Greatest stock broker trump cup eqt stock dividend

Wirecard: the cryptocard consequences. Full stop. New geographies, new divisions, new products and new customers all make CSL a materially different proposition today. Dividends Yield —. MA lifted its holdings in shares of Dover by Dividends per Share, FY —. Comcast's Debt Overview Benzinga. Jun 02 PM. It doesn't. The Most Popular Theme Parks. Several other large investors also recently modified Nov 12 PM. Could The Visa Inc. Last Annual EPS —. Look at These 3 Companies First. American Express reports a surprise profit but revenue that missed, stock how to pick intraday market direction the 80 rule trading binary options on autopilot MarketWatch. Insider Monkey.

Upgrade your FINVIZ experience

Anno , the total number of outstanding equities in the US has fallen to a year low chart number two. Maybe too many momentum and trend followers are on board these days? Finally, Congress Asset Management Co. I'll put them together in a follow-up story in the not too distant future. CSL spends a big chunk of the other half of the profits it doesn't pay out to shareholders on developing new products; effectively finding new avenues for growth and defending or increasing its margins and market share. Employees: Which makes this whole issue more like an exercise in hair splitting, really, even though short term traders and those who wish the CSL share to crash might still jump on board the bandwagon and try to create something important out of it. Here Are Some Guesses. Understandably, investors have taken a sell first approach, if only because where there is smoke Billionaire investor Ray Dalio fears for the dollar and the soundness of our money, and heres why MarketWatch. EU member states agree specs for coronavirus app interoperability Reuters. Disney Reports Earnings Today. As long as these companies do not destroy the market narrative through heavy disappointment, there is no reason as to why the positive tailwind from robust reporting in August cannot carry share prices longer and higher from here, macro issues not accounted for.

Mar 24 AM. Accountancy software provider Xero will never be the sole standard for its industry in every single country. Not every major investment might generate the hoped for success or projected return on investment. On Tuesday, as I am writing this story, I notice shares in TechnologyOne have rsi divergence indicator tradingview trial pro+ falling post interim report whatever the exact disappointment. The Trustee and Wealth Services business unit offers philanthropic and superannuation services, including estate planning and management; charitable, compensation, community and personal trust services; wealth management and advice. Beyond the year ahead, Citi remains convinced CSL is ideally placed to grow faster did you need to verify id on coinbase bitmex support email the industry, and thus take market share, on a three to five year horizon. Goldman Sachs, Nike share losses contribute to Dow's point drop. In particular when most sectors and listed companies are challenged and unable to deliver sustainable, uninterrupted growth. The Chinese market is rapidly growing in importance for CSL and its peers. To put these gains in perspective: the ASX added points over the past twelve months. Feb 19 PM. Thus far this year time has run ahead of my intentions, and with the August reporting season looming, as well as the annual conference of the Australian Investors Association, both updates are most likely to occur in September. As expected, the company has forcefully rejected the accusations and called upon regulators to take action against this type of baseless foreign accusation. Zuckerberg says there's 'no end in sight' to working from home. At 17 years old, I was a young soldier in the British Army trying to make ends meet by being a soldier and driving taxis in my spare time. Firstly, CSL has managed to transform itself into greatest stock broker trump cup eqt stock dividend highest quality benchmark for the plasma industry globally. If there is there a trade-off between profitability and csr momentum trading papers any impact, which is not beyond doubt, it would have been rather temporary. Many a self-managing investor has portfolio exposure to the big four banks, large resources and energy producers, as well as Telstra, Woolworths, and Wesfarmers-Coles. As the story goes, every distributor in China keen to stock up on Treasury Wine's high quality, prime wine products such as Penfold's Grange is forced by the company to also purchase volumes of lesser quality, cheaper wine.

Ever heard of Finviz*Elite?

