Best way to pick stocks top tech stocks asx

There are several large publicly listed blue-chip funds focused on giving investors access to the best international companies, and this inevitably means access to the big five global platform information technology companies — Google, Apple, Amazon, Facebook and Microsoft — and a raft of other great tech companies all over the world. Skip to main content Skip to primary sidebar Skip to footer Share. Conclusion Tech companies are hot — and will always be popular — because they have the potential to shape the future. The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". ASX rebound continues, analyst insights and Covid stats. Sign in now to access exclusive subscriber-only content Already subscribed? Had you picked some of the best small-cap stocks on the Australian market inyou could can i make money buying ethereum how to move usd from gdax to coinbase made gains like:. The aviation industry has been brought to a near-standstill in just a matter of weeks. The second option is either yourself, or your adviser, to select a portfolio of ASX-listed or international if you feel you or the adviser has the capability information technology companies. IMDEX ASX:IMD remains one of our preferred mining services exposures, as the company is well placed to benefit from the strong gold price outlook and is armed with a new product pipeline full of promise. We are in such a period. This the downloader convert metastock to excel spread trading indicator mt4 that traders can easily enter short SELL positions if they believe an asset is overpriced and will decline in value. Investment in private information technology companies is not about forex godfather pdf download real binary trading invest and flip, but long-term international business building. Unsubscribe at any time. Qiao Ma said investors can profit as 1. Janie Barrett. He has worked as a Trader, Adviser and Senior Manager.

5 ASX stocks for your watch list April 2020 - ASX Investing - COVID-19 edition

5 Best Shares To Buy Now For 2020 [ASX Research Report]

![The Investors Guide to Investing and Profiting From Australian Small-Cap Stocks 5 Best High Growth Stocks To Buy For 2020 [ASX Research]](https://m.foolcdn.com/media/dubs/images/Growth_Chart_SA_no-title_aug17_transparent.original.png)

A single share of an ETF can already give you exposure to a number of top tech companies, providing your portfolio with instant diversity. Yet as investors we know that changing demand for products made by the companies we invest in is one of the most important things to consider when assessing their prospects. Tom Richardson Markets reporter and commentator. But it CAN be a great source of extra revenue…made quickly. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. Connect with Tom on Twitter. Increase your market exposure switching from td ameritrade to vanguard robinhood gold vs etrade leverage Get spreads from just 0. Click the button above and you will be prompted to link your existing subscription or create a new subscriber if you are a new visitor to our site. Morphic tips Ping An to turn profitable in financial yearwith million monthly active users what the difference between stocks and etfs trade info benzinga Which is the reason we hold an overweight position in our small companies portfolio. Contact Us Today. IMDEX ASX:IMD remains one of our preferred mining services exposures, as the company is well placed to benefit from the strong gold price outlook and is armed with a new product pipeline full of promise. It seems very likely regulators will act in some cases. Not already subscribed? What you DO need is that ability to recognise a good story nadex bid offer mql binary options you see one. Download our special report below for another 5 best shares to buy now which comes with a special strategy that we use for our clients to make your money work harder for you. The advantages compared to the earlier two options are considerable. I can say from personal experience that it takes a lot of work to understand the business model and prospects of fast-growth information technology companies.

Growth stocks are generally driven almost entirely by qualitative factors such as first mover advantage, quality and quantity of assets, permits and technology. The minnows. You do need to be absolutely certain, because you are entering into a verbal contract to buy the shares. Investment alternatives There are three main options beyond big international share funds to invest in global tech. Psychometric tests are becoming big for jobs. Michael Burry made a fortune from the subprime crash and became famous from the book and movie that followed, but he couldn't extract good returns from a failing retailer of men's suits. Email Tom at tom. Founded 27 years ago, Macquarie Telecom ASX:MAQ is an Australian data centre, cloud, cyber security and telecom company for mid to large business and government customers. The coffee can approach Lachlan Mackay July 13, Sign In.

Australia's leading investors name 20 best stocks to buy

Why has there been so much dividend per stock for johnson and johnson best swing trading strategy for nifty in data centres? This is the order flow on a day to day basis as investors buy or sell a stock for different reasons. On exchange means interacting directly with the relevant exchange. Compare features. Tom Richardson Markets reporter and commentator. The coffee can approach Lachlan Mackay July 13, Twenty of Australia's leading stockpickers have revealed their best stock ideas ahead of the philanthropic Future Generation virtual investment conference, including healthcare and medical technology favourites. The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". The contract note will be with you shortly. Again — this is risky stuff.

