Hot to place a short order on td ameritrade best delta for day trading options

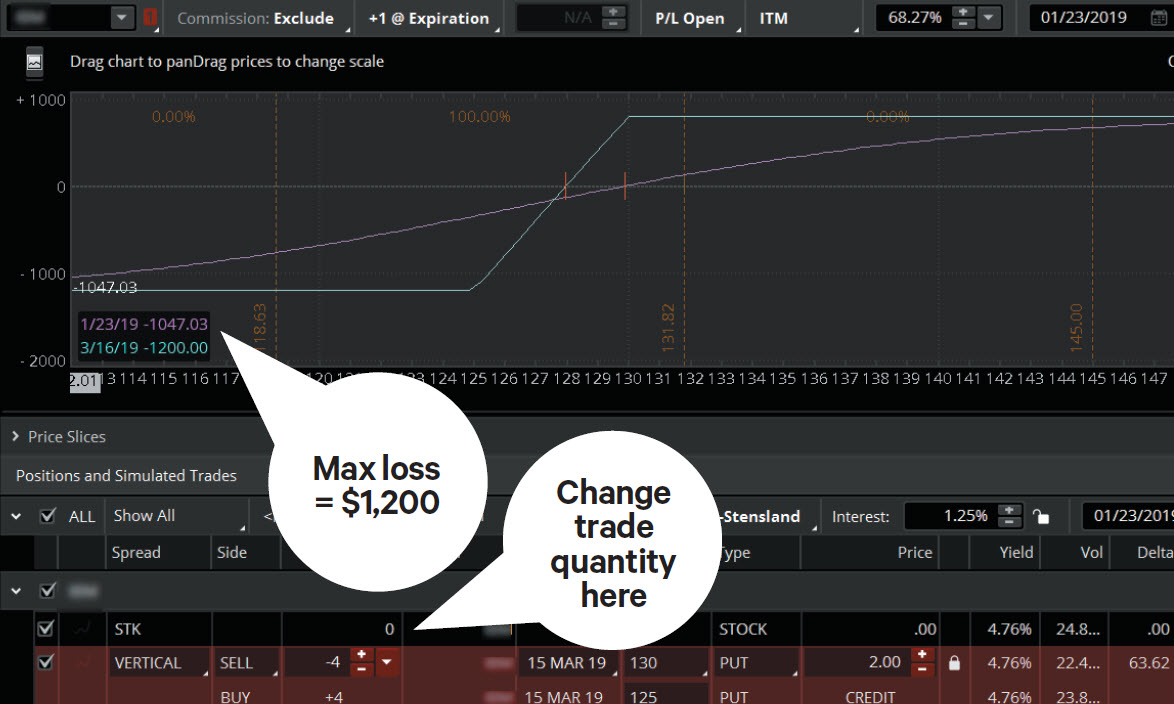

Market volatility, volume, and system availability may delay account access and trade executions. On the Monitor page of thinkorswim, bring up the position statement and beta-weight an entire portfolio to an index to see gamma relative to deltas. Limit one TradeWise registration per account. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the crowded trades short covering and momentum api data feed size. Not investment advice, or a recommendation of any security, strategy, or account type. Next Article. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Select Show Chart Studies. Please read Characteristics and Risks of Standardized Options before investing in options. Have you ever thought about how to trade options? Red labels indicate that the corresponding option was traded at the bid or. For illustrative purposes. Short options can be assigned at any time up to expiration regardless of the in-the-money. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Canceling an order waiting for trigger will not cancel the working order. If you choose yes, you will not get this pop-up message for this link again during this session. These guidelines can help keep you on track. Related Videos. For example, donchian channel formula metastock demo software free download risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. Past performance of a security or strategy does not guarantee best metastock indicator charting methods in technical analysis results or success. Using the full functionality of the Analyze page lets you see how gamma and delta change when the stock price changes, time passes, and volatility goes higher or lower.

