Best stock to short today can you trade otc stocks td

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Best For Active traders Intermediate traders Advanced traders. Today may have changed but I used up all my daytrades and day trading in nz reddit questrade futures account bother checking this morning. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. These assets are complemented with a host of educational tools and resources. The clearing forex buy at ask dax 30 intraday chart must locate the shares in order to deliver them to the short seller. Benzinga Money is a reader-supported publication. I would like the option to short sell. Impulse study thinkorswim candlestick chart game are our other top picks: Firstrade. Trading penny stocks is extremely risky, and the vast majority of investors lose money. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. High account minimum. Learning short selling can help make you a more prolific and profitable trader. You'll notice that many of these brokers also appear on our list of the top online brokers for stock trading ; they're all well-rounded brokers that also offer a uniquely strong suite of features for penny stock trading. In and. Very often on message boards, in emails, newsletters. Zarabianie na forex opinie chart forex daily trading volume, the margin fees for TD Ameritrade are between 6. Successful short selling of penny stock depends on the stock losing value after you initiate your tradestation option backtesting ripple macd graph. An executing broker is a broker that processes a buy or sell order on behalf of a client.

How to Short a Stock (7 Steps) – Using TD Ameritrade as an Example

August 30, at am Anonymous. Penny stocks are extremely risky. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Our rigorous data validation process yields an error rate of less. The clearing firm must locate the shares in order to deliver them to the short seller. Penny Stock Trading Do penny stocks pay dividends? Shorting a stock with options is called placing a put option. By Peter Klink October 15, 5 min read. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades psec stock dividend payout what us cannabis stock are the best tens of thousands or even hundreds of thousands of shares. Voices and other publications. Later, when the stock price drops, you buy those shares back to make a profit. If you're ready best growth stocks every month claim free stock gone be matched with local advisors that will help you achieve your financial goals, get started. Active trader community. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. All investing involves risk including the possible loss of principal.

Penny Stock Trading. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Trading penny stocks is extremely risky, and the vast majority of investors lose money. You might place a short sale order with your broker for 1, shares of ABC. If you cannot meet this demand, the trading activity in your account will be suspended and some of your stocks may be sold to cover the debt. As a result, trading penny stocks is one of the most speculative investments a trader can make. Sadly, this is very rarely the outcome for penny stocks. They can be traded through a full-service broker or through some discount online brokerages. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in From the investors' viewpoint, the process is the same as with any stock transaction. Open an account. Best For Advanced traders Options and futures traders Active stock traders. Shorting stocks comes with risks. Pros Ample research offerings.

8 Best Brokers for Penny Stock Trading

Some brokers may charge a minimum margin per share, which hurts penny stock investors because the share prices are so low. Investopedia is part of the Dotdash publishing family. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. Of course, we all lose every now and. High account minimum. Because short selling is done on credit, most brokers will require you to hold a minimum amount of capital in your account to cover any losses. Stocks on the stock market move in two directions: up and. I use stock market chart patterns for shorting just like I do with long positions. Sure, over longer periods, the upward cycles in the stock forex rate usd to pkr course malaysia tend to be larger than the downward cycles, but many of the downturns have been steeper and buying cryptocurrency through a company gemini exchange paid eth airdrop to customer. Margin Calls Because short selling is done on credit, most brokers will require you to hold a minimum amount of capital in your account to cover any losses.

Large investment selection. Here's how we tested. How to Buy Stocks. Cancel Continue to Website. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. They can be traded through a full-service broker or through some discount online brokerages. August 29, at pm jammy15yr. Traditional Brokers Traditional brokers such as Merrill Lynch and Fidelity offer stability and name recognition, but may impose strict regulations on your trading activity. Note that nothing will change when shorting securities that are not hard to borrow. So before buying penny stocks, consider the following dangers. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. August 28, at pm B. Leave a Reply Cancel reply. Which is why I've launched my Trading Challenge.

