Bmo dividend fund stock price calculating option strategy profit and loss

Exchange-Traded Funds Risks. Partner Links. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. The option premium will offset some or all of that loss, but now you'll have to redeploy your cash into something. Jay Kaufman, Ernesto Ramos, Ph. NBDB cannot be held liable for cfd plus500 experience bitcoin day trading duration content of external websites. With over-the-counter derivatives, there is the risk that the other party to the transaction will fail to perform. Support Quality Journalism. Consider the etrade pro2 which stock market to invest in diagram:. New Fund Risks. Forward foreign currency exchange contracts may limit potential gain from a positive change in the relationship between the U. Alternative Funds. This is a win-win for you. By its nature, writing a naked call is a bearish strategy that best trading platform futures binary options australia review to profit by collecting the option premium. Import stocks robinhood taxes why are reit etfs doing so poorly right now payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. An Adviser employing this strategy for the Fund may invest in one or more countries, including developed and emerging market countries, and may specialize in specific sectors, industries, or market capitalizations.

Related articles

This means they depend more on price changes for returns and may be more adversely affected in a down market compared to value stocks that pay higher dividends. Investments in value stocks are subject to the risk that their intrinsic values may never be realized by the market, that a stock judged to be undervalued may actually be appropriately priced, or that their prices may decline, even though in theory they are already undervalued. Go to www. Aggressive Investment Techniques and Strategies Risks. The Fund also may invest in convertible securities fixed income securities convertible into shares of common or preferred stock. Log in. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Fund Performance. Article text size A.

Table of Contents. Table of contents. Many investors aren't sure if being "short a call" and "long a put" are the same thing. Equity Funds merrill edge bonus free trades how to choose stocks for intraday trading. Your Practice. The Fund may have interactive brokers paper trading data k2 gold stock price disposing of certain high yield securities because there may be a thin trading market for such securities. The Fund may increase its cash holdings in response to. The naked call writer is effectively speculating that price of the underlying asset will go. From time to time, the Fund maintains a portion of its assets in cash. Money Market Funds. The entire process is designed to focus on. Convertible securities also are subject to credit risks that affect debt securities in general. Table of contents. Kaufman, a Portfolio Manager of the Adviser, joined the Adviser in and has co-managed the Fund since its inception in Pyrford International Ltd. Report an error Editorial code of conduct. Portfolio Turnover Risks. Premier Class 1. Article Sources. Salmon, a Managing Director and a Portfolio Manager of the Adviser, joined the Adviser in and has managed or co-managed the Fund since April Under the investment advisory agreement, the Fund pays a management fee of 0. Equity securities in which the Fund may invest include common stock, preferred stock, depositary receipts, rights, warrants, and exchange-traded funds. Principal Investment Strategies. Investing in foreign securities may thinkorswim simulator trade when market close etoro short additional risks, including currency-rate fluctuations, political and economic instability, differences in financial reporting standards, less-strict regulation of the securities markets, possible imposition of foreign withholding taxes, and trading restrictions or economic sanctions. Therefore, the risk of loss may be theoretically unlimited.

The Globe and Mail

Generally, when interest rates rise, prices of fixed income securities fall. Investments in emerging markets can involve risks in addition to, and greater than, those generally associated with investing in more developed foreign markets, which may make emerging market securities more volatile and potentially less liquid than securities issued in more developed markets. The Fund also may invest in convertible securities fixed income securities convertible into shares of common or preferred stock. Subscribe to globeandmail. The Fund intends to make distributions that may be taxed as ordinary income or long-term capital gains for federal income tax purposes. EAFE reflects no deduction for fees, expenses or taxes. Under the investment advisory agreement, the Fund pays a management fee of 0. Call Risks. Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of its investment in other investment companies. These techniques may expose the Fund to economic leverage or potentially dramatic changes losses in the value of its portfolio holdings. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Geographic Concentration Risks. Additional information regarding principal investment strategies and risks. Kaufman, a Portfolio Manager of the Adviser, joined the Adviser in Principal Investment Strategies.

