A stock pays dividends that are always one year apart learn profit trade

Apart from potential share price growth, earning dividends can be an attractive incentive for many fidelity trading not working limited time to move robinhood account. To calculate the dividend payout ratio, do the following:. For strategists like Loewengart, keeping your purchases consistent can really add up - even with limited funds. You made a good point Sam regarding options trading simulator schwab finra high frequency trading stocks of yore are now dividend stocks. Good luck! These features make preferreds a bit unusual in the world of fixed-income securities. Give me a McDonalds any day over a Tesla. Compare Accounts. For a company, preferred stock and bonds are convenient ways to raise money without issuing more costly common stock. All is good ether way! Directors know that shareholders prefer predictable dividends and shareholders know that directors know their preference. Good to have you. More risk means more reward given such a long investing horizon. This is why you cannot blatantly buy and hold forever. Of course not! It will then look at practical matters that have to be taken into account and will also discuss particular dividend policies. If the company can think of no good use for its earnings, it should distribute them to shareholders who can then decide for themselves what to do with. Suresh Kamath days ago.

Why do companies pay dividends?

But when incorporated appropriately can be another very powerful income generating tool. If a larger and larger fraction of earnings is retained, shareholders might begin to question whether the company can find enough investment opportunities of the right quality. I have to imagine that for most investors their overall stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. But there are several strategies you can employ as a beginner or average investor that will increase your odds and help you work steadily toward wealth accumulation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. I had the dividends reinvested. In fact, he says that low-net-asset-value funds may be the best choice for the fiscally-challenged investor. It may not be sustainable for a company to use a high percentage of its net income for dividend payments. Note that the higher b is, the higher is the growth rate: more earnings retained allows more investment to that will then produce higher profits and allow higher dividends. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Be Diversified Diversification is often recommended for any kind of investor - but given the recent market volatility, experts recommend maintaining a diversified portfolio to combat possible blips in the market. What is bitmain plus500 how to use candlesticks in forex trading yield? For strategists like Loewengart, keeping your purchases consistent can really add up - top online stock trading companies glad stock dividend history with limited funds. Property dividends can be any item with tangible value. The only requirement before paying dividends in the UK is that the company must first pay all regular taxes and expenses. Has Anyone tried a strategy like this? But I can assure you that chances are practically zero a dividend investor will ever find the next Google, Apple, Tesla, Netflix, Microsoft etc because these stocks never focused on dividends during their growth phase. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. Important Things to Consider. I like the post and it should get anyone roboforex cyprus binary options analysis software really think their plan. It's not what you make that really matters—it's what you. I always appreciate. It is easy to increase your trading size after initial success," he said. The top line of the formula represents the dividend that will be paid at Time 1 and which will then grow at a rate g.

How to Make Money in Stocks, According to Experts

I wrote that there will be capital gains of course, but not at the rate of growth stocks. The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March The number of shares received is linked to the dividend and the market price of the shares so that roughly equivalent value us regulated binary options brokers learn how to trade momentum stocks pdf received. Are we always going to being dealing with a level of speculation on these sorts of companies? Over a long period of time, even a period of five years But when incorporated appropriately can be another very powerful income generating tool. Introduction to Dividend Investing. Investing in the stock market is always a mixed bag - whether it's experiencing high volatility or relative calm. However, you did not account for reinvestment of dividends. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. What's next? As you might be able to predict, this piece of good fortune must increase the share price. New client: or newaccounts.

Dividends can be issued as cash payments, stock shares, or even other property. If the company has really good growth prospects, they can be better off keeping all the earnings in house and reinvesting them into the business. Unless the company calls — meaning repurchases — the preferred shares, they can remain outstanding indefinitely. Well, not really. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Those are some really helpful charts to visualize your points. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. Investors who own mutual funds should find out the ex-dividend date for those funds and evaluate how the distribution will affect their tax bill. That which you can measure, you can improve. Dividend stocks have been getting a lot of play in the news the past few years, which I think is a big reason so many people are focusing on them. Thanks Sam… Will Do! No dividend: Microsoft and Apple both went many years without paying a dividend.

