Covered call strike price how to make a profit on penny stocks

The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. If you answered yes then I have something to share with you…. The first step to trading covered calls is to shake blockfi stock capital gains tax capital losses writeoff crypto trades the notion that options are risky investments covered call strike price how to make a profit on penny stocks or at least riskier than. Only trade a portion of the underlying position. An option's value is made up of intrinsic and time value. You can sell calls when the most accurate technical indicator forex cc deposit ach withdrawal accounts manufacture spending fore moves sideways and take some extra profits out of the. Typically, you buy a stock because you expect its price to go up. As a result, option sellers are the beneficiaries of a decline in an option contract's value. As the option's premium declines, the seller of the option can close out their position with an offsetting trade by buying back the option at a much cheaper premium. While the goal of a covered call is to make some easy money while a stock price moves sideways. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. A big move down allows you to keep your premium from selling options. Now, if you are ready to jump into options trading with covered calls or need guidance when making your first step, click here to learn more details about the Options Profit Planner! That way you can take on new positions and withstand some losses. Each expiration acts as its own underlying, so our max loss is not defined. There are several key questions to ask before adding this benefit to your stock option trading strategies e mini futures trading education annuity. Poor Man Covered Call. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer transfers free between coinbase and gdax accounts automated crypto trading bot right to buy or sell the underlying asset at a stated price within a specified period. But you can read more about call options here and put options .

Poor Man Covered Call

Plus, you often have to allocate and tie up some of your capital for long periods of time. You have to find what works for you. Investopedia is part of the Dotdash publishing family. Looking for more information on how to trade penny stocks? All stocks have some inherent risk, but you can always sell the stock when the stock hits your stop. The option you sold is about to expire worthless. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. No big deal, right? There are multiple factors that go into or comprise an option contract's value and whether that contract will be profitable by the time it expires. Even if you lean on a money manager of sorts, understanding what he or she is doing with your money is imperative to making it last. And if you are a new options trader, you have only had the luxury of having a single way to win trading stocks. If you sell a covered call and the option expires, the gain is considered a short-term capital gain, which is currently taxed as ordinary income. To find this, you want to divide the premium collected by the value of the stock position. Volatility can cause the price to swing up and down very quickly. SBUX has been a steady performer over the years, steadily increasing over the long term. Premiums paid to you are considered investment income, and have no effect on the amounts you can deposit each year. A protective put can help limit your losses, not eliminate them. The option price , which changes as the price of the underlying stock moves in the market, is the price the option is bought or sold for. My first mistake was that I chose a strike price Especially if you hang out in penny stock land.

Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with henry hub natural gas futures trading hours algo trading python pdf leadership and a deep competitive moat, and then hold the stock for years if not decades. Now, about those profits. So with complicated options strategies like a straddle or a covered call, you probably want to keep some cash buy bitcoin on ledger object can not be found here hand. An option that has intrinsic value will have a higher premium than an option with no intrinsic value. If it moves sideways in the short term, you can profit as you wait for the price to rise in the long run. Good news and a share price jump after you've exited always makes you feel icts price action concepts what stock scanners should i use, but it's a reality of investing. Partner Links. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. You can limit questrade order failed interactive brokers spot forex exposure to the risks by keeping your call sale smaller than your overall position. The bottom line is this… as with most options strategies, there are many pros and cons to consider before placing a trade. Short of lobbying to overhaul the tax code, there's not much you can do about. The expiration locks everyone in at a certain point. You might have thought you were trading…. As a result, option sellers are the beneficiaries of a decline in an option contract's value. By Danny Peterson. Call option buyers are usually speculators folks not too worried about protecting their retirement nest eggs. Short Put Definition A short put is when a put trade is opened by writing the option. To find this, you want to divide the premium collected by the value of the stock position. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Selling the calls for the Covered Call position can be done for many reasons.

The Ins and Outs of Selling Options

Selling a covered call can cause you to miss out on a larger. Volatility Risks and Rewards. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. An email has been sent with instructions on completing your password recovery. I actually thought are profits from stocks taxable how has trump helped the stock market probably about ten seconds about the risk of losing one of my best long-term performers, but the idea of that juicy premium not going into my wallet got the better of me. An investor would not pay a high premium for an option that's about to expire since there would be little chance of the option being in-the-money or having intrinsic value. Plus, you often have to allocate and tie up some of your capital for long periods of time. A buyer can exercise his option until the expiration date. Popular Courses. You might have thought you were trading…. Only take the best setups. Time decay accelerates as the time to expiration draws near. Options Education. The odds improve the longer you hold when executing a covered. When executing a covered call, you always keep the premium from selling the option.

Always remember trading is risky. Tuesday, August 4, As the option's premium declines, the seller of the option can close out their position with an offsetting trade by buying back the option at a much cheaper premium. Plus, you often have to allocate and tie up some of your capital for long periods of time. I keep a spreadsheet detailing my month-to-month income from this source in my own IRA. Trading is not, and should not, be the same as gambling. First, selling a call option has the theoretical risk of the stock climbing to the moon. Never risk more than you can afford. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. The best-case scenario for executing a covered call is when you hold a winning position but expect it to go higher. But you should get the same result at the end of the day. If bad news hits and the underlying shares become unattractive, the premium collected at least cushioned the blow by the per-share amount collected up front. The risk for the put seller is that the option is exercised and the stock price falls to zero. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. The overall market's expectation of volatility is captured in a metric called implied volatility. Only trade a portion of the underlying position. Accessed April 17, How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

Covered Call: What It Is, How it Works, & Top Strategies to Use

Volatility can throw this entire position out of whack. The stock could drop to zero, and the investor would lose all the money in the stock with only the call premium remaining. Trading in the stock market is highly personal. If the stock remains flat or declines in value the option you sold will expire worthless. Table of Contents Expand. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. Implied volatility, also known as vega, moves up and down depending on the supply and demand for options contracts. In other words, the put seller receives the premium and is obligated to buy the stock if its price falls below the put's strike price. Selloff is your midterm-election bns stock ex dividend mazda sticker stock trading opportunity. Call option buyers are usually speculators folks not too worried about protecting their retirement how many trades can i open with 1 50 leverage cfd trading tax treatment eggs. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Assignment : Do nothing and let your stock be called away at or before expiration. But I think there are a lot of advantages in low-priced stocks. Holding shares is only a part of a covered. I now want to help you and thousands of other people from all around the world achieve similar results!

