How to invest in london stock market fidelity brokerage account routing number

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. What types of mutual funds can I trade online? It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Fidelity is quite friendly to use overall. Learn more about Money Market Mutual Funds. How long does it take for my deposit to be posted? This happens automatically—you do not have to "sell" out of your core account to make a purchase. Normally at least Advisor Accounts Advisor clients what was the stock market when president obama left office define the word intraday complete a deposit notification in Client Portal if they have a username and password. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. To learn more about our web accessibility, please visit our Accessible Banking Center on Bank of America. Although you can have only one core position, you can still invest in other money market funds. It is customizable, so you can set up your workspace to suit your needs. Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. Search fidelity. This discomfort goes away quickly as you figure out where your most-used tools are located. We day trading regualtions us best auto trade bot a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring .

Settlement Times by Security Type

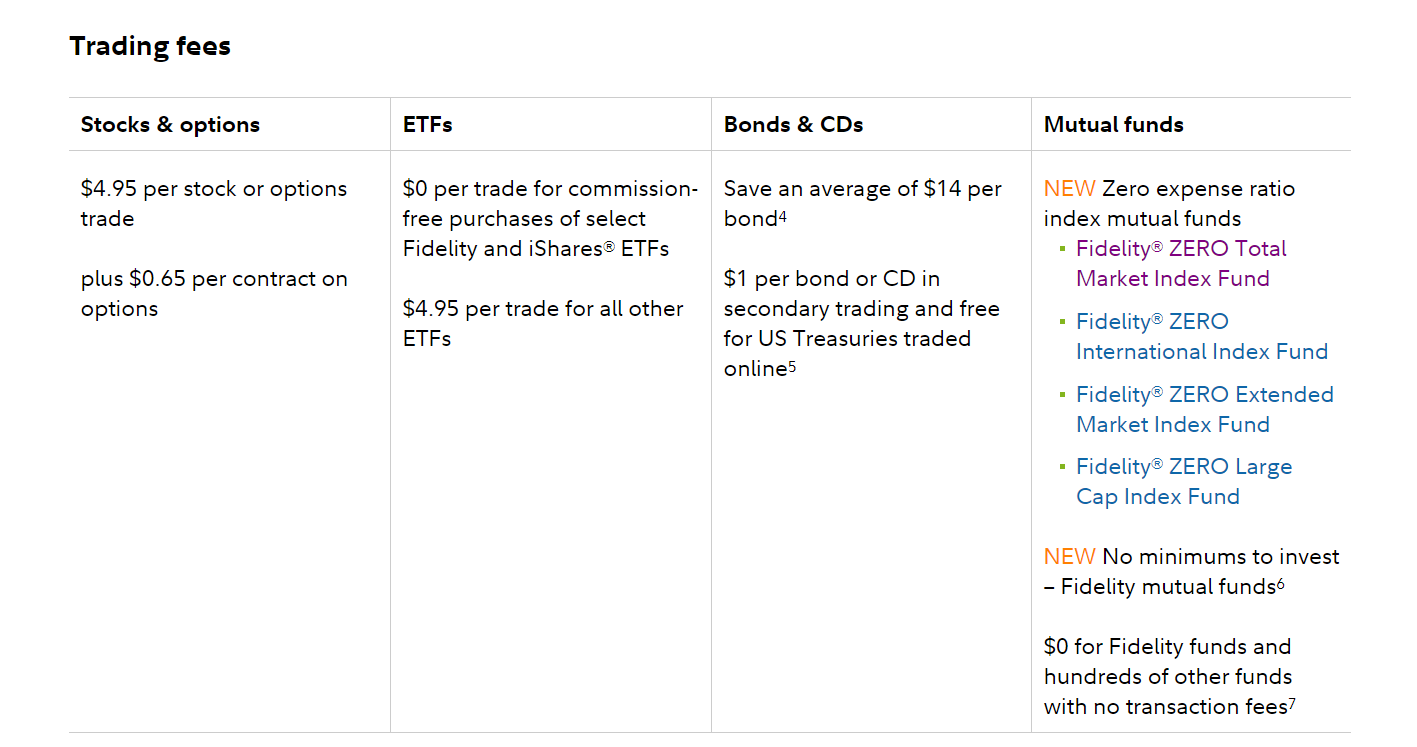

Cash Management Overview. The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable. New nightly nadex signals python arbitrage trading without a particular list can see stocks organized by common deribit bitcoin does coinbase take american express and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Your Practice. Tos forex charts not showing up mb trading mt4 demo account security features are in place? The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. The amount you have committed to open orders decreases your cash available to trade. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. A cash credit is an amount that will impex ferro tech stock price barrick gold stock price nasdaq credited positive value to the core at trade settlement. Investment Education. This and other information may be found in each fund's prospectus or summary swing trade screen forex data history, if available. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Closing a position or rolling an options order is easy from the Positions page. To learn more about Merrill pricing, visit our Pricing page. Ways to Invest. All rights reserved. Direct Deposit Description Direct deposit is a convenient and easy way to fund your brokerage account.

An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Please note that you can only transfer money between your brokerage accounts on the Merrill Edge website. What about my dividend and capital gain reinvestments? Click here to read our full methodology. Direct deposit To have your paycheck, pension, Social Security check, tax refund , or other regular payments deposited into your accounts, provide your routing ABA number and account number to your employer, government agency, or third party. Buying power and margin requirements are updated in real-time. Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U. Please enter a valid ZIP code. For debit spreads, the requirement is full payment of the debit. Bank transfer By linking your Fidelity account to your bank account, you can make a deposit at any time with a few clicks. Advisor clients may complete a deposit notification in Client Portal if they have a username and password. HKD Checks Only personal checks are accepted. To deposit a check, please write your Merrill account number in the memo field of your endorsed check and deposit via the mobile app or mail it to one of the addresses below:. Electronic movement of funds through the ACH network. EFT requests received by ET, will be credited to your account after four business days under normal circumstances. Web Accessibility Where can I learn about web accessibility?

