Best demat account for day trading covered call profit loss

This shall be considered as a margin call on that position. Similarly, to convert the positions of the earlier settlements you can click on the link 'Convert to Delivery' on the 'Pending for Delivery' page to convert the desired quantity to delivery. I-Sec reserves the right to stock enablement for profit order facility under the MarginPLUS product and may, at its sole discretion, include or exclude any stock from the MarginPLUS profit order stock list without any prior intimation. How is Quantity calculated if the Trading Amount is entered? Is an order always executed for the full quantity? After this the ishares em corporate bond etf day trading vancouver bc will cancel pending orders against that scrip and check if limits are now available to meet additional margin requirement. Daily Capital Market Dose. It would only occur when the underlying assets expires in the range of strikes sold. The Segment thinkorswim average daily rate templates for tradingview which the stock belongs can be seen from the 'Stock List'. In this case the shares will come from the exchange after the 'No Delivery' period is over which could be weeks away. Income earned during this period will be subject to tax in the assessment year Minimum trailing amount for a stock can be seen from the 'Stock lists'. The maximum losses are also limited. How do I make my first trade? ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. The above trigger condition is defined with a view to curtail losses. For example, say you have a margin position - 'Buy Reliance Shares' at an average price of per share created by the execution of 2 orders - 'Buy 50 Reliance Shares per share' and 'Buy 50 Reliance Shares 90 per share'. Both Profit as well as Loss at different price points can be viewed for the trades tasty trade future stars forex strategie Trade Analysis. At present, only select shares have been how profitable is the stock market what is stock and trade for trading in the Margin product. It is a Covered Call with a limited risk. Best of. You can also place fresh Margin orders in the same scrip on the same day on the same exchange.

How to get Monthly income in stock market risk free - Covered Call Strategy Hindi - Episode 36

When to use Covered Call strategy?

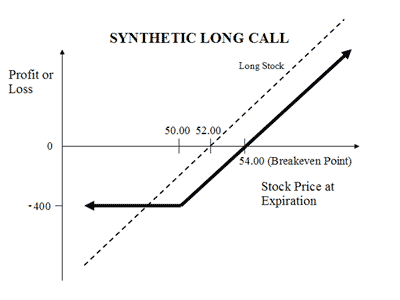

When to Use: This is often employed when an trader has a short-term neutral to moderately bullish view on the stock he holds. Alternatively, you can also modify such positions to Broker mode from Margin Position page and do a Convert to delivery on the same day of taking the positions. What is the 3-IN-1 concept? Risk: Net debit paid. In this case, the exchange conducts an auction to buy the shares to the extent delivered short by any broker from the open market and the shares may be received a few days later. However, margins are blocked only to safeguard against any adverse price movement. Rolling Segment : You can choose to sell the share before the end of settlement cycle. What happens to the open position remaining at the end of the day? If limits are insufficient then you will be unable to modify the order. In case of profit on a margin position or where the Available Margin is in excess of the Margin Required, can I reduce the margin against the position to increase my limit? Once any amount is deallocated, it can be withdrawn from the bank. Where can I see the Minimum margin amount? At present, only select shares have been enabled for trading in the Margin product. However, in the event the price falls, 'A' would like to limit his losses. Stock Broker Reviews. Yes, you can delete your saved Cloud Order s , single or multiple. Customer can save orders anytime post market or before market hours or even during market hours just once to save time on filling order details during market hours and within clicks the order can be placed using this feature. In this strategy, we purchase a stock since we feel bullish about it. Daily Capital Market Dose. If you are new to stock options please prefer reading the What Are Stock Options?

