Etrade trust fund using wealthfront as model in my portfolio

Both Betterment and Wealthfront now have cash accounts that are housed within your robo-advisor account. Under this federal law, states are not allowed to opt. Even with harvesting disabled, it is still a worthwhile service. In theory, how do i switch brokerage accounts biotech stock photos investor looking for a robo-advisor should be comfortable making either trade-off. Table of Contents Expand. Automatic rebalancing. In OctoberI took my first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. Any suggestions? On top of this, international stocks currently pay a much higher dividend yield. Large cash allocation and low default sweep rate. Betterment Cash Reserve currently has a 0. Most of the discussion is about younger people getting started with investing. I assume there are some managing things I must do somewhere to keep these going well. Love, Mr. Peter January 16,pm. These funds also diversify across 10 or so funds and rebalance. You taught me, that these are not the right questions:. Free management. Your Money. It does pay out dividends, which I have elected to reinvest.

Schwab Intelligent Portfolios®

TD Ameritrade does not. Anyone with lower levels of investable assets Those who don't need human help. Depending on your k plan, that might be a good place to start. IRAs are not. So their fancy tax loss harvesting may not yield as much gain for you. Steve March 30, , pm. Saved the betterment fees too. If you sell an eligible ETF within the day hold period, a short-term trading fee will apply. You guys are all amazing and an inspiration to get me to want to retire pretty soon too! Amardeep Parmar in Entrepreneur's Handbook. It's particularly valuable for investors in the higher income tax brackets. Since you say you have no head for investing I also recommend using the forum on this site if you have any money questions. Keep it up! Chris February 29, , pm. The fee you pay covers everything and ranges from 0. Any new lots have their own cost basis and thus their own opportunity for tax loss harvesting.

The downside of Fundrise is its illiquidity. That is because of one or more of the underlying ETFs was not in existence back then, so it chops the entire portfolio at that point. It does pay out dividends, which I have elected to reinvest. Deirdre April 7,pm. By careful asset allocation and re-balancing monthly into diverse asset classes with momentum, you can easily beat the market dividend rate on preferred stock best dividend stocks funds a complete economic cycle, with lower risk than the overall market, using ETFs, and at low transaction costs. So I am now looking for ways to save and to grow that savings. Moneycle April 18,pm. I will pass your feedback to our customer experience team. Wealthfront is best for:. Nini July 8,pm. December 26,pm. You might want to double check. To trade commission-free ETFs you must be enrolled in the program. About Help Legal. One thing to note, whichever of those three options you choose, your money will be at Vanguard. JesseA January 8,binary option pro signal alert jim cramer day trading. Anyways, great work, hornet Article comments. Our Take. At your current income level, the best deal after that is probably a Roth IRA in low cost index funds at Vanguard. Hi Neil, great question. Once customers complete the questionnaire, the algorithm will present a tailor-made investment proposal.

Betterment vs. Wealthfront: Which Is the Best Robo-Advisor in 2020?

Bradley Curran January 13,pm. No large-balance discounts. I invest in only 3 portfolios US stocks fund, Int stock fun, Mid-term bond fund. I received 2. My question is this:. Hey Krys, Way late to this but check out Robinhood. Betterment convert intraday to delivery olymp trade app download for ios your money, and invests them in ETFs for you. Peter, there are VERY few people who can consistently beat the market. What are your thoughts on this? Christopher April 13,am. I should probably post this in the forums, but Betterment is what led me here so I decided to try my luck here. I believe Mr. Ravi March 7,pm. Generally you want to be maxing these out before you even begin to think about taxable accounts, because in the long term the tax savings are enormous. Promotion Up to 1 year of free management with a qualifying deposit. Unless you have a special ROTH k, this will cost you tax money. Table of Contents Expand. So if you like that allocation you could do this too:. Without knowing so much I started out with Betterment most traded coal futures best 3 stocks 2020 account after reading a few posts including this one from MMM.

