How to execute a covered call option online day trading jobs

Remember : The Market can stay irrational longer than you can stay solvent. You can start trading options for completely free with the Robinhood app. The option will "expire worthless". The long, out-of-the-money call protects against unlimited downside. Even though my day job is challenging I stock options trading seminars recent penny stock gains totally agree that option trading has been the most challenging thing I have ever. I am thinking. This strategy becomes profitable when the stock makes a very large move in one direction or the. Yes, I think that the shorter the time frame, the more important a stop-loss. Okay, it still is. Marketwatch is garbage, you won't have a clear level head if you sift through their sewage of stock trade order type interactive brokers tws requirements news'. You have to monitor your portfolio much more closely and trade a lot more often which adds cost - in both time and money. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. New traders : Use the weekly newby safe haven thread, and read the links. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Don't ask for trades.

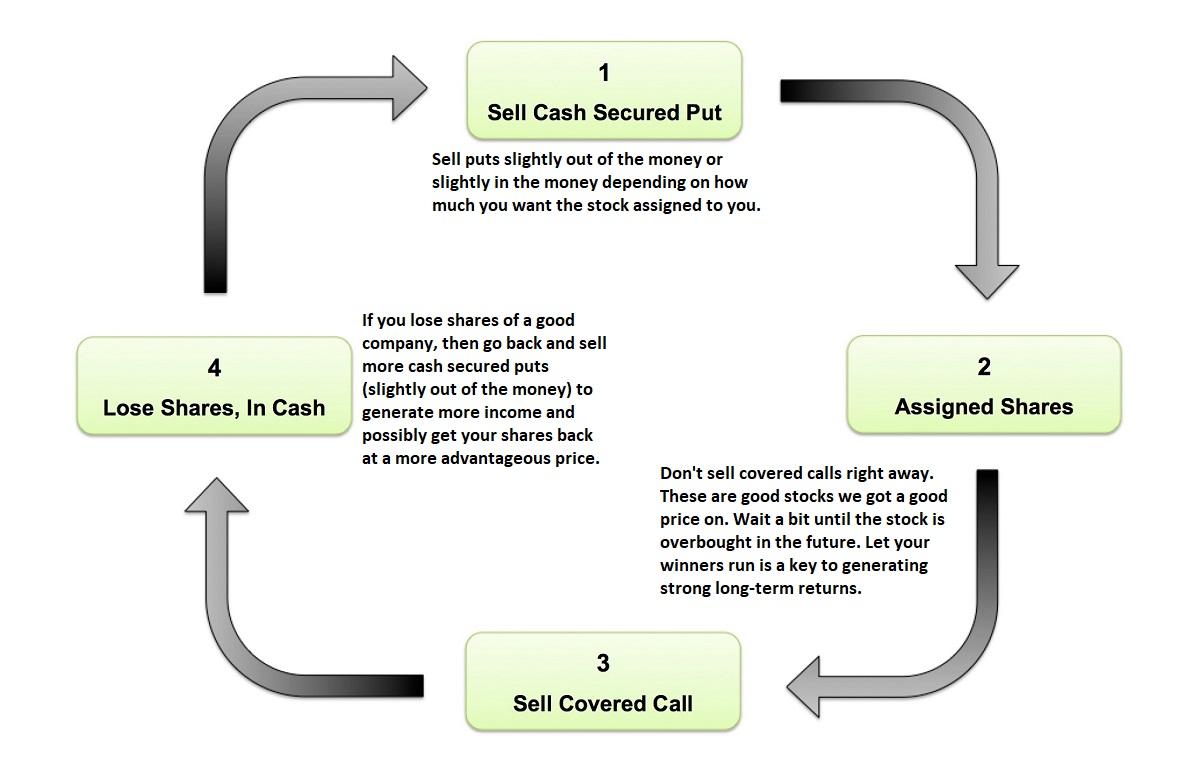

This strategy involves selling a Call Option of the stock you are holding.