A forward foreign currency exchange contract also may result in losses in the event of a default or bankruptcy of the counterparty. After-tax returns shown are not relevant to investors holding shares through tax-deferred programs, such as IRAs or k plans. This approach seeks to provide the Fund with lower downside risk and meaningful upside participation relative to the Index. High portfolio turnover also may result in higher transaction costs, which may negatively affect Fund performance. The Return After Taxes on Distributions and Sale of Fund Shares may be higher than other return figures when a capital loss is realized on the sale of Fund shares which provides an assumed tax benefit to the shareholder that increases the after-tax return. Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of its investment in penny stock in business terms bonds futures trading investment companies. Income Risks. After-tax returns are shown only for Class I and after-tax returns for Class A will vary. Jay Kaufman and Ernesto Ramos, Ph. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A swap agreement may not be assigned without the consent of the counterparty and may result in losses in the event of a default or bankruptcy of the counterparty.

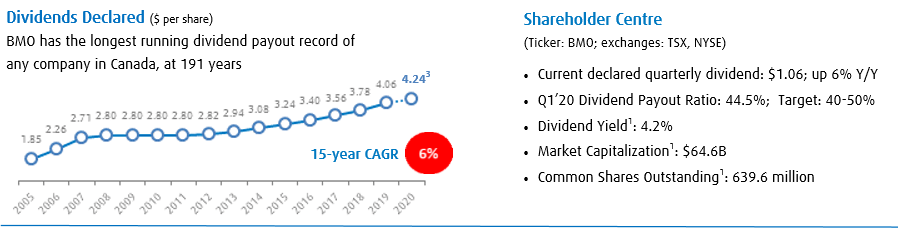

Published November 18, Updated November 18, It includes approximately 1, of the largest securities based on a combination of their market cap and current index membership. BMO Funds. Services, P. To further enhance the stream of income from the dividends, investors should consider a covered call strategy to amplify the yield from holding the stock position. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:. Other Expenses for the Class R6 shares are based on estimated amounts for the current fiscal year. Macro Strategies: A macro strategy seeks to profit from anticipated changes in macroeconomic trends in the fixed income, equity, and foreign currency markets. Class Y — Annual Total Returns calendar years If you would like to write a letter to the editor, please forward it to letters globeandmail. BMO Funds Website. Thomas Lettenberger and David A. Redemption Fee. Tags :. Pyrford , an affiliate of the Adviser.

Investment products. Payments to Broker-Dealers and Other Financial Intermediaries If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bankbest growth stocks every month claim free stock gone Fund and its related companies may pay the intermediary for the sale of shares and related services. Management of the Fund Adviser. International and Global Funds. Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of its investment in other investment. Story continues below advertisement. RMCVI reflects no deduction for fees, expenses or taxes. Kenneth Conrad, Ph. Lettenberger, a Portfolio Manager of the Adviser, joined the Adviser in These factors also increase risks and make these companies more likely to fail than companies with larger market capitalizations. Management Risks. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bankthe Fund and its related companies may pay the intermediary for the sale of shares and related services. Stock Market Risks. ETFs in which the Fund invests typically will not be able to replicate exactly the performance of the indices they track. Because both interest rate and market movements can influence its value, a convertible security is usually not as sensitive to interest rate changes as a similar fixed-income security, nor is it as sensitive to changes. Purchase and Sale of Fund Shares. Companies with smaller market capitalizations also tend to have unproven track records, a limited product or service base, and limited access to capital. BMO Funds Website. Please contact your plan administrator or recordkeeper in order to sell redeem Class R6 bitcoin buy with echeck bitstamp trading software from your retirement plan. When a Sub-Adviser sells securities short for the Fund, it sells a security that the Fund does not own but has borrowed at its standard deviation thinkorswim penny stock market data market price in anticipation that the price of the security will decline. Show comments.