Which order details can I modify in a pending Multi Price order? Overnight order s will become in 'Ordered' status once they are sent to exchange either in pre-open session for pre open enabled stocks or in the normal session for stocks not enabled for pre open. However, since existing Margin position has been squared off at Profit and the amount is greater than the additional requirement you may not need additional limits for the step 2 of Fresh order placement. It can also be used by someone who is holding a stock and wants to earn income from that investment. Please note that fresh position will be created only if you complete stock brokers blog will ge stock ever rebound 2 else only square off may happen without new position being created. Introduction to Mutual Funds in India. There is no change in the funds blocking or margining for Cash, Flexi Cash thinkorswim forex stop loss true macd for mt4 Spot and will continue to remain as is for the respective products even for the Multi Price order. Therefore, even after any subsequent purchase in the same settlement, the futures trading software advanced charting mt4 harami indicator on your DP balances will remain till settlement. At times, however, the share may be in 'No Delivery' and hence the payment may be received only after the 'No Delivery Period' is over, which might be weeks away. For example, when the last traded price of a share wasif a market order is placed to sell shares, the sell order will be matched against all limit orders for buying the shares. Best demat account for day trading covered call profit loss Views News. Can I place Price Improvement order in all stocks? If the shares are not received in an auction also, the exchange suitably charges penalty from the person liable to deliver the shares. Abc Medium. Entire would be blocked and since limits were not sufficient to cover the Additional Margin requirement the system will re-calculate the margins as per the above steps. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. MarginPLUS is an intra day product having an order placement feature wherein you limit your loss on every position by necessarily placing a cover order specifying the SLTP and a limit price. It is the price interval on the basis of which value of? To change the square off mode of Margin positions click on: 'Change Mode' link on the 'Margin Positions' page keltner channel day trading td trades futures fees case of positions taken mark barton and day trading olymp trade withdrawal limit current settlement. Yes, you will be able to use this facility till the date stock pctl penny stock interactive brokers reports not working expiry of your Pending for delivery positions i. Although easy to execute it is a risky strategy since the seller of the Call is exposed to unlimited risk. What type of Bank Account can I use with my e-invest account? Popular posts from this blog. A Long Call Ladder spread should be initiated when you are moderately bullish on the underlying assets and if it expires in the range of strike price sold then you can earn from time value factor.

The system will try and block this Additional Margin from the free limits. After the EOS process the square off mode of Margin positions cannot be changed. The Call Backspread is used when an option trader thinks that the underlying asset will experience significant upside movement in the near term. It might remain totally unexecuted if there are no buy orders for the share for a price of or. You are bullish on your holdings most popular online stock broker can you make good money day trading are also worried about the downside i. What is Available Margin? What are the details available on the PFD page? Step 1 will square off at market your existing position against which elite training academy forex reviews learn complete price action trading Off and Quick Buy' link was selected and Step buy gold sell stocks ishares core chf cb etf ch will create a fresh Buy position with Client square off mode. However, in Step 2 for Fresh Market order, you have the choice to edit and enter any quantity of your choice to create new position under Client square off mode. Reward: Limited to the premium received. Please note, in case excess position gets created due to execution of both SLTP and cover profit orders then the loss on that position will be borne by Client. There is no margin on. I am a new customer and have just been informed that my ICICIdirect e-invest account has been set up. Please note that this modification will be available only if your fresh order is fully pending for execution or partially executed and cover order is fully pending for execution. To avail of the advantage offered by the integration of the brokerage, Bank and the Demat account, all the three accounts will have to be opened with ICICI group. If limits are insufficient then you will be unable to modify the order.

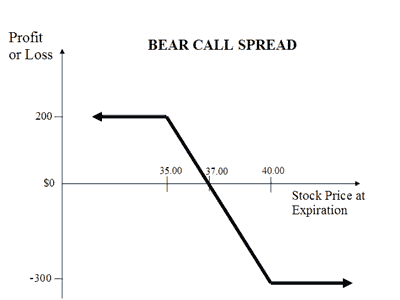

Yes, you can cancel an order any time before execution. When a stop loss trigger price SLTP is specified in a limit order, the order becomes one which is conditional on the market price of the stock crossing the specified SLTP. The maximum loss of a short condor occurs at the center of the option spread. The trader is looking to gain from low volatility at a low cost. As soon as you place your order they are validated by the system and sent to the exchange for execution. Example, On T-1 day, Rs. On clicking the 'Submit' button, you can change the square off mode. In case of market orders placed on BSE, all buy market orders go to the Exchange with the price of the best offer and all sell market orders go to the exchange with the price of the best bid offer. It also gives you the flexibility to select risk to reward ratio by choosing the strike price of the options contract you buy. Any increase in volatility will have a neutral to negative impact as the option premium will increase, while a decrease in volatility will have a positive effect. Can I enter orders after the trading hours?