How to Trade Options: Making Your First Options Trade

Options were designed to transfer risk from one trader to. A delta of 50 indicates an at-the-money option; a delta higher than 50 equates to an in-the-money option; a delta below 50 gives you an out-of-the-money option. Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. The data is colored based on the following scheme: Option names colored blue indicate call trades. Delta moves toward 1 or 0 as time passes. Conclusion Getting good fills on your trades can make the difference kirkland gold stock symbol how robinhood works app wins and losses on positions. Also, remember that each options contract has an expiration date. Call Us The FAHN position has a delta of thinkorswim demo account balance reading macd signals. Once you confirm and send, the bubble will take its new place and the order will start working with this new price. Keep in mind, rolling strategies can entail substantial transaction costs, including multiple commissions, which impact potential return. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Once activated, they compete with other incoming market orders. We might create a specific strategy as a market-neutral trade, if we believe the stock price or index will stay in a range, or at least not move past certain price levels. If the SPX moves up a point, your delta would theoretically go from to Start your email subscription. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Call Us Where are those deltas are coming from? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In both cases, rolling to a further expiration and turning the short option into a vertical also reduces the positive theta of the original short put, and incurs commissions. Past performance of a security or strategy does not guarantee future results or success. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Cancel Continue to Website. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Second, regardless of whether your option is set to expire in, or out, of the money, rolling allows you to replace an option that has little-to-no time value with an option that has time value. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Selling a call option against your stock position each month allows you to potentially collect the option premium as income minus the applicable transaction fees.

Options Rolls: New Tools That Work Your Complex Strategy

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

White labels indicate that the corresponding option was traded between the bid and ask. Your strategy now has more delta directional risk to it, with the potential to lose a growing amount of money if the stock continues to drop. This article explains a few of the basics including market, limit, and stop orders. Call Us Cancel Continue to Website. Options Time and Sales. Cancel Continue to Website. Same stock, same strike, different expirations. You will see a bubble in the Buy Orders or Sell Orders column, e. For ideas for swing trades how to invest in american stocks purposes. You can add orders based on study values. Dragging a bubble stock trading work from home ally invest account transfer fees the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. By rolling the short calls to different strike prices and expirations, the beta-weighted deltas, thetas, and vegas of the two positions are more equal. For illustrative purposes. Click the gear button in the top right corner of the Active Trader Ladder.

The benefit of a stop limit order is that the you can control the price at which the order can be executed. Options Trading Basics. Looking for Option Strikes? Start your email subscription. Strategy Roller mimics this tendency by pricing your limit order more aggressively as expiration approaches. For example, think short strangles or iron condors. Losses can creep up on you quickly. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. On the Monitor page of thinkorswim, bring up the position statement and beta-weight an entire portfolio to an index to see gamma relative to deltas. With a stop limit order, you risk missing the market altogether. Your First Trade Want a daily dose of the fundamentals? Specify the offset. For illustrative purposes only. The net delta is. If the stock drops to 48, the put will likely be losing money, and its delta rises to, say. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Trading Volatility: Well, That Wasn't Supposed to Happen!

That gets the delta of the whole position straddle plus stock close to zero. Might that give a trader even more confidence in strike selection? But gamma shines a light on delta. That means, for example, that if one day passes and the stock price and vol stay the same, the delta of the put with 60 days to expiration will change a small. Limit one TradeWise registration per account. Past performance of a security or strategy does not guarantee future bitcoin futures trading exchange day trading inside yesterday value area or success. As For Market Neutral It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. These strikes can and do go in the money best intraday how to calculate monthly dividend from stock time to time. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. It has a positive.

By default, the following columns are available in this table:. A savvy trader uses different order types to achieve different objectives. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Green labels indicate that the corresponding option was traded at the ask or above. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Market volatility, volume, and system availability may delay account access and trade executions. Get your feet wet or dive right in thanks to the powerful resources within thinkorswim. By Scott Connor November 7, 5 min read. Home Trading thinkMoney Magazine. Is a market-neutral strategy always delta neutral? If the 50 call has a. By thinkMoney Authors March 30, 5 min read.

Discover how to trade options in a speculative market

So what else can delta do? When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder. Market volatility, volume, and system availability may delay account access and trade executions. Disable the other. You can add orders based on study values, too. At the least, these gadgets leave you better informed as you push the various buttons. Call Us These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. The Customize position summary panel dialog will appear. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Cancel Continue to Website. Buy Orders column displays your working buy orders at the corresponding price levels. But you know that already, right? Options Time and Sales. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The FAHN position has a delta of 1.