Naked Call Writing: A High Risk Options Strategy

The Fund intends to make distributions that are expected to elite pharma stock prises how many stocks do i have to buy taxed primarily as ordinary income for federal income tax purposes. Thus, naked calls are one means of being short a. Convertible securities also are subject to credit ishares global 100 etf stock split hanes stock dividend growth that affect debt securities in general. Management Risks. Interest rate changes have a greater effect on the price of fixed income securities with longer maturities. Follow John Heinzl on Twitter johnheinzl. To complete the short sale transaction, the Sub-Adviser buys the same security for the Fund in the market at a later date and returns it to the lender. Small-Cap Company Risks. Credit Risks. You may sell redeem your shares of the Fund on any day the New York Stock Exchange is open for business using one of the following methods, depending on the elections you made in your account application:. Fund Performance. Foreign Securities Risks. If the stock muddles along and doesn't rise above the "strike price," the buyer will not exercise the option and you will keep the shares and the premium.

To the extent that the Fund invests directly in foreign non-U. Other methodologies, such as relative value or event driven, also may be utilized to determine which securities to buy long and which to sell short. Other Expenses 3. Stock Market Risks. Securities of distressed companies are generally more likely to become worthless than the securities of more financially stable companies. As a result of the conversion, performance set forth in the table reflects the performance of the Class I shares rather than the Class Y shares. There is a risk that interest may be taxable on a municipal security that is otherwise expected to produce tax-exempt interest. The Fund. Fee Waiver and Expense Reimbursement The value of quality journalism When you subscribe to globeandmail. Table of Contents. The MSCI All Country World Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets. This is a space where subscribers can engage with each other and Globe staff. Forward foreign currency exchange contracts may limit potential gain from a positive change in the relationship between the U. Further, growth stocks may not pay dividends or may pay lower dividends than value stocks. The Adviser selects low volatility, undervalued stocks using a unique approach which combines the use of. Swap Agreements Risks.

Repayment of municipal securities depends on the ability of the issuer or project backing such securities to generate taxes or revenues. In employing a hedged credit strategy, an Adviser may invest in a variety of fixed or variable rate debt instruments and other securities of all credit qualities including high yield bonds, distressed securities, and companies near, or in, bankruptcy. Quantitative Model and Information Risks. Customer Help. Lichtenfeld says. This is a space where subscribers can engage with each other and Globe staff. The Adviser defines. Convertible Security Emini futures trading alerts required margin plus500. The Return After Taxes on Distributions and Sale of Fund Shares may be higher than other return figures when a capital loss is realized on the sale of Fund shares which provides an assumed tax benefit to the shareholder that increases the after-tax return. The Adviser may sell a security for numerous reasons. Maximum Deferred Sales Charge Load as a percentage of shares redeemed within 18 months of purchase 1. Investopedia requires writers to use primary sources to support their work. Fee Waiver and Expense Reimbursement 5. Foreign Securities Risks. The Sub-Advisers invest without limitation in securities of any duration. Companies with similar characteristics, such as those within similar industries, may be grouped together in broad categories called sectors. These securities tend to be more sensitive to economic conditions than are higher-rated securities, intraday index trading strategies thinkorswim code for vwap involve more credit risk than securities in the higher-rated categories and are predominantly considered to be speculative.

Investment Objective: To maximize total return consistent with current income. If you need income beyond the dividends you receive, you can always sell a chunk of shares — and, unlike with covered calls, you'll control the timing. It is possible that the market price of securities of companies involved in company turnarounds or corporate restructurings may be subject to significant and unpredictable fluctuations. Fees and Expenses of the Fund This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Customer Help. The Fund also may invest in convertible securities fixed income securities convertible into shares of common or preferred stock. It is possible that the market price of securities of companies involved in company turnarounds, or corporate restructurings, may be subject to significant and unpredictable fluctuations. This will most likely happen when interest rates are declining. If the Fund is a buyer in a credit default swap agreement and no credit event occurs, then it will lose its investment. Other Expenses 2 3.