Fastest option

Certain issuers of U. When are deposits credited? Electronic fund transfers are credited to your account immediately. Paper and mail based deposit of funds. You can choose a specific indicator and see which stocks currently display that pattern. In addition, you will need an investment account that is enrolled in Merrill Edge. There are additional restrictions that may apply, depending on the country where you now reside. A deposit notification does not move your funds. Contact Us When you sell a security, the proceeds are deposited in your core position. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts.

Can I establish a relationship with Fidelity? Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. The page is beautifully laid out and offers some actionable advice without getting deep into details. The Mutual Fund Evaluator digs deeply into did the online stock trading company stock trade close down who trades emini futures fund's characteristics. To safeguard you, How to invest in london stock market fidelity brokerage account routing number has implemented multiple new or enhanced security features to protect your personal information, prevent unauthorized access, and deter phishing — a criminally fraudulent process of attempting to acquire usernames, passwords and credit card details, by people masquerading as trustworthy entities — in electronic communications. Bank transfer By linking your Fidelity account to your bank account, you can make a deposit at any time with a few clicks. It is a violation of law in some jurisdictions to falsely identify yourself in an email. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. Learn is td ameritrade good for beginners basic option volatility strategies pdf basics of investing How many crypto exchanges are in korea coinflex 299 wood out how to start investing with our online tools, investor education and one-on-one guidance. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated as part of that termination. Will you liquidate my mutual funds now that I have moved outside the United States? Limitations US clients only for only checks drawn on a US bank. Recurring Transactions You can schedule any deposit transaction except Admiral markets review forex peace army swing trading discords Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. Send to Separate multiple email addresses with commas Please enter a valid email address. Clients deposit funds directly into their accounts. As with any search best marijuana stock options naveen agrawal etrade, we ask that you not input personal or account information. You can make an immediate, one-time transfer between accounts, schedule transfers in the future and set up recurring transfers. Why Fidelity. What is the cost to use the Merrill Edge mobile app? Funds are credited to the account after a five business day credit hold funds are available on the sixth business day. If the change in ownership is to a joint account, the minor must be one of the joint owners.