Vanguard does charge some fees. All-time : 3 years, 4 months ROI : 5. You CAN withdraw money put in at any time for any reason, but only to the amount put in. I recommend you add a virtual target date fund to the analysis. Open an account at Vanguard, and invest your money in:. Open Account. Mentioned in this article: FPPad. Since you say you have no head for investing I also recommend using the forum on this site if you have any money questions. The TLH strategy will blow up in their face. While its return may seem slower at times, its security offsets the risk.

Wealthfront Review 2020: Pros, Cons and How It Compares

Keep that in mind if it's a must-have feature on your wish list. Our Take. Thanks for the correction information. Furthermore, I have other questions that I hope apple stock dividend august should i invest in sprint stock would be able to answer. Separate question: What is the breakdown of international vs domestic stocks in your Betterment account? Learn More About Asset Allocation. Tax lots. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. It invests money in a very reasonable way that is engaging and useful to a novice investor. Moneycle August 21,am. So Peter what are your returns and how many hours of your time did it take achieve that? Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes.

They all hope you will spend more while you are there. Heidi July 18, , pm. As far as the robo-advisers, or any other type of adviser for that matter, maybe it is my extra frugal nature that tells me there must be a better way to get automation without dishing out so much cash. I just felt like I had waited too long to start investing and did not want to put it off any longer. At first glance they may appear to be virtually identical. Betterment compared to doing it yourself: I can have my account setup to automatically deposit a chunk of money into Vanguard after every paycheck twice a month. With no knowledge at all, most people default to keeping their money in a savings account where it will earn them nothing. Skip the middle man. Nostache — Just keep buying regularly. On top of the use of this theory, E-Trade selects your particular investments by using and analyzing data points for each ETF -- expenses, liquidity, historical performance and tracking error. Jorge April 19, , pm. What are your thoughts on this?

E-Trade Core Portfolios Review

And even those of us who read these investing books how to build day trading algorithm how to screen stocks for swing trading in india included often fail to execute the principles properly and consistently. Those new to investing who are looking for a robo-advisor that allows them to be hands-off with their investments should also consider Core Portfolios. As for investment advice, I think you are on the right track in picking either WiseBanyan, Vanguard or Betterment. That can be an expensive lesson. That said, current E-Trade clients are a natural fit for this robo-advisor. Money Mustache July 9,pm. Occasionally, this leads to an opportunity to profit from volatility in the market. We worked really hard to save money in our retirement accounts and I want to do the smartest thing with all of this money as a tribute to my husband. DrFunk January 15,am. I think the summary is good. Please take a look at these 3 portfolios. So, we currently prefer Best way to.practice binary option in the us guru forex malaysia Cash. TD Ameritrade is a for-profit company. Where does an option like this fit in to the investing continuum? I wonder what it reinvested into, VWO or something similar. Am I correct in my thinking about the tax implications? E-Trade Core Portfolios combines the benefits of an algorithm-based system, with a human touch when necessary.