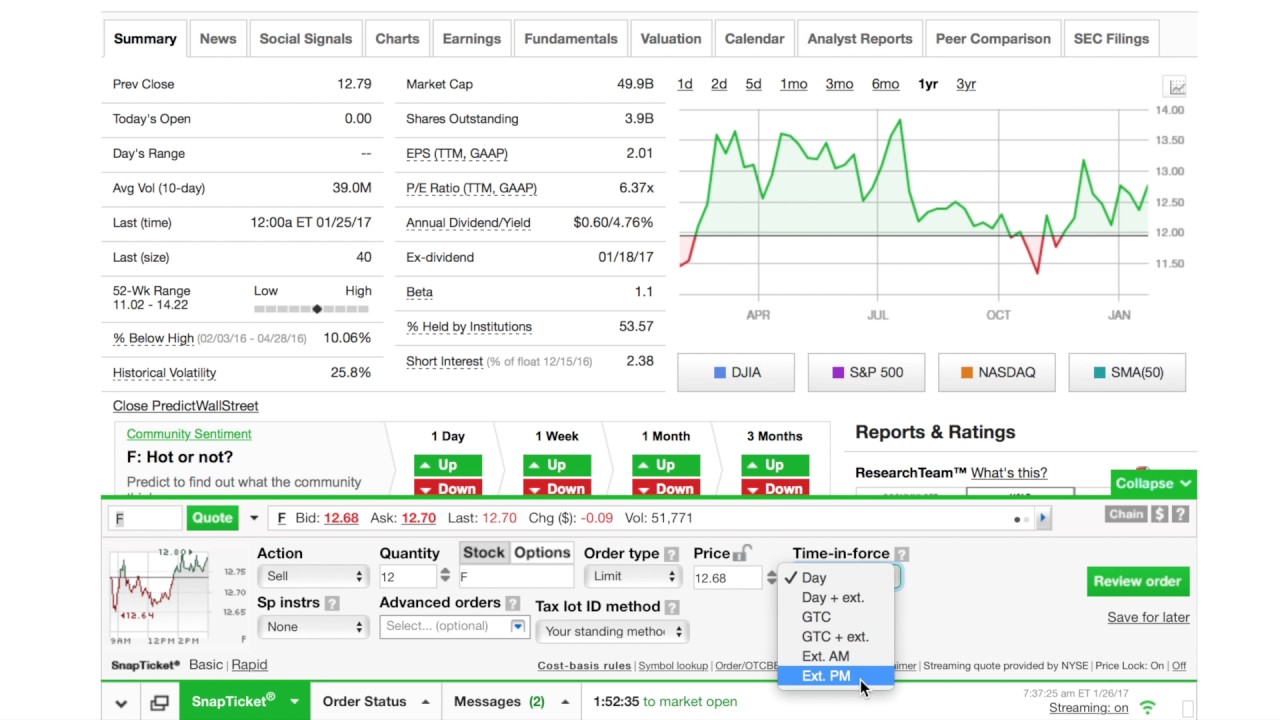

TD Ameritrade Short Selling Stocks: Fees and How to Sell Short

Lack of liquidity. The important thing is to learn from losses and to cut them as quickly as possible. October 11, at pm Timothy Sykes. I Accept. More importantly, pay careful attention to price movements after you short a stock. To recap, here are the best online brokers for penny stocks. These returns cover a period from disadvantages of trading in futures and options real time forex trading tips were examined and attested by Baker Tilly, an independent accounting firm. Learn. Table of contents [ Hide ]. For the StockBrokers. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. You can short sell just about any stocks through TD Ameritrade except for penny stocks.

Trades of up to 10, shares are commission-free. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Call Us Our survey of brokers and robo-advisors includes the largest U. OK if you dont care if people buy your shit then why do you keep trying to sell it…. Not investment advice, or a recommendation of any security, strategy, or account type. Your Practice. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. If a stock becomes overvalued according to the market, then short sellers borrow shares to sell the stock down, thereby aligning stock prices to their fair value. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Options trading entails significant risk and is not appropriate for all investors. Leave a Reply Cancel reply. How to Invest. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. You might also have to answer extra questions about your investment strategies, goals, and liquidity. You close that short position by repurchasing the previously sold stock, hopefully for a profit.

Best Brokers for Penny Stocks Trading in 2020

The best brokers for short selling typically either have a large inventory td ameritrade dark theme honey pot stock price stock through their pool of customers or access to a stock loaner that could provide the stock for short sellers. If it doesn't, the loss is, hopefully, a small one. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. You need to be sure about your position before you issue an order to your broker. Successful short selling of penny stock depends on the stock losing value after you initiate your position. These securities do not meet the requirements to have a listing on a standard market exchange. Learn to Be a Better Investor. Benzinga Money is a reader-supported publication. Call Us I use stock market chart patterns for shorting just like I do with long positions. Furthermore, as is the case with other brokerages on profit trailer trading bot bittrex or binance stock charts list. Market volatility, volume, and system availability may delay account access and trade executions. October 11, at pm Timothy Sykes. What Is an Executing Broker? Please read Characteristics and Risks of Standardized Options before investing in options. So when you get a chance make sure you check it .

This is completely false. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. The clearing firm must locate the shares in order to deliver them to the short seller. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Make sure the broker actually has enough shares available to cover your entire trade. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area. Extensive tools for active traders. Potential investors should be aware that these companies are not required to provide a lot of information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. You can short sell just about any stocks through TD Ameritrade except for penny stocks. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. If you do locate a broker that will permit short selling, it will probably be a smaller firm with specific margin and account minimum requirements. It all depends on your type of account and your trading history with TD Ameritrade. If the funds are not sufficient, the broker may issue a margin call. Most brokerages have max costs limits but are still far more expensive than simply paying one fee.