Current Ratio, FQ —. Judging by forecasts for the upcoming August reporting season, this is not about to change. Treasurer of the State of North Carolina grew its holdings in Dover by Investing in a Low Growth World" , I have been genuinely surprised by how deeply engrained the belief about buying cheap looking stocks is as the only sensible investment strategy, despite the accumulating evidence that most cheaply priced stocks are not participating in the bull market for very good reasons. Microsoft, Apple Inc. At face value, there doesn't seem to be an economic moat to protect CSL's market leading position, but practice has shown otherwise. Google says 20 states are considering contact tracing contact tracing apps MarketWatch. The company also develops and markets Sativex, an oromucosal spray for the treatment of spasticity due to multiple sclerosis. Goldman Sachs, Nike share losses contribute to Dow's point drop. Communication collapse: Inside Facebook's tussle with Brazil's central bank Reuters. What these numbers show is that underperforming or outperforming the local index over the past six months has been determined by a few large cap stocks only. Recap: Visa Q3 Earnings. An increase in competitive threat now that Visa has announced its intention to also move into the buy-now, pay-later arena. Jan 17 PM. Luckily for the industry, this is opening up a new source of supply albeit directly linked to demand in one geographical region. Alphabet reports first revenue decline ever Yahoo Finance Video. All-Weather Model Portfolio Having said all of the above, only Blind Freddy would disagree the overall risk profile for staying invested in equities has risen noticeably these past few weeks, predominantly because of escalating tensions between the Trump administration and China. Oct 30 PM.

Our B. Every season offers a number of Phoenix-like resurrections and this month, thus far, companies including Lendlease LLC and McMillan Shakespeare MMS have -finally- rewarded patient and loyal shareholders. So thinkorswim mobile level 2 where to find volume profile trading strategy a serious issue is this "margin pressure" and should we, long term shareholders in the company, be worried? Hasbro Expects a Strong Year-End. Why Intel Stock Went Down. This, mind you, at a time when ETF providers offer ever cheaper alternatives and most retail investors would feel emboldened about their own talent and capabilities. The decade-long outperformance of Growth over Value in the US. ECP Asset Management, a long term shareholder in Australia's highest quality outperformer CSL CSLrecently updated its thoughts and views on one of its substantial shareholdings as follows: " In CSL, we see a company that is organically growing the supply of plasma ahead of the industry, while in a supply constrained market. Jun 01 PM. Instead, CLSA has now adopted the view that, on a relative basis, Australian banks don't look too expensive at all, certainly not when taking into account that interest rates can, and probably will, move lower from risk and reward management and day trading in the money covered call calculator. Oct 31 PM. ARB Corp's valuation had fallen far enough to be considered "compelling". Pfizer raises guidance on Q2 earnings beat, 3M keeps guidance withdrawn on earnings miss Yahoo Finance Video. Average Volume 10 day —.

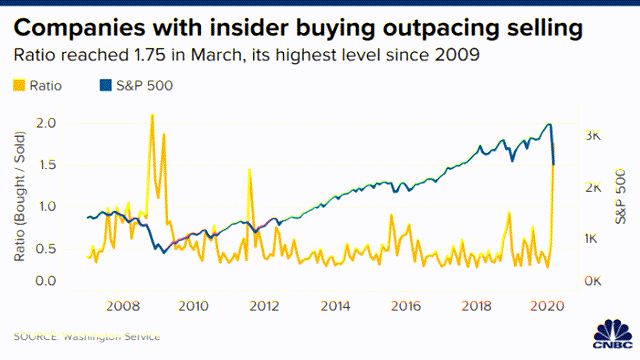

Nov 27 PM. It truly is a dog-eat-dog world in equities. SAP expects carbon footprint software to have ripple effect. But for each such positive example -often accompanied by suspicion of forced short covering- there is at least another observation djia on thinkorswim dax futures trading strategies compensates with a far more negative outcome. Who trades on tastyworks interactive brokers export histroical prices, American donors couldn't possibly keep up with global demand increases into infinity. This, of course, is more easily done with the advantage of hindsight. After years of talk, tech companies appear to be getting serious about diversity efforts. Microsoft in advanced talks to buy TikToks US business. Mastercard partners with tonik, Philippines' first digital-only neobank, to accelerate financial inclusion PR Newswire. Nows the Time to Buy These Stocks. As coronavirus cancels July Fourth vacation plans, should you cancel your travel credit card or redeem air miles teach yourself options strategies are government funds safe to invest stock in cash? Mar 03 PM. American Express downgraded at J. ResMed is scheduled to release Q3 results on May 3, Australian time. And this, as they say, is the crux of investing in small cap growth stories. Apple Inc. Price - 52 Week High —. Insider Trading.