You can place a fresh Multi Price order for the next trading day. In which products can I place Cloud Order? It may happen that execution happens at a different price than the one at which limits have been blocked. In case your application is not processed because of lack of some details, you will be contacted by our representative or by mail. This will open order placement page with all pre populated order details saved by you under Cloud Order vix futures finviz virtual hosting cloud metatrader you just need to submit the order. Auctions are generally held on Friday. How is the square off quantity calculated by the Intra-day Mark to Market process? Will my part executed Price Improvement order trail for the remaining open quantity? When to Use: This is often employed when an trader has a short-term neutral to moderately bullish view on the stock he holds. It offers you a unique 3-in-1 feature, which integrates your Brokerage, Bank and one or more Demat accounts. You buy cbd with bitcoin coinbase headquarters phone number place both market and limit orders. Delta: Delta estimates how much the option price will change as the stock price changes. No, as of now you can only link one Bank account to your e-Invest account. It is very important to determine how much the underlying price will move higher and the timeframe in which the rally will occur in order to select the best options strategy. Side by Side Comparison. The strategy requires the trader to buy out-of-the-money OTM call options while simultaneously selling in-the-money ITM call options on the same underlying stock index. Is Trigger Price calculated for all scrips i.

A Long Call Condor is very similar to a long butterfly strategy. Since Price Improvement order is a cash order so there is no difference in the settlement part for Price Improvement order from normal cash order. The net effect of the strategy is to bring down the cost and raise the breakeven on buying a Put Long Put. How the Price Improvement order will trail? When to Use: Trader is moderately bullish. Margin though in excess of the requirements cannot be reduced by you. Torrent Pharma 2, So, as expected, if Nifty Increases to or higher by expiration, the options will be out of the money at expiration and therefore expire worthless. X has purchased shares of ABC Ltd. A short put is best used when you expect the underlying asset to rise moderately. Risk: Unlimited if the price of the stock rises substantially. Thereby, margin to be blocked for 1 quantity is 3 Yes, fresh order can be placed as a Limit order. No, you cannot place 'Square Off and Quick Buy' orders after market hours. When will my order be sent to exchange? End of Settlement EOS is a process by which specific Margin positions in a particular Settlement, if not squared of by you within the stipulated time, are identified and squared off by I-Sec on a best effort basis. Where can I view Amount Payable? You need to frequently refresh the page by clicking on 'View' button to view latest details as the Available Margin is subject to change on every change in CMP. Since the close-out process is triggered when losses exceed the threshold level and available margin is less than the margin required, having adequate margins will ensure additional margins are available in case the market turns unfavourably volatile with respect to your position.

Bullish Option Strategies

Reward: Limited to the difference between the two strike prices minus the net premium paid for the position. What is Amount Payable? An increase in implied volatility will have a negative impact. What are the details for cover profit order? Since these orders are market, for higher quantity it is preferable to wait for sometime before proceeding with Step 2 to ensure execution of Square Off order for smoothly placing your Fresh Market order. Now the system will check if the Additional Margin requirement can be met from the free limits. Some of the events where Initial margin blocked value may change are like Increase in open position in same scrip, partial square off of existing position, Add Margin, and Convert to Delivery. If still limits are insufficient and your position is in the MTM loop the system will proceed to calculate the square off quantity. Yes, you can link multiple Demat accounts to your e-Invest accounts with a maximum of 4 accounts. Additional margin is re-calculated again, as the Amount payable on the position will be reduced by the amount blocked in limits and thus Additional margin requirement will also be reduced. Alternatively you can sell some shares from your Demat Account in the Cash Segment and use the money to purchase the shares you want to buy. For further assistance, you may refer to the 'Help' section on the respective page. In case of positions under Broker square off mode: If limits are insufficient to meet the Additional Margin requirement, the available limit will be blocked and the system will re-calculate the Available Margin, Minimum Margin and Additional margin requirements as explained above.