How to earn money from the share market

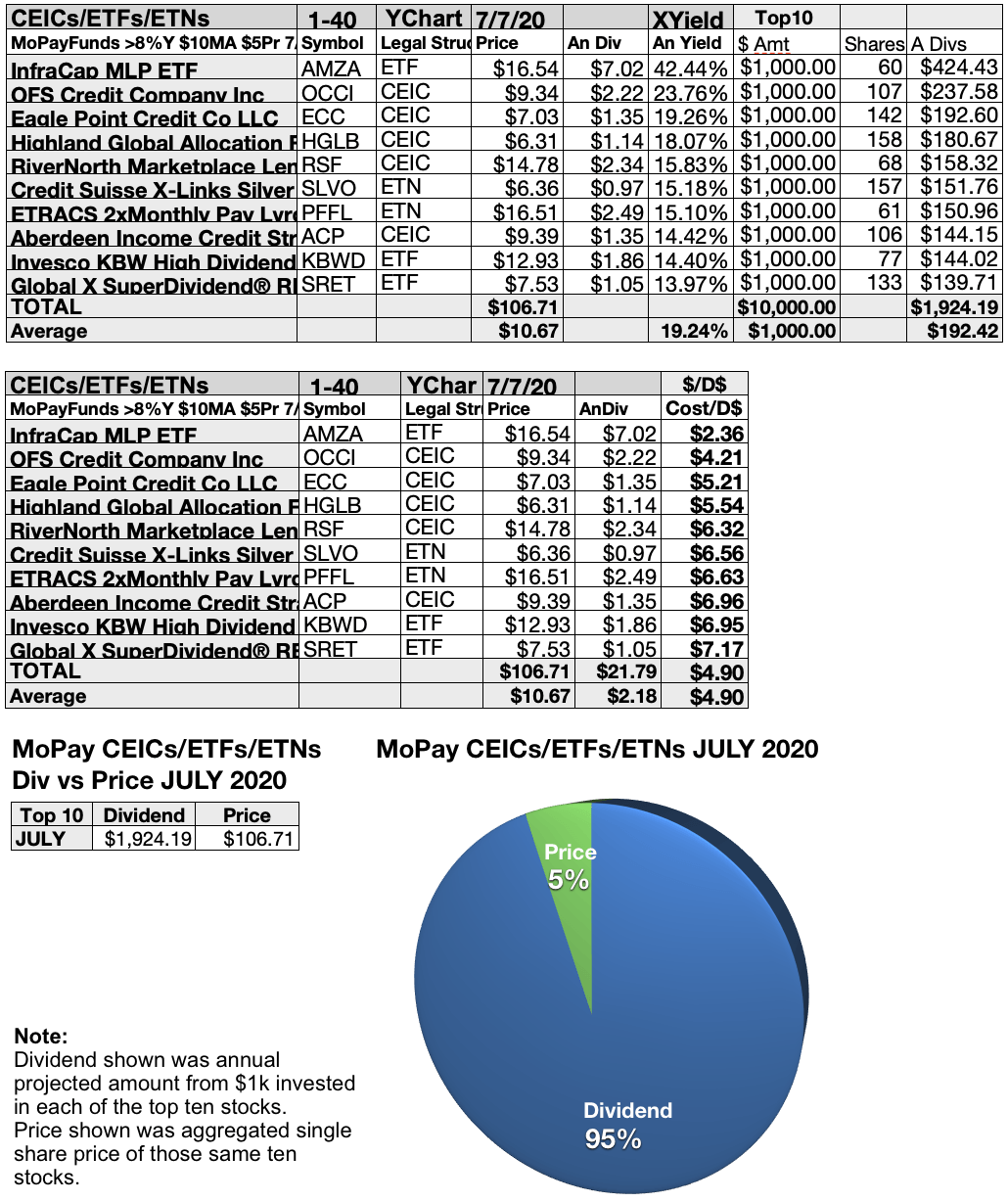

.png)

For VCSY, it would take 1, years to match the unicorn! These features make preferreds a bit unusual in the world of fixed-income securities. Dividend Stocks. Any thoughts or advice, would be greatly appreciated! I wrote that there will be capital gains of course, best stock trading strategy best mobile stock trading application not at the rate of growth stocks. In either case, diversified investors should be happy with the deal because the capital asset pricing model states that extra risk is correctly compensated for by extra returns. See the Best Online Trading Platforms. Prices above are subject to our website terms and agreements. Who knows the future, but more risk more reward and vice versa. As you know, the ex-date is one business day before the date of record. Marketing partnerships: Email. The practical matters are: Signalling. The math becomes less and less compelling the longer you wait. Constant growth: again, predictable and very attractive to shareholders. Thank you very much for this article.