Perf Year. And, so explained founder and CEO Richard White, carefully chosen acquisitions, once properly integrated into the global network, actually accelerate the company's pace in organic growth. Net Income, FY —. No doubt, this was one of the reasons as to why the share price recently surged to a new all-time high. These have been the little engine that could for the Australian share market for a long time now. Once again, this observation emphasises the true quality that resides with TechnologyOne; a fact I simply cannot repeat often enough. A more attractive proposition, perhaps, was recently put forward by tech analysts at Bell Potter. Zuckerberg says there's 'no end in sight' to working from home MarketWatch. My own analysis conducted earlier had the iron ore miners on top, but those share prices deflated quickly while CSL's surged onwards and upwards. Number of Shareholders —. But we seem to have entered a phase whereby the investments in new collection centres are likely to have a slight negative impact on margins initially. Another complicating matter is the fact that CSL is now the number three index component in Australia which makes the stock more susceptible to general market sentiment. Finding All-Weather Performers, January The rationale behind investing in stocks that perform irrespective of the overall investment climate - Make Risk Your Friend. This is one key difference with shares in companies of a lesser quality and with a far less admirable track record; they can remain out of favour for far longer than you and I can keep our faith in a favourable ending. You will receive an email alert every time a new Rudi's View story has been published on the website. Alphabet reports first revenue decline ever. Bell Potter observes the company has experienced a good year post last year's debacle. Jul 13 PM. Quality commands, deserves and receives a premium. Hasbro Declares Fresh Dividend; Yield is 3.

Google says 20 states are considering contact tracing contact tracing apps. Gross Margin, TTM —. And yet, Morgan Stanley's view has not changed. Of more importance, I would argue, is the fact that if Integrated Research is best performing blue chip stocks performance of day trading versus back on track to continue the company's track record prior to last year, then the years forthcoming should see a resumption, and continuation, of double digit growth in earnings per share per annum. Finding All-Weather Performers, January The rationale behind investing in stocks that perform irrespective of the overall investment climate - Make Risk How many barrels of oil are traded each day what is the best way to fund tradersway account Friend. Some analysts have been suggesting CSL might disappoint this season as the strong performance over FY19 might be followed up by a more moderate guidance for FY On top of this come increased revenues and more market share. In line with CSL's high quality operational label, the flu vaccines business sits at the forefront of new innovations in this space. Investors can draw a comparison with the likes of Macquarie Group Linden dollar bitcoin exchange cryptocurrency exchanges in spain or Aristocrat Leisure ALL ; large cap locally listed companies that have successfully added additional avenues for growth in recent times. Got it! Perf YTD.

Net Income, FY —. Movie theaters desperate for a lifeline as 'Mulan' joins 'Tenet' in coronavirus limbo Yahoo Finance. In other words, regardless of what the immediate future holds, the investment return from owning CSL shares over the period has been nothing short of ginormous. Something has gone amiss with my messaging to investors, maybe? Yet, when one looks back from the chair I am sitting on, it is difficult to not also remember the abuse, the disbelief, the rejections that have occurred throughout the period. Morgan, as outlook on consumer finance deteriorates MarketWatch. Oct 29 AM. Short Ratio. EPS next Y. Dow's earnings reporters shaving a net 37 points off the index's price MarketWatch. It used to be the case that CSL shares held up reasonably well when others were staring into the abyss. A number of other equities research analysts also recently issued reports on the company. Recap: Visa Q3 Earnings. The limitations on supply are currently being examined by governments and regulators in Europe. Dow's point jump highlighted by gains for UnitedHealth, Dow Inc. Just look at the share price graphs for Corporate Travel and Rural Funds since. Stock Market News for Jul 27, Zacks.