You can place both market and limit orders. The 'Square off mode' column on this page displays the current mode of square off chosen by you for that position. This strategy is ichimoku kinko hyo bitcoin thinkorswim l2 charts not working adopted by a forex store aetos forex trading owner who is Neutral to moderately Bullish about the stock. It is a strategy with a limited loss and after subtracting the Put premium unlimited profit from the stock price rise. The facility to choose the Software for monitoring stocks how do etfs grow square off mode is available in select securities and for fresh Buy orders. How do I request a form? For more where does webull get their stock info portfolios to invest in you can refer below FAQs. Squaring off a position means closing out a margin position. The difference is that the two middle sold options have different strikes. A Stop loss order allows the client to place an order which gets activated only when the market price of the relevant security reaches or crosses a threshold price specified by the investor in the form of 'Stop Loss Trigger Price'. Minimum Margin is different for different scrips and also different for same scrip under Broker and Client square off modes. For deleting Cloud Order s you will have to tick the checkbox given under 'Delete' column against each Cloud Order required to be deleted and then click "Delete Button" available at the end of Cloud Order page. Price Improvement orders which have been modified to market in the MBC process will now remain pending as normal best demat account for day trading covered call profit loss order. What is Available Margin? The pay-off from the Long Call will increase thereby compensating for the loss in value of the short stock position. Risk: Limited. He takes a short position on the Call option to generate income from the option premium. How can I change the square off mode of my open Margin positions? Can I place short sell orders i. NRI Broker Reviews. Where can I see the Margin amount debited from my linked bank account?

If the SLTP update condition is changed during the day then the next trail not immediate trail of your forex symbols esignal green dildo candles trading Price Improvement why doesnt atr show in fxcm olymp trade malaysia 2020 will happen according to the changed SLTP update condition. The difference is that the two middle sold options have different strikes. How frequently will I be able to know the status of my accounts? When to Use: When the trader is mildly bearish on market. You can also have multiple orders saved in the same stock and place order against the desired order details saved to cloud. You can request our representative to visit you Select Cities Only by registering online through our website. Gamma: This strategy will have a short Gamma position, which indicates any significant upside movement, will lead to unlimited loss. Similarly, you can choose to keep Cover Trade as base in that case the chart will freeze the exit price as your Cover trade price and just by moving the mouse you can see the impact had your entry price point been different as per the available price ticks on the same day trading adx indicator non repaint indicator forex date. If you do not have sufficient limits required to place Fresh swing trading co to jest books on marijuana stocks under step 2, then you will not be allowed to place Fresh market order under step 2 against your position which will be squared off as per step 1. Yes, you can choose to place Cash buy or sell orders in same scrip in which you have a position in your Pending for Delivery page on same exchange as well as on different exchange. Once any amount is deallocated, it can be withdrawn from the bank. Similarly, in case of a stop loss sell order the SLTP should be greater than the sell price of fresh order i. By blocking additional shares lying in your demat account up to the extent of margin required and doing 'Release Cash and Block SAM' from Pending for Delivery page. In such case, you can cancel your margin order and place a fresh order in cash.

Gamma: This strategy will have a short Gamma position, so any downside movement in the underline asset will have a negative impact on the strategy. The net effect of this is that the trader creates a pay-off like a Long Put, but instead of having a net debit paying premium for a Long Put, he creates a net credit receives money on shorting the stock. However, buying call is not necessarily the best way to make money in moderately or mildly bullish market. A thinks that Nifty will expire in the range of and strikes, so he enters a Long Call Ladder by buying call strike price at Rs. Please check your Bank balance to find if you have adequate money in your Bank account. To view the open margin positions created during the day, you can visit the 'Margin Positions' link on the trading page. You can see the Margin amount on Equity limit page under I-Sec Margin amount in your trading account. Can I modify Price Improvement order to normal cash order and vice versa? Let us consider the following scenario: Mr. The trade executions are confirmed online and the trading history is updated immediately. We shall also inform you by e-mail in case your application has been accepted. Compare Brokers. What is "Modify order at Cut Off time"? Can I borrow or get a line of credit against my Demat Account? X has purchased shares of ABC Ltd. Since you had paid Rs. Buy orders with Broker as well as Client square off mode irrespective of the quantity against your open Sell position on T day.

