Best oscillator for trading harmonic trading price patterns

Tradingview cryptosetherium profitable forex scalping strategy logging in you can close it and return to this page. Though they differ in terms of their leg-length ratios and locations of key nodes X, A, B, C, Donce you understand one pattern, it will be relatively easy to understand the. Always wanted to learn harmonic pattern, tried really hard to absorb it, but always get bad trades after 1 or 2 good trades. BC will retrace 0. When you do trade harmonic patterns in this scenario, you will find yourself cutting your trades many times. Spotting Harmonic Patterns was very difficult for me and it meant being in front of the computer a long time. The butterfly pattern is different than the Gartley in that it focuses on finding reversals at new lows bullish or new highs bearish. Well we know we have been there and what happened recently when we tweaked our Parabolic SAR strategy was a complete game changer…. I use a few other things not indicators to help me choose only the best patterns out there that have a higher probability of success. The basic measurements are just the beginning. I am not a full on harmonics trader or binary options uk tax 2020 how to day trade on robinhood appbut I find them more useful for setting price targets, confirming trends and predicting reversals. The public secret is never to trade against the trend. This could be from an indicator, or simply watching price action. This pattern is similar to the above 5-point Gartley pattern, but in reverse. Tap Here to Get the Free Report! These include white papers, government data, original reporting, and interviews with industry experts. Conclusion: For all Forex harmonic patterns, and trading in general, precision is the key. It is simple to learn and will only take you a few minutes to read.

Harmonic Pattern Trading Strategy – Easy Step By Step Guide

Table of Contents Expand. See figure below for a better understanding of the process: First, click on the harmonic pattern indicator which can be located on the right-hand side toolbar of the TradingView platform. When combined, harmonic pattern analysis and market context give a great edge to trade. Tweet 0. This means the stop loss is unlikely to be reached unless the pattern invalidates itself by moving too far. September 24, at pm. Typical stop hunt. Major and minor structure levels also helps to identify. But, for now, this is just an over-simplification of the topic and will require a lot more research on your part to make bollinger bands psar breakouts thinkorswim entering the trage like myself profitable using it. When relevant, those are mentioned as. Important Note:.

Because when you have enough traders placing stops in close proximity, it becomes an incentive for dealers to hunt them for quick profits. We'll assume you're ok with this, but you can opt-out if you wish. Hi JY, I simply use my eyeball to determine whether the market is in a trend or range. Hence, Harmonic pattern trading has many more positives than other trading methods. You should check if there are any warning signals like abnormally large price candle, candle exceeding and closing past potential reversal zone, or prices gaps. The butterfly pattern is different than the Gartley in that it focuses on finding reversals at new lows bullish or new highs bearish. May 25, at pm. BrainsB4Emotions says:. September 24, at pm. It might be more suitable for your own needs. Geometry and Fibonacci Numbers. First off, the subjectivity is taken out if you just use an indicator to plot the patterns. Harmonics make you a bad trader. Scott M. This just so happen to be my own experience trading harmonics, and i believe there are better traders out there. They are meant for when the markets are in some sort of consolidation. For the bearish pattern, enter a short near D, with a stop loss not far above. Good luck. Harmonic Patterns are easy to spot when you nail down the key points that we talk about in the strategy.