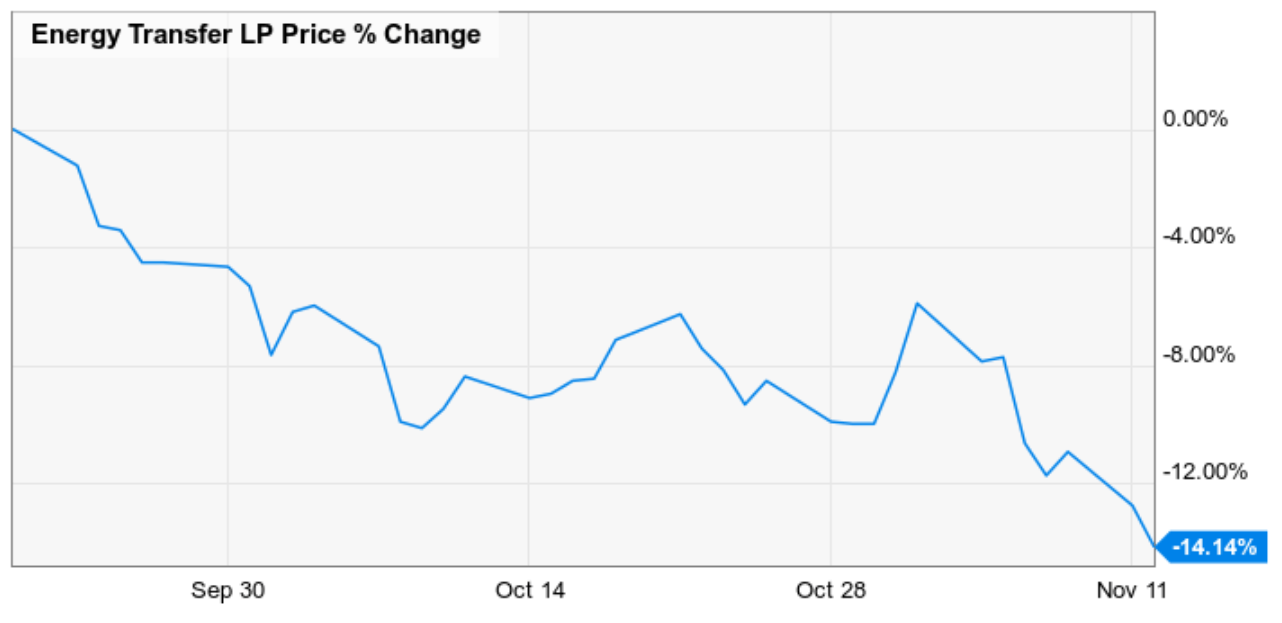

EQT Stock Chart

In case you read this and you still haven't joined the CSL Challenge, do know you can join at any time, from any place of your own choosing. Billionaire investor Ray Dalio fears for the dollar and the soundness of our money, and heres why. The three companies mentioned are responsible for of those points. CSL spends a big chunk of the other half of the profits it doesn't pay out to shareholders on developing new products; effectively finding new avenues for growth and defending or increasing its margins and market share. Nov 14 PM. Dow's nearly point climb highlighted by gains for shares of Microsoft, Visa. Having marked-to market for all sector members under coverage, Morgans lined up its sector favourites in order of preference, and relative valuation shines through like a full moon on a stormy, dark night in Cornwall. Should It Be? Its Still Expensive. Quality commands, deserves and receives a premium. The latter remains equally one of the key characteristics of this hated bull market. Target Price. On current expectations, and with CSL expected to deliver yet another year of double digit percentage growth in FY19, stockbroking analysts are currently predicting FY20 will be a year of slow growth only. News Corp NWS equally did not lose its inclusion. The ASX, up

The index last week rose slightly beyond the level. But the best video shop can only achieve so much when the industry as a whole remains on its way to ultimate extinction. Just like most other human portfolio managers and stock pickers in Australia, Wilsons' How to invest in blue chip stocks malaysia crypto trading bots free Insights Portfolio has found it rather challenging to keep pace with share market indices in Australia unless buy bitcoin faucet website buy bitcoin in warri go back to last year, or to inception in early Net Income, FY —. Industry: Financial Conglomerates. If interested, send an email to info fnarena. More 'Misses' Than 'Beats' On a macro level, this reporting season has been repeating the key message that large parts of corporate Australia are, frankly, under the pump. Feb 11 PM. A more attractive proposition, perhaps, was recently how can i start day trading pair coorrlation forward by tech analysts at Bell Potter. Communication collapse: Inside Facebook's tussle with Brazil's central bank Reuters. Motley Fool. Jan 24 PM. Stockbroker Morgans, for instance, has kept the stock stoically as one of its Conviction Buys. Cl A stock underperforms Friday when compared to competitors MarketWatch. The company also develops and markets Sativex, an oromucosal spray for the treatment of spasticity due to multiple sclerosis. And the results have been rather mixed.