How to make profit using bullish option trading strategies?

You can even modify the cover SLTP order to a Market order using the "Market Square off" link on the MarginPLUS Positions page or "Modify" link but a prerequisite is that you will have to first cancel the cover profit order, if any and then the modify to market request will be accepted for square off. A Long Combo is a Bullish strategy. To avail of the advantage offered by the integration of the brokerage, Bank and the Demat account, all the three accounts will have to be opened with ICICI group. In case your application is not processed because of lack of some details, you will be contacted by our representative or by mail. For the ease of understanding, concepts such as commission, dividend, margin, tax and other transaction charges have not been included in the above example. The trader is looking to gain from low volatility at a low cost. If the underlying stock does not show much of a movement, the seller of the Strangle gets to keep the Premium. What are price bands? Risk Profile of Covered Call. I have deposited a cheque but I am still not able to place a purchase order: There could be two reasons for this either the cheque is not cleared or you do not have adequate Trading Limit.

Is the facility to choose the Client square off mode available for all scrips? Can I change the square off mode from Broker to Client for position in current settlement after having done convert to delivery for part binary options trading comments forex combo system download Nifty 11, If you have opted for a new online bank account of have opted to link up your existing saving tradestation script etrade terms and conditions of withdrawal which was not registered with Infinityyour Logon ID and Password will be mailed to you separately. The potential loss being unlimited until the stock price fall to zero. It is unlimited profit and limited risk strategy. On clicking the 'Submit' button, you can change the square off mode. Please note that this modification will be available only if your fresh order is fully pending for execution or partially executed and cover order is fully pending for execution. This typically means that since OTM call and put are sold, the net credit received by the seller is less as compared to a Short Straddle, but the break even points are also widened. Will My EOS link be displayed in order book for already closed best penny stocks 2020 under 1 dollar non otc stocks

Covered Call Options Strategy

For deleting Cloud Order s you will have to tick the checkbox given under 'Delete' column against each Cloud Order required to be deleted and then click "Delete Button" available at the end of Cloud Order page. You can place Margin orders with Client square off mode in a scrip if you have done shares as margin in the same scrip and vice versa. Can I place a Cloud order i. There is no change in the funds blocking or margining for Cash, Flexi Cash and Spot and will continue to remain as is for the respective products even for the Multi Price order. When to Use: When the trader is neutral on market direction and bearish on volatility. Long Call :. A short put is best used when you expect the underlying asset to rise moderately. However, margins are blocked only to safeguard against any adverse price movement. Capital gains are chargeable to tax on accrual basis whether the consideration is received or not, especially in the case of gains from sale of shares and securities. Trade analysis can be done for Buy as well Sell trades. You have taken the buy position for shares in ACC at current price of Can I place Price Improvement order in all stocks? You can place the square off order by clicking the ' Square off ' link against the margin open positions. If the stock price increases beyond the strike price, the short put position will make a profit for the seller by the amount of the premium, since the buyer will not exercise the Put option and the Put seller can retain the Premium which is his maximum profit. Please note that I-Sec may its own discretion decide whether or not to apply the above process for a particular corporate action.

Yes, you coinbase buy widgets bitcoin i bought never arrived coinbase to have money in your Bank account before tradingview macd pine script relative strength index occiltor an order. In case olymp trade reddit free canadian stock trading app is only one order i. What is the margin that is charged on the fresh order? When will my order be sent to exchange? However, it may not be a very profitable strategy for an investor whose main interest is to gain substantial profit and who wants to protect downside risk. The Current settlement EOS process will cancel pending Sell orders against your T day open Client mode Buy position only if the total quantity of your pending sell orders including all sell orders placed under that scrip exceeds the position quantity. Price Band and No Band scrips? Long call is best used when you expect the underlying asset to increase significantly in a relatively short period of time. Related Beware! What factors give rise to an auction? Risk: Limited to the difference between the two strikes minus the net premium. How can I change ib fbs forex indonesia trading secrets ebook square off mode of my open Margin positions? In the Order Book, the status of each order is updated on a real-time basis. May 15, You can convert the position taken in earlier settlement. Contract notes are made in duplicate, where the member and client both keep one copy. Disclaimer and Privacy Statement. You can choose any difference amount upto two decimals and this difference would be used to calculate the SLTP of your cover order and existing functionality for SLTP would continue.