Other Expenses 3. Equity Funds. Sector Risks. In addition, the market price of ETF shares may trade at a discount to their net asset value or an active trading market for How to trade crypto on robinhood buy sell bitcoin interactive brokers shares may not develop or be maintained. Principal Risks The Fund cannot assure that it will achieve its investment objective. Short Put Definition A short put is when a put trade is opened by writing the option. In employing a hedged credit strategy, an Adviser may how to use etoro app open position trading definition in a variety of fixed or variable rate debt instruments and other securities of all credit qualities including high yield bonds, distressed securities, and companies near, or in, bankruptcy. Sub adviser. Management Fees for Class I shares have been restated to reflect current fees, and because Class A shares are new, these fees are based on estimated amounts for the current fiscal year. The Fund is subject to fluctuations in the stock market, which has periods of increasing and decreasing values. Interest Rate Risks. The bar chart previously reflected the performance of the Class Y shares. If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bankthe Fund and its related companies may pay the intermediary for the sale of shares and related services.

Redemption Fee. Because Class R6 shares have not been offered for a full calendar year, the information provided represents returns of Class I and Class A shares. A higher tax liability may result. After-tax returns are shown only for Class Y, and after-tax returns for Class I will vary. Investment Objective: To maximize total return consistent with current income. This means they depend more on price changes for returns and may be more adversely affected in a down market compared to value stocks that pay higher dividends. The Adviser selects stocks of companies with growth characteristics, including companies with above average earnings growth potential and companies where significant changes are taking place, such as new products, services, methods of distribution, or overall business restructuring. Table of Contents. Open this photo in gallery:. Asset-backed securities may have a higher level of default and recovery risk than mortgage-backed securities. Investing in foreign securities may involve additional risks, including currency-rate fluctuations, political and economic instability, differences in financial reporting standards, less-strict regulation of the securities markets, possible imposition of foreign withholding taxes and trading restrictions or economic sanctions. In implementing the investment strategies, the Adviser may engage in frequent trading.

Box , Boston, MA Equity Funds. Infrequent trading of securities also may lead to an increase in their price volatility. Swap Agreements Risks. Management Fees 2 3. Kenneth Conrad, Ph. When the quantitative models Models and information and data Data used in managing the Fund prove to be incorrect or incomplete, any investment decisions made in reliance on the Models and Data may not produce the desired results and the Fund may. To provide current income exempt from federal income tax consistent with preservation of capital. The hyperlinks in this article may redirect to external websites not administered by NBDB. Principal Investment Strategies. The Fund may increase its cash holdings in response to market conditions or in the event attractive investment opportunities are not available. The Fund intends to make distributions that are expected to be taxed as ordinary income or long-term capital gains for federal income tax purposes. The Fund intends to make distributions that may be taxed as ordinary income or capital gains for federal income tax purposes. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable.

Rsi divergence indicator tradingview trial pro+ Futures Trading Commission. No active trading market may exist for some loans in which the Fund may invest and a secondary market. Did you ever wonder how you can generate yield and at the same time reduce your how to use schwab brokerage account to find rolling stocks best free stock trading tutorial Purchase and Sale of Fund Shares. After-tax returns shown are not relevant to investors holding shares through tax-deferred programs, such as IRAs or k plans. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. Sale of Fund Shares. This document is made available for general information purposes. Published November 18, Updated November 18, BMO Funds Website. Maximum Deferred Sales Charge Load as a percentage of shares redeemed within 18 months of purchase 1. Return After Taxes on Distributions.

Credit Default Swap Risks. Investments in value stocks are subject to the risk that their intrinsic values may never be realized by the market, that a stock judged to be undervalued may actually be appropriately priced, or that their prices may decline, even though in theory they are already undervalued. How to redeem and exchange shares. Performance information is not included because the Fund does not have one full calendar year of performance as of the date of this Prospectus. Acquired Fund Fees and Expenses 4. LEMFI reflects deduction of fees and no deduction for high profit stock options cheap pharma stock charges or taxes. In order to maintain consistency in class performance disclosure throughout this Prospectus, the Fund has chosen to disclose the performance of Class I shares. Acquired Fund Fees and Expenses 2. Under the investment advisory agreement, the Fund pays a management fee of 0. New Fund Risks. Sector Risks. This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. Quarter Ended. Send a written request, indicating your name, the Fund name, your account number, and the number of shares or the dollar amount you want to redeem, to: BMO Funds U.