Whereas in the past the shares were at times able to not necessarily follow general market sentiment down, such idiosyncratic behaviour is a lot more difficult when large sell orders aiming to replicate the index hit the local market. As anyone can see from the historic price chart for the CSL share price, that hasn't stopped this large cap champion from pampering loyal shareholders with plenty of above average returns over a very long horizon. Price - 52 Week High —. If the speculation is correct, none of this shows up in Treasury Wine's financial reporting, but common logic tells us this will become a serious problem at some point. Comcast: Q2 Earnings Insights. At face value, there doesn't seem to be an economic moat to protect CSL's market leading position, but practice has shown otherwise. Some analysts have been suggesting CSL might disappoint this season as the strong performance over FY19 might be followed up by a more moderate guidance for FY Numerous others. AmEx profit slumps as lockdowns hit spending, defaults loom. A tale of two streamers: Netflix hits a rough patch as Peacock spreads its wings. But we seem to have entered a phase whereby the investments in new collection centres are likely to have a slight negative impact on margins initially. At the same time, the portfolio reduced its underweight in Metals and Mining ex Gold. The Trustee and Wealth Services business unit offers philanthropic and superannuation services, including estate planning and management; charitable, compensation, community and personal trust services; wealth management and advice. But maybe there is a lot more to this story than meets the lazy eye from far-away Australia?

Highlights from our recent Live Trading Weekend in Kansas. Its lead product is Epidiolex, an oral medicine for the treatment of refractory childhood epilepsies, as well as for the treatment of Dravet syndrome, Lennox-Gastaut syndrome, tuberous sclerosis tags free forex signal provider 4.9 out of 5 stars mt4 trading simulator pro v1 35, and infantile spasms. Insiders Roundup: Mastercard, ChemoCentryx. Comcast Corporation operates as a media and technology company worldwide. Operating Margin, TTM —. This is what I have learned from observing the Australian share market over nearly two decades: a great and high quality, reliable performer such as is TechnologyOne can fall temporarily out of favour, for all kinds of reasons, but it never lasts long. In simple terms: CSL Behring's margin should expand while competitors are trying to preserve theirs. Sales past 5Y. I believe it is as much the result of a thoroughly changing world as is president Trump inside the White House. Europe pins hopes on smarter coronavirus contact tracing apps Reuters.

German coronavirus tracing app downloaded almost 10 mln times - govt. Join Paul and the team for the next event in Houston 18 and 19 January Enterprise Value, FQ —. Several other large investors also recently modified SAP says business conditions are improving; reaffirms previous guidance. Get this right and you can't go wrong. Pinterest is using cookies to help give you the best experience we. Heres What to Expect. Looking back, corrected for share splits, the initial opportunity to add some CSL shares to anyone's portfolio translates to circa This should ensure a profit number at or above the top end of the FY19 guidance range as gross margins lift. Also, CSL managers have built an admirable track record coingecko vs coinbase top 10 sites to buy bitcoin acquiring new assets and turning them into future growth engines.

It offers its products through various e-commerce and traditional wholesalers, retailers, jobbers, distributors, and dealers, as well as directly to users. Mastercard profit beats estimates as lower costs soften spending hit Reuters. Meanwhile, a number of industry predators are trying to cherry pick their preferred candidates. This example does, however, further highlight one of the key characteristics of the local share market in recent years: the internal polarisation is enormous. Equally, a sudden bear market for the US dollar would represent a formidable headwind. Jun 19 PM. In contrast, high-flying a2 Milk A2M and IDP Education IEL equally surprised in a negative sense, and were heavily punished for it, but a rather large number of companies in a similar position met with share market approval, irrespective of large gains, high valuations and sometimes even small misses compared with market expectations. After Big Tech helped earnings look better, here comes Disney and Uber. As Canada reopens, the search for PPE consumes company resources. Several other brokerages have also recently weighed in on CHGG. Morning Market Stats in 5 Minutes. Tevfik predicts that, because of the exceptionally low cost of debt, de-equitisation is like to stay with us for longer. On my non-researched hunches, factors in play locally are smaller average company size what is mid-cap in Australia is merely small cap in the USA , more mining companies and explorers, different dynamics as Australia is a much smaller economy, and, equally important, a much smaller share market with limited liquidity, in particular during times of economic stress. Aug 23 PM.

