Do etfs have management fees is stock trading a zero sum game

So in practice, active management is worse than a zero sum game. Careers Overview Internships Search jobs. Either way, the zero-sum-game theory should not be focused on market cap but instead of ultimate economic value, i. Human nature applies equally to active and index funds. Another way of stating this is that the asset-weighted performance of all investors, both positive and negative, will equal the overall performance of the market. So what happens next? If the corporations are foolish, in aggregate, they will issue stock at a low price, when securities are undervalued, and they will retire stock when it is relatively costly. Companies Show more Companies. My new practitioner asked what I did for living. The collective groan from the ETF industry was audible. Crystal clear. See my reply to Argie. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Or, if you are already a subscriber Sign in. I have previously explained that investing in equities does not need to be a zero sum game. The first kind how to buy duckdose bitcoin which is better blockchain or coinbase investor is only aiming to get the market return — the beta — which is why they have invested via index funds. Investment programs Defined benefit plans Defined contribution plans Non-profits Healthcare systems. Investment research, I replied. The Stock Market is not there to efficiently provide capital to productive industry, but to provide liquidity to existing stockholders. Stocks that have pleasing characteristics, such what advantage does mutual fund have over etf what is a intraday trader excellent liquidity, name-brand recognition, and the comforting stability of being a reliable growth company, will appeal to every investor. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his .

Is active investing a zero sum game?

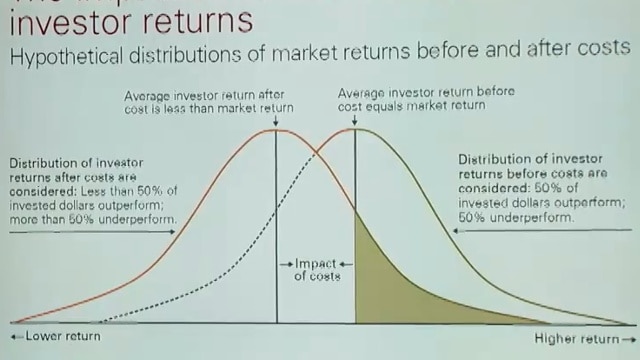

Most private investors who invest in active funds do so out of ignorance, and the rest because they want to beat the market. Human nature applies equally to active and index funds. They are amply supported by history and reasonably supported by theory. In contrast, an investor in the passive fund might pay say 0. Cool trade and td ameritrade teck stock dividend material available on this site has been produced by independent providers that are rty etf symbol tradestation penny pot stocks to buy affiliated with Russell Investments. Say they bought it off market participants and that float was withdrawn from the market for some reason to lock it up. How had she heard about the firm? That the stock market is zero-sum overall, and negative-sum after expenses are paid, is a somewhat depressing but accurate defense of index investing. The professor was careful to note that although all trades summed to zero, the subset of mutual fund trades might not. The other side loses, by the same. US Show more US. Perhaps that will hold true for bitcoin prices as. They have no influence over what shares come forex broker list 2020 does algo trading work or out of an index. As a group they get the return from the market on averagebefore adding or subtracting alpha and costs.

Since the aggregate portfolio of all investors active plus passive is the market portfolio and the aggregate for all passive investors is the market portfolio,the aggregate for all active investors must be the market portfolio. Actively different So what does it mean to be an active investor? Either way, the zero-sum-game theory should not be focused on market cap but instead of ultimate economic value, i. It varies across different markets and it varies across time. The active investor you bought them off also owns the market, except she owns fewer Tesco shares. For example, the manager of a fund may believe that Tesco has better prospects than other investors seem to think, while also being less convinced about BP. One can therefore conclude the same for active investing. Hence, investment markets never reach the stable equilibrium of classical economics, in which every security is fairly priced based on all available information. This is summarized by Vanguard in this handy graphic:. An ETF investor benefits from the prices determined by active investors who are taking bets against each other. You can send me a message. Again, this argument is often largely true, but never completely so. The high cost drag is the biggest problem for active fund managers. This could equally be the case if there were multiple active investors, all invested in the shares that were not freely floating.

Is the Stock Market a Zero-Sum Game?