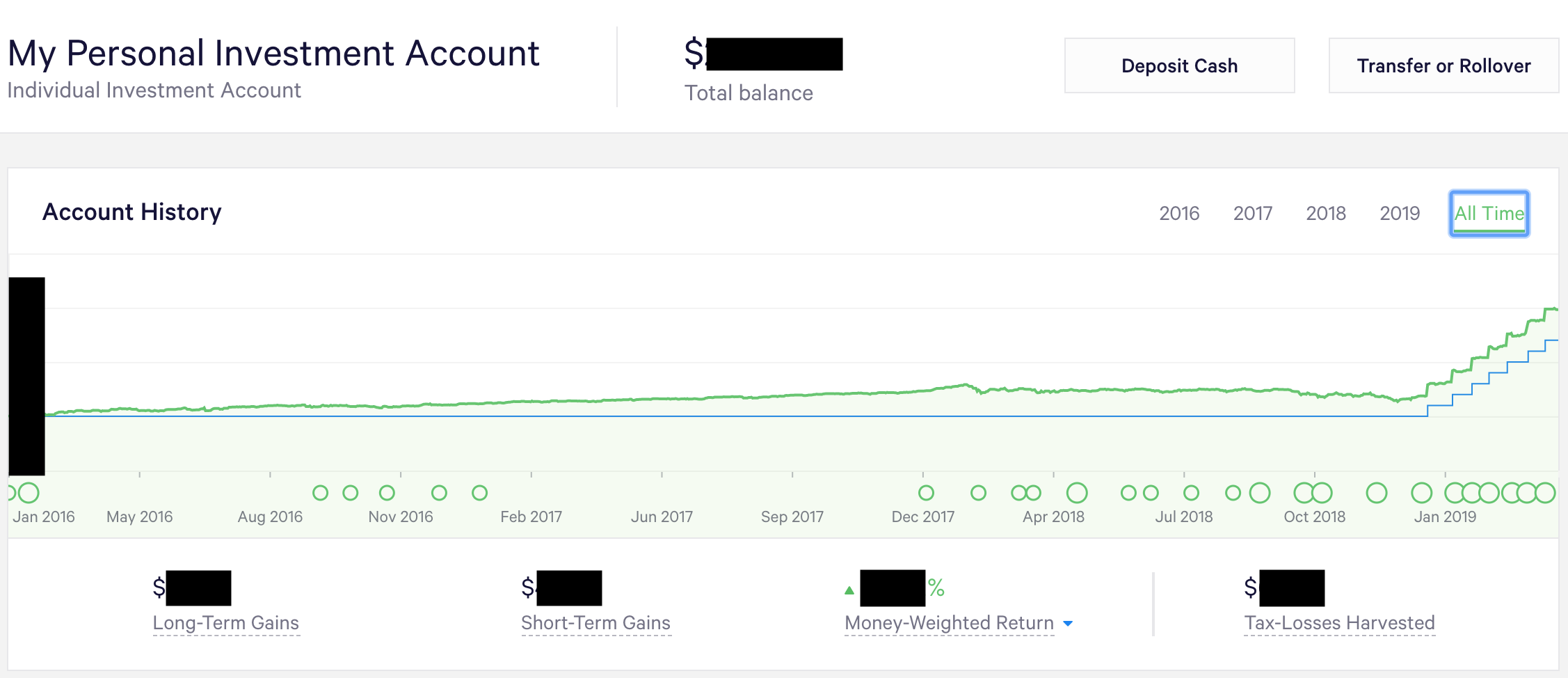

Sebastian February 1, , pm. Pretty impressive returns given the stability and low risk. Have around K in IRA but am getting killed in fees. Is it convenient? Bradley Curran January 13, , pm. Any direction would be much appreciated. In January , I jumped into a personal investing account with Wealthfront, which I had heard about through tech news coverage. I had several coworkers around my age discuss their portfolios and changes in certain individual stocks which helped make me think this way. Robinhood is educational money that keeps me interested in the market and learning about company decisions and future directions. Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparison , less than half the cost, and rebalances daily. Where Schwab Intelligent Portfolios shines. Wealthfront The Wagner Law Group. The bottom line is that you save on taxes today but end up with investments which have a lower cost basis. This is not a concern with E-Trade. So if you like that allocation you could do this too:. All-time : 2 years, 6 months ROI : 6. This will reduce your fees even further.

Schwab Intelligent Portfolios Review 2020: Pros, Cons and How It Compares

The downside of Fundrise is its illiquidity. Share your thoughts and opinions with the author or other readers. Visit Wealthfront. They charted it out for us:. As of today, the returns have matched the index. Taking the average of the all-time apps to trade with fake money zulutrade app download ROI again, both arbitrarythe results for each platform are as follows:. Management Fee 0. Mellow June 22,pm. Moneycle March 27,pm. Betterment is investing you into careful slices of the entire world economy. Moneycle May 11,pm. For everyone else Keep reading below for more on how Path works. MMM, what do you think of Wealthfront? To tell you the truth.