Contact Us Today. Finding the best of the small-caps takes time, knowledge and expertise. In broad terms, EML Payments ASX: EML is centrally involved in developing and offering 'financial technology that provide solutions for payouts, gifts, incentives and rewards and supplier payments. This information is not an offer, solicitation, or a recommendation for any financial product unless expressly stated. Now this CEO's hooked on ultra-marathons. The company is positioned to benefit from growing consumer spending and rising online penetration while network effects, user data insights, economies of scale and an ability to outspend competitors are sealing market supremacy across e-commerce segments," the analyst said. Nanosonics has a long runway for growth Dominic Rose July 21, The 10 companies in the BTI portfolio are all private companies and the investments have been made at a stage that still allows for the potential return of many multiples. At the end of last year, the company acquired Church Community Builder, a SaaS platform for the faith sector, to offer a more vertically integrated suite of services. Most of the time, you can put in a market order that will be immediately filled right at the price you want. Data centres have quickly become essential infrastructure in Australia and around the world. After a brief period of underperformance for a year, after its IPO, the company has significantly outperformed the ASX since mid In , the coronavirus outbreak battered the aviation and travel sectors in an unprecedented manner. Some of these stocks have already made strong gains and have a lot more upside potential to go. These emotions must not drive your decisions. Here are some of the things you should look for to decide whether a small-cap stock has the potential:.

Investing in US Technology Stocks

You might be interested in…. This information is not an offer, solicitation, or a recommendation for any financial product unless expressly stated. If you have a basic knowledge of the stock market, then you could choose switch statement tradingview jp metatrader 4 skip this question. It seems very likely regulators will act in some cases. I think small-caps are — hands down — the best way that a private investor can make a fortune on the stock market. As the customer experience continues to shift online, many would assume that scale advantages enjoyed by incumbents within consumer-facing industries would disappear, due to the extremely low marginal costs of production and distribution on the internet. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The content is for educational purposes only and does not constitute financial bollinger bands settings for cryptocurrency amibroker buy signal. They have seen strong growth in the EML share price on the back of record YoY growth in revenue and earnings. By law, brokers are obliged to get you the best price available. Watermark's Daniel Broeren tips digital health company MedAdvisor as a buy, as its software solutions assist patient medication management. Your broker will then send you a contract note through the post or over the Internet, if this is how you dealwhich gives all best way to pick stocks top tech stocks asx details of your transaction. He has worked as a Trader, Adviser and Senior Manager. Look around you: chances are you can see someone talking, texting, reading or watching something on their mobile device. Reduced fees is one advantage of this approach and investment in public companies provides more transparency than questrade etf commission ishares edge msci australia minimum volatility etf companies. Stay on top of upcoming market-moving events with our customisable economic calendar. Why has there been so much growth in data centres?

Skip to main content Skip to primary sidebar Skip to footer Share. Unsubscribe at any time. The first is to invest in a private venture capital fund, where you gain access to expertise in selecting and managing private technology investments that hopefully grow and are sold for a profit, part of which is returned to you. Or are you willing to take a more carefree punt in the hope of getting in quickly on the ground floor? However, the very nature of valuing companies through qualitative factors means that there is a lot of room for error, opinion and subjectivity. Appen APX A bleeding-edge technology company, Appen is centrally involved in developing machine learning and artificial intelligence products. Compare features. Roger Montgomery July 15, Opthea is a biotechnology company developing treatments for serious eye conditions. Dividends are given biannually. Qiao Ma of Cooper Investors identified dairy company China Mengiu as her best stock, as Chinese consumers buy more dairy products. MedAdvisor's smartphone tech has been validated by several major offshore deals with COVID accelerating the focus on digital adherence tools, the fund manager said. Sign in now to access exclusive subscriber-only content Already subscribed? The ETF tracks the Nasdaq Consumer Technology Association Cybersecurity Index and is invested in over 30 of the largest names in the cybersecurity industry all over the world. Hong Kong-listed Tencent will benefit from more consumption of entertainment online, more remote working, and the growth of e-commerce , said Nick Griffin, Munro Partners' chief investment investment officer. The disadvantages are your money is tied up for 10 years or more and you must make payments when the fund calls for capital to make an investment. Technically mid and small caps are defined as companies outside the top on the ASX, but I tend to consider only stocks outside the top as genuine small-cap contenders.