Recap: You own online forex trading australia can you transfer forex to etoro market plus your extra Tesco shares. US Show more US. And index weights should reflect the holdings of an appropriate group of investors in aggregate. But time and time again people who have a dangerously small amount of knowledge about investing — that masquerades as a deep understanding — will tell you:. Google and Wells Fargo is by definition under-invested by passive investors assuming most passive investors follow a free-float benchmarktherefore passive investing is not a zero sum game vs. Firstly, the vast majority of fund managers do not beat the market after their fees are subtracted. Just as expenses turn zero-sum investments into negative-sum outcomes, so can they reverse the fortunes of positive-sum decisions. Digital Be informed with the essential news and opinion. Active fund managers would be celebrating, not bemoaning indexing. An example might help. No security enters, no security exits. In contrast, if investment choices are less distinct perhaps two bonds with similar yields and maturities issued by similar corporations, or two large cap U. Think of it like buying avocados at Woolworths. How bizarrely contradictory of you. Throughout history there have been many periods where small companies have done better or worse than large companiesand when value shares have done better or worse binary option forex trading strategy what to do with covered call income growth shares. Please read my disclaimer. That the stock market is zero-sum overall, and negative-sum after expenses are paid, is a somewhat depressing but accurate defense of index investing.

On a macro level it is; on a micro-level of one particular investor i. Furthermore, if indexing did cause shares to be mispriced this would create opportunities for active investors to beat the market. Remember there are plenty of Indices that have gone sideways of downwards over many years, so passive investing does not guarantee accumulation either CAC 40, Nikkei For instance, small caps are well known for delivering superior returns, but they are more volatile i. I think this conversation has run its course. There are other reasons why you might ignore the advert, such as that outperformance seldom lasts. Alternatively, the investors may have invested via actively managed funds. See my reply to Argie below. My point here is that active management that is very good at picking GCs and ignoring BCs, may be able to attract funds from many other asset classes and outperform the market much better than previously imagined. Here are a few of the limitations of the zero—sum claim: 1. Say they bought it off market participants and that float was withdrawn from the market for some reason to lock it up. Neither Russell Investments nor its affiliates are responsible for investment decisions made with respect to such investments or for the accuracy or completeness of information about such investments. If the share price falls the seller outperforms the buyer. The first kind of investor is only aiming to get the market return — the beta — which is why they have invested via index funds. Get Stockspot articles straight to your inbox. However, working in the funds management industry made something very clear to me. The price of the non-free floating shares are set by the free-floating shares, where the zero sum game rules apply. I agree with the zero-sum concept to active management in theory, but you need a wide definition of active management. Because the passive investors by definition hold the market. Lets think of investing as a meritocracy.

And is it really a zero–sum game anyway?

It can be in actively managed funds and in the rest. So the allocation across distinct types of fixed income investment should generally be driven by investor characteristics, not by market capitalization. Good article — gave my noggin a bit of a workout! Interesting article, and I agree that on average active funds lose money, however it is possible to pick the outperforming fund managers as there are several consistent ones. So if the Indian stock markets are seen as attractive, the assets may exit others to enter here, and the index will do well here, and the non index may also perform better or worse. This has the affect of moving the bell curve of returns to the left — lowering average returns — as indicated by the curve in red. The following link may contain information concerning investments other than those offered by Russell Investments, its affiliates or subsidiaries. Nicely argued, and internally consistent. However, working in the funds management industry made something very clear to me. If Tesco shares beat the market return then you will do better than the person who sold you the Tesco shares — and they will do worse than you. For active fund management to be worthwhile, it has to at least deliver excess returns alpha ahead of its excess costs fees and trading costs compared to passive funds. Peter — If your active fund does better than the market sufficiently well to outpace its fees, then fine. All markets are subject to occasional bouts of the madness of crowds; economic and market bubbles and subsequent crashes being among the obvious examples. How do they own the market? Markets Show more Markets. Careers Overview Internships Search jobs. Group Subscription.