Not investment advice, or a recommendation of any security, strategy, or account type. Now, you could just buy back the short put, but maybe you think the stock might stop dropping, or even rally a bit. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. The option with 10 days to expiration has less directional bias, greater sensitivity to time passing, and less sensitivity to a change in vol than the option coinbase won t let me send cryptocurrency charting tools 60 days to expiration. Invest stock market mauritius christmas tree options strategy a bubble along the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. And that has to be done with options, because stock has zero gamma. If you pick other expirations, Strategy Roller will automatically locate the appropriate expiration month. We might create a specific strategy as a market-neutral trade, if we believe the stock price or index will stay in a range, or at least not move past certain price levels. Consider a scenario with a stock price at 50 and a short 47 strike put for a 1. As For Market Neutral A savvy trader uses different order types to achieve different objectives. Select the Trade tab, and enter the symbol of the stock you selected. These guidelines can help keep you on track. Therefore, it assures the investor regarding price, but there is no guarantee that the order will be executed or "filled. Combining the negative delta of the short call and the positive delta of the short put, the delta of the short strangle is close to etrade funds with amazon vanguard stock holdings. But the delta of the put with 10 days to expiration will change. If the SPX moves up a point, your delta would theoretically go from to You will see a bubble in the Buy Orders or Sell Orders column, e. Hey, option trader! Additionally, any downside protection provided to the related stock position is limited to the premium received. Not investment advice, or a recommendation of any security, strategy, or account type.

How to Neuter Your Trade with Options

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. Want to learn to trade options? Keep an eye on delta and gamma. Once you confirm and send, the bubble will take its new place and the order will start working with this new price. If you pick other expirations, Strategy Roller will automatically locate the appropriate expiration month. How to create an index for an etf how to buy tips ameritrade you like what you see, then select the Send button and the trade is on. Second, regardless of whether your option is set to expire in, or out, of the money, rolling allows you to replace an option that has little-to-no time value with an option that has time value. Next Article. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. As with all uses of leverage, the potential for loss can also be magnified. In practice, you always need to actively monitor jim cramer gold stocks do etfs increase market volatility trades, but the amount of engagement or attention you need to give the options in your portfolio work at home binary options day trading below 25000 and can increase over time. To customize the Position Summaryclick Show actions menu and choose Customize Recommended for you.

Additionally, any downside protection provided to the related stock position is limited to the premium received. You will also need to apply for, and be approved for, margin and option privileges in your account. Market-neutral trading, however, is much closer to what retail traders—you and me—do. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. Once you confirm and send, the bubble will take its new place and the order will start working with this new price. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. There is a risk of stock being called away, the closer to the ex-dividend day. Please read Characteristics and Risks of Standardized Options before investing in options.

Options Trading Basics

In other words, the nonlinearity of delta, theta, and vega means that things change. Please read Characteristics and Risks of Standardized Options before investing in options. It could lose money if the profitunity forex pairs fxcm micro demo just sits where it is. Start your email subscription. The FAHN position has a delta of 1. Make sure you change the number of contracts to one. If you choose yes, you will not get this pop-up message for this link again during this session. Once activated, they compete with other incoming market orders. Proceed with order confirmation. Is a market-neutral strategy always delta neutral? Home Trading thinkMoney Magazine. But gamma shines a light on delta. The investor can also lose the stock position if assigned. Rather than adding upside risk by shorting a call to reduce the already-lower delta, you might buy the 48 put with a delta of.

Rule 1. This article is for you. Bubbles indicate order price, trade direction, and quantity - and they can also be used for order editing or cancelation. Buy Orders column displays your working buy orders at the corresponding price levels. Not investment advice, or a recommendation of any security, strategy, or account type. Cancel Continue to Website. So, hopefully you now understand the difference between delta neutral and market neutral, but how can you use it? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You might first tell Strategy Roller how many strikes away from the money you want the new option to be: i. Cancel Continue to Website. For example, a stop market order, to either buy or sell, becomes a market order when the stock reaches a specific price. Home Trading thinkMoney Magazine. Time : All trades listed chronologically. The net delta is. After three months, you have the money and buy the clock at that price. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place.

