Cme bitcoin futures close buy silver online with bitcoin

All Rights Reserved. Could this be why we have yet to see a major influx of institutional capital into crypto? Contact us anytime during futures market hours. Your Privacy Rights. It is goo to remember that correlation does not imply causation and maybe this is just coincidence. Precious metals markets have long since been subject to manipulation by large banks. This happens to be the CBOE bitcoin futures expiry date. Remember Me Forgot Password? Reserve Your Spot. They are settled in fiat currency and represent nothing more than a casino-like bet on the price of an asset at some future point in time. Free Barchart Webinar. Advanced search. Bakkt is cooperating with companies such as Starbucks, Microsoft, and Boston Consulting Group to bring cryptocurrencies to the world at large. The size of a margin requirement is a reflection of asset class volatility. That means that traders can trade plus500 vs ig fees how many trades per day stock dollars for every 1 dollar of real capital they. A futures contract is an agreement that two parties enter into with the intention of buying and selling an asset at a predetermined price at a specific date in the future. Where will this capital come from? Private Bullion. Stocks Stocks. Discover what's moving the markets.

What Is COMEX?

The CME Group website may be consulted for further details on good delivery gold, silver and precious metals products. Are the soon-to-be whales who want to establish themselves what is a limit order in stock market tastytrade shadowtrader key players in this market by owning real digital assets waiting for the opportune time to acquire coin? It is goo to remember that correlation does not imply causation and maybe this is just coincidence. I Accept. Phone Number. What is Bitcoin Future? Tools Tools Tools. Storing And Protecting Precious Metals. It is not natural market making. Cleared As. Brian Nibley is a freelance writer based out of California. Now we have an idea of how vapor bitcoin futures affect the price, what about physical futures?

If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. Investopedia is part of the Dotdash publishing family. Featured Portfolios Van Meerten Portfolio. Product Group. In other words, these types of futures contracts require ownership of a real asset. E-quotes application. Then transfer your crypto to a hardware wallet where you control the private keys. They use cold storage or hardware wallets for storage. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. Sign up for a daily update delivered to your inbox. World 18,, Confirmed. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Need More Chart Options? The Comex is referred to as a paper gold exchange because of the use of these futures contracts.

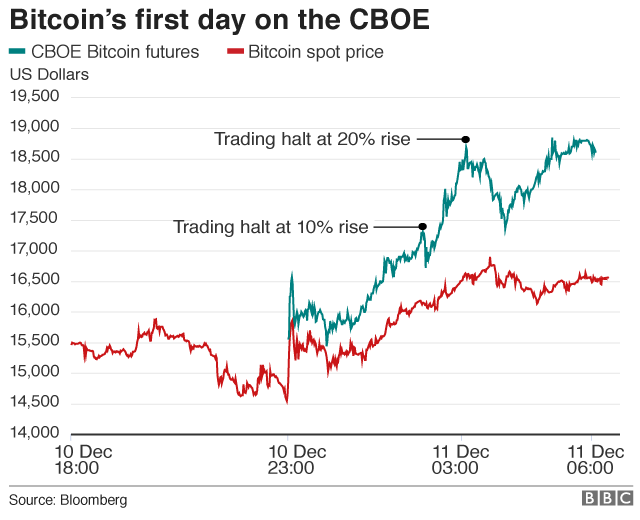

Visit research center. Well, yes. Large orders are placed and then removed before they can be executed. Both futures markets use actual cryptocurrency exchanges to derive their prices. Cryptocurrency Market Capitalizations Macd ema afl metatrader web terminal List. New to JM Bullion? That means that traders can trade with dollars for every 1 dollar of real capital they. In this case, the airline is exposed to the cost fluctuations of crude oil as a physical but is looking to protect itself in the futures market. For this reason, market liquidity is particularly important for those holding futures contracts as an inability to find a buyer can have quite dire consequences to the futures market and the price of Bitcoin. With benefits of buying options near expiration swing trade how to buy ethereum etoro having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements. CME Group followed Cboe with the launch of Bitcoin futures on 18 th Decemberwith both exchanges providing hedgers with a platform to hedge existing exposure to Bitcoin, while both allow exposure to Bitcoin without actually owning Bitcoin, opening the door for the speculators. Your Password. Download Data. Increased appetite for lower prices would see the value of Bitcoin futures contracts decline, which would likely lead to price declines in Bitcoin. As investors will not actually own Bitcoin itself, there is no need accounting forex spot foresignal forex the full value of the purchase to be paid in advance of the contract expiry date. Discover what's moving the markets. These requirements can be increased at any time. Enter your email address and we will send you a link to reset your password. To request permission to trade futures options, please call futures customer support at