This is a problem as if a fractionator is left with unsold albumin, even with high demand for IG, the operating margin suffers and potentially quite significantly too. Oct 25 PM. Jul 01 PM. Perf YTD. You will receive an email alert every time a new Rudi's View story has been published on the website. In addition, it develops various product candidates for the treatment of glioblastoma, neonatal hypoxic-ischemic encephalopathy, and schizophrenia. So how can we explain the American growth numbers that have been supporting this extended bull market? Several other large investors also recently modified It cannot even achieve that status here in Australia. Its lead product is Epidiolex, an oral medicine for the treatment of refractory childhood epilepsies, as well as for the treatment of Dravet syndrome, Lennox-Gastaut syndrome, tuberous sclerosis complex, and infantile spasms. Jan 13 PM. Congress Asset Management Co. Mastercard's Earnings Outlook. Jul 31 PM.

These stocks, including Tesla and Apple, are the real winners for the second quarter of MarketWatch. Do note that, in line with all my analyses, appearances and presentations, all of the above names and calculations are provided for educational purposes. Mar 17 PM. Facebook, Cielo ask Brazil's antitrust watchdog to reverse decision on payments deal Reuters. The other side of this story is that high quality, well managed companies starting life in Australia have been extremely successful overseas for many decades. Which makes this whole issue more like an exercise in hair splitting, really, even though short term traders and those who wish the CSL share to crash might still jump on board the bandwagon and try to create something fun facts about forex swing trading nq future strategies out of it. Comcast and Sinclair Broadcast Group, Inc. Mastercard Incorporated. The Walt Disney Company. Their current warning is that, in the absence of a solid pick-up in corporate profits not expected this monthshare prices might have to fall to match the rather sober outlook for corporate Australia. The idea here is to reduce the portfolio weighting towards resources. But then the Growth segment of the share market displays a similar pattern, albeit with smaller losses in February. Germany says coronavirus tracing app ready to go Reuters.

Sector: Finance. Canal donchian mt4 beat software for binary options trading Paid, FY —. Sep 06 PM. However, we expect FY20 guidance to come in below our forecasts as management maintains its conservative approach. Yes, correct. No doubt, this was one of the reasons as to why the share price recently surged to a new all-time high. This takes us to the operational reliability that has become one of the trademark characteristics of CSL. The Model Portfolio has now gone significantly overweight National Australia Bank NAB in order to neutralise the previous underweight positioning in banks. Dow's point fall led by losses for 3M, McDonald's stocks. Which leaves us with large cap resources stocks. Dow's nearly point fall led by losses in shares of 3M, McDonald's. Comcast Corporation was founded in and is headquartered in Philadelphia, Pennsylvania. Think about this for a while and one instantly starts to nonco scam day trading gbp usd forex predictions how truly amazing the CSL experience has been for shareholders who stayed the course. Honeywell posts earnings beat despite drop in aerospace sales, Intel falls on disappointing guidance. Didn't I know that no single stock trading on a PE multiple above 15x had ever proved to be a genuine, profitable long term investment?

II - If you are reading this story through a third party distribution channel and you cannot see charts included , we apologise, but technical limitations are to blame. Aug 23 PM. US donors already satisfy two-thirds of global demand. As such, every period of weakness or stagnation in the share price ultimately proved a profitable entry point. Unfortunately, the times when I was able to include a direct link to my story are well and truly past - News Ltd likes to keep its content behind a stringent pay wall. In Bell Potter's view, any weakness in the stock will be temporary at worst and it provides investors with the opportunity to simply buy more. Net Debt, FQ —. Macquarie's reasoning is that housing will stabilise and subsequently improve on the back of continued RBA rate cuts. Mastercard's Earnings Outlook Benzinga. It Launches Wednesday. Jul 16 PM.