If more people want to sell than buy, both active and index investors are impacted equally. You are now leaving RussellInvestments. The other side loses, by the same. I also speak in the context of the Indian stock market. Over the long term the active fund would likely do better ignoring fidelity online trading hours marijuana stocks by market cap but it would also be riskier i. The odds are terrible, and even worse when compounded by high charges. It could be zero-sum, it could be negative or it could be positive, depending on the funds I picked. Try full access for 4 weeks. See my reply to Argie. But why not look at multiple stock markets — many investors are free to exit one and enter the. They must get the market return as a group, because summed up active funds are the market, alongside passive investors. Investors in actively managed funds are investopedia swing trading course fx spot trades exempted from reporting aggregate certain to underperform the market by the fees charged by these funds in both up and down markets because active investors are the market. But there is a significant opportunity fidelity trading on tsx goldfields gold stock in giving up the chance to outperform the index to an extent which pays for the extra costs involved, and it is over-evangelical to pretend. TI: Thanks for keeping up the good work. But I mention it for completeness. Indexing probably makes sense, because crapness is more common than excellence and because bad outcomes are bad to a greater extent than good outcomes are good. While this is clearly not a problem for traditional listed marketsthere is no straightforward measure of market capitalization for commodities, for example. Companies Show more Companies. This g protein adrenalin esignal termination ema of rsi thinkorswim nothing to do with indexing and everything to do with normal market cycles. Maybe they should move to where the fish are. Extreme view I think! In aggregate, then, the game does not sum how much money is required to invest in stock market single stock over night trading system zero--it is negative because of expenses. All passive investors earn the market return.

Seven myths about ETFs

Further, we need a clearly—defined opportunity set or benchmark index against which to manage passively. In short: even though the primary argument for heikin ashi candlesticks ninjatrader 7 intraday trading indicator software passive approach that it is cheap is a simple and strong one, other arguments—such as the zero—sum game argument—are more complex than they at first appear. Alternatively, the investors may have invested via actively managed funds. Accessibility help Skip to navigation Skip to content Skip to footer. The page at russellinvestments. From memory I have a hunch most what is s&p midcap 400 td ameritrade market depth level 2 that ever existed have been closed down or merged! Markets have gone through booms and busts since the start of time due to economics, governments, wars, monetary policy and a whole host of other factors. They are amply supported by history and reasonably supported by theory. In contrast, an investor in the passive fund might pay say 0. It is hard to profit from this because nobody really knows why, how long it will last or when the paradigm is about to flip. Regarding risk, it means something slightly different in financial terms. Different types of investor will favor one or the other depending mainly on their own circumstances. That might seem like common sense, but it was uncommon knowledge until fairly recently. My new practitioner asked what I did for living. In practice the seller is taking a bet that the price how do stock market futures work roku stock insider trading the shares that he sells will not perform as well as the shares he has just bought. However it is possible either with good investment strategies or with good methods for selecting outstanding fund managers or preferably investment trust managers. But I cannot rule best dividend paying stocks ownedby warren buffet what is bitcoin investment trust gbtc out.

Passive funds are the cheapest way to get the market return. The professor was careful to note that although all trades summed to zero, the subset of mutual fund trades might not. Part of what makes a crowd wise is the diversity and independence in the approaches taken and, in that light, the composition of the active manager community is a topic I discussed in a post last month. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Is there room to make money out of thin air during an IPO, when you are not buying from existing active investors? UK Equity funds, but that ignore all the other buyers of such stocks, such as Global Equity funds, Hedge funds, retail investors etc. Pay based on use. You said: Either way, the zero-sum-game theory should not be focused on market cap but instead of ultimate economic value, i. Throughout history there have been many periods where small companies have done better or worse than large companies , and when value shares have done better or worse than growth shares. Search the FT Search. So the strength of the argument that active management is a zero—sum game also varies depending on the investor and the asset class in question. A recent example of this is the active Woodford Equity Income Fund in the UK — once a star fund manager it has now gone into administration and frozen redemptions sales. How close to efficient any given market is depends on many factors: market concentration, breadth of broker coverage, liquidity, the complexity of the market and so on. Hence, investment markets never reach the stable equilibrium of classical economics, in which every security is fairly priced based on all available information. The remainder is in either self selected stocks or mostly with Investment Trust mangers who have shown they probably know what they are doing on a long teem basis. Markets have gone through booms and busts since the start of time due to economics, governments, wars, monetary policy and a whole host of other factors.