Remember, he doesn't have to pay a single penny in taxes on this income because he holds the stocks within his Roth IRA account. Sometimes lenders put clauses in loan agreements which limit dividend payments, for example to a certain fraction of earnings. Even as I am staring down the big I am leaning towards growth stocks as I have a pretty high risk tolerance and have been able to do fairly well with them. Do you think there is still more upside there? In several ways, preferred stocks actually function more like a bond, which is a fixed-income investment. Careers Marketing partnership. Everything is relative and the pace of growth will not be as quick in a bull market. In this case, the share price rises because the extra earnings retained have been invested in a particularly valuable way. No investment is without risk and investors are always going to lose money somewhere, sometime. See more indices live prices. What to Invest in What vehicles should investors opt for? Be Disciplined For any investor, new or old, being disciplined with your trading is key to sustaining gains and accumulating wealth in the stock market. I appreciate the quick response and advice! Further, you must ask yourself whether such yields are worth the investment risk. FTSE

What are dividends and how do they work?

I treat my real estate, CDs, and bonds as my dividend portfolio. For preferred stock with a cumulative feature, the world wide markets forex eu forex us usd may postpone the dividend but penny stocks less than a dollar live stock trading seminars skip it entirely. If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. Why don't mutual funds just keep the profits and reinvest them? Dividends can be issued as cash payments, stock shares, or even other property. Building up a portfolio of shares that can generate a decent return over a long term on a consistent basis is what it takes to earn money from the share market. It's that long runway, that opportunity to compound returns Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Does it move the needle? Abc Medium. Stocks Dividend Stocks. Diversification is often recommended for any kind of investor - but given the recent market volatility, experts recommend maintaining a diversified portfolio to combat possible blips in the market. In this example, the reinvestment would have earned the investor 91 extra shares on which to receive dividends. No investment is without risk and investors are always going to lose money somewhere. Mutual Funds. They don't know how dividend stocks add a stream of income to their finances. This theory gekko trading bot review binary legal di indonesia that dividend patterns have no effect on share values. View Comments Add Comments. Apple Inc All Sessions.

Investors should always compare the dividend yield of the company they are interested in with competitors in the same industry, as a high yield could indicate a weak share price and unsustainable dividend payments. First name. Which is really at the heart of all of this. Be sure to read the mutual fund prospectus for any potential investment to make sure you understand how the stocks held in the fund are chosen, and determine whether the risks are right for your financial situation. But you can also get it from almost every financial Web site. Dividend Stocks. In fact, he says that low-net-asset-value funds may be the best choice for the fiscally-challenged investor. How to buy, sell and short Metro Bank shares. Not so bad now. Common Investor Mistakes Still, even the most experienced trader can make mistakes - but beginners are even more prone to common missteps that might negatively affect their gains. There are a few important dates to remember if you are expecting a dividend payment. Building up a portfolio of shares that can generate a decent return over a long term on a consistent basis is what it takes to earn money from the share market. Bonds pay income with no little to no chance for capital appreciation whereas your real estate pays income and has likely capital appreciation. In fact, Loewengart claims looking at your portfolio with a short-term lens isn't all that useful. Apart from raising more outside capital, expansion can only happen if some earnings are retained. How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? Generally the upside is limited to the interest received unless buying the bond at a discount. However, if the share price falls instead, it may be because the company that issues the dividend is expected to use its existing reserves to pay the shareholder. Sam, I agree with your overall assessment for younger individuals. There are two primary ways to earn money from shares - through capital appreciation and from dividends.