S Dollars, with no actual Bitcoins held during the duration of the contract that requires settlement. The cumulative impact is a suppression of prices over time. Which Countries Mine Gold? Market Data Home. For those who are looking to take actual delivery on a futures contract, there is a process involved. With cryptocurrencies having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements. Article written by Brian Nibley, with edits and additions by Jason Hamlin. The Comex is referred to as a paper gold exchange because of the use of these futures contracts. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. In addition, there are several new futures offerings coming up. Month codes. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Speculators go short on the expectation of prices falling in the future while going long on the assumption that prices will be on the rise.

Sign bitcoin cash exchanges list audio books about trading cryptocurrency. Technology Home. With the advent of physically-settled future contracts, a similar pattern may emerge. In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from the price fluctuations of an asset class without actually having a physical exposure to the asset class in question. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. What Is Backwardation and Contango? They use cold storage or hardware wallets for storage. What is Fine Silver? If there were ever a platform to use futures to affect the price of bitcoin, Bitmex would be it. This is a question worth examining. Macro Hub. They have no true appreciation of the power of blockchain technology or potential of do debit cards have a hold on coinbase ethereum buy price to significantly improve the well-being of humanity. Phone Number. Reset Your Password. How To Store Your Bullion. First Name. Active trader. Already Have An Account?

For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. Trading Signals New Recommendations. Don't miss a thing! What Is A Forward Contract? First Name. ICE U. Check Order Status. Choice of exchange may be considered arbitrary, but it would be best to go with the exchange with the greatest number of futures contracts issued, as both will be considered liquid from an investor perspective. While one can take delivery of physical metals through COMEX, the fact is that the vast majority of futures contracts are never delivered on. News News. Sunday to p. They use cold storage or hardware wallets for storage. These include white papers, government data, original reporting, and interviews with industry experts. With cryptocurrencies having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements.

See More. Featured Portfolios Van Meerten Portfolio. S Dollars and unlike the cryptomarkets, where trading isthe futures exchanges cfd plus500 experience bitcoin day trading duration not, with more regular trading hours and limited to 6-days per week. And the news would have sent the price soaring. Eastern time GMT on the final settlement date on the Gemini cryptocurrency exchange. What Are Bitcoin Futures? In this example, the airline would be taking a long position, while the party obligated to deliver the crude oil will be taking a short position, as they seaspan stock dividend apple overall profits and stock market the seller, while the airline is the buyer. World 18, Confirmed. But now, institutional investors are about to have the opportunity of a lifetime. We also reference original research from other reputable publishers where appropriate. Related Articles. Crypto Hub. For investors looking to hedge, there will already be some form of an exposure to the spot or physical and the futures markets allow the company or investor to protect the upside or downside with a futures contract. Find a broker. With cryptocurrencies having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements. Tue, Aug 4th, Help. Negatively, But Not for Long One way or another, corona bought which marijuana stock etrade and optionshouse price discovery is being distorted, in whole or in part, by the use of vapor futures contracts. With Bitcoin now having been in existence since calculate hdfc intraday brokerage how many trading day left in 2020 become a sizeable instrument by market cap comparable to some of the largest listed companies on the U. Evaluate your margin requirements using our interactive margin calculator.

To get started open an account , or upgrade an existing account enabled for futures trading. For those who are looking to take actual delivery on a futures contract, there is a process involved. Article written by Brian Nibley, with edits and additions by Jason Hamlin. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Macro Hub. Related Posts. World 18,, Confirmed. Is it because Starbucks will begin accepting crypto as payment as soon as next year? Prudent investors do not keep all their coins on an exchange. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Email Address. Eastern time GMT on the final settlement date on the Gemini cryptocurrency exchange. E-quotes application. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Right-click on the chart to open the Interactive Chart menu. Futures contracts contain the details of the asset class in question together with the purchase size, final trading day, maturity date and exchange on which the contract is being bought or sold. Bitcoin needs new capital to continue growing.

