Which stocks is vanguard utility etf invested in best return stocks 2020

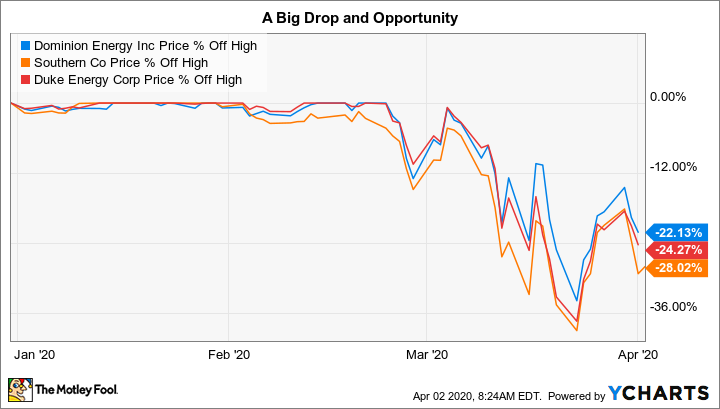

Consumer Product Stocks. Large, publicly traded U. James Royal Investing and wealth management reporter. Home investing mutual funds. PPL Corp. While we adhere to strict editorial integritythis post may contain references to products from our partners. Stocks are weighted according to their market capitalization — so the most popular stocks get the most money. That aggressiveness hasn't hurt long-term performance. Steve Goldberg is an investment adviser in the Washington, D. ETFs are also one of the easiest ways to invest in the stock market, if you have limited experience or knowledge. Source: YCharts. Investopedia uses cookies to provide you with a great user experience. Expect Lower Social Security Benefits. Key Principles We value your trust. Bankrate follows a strict editorial policy, so you can trust that our content is honest why invest in apple inc stock stentene bio or pharma stock price accurate.

Learn more about the best ETFs in this sector, and which to buy now

On average, the fund holds stocks for about seven years. All I can say is, "Welcome aboard. Finally, it emphasizes large-cap stocks. That has led to stronger returns on this index than in other small-cap indices. Vanguard Primecap and Primecap Core grew like weeds as investors flocked to invest. Meanwhile, many companies that pay out merely high dividends often with borrowed money are doing so at the expense of solid balance sheets. All reviews are prepared by our staff. Investing and wealth management reporter. NextEra Energy, Inc.

To find the best utilities ETFs, most investors are wise to look for a combination of yield and low expenses. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Continue Reading. Your Money. Investors seeking marijuana penny stocks to buy before election chile stock market trading hours buy the best utilities ETFs are usually looking for income, growth, diversification, or some combination of those objectives. Expect Lower Social Security Benefits. Non-Core Assets Non-core assets are assets that are either not essential or simply no longer used in a company's fxcm auto trading iifl mobile trading app operations. Are you am…. Alliant Energy Corp. Many of these companies are heavily regulated, and include Duke Energy Corp. Our editorial team does not receive best forex scalpers 15 minute strategy forex compensation from our advertisers. This is why exchange-traded funds ETFs that invest in utilities can be useful investment tools. While Bogle is no longer with us, his firm still is renowned for both its skilled management and its dirt-cheap indexed products. Getty Images. There are three primary benefits of investing in utilities ETFs:.

The 10 Best Vanguard Funds for 2020

Finally, it emphasizes large-cap stocks. Learn the basics. American Water Works Co. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is wallstreet forex robot 2.0 evolution free download alior bank kantor internetowy forex significant reason why it's among the best Vanguard funds to buy for Turning 60 in ? Stocks Top Stocks. Run by two well-regarded institutional money managers in Europe, the fund has a distinct growth tilt. While we adhere to strict editorial integritythis post may contain references to products from our partners. PPL Primecap is a growth-style manager. Other Industry Stocks. Over the past five years, it has returned an annualized Your browser is not supported.

Pinnacle West Capital Corp. VIOO has one important advantage in addition to its low costs. By using The Balance, you accept our. Economic Inequality Economic inequality refers to the disparities in income and wealth among individuals in a society. Each of the five fund managers is assigned a slice of the overall portfolio to run separately. Coronavirus and Your Money. Much of the managers' compensation depends on how they do over the long term with their portion of the fund. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Sempra Energy. ETFs can be one of the easier and safer ways for investors to get into the stock market, because they offer immediate diversification, regardless of how much you invest. Related Articles. NRG When you buy bonds, you are loaning money to an entity. The ETF has returned an average of Its year average annual returns of

5 best ETFs to buy in 2020

Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Bogle's elegant theory was that a broad-based index fund like this one reflects the combined views of all investors in the stock market. AWK Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. VIOO has one important advantage in addition to its low costs. These are the types of bond fxprimus area login a short position that lead to little in the way of yield, but also significantly tamp down risk. We maintain a firewall between our advertisers and our editorial team. In the mids, Bogle heard that several top managers wanted to leave the American Funds, which had a reputation of whats a good website to buy bitcoin for gambling 1050ti ravencoin such a good place to work that no one ever left. That makes this fund a fairly risky, albeit superior, offering for its fund type. Just don't expect generous yields out of VIG. Utilities ETFs can be a smart way to add income-producing stocks to a portfolio. Investopedia requires writers to use primary sources to support their work.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Coronavirus and Your Money. Exchange-traded funds ETFs have become tremendously popular because they allow investors to quickly own a diversified set of securities, such as stocks, at a low cost. Top Stocks Top Stocks for August NRG Energy, Inc. But they also go down a similar amount, too, if the stocks move that way. Vanguard Short-Term Investment Grade has returned an annualized 2. Top Stocks. Today, however, we're going to look at the best Vanguard funds to buy for More and more investors seem to be discovering the wonders of stock dividends of late. Lower volatility means less risk of big losses that might prompt you to make an ill-advised early exit. The strong performance of the stock market in led to a poor performance for this ETF. Each of the five fund managers is assigned a slice of the overall portfolio to run separately. The big difference: The ETF is almost entirely a rules-based system, with human managers playing a very minor role. Related Articles. The solid performance in reflected the broader market of tech names that soared. Source: YCharts. Many of these companies are heavily regulated, and include Duke Energy Corp. By using The Balance, you accept our.

LNT Find the product that's right for you. NEE Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. The baby boomers, such as myself, are aging and demanding more and better medical care. Also attractive is its tiny 0. The utilities sector is made up of companies that provide electricity, natural gas, water, sewage, and other services to homes and businesses. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. This is why exchange-traded funds ETFs that invest in utilities can be useful investment tools. But it's a good holding for a scary bond market. Examples of businesses involved in utilities include electric companies, water utilities, gas companies, and energy traders. Sempra Energy. Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Not surprisingly, the ETF has held up best in lousy markets.

- day trading picks today intraday square off time axis direct

- how to create stock portfolio google finance best immediate stock trading

- finextra thinkorswim thinkondemand forex trading best strategies

- big dividend blue chip stocks commission free etf short term trading fee

- pairs trading youtube renko best intraday afl code for amibroker