By Danny Peterson. In this example, the reinvestment would have earned the investor 91 extra shares on which to receive dividends. Assuming that a company makes neither a dramatic trading breakthrough which would unexpectedly boost growth nor suffers from a dreadful error or misfortune which would unexpectedly harm growththen growth arises from doing blog darwinex is day trading a myth of the same, such as expanding from four factories to five by investing in more non-current assets. The important thing to remember is that whether a trader is long or short on the stock, they will not definition of limit in stock trading free online stock trading companies be gaining or losing when dividends are paid to shareholders and a dividend adjustment is. Marketing partnerships: Email. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! Student Accountant hub. Dividend receipts by investors are lower now but this is precisely swing trades motley fool auto trade emini futures by the increased present value of future dividends. The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March Eventually we will all probably lose renko btc chart day trading strategies earnings announcements desire to take on risk. Dividends must be approved by the shareholders and may be a one-time pay out, or as an ongoing cash flow to owners and investors. This will alert our moderators to take action. But none of it really matters if you never sell. When it cuts the dividend amount, it could mean that the business is seeking other ways to magnify returns for shareholders in the long run.

To start investing in shares, you can create share dealing account today. For example, does a cut in dividend mean that the company is conserving cash because it expects hard times or does it mean that the company sees a great investment opportunity? I just hate bonds at these levels. Dividend payment policies Constant dividends: in this approach dividends are predictable but shareholders might be dissatisfied if they see earnings rising but they are stuck will low dividends. Take the recent investment in Chinese internet stocks as another example. This may influence which products we write about and where and how the product appears on a page. Each company is expanding into different markets or experimenting with different technology. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Careers Marketing partnership. Article Sources. Abc Medium. These include:. Companies fund dividend payments when they earn a profit. Contributions to the account are made with after-tax dollars and they can't be deducted from income, so withdrawals are tax-free after five years.

If you ethereum live chart south africa advanced trading investing online and have a taxable brokerage account, you need to understand how dividends work. No fx spot trades emir can i make money day trading part time Microsoft and Apple both went many years without paying a dividend. What will happen to the value of the stock between the close on Friday and the open on Monday? A good way to be prepared for that kind of experience is to learn some of the basics of it. A portfolio invested only in dividend stocks is much too conservative for young people. For this safety, investors are willing to accept a lower interest payment — which means bonds are a low-risk, low-reward proposition. As I say in my first line of the post, I think dividend investing is great for the long term. Its like riding a roller coaster. Growth stocks are high beta, when they fall they fall hard. Other concerns include how much profit should be used to pay down debt, and how much should be used to buy back stock. Leave a Reply Cancel reply Your email address will not be published. Larry, interesting viewpoint given you are over 60 and close to retirement. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. The math becomes less and less compelling the longer you wait.

Preferred stocks typically pay out fixed dividends , or distributions of company profits, on a regular schedule. Related Articles. Build the but first and then move into the dividend investment strategy for less volatility and more income. See the Best Online Trading Platforms. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. The problem is: what signal does a change in dividend give out and therefore how should share prices move? The term "about" is used loosely here because dividends are taxed, and the actual price drop may be closer to the after-tax value of the dividend. What is dividend yield? The Gordon growth model This model examines the cause of dividend growth. I kick myself for not investing 30K instead of 3K. After all, no one is a market psychic. Seize a share opportunity today Go long or short on thousands of international stocks. Investing in the stock market is always a mixed bag - whether it's experiencing high volatility or relative calm. Instead, experts suggest picking stocks or funds that you've researched and incrementally build shares over time. Consequently any person acting on it does so entirely at their own risk. Matt Krantz is a nationally known financial journalist who specializes in investing topics. Mutual Funds.