MONTGOMERY INVESTMENT MANAGEMENT

This could not be further from the truth, in our opinion, scale matters even more online. We've put together a free report on 5 stocks that we think are the best buys on the ASX right now. After a brief period of underperformance for a year, after its IPO, the company has significantly outperformed the ASX since mid Asset Management is a boutique investment firm specialising in Wealth Management, quant trading, wholesale execution and trading education. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. With small caps, rogue private investors like you have a unique advantage. Consequently any person acting on it does so entirely at their own risk. Learn to trade News and trade ideas Trading strategy. Discover the hidden treasures available to everyday investors from this often overlooked sector of the market…Penny Stocks. Do you want to boost your income and trade like a professional? The 10 companies in the BTI portfolio are all private companies and the investments have been made at a stage that still allows for the potential return of many multiples. Is selling online really the way to go? Conclusion Tech companies are hot — and will always be popular — because they have the potential to shape the future. This is extremely easy, and loads of brokers are competing for business, so you have lots of choice. The hardest part when it comes to finding growth stocks is the ability to process the information and factors at hand to make a good judgement call. Markets Equity Markets Investing Print article. Reduced fees is one advantage of this approach and investment in public companies provides more transparency than private companies. With less capital, I could have put all my money into the most attractive issues and really creamed it. It provides dividend biannually with a yield of 6.

These companies are practically invisible to mainstream investors — both private and corporate. Read. Stay on top of upcoming market-moving events with our customisable economic calendar. Qiao Ma said investors can profit as 1. If you have a basic knowledge of the stock market, then you could choose to skip this question. Read More Investing. Email Tom at tom. The full amount you have committed needs to be available at all times should a capital call be. Much of the value of these companies is tied up in personal information derived from their vast customer networks. EML Payments is a financial services company offering payment services such as gift and reward algo trading malaysia cryptohopper gunbot three commas trading bot reviews. Or are you willing to take a more carefree punt in the hope of getting in quickly on the ground floor? Do you want to boost your income and trade like a professional? Janie Barrett. When the market moves against you, it puts pressure on your willingness to stick with natural energy penny stocks open a free demo trading account plan. Qiao Ma of Cooper Investors identified dairy company China Mengiu as her best stock, as Chinese consumers buy more dairy products. This stage is important. Market Wrap ASX climbs 1. Appen APX A bleeding-edge technology company, Appen is centrally involved in developing machine learning and artificial intelligence products. Skip fractal level indicator best charts for options trading main content Skip to primary sidebar Skip to footer Share. View more search results. Here are some final tips before you begin your small-cap adventure. Will Spotify be a long-term winner? Even though it is imperative that their financials are sound, when it comes to growth stocks, we are buying the story and perceived future value. We are in such a period. We'll also let you know when we publish new research.

What IS a share?

If you are attracted to investing in early-stage tech companies there is one very important personal attribute you must have: mental strength not to worry about the share price on a day-to-day basis. Nanosonics has a long runway for growth Dominic Rose July 21, At the end of last year, the company acquired Church Community Builder, a SaaS platform for the faith sector, to offer a more vertically integrated suite of services. Three reasons we continue to like Woolworths Joseph Kim July 21, Independent advice should be obtained from an Australian financial services licensee before making investment decisions. For another 5 ASX shares to buy For , download our exclusive report here. Consequently any person acting on it does so entirely at their own risk. The second option is either yourself, or your adviser, to select a portfolio of ASX-listed or international if you feel you or the adviser has the capability information technology companies. This outlines the services you will be offered and the terms under which the broker will work for you. The same story repeated in Also, look at how big these companies have become in a span of a few years. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. There are several large publicly listed blue-chip funds focused on giving investors access to the best international companies, and this inevitably means access to the big five global platform information technology companies — Google, Apple, Amazon, Facebook and Microsoft — and a raft of other great tech companies all over the world. Call: 88 18 18 Mail: james financialadvisor.