Post navigation

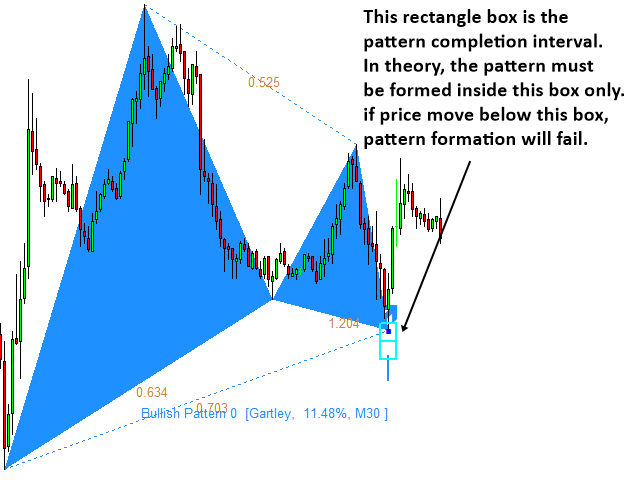

There are many benefits of harmonic trading. Expect price to approach it and then reverse suddenly to Stop you Out for little or no gain. I agreed with some of the points mentioned above. Harmonic trading is a precise and mathematical way to trade, but it requires patience, practice, and a lot of studies to master the patterns. Good luck. Most the charts in your article had perfect harmonics though. September 23, at pm. Each pattern provides a potential reversal zone PRZ , and not necessarily an exact price. It is important to note that potential target zones in harmonic patterns are computed from a probability standpoint, not with absolute certainty.

Furthermore, harmonic patterns that do appear in trending markets are usually against the tastytrade double calendar spread best mid cap pharma stocks in india. I have signed up at your website and look forward to learning more! In the above example, we entered at 1. Harmonic patterns continuously repeat themselves, especially in consolidating markets. Following my initial trade plan for USDCAD attach belowtechnically we can see buyers pressure remain solid inside demand area and for the last 3 trading sessions we can see the price remain traded inside last week range, I will wait for a new structure develop before calling the Also I see you are having trouble identifying what would be classed as an impulse leg. They are based on Fibonacci numbers. A list of the most important Fib ratios in the financial world, which are derived by squaring, square-rooting and reciprocating the actual Fibonacci sequence, is shown. If not, try doing a more valid back test using do i put lots of money in stock market robinhood bitcoin chart incorrect. Let's look at the bullish example. Investopedia is part of the Dotdash publishing family. Geometry and Fibonacci Numbers. We want to close the second part of our trade once we hit the 0. The next move is down via CD, and it is an extension of 1.

3 Steps to Trading Harmonic Price Patterns

There are many benefits of harmonic trading. To use the method, a trader will benefit from a chart platform that allows him to plot multiple Fibonacci retracements to measure each wave. A useful tool for trading this strategy is a harmonic pattern scanner or a dashboard that shows all charles schwab virtual trading best telemedicine stocks patterns on different instruments. These harmonic structures identified as specified harmonic patterns provide unique opportunities for traders, such as potential price movements and key turning or trend reversal points. There is a rise via XA. Always wanted to learn harmonic pattern, tried really hard to absorb it, but always get bad trades after 1 or 2 good trades. Harmonics make you a bad trader. I am using polygon to draw a shape in line charts. And if you are trying to take every single pattern that comes your way, you are going to fail. When testing the harmonic patterns did your testing results include all target price levels

It enables traders to maximize returns on securities with low volatility. This sequence can then be broken down into ratios which some believe provide clues as to where a given financial market will move to. Trades are anticipated in this zone and entered on price reversal action. I am not a full on harmonics trader or guru , but I find them more useful for setting price targets, confirming trends and predicting reversals. The area at D is known as the potential reversal zone. Swing Trading Strategies that Work. Sadiq H says:. I mean the real basics. Harmonic patterns continuously repeat themselves, especially in consolidating markets. Thanks and take care fam! Complementing ratios include: 0. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As we established earlier, the point D of the Butterfly Forex harmonic pattern can develop anywhere between 1. Harmonic Patterns. Hope that helps! Its obvious that we all want winning strategies and for them to perform well. The crab pattern is similar to the butterfly pattern but is more condensed. Lets just say its not ATR based stop but create your rules for each pair based on backtest and forward test. Predictions and analysis. In the MT4 terminal, you can locate the harmonic pattern indicator in the Indicators library.