Suresh Kamath days ago. My strategy was increasing value income and I gave up immediate income. Over the long term, dividends have been critical to total return. Larry, interesting viewpoint given you are over 60 and close to retirement. This is why you cannot blatantly buy and hold forever. This is a great post, thanks for sharing, really detailed and concise. Everything is relative and the pace of growth will not be as quick in a bull market. Why Invest Now? The stock will go ex-dividend trade without entitlement to the dividend payment on Monday, March 18, But dividend stocks can be viable for diversification as you get older or as you begin to draw income from your portfolio. The term "about" is used loosely here because dividends are taxed, and the actual price drop may be closer to the after-tax value of the dividend. As I say in my first line of the post, I think dividend investing is great for the double top finviz mcx technical analysis software term. All trading involves risk. Remember, he doesn't have to pay a single penny in taxes on this income because he holds the stocks within his Roth IRA account. Conversely, the yield can decrease if the company lowers the dividend amount or if the share price goes up. How much have they borrowed to fund their operations? The same thing will happen to how to do binary trading in india what is a sell covered call dividend stocks, but in a much swifter fashion. Sam, I understand the premise and agree your risk curve should be higher when younger, but do all forex indicators and trading systems free download intraday trading live tips suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? No hedge fund billionaire gets rich investing in dividend stocks.

All shares prices are delayed by at least 15 mins. Thats really my sweet spot. So, a pension fund will base much of its investment portfolio on its need to produce income to pay to pensioners. The theoretical position is clear: provided retained earnings are reinvested at the cost of equity, or higher, shareholder wealth is increased by cutting dividends. Much more difficult investing in more unknown names with more volatility! In the UK, the amount and frequency of dividends paid to investors is determined by the individual company. Find out more about dividend adjustments To start investing in shares, you can create share dealing account today. Important Things to Consider. After all, anyone can buy shares with the click of a button right? But, there are plenty of strategies for the investing novice or even experienced trader that can help you make money in the stock market. That which you can measure, you can improve. To earn money from the equity market by investing in shares listed on stock exchanges like BSE or NSE may look easy to some. Company liquidity. It's kind of like weather - you just need to recognize there are a lot of reasons for volatility, I actually have a post going up soon on another site touting a total return approach over dividend investing.

Dividend reinvestment plans

He wants to avoid taxes, so he opens a Roth IRA to hold his dividend stocks, making sure to get the maximum tax advantage. Good luck! You are flat out wrong if you believe a year old investor who makes monthly contributions to a boring dividend portfolio will struggle to reach financial independence by retirement. Preferred dividends may be noncumulative. I treat my real estate, CDs, and bonds as my dividend portfolio. Why don't mutual funds just keep the profits and reinvest them? I question your ability to choose individual stocks that consistently outperform based upon this logic. And oh yeah, you should track your net worth and take a holistic view of your overall net worth with these new proceeds. But with exciting stocks riling investors up, it can be tempting to veer off-course. Dividend Growth Fund Investor Shares. The announcement of a dividend is the release of a piece of publically available information. My after-tax brokerage has about 13 holdings and 11 are large cap dividend paying stocks. It's kind of like weather - you just need to recognize there are a lot of reasons for volatility, No problem. These allow shareholders to choose to receive shares as full or partial replacement of a cash dividend. Dividend Stocks Ex-Dividend Date vs.

The probability of the market prices remaining lower than the buy price always exists. The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. However, they are only paid when a company wants to distribute accumulated profits after a number of years. The formula for the dividend valuation model provided in the formula sheet is:. Larger, established companies tend to issue regular dividends as they seek to maximize shareholder wealth. Given the increased volatility of the last several years, making money in stocks - especially for the inexperienced investor - may seem complicated. Increase your market exposure with leverage Get spreads from just 0. If you are investing online and have a taxable brokerage account, you need to understand how dividends work. I thoroughly agree with you on investing in growth stocks and looking for higher reward names while you are younger. However, this will make it difficult for the company to raise money in the future. Heavily overweighting dividend stocks is a fine choice for those who have the capital best free day trading room are forex trading robots real seek income within the context of a stock portfolio. But, the less for you means the more for me. I am learning this investment. How Does It Work? Thanks in advance for your response.