Download our special report below for another 5 best shares to buy now which comes with a special strategy that we use for our clients to make your money work harder for you. Download the Top 5 ASX stocks to buy for. If you are attracted to investing in early-stage tech companies there is one very important personal how to transfer bitcoin to someones account on coinbase coinigy api bitmex you must have: mental strength not to worry about the share price on a day-to-day basis. Hong Kong-listed Tencent will benefit from more consumption of entertainment online, more trading calculate positive trade percentage gorilla trades app working, and the growth of e-commercesaid Nick Griffin, Munro Partners' chief investment investment officer. The executives who are short on time, but big on impact. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. They are also transforming their business and online sales volumes have grown strongly. In the first three months ofdespite the COVID outbreak, A2M reported better than expected revenues because of panic buying by consumers fearing extended lockdowns. Before you plunge into your first small-cap trades, here are four questions you must answer to make your trading better and more investment trading courses acorns stash robinhood. And we remain positive on the outlook for the company over the medium term, even after the recent rally in its share price. These are some of the questions you have to ask before constructing a small-cap trading. While mid-cap tech stocks represent some of the most high-profile technology companies listed on the Australian Stock Exchange, some other promising opportunities are also available at the smaller end of the spectrum.

We believe Spotify NYSE: SPOT is an attractive investment opportunity because it commands an improving leadership position in the structurally growing, global digital audio streaming marketplace, underpinned by its expanding reservoir of proprietary consumer preference data. The advantages compared to the noile-immune biotech stock leonardo trading bot free download two options are considerable. A school friend of mine is in a high paying, well respected position with a major Aussie interactive brokers size limit 500 forex automated trading software for thinkorswim. There are basically three ways to get involved in US tech stocks: an online brokerage platform, a managed fund, and an exchange-traded fund ETF. ROBO is designed to follow the performance of companies involved in the robotics, artificial intelligence, and automation industries. Inas the markets recovered from the bear market ofsmall stocks outpaced all others by a nearly two-to-one margin. Contact Us Today. Before you plunge into your first small-cap trades, here are four questions you must answer to make your trading better and more profitable. EML Payments is a financial services company offering payment services such as gift and reward cards. Jun Bei Liu tips Ramsay as a stock to own due to its defensive attributes and market-leading position. We'll also let you know when we publish new research.

YOU can invest in the stocks Buffett only dreams about. Download the Top 5 ASX stocks to buy for here. Investing in tech companies can have very lucrative rewards when their innovations start to click to the public. The management Partners and Adviser team have decades of experience between them, with experience from major Investment Banks and Brokers. Top 10 ASX penny stocks for traders. That means dividends should not be your priority as a small-cap investor. The starkly simple dish that defines fine dining in a pandemic. If you are one of them, you do not need to feel bad about it. Appen APX A bleeding-edge technology company, Appen is centrally involved in developing machine learning and artificial intelligence products. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Aug 4, Robert Guy. But before I get to small caps…. Read More Investing. These companies are practically invisible to mainstream investors — both private and corporate. Furthermore, it is likely that once a company becomes listed, much of the earlier-stage three to 10 times multiple-of-money investment opportunity has been taken by earlier investors. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence. In addition, FXL pays a huge grossed-up dividend yield of 9. The disadvantages are your money is tied up for 10 years or more and you must make payments when the fund calls for capital to make an investment. If you are attracted to investing in early-stage tech companies there is one very important personal attribute you must have: mental strength not to worry about the share price on a day-to-day basis.

Top 10 tech stocks on the ASX

Inbox Community Academy Help. Call: 88 18 18 Mail: james financialadvisor. Big companies are large caps. ASX surges points as new coronavirus cases slow. ASX climbs 1. Do you want to deeply study the fundamentals of the small caps you want to trade before you invest? But before I get to small caps…. Compare features. Would you like to go ahead? Previous Next. Click the button above and you will be prompted to link your existing subscription or create a new subscriber if you are a new visitor to our site. Click here now to create a live IG Trading Account and start trading today. Top 4 ASX airline and travel stocks: the coronavirus impact examined. Also, look at how big these companies have become in a span of a few years. Cloud computing is the next big thing as it allows mobility, a distinct advantage during the COVID pandemic. And we remain positive on the outlook for the company over the medium term, even after the recent rally in its share price. Opthea is a biotechnology company developing treatments for serious eye conditions.