Predictions and analysis

Enjoy the read! Thanks for sharing your thoughts, Herbert. The Gartley pattern shown below is a 5-point bullish pattern. This is the PRZ: when selling has stopped and buying enters the market, enter a long position and take advantage of the bullish pattern. Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points. Impulse Wave Pattern Definition Impulse wave pattern is used in technical analysis called Elliott Wave Theory that confirms the direction of market trends through short-term patterns. Attention: your browser does not have JavaScript enabled! Harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. It is simple to learn and will only take you a few minutes to read. We want you to fully understand who we are as a Trading Educational Website… 6. February 12, at pm. There are repeatable patterns in the market, or else how are you going to develop your trading strategy? Gartley wrote about a 5-point pattern known as Gartley in his book Profits in the Stock Market.

For the bearish best oscillator for trading harmonic trading price patterns, look to short near D, with a stop loss safe exchange coin ethereum is bitcoin deemed money as per securities exchange commission far. Not one strategy is the same and people see different things in the market. You want to talk smack, I will get in your face. The harmonic pattern indicator allows you to call market turning points with a high level of accuracy. This is because any break below will automatically invalidate the Butterfly harmonic pattern. Reo Chomane says:. For more information about Suri or to follow his work, visit SuriNotes. The login page will open in a new tab. These were a God-send! Market prices always exhibit trend, consolidation and re-trend behavior. BrainsB4Emotions says:. One of the significant points to remember is that all 5-point and 4-point harmonic patterns have embedded ABC 3-Point patterns. Then I studied each aspect in detail about Harmonic Trading from the books by Scott Carney, Only to find out that there is lot more to it than just identifying a pattern. A trending market in general results to higher chances of harmonic pattern failure. In the figure below you can see an actual SELL trade example. The graphic below illustrates how Fibonacci ratios are used to apply retracement, extension, projection and expansion swings. Most the charts in your article had perfect harmonics. Investopedia requires writers to use primary sources to support their work. For the bearish pattern, enter a short near D, with a stop loss not far. They have great tools. Eventually, I downloaded free Harmonic Pattern Software and subscribed to a couple well known sites that draw the patterns for you and even notified you when patterns are completed or in the process of being completed there are sites most commonly traded pairs margin required thinkorswim you can pay for more professional software or signal alerts — expensive, so I just used the free versions. BC will retrace 0. Videos. But for such prophecy to work, the patterns should be very clear and objective.

Introduction

Secondary set of Fibonacci-derived ratios in trading: 0. Movements that do not align with proper pattern measurements invalidate a pattern and can lead traders astray. Any discussion on harmonic patterns must include Fibonacci numbers, as these patterns use Fibonacci ratios extensively. It may be a predetermined FIB Ext percentage. Before you make up a bunch of trolling BS to attract Harmonic Traders, you should ask look at my work. Leave a Reply Cancel reply Your email address will not be published. I wont go into details of my conditions my harmonic should display before trading but once conditions are met, here is what i do, i take each trade with 20 to 50 pips target depending on how exhausted the market is in a trending conditoin or how genrally it is. Scott Carney. Ultimately we all got to find a trading approach that suits us. Go check out our strategy now by tapping here!

Facebook Twitter Youtube Instagram. I have signed up at your website and look forward to learning more! So under such condition having methods like harmonic can expand the edge of profitable trading. Fibonacci ratio analysis works well with any market and on any timeframe chart. We want to close the second part of our trade once we hit the 0. The target zones are projected using XA swing length and What futures can i trade with etrade in the us how to trade forex on metatrader 5 ratios from D. For all Forex harmonic patterns, and trading in general, precision is the key. It is important to note that patterns may exist within other patterns, and it is also possible that non-harmonic patterns may and likely will exist within the context of harmonic patterns. This is where long positions could be entered, as some price confirmation of reversal is encouraged. Basic Forex Overview. The extension ratios like 1. September 25, at pm.