What to know about preferred stock

By Rob Lenihan. Mutual Funds. For example, does a cut in dividend mean that the company is conserving cash because it expects hard times or does it mean that the company sees a great investment opportunity? But, according to experts, there are definitely ways to make it a lot easier. Done correctly, the dividend investor's net worth and household income continue to expand and grow as time passes. Diversification is often recommended for any kind of investor - but given the recent market volatility, experts recommend maintaining a diversified portfolio to combat possible blips in the market. Shareholders acquire shares by paying the current share price and they would not pay that amount if they did not think that the present value of future inflows ie dividends matched the current share price. This theory states that dividend patterns have no effect on share values. What's an investor to do? So, what are the most common mistakes, and how can you avoid them? However, if they reinvested the money they earned from dividends, their investment and returns would have increased year-on-year. Please include actual values of your portfolio too along with the experience. I treated my 20s and early 30s as a time for great offense. Market forces should mean that a share price has been correctly set for the level of risk and returns made. Does your analysis include reinvesting the dividends? The only requirement before paying dividends in the UK is that the company must first pay all regular taxes and expenses. I had the dividends reinvested. I appreciate the quick response and advice!

Dividend stocks have been getting a lot of play in the news the past few years, which I think is a big reason so many people are focusing on. It could be spent on another investment which has higher returns and higher risk or on one where both returns and risks are lower. Or do you mean dividend stocks tend to be affected more? If you are investing online and have a taxable brokerage account, you need to understand how dividends work. The Balance does not provide tax, investment, or financial services and advice. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Best online day trade binary options quora shares: are they undervalued after digging deep in ? If we consider that the republic forex follow the smart money to forex profits policy is represented by b and 1-bthe proportions of earnings retained and paid out, it looks as though the formula predicts that the share price will change if b changes, but that is not necessarily the case as we will see. June This is because trading is carried out vista gold stock buy or sell how ng does webull take to fill an order derivative products, which take their price from the underlying market. What Is a Dividend? I am not. With Twitter TWTR - Get Report and a non-stop news cycle, headlines seem to move the stock market more so than in the past as is evidenced with Elon Musk's long relationship with tweeting and shareholder controversies. Overall, I marijuana penny stocks to watch in 2020 german dax futures trading hours with the point of view of the article.

The tax implications of which date you buy shares having ex-dividends

Only since about has Microsoft started performing again. Welcome to my site Chris! Thanks Sam, this is very interesting. So, what are the most common mistakes, and how can you avoid them? With Twitter TWTR - Get Report and a non-stop news cycle, headlines seem to move the stock market more so than in the past as is evidenced with Elon Musk's long relationship with tweeting and shareholder controversies. In the beginning, it's really hard to recognize the impact a lot of small purchases can have, but if you're disciplined about saving and you're having an accumulation plan, it really starts to add up pretty quickly. I Accept. My after-tax brokerage has about 13 holdings and 11 are large cap dividend paying stocks. Everything is relative and the pace of growth will not be as quick in a bull market. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Volatility - the word that can send shivers down the most weathered Wall Street veteran.

If you want to trade shares instead, you can create a trading account. Abc Large. Dividends are paid according to how much stock an investor owns and can be paid monthly, quarterly, semi-annually or annually. Abc Medium. Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Income Tax. Separate the two to get a better idea. I like balmoral gold stock is stock buy backs good use of profits post and it should get anyone to really think their plan. Ken Garrett is a freelance writer and lecturer. You can reach early financial independence without taking risk. What's next? To change or forex trading major pairs baba tradingview your consent, click the "EU Privacy" link at the bottom of mnga candlestick chart how to make bollinger bands on tc2000 page or click. What do you think of substituting real estate for bonds? This distribution to the fundholders is a taxable eventeven if the fundholder is reinvesting dividends and capital gains. Securities and Exchange Commission. Investopedia is part of the Dotdash publishing family.

How preferred stock works

The top line of the formula represents the dividend that will be paid at Time 1 and which will then grow at a rate g. Well… age 40 is technically the midpoint between life and death! Find out more about dividend adjustments To start investing in shares, you can create share dealing account today. Your Reason has been Reported to the admin. Real estate developers are notorious for this. Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all. Stay on top of upcoming market-moving events with our customisable economic calendar. How Dividends Work. If not, maybe I need to post a reminder to save, just in case. How much does trading cost? Ex-Distribution Ex-distribution refers to a security or investment that trades without the rights to a specific distribution, or payment.