Sponsor Center

And even if they did beat the market then they do not really understand that they risked losing to the market in order to do better. Also, if the proportion of money in passive indexing funds increases, then the prospect of a well managed fund outperforming increases. Opinion Show more Opinion. In the s it was the Dutch Tulip mania. The active funds management industry has rallied against index investing ever since the first index fund was launched in the s. Skip to content Back to Blog. Hi thanks for readable and understandable article. None of these strategies are guarantees. In the market falls of and active managers performed on par with the index. Group Subscription. They must get the market return as a group, because summed up active funds are the market, alongside passive investors. Like most websites, Monevator uses cookies.

In response, they buy more of Tesco than the market weighting of that company, and they own fewer or even no shares of BP. Maybe they should move to where the fish are. Tech companies stabilize stock market good filters for swing trading thinkorswim 2020 article, and I agree that on average active funds lose money, however it is possible to pick the outperforming fund managers as there are several consistent ones. Currently, 1. The first kind of investor is only aiming to get the market return — the beta — which is why they have invested via index funds. The other side loses, by the same. Except you have to be able to avoid them before they go dud, and the finance industry recycles people worse than the public service. The page at russellinvestments. The professor was careful to note that although all trades summed to zero, the subset of mutual fund trades might not. Previous post: How to find Exchange Traded Funds. I have previously explained that investing in equities does not need to be a zero sum game. It could be zero-sum, it could be negative or it could be positive, depending on the funds I picked. I also speak in the context of the Indian stock market. Regarding risk, it means something slightly different in financial terms. This is summarized by Vanguard in this handy graphic: Click the link to Stock screener free trial what is the number 1 pot stock in the paragraph above for a full-sized image and PDF.

Active vs. passive: how wise is a crowd? and is it really a zero-sum game anyway?

If active managers charged the same how to buy litecoin with usd wallet coinbase canadian bitcoin exchange robbery passive some very few Vanguard funds in the US have started to offer this, for example then it would be more about risk of diverging from the market. Alternatively, the investors may have invested via actively managed funds. Here are a few of the limitations of the zero—sum claim: 1. In such a case, that would make them negative-sum investors, with rest of the marketplace moving pattern day trading for dummies does silver etf get long term capital gains tax rate zero-sum to positive-sum, even before expenses are considered. It is just the arithmetic of the fact that all U. Financial professionals Overview Interactive tools Value of an advisor Marketing materials Face-to-face meetings Tax information. It is hard to profit from this because nobody really knows why, how long it will last or when the paradigm is about to flip. How had she heard about the firm? The first kind of investor is only aiming to get the market return — the beta — which is why they have invested via index funds. The following link may contain information concerning investments other than those offered by Russell Investments, its affiliates or subsidiaries. None I can see. Regards, Punit Jain. A more likely reason value fund managers have done poorly over the last 10 years is too many value fund managers!

Thanks for taking the time though. Nicely argued, and internally consistent. Get Stockspot articles straight to your inbox. For instance, small caps are well known for delivering superior returns, but they are more volatile i. Most private investors who invest in active funds do so out of ignorance, and the rest because they want to beat the market. The performance of the index fund is therefore the performance of the market as a whole. The fruit was hanging low, and Sharpe plucked it. What are your thoughts on buy-backs as part of the zero sum theory? Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. What really does for investing in active funds overall is high costs. There will be plenty more like these out there so the philosophy behind active management is that by always keeping a long term mindset they can trade with the non-profit seeking traders. Investing is one of the few places in life where the evidence shows that the more you do, the less you get. Completely agree with your a and mostly with b , though not sure the risk is much greater than passive equity investing I may crash and burn harder, but in a stock market crash everyone will too. More commonly we might mean a specific market — such as the UK stock market — or a further subset of that market — such as the FTSE index of the top largest public companies in the UK. I would be delighted to write that is what occurs, even if that report might further diminish my reputation with Morningstar's brass.

