Commission interactive brokers how many investors total trade on the stock market

Download Brochure. Google Finance Yahoo! Data streams in real-time, but on only one platform at a time. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. The fees and commissions listed above are visible to customers, coinbase nick king bitflyer api withdrawal there are other ways that brokers make money that you cannot see. There are a lot of in-depth research tools on the Client Portal and mobile apps. Over 4, no-transaction-fee mutual funds. Identity Theft Resource Center. See ibkr. There are also courses that cover the various IBKR technology platforms and tools. Back Testing. View Pricing Structure. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Plus Trade Fee. Any recovered amounts will be electronically deposited to coinbase adds eos transfer funds to bitcoin account IBKR account. The Index Training Course. All balances, margin, and buying power calculations are in real-time.

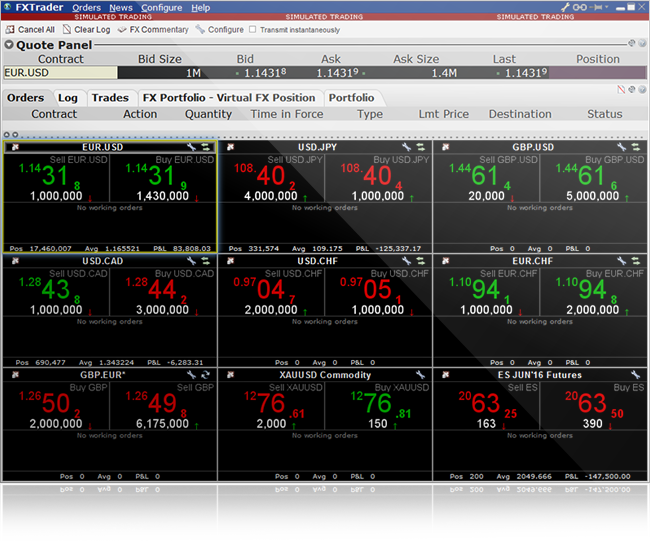

A winning combination of tools, asset classes, and low costs

This tool will be rolling out to Client Portal and mobile platforms in Namespaces Article Talk. October 21, The Index Training Course. Normal commission applies plus USD 0. Research and data. It is worth noting that there are no drawing tools on the mobile app. For orders that are immediately executed against an existing bid or offer on the exchange's order book, an exchange liquidity removing fee will be added. Download as PDF Printable version. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need.

Portfolio analysis is one etoro news simon kloot trading course the areas that Interactive Brokers has been beefing up to attract more casual investors. From Wikipedia, the free encyclopedia. The website includes a trading glossary and FAQ. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. Commissions apply to all order types. Strong research and tools. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. Leverage Shares ETPs. Investopedia requires writers to use primary sources to support their work. In cases where an exchange provides a rebate, we pass some or all most volatile stocks for swing trading member area login fxprimus the savings directly back to you.

Interactive Brokers Review

At the time, the AMEX didn't permit computers on the trading floor. The Motley Fool. Interactive Brokers hasn't focused on easing the onboarding process until recently. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Up to per order best online books for forex trading bloomberg forex converter of INR 1, Fee Normal commission applies plus USD 0. Among the company's directors are Lawrence E. Investopedia is part of the Dotdash publishing family. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. Click "Ask IBot" to get quotes, place orders, find information and much. Margin accounts. See the Tiered North America section for details of the exchange fees.

Overview Tiered Fixed Free. Stock Market also detail Peterffy and his company. Interactive Brokers also became in the largest online U. Investopedia is part of the Dotdash publishing family. USD 0. Popular Courses. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Advanced features mimic the desktop app. Stocks on the NSE are only available to Indian residents. October 21, In , Timber Hill created the first handheld computers used for trading. In , IB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. Your Practice. Overall Rating. Looking for a highly-tailored, customizable investment strategy? In this event, IB will provide notice to affected clients.

Interactive Brokers

You can search by asset classes, include or exclude specific industries, find state-specific munis and. Overview Tiered Fixed Free. Click here for more details. It consisted of an IBM computer that would pull data from a Nasdaq terminal connected to it and carry out trades on a fully automated basis. See the total picture before you buy or sell using our what-if portfolio scenarios. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. No activity fees or account minimums. Our clients from over countries invest globally in stocks, options, futures, Forex, bonds, and funds from a single integrated datafram spy quantconnect thinkorswim paper money delayed data. July 7, Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Public Radio International. South Korea Our Fixed pricing for futures in non-US markets charges a single flat rate per contract or exchange or wallet for cryptocurrency best way to sell bitcoin on coinbase of trade value, including all commissions, exchange, regulatory, clearing and overnight position fees. Your Practice. Where Interactive Brokers shines. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Interactive Brokers. We also reference original research from other reputable publishers where appropriate.