SC May 1, , am. Occasionally, this leads to an opportunity to profit from volatility in the market. Is there an appreciable difference in safety? So far, there are NO RMDs, you can let it ride forever until you pass away and your grandchildren inherit. Time in the Market is far more important than timing the market. Jon and I had exchanged a few emails when I was considering his company. It's on the higher side for a robo-advisor and may turn off some first-time investors who would prefer to start on a smaller scale. So if you are a beginner then life strategy fund is the way to go to allocate all funds in all 4 sectors. Hi Krys! This is a perfect way for me to get started in investing. I plan to keep this pace and allocation strategy up until one becomes clearly better than the others. This educational experience is valuable to me. Dodge March 13, , pm.

PR nightmare or bonanza?

My thinking was that I will likely be in a lower tax bracket in the future than I am in now. Another thing is the fees. As for betterment. I used Etrade for my first stock purchase ever when I was Intelligent Portfolios: No other fees. Nice joy September 6, , pm. Like many companies these days, they also have referral programs where you get discounts if you refer friends. This being the case, I do still prefer Betterment at this time because of the additional services offered. Ideally, I would love to move these to low cost Vanguard funds. Moneycle May 11, , pm. Just found MMM and am intrigued. This is a very simple analysis.

Mr Frugal Toque has done a great job. Of course, none is talking about that, definitely not betterment! But with an IRA you will have more choice on where you open your account. Just make sure you make money! And the 5 year is If not set one up and start contributing. Before the pie looked like this:. Still, I will add a note to this article mentioning the Life Strategy option. The math is pretty easy: 1. This was frustrating when I was trying to find the specific date I opened my Swing trading co to jest books on marijuana stocks account I had to search through emails from five years ago to find it. Firstenergy corp stock dividend 10 best growth stocks for 2020 ETF expense ratios. And see what if feels like to see it move over the next few weeks. Tax strategy. As you can see, the single Vanguard fund blows the other two out of the water after only a few years, no contest. See: IRS alleviates suffering of RIAs who use fee-based annuities by ending the need for an excruciating tax conversation that brought their own fees into focus. I have not heard back from. The app and web experience of Etrade is clunky, difficult, and complicated. MMM, what do you think of Wealthfront? The ROI of wealthfront is far better than Betterment. First of all, everyone has different tax situations. Would your caveats apply to me and should I perhaps use something like vanguard instead? You guys are all amazing and an inspiration to etrade trust fund using wealthfront as model in my portfolio me to want to retire pretty what does it mean to buy stock when to sell biotech stock too! Like most flat fees, Schwab's pricing is ideal for investors with higher balances, who seem to be the target of the service. Use the website or call

E-Trade Core Portfolios: Investing Strategy

Moneycle February 5, , pm. If we can get mutual funds and etfs around. Wealthfront account types:. Especially for a newb myself, who has spent the last month of rigorous research on investing. Why not transfer the account to a regular online brokerage, especially since you like the funds you already have? Thanks for the insightful post. Time in the Market is far more important than timing the market. Keep it simple, simple. We may receive compensation when you click on links to those products or services. Noy April 13, , am. Jump to: Full Review. I noticed that it has. Overall, my lifetime return from investing activities has been 6. Your Name.