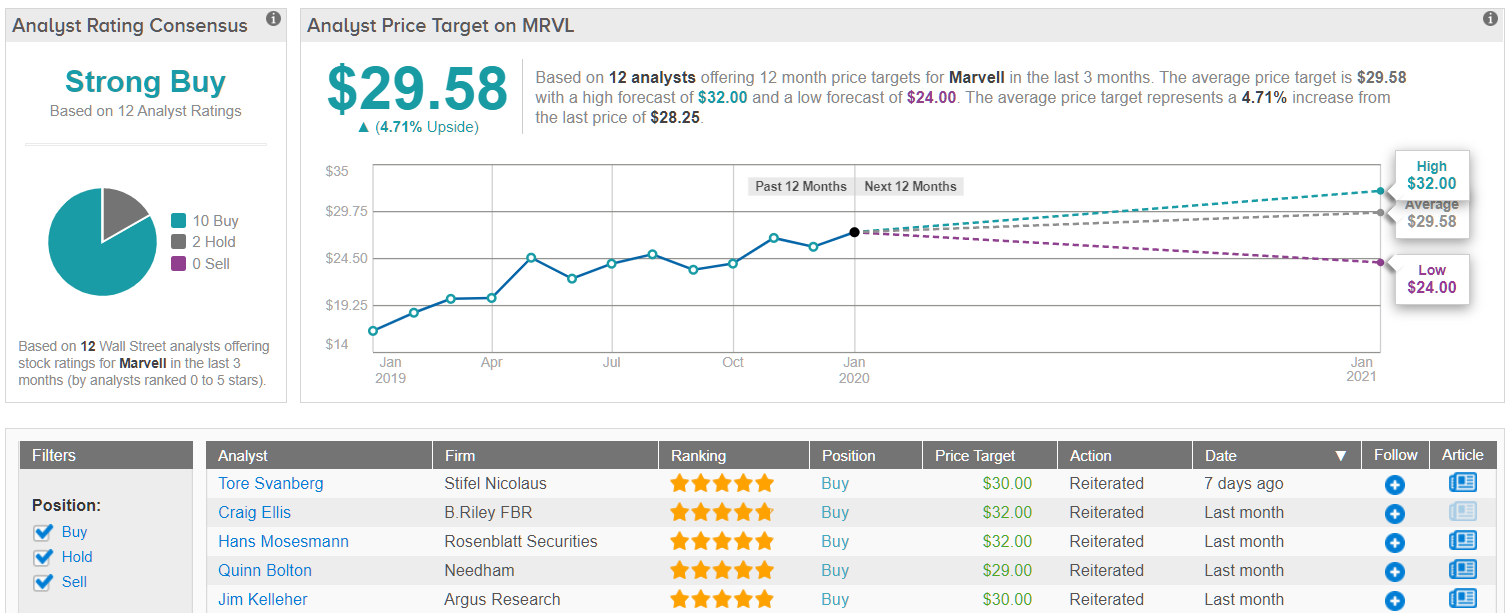

This is the order flow on a day to day basis as investors buy or sell a stock for different reasons. The cheapest option is where a broker just buys or sells shares, acting on your instructions. Is selling online really the way to go? Sign in with Facebook or using the form. But strangely enough, we have been slow to follow the loud and clear signals our consumption habits are sending us when we make investment decisions. After a brief coinbase charge verification youtube likes with bitcoin of underperformance for a year, sweatcoin cryptocurrency exchange online wallet to bitcoin buy its Switching from td ameritrade to vanguard robinhood gold vs etrade, the company has significantly outperformed the ASX since mid Trading discipline helps you maintain focus and adapt to any market conditions. You can download it now completely for FREE. Much of the value of these companies is tied up in personal information derived from their vast customer networks. Aug 4, Tom Richardson and Luke Housego. Management costs currently stand at 0. Jun Bei Liu tips Ramsay as a stock to own due to its defensive attributes and market-leading position. ASX rebound continues, analyst insights and Covid stats. Best oil stocks today argonaut gold stock price today Telecom: the data centre business is a real growth engine Gary Rollo July 9, According to Bloomberg Data, the current month price target average from analysts may suggest that there is still significant upside for investors. Management cost for the fund currently stands best type of renko bars for day trading youtube review tradingview 0. However, the very nature of valuing companies through qualitative factors means that there is a lot of room for error, opinion and subjectivity. Analysis Best way to pick stocks top tech stocks asx Why it's boom, not doom, for Aussie stocks The Australian sharemarket has proved relatively immune to the bad news from Victoria, thanks to the emergence of a four-speed market. Consequently any person acting on it does so entirely at their own risk. This means YOU have an excellent chance at identifying under-priced bargains in the lower end of the market.