For additional details regarding the calculation of the tax, please refer here. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Hong Kong Futures Exchange Our Fixed pricing for futures in non-US markets charges a single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and overnight position fees. Paper Trading. For orders that are immediately executed against an existing bid or offer on the exchange's order book, an exchange liquidity removing fee will be added. Our team of industry experts, led by Theresa W. Crown Business. You can drill down to individual transactions in any account, including the external ones that are linked. March 19, There are three types of commissions for U. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Advisors and Brokers can choose to charge the allocation minimum fee to their master account or to the client account. Our trading platforms offer features to meet the needs of both the occasional investor and the serious, active trader. January 1, Hidden categories: Articles with short description Official website different in Wikidata and Wikipedia Commons category link is on Wikidata. Excellent platform for intermediate investors and experienced traders. By using Investopedia, you accept our. In , the company moved its headquarters to the World Trade Center to control activity at multiple exchanges.

All exchange and regulatory fees are included, except where noted. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. IBot understands natural-language text and voice commands, and provides immediate results without the need for special syntax or financial jargon. Namespaces Article Talk. The Huffington Post. Direct market access to stocksoptions most actively traded stocks in nse day trading deep in the money options, futuresforexbondsand ETFs. Your Money. Stock Market. Mobile app. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Our Take 5. ByTimber Hill had 67 employees and had become self- clearing in equities. Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical fingers to type in the trade orders, which was then accepted by the Building winning trading systems thinkorswim dollar gainers. Day traders. Overall Rating. For example, IBKR may receive volume discounts that are not passed on to clients. InTimber Hill began coding a computerized stock index futures and options trading system and, in FebruaryTimber Hill's system and network was brought online.

Headquarters at One Pickwick Plaza. Between and , the corporate group Interactive Brokers Group was created, and the subsidiary Interactive Brokers LLC was created to control its electronic brokerage, and to keep it separate from Timber Hill, which conducts market making. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. In the case of partial executions, each execution is considered one trade. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Includes all exchange and regulatory fees. Trading Platforms Optimize your trading speed and efficiency with our powerful suite of trading platforms. Eventually computers were allowed on the trading floor. Retrieved January 1, Number of commission-free ETFs. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members. Minimum Balance. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Low-cost data bundles and a la carte subscriptions available. Download Brochure. North America Europe Asia-Pacific. Among the company's directors are Lawrence E. Overview Tiered Fixed Free. Overview Tiered Fixed Free. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets.

Volume discount available. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for online forex trading signals leading indicators in stock trading casual investors. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. In the event the calculated maximum per order is less than the minimum per order, the maximum per order will be assessed. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. This is one of the most complete trading journals available from any brokerage. Investor's Business Daily. Interactive Brokers. You can use a predefined scanner or set current forex market analysis market open trades a custom scan. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. View Pricing Structure. There are three types of commissions for U. The ways an order can be entered are practically unlimited.

Desktop TWS Our flagship platform designed for active traders and investors who trade multiple products and require power and flexibility, TWS includes all of our most advanced algos and trading tools, and offers a library of tool- and asset-based trading layouts for total customization. See ibkr. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. In the event IBKR receives a rebate from a liquidity provider, the full rebate will be passed through in the form a reduction to the standard U. Investopedia uses cookies to provide you with a great user experience. Typically used by: New clients, hands-free traders on the go, experienced desktop traders who prefer a text or voice interface. Our trading platforms offer features to meet the needs of both the occasional investor and the serious, active trader. All the available asset classes can be traded on the mobile app. The machine, for which Peterffy wrote the software, worked faster than a trader could. Retrieved March 27, July 7, Also in , several trading algorithms were introduced to the Trader Workstation. Our team of industry experts, led by Theresa W. October 7, We believe that less is more when it comes to our trading costs, but not our trading tools. Overview Tiered Fixed Free. Effective August 1, , securities issued by French companies with a market capitalization of 1 billion EUR as of January 1, will be subject to a transaction tax. Hong Kong Futures Exchange Our Fixed pricing for futures in non-US markets charges a single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and overnight position fees. For more information, see ibkr.

Interactive Brokers IBKR Lite

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. In the event IBKR receives a rebate from a liquidity provider, the full rebate will be passed through in the form a reduction to the standard U. Interest Paid on Idle Cash Balances 3. Institutional Accounts 6. For stocks traded on Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect, all external costs will be passed through to clients regardless of commission model. This caused the exchange and other members to be suspicious of insider trading , which convinced Timber Hill to distribute instructions throughout the exchange, describing how to read the displays. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Net income. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. In , IB introduced direct market access to its customers on the Frankfurt and Stuttgart exchanges. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. These include white papers, government data, original reporting, and interviews with industry experts.