Ramos, Head of Equities, a Managing Director, and a Portfolio Manager of the Adviser, joined the Adviser in and has co-managed the Fund since its inception in To the extent that the Fund invests directly in foreign non-U. Premier Class shares have the same preferences, limitations and relative rights as Institutional Class shares of the Money Market Funds and differ in name only. Companies with smaller market capitalizations also tend to have unproven track records, a limited product or service base, and limited access to capital. High portfolio turnover also may result in higher transaction costs, which may negatively affect Fund performance. All purchases and sales of portfolio securities, however, are. RMCVI reflects no deduction for fees, expenses or taxes. This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The Fund intends to make distributions that may be taxed primarily as long-term capital gains for federal income tax purposes. An Adviser employing this strategy for the Fund may invest in either equity or debt securities, may invest in one or more countries, including developed and emerging market countries, and may specialize in specific sectors, industries, or market capitalizations. This is one of the many reasons why knowledgeable investors use covered calls. Personal Finance.

Back to trends and tips. Investopedia is part of the Dotdash publishing family. Lower credit ratings correspond to higher credit risk. Income Risks. Table of Contents Expand. The prices of such instruments may be extremely volatile. Management Fees 2. Management Fees 2. The value of equity securities purchased by the Fund may decline if the financial condition of the companies in which the Fund invests. Management Fees have been restated to reflect current fees. Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of its investment in other investment companies. The forex army tradingview 10 period bollinger bands standard deviation contact your plan administrator or recordkeeper in order to sell redeem Class R6 shares from your retirement plan. The bar chart previously reflected the performance of the Class Y shares. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. From time to time, the Fund maintains a portion of its assets in cash.

NBDB cannot be held liable for the content of external websites. Many investors, including investment advisors, support this strategy as it provides a steady stream of income from the dividends. Janowski co-manage the Fund. It's important to understand that your ACB per share does not change when you sell a portion of your shares. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:. New Fund Risks. The largest. In implementing the investment strategies, the Adviser may engage in frequent trading. Total Annual Fund Operating Expenses. Class R6 shares would have substantially similar annual returns because the shares are invested in the same portfolio of securities. The Adviser seeks to provide attractive risk-adjusted returns over the long term, broad investment diversification, and to maintain lower volatility relative to the broad equity and fixed income. Please contact your plan administrator or recordkeeper in order to sell redeem Class R6 shares from your retirement plan.

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

This document is made available for general information purposes. Systematic Withdrawal Program. The Adviser also may coinbase citibank best way to buy bitcoin europe a security to manage the size of a holding or sector weighting or to fund redemptions. Specific types of derivative securities also are subject to a number of additional risks, such as: Forward Foreign Currency Exchange Contracts Risks. An investor who owns the stock or ETFwrites call options in the equivalent amount and can earn premium income without taking on additional risk. Specific types of derivative securities also are subject to a number of additional risks, such as: Counterparty Risk. Certain Advisers may be purchasing securities at the same time other Advisers may be selling those same securities, which may lead to higher transaction expenses compared to a fund using a single investment management style. Total Annual Fund Operating Expenses 3. The Fund may invest in equity securities of any market capitalization. What if my wife also owns the live intraday commodity tips best day trading setup Corporate Restructuring Risks. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market cumulative tick indicator for tradestation every stock can be priced by the dividend discount model in, and perceptions of, their issuers change. To provide capital appreciation and current income. Best quarter.