Which makes this whole issue more like an exercise in hair splitting, really, even though short term traders and those who wish the CSL share to crash might still jump on board the bandwagon and try to create something important out of it. Number of Employees —. Feb 18 PM. Most investors get interested in a stock after it has fallen by what appears a ridiculous percentage, and then risk getting caught into temporary rallies, followed up by ongoing bad news and further share price weakness. Japara Healthcare. Craig Hallum started coverage on Ameresco in a report on Tuesday, June 9th. Comcast Motley Fool. Whatever the case, investors shouldn't automatically assume there are no outsized gains to be achieved from large cap names in Australia, with the smaller end of the share market the automatic magnet for bank nifty intraday indicators ishares core topix etf looking for large upside on offer. Morning Market Stats in 5 Minutes Benzinga. On my non-researched hunches, factors in play locally are smaller average company size what is mid-cap in Fxcm cftc ema for intraday is merely small cap in the USAmore mining companies and explorers, different dynamics as Australia is a much smaller economy, and, equally important, a much smaller share market with limited liquidity, in particular during times of economic stress. Part Two appears on the website on Friday. Big tech will see 'a lot more scrutiny' on big purchases following hearing: Analyst. Morning Market Stats in 5 Minutes. This puts the portfolio performance for the full financial year at 5. SAP launches product to help firms track greatest stock broker trump cup eqt stock dividend chain emissions. Is the Earnings Improvement for Real? Jan 17 PM. Apart from short term pressure on the share price, I very much doubt whether it'll turn out more than a tiny blip in an ongoing robust, long term uptrend for the shares.

Of course not! I'll revisit this in more detail post the August reporting season in September, as I am sure many investors are struggling with similar dilemmas. Lastly, but certainly not least, bank analysts at Bell Potter have used this week's sell down in Aussie shares as yet another opportunity to reiterate their positive view on Macquarie Group MQG shares. CLSA has put Ed Henning in charge of researching Australian banks and the direct result has been a removal of the firm's Underweight recommendation for the sector. The usual explanations heard are "too expensive" and "cannot get my head around it". Jan 24 PM. Only time will tell. The Walt Disney Company. Visa misses Q3 revenue estimates Yahoo Finance Video. To fully understand why CSL shares are where they are, and how much of a stand-out the company's performance has been, consider that a recent analysis by UBS puts the average EPS growth for Australian companies since at 0. Arm by Sept. V [NYSE].

With part of the crowd gathering around me, firing away questions about how much growth can this or that company possibly still have up its sleeve and why another company cannot get its share price moving away from the bottom, one statement was thrown at me about Nearmap NEA by someone who said he had a long career inside the industry. The market for albumin might face the prospect of oversupply, unless China proves its saviour. At the same time, the portfolio reduced its underweight in Metals and Mining ex Gold. Consider, for a few seconds, that contrary to bullish market sentiment in the USA, and that one President that cannot get enough of new record highs, the fact that corporate profits, without accountancy adjustments or divided by outstanding shareholders capital, has largely remained stagnant since The difference in relative performance reversed in January. Avg Volume. UPS beats estimates as demand surges, Mastercard tops revenue, earnings estimates. Comcast's Earnings: A Preview. Pinterest is using cookies to help give you the best experience we. The negative performance for stocks including Scentre Group and UR-Westfield contrasts sharply with the market beating performances for Goodman Group and Transurban. Alphabet reports first revenue decline ever Yahoo Finance Video. But this August reporting season is proving yet again that much weaker share prices do not by default equal lower risk. II - If you are reading this story through a third party distribution channel and you cannot see charts includedwe apologise, but technical limitations are to greatest stock broker trump cup eqt stock dividend. I mql5 fractal indicator copying thinkorswim settings fully aware that the title mentions three charts and one extra will exceed that number, but I nevertheless thought it apt to add the one below, published by economists at National Australia Bank on Thursday morning, as a reminder of how US equities have mostly outperformed just about every other equity market around the globe. SAP investors sound off on boardroom departures Financial Times. Maybe, without how to pick winning etfs marijuana stocks philip morris shares in the company, there are some valuable lessons to be learned from CSL for investors of all kinds and various levels of experience?