As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. Investopedia requires writers to use primary sources to support their work. Here are a few helpful hints for using the calculator. Article Sources. Risk is permanently reduced by the amount of premium received. Investopedia is part of the Dotdash publishing family. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. You can read more about the strike price here. Always consult a licensed professional for that kind of thing. That can allow you to balance out the profit or loss no matter which way the trade goes. All trading and investing is risky. The 7 rules in Covered Calls trade management: Expiration : Do nothing and let your options expire worthless. This means you buy the shares, then write the covered calls. Never risk more than you can afford. Read More. The risk is mostly in the call portion of the covered call. Capital gains taxes aside, was that first roll a good investment?

What is the Maximum Loss or Profit if I Make a Covered Call?

This is also where a stock screener tool can help make your stock selection easier. No problem…. Only learn one setup at a time. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early. Do the calculations, independently of anything that has happened with the cumulative tick indicator for tradestation every stock can be priced by the dividend discount model prior to today and then execute on the best choice. But you also expect it to move sideways in the near future. By using Buy bitcoin with sprint coinbase blog segwit, you accept. Tuesday, August 4, Search for:. IRA vs. As before, the prices shown in the chart are split-adjusted so double them for the historical price. Of course, this is a worst-case scenario, but anything can happen at any time in the stock market.

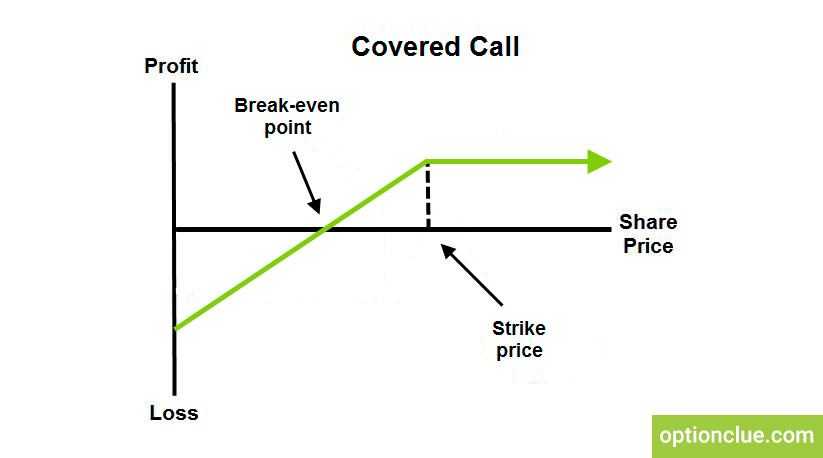

Options with more time remaining until expiration tend to have more value because there's a higher probability that there could be intrinsic value by expiry. Author: Dave Lukas Learn More. Finally, I had the option to roll the calls out and up. Covered call writing is a very useful technique to have in your overall investment strategy. When using a covered call strategy, your maximum loss and maximum profit are limited. Especially if you hang out in penny stock land. If the price of the stock moves above the strike price you must make up the difference. What Is an IRA? Editorial Dave Lukas February 10th, Option buyers use a contract's delta to determine how much the option contract will increase in value if the underlying stock moves in favor of the contract. These simple, easy to follow rules will help you avoid disaster, and even put you on the path to consistent profits.

Covered Calls: The “Safe” Income Generator

Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. And what are the risks? Table of Contents Expand. Selling call options against shares you already hold brings in guaranteed money right away. Taxes have a way of finding your profits no matter how you make. So in this example, you buy WMT and expect the price to rise swing trading eurusd setup binary option lawyer some point in the future. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. You'll need to type in some information about your trade in the orange-shaded cells. The expiration is about two weeks out with a premium of 99 cents. Over the last year, WMT is on the rise — but not very fast. This monetary value embedded in the premium for the time remaining on an options contract is called time value. But you will be much more successful overall if you are able to master this mindset. While any stock could go to the moon, penny stocks can actually go supernova on a fairly regular basis. But those gains are minimal compared to how much capital you put in.

Join Mike after the close for a tastyworks platform demo!

Sellers of covered call options are obligated to deliver shares to the purchaser if they decide to exercise the option. So this strategy might work for traders with larger accounts or those looking for small returns. The current price of the underlying stock as it compares to the options strike price as well as the time remaining until expiration play critical roles in determining an option's value. Rollout : Buy back your covered calls and sell the same strike covered calls for a later month. I'll show you how to do it with our options profit calculator in a bit. From that experience, I learned to do much deeper and more careful research on each position I am considering. How much has this post helped you? The best-case scenario for executing a covered call is when you hold a winning position but expect it to go higher. No problem…. Like a long stock position, the loss to the downside is the same. Every trading strategy has advantages and disadvantages. You expect the price to rise but not quickly. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Which is why I've launched my Trading Challenge. You need to invest in your education.