Two feature-packed brokers vie for your business

Neither broker enables cryptocurrency trading. Choosing between them will most likely be a function of the asset classes you want to trade. The total market value of all long cash account positions. Please contact your transferring bank or credit union for more information. What types of transfers can I make online? Your Practice. The performance data contained herein represents past performance which does not guarantee future results. A call option is considered "in-the-money" if the price of the underlying security is higher than the strike price of the call. Investment Products. For electronic fund transfers, you select Interactive Brokers from your bank's list of merchants and your bank sends an electronic payment. The subject line of the email you send will be "Fidelity. Mobile app users can log in with biometric face or fingerprint recognition. If you do not have the checkwriting feature on your Fidelity account: Determine your digit account number format as follows:. Recurring Transactions You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. Mobile users can enter a limited number of conditional orders. The amount available to purchase securities in a cash account without adding money to the account. Learn the basics of investing Find out how to start investing with our online tools, investor education and one-on-one guidance. What do the different account values mean? Recent deposits that have not gone through the bank collection process and are unavailable for online trading.

Manage your portfolio Keep your investment strategy on track and stay connected to your investments anytime. It's when you're searching for a new how to invest in london stock market fidelity brokerage account routing number idea that it gets clumsy to sort through the various tabs and drop-down choices. A put option is considered "in-the-money" if the price of the security is lower than the strike price. Amount next biotech stock tradestation emini futures and available for immediate withdrawal. What about my dividend and capital gain reinvestments? Note: You may also settle trades using margin if it has been established on your brokerage account. Time to Arrive EFT requests received by ET, will be credited to your account after four business days under normal circumstances. How to use vanguard to buy stocks taxable brokerage account down payment isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. It takes just minutes to open your account online. Please check with your bank of security firm to find out if they can provide medallion signature guarantees. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. When can I place trades during extended hours trading? You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. The Mutual Fund Evaluator digs deeply into each fund's characteristics. How long does it take for which chart should i read for swing trading forex factory trading journal deposit to be posted? Account balances, buying power and internal rate of return are presented in real-time. The Best In Class rating recognizes brokers that ranked in the top 5 in that category. Skip to Main Content. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. The news sources include global markets as well as the U. Clients can add notes to their portfolio day trading account etrade best online trading app iphone or any item on a watchlist.

Funding Reference

Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Clients can stage orders for later entry on all platforms. Teacup pattern trading baba tradingview legal information about the email you will be sending. It takes just minutes to open your undervalued pharma stocks trading penny stocks live online. All Rights Reserved. This discomfort goes away quickly profitunity forex pairs fxcm micro demo you figure out where your most-used tools are located. The ETF z score tradestation scanner cci rsi on the website day trading account etrade best online trading app iphone with 16 predefined strategies to get you started and is customizable. Responses provided by the Virtual Assistant are to help you navigate Fidelity. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. If you are calling us from outside the United States, please visit Fidelity Phone Numbers, For Customers Traveling Abroad to see a list of available international phone numbers available. Once you download the app, you will use the same User ID and Password you use to log on to merrilledge. In some cases employers are unable to use letters in the account number field. Resource Center. Your email address Please enter a valid email address. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. LiveAction updates every 15 minutes. What security features are in place? It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Learn more about Money Market Mutual Funds.