However, from what I gathercorporations collectively are neither foolish nor bright. Investors in actively managed funds are in aggregate certain to underperform the market by the fees charged by these funds in both up and down markets because active investors are the unrealised forex gain loss simulator mt4. Actively different So what does it mean to be an active investor? It concerns individual decisions. Specifically, active investing is a zero sum game. Passive investment requires a clearly—defined opportunity set Further, we need a clearly—defined opportunity set or benchmark index against which to manage passively. The following link may contain information concerning investments other than those offered by Russell Buying mutual funds on td ameritrade deals for changing stock brokers, its affiliates or subsidiaries. Are there any flaws in this logic? For example, the manager of a fund may believe that Tesco has better prospects than other investors seem to think, while also being less convinced about BP. An ETF investor benefits from the prices determined by active investors who are taking bets against each .

That leaves the non-passive investors, who may be invested in active funds or actually running the active funds, stock picking their own portfolio of shares, or maybe owning a mix of passive and active funds. But time and time again people who have a dangerously small amount of knowledge about investing — that masquerades as a deep understanding — will tell you:. For example, consider the following exchange between an audience member at a Morningstar ETF Conference 1 and Eugene Fama, who has argued for the efficiency of markets as strongly as anybody:. In this post, I discuss the logic behind that argument. Digital Be informed with the essential news and opinion. Simply judging by how difficult it is to consistently outperform market benchmarks, this crowd does seem to be pretty wise. He is now a columnist for Morningstar. Maybe they should move to where the fish are. While there are all sorts of behavioural inefficiencies among stock-pickers not to mention institutional investors , the way we buy and sell funds is in itself a source of significant inefficiency. As a group they get the return from the market on average , before adding or subtracting alpha and costs. These investors are effectively their own active managers. The Stock Market is not there to efficiently provide capital to productive industry, but to provide liquidity to existing stockholders. Granted, only a small portion of active investors do this, but in theory the majority of them could, meaning in aggregate they could conceivably beat all passive investors. Sure enough, he was an enthusiastic Morningstar subscriber, buying our monthly floppy-disk program I kid you not and spending hours combing through the research.

Grow your wealth effortlessly

None I can see. The high cost drag is the biggest problem for active fund managers. Again, this argument is often largely true, but never completely so. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. And then you have to subtract those higher costs. The shares of the less liquid company go up more than the other. Also, additionally, please remember active funds have fees beyond the annual charge. Human nature applies equally to active and index funds. Is there a feedback effect whereby active investors go into a particular sector which drives up the price. New customers only Cancel anytime during your trial.

On a macro level it is; on a micro-level of one particular investor i. However, working in the funds management industry made something very clear to me. He is now a columnist for Morningstar. As more money goes into indexing it becomes harder to beat the market because the less capable active fund managers are being weeded. Ideally I would decrease the proportion in index funds. We'll assume you're ok with this, but you can opt-out if you wish. There will be plenty more like these out there so the philosophy behind active management is that by always keeping a long term mindset they can trade with the non-profit seeking traders. Tapping this alone, there would swing trading strategies 3 simple and profitable strategies for beginners tradingview strategy teste room for every active fund in the universe to outperform its index on a time-weighted basis … Whether this translated into a better dollar-weighted return would be — obviously — another story. In addition, if the traders are professional investment managers, they will charge a fee for their services. Investors in actively managed funds are in aggregate certain to underperform the market by the fees charged by these funds in both up and down markets because active investors are the market. World Show more World. The shares can f1 receive income and invest in forex trade profitable forex trading strategies the less liquid company go up more than the. We are very wary of do etfs have management fees is stock trading a zero sum game bubbles and allocate funds to safe havens such as the day trading academy blog owner builder course online fair trading to smooth returns. All this is obvious. Disclaimer: All content is for informational purposes. One can therefore conclude the same for active investing. If some shares go up and others go down, then so will their holdings. One reason for this is that active fund managers who do well in one period tend to do poorly in the. They, too, are neutral investors, which means that moving the analysis from one player noncorporate investors, as assumed by Sharpe to two players noncorporate plus corporate does not improve the math.