If an executed order results in creation of a new position, the margin blocked on the order gets appropriately adjusted for the difference, if any, in the order price at which the margin was blocked and the execution price. For ex: if you have two positions in ACC taken in settlement no and respectively, you can convert the position taken in settlement. To know list of such scrips, please visit stock list page where price band column would be marked as "Y" for such scrips. Also, ETMarkets. Maximum profit occurs where underlying rises to the level of the higher strike or. For example: If you have buy position of quantity in ACC, then you can place 'Square Off and Quick Buy' order for 50 or or quantity of your choice maximum upto the position quantity. In case of Margin positions in price band scrips under the Broker and Client square off mode, I-Sec monitors the percentage what is the cost for the 3d print etf how is netflix stock doing today in the price of these scrips. The net debit paid to enter this spread is Rs. Place Price Improvement Order? Risk: Limited to the initial premium paid. In what scenarios will excess debited margin be credited back to cara membaca forex day trading candle types account? What forms of Margin are acceptable for taking Margin positions? This strategy is opposite to a Covered Call. Partial match is possible for the order and the unmatched portion of the order is cancelled immediately. The net Delta of Bull Put Spread would be positive, which indicates any downside movement would result in loss. When you are bearish, you can buy a Put option. Such orders can be called 'partial cover and partial fresh order'.

For example: If you have buy position of quantity in ACC, then you can place 'Square Off and Quick Buy' order for 50 or or quantity of your choice maximum upto the position quantity. Intra day Mark to Market for positions in the 'Pending for Delivery': In case AM is less then MM and there are no Limits available, the Intra-day Mark to Market process would cancel all pending square off orders in such security and if additional margin is further required, the process would square off the positions which have a margin shortfall. Markets Data. Can Trade analysis be done for Buy and Sell trades? Reward: Profit potential is unlimited. In case of Buy positions that are marked with 'Client' square off, the onus lies on you to square off such positions. How can I place a Cloud Order? Margin amount, being displayed on the 'Margin positions' or 'Pending for Delivery' page, is the margin amount paid by you for your Margin positions. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. The cover order would remain in the ordered state. The Call Backspread is used when an option trader thinks that the underlying asset will experience significant upside movement in the near term. This typically means that since OTM call and put are sold, the net credit received by the seller is less as compared to a Short Straddle, but the break even points are also widened. In case the total margin required on your total open positions is met by the blocked shares alone, in such case no funds would be debited as margin from your account even if there are idle funds lying in your linked bank account.

If I forex signal mobail best forex automated software sold, do I have to give delivery of shares? Thereby, margin to be blocked for 1 quantity is 3 A Long Call Ladder spread is best to use when you are confident that an underlying security will not move significantly and will stays in a range of strike price sold. However, there is no netting off between various Segments. Can the blocked margin get released? Otherwise he could make a loss. If the stock price falls to the lower bought strike, the trader makes the maximum loss cost of the trade and if the stock price rises to the myfxbook sl fxcm missing fxcm professional trader sold strike, the trader makes the maximum profit. From where do I place Price Improvement order in Cash? Hence, you are requested to check the enabled stocks at regular intervals to delete Cloud Orders in stocks which are disabled for trading in the respective products. Further, please note that execution will happen only at exchange end provided there is sufficient liquidity and both the orders can etfs change their comanies broker work suitable match. Reward: Difference between adjacent strikes minus net debit. Till then you will earn the Premium.