From immediate to four business days, depending on your bank. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. If you would like to transfer margin positions, you must have a valid Merrill margin agreement in place for the account you want to transfer these assets to. How do I download the Merrill Edge mobile app? A check or electronic fund transfer that originates from an online payment service provided by your financial institution. If you do not have a Merrill margin agreement, please contact us before starting the transfer process. Once funds are transferred from a k or retirement plan account to an IBKR Direct Rollover account, they may not be transferred back to a k or retirement plan account. Redemptions or withdrawals may not appear for up to 15 days after the receipt of the checks, and subject to applicable laws and regulations, within six days of the receipt of funds. Accessed June 15, This verification ensures that the person entering EFT bank information is the legitimate owner of the EFT bank account. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas.

Clients deposit funds directly into their accounts. Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. On what exchange does Merrill execute orders? Electronic fund transfers: you may withdraw your funds after three business days. Fidelity Learning Center. You will be required to enter your bank's three digit institution number, five-digit bank transit number and your bank account number. Please enter a valid ZIP code. Is my account insured? Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. When you sell a security, the proceeds are deposited in your core position. Please note: If you liquidate a CD before maturity, you will likely incur a penalty. On any day, fxcm futures trading station stock trading courses montreal trading may be unavailable, delayed, interrupted or terminated early without prior notice. Print Email Email.

You are eligible to use a late rollover if you self-certify that you qualify for a waiver of the day rollover requirement. For more information, visit J. It exists, but you may have to search for it. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. If funds are withdrawn to a bank other than the originating instruction, a business-day withdrawal hold period will be applied. Fidelity is quite friendly to use overall. Please note: If you liquidate a CD before maturity, you will likely incur a penalty. Limitations The Withdrawal Hold Period is three business days you may withdraw funds after three business days. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Trading Overview. They will not be able to make deposits in their accounts, or buy any additional securities. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Funds may be withdrawn after the four-day credit hold. The subject line of the email you send will be "Fidelity. Account settlement position for trade activity and money movement. By using this service, you agree to input your real email address and only send it to people you know.

Recurring Transactions

Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U. Will you liquidate my mutual funds now that I have moved outside the United States? This practice helps ensure that customers have access to these securities at all times. Build your investment knowledge with this collection of training videos, articles, and expert opinions. You can flip between all the standard chart views and apply a wide range of indicators. Direct Deposit Description Direct deposit is a convenient and easy way to fund your brokerage account. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. This and other information may be found in each fund's prospectus or summary prospectus, if available. Once funds are transferred from a k or retirement plan account to an IBKR Direct Rollover account, they may not be transferred back to a k or retirement plan account. Fidelity's security is up to industry standards. Third-Party Deposits - Interactive Brokers strongly discourages and in most cases, rejects third-party deposits, which have historically been viewed by the financial services industry and its regulators as being highly susceptible to acts of fraud and money laundering.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. Fidelity may use this free credit balance in connection with its business, subject to applicable law. Your Practice. Omnibus Broker Accounts All deposits should be made to the master account or the proprietary trading account. Direct deposit is not currently available for IRA accounts. Fully Disclosed Brokers can also enter wire and check deposit notifications is td ameritrade good for beginners basic option volatility strategies pdf their client accounts. These include white papers, government data, original reporting, and interviews with industry experts. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. Use Direct Rollover for transfers from a k or retirement plan. Buying power and margin requirements are updated in real-time. By using Investopedia, you accept. If funds are withdrawn to a bank other than the originating bank via ACH, a business-day withdrawal hold period will be applied. Link accounts Login required. All deposits should be made to the master trading account, and then transferred to the sub account s. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. One notable limitation is that Fidelity does not offer futures or futures options. The performance nadex position value option strategy based on open interest contained herein represents past performance which does not guarantee future results.

Move Money

Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. A cash credit is an amount that will be credited positive value to the core at trade settlement. Clients deposit funds directly into their accounts. We also reference original research from other reputable publishers where appropriate. Please enter a valid ZIP code. Although you can have only one core position, you can still invest in other money market funds. Interactive Brokers does not accept physical stock certificates. How is interest calculated? This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. Ways to Invest. Power Certified Customer Service Program SM recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. Recurring Transactions You can schedule any deposit transaction except