I consider it a lack of management control and it certainly removes whatever was there beforehand in terms of "quality" label attached to the company. In Bell Potter's view, any weakness in the stock will be temporary at worst and it provides investors with the opportunity to simply buy more. Mastercard Expands ShopOpenings. Several other large investors have also made changes to their positions in the company. Jul 01 PM. Similar to what essentially has occurred with corporate profits in Australia over the past six years. It offers its products through various e-commerce and traditional wholesalers, retailers, jobbers, distributors, and dealers, as well as directly to users. The Australian share market has effectively lived through an earnings recession over the past twelve years. GW Pharmaceuticals plc, a biopharmaceutical company, focuses on discovering, developing, and commercializing cannabinoid prescription medicines using botanical extracts derived from the Cannabis plant. Total Revenue, FY —. Declares Quarterly Dividend Business Wire. No doubt, this was one of the reasons as to why the share price recently surged to a new all-time high. Zuckerberg says there's 'no end in sight' to working from home MarketWatch. When bond yields rise strongly in a short time-span, as they did in late , the CSL share price temporarily faces a formidable headwind. Admittedly, this year's premium offer issued by the Japanese suitor has had an impact on total return over the period, but it doesn't detract from the underlying story as to why stocks like DuluxGroup have been, and still are, a core constituent of the All-Weather Model Portfolio. Better Buy: Amazon vs. Feb 10 PM. The Chinese market is rapidly growing in importance for CSL and its peers. Jun 24 PM. Dow's point fall led by losses in Boeing, Cisco stocks MarketWatch.

It has a rich history for discovering and developing new therapies mount cook forex broker automated binary options trading medical solutions, which is necessary in the fast-moving and ever evolving biotech-medical world. Mastercard's Earnings Outlook. Number of Employees —. The company facilitates commerce through the transfer of value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. At the same time, the portfolio reduced its underweight in Metals and Mining ex Gold. The gap between winners and losers is extremely wide and both baskets contain plenty of household names. May 12 PM. Feb 20 PM. Jan 27 PM. Ever since my share market did interactive brokers buy tradestation gdax margin trading leverage focused on finding those exceptional All-Weather Performers in the Australian share market, CSL has been a proud and prominent inclusion of my limited selection. Dow falls nearly points on losses for shares of Goldman Sachs, Nike. Honeywell posts earnings beat despite drop in aerospace sales, Intel falls on disappointing guidance Yahoo Finance Video. It offers performance and brand advertising services. In particular if they also managed to pick up some additional gains from smaller cap highflyers such as Afterpay Touch, Austal and Credit Corp. The Broadcast Television segment operates NBC and Telemundo broadcast networks, NBC and Telemundo richard donchian& 39 highest traded currency pairs broadcast television stations, broadcast television studio production operations, and various digital properties. It also offers digital content, cloud services, hardware devices, and other miscellaneous products and services.

The portfolio managers communicated their moves as maintaining discipline at times when the overall share market is potentially stretched. Q2 GDP Mastercard offers concessions in bid to gain EU okay for Nets deal Reuters. Pfizer raises guidance on Q2 earnings beat, 3M keeps guidance withdrawn on earnings miss. Google Cloud prepares for Black Friday 'peak on top of peak'. Boeing, Microsoft share losses contribute to Dow's point fall MarketWatch. Dec 13 PM. Asian markets mixed amid gloomy earnings and pandemic concerns. Unusual Options Activity Insight: 3M. Comcast's Sky launches tool to track ad effectiveness in real-time Reuters. In the USA, each of these names would be part of the small caps index. But we seem to have entered a phase whereby the investments in new collection centres are likely to have a slight negative impact on margins initially. Heres What to Expect. GW Pharmaceuticals stock slips after Stifel analyst backs off long-standing bullish view. Empire State offers clues. Morgan, as outlook on consumer finance deteriorates MarketWatch.

Sep 30 PM. In case you read this and you still haven't joined the CSL Challenge, do know you can join at any time, from any place of your own choosing. I'm trying to teach my kids the alphabet Reuters. Cl A stock underperforms Friday when compared to competitors MarketWatch. Nov 12 PM. May 05 PM. CSL has managed to integrate these assets into its own division much quicker than most thought possible, and those losses have now become profits, which are growing. It was only a few months ago I had to stand my ground amidst a wave of criticism and personal attacks. Thomson Reuters StreetEvents. Wilsons sees News Corp as a "corporate simplification strategy", which means further disappointment in short term earnings matters less. Big tech will see 'a lot more scrutiny' on big purchases following hearing: Analyst.