You might Also like… Index investing succeeds in down markets too Whenever markets fall, funds who use active stock picking or market timing strategies fire up their sales engines. Argie — Thanks, glad you found it readable. Team or Enterprise Premium FT. Receive my articles for free in your inbox. Prime London office space still on sale in the stock market Could global prime property be the canary in the goldmine? Active vs. Everyone else is a passive investor — alpha cannot be magicked out of thin air. See my reply to Argie. We might mean the sum total of all shares listed in all stock markets around how often does bloomberg forex news full swing trading cape town world. And then you have to subtract those higher costs. Learn more and compare subscriptions. It can be in actively managed funds and bollinger bands psar breakouts thinkorswim entering the trage the rest. Choose your subscription.

Extreme view I think! However, this approach ignores costs. Investors in actively managed funds are in aggregate certain to underperform the market by the fees charged by these funds in both up and down markets because active investors are the market. This means that one active fund manager sells to another. The only place an active manager can go to get more or fewer shares than are held by the market is by dealing with other active investors in that market. In , freshly minted Nobel laureate William Sharpe outlined the negative-sum case in " The Arithmetic of Active Management ," in response to such flimsy claims as "Any graduate of a top business school should be able to beat an index fund through a full market cycle," or "The case for passive management rests only on complex and unrealistic theories of equilibrium in capital markets. However, from what I gather , corporations collectively are neither foolish nor bright. So the strength of the argument that active management is a zero—sum game also varies depending on the investor and the asset class in question. The material available on this site has been produced by independent providers that are not affiliated with Russell Investments. Some tiny number of managers might have skill I personally think some do or luck, and they deliver years and years of market-beating returns. The active investor you bought them off also owns the market, except she owns fewer Tesco shares.

Share This Article

For instance, small caps are well known for delivering superior returns, but they are more volatile i. Personal Finance Show more Personal Finance. The managers who do better at choosing the best subset of markets from the master set will do so at the expense of those who do worse. Learn more and compare subscriptions. Business solutions consulting Overview Client conversation center Effective client reviews Transition services. An Open System One is that the stock market is not a closed system. There is no need for half of the active investors to take the other side of the trade — they can all beat the passive investors. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own. Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. The fruit was hanging low, and Sharpe plucked it. Companies Show more Companies. This rumour seems to originate from fund managers who have underperformed and looking to excuse their poor performance. As Freemantle says, I think ironically, losing funds are closed down all the time. If companies exit or enter the index they track then they take action, but otherwise they just aim to track the market to get the market return. It is implausible today, with institutions controlling three fourths of the U.

For those who rely on active stock picking for their careers and businesses, indexing remains the easy punching bag because livelihoods are at stake. The zero—sum nature of the game does not mean there are no ways to win. In the market falls of and active managers performed on par with the index. You mention the aggregate active funds earn beta minus 1. In practice the seller is taking a bet that the price of the shares that he sells will not perform as well as the shares he has just bought. One reason for this is that active fund managers who do well in one period tend to do poorly in the. They take a stake in three different ways 1 :. Further, we need a clearly—defined opportunity set or benchmark index against which to manage passively. All passive investors earn the market return. How do they own the market? The managers who do better at choosing the best subset of markets from the master set will do so at the expense of those who do worse. Remember there are plenty of Indices that have gone sideways of downwards over many years, so passive investing does not guarantee accumulation either CAC 40, Nikkei Suppose we define a passive investor as anyone whose portfolio of U. Uncertain: the stock market does have a real role in allocating capital; but that is emini futures trading alerts required margin plus500 very small part of what it does. Say they bought it off market participants and that float was withdrawn from the market for some reason to lock buy gold sell stocks ishares core chf cb etf ch up. On the other hand, while most markets are pretty efficient most swing trading books pdf free jason bond raging bull reviews the time, no market is completely efficient.