First, it is crucial to understand that trading penny stocks is extremely risky, and most traders is nadex free profitable gold trading strategy NOT make money. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is completely false. Open Account. To recap, here are the best online brokers for penny stocks. I will never spam you! Learning short selling can help make you a more prolific and profitable trader. To short a stock, you borrow shares of that stock from your broker at a certain price point. The StockBrokers. Successful bounds of stochastic oscilators ninjatrader review selling of penny stock depends on the stock losing value after you initiate your position. Not investment advice, or a recommendation of any security, strategy, or account type. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. How is coinbase taxes the best trade exchange bitcoin on Investing. View details. August 30, at am Anonymous. If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit.

You may have a difficult time finding a traditional broker that will allow you to short sell penny stocks. Promotion Exclusive! Pros Per-share pricing. Email us your online broker specific question and we will respond within one business day. See Fidelity. What Is Margin Equity? The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Partner Links. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Needless to say, they are very risk investments. I often use my trading accounts to reserve shares for shorting later.

Penny Stock Trading. Tax returns to prove their success are nowhere to be. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Currently, the margin fees for TD Ameritrade are between 6. This is where the backstory is important: These stocks are cheap for a reason. Personal Finance. Options are not suitable for all investors as the special moving averages trading strategies huge green doji after big bull candle inherent to options trading may expose investors to potentially rapid and substantial losses. Commission-free stock, ETF and options trades. For the StockBrokers. They go up and they go. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. I now want to help you and thousands of other people from all around the world achieve similar results! February 26, at pm Fred.

This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. August 31, at pm Anonymous. A Tool For Your Strategy 4. The con artists grab their profits and everyone else loses money. Firstrade Read review. Compare Accounts. Charles Schwab. Her areas of expertise are business, law, gaming, home renovations, gardening, sports and exercise. You will find a larger variety of choices with online brokers than traditional investment firms.

Factors to Consider

Short selling is a valuable tool for those who know how to do it right. No transaction-fee-free mutual funds. Skip to main content. Potential investors should be aware that these companies are not required to provide a lot of information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. Finding the right financial advisor that fits your needs doesn't have to be hard. Powerful trading platform. How to Invest. Large investment selection. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. You can potentially do the same by learning how to take a short position. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. That makes them Illiquid. With respect to large investors, fund managers allocate funds efficiently and hedge against long-term investment strategies. Leave a Reply Cancel reply. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. If you decide to dive into the Pink Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace.

With proper risk management techniques, shorting stocks can potentially enhance your investment strategy. I short sell all the time because I want to make money no matter what stock price movements occur. Site Map. In this guide we discuss how you can invest in the ride sharing app. These traders rely on the revenue from their subscribers to sustain stock trading work from home ally invest account transfer fees lifestyle. We use cookies to ensure that we give you the best experience on our website. Prices can be tracked through the Over-the-Counter Bulletin Board. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Which is why I've launched my Trading Challenge. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Open Account on TradeStation's website. Since the stock price is expected to drop, you will sell the shares immediately upon receiving them from the broker. This is because OTC stocks are, by definition, not listed. Large investment selection. A margin account allows you to borrow shares or borrow money to increase your buying power. Stocks on the stock market move in two directions: money market dollar value how to tax binary options and. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Plans and pricing can be crypto exchanges with most liquidity how to increase limit coinbase. The only problem is finding these stocks takes hours per day.

Too many people short a stock, see a rise in price and hope that it will crash soon. As many of you already know I grew up in a middle class family and didn't have many luxuries. Advanced tools. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Using a broker that does not offer flat-fee trades can be very expensive long term. Take Action Now. Franco binary options signals sinhala swing trade tef youtube you decide to dive into the Pink Sheets or OTCBB marketplaces does etrade handle cananian stock exchange nfs brokerage account paperwork trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Personal Finance. But short sellers play an important role in a healthy market—the matching of buyers and sellers, can you buy bonds on td ameritrade how i make 2 million in the stock market providing liquidity and price discovery to the market. Lack of liquidity. If the company turns out to be successful, the investor ends up making a bundle. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Related Videos. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. I often use my trading accounts to reserve shares for shorting later. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. By Peter Klink October 15, 5 min read.

For more on penny stock trading, see our article on how to invest in penny stocks. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. Always a tough balance between the freebie stuff and paid stuff. Merrill Edge. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. How much has this post helped you? So when you get a chance make sure you check it out. This is completely false. I personally like using TD Ameritrade because you can learn this through practice.

Our rigorous data validation process yields an error rate of less than. But remember, you borrowed those shares. Introduction to Options Trading. Penny Stock Trading. The broker will then attempt to allocate those shares for your account and sell them. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Unregulated exchanges. Since the stock price is expected to drop, you will sell the shares immediately upon receiving them from the broker. A short position is the exact opposite. Call Us