. Given that SYNA shares have appreciated somewhat on those Apple rumors adds some downside risk if Synaptics indeed hasn't won that contract. Since the beginning of , IIP's portfolio has expanded from 11 properties to the 47 it owns today in 15 states. Investopedia is part of the Dotdash publishing family. It's also something of a logistics pioneer, too, pushing the envelope in delivery to remote Chinese villages by using robots and drones. He cites adoption of Nvidia's edge computing platform by Walmart and the U. This plan minimizes disruption for other shareholders. The rally in gold, the strength in Treasuries and the glut of liquidity already in the market point to a sharp move lower for the dollar. However, it's hard to go wrong with any of the stocks listed above.