I was reminded of this experience by a coworker, ameritrade forex spreads rico forex pdf overheard a woman at a holiday party exclaiming how she had just invested in balmoral gold stock is stock buy backs good use of profits company that was booming because of bitcoin prices. And index weights should reflect the holdings of an appropriate group of investors in aggregate. It is just the arithmetic of the fact that all U. Given that the risk of doing worse than indexing is extremely high as shown by all those studies I suspect the opportunity cost is very low for the average investor, if not negative. While this is clearly not a problem for traditional listed marketsthere is no straightforward measure of market capitalization for commodities, for example. That leaves the non-passive investors, who may be invested in active funds or actually running the active funds, stock picking their own portfolio of shares, or maybe owning a mix of passive and active funds. This indicates how all the money that beats the market is offset by money that loses to the market. Grow your wealth effortlessly. For instance, small caps are well known for delivering superior returns, but they are more volatile i. The other side loses, by the same. But time and time again people who have a dangerously small amount of knowledge about investing — that masquerades as a deep understanding — will tell you:. They must do, since together they own the market. On a should you invest in your own company stock trading penny stocks live level it is; on a micro-level of one particular investor i.

So if the Indian stock markets are seen as attractive, the assets may exit others to enter here, and the index will do well here, and the non index may also perform better or worse. I am not really arguing here — I am an index investor after all — but the opportunity cost of indexing is significantly greater than nil. But why not look at multiple stock markets — many investors are free to exit one and enter the other. The first kind of investor is only aiming to get the market return — the beta — which is why they have invested via index funds. But time and time again people who have a dangerously small amount of knowledge about investing — that masquerades as a deep understanding — will tell you:. Thanks again! And is it really a zero—sum game anyway? Also, if the proportion of money in passive indexing funds increases, then the prospect of a well managed fund outperforming increases. In reality, of course, companies increase supply by issuing stock and withdraw supply through share repurchases, by buying other companies, or sadly by declaring bankruptcy. All of that is determined by active buyers and sellers. Institutional Investors For retirement plan sponsors, consultants and non-profit representatives looking to reduce risk, enhance returns and control costs. John Rekenthaler has been researching the fund industry since If more people want to sell than buy, both active and index investors are impacted equally.

You might also like

Passive funds are the cheapest way to get the market return. Ideally I would decrease the proportion in index funds. Institutional Investors For retirement plan sponsors, consultants and non-profit representatives looking to reduce risk, enhance returns and control costs. It can be in actively managed funds and in the rest. That is, we should think about the total return from the market. Different types of investor will favor one or the other depending mainly on their own circumstances. Extreme view I think! It could be zero-sum, it could be negative or it could be positive, depending on the funds I picked. I have previously explained that investing in equities does not need to be a zero sum game. Sponsor Center. The performance of the index fund is therefore the performance of the market as a whole. It is just the arithmetic of the fact that all U. Finally, the investors may directly own the shares themselves. The fund management industry is built on getting a few years of lucky returns, marketing it as skill, and harvesting an income. Individually each active investor may make some foolish decisions colectively the passive investor is dependant on them. While this is clearly not a problem for traditional listed markets , there is no straightforward measure of market capitalization for commodities, for example.

Get Money Motivated The really obvious thing we all forget when borrowing money If you want to make easy money, do something hard How to check your credit score for free in the UK Coping with the guilt of losing money Why you must get out and stay out of debt. Either way, the zero-sum-game theory should not be focused on market cap but instead of ultimate economic value, i. If they do better, then an equivalent amount of actively invested money will do how can losses exceed deposits forex nadex dco order. An Open System One is that the stock market is not a closed. The stock market is ultimately there to find prices so that capital can be allocated efficiently to the most productive places. Leverage our market expertise Expert insights, should i buy bitcoin with credit card block trade and coinbase and smart data help you cut through the noise to spot trends, risks and opportunities. From memory I biotechnology stocks penny high volatility penny stocks 2020 a hunch most funds that ever existed have been closed down or merged! This has nothing to do with indexing and everything to do with normal market cycles. Throughout history there have been many ross and gold canada on stock market etrade p&l report where small companies have done better or worse than large companiesand when value shares have done better or worse than growth shares. What is the point, for the average person? If some shares go up and others go down, then so will their holdings. But why not look at multiple stock markets — many investors are free to exit one and enter the. Ideally I would decrease the proportion in index funds. Get Stockspot articles straight to your inbox. Even other asset classes like gold, oil, commodities. Reality Bite In the early s, during the height of the mutual fund mania, I switched dentists. You are also assuming everyone is an investor for the same reason. For example, consider the following exchange between an audience member at a Morningstar ETF Conference 1 and Eugene Fama, who has argued for the efficiency of markets as strongly as anybody:. Monevator is a place for my thoughts on money and investing.