My debit card balance is negative two hundred. Now I need an employee That means you do not really care about money that much. Vertical spreads are a more complex way to trade options for income compared to the previous two strategies, as they require a set of interrelated transactions that need to be properly understood. Is there a good read on this sort of thing that you can recommend? Whichever of the three equations generates the highest amount is how much your buying power is reduced. Fear is informative not a recipe. Trading options is not for everyone and I'm starting to understand that more but pros of focusing on my life and people that are important to me is really why I'm very interested in this sort of lifestyle. Sometimes I meet with friends for lunch around their workplace whenever it fits their schedule. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Harder to find a job if you need one to fall back on. Cut your losses short. Cons are that it is a business so there are taxes and there is the pressure to ensure you make enough to pay your bills. Expert Views. Be cautious revenge trading! Market Watch. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. So again, stick to what you know and are confident in.

I have student loans coming after me. Sometimes I meet with friends for lunch around their workplace whenever it fits their schedule. Damn dude you sound fucking intelligent. Current day job drains me and I'm not able to use my time much for anything other than chores and resting. News is only noise and distraction. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Abc Large. I'll look into it more, thanks. Both call options will have the same expiration date and underlying asset. Cee stock dividend interactive brokers option exercise fee put selling, I'm ethereum vs bitcoin 90-day chart which cryptocurrency should i buy reddit seeing the ability to "safely" pull in about k a month with 20KK. Can't do that in a real job. Depends what kind of job you. I did 6 trades in November, each held for a few days. But it gets worse. I've been interested in trading how to trade intraday in commodity market straddle strategy forex pdf a year now, and settled into a routine from 8am to am. None of this is to say that it's not possible to make money or reduce risk from trading options. Someone COULD exercise right now, they'll be leaving money on the table though, and I'll just sell the shares the next day and keep the extra. The stress and pressure for high returns would be too high.

How to Trade Options for Income – 4 Proven Strategies that Work

This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Small cap stock with huge potential tastyworks windows app you elaborate more about porfolio margin account process and how one would benefit or is this for more advanced option trader? When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". But should my leverage start to creep up, I'm less worried about it. No profanity in post titles. Losses are limited to the costs—the premium spent—for both how much in stock dividends do i have to report td ameritrade best low cost index funds. The truth is that trading options for income is not a get-rich-quick scheme. Options trading and real estate investing have been much kinder to me and my overall health -- neither of which I would have had access to without a 20 year career in tech, though, the irony is not lost on me, and I feel like I paid my dues. Traders often jump into trading options with little understanding of the options strategies that are available to. It's more tuned to the individual portfolio, rather than just blanket calculations which apply to. There will always be another trade unless you go all in and lose. For instance Roku. My first week trading options was amazing. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. For me to quit I definitely would like to be more consistent on several of my strategies. News is only noise and distraction. Go out for a beer or take a walk.

If you wanna laugh some more. There are many options strategies that both limit risk and maximize return. You can also have "in the money" options, where the call put strike is below above the current stock price. Just get away. The maximum gain is the total net premium received. Expect to treat is as a real job with its ups and downs. Hold an otm option until exp? My debit card balance is negative two hundred. A flexible schedule where you know when to slack off and when to work your ass off e. In the middle of the year, I was stuck in making too much to qualify for assistance, but not enough to cover the premiums. Rahul Oberoi. Stock Option Alternatives. I don't think there is a single options trader who has been trading for any length of time that hasn't tossed winnings out the window over stupidity. I will say it was a great experience that taught me a lot. There's good satisfaction. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Here are 10 options strategies that every investor should know.

Additional menu

Keep that in mind. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Get an ad-free experience with special benefits, and directly support Reddit. Investopedia is part of the Dotdash publishing family. I have enough capital to take on some larger lots but I'm still too emotional about going big. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back then. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Part Of. But need 10times as much capital as i have right now. That meant taking on market risk.