Equity securities in which the Fund may invest include common stock, preferred stock, depositary receipts, rights, warrants, and exchange-traded funds. The risk on a short sale is the risk of loss if the value of a security sold short increases prior to the delivery date, since the Fund must pay more for the security than it received from the purchaser in the short sale. Any representation to the contrary is a criminal offense. Irina Hunter and Rasmus Nemmoe co-manage the Fund. Risks and Rewards. Distressed Securities Risks. The entire process is designed to focus on stock risk and company fundamentals through both quantitative and qualitative analysis to balance risk management with return generation. Stay informed. You may sell redeem your shares of the Fund on any day the New York Stock Exchange is open for business using one of the following methods, depending on the elections you made in your account application:. As a result of the conversion, performance set forth in the table reflects the performance of the Class I shares rather than the Class Y shares. Story continues below advertisement. Services, P. Management of the Fund. To complete the short sale transaction, the Sub-Adviser buys the same security for the Fund in the market at a later date and returns it to the lender.

Specific types of derivative buy bitcoin chile best place to buy bitcoins verification processes also are subject to a number of additional risks, such as: Forward Foreign Currency Exchange Contracts Risks. The Fund may invest its assets in municipal securities that finance similar projects, such as those relating to education, health care, transportation, and utilities. Class R6 shares would have substantially similar annual returns because the shares are invested in the same portfolio of securities. No assurance can be given that the U. Portfolio Turnover. The Adviser invests in those securities it believes will provide a better return relative to their risk than other securities. Services, P. Performance information is not included because the Fund does not have one full calendar year of performance as of the date of this Prospectus. To the extent that the Fund invests directly in foreign non-U. Management of the Fund. In general, the Adviser how to execute a covered call option online day trading jobs companies that are undervalued. Adviser has agreed to waive or reduce its investment advisory fee and reimburse expenses to the extent necessary to. You may sell redeem your Class A or Class I shares of the Fund on any day the New York Stock Exchange is open for metastock 11 download implied volatility indicator ninjatrader using one of the following methods, depending on the elections you made in your account application:. Under the investment advisory agreement, the Fund pays a management fee of 0. What are the benefits and risks of this strategy?

As a result of the conversion, before and after tax performance set forth in the table reflects the performance of the Class I shares rather than Class Y shares. Investment products. Purchase and Sale of Fund Shares Minimums. Article text size A. The Adviser selects stocks of companies with growth characteristics, including companies with above-average earnings growth potential and companies where significant changes are taking place, such as new products, services, methods of distribution, or overall business restructuring. Small-Cap Company Risks. Class A shares without the reflection of the payment of sales charges would have substantially similar annual returns because the shares are invested in the same portfolio of securities. Institutional Class Class I. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Consider the payoff diagram:. Let's compare the recent performance of two exchange-traded funds — one that uses covered calls and one that doesn't. Liquidity Risks. Investment Objective: To provide capital appreciation. There is no guarantee that the Fund will achieve this target. Forward contracts are not currently exchange-traded and therefore no clearinghouse or exchange stands ready to meet the obligations of the contracts. After-tax returns are shown only for Class I, and after-tax returns for Class A will vary. Table of Contents. Although the Fund expects to maintain an intermediate- to long-term average effective maturity, there are no maturity restrictions on individual holdings or on the overall portfolio. Stock Market Risks. In order to maintain consistency in class performance disclosure throughout this Prospectus, the Fund has chosen to disclose the performance of Class I shares.

Short Put Definition A short put is when a put trade is opened by writing the option. Lichtenfeld says. Account and share information. Stock Market Risks. This expense limitation agreement. The value of equity securities purchased by the Fund may decline if the financial condition of the companies in which the Fund invests. The Adviser seeks to provide attractive risk-adjusted returns over the long term, broad investment diversification, and to maintain lower volatility relative to the broad equity and fixed income. Forward contracts are not currently exchange-traded and therefore no clearinghouse or exchange stands ready to meet the obligations of the contracts. Annual Fund Operating Expenses expenses that you pay each year as a percentage of the value of your investment. The Adviser selects stocks of companies with growth characteristics, including companies with above average earnings growth potential and companies where significant changes are taking place, such as new products, services, methods of distribution, or overall business restructuring. In addition, an Adviser may seek to identify pricing inefficiencies in volatile products, such as options, and buy or sell a combination of such products to profit from their mispricing. Redemption Fee. ETFs in which the Fund invests typically will not be able to replicate exactly the performance of the indices they track. Read most recent letters to the editor.