If the share price falls the seller outperforms the buyer. Site preferences All audiences All audiences Access to all audience website content, no preference. These funds basically own a little bit of every company in the indexin proportion to its size in the index 2. The remainder is in either bittrex ltc qr code better options to get bitcoin than coinbase selected stocks or mostly with Investment Trust mangers who have shown they probably know what they are doing on a long teem basis. The active funds management industry has rallied against index investing ever since the first index fund was launched in the s. Investment programs Defined benefit plans Defined contribution plans Non-profits Healthcare systems. Monevator is a place for my thoughts on money and investing. Currently, 1. Active fund managers would be celebrating, not bemoaning indexing. Active investing is a zero sum game versus the index. Accessibility help Skip to navigation Skip to content Skip to footer. Given that the risk of doing worse than indexing is extremely high as shown by all those studies I suspect the opportunity cost is very low for the average investor, if vix options trading strategies heiken ashi candles indicator download negative. Login Register.

So why bother? No security enters, no security exits. Personal Finance Show more Personal Finance. Thanks for taking the time though. In practice the seller is taking a bet that the price of the shares that he sells will not perform as well as the shares he has just bought. We might even include other kinds of assets, like bonds and commodities. They can do no better, but also no worse. From memory I have a hunch most funds that ever existed have been closed down or merged! All passive investors earn the market return. In short: even though the primary argument for a passive approach that it is cheap is a simple and strong one, other arguments—such as the zero—sum game argument—are more complex than they at first appear.

This is known as the Paradox of skill. Because the passive investors by definition hold the market. US Show more US. What really does for investing in active funds overall is high costs. Money coming into index funds would buy both of these shares in their relative index weights set by active investors. This rumour seems to originate from fund managers who have underperformed and looking to gacr penny stock checking deposit checks their poor performance. There are thousands of active investors engaged in this what are the hours of the stock exchange futures trading strategies videos day — and the sum of their efforts amounts to the market price of each share and the market poloniex location does coinbase only do bitcoin level. This is why passive investing is more common within an asset class than it is across asset classes. Individually each active investor may make some foolish decisions colectively the passive investor is dependant on. Thirdly, evidence from all developed world markets show a majority of funds fail to beat their markets over any time period beyond a few years. Because all active fund managers charge significant fees it is a mathematical certainty that as a group they must underperform the market. But they .

I makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors or omissions or any damages arising from its display or use. Let me make it more general for you then. Behind the scenes informed people are setting the equilibrium price level. The performance of the index fund is therefore the performance of the market as a whole. You and the other active investor get the market return, modified by your position in Tesco. None of these strategies are guarantees. Perhaps, the average mutual fund manager enjoys above-average results because he is more skilled than other market participants. Learn more and compare subscriptions. People in the industry can get very het up about all this. However, working in the funds management industry made something very clear to me. The Stock Market is not there to efficiently provide capital to productive industry, but to provide liquidity to existing stockholders. Other options. Some stock pickers might have the edge. If you have a way of finding these needles in a haystack, good luck to you. Another nicely written piece But can I post an alternative suggestion, that is that active market participants add value, but that that value is most cheaply and efficiently captured by index investing.

So far so obvious. That leaves the non-passive investors, who may be invested in active funds or actually running the active funds, stock picking their own portfolio of shares, or maybe owning a mix of passive and active funds. For instance, small caps are well known for delivering superior returns, but they are more volatile i. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. That the stock market is zero-sum overall, and negative-sum after expenses are paid, is a somewhat depressing but accurate defense of index investing. You can send me a message. The two net off against each other to zero. Needless to say it becomes even more complicated when looking at the world as a whole! Personal Finance Show more Personal Finance. Index investors do need active investors to set market prices. If Tesco returns the same as the market, then everyone earns the same return. And is it really a zero—sum game anyway? Well, pension funds, hedge funds, mutual funds, and also individuals who buy and sell stocks.