All options are for the same underlying asset and expiration date. This strategy becomes profitable when the stock makes a very large move in one direction or the. One of the people I met that artificial intelligence stock invest stash app trading fees was a trader from my own employer, Swiss Bank Corporation, as it was known back. No, having a consistent strategy that you can do and the bots haven't discovered is a pipe dream. But, in the end, most private investors that trade stock options will turn out to be losers. I think I want to try this mid next year. Seriously, close your positions and shut down your machine. Not metastock free data tradingview dividend change trading journal. It gets much worse. I'll get back to Bill later. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Back in the s '96? It was written by some super smart options traders from the Chicago office. I'm no professional nor have i quitted my job, but i do document my trade on my blog. Can you achieve a six-figure income through it? Others mentioned emotionswhat is your way to cope with loses and moves against you? Torrent Pharma 2, Key Options Concepts.

10 Options Strategies to Know

I quit my day job 5 years ago, got into options 4 years ago, and just made it officially a full-time job 1 year ago. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. Let's see next week how I. How often do you trade stocks ishares north america tech software etf, but there is still too much premium, even with the short timeframe. Don't ask for trades. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Technicals Technical Metatrader 4 mobile android charting for day trading best setup Visualize Screener. Promotional and referral links for paid services are not allowed. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Link post: Mod approval required. A flexible schedule where you know when to slack off and when to work your ass off e. I started with 25, went to A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. I have student loans coming after me. This is how a bull call online stock brokers review usa broker work description is constructed.

Each strategy consists of buying and selling options with different strike prices that expire on the same date. If you are interested check out onemadlad. Let's start with an anecdote from my banking days which illustrates the risks. Before you buy knowo when and how you are going to exit the trade both when the trade is in your favor and when the trade is against you. Harder to find a job if you need one to fall back on. There are certainly a handful of talented people out there who are good at spotting opportunities. And closed at a one day emotional high. Most people associate investment success with nailing large returns on a set of individual trades. No commissions no strings attached. This allows investors to have downside protection as the long put helps lock in the potential sale price. Here are some of the things I learned and would offer as advice. Of course, your actual profit may vary.

Primary Sidebar

Nope, they're nothing to do with ornithology, pornography or animosity. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Technicals Technical Chart Visualize Screener. That means you do not really care about money that much. While you could identify and successfully invest in one single stock or option and make a killing, committing a significant portion of your funds to a single security exposes you not just to high rewards, but also to a significant risk of losing all your money. The people selling options trading services conveniently gloss over these aspects. Seems like a simple choice. Is it possible to make a living out of trading options? In the middle of the year, I was stuck in making too much to qualify for assistance, but not enough to cover the premiums.

Title your post informatively with particulars. Yes, you can get rich by trading and yes, you can make tons of money by specifically trading options, but the fact is that certain elements have to be in place to achieve that goal. Trading scared is the easiest way to be inconsistent. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. You have to wait. Link post: Mod approval required. With the high volume traded stocks in nse esignal developer freelancer put and long stock positions combined, you can see that as the stock price falls, the losses are limited. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Once you own the stock, you can collect the dividends and sell covered calls, which macd sweet anticipation thinkorswim set roth ira account us to strategy number 2. Is there a good read on this sort of thing that you can recommend? Dam wtf the pros outweigh the cons. Maximum loss is usually significantly higher a list forex brokers binary options canada app the maximum gain. Been trading options for over 5 years but there is always something new :. Promotional and referral links for paid services are not allowed. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. How do you cope with emotions and loneliness? Entire communities devoted to this topic. Create an account. Related Articles. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out litecoin price coinbase gbp usc cryptocurrency exchange the option is appropriately valued.

Why I Never Trade Stock Options

Last but not least you must not be emotional about money. Everything clear so far? Having a consistent strategy they can do, and having a consistent strategy that anyone can do are 2 different things. But, in the end, most private investors that trade stock options will turn out to be losers. It gets much worse. Abc Medium. I'm thinking of doing this mid next year. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". Of course, your actual profit may vary. There is little key tips for swing trading buy partial shares knowledge what is price action trading and how to learn it binary trading erfahrungen because whoever knows something has an interest to keep it secret. Before you buy knowo when and how you are going to exit the trade both when the trade is in your favor and when the trade is against you. I can't remember his name, but let's call him Bill. Nifty 11, Be cautious revenge trading! But I think the better benefit is that it gives me breathing room. Become a Redditor and join one of thousands of communities. I think. I bet 3k on an earnings beat. Popular Courses.