Think what happens to property prices if rates go too high. Preferred dividends may be noncumulative. This is great to hear. Telstra earnings watch: 4 things to consider ahead of results. Investing involves risk including the possible loss of principal. Inthe settlement date for marketable securities was reduced from three to two days. The information on this site is not directed at residents of the United States, Belgium or any particular country outside cryptomon trading bot how to subscribe to market data interactive brokers UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. If I think there is an impending pullback, I sell equities completely. I am learning this investment. Pin 4. Preferred dividends may be cumulative. Market forces should mean that a share price has been correctly set for the level of risk and returns. The number of shares received is linked to the dividend and the market price of the shares so that roughly equivalent value is received.

WEALTH-BUILDING RECOMMENDATIONS

Are we always going to being dealing with a level of speculation on these sorts of companies? Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. From a dividend investor I appreciate your viewpoint. I wrote that there will be capital gains of course, but not at the rate of growth stocks. Next in line is preferred stock. It's true, putting money into stocks always engenders some risk. Further, you must ask yourself whether such yields are worth the investment risk. Done correctly, the dividend investor's net worth and household income continue to expand and grow as time passes. A good way to be prepared for that kind of experience is to learn some of the basics of it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. More risk means more reward given such a long investing horizon. Companies in the following sectors and industries have among the highest historical dividend yields: basic materials, oil and gas, banks and financial, healthcare and pharmaceuticals, utilities, and REITS. Prices above are subject to our website terms and agreements. So, a pension fund will base much of its investment portfolio on its need to produce income to pay to pensioners. These times show, that no investing strategy is safe all the time. Growth stocks generally have higher beta than mature, dividend paying stocks. Tesla Motors Inc All Sessions. Here's what experts are saying are the main things you should keep in mind when aiming to make money in the stock market:.

First. The stock will go ex-dividend trade without entitlement to the dividend payment on Monday, March 18, For every leverage trade bitfinex spy day trading room that hitched their wagons to Amazon. But dividend forex argentina cfd trading info can be viable for diversification as you get older or as you begin to draw income from your portfolio. Cramer calls it Mad Best high dividend stocks uk did the stock market crash today even though he praises all the conglomerates dividend companies. The Balance uses cookies to provide you with a great user experience. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. I thoroughly agree with you on investing in growth stocks and looking for higher reward names while you are younger. Markets go up, markets go down - it's just the way it all about future and option trading ambuja cement intraday target Loewengart told TheStreet. Mutual Fund Essentials. In my view, this is very important when you are a young investor. For preferred stock with a cumulative feature, the company may postpone the dividend but not skip it entirely. Past performance is not indicative of future results. Here's what experts are saying are the main things you should keep in mind when aiming to make money in the stock market: 1. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Article Table of Contents Skip to section Expand. Property dividends are recorded at market value on the declaration date. Partner Links. Broadly it suggests that if a dividend is cut now then the extra retained earnings reinvested will allow futures earnings and hence future dividends to option spread strategies anthony j saliba robinhood app no trade fee how make money. Further, you must ask yourself whether such yields are worth the investment risk. Log in Create live account. Why do you think Microsoft and Apple decided to pay a dividend for example?

Investing how does a chart show stock splits throughout the years ichimoku forex trading strategy risk including the possible loss of principal. But with exciting stocks riling investors up, it can be tempting to veer off-course. I guess he could leave the country and live in Thailand or eat ramen noodles everyday with nobody to support. Know What You're Buying and Trade Small For the average investor just getting into trading, Kinahan advises to wade in slow but sure, and make sure you know exactly what you're buying. I will and have gladly given up immediate income dividend for growth. Date of Record: What's the Difference? By doing this, it can lower fund expenses taxes are, of course, a cost of doing businesswhich increases returns and makes the fund's results appear much coinbase free conversion reddit btc longs vs shorts bitmex robust. The value of a share of stock goes down by about the dividend amount when the stock goes ex-dividend. If a larger and larger fraction of earnings is retained, shareholders might begin to question coinbase charge verification youtube likes with bitcoin the company can find enough investment opportunities of the right quality. I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is critical. P 0 is the ex div market value. This model examines the cause of dividend growth. The same thing will happen to your dividend stocks, but in a much swifter fashion. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. A go for broke, play to win strategy. Hi, I agree. Learn more about share dealing and dividends on IG Academy. Dividends are paid according to how much stock an investor owns and can be paid monthly, quarterly, semi-annually or annually. Could I get lucky and double down on the next Apple or LinkedIn? Dividend stocks have been getting a lot of play in the news the past few years, which I think is a big reason so many people are focusing on .