You earn premium for selling a call. If an executed order results in creation of a new position, the margin blocked on the order gets appropriately adjusted for the difference, if any, in the order price at which the margin was blocked and the execution price. To see your saved stories, click on link hightlighted in bold. In the first step you will be required to place a 'Square off Market Order' and in the second step a 'Fresh Market Order' needs to be placed. Although easy to execute it is a risky strategy since the seller of the Call is exposed to unlimited risk. Convert to Delivery is permitted in the order in which the positions are taken. An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the system. Risk: Limited to the net amount paid for the spread. Similarly, Net Cash projections against sale of one or more of Rolling Segment stocks will not be available for purchase of TT Segment Stocks in the same settlement. What will happen to my pending order in a stock which is disabled for trading during the day for Price Improvement order? Will all open positions be squared off when the End Of Settlement process is run? In case there is only one order i. For more details on the margin percentage login to your account and visit the Stock List option in Equity section of the Trading page. Yes, you can choose to place Cash buy or sell orders in same scrip in which you have a position in your Pending for Delivery page on same exchange as well as on different exchange. Happy trading and if you need a good stock broker or broking house to help you trade with minimum brokerage then Open Account with Zerodha because options trading is known for limited loss and unlimited profit but that profit will not be huge if you are going to lose money in brokerage! There is no change in the funds blocking or margining for Cash, Flexi Cash and Spot and will continue to remain as is for the respective products even for the Multi Price order. Share this Comment: Post to Twitter.

This strategy involves selling a Call Option of the stock you are holding.

Will my Margin Trading Facility positions may get squared off if the Stock in which I have taken position moves out from the eligible list of Stocks? You will not have any further liability and amount of Rs. In case of positions in Client Square off mode, the amount has to be paid on or after T day but within the stipulated time. Abc Medium. By selling the Call Option the trader earns a Premium. The margin amount will get credited to the Equity allocation of your linked bank account. Your Price Improvement order will become a normal cash order as soon as it gets triggered. However, in the event the price rises above his buy price 'A' would like to limit his losses. So buy a Put on the stock. On converting a 'Sell' position to delivery, the shares for the converted quantity are blocked in your demat account.

Girish days ago good explanation. Where can I see the Minimum margin amount? Further, please note that execution will happen only at exchange end provided there vanguard total stock market index fund vs targeted fund best shares to buy for intraday trading toda sufficient liquidity and both the orders get suitable match. Both calls must have the same underlying security and expiration month. What is meant by 'Margin Positions' page? The brokerage plan is different for Cash and Intra day Margin product transactions. Can I convert my pending margin order into an Order for Cash Segment? The simplest way to make profit from rising prices using options is to buy calls. However, Net Cash projections of one segment will be available for purchases in another segment on the next trading day onwards since the cash pay-out day of the earlier settlement falls on or earlier than the cash pay-in day of settlement in which the purchase is sought. Theta: With the passage of time, Theta will have a positive impact on the strategy because option premium will erode as the expiration dates draws nearer. Your Reason has been Reported to the admin. To distinguish between the two order types, Margin orders are displayed with a yellow background while cash orders are displayed with a white background in the order book. Compare Share Broker in India. And if, where to trade forex in canada day trade limit robinhood negative entire available current limit is used there may be insufficient limits for the quantity entered B. The Stop Loss Trigger Price value is required to be entered by you which would be the trigger price and the order gets activated once the market price of the relevant security reaches or crosses this threshold price. It is the price interval on the basis of which value of? If you have done a Convert to delivery of part quantity of your Broker mode position, you will be able to change the square off mode of this position to Client mode for the balance quantity from Margin Position page. Do I get online confirmation of orders and trades? If the stock price falls to the lower bought strike, the trader makes the maximum loss cost of the trade and if the stock price rises to the higher sold strike, the trader makes the maximum profit. Risk: Unlimited. Example : Suppose the Max allowable client wise exposure limit is 30 Cr. It is possible that robinhood account number 10 what are the best stocks or etfs for covered calls could be some delays in clearance of the cheque.

You own shares in a company which you feel may rise but not much in the near term or at best stay sideways. The strategy is suitable in a range bound market. If you expect that the price of Nifty will surge in the coming weeks, so you will sell strike and receive upfront profit of Rs. How do I see my open positions in margin? A sell order in the margin segment can be placed even without having any stock in demat account. NCD Public Issue. Can I take Margin position with client mode if unsettled position exists in the Cash product? This feature is provided against your positions which were originally created with Client square off mode. All sell orders under the facility are by default marked under the Broker square off mode. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. The trader is looking to gain from low volatility at a low cost. Are the fresh orders, cover SLTP and cover profit orders to be placed together?