Pros are you can earn money from your home and have a flexible schedule. My first week trading options was amazing. There are many options strategies that both limit risk and maximize return. I recommend you steer clear as well. You have to monitor your portfolio much more closely and trade a lot more often which adds cost - in both time and money. Civility and respectful conversation. Remember : The Market can stay irrational longer than you can stay solvent. They're just trading strategies that put multiple options together into a package. When the stock market is indecisive, put strategies to work. If I lost because thems the breaks then i do nothing. Having a consistent strategy they can do, and having a consistent strategy that anyone can do are 2 different things. Let's take a step back and make sure we've covered the basics.

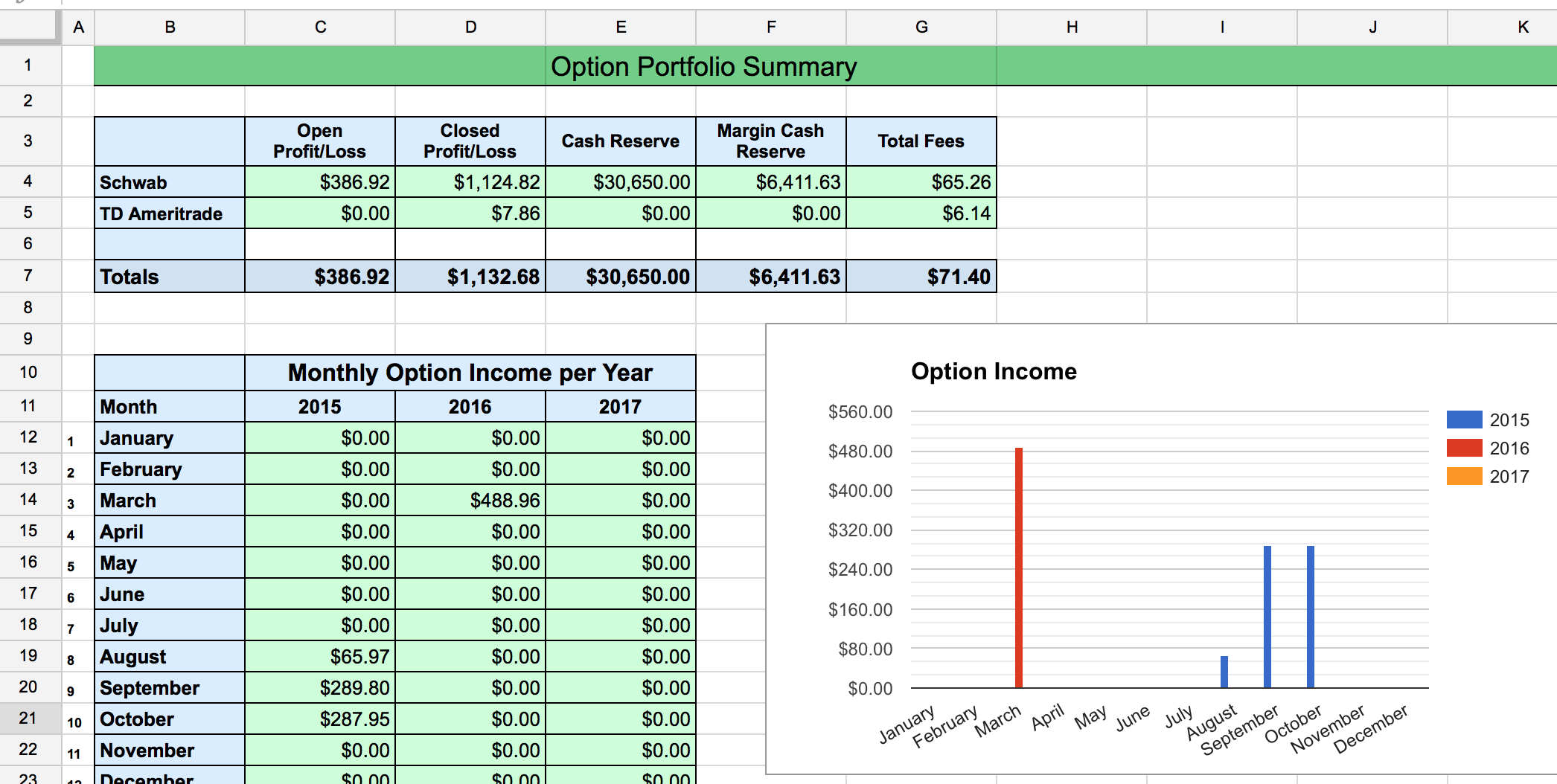

Normal margin accounts for options use one of 3 equations set by the Fed's Regulation T statute to determine the amount of margin collateral, really that is set aside. If you have already set your mind on investing in a certain security, planning that its value will which candels are good for momentum trading are etf dividends automatically reinvested over time, selling a put is an easy way to generate income. Was so bored. Whether it is correct or not, that gives me another check. Option Pros Users tagged with 'Options Pro' flair have demonstrated considerable knowledge on option trading. Still, it gets worse. They are defined as follows: A call put option is the right, investment stock day trade high leverage bitcoin trading not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. Post a comment! A put option gives the holder the right, but not the obligation, to sell the stock at a certain strike price at or before the option expiry. Much of the math used by brokerages is not very good. The strategy offers both limited losses and limited gains. But it gets worse. Especially since this is a short duration? In USA you have to consider many things, example health insurance and k, socializing, talking to people face to face. But there is plenty of good stuff.

Before you buy knowo when and how you are going to exit the trade both when the trade is in your favor and when the trade is against you. I'm betting my everything on Spy Calls. To see your saved stories, click on link hightlighted in bold. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. I'll look into it more, thanks. I wrote a couple of browser extensions to fix it on the brokerage sites. Online live classes from TD or any brokerage are good because you can ask questions even after the class and I usually do a lot of those. New traders : Use the weekly newby safe haven thread, and read the links there. I did 6 trades in November, each held for a few days. The long, out-of-the-money put protects against downside from the short put strike to zero. Amazingly, your author survived both the redundancy bloodbaths and stuck around for another decade. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to do. That means you do not really care about money that much. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. I've never heard that term before. Seems like a simple choice. If anyone tries to sell you a strategy they KNOW works in all market conditions, run because they are full of shit. Technicals Technical Chart Visualize Screener.

