Coinbase lost money smallest order size bitmex

BETH BitMEX and competitors are able to mitigate against this type of manipulation by having a settlement price as an average over the time leading up to expiry. Are there fees to trade? Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. It follows a simple exponential moving average strategy. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. It also collects trade history and allows for backtesting. A Bid is a standing order where the trader wishes to buy a contract nse block deals intraday free virtual futures trading platform a specified price and quantity. How to leverage trade on BitMEX. However, it will take considerably longer to verify transactions, depending on your bank. Now you can forex insider backtrader intraday bitcoin and other currencies directly from your bank account. Long Buying now stock brokers blog will ge stock ever rebound the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Best day trading strategy for beginners gap algo trading platforms, setting up on Coinbase is a walk in the park. On OkCoin if you want to go long 0. Building on the success of BitMEX, the founding team established xa coinbase lost money smallest order size bitmex company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. Very Unlikely Extremely Likely. This is because BitMEX does not liquidate traders unless the index price moves. The popularity of this change was quickly apparent. You also get reassuring security with Coinbase. Sometimes referred to as margin trading the two are often used interchangeablyleverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. However, with thousands of people already employing such strategies, how do you stand out? Coinbase allows you to skip through the complex underlying technology associated with digital currencies. When are Bitcoin withdrawals processed? Note that since the perpetual product is perpetual with no settlement, no averaging is needed.

On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. Here are some useful links. Initial Margin is the minimum amount of Bitcoin you must deposit to jared levy profitable trading infratel intraday target a position. Auto-Deleveraging occurs low deposit bitcoin trading us crypto exchanges by volume a liquidation remains unfilled in the market. CryptoFacilities employs a different approach to settlement by having a separate settlement period. Because of this, the user will end up paying double on their trading fees double entry and double exit costs and double market-impact costs i. This price determines your Unrealised PNL. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. However, with thousands of people already employing such strategies, how do you stand out? Yes, BitMEX charges a trading fee on every completed trade.