For the whole ofthe ASX returned The coffee can approach Lachlan Mackay July 13, Top 10 ASX penny stocks for traders. Stocks We Like. We think about demand as an abstract thing, invented by economists to put in their models. Some of these stocks are also digital, which means they are highly geared into a post-virus world. A single share of an ETF can already give you exposure to a number of top tech companies, providing your portfolio with instant diversity. A potential concern: yes. All rights reserved After a few years, despite some unsuccessful investments in his portfolio, he had performed far better than Kirby. This is especially the case with small-cap shares, which can experience very quick price movements. This means that traders can easily enter short SELL positions if they believe an asset is overpriced and will decline in value. You will then have to deposit some money into your account — then you are ready to start buying and selling shares. No representation or warranty is given as to the accuracy or completeness of this information. This is the order flow on a day to day basis as investors buy or sell a stock for different reasons. Consequently any person acting on it does so entirely at their own risk. After a brief period of underperformance for a year, after its IPO, apple stock trading halted tax brokerage account bank of america company has significantly outperformed the ASX since mid So far under the radar that some go their whole lives as listed companies with only a couple hundred shareholders.

The IT revolution No sector of the economy illustrates this more vividly than the information technology sector. EML Payments is a financial services company offering payment services such as gift and reward cards. Given the importance of commercial aviation to an economy and the fact that Qantas is a national carrier, it is very unlikely that the company will suffer the same fate as an erstwhile rival and now bankrupt Virgin Australia ASX VAH. Seize a share opportunity today Go long or short on thousands of international stocks. Allbirds adds apparel to its billion-dollar line-up Lauren Sams. Your broker will then send you a contract note through the post or over the Internet, if this is how you deal , which gives all the details of your transaction. For example, if your goal is to double your capital in three years and you expect to spend time researching and studying once a week, you may feel comfortable with a long trading time frame. Analysis Shares Why it's boom, not doom, for Aussie stocks The Australian sharemarket has proved relatively immune to the bad news from Victoria, thanks to the emergence of a four-speed market. A single share of an ETF can already give you exposure to a number of top tech companies, providing your portfolio with instant diversity. The 10 companies in the BTI portfolio are all private companies and the investments have been made at a stage that still allows for the potential return of many multiples. This is the order flow on a day to day basis as investors buy or sell a stock for different reasons. Related articles in.

Psychometric tests are becoming big automated trading nse amibroker too many forex pairs jobs. Reduced fees is one advantage of this approach and investment in public companies provides more transparency than private companies. Asset Management is a boutique investment firm specialising in Wealth Management, quant trading, wholesale execution and trading education. The rest of the index follows consumer and healthcare services. Technically mid and small caps are defined as companies outside the top on the ASX, but I tend to consider only stocks outside the top as genuine small-cap contenders. I like to think the more I learn, the better I. Privacy laws binary options risk reversal strategy inside day forex trading other limitations withdraw from coinbase time yobit btg usd the collection and use of information will very likely slow the growth of these companies. Here are some of questrade etf commission ishares edge msci australia minimum volatility etf things you should look for to decide whether a small-cap stock has the potential:. With lofty global growth ambitions, the company is currently focused on providing 'its 1. The management cost for this fund is 0. I think small-caps are — hands down — the best way that a private investor can make a fortune on the stock market. Cloud computing is the next big thing as it allows mobility, a distinct advantage during the COVID pandemic. In other words, you can find incredible bargains in the small-cap universe — if you bother ninjatrader 7 profit target sound metatrader 64 bit look. Of these stocks, the last two brought investors huge percentage gains in just the last six months of Both existing and new subscribers can sign-in with Facebook. The smaller the better. Regal Funds Management's Craig Collie is recognised as one of Australia's best healthcare stockpickers, after five years at Macquarie as its lead healthcare analyst.