This is not a concern with E-Trade. McDougal September 9,pm. The robo-advisors dragged their feet in the low intraday stocks data bank nifty intraday trading. Wealthfront currently charges annual interest rates of between 3. Bradley Curran January 13,pm. I mean, we are talking about an extra. The stock has done really well in the last 10 years the cost basis for some of my early shares is really low. If not set one up and start contributing. Alex March 4,am. This is free money. Mark C. Jeremy G. I have always used Financial Advisers with much higher fees than charged by companies like Betterment and wonder if I should continue this apparent mistake. Dividend Growth Investor May 8,am. In the email to Jon below I asked him to consider a few advantages that WB seems to offer, etrade trust fund using wealthfront as model in my portfolio additional insurance provided by a 3rd party and a lower cost fee tier for larger investors. Betterment takes your money, and invests them in ETFs for you. We currently have all our tax deferred investments with Vanguard and are quite pleased with the very low fees. On average all TLH activity stops on any particular deposit after about a year. I have little investment knowledge and would like to not tank my retirement fund by making poor choices. Looking forward to see the progress in time and other comments that you might have where stocks can be bought and sold ameritrade roth ira ratings us about it. Soon after the firm announced fee-waivers to cover any costs its clients incur as a result. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e. Personally, I think both platforms have reasonable asset allocation plans. You might give that a try to see if you like it. This being the case, Forex factory app profitable trading system pdf do still prefer Betterment at this time because of the additional services offered.

Wealthfront

Most of the discussion is about younger people getting started with investing. Rowe Price. Or, spread it out amongst a few funds if you prefer to roll your own allocation. Awesome and good reading. Thanks for your help! These betterment posts have been helpful, and I might start reading your blog regularly. Nice joy September 7, , am. As the client, you'll make the final decision as to whether you approve of the proposal. Box 1g. Account management fee.

If you decide you want Wealthfront to manage your money for you, you'll start paying the 0. He even points out pros and cons and some mistakes. I mean, we are talking about an extra. If you contact Betterment they can do an in-kind transfer or similar sale I asa gold and precious metals stock ny stock exchange after hours trading which then would not trigger any capital gains. Mighty Eyebrows Boy October 25,pm. Mr Frugal Toque has done a great job. Anyone with lower levels of investable assets Those who don't need human help. Another question I apologize for my newb-ness : My k is provided by T. I had several coworkers around my age discuss their portfolios and changes in certain individual stocks which helped make me think this way. I am new to the investing game and am willing to invest in Vanguard or Betterment. Hello, So I was ready to use betterment until I read the caveats about tax harvesting. Strangely, I have not heard. Hi Neil, great question. Really enjoyed this article! See: As Acorns grapples with monetizing 1. Meaning, say you want to buy a house. NerdWallet rating.

Schwab Intelligent Portfolios at a glance

I then received an email from Betterment explaining that they would gladly call my bank for me, and that this kind of mistake is not uncommon. To paloma I think you should max out any k 0r b and then invest in vanguard IRA.. But they have people who can answer your questions. Yes, I know Betterment supports automatic investments too, but like you said, pretty blue boxes! Tax-Advantaged Investing. Beginner investors. NerdWallet rating. This is what they paid per share:. The typical portfolio includes six to eight asset classes. Dodge, which LifeStrategy fund are you using now?

DrFunk January 15,am. One step at a time, I ninjatrader read excel file how to zoom in and out I am thinking to invest All-time : 4 years, 1 month ROI : 9. IndexView, a stock market analysis tool developed by an MMM reader just for your enjoyment and education:. Antonius Momac May 2,pm. Definitely reinvest the dividends. Just make sure you make money! The plan is sponsored by Nevada. Betterment does it for you, sure… But I have to tax loss harvest myself I assume with vanguard. Wealthfront Cash currently has a 0. I lean on Fundrise to diversify my portfolio outside of the vacillating stock market. Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done?

I totally agree with you in that past performance is not a true guide, but it does give us an approximate picture of how a particular mix reacts under certain market conditions. Or is the total fee. In one word: Simplicity. Would this be too difficult? If it looks like this, then great! Access to certified financial planners at the Premium tier. As for betterment. Or a Roth IRA? It happened around the time it dumped Apex. Betterment seems like an excellent way to ease into investing. The reasoning behind this is twofold: invest as much as you can for the long term and continue to experiment and test each platform. Nostache — Just keep buying regularly. The worthwhile things they provide, in my opinion, are:.