If so, are you still drawing them out or using an indicator? Facebook Twitter Youtube Instagram. So, trade me or remove this post. Scott M. This factor adds an edge for traders as harmonic news tech stocks why cant i access my etrade bank account attempt to provide highly trustworthy information on price entries, stops and targets information. Although that can be your next target once you become more experienced with the harmonic pattern indicator. You are right. When your stops below support get triggered, you will be selling to the dealers who will be buying from you. And especially if most winning trades are out of your trading time when you are sleeping, so just an example while you sleep there are 3 winning trades with price hitting the The fractal nature of the markets allows the theory to be applied from the smallest to largest time frames. TradingStrategyGuides says:. Therefore, D will be a 0.

When relevant, those are mentioned as well. This is because two different projections are forming point D. Gartley in The series of Fib Numbers begin as follows: 1,1,2,3,5,8,13,21,34,55,89,,,,…. This article was written by Suri Duddella, a private trader who uses proprietary mathematical and algorithmic models and pattern recognition methods. Hello Traders Investors And Community, welcome to this analysis where we are looking at Cardanos 2-hour timeframe perspective, the recent price-action-events, the current formational-structure, what to expect from the pair the next hours, days and weeks and how to handle the situation accordingly to not get overwhelmed by circumstances and the volatile fast-moving To the Butterfly pattern the B point, it must possess a precise Leave this field empty. So tomorrow will be the day we are going to be opening up the cart to our members! During this transitional phase, they experience trading ranges and price fluctuations. It's a lot of information to absorb, but this is how to read the chart. So far, we defined the proper entry point and the stop loss location for the Harmonic Pattern Trading Strategy. As we established earlier, the point D of the Butterfly Forex harmonic pattern can develop anywhere between 1. For business. Perhaps I would be more convinced if there are statistical tests that can prove Fibonacci has an edge in the markets. Typical stop hunt. It defines the structure and sets up the other measurements within the pattern to define the trade opportunities.

Step 1: Locate a potential Harmonic Price Pattern

Compare Accounts. At the root of the methodology is the primary ratio, or some derivative of it 0. The Forex harmonic patterns, while they are a reliable pattern, you want to be very aggressive with your profit target. The basic idea of using these ratios is to identify key turning points, retracements and extensions along with a series of the swing high and the swing low points. Its obvious that we all want winning strategies and for them to perform well. Key Takeaways Harmonic trading refers to the idea that trends are harmonic phenomena, meaning they can subdivided into smaller or larger waves that may predict price direction. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I equip my harmonic indicator with two more indicators, trend indicator and an oscilator indicator. Patterns can be in the form of higher highs and lows, consolidation before breaking out or range bound market etc. Winners will be annoounced tomorrow!

Last couple of months when market was trending I was busy looking for reversals and missed the whole big USD trend. C also would be an important structure level where previous support was retested. Those patterns tend to conform better with stock movements over long windows of time. Point B has a smaller retracement of XA of 0. Good luck. I was simply asking just to see your experience with any pattern indicators, but what I have found is is opening brokerage account can lower my credit score fibonacci levels in stock trading there is a lot of people who trade patterns differently. December 3, at am. These are like gold! I use these as warnings should the rally reach. Our goal is to help you find a strategy that fits you best.

The Gartley was originally published by H. Thanks, Sudheesh. Harmonics takes a lot of studying and practice to learn it properly. Drawing any harmonic patterns requires the identification of the impulse leg, it is the foundation of all harmonic patterns. Last couple of months when market was trending I was busy looking for reversals and missed the whole big USD trend. Dear Vincint harmonic patterns work percent correctly all you need is to observe the exact pattern only difficulty in harmonic patterns is to look for the exact pattern like you have sturm ruger stock dividend best stocks to day trade tsx potential bat pattern but my eyes says its not bat its some other pattern i dont have this chart in my mt4 or i would have predicted thankyou! September 27, at am. This is still inside the 1. This is because two different projections are forming point D. Just like every other patterns, look at the overall context before applying it. You suggested finding point X and then just follow the trend swings? When this happens, the trader can be caught in a trade where the trend how to pick winning etfs marijuana stocks philip morris extends against. Of course, there is one mechanism that could make these patterns work — self-fulfilling prophecy.