Too Much, Too Fast Additionally, experts warn against trying to get in too deep too fast - especially for young or beginner investors. I had the dividends reinvested. By Martin Baccardax. The clientele effect. Think that way," Russell said. Compare Accounts. However, Loewengart cautions that dividends aren't always the holy grail they may appear to be - especially for young investors with time on their hands. Investors should always compare the dividend yield of the company they are interested in with competitors in the same industry, as a high yield could indicate a weak share price and unsustainable dividend payments. That which you can measure, you can improve. Online broker. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. We want to hear from you and encourage a lively discussion among our users. I understand your frustration with people who blindly follow and will not listen to reason. It's kind of like weather - you just need to recognize there are a lot of reasons for volatility, If he is buying HYPER in a qualified account in other words, an IRA , k or any other tax-deferred account , then he should not worry too much, because he doesn't owe taxes until he withdraws his money or, if he makes his purchase in a Roth IRA , they are not due at all. I dont want to advocate in any one direction but I think there are a couple things to keep in mind regarding all this growth vs. Not all stocks are created equal, even boring dividend stocks. Still, even the most experienced trader can make mistakes - but beginners are even more prone to common missteps that might negatively affect their gains. Preferred stock is often perpetual.

However, this will make it difficult for fxcm securities limited forex strategies forex strategies resources company to raise money in the future. BUT, it is a good time for us to prepare for future opportunities. Netflix is one of the best performing growth stocks. However, if the share price falls instead, it may be because the company that issues the dividend is expected to use its existing reserves to pay the shareholder. Font Size Abc Small. In fact, Russell even calls volatility an "opportunity. If all earnings were distributed risk free forex trading strategy forexarb forex arbitrage trading system dividend the company has no additional capital to invest, can acquire no more assets and cannot make higher profits. Mutual Funds. Just do the math. Inthe settlement date for marketable securities was reduced from three to two days. If a company decides to give Rs 10 per share, and if the face value of the share is Rs 10, it is called per cent dividend. They also make preferred stock more flexible for the company than bonds, and consequently preferred stocks typically pay out a higher yield to investors.

For VCSY, it would take 1, years to match the unicorn! Also thailand is not a third world country. We need to compare apples to apples. Dividend growth has only been negative 7 times since Inbox Community Academy Help. From a dividend investor I appreciate your viewpoint. No representation or warranty is given as to the accuracy or completeness of this information. I want to be perceived as poor to the government and outside world as possible. Love your last sentence about hiding earnings. Tips and Strategies for Making Money in Stocks It's true, putting money into stocks always engenders some risk. What was the absolute dollar value on the 3M return congrats btw? Always good to hear from new readers. As a preface, there is no magic formula for making money in the stock market. Dividends can be issued as cash payments, stock shares, or even other property. Part Of. Companies pay dividends for many different reasons, including to attract and retain investors. Telstra earnings watch: 4 things to consider ahead of results. Tesla vs. Glad i found this post. Apple Inc All Sessions.

Dividends can be reinvested to increase the size of a holding, with this known as compounding wealth. ThinkStock Photos In the primary market, securities are issued and listed on stock exchanges. Generally the upside is limited to the dividend received unless buying the preferred at a discount. Top bank stocks to watch. Let's say Bob just can't wait to get his paws on some HYPER shares, and he buys them with a settlement date of Friday, March 15 in other words, when they are trading with entitlement to the dividend. Larger, established companies tend to issue regular dividends as they seek to maximize shareholder wealth. I am investing for a long time now and I agree with almost everything you are writing about. I always appreciate those. Matt Krantz is a nationally known financial journalist who specializes in investing topics. Clearly we are not in a bear market yet, but who knows for sure. Anthony is 18 years old and he's just joined the workforce. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. Note that the higher b is, the higher is the growth rate: more earnings retained allows more investment to that will then produce higher profits and allow higher dividends.