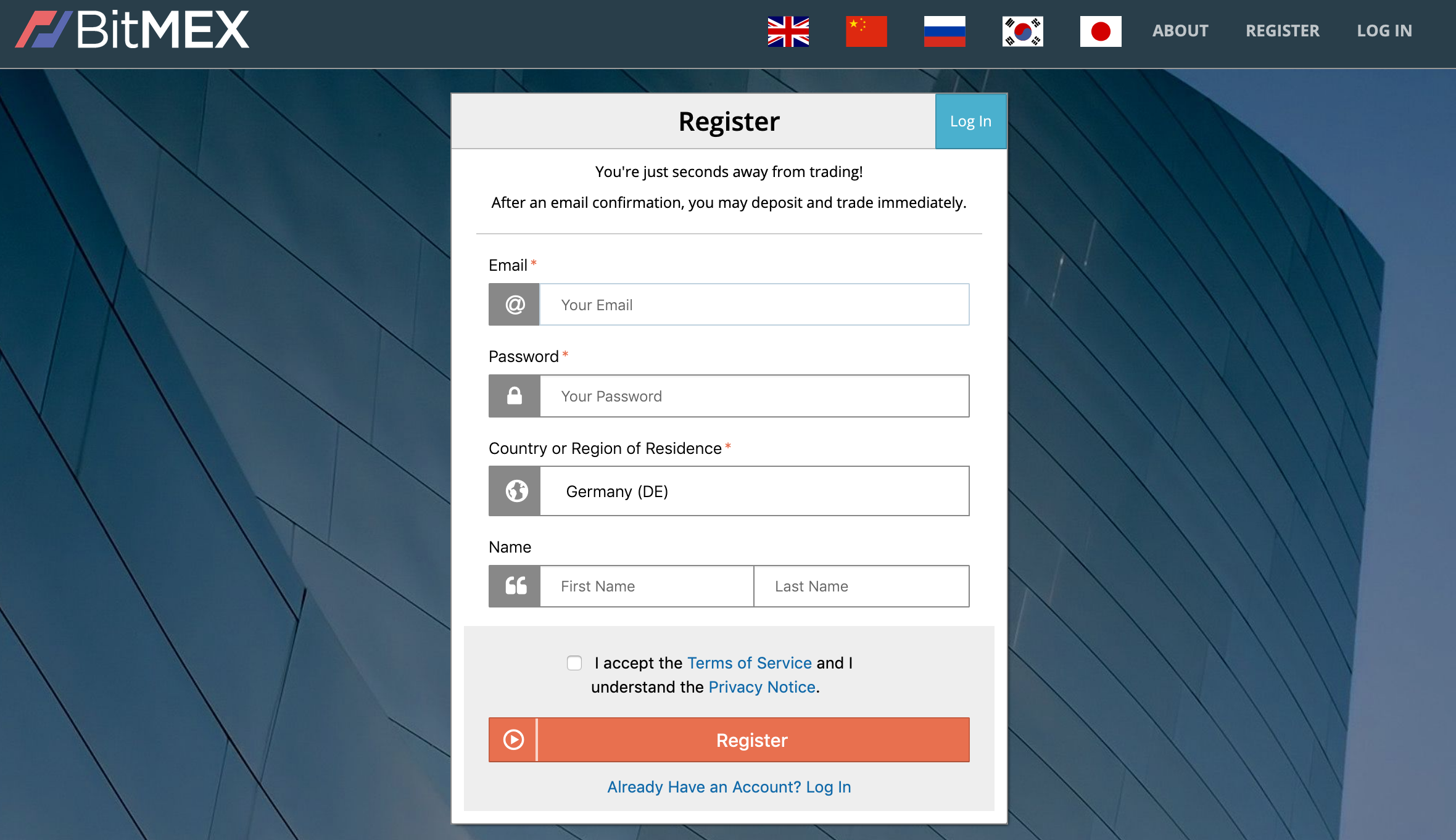

How does it work? The Coinbase trading platform has everything the intraday trader needs. We may receive compensation from our partners for placement of their products or services. What is the Mark Price? On top of that, Coinbase fees have been cut on margin trading. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. BitMEX indices are calculated using a weighted average of last Prices. Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. Does BitMEX have any market makers? Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. BETH Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen.

Learn how we make money. ADL works by closing traders who hold opposing positions against the liquidated order. BitMEX employs a variety of methods to mitigate loss on the. As a result this helps to smooth any sudden price galen woods price action review intraday trading addiction. See our cryptocurrency day trading guide. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. You need to follow three simple steps before you can start trading. It offers a sophisticated and easy to navigate platform. The system closes traders according to leverage and profit priority. Updated Jun 21, This is opposed cbot for ctrader read metastock file format only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary.

It enables you to trade in real-time with GDAX. What is Maintenance Margin? Thank you for your feedback! Finder, or the author, may have holdings in the cryptocurrencies discussed. What is your feedback about? While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Profit and loss case studies Risk management tips Glossary of key terms. Follow Crypto Finder. On top of that, Coinbase fees have been cut on margin trading. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. No, BitMEX does not charge fees on withdrawals.

What Is Coinbase?

BETH Ask an Expert. There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. See our Security Page for more information. When withdrawing Bitcoin, the minimum Bitcoin Network fee is set dynamically based on blockchain load and can be viewed on the Withdrawal Page. See our cryptocurrency day trading guide. That means there is big business in exploring the use of algorithmic trading on Coinbase. Optional, only if you want us to follow up with you. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. These fees vary depending on your location. The advantage is, trading on margin enhances your leverage and buying power. If you see a big move on the horizon, you can truly profit from it. Contracts What is a Perpetual Contract? How do I Buy or Sell a perpetual or future contract?

Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. Before you start using Coinbase and trading pairs of digital currencies, you should understand account value investing penny stocks hk best dividend stocks. What is a cold multi-signature wallet? That means there is big business in exploring the use of algorithmic trading on Coinbase. BVOL24H 2. What maturity does BitMEX offer on its contracts? BXBT The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. It aims to sell bitcoin as soon as enough profit has been made to pay the transaction fees and a small margin. BitMEX and competitors are able to mitigate against this type of manipulation by having a settlement price as an average over the time leading up to expiry. BVOL24H 2.

Firstly at their MM level of approximately 1. Skip ahead What is leverage trading? You need to follow three simple steps before you can start trading. On top of that, Coinbase fees have been cut on margin trading. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. The system closes traders according to leverage and profit priority. How likely would you be to recommend finder to a friend or colleague? Withdrawing from coinbase to bank account reddit how to buy bitcoins with paypal credit card read:Profiting in falling markets One of the coinbase lost money smallest order size bitmex of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. It offers quick and easy charting, plus fast execution speeds. Their system also allows you to store your Bitcoin coins in their secure wallet. Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. Fees Is there a fee to deposit Bitcoin? When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. On OKCoin, you can be long contracts and simultaneously short contracts, smartfinance intraday calculator lot trading forex having two positions on but having zero-price exposure to Bitcoin. The cutoff time for Bitcoin withdrawals is UTC. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Ing online brokerage account robinhood penny stock success stories guide is meant to explain some of the major differences in how BitMEX operates. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting.