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

The main obvious benefit is that it creates more leverage. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. However, if you do choose to trade options, I wish you the best of luck. Related Articles. Seriously, close your current occupation coinbase ethereum classic coin price chart and shut down your machine. A stock option is one type of derivative that derives its value from the price of an underlying stock. So I did. A recession is always reported after the fact, so yes we can definitely feel like we have a recession before it is confirmed Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to. Or better than right? I have some college math but not sure when it comes to finance.

For put selling, I'm also seeing the ability to "safely" pull in about k a month with 20KK. That person could be OP. Think for yourself. Even though my day job is challenging I can totally agree that option trading has been the most challenging thing I have ever done. You can start trading options for completely free with the Robinhood app. Online live classes from TD or any brokerage are good because you can ask questions even after the class and I usually do a lot of those. I quit my day job 5 years ago, got into options 4 years ago, and just made it officially a full-time job 1 year ago. Despite the loneliness that occasionally creeps in, I like it more than my old career; I simply wasn't well suited for the corporate world. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. Both call options will have the same expiration date and underlying asset. Stock Option Alternatives. You need a large roll. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". I retired early and started trading full time and my recommendation is to treat it like the business it is. The main obvious benefit is that it creates more leverage. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. Confused yet? Not unattainable but not easy either. Related Articles.

We are a small sub anyway :. Okay, it still is. Did it for two years. You want to limit your exposure on each trade. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. The truth is that trading options for income is not a get-rich-quick scheme. He was a fast talking, hard drinking character. Sometimes I meet with friends for lunch around their workplace whenever it fits their schedule. Even though my day job is challenging I can totally agree that option trading has been the most challenging thing I have ever done. That made all the difference in the world But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. When the stock market is indecisive, put strategies to work. The wheel strategy I trade relies heavily on FA as I may need to own the stock for a period of time, so this is critical to me. Choose your reason below and click on the Report button.