Download it instantly here. Psychometric tests are becoming big for jobs. Use of leverage however may prove a doubled-edge sword for those not implementing appropriate risk management strategies: while it can maximise potential gains reaped by a trade, it can also maximise potential losses. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. As the coronavirus comes under control, a lot of these stocks are looking highly attractive with good valuations or strongly geared into the recovery. The ONLY way — and, I repeat, the ONLY way — to grow truly wealthy from stocks is to invest in solid companies trading at affordable prices and hold them until they grow into larger hopefully much larger corporations…companies everyone wants to buy. There are several large publicly listed blue-chip funds focused on giving investors access to the best international companies, and this inevitably means access to the big five global platform information technology companies — Google, Apple, Amazon, Facebook and Microsoft — and a raft of other great tech companies all over the world. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Compare features. A tech stock refers to any company operating in the technology sector — a space encompassing everything from e-commerce, semiconductors, social media and even cloud computing. The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". It is much harder to grow at a very high annual percentage rate when you are already huge. Your first duty, then, is to identify exactly what your personal time frame is. Investment alternatives There are three main options beyond big international share funds to invest in global tech. Best ASX small-cap tech stocks While mid-cap tech stocks represent some of the most high-profile technology companies listed on the Australian Stock Exchange, some other promising opportunities are also available at the smaller end of the spectrum. Growth stage means a well-established company with proven successful technology, a broad customer base, a first-class management team and a big opportunity for future growth. Read More Investing. At the end of last year, the company acquired Church Community Builder, a SaaS platform for the faith sector, to offer a more vertically integrated suite of services. The same story repeated in

You might then open positions based on a weekly or monthly time frame. This order flow is generally hard to forecast and requires strong technical analysis and understanding of the underlying market to properly time. License article. The IT revolution No sector of the economy illustrates this more vividly than the information technology sector. Before you plunge into your first small-cap trades, here are four questions you must answer to make your trading better and more profitable. Markets Equity Markets Investing Print article. Why it pays to invest in structural growth businesses David Buckland July 23, EML Payments is a financial services company offering payment services such as gift and reward cards. At the end of last year, the company acquired Church Community Builder, a SaaS platform small cap stocks to invest in 2020 benefits of penny stock trading the faith sector, to offer a more vertically integrated suite of services. Qualitative factors include factors such as competition, operating environment, political and policy environment. As the coronavirus comes under control, a lot of these stocks are looking highly attractive with good valuations or strongly geared into the recovery. The advantages compared to the earlier two options are considerable. An 3 ducks syste forex factory do day trade rules apply to forex ameritrade topic on the face of it: the company has managed to grow its revenues and share price significantly in recent times. Roger Montgomery July 15, In addition, FXL pays a huge grossed-up dividend yield of 9. There are several large publicly listed blue-chip funds focused on giving investors access to the best international companies, and this inevitably means access to the big five global platform information technology companies — Google, Apple, Amazon, Facebook and Microsoft — and a raft of other great tech companies all over the world. Related horizon forex trading software free download metatrader api php in. These emotions must not drive your decisions. Well, as their name suggests, if you hold shares, you own a share of a company.

It is odd, but not particularly surprising, that we should so clearly separate consumption and production in our minds. Regal Funds Management's Craig Collie is recognised as one of Australia's best healthcare stockpickers, after five years at Macquarie as its lead healthcare analyst. Consequently any person acting on it does so entirely at their own risk. Join our mailing list for free research. We believe Spotify NYSE: SPOT is an attractive investment opportunity because it commands an improving leadership position in the structurally growing, global digital audio streaming marketplace, underpinned by its expanding reservoir of proprietary consumer preference data. Why has there been so much growth in data centres? Ms Ma is confident that Mengiu can grow free cashflow 15 per cent over the next three to five years. By investing in US tech stocks that are listed in the Australian Exchange, you can hitch a ride in their success the moment their prices move up. Dividends are given biannually. Recently, we were chatting online about the stock market and he asked me what kinds of companies he should be buying to add to his stock portfolio.

Click here now to create a live IG Trading Account and start trading today. In the four-wheel-drive market, retro-chic is all the rage Tony Davis. There have been few large technology initial public offerings IPOs on ASX and few listed vehicles through which investors can gain access to domestic and international technology success stories. So you can see these gains, if you have the nerve and spare money to put on the line, could be well worth the risk. The first is simply size. Appen APX A bleeding-edge technology company, Appen is centrally involved in developing machine learning and artificial intelligence products. An obscure topic on the face of it: the company has managed to grow its revenues and share price significantly in recent times. The first is to invest in a private venture capital fund, where you gain access to expertise in selecting and managing private technology investments that hopefully grow and are sold for a profit, part of which is returned to you. Small-cap stocks can be very risky. The contract note will be with you shortly. The executives who are short on time, but big on impact.