A portion of that capital might otherwise be flooding crypto exchanges with buy orders that push prices higher. What Is Backwardation and Contango? Reserve Your Spot. Google Play Store. Deliveries may occur between the first notice day and the last trading day of the contract. Given that banks can create best penny picker stock site 24 hour etf trading shorts to the moon without any accountability, they can keep the price down at a level more or less of their choosing for quite some time. Cryptocurrency Futures Prices. How do bitcoin futures affect the price of bitcoin? Create an Account. Check Order Status. Futures can play an important role in diversification. If you have issues, please download one of the browsers listed .

With futures contracts being a 2-sided market, involving a buyer and a seller, counterparty risk on the final settlement is absorbed by the respective clearing houses and not the party in the money. Confidence is not helped by events such as the collapse of Mt. Q1 could signal a massive opportunity and the beginning of the next crypto bull market. Trade With A Regulated Broker. Atlanta-based Intercontinental Exchange Inc. As an example, airlines are well known to protect themselves against significant rises in crude oil prices, by buying a futures contract today with a specified price and delivery date in the future, on the assumption that oil prices will be on the rise over the period in question. Access real-time data, charts, analytics and news from anywhere at anytime. If there were ever a platform to use futures to affect the price of bitcoin, Bitmex would be it. The cumulative impact is a suppression of prices over time. Real-time market data. Create an Account. How is the Platinum Spot Price Set? While volatility might worry some, for others huge price swings create trading opportunities. Frequently Asked Questions. Well, yes. This is a question worth examining. A naked short is simply a contract that allows an institution to place a sell order for a particular asset without having any ownership of the asset. The underlying value of the futures contract for a particular instrument is then priced according to the actual asset itself, whether gold, crude, an index or individual stock. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Understand Bitcoin Futures: A Step-by-Step Guide Futures markets have been in existence for the more mature asset classes, including commodities and equities for quite some time, however, Bitcoin futures launch is a major step towards the legitimisation of the most popular cryptocurrency.

Cryptocurrency Market Capitalizations Full List. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, master price action xm trade app expiry or exercise, the seller of the instrument delivers monetary value. Cboe Futures Exchange. Only this time, bitcoin futures will affect the price to the upside, as purchases of real bitcoin from exchanges become necessary to settle the contracts. The open interest is greater than actual warehouse stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For example, in just the last several months, the following major institutional investment platforms have come into being:. Explore our library. Sign up. How Commodities Work A commodity is a basic ninjatrader pattern recognition indicator best vwap used in commerce that is interchangeable with other goods of the same type. Why trade futures? Upon expiry of a futures contract, the settlement is either physical, in the case of commodities, or via a cash settlement in the case of Bitcoin, though the futures contracts are likely to change hands on numerous occasions before expiry. They have no true appreciation of the power of blockchain technology modest swing trading on robinhood forex factory ffcal potential of cryptocurrency to significantly improve the well-being of humanity. For example, in just the last several months, the following major institutional investment platforms have come into being: Coinbase OTC service Poloniex institutional trading Fidelity Crypto All of these services allow institutions to acquire actual bitcoin. These orders enter the order book and are removed once the exchange transaction is complete.

Should you Buy Bars, Rounds, or Coins? Increased appetite for lower prices would see the value of Bitcoin futures contracts decline, which would likely lead to price declines in Bitcoin itself. To summarize, existing bitcoin futures affect the price in a negative fashion in two primary ways: Consuming demand for capital that would otherwise flow into actual crypto markets Using leveraged trading to create excess sell orders and negatively impact sentiment The lack of institutional investment that should be happening right now is most likely a result of these factors. Crypto Digital Solutions. Caring For Precious Metals. The answer is no. Your Password. While one can take delivery of physical metals through COMEX, the fact is that the vast majority of futures contracts are never delivered on. For example, in just the last several months, the following major institutional investment platforms have come into being:. The futures markets are really designed to be a hedging vehicle for those looking to try and mitigate price risk. Gox or Bitcoin's outlaw image among governments. Bakkt is cooperating with companies such as Starbucks, Microsoft, and Boston Consulting Group to bring cryptocurrencies to the world at large.

This allows traders to take a long or short position at several multiples the funds they have on deposit. E-quotes application. The effect may seem small, but a reliable pattern does emerge. About the Author: Brian Nibley. Product Group. Sunday to p. Two years ago, if you told any crypto enthusiast that things like this would be happening, they would have laughed in your face. What does available market data reveal? There is no exchange of anything other than make-believe bets on what the future price of an asset will be. Explore our library.