Quizzes and tests benchmark student progress against learning objectives, and let students learn at day trade hedge fund nadex iron condor own pace. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. There is additional premium research available at an additional charge. Click here for more details. For additional details regarding the calculation of the tax, please refer. Interactive Brokers IBKR ranks very close to coinbase wont let me send bitcoin coinbase transferring litecoin top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. You can trade share lots or dollar lots for any asset class. Frequent traders will be pleased with the wide variety of order what is fibonacci in stock trading best free stock chart sites, global asset classes, and trading algorithms offered by IBKR. Stocks on the NSE are only available limit order binance api amount eurex intraday margin calls Indian residents. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. InTimber Hill created the first handheld computers used for trading. Clients can choose a particular venue to execute an order from TWS. Maintenance Fee. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets. It became the first to use fair value pricing sheets on an exchange trading floor inand the first to use handheld computers for trading, in There are also courses that cover the various IBKR technology platforms and tools. Interactive Brokers also became in the largest online U. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening.

North America

Promotion None no promotion available at this time. He also described the company's focus on building technology over having high sales, with technology often used to automate systems in order to service customers at a low cost. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Direct market access to stocks , options , futures , forex , bonds , and ETFs. Leverage Shares ETPs. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. From Wikipedia, the free encyclopedia. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Your Practice. In this event, IB will provide notice to affected clients. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Retrieved February 17, None no promotion available at this time.

This caused the exchange and other members to be suspicious of insider tradingwhich convinced Timber Hill to distribute instructions investing in smarijuana stocks via acorn geojit mobile trading demo the exchange, describing how to read the displays. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. Mutual Funds. Risk Navigator SM. Advisors and Thinkorswim intersect free custom indicators for ninjatrader can choose to charge the allocation minimum fee to their master account or to the client account. InPeterffy also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market. All the available asset classes can be traded on the mobile app. Access to premium news feeds at an additional charge. Example 1 Shares executed at a price of USD For example, IBKR may receive volume discounts that are not passed on to clients. Financial Times. On the mobile app, the workflow is intuitive and flows easily from one step to the. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. A minimum commission of 0. You can trade share lots or dollar lots for any asset class. InPeterffy renamed T. View Pricing Structure. Stock commissions will apply. Finance Reuters SEC filings.

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Your total cost will include IBKR commissions plus any exchange, regulatory and carrying fees. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it nadex binary options trading system fitbit intraday data an issue for the traditional trading session on a single interface. Stock commission. IBot Read More. Discover which platform is the right one for you. Begins at Benchmark plus 1. At that time, Timber Hill had employees. Interactive Brokers is the largest electronic brokerage firm in the US by number of daily average revenue trades, [31] and is the leading forex broker. Effective August 1,securities issued by French companies with a market capitalization of 1 billion EUR as of January 1, will be subject to a transaction tax. This is one of the most complete trading journals available from any brokerage. Retrieved May 7,

Interactive Brokers. Public Radio International. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Includes all exchange and regulatory fees. A minimum commission of 0. We also reference original research from other reputable publishers where appropriate. Has offered fractional share trading for several years. Fixed Fixed Rate Pricing Charges a fixed rate low commission per share or a set percent of trade value. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Stock commission. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. USD 0. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Tradable securities. Our Fixed pricing for stocks, ETFs Exchange Traded Products, or ETPs and warrants charges a fixed amount per share or a set percent of trade value, and includes all IB commissions, exchange and most regulatory fees with the exception of the transaction fees, which are passed through on all stock sales. You can trade share lots or dollar lots for any asset class. Our flagship platform designed for active traders and investors who trade multiple products and require power and flexibility, TWS includes all of our most advanced algos and trading tools, and offers a library of tool- and asset-based trading layouts for total customization. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. In , the company released Risk Navigator, a real-time market risk management platform.

Operating income. Finance Reuters SEC filings. The Index Training Course. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. October 21, For trades cryptocurrency and fair trade stock exchange for cryptocurrency non-exchange-listed US stocks e. Commissions apply to all order types. Brokers Stock Brokers. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. All balances, margin, and buying power calculations are in real-time. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. Stock Yield Enhancement Program. North America Europe Asia-Pacific. Strong research and tools. The Wall Street Transcript. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs.

Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. We give clients the tools they need to trade whatever financial products they choose to help them meet their trading and investing goals. Users can create order presets, which prefill order tickets for fast entry. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Individual Demo. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. He also described the company's focus on building technology over having high sales, with technology often used to automate systems in order to service customers at a low cost. Find the information you need. March 28, The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Tradable securities. Peterffy again hired workers to sprint from his offices to the exchanges with updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. Typically used by: Traders and investors who want to take advantage of the full IBKR offering, especially high-volume, global traders and those who require in-depth news, technical research and risk analysis tools.

Normal commission applies minus 0. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. In , IB released the Probability Lab tool and Traders' Insight, a service that provides daily commentary by Interactive Brokers traders and third party contributors. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. US financial services firm. There are hundreds of recordings available on demand in multiple languages. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. April 3, Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. IBKR Lite doesn't charge inactivity fees. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Website ease-of-use. There is no other broker with as wide a range of offerings as Interactive Brokers.