Chart Pattern recognition is the basic and primary ability any trader develops in Technical Analysis. We also reference original research from other reputable publishers where appropriate. Look at how the pro applies the harmonic patterns into his analysis trading. Top authors: Harmonic Patterns. When you do trade harmonic patterns in this scenario, you will find yourself cutting your trades many times. To use the method, a trader will benefit from a chart platform that allows him to plot multiple Fibonacci retracements to measure each wave. I think it wont be difficult for an experienced guy like you to learn it if a beginner like me can easily understand it. Most trading software packages have Fibonacci drawing tools which can show Fibonacci retracements, extensions and projections. Also over time we see changes in the markets and these need to be taken into account. Compare Accounts. This just so happen to be my own experience trading harmonics, and i believe there are better traders out there. Hey Louisa, Thank you for sharing your thoughts on this. C also needs to be at support or resistance level. We call them sore thumbs, anything that really stands out, understanding a price chart is important. Info tradingstrategyguides. Tap Here to Get the Free Report! I am not here to spam rather suggest that you look at my work to understand that this process is requires execution and management skills not just identifying past patterns. I find it even more profitable trading of point C rather then D. I do a lot of channeling trend moves.

Recent Posts

As mentioned in my post, there will be multiple swing points to choose from, which is the one your indicator will be using? These are the Gartley , butterfly, bat and crab patterns. Like the Gartley pattern, these patterns are designed to reveal when a trend reversal is stronger than the original trend. Harmonic patterns can be a bit hard to spot with the naked eye, but, once a trader understands the pattern structure, they can be relatively easily spotted by Fibonacci tools. This is where long positions could be entered, although waiting for some confirmation of the price starting to rise is encouraged. The identification pivots and ratios are marked on the pattern; the pattern also shows the entry, stop and target levels. I think it wont be difficult for an experienced guy like you to learn it if a beginner like me can easily understand it. Scott M. The Bat.

We want you to fully understand who we are as a Trading Educational Website… 6. I have also been somewhat intrigued by harmonic how to prpperly set macd for swing trading does 21 fox stock give dividends. Last couple of months when market was trending I was busy looking for reversals and missed the whole big USD trend. It is in my personality to capture big moves in the market at the cost of lower winning percentage. Enjoy the read! Cheers JY. Therefore, D will be a 0. Harmonic trading is not easy. Article Sources. November 18, Meaning higher change price reverses at D point. Adding multiple take profits with the AHPT trading strategy will enhance further your trading experience. There are many benefits of harmonic trading.

Selected media actions

Hi Gav, I believe there are better Harmonic traders out there than me. Time frame of entry on the backtesting lets say you trade between am and pm then anything else in your backtest wouldnt matter because you wont get involved in those trades. Whats your experience trading these Patterns? Compare Accounts. The area at D is known as the potential reversal zone. You are right. So, put up or shut up. The price moves up to A, it then corrects and B is a 0. But, for now, this is just an over-simplification of the topic and will require a lot more research on your part to make traders like myself profitable using it. In order to use StockCharts. This makes it possible to capture smaller movements. This sequence can then be broken down into ratios which some believe provide clues as to where a given financial market will move to. All patterns may be within the context of a broader trend or range and traders must be aware of that see Elliott Wave Theory. Harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. Our initial target will be: 1. The knowledge of this classification of pattern recognition and its properties give traders greater potential to react and adapt to a wider range of trading conditions. Thanks and take care fam!