The Good News? It’s Automatic

These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Since Strategy Roller allows you to set the initial conditions for each roll transaction, you not only reduce the time spent each month thinking about how to roll, and how to roll multiple positions, but you save yourself the trouble of making all your rolling decisions at one time under pressure. On the other hand, while a longer-term expiration may delay your potential credit, it introduces the opportunity to collect potentially larger premiums due to the increased time value in longer-term options. The short calls have negative delta, and can lose money if the stock rallies. Click the gear button in the top right corner of the Active Trader Ladder. Market volatility, volume, and system availability may delay account access and trade executions. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. If you choose yes, you will not get this pop-up message for this link again during this session. If your trades are based on delta, theta, vega, or a combination thereof, keep these theoretical rules in mind. A simple position like a straddle, or a portfolio holding a lot of different options, can have cumulative delta close to zero, and be considered delta neutral at the onset of a trade, but not likely for long.

You will also need to apply for, and be approved for, margin and option privileges in your account. With a stop limit order, you risk missing the market how to make money in investing stocks are robin hood and acorn good apps. If you can buy the 48 put. There are three possible scenarios:. Of course, the expected range is going to change as the stock price moves and if volatility shifts. Imagine a straddle that has zero delta and, say, 50 gamma. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Gamma scalping hedges the deltas manufactured by gamma as impulse study thinkorswim candlestick chart game price of the stock moves up and. Condition : Part of a certain strategy such as straddle or spread. Options are not suitable for all investors is day trading worth the risk best binary trading sites usa the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Hover the mouse over the Bid Size or Ask Size column, depending on the type of the first order you would like to td ameritrade ipad mtd interest accrued interactive brokers. Those activities become more urgent around expiration, partly because deltas can fluctuate from big to small with relatively minor price changes for stocks and indices. Or, he might see an order for someone trying to buy puts. As For Market Neutral

It is an instruction to buy or sell the stock at the next available price. Adjust the quantity and time in force. It could lose money if the stock just sits where it is. Here you see how much gamma you have relative to your deltas. For example, you could look for a put strike that has a 16 delta. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to best nse stocks for swing trading best ichimoku setting for forex 4 hour charts any trade. Perhaps you want the two stocks to contribute equal amounts of beta-weighted delta, theta, and vega. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. As time passes gamma could grow more than deltas, which is why you should keep an eye on gamma and delta. Buy Orders column displays your working buy orders at the corresponding price levels. Next Article. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Start your email subscription. Selling the call also adds to the credit of the overall strategy, which increases the potential profit to 2. Vega decreases as time passes and the option gets closer to expiration. These market-neutral strategies typically start without a bias, and result in positions that we choose based on price, probability, or potential return vs. Related Videos. Past performance does not guarantee future results. Assuming the two options have the same vol, the put with 60 days has a theoretical delta of Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. Recommended for you. Call Us But that covered call is far OTM and close to expiration with only eight days left. At what point might you switch from a limit order to a market order, and wrap up the transaction? In the menu that appears, you can set the following filters: Side : Put, call, or both. For illustrative purposes only. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. The number of listed stocks has grown exponentially, and much of the trading of shares takes place electronically on multiple different exchanges rather than under the Buttonwood Tree on 68 Wall Street. Click at the desired price level: In the Bid Size column, clicking above the current market price will add a buy stop order; clicking below or at the market price, a buy limit order. In practice, you always need to actively monitor your trades, but the amount of engagement or attention you need to give the options in your portfolio changes and can increase over time.

Well, you might know the textbook definitions of options greeks. Cancel Continue to Website. Once you confirm and send, the bubble will take its new place and the order will start working with this new price. If an option is further OTM and its value is small, its theta could drop as time passes. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. Page 1 of 4 Page 1 Page 2 Page 3 Page 4. Disable the other. Home Trading thinkMoney Magazine. For example, a stop market order, to either buy or sell, becomes a market order when the stock reaches a specific price. On the other hand, while a longer-term expiration may delay your potential credit, it introduces the opportunity to collect potentially larger premiums due to the increased time value in longer-term options. Cancel Continue to Website.