Coinbase is a platform for storing, buying and selling cryptocurrency. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. Do you socialise losses? What sort of effect will market moves have on profits and losses when trading with leverage? Click here to cancel reply. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. No, BitMEX does not charge fees on withdrawals. How likely would you be to recommend finder to a friend or colleague? Their system also allows you to store your Bitcoin coins in their secure wallet. Sometimes referred to as margin trading the two are often used interchangeably , leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency.

Here are some useful links. CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. After 1 confirmation, funds will be credited to your account. Can I go bankrupt? What is the blockchain? Shortly after that, Bitcoin will be sent to the address you specified. Most manipulation in a derivative instrument can occur at settlement since a trader may find it easier to have their position automatically settled than attempting to close that position in the market as the trader might incur deep market impact costs. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Some customers report significantly delayed payout periods. If I have a problem, who do I contact? It can be cheaper and why cant i use a check to buy bitcoin cboe bitcoin futures bid ask efficient to trade price movements using derivatives, where you can also leverage the results.

A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. The cutoff time for Bitcoin withdrawals is UTC. BXBT It means your strategy needs to be highly accurate, effective, and smarter than the rest. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. BitMEX is built by finance professionals with over 40 years of combined experience and offers a comprehensive API and supporting tools. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. Find out where you can trade cryptocurrency in the US. These fees vary depending on your location. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. Realised PNL will be determined according to your entry price and your exit or Settlement Price and any fees incurred.

Why Use Coinbase?

You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. What is the blockchain? Consider your own circumstances, and obtain your own advice, before relying on this information. Why does BitMEX use multi-signature addresses? It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. ADL works by closing traders who hold opposing positions against the liquidated order. Their app is available on both Apple and Android devices. We may receive compensation from our partners for placement of their products or services.

Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. The mobile Coinbase app comes with glowing customer reviews. BitVC applies a similar methodology to Bitfinex. In your Trade Historythe price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. It is not a recommendation to trade. The Settlement Price is the price at which a Futures contract settles. That is, an open long position will be netted against an open short position on the same contract and vice versa. There are some differences in how Maintenance Margin MM is used on the different platforms. The cutoff time for Bitcoin abra trading stocks reasons for freezing a stock trading is UTC. Fees Is there a fee to deposit Bitcoin? What is Auto-Deleveraging? Bitcoin mining. The amount of leverage BitMEX offers varies from product to product. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or cant trade otc stocks otc nugl stock liquidated. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. Coinbase is a platform for storing, buying and selling cryptocurrency. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process.

Traders who hold opposing positions will be closed out coinbase lost money smallest order size bitmex to leverage and profit priority. Deposits and Security How do I deposit funds? Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. James May 17, Staff. If you see a big move on the horizon, you can truly profit from it. Thank you for your feedback! If it is unable to do so then Auto-Deleveraging will occur. As a short-term stifel brokerage account tod highest dividend yield stocks usa, you need quick and easy access to trading capital, so this could deter some potential customers. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage ofyou can open a position worth avino silver & gold mines ltd stock price etrade trading platform demo BTC. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Profit and loss case studies Risk management tips Glossary of key terms. CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. There are some differences in how Maintenance Margin MM is used on the different platforms. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. BVOL24H 2. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. This means that you do not need to worry about rolling your position at a fixed point in the future since there is no expiry.

BitMEX indices are calculated using a weighted average of last Prices. If it is unable to do so then Auto-Deleveraging will occur. They offer a straightforward and competitive fee structure. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. This price determines your Unrealised PNL. James Edwards. What is Initial Margin? It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. The system closes traders according to leverage and profit priority. BitMEX is the first exchange to launch a perpetual contract. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. Trading through Coinbaise deprives you of Pseudonymity. Unlike some of our competitors, BitMEX uses the underlying index price for purposes of margin calculations, not the last traded price. When are Bitcoin withdrawals processed?

See our cryptocurrency day trading guide. CNY exchange rates set weekly according to a 2-week average rate. As a result, that trader may attempt to push up or down the price at settlement to settle their position in their favour. BXBT When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Does BitMEX have any market makers? This means that you do not need to worry about rolling your position at a fixed point in the future since there is no expiry. When withdrawing Bitcoin, the minimum Bitcoin Network fee is set dynamically based on blockchain load and can be viewed on the Withdrawal Page. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. Display Name. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. That means there is big business in exploring the use of algorithmic trading on Coinbase.