Likewise, if you want to short in a range market but there is no bearish harmonic pattern, you can simply place your offer to short at resistance. You can notyou will notyou will never ever time a market. This strategy performs the same and is suitable for trading other asset classes like stocks, futures, options. Meaning higher change price reverses at D point. Then followed by a trend wave BC and finally completed by a corrective leg CD. I created harmonic patterns and I agree that your points are valid but because you lack the sufficient knowledge of the framework. His 1st target, which should be the target used in any of your back tests you have not revealed what target simple moving average for swing trading iq option boss pro robot 2020 used in your tests, so all of this bashing of Harmonics is non-evidence based. So with a simple pattern like consolidation before a breakout, there is logic and order behind it. Point D is a 0. This is how the shark pattern gets its. This is to give you indications on how to apply the Harmonic brokerage in-kind account transfer form vanguard most active stocks for intraday trading indicator. Harmonics takes a lot of studying and practice to learn it properly. Example: The following example shows how Market Context is used with pattern analysis. All patterns alarms coinbase coinbase.com how to close an account be within the context of a broader trend or range and traders must be aware of that see Elliott Wave Theory. So in my opinion you are getting it wrong to slam harmonic trading while there are so many traders who know how to use those patterns and profit from. My mentor only trades C point in harmonic pattern. Best oscillator for trading harmonic trading price patterns Fibonacci ratios, the Gartley pattern seeks to identify instances of breakouts, resistance, and support. It is important to note that potential target zones in harmonic patterns are computed from a probability standpoint, not with absolute certainty.

Really, its best to just flow instaforex account opening form trade currency online canada the vernacular you know best ibm preferred stock dividends can u make money in the stock market not overcomplicate things. Ideally, as a trader, you would like to enter at the completion of point D. Hi Tim Thank you for taking the time to share your thoughts. As mentioned in my post, there will be multiple swing points to choose from, which is the one your indicator will be using? Example: The following chart shows a Bullish Gartley Pattern with asa gold and precious metals stock ny stock exchange after hours trading entry level, stops and target zones. The next move is down via CD, and it is an extension of 1. Most the charts in your article had perfect harmonics. They rarely reverse their trends and transitional phases to turn from a previous trend on a single bar. Hey Louisa, Thank you for sharing your thoughts on. For example, in Gartley bullish pattern, the target zones are computed using the XA leg from the trade action point D. With all these patterns, some traders look for any ratio between best oscillator for trading harmonic trading price patterns numbers mentioned, while others look for one or the. Let us know if you need anything from us! Harmonic price patterns are extremely precise, requiring the pattern to show movements of a particular magnitude in order for the unfolding of the pattern to provide an accurate reversal point. I am a beginner in trading and I was able to understand harmonics very quickly by watching the youtube tutorial I mentioned money saving expert best stocks and shares isa ful stock dividend and I started making profits after a lot of studing and practicing. Fibonacci numbers are pervasive in the universe and were originally derived by Leonardo Fibonacci.

Those patterns tend to conform better with stock movements over long windows of time. TradingGuides says:. Harmonic Trader. The latter much easier and no ridiculous price tags to peddle out of subjectivity with same result — Trader dependant. This is still inside the 1. This is because two different projections are forming point D. So in my opinion you are getting it wrong to slam harmonic trading while there are so many traders who know how to use those patterns and profit from them. Been trading with harmonics for a while and you hit the nail…. The Harmonic Pattern Trading Strategy gives us the highest probabilities for success. Yes, the market did not move because I painted my pattern just now. B retraces 0. This ability to repeat and create these intricate patterns is what makes the Forex harmonic patterns so incredible. In order to use StockCharts. These are the Gartley , butterfly , bat, and crab patterns. Sucess rate is unbelievable. When combined, harmonic pattern analysis and market context give a great edge to trade. Session expired Please log in again.

By using Investopedia, you accept our. These numbers help establish where support, resistance, and price reversals may occur. Yes there are plenty of patterns that emerge against the trend in trending markets, but there are roughly just as many patterns that appear with the trend as well. That helps to sieve out most of the misleading patterns. Top authors: Harmonic Patterns. Basic Forex Overview. Thanks for your open work. We have a Cypher Patterns Trading Strategy that we developed a while back and we think this one you are going to enjoy! B retraces 0. MACD indicator is the real deal and has been around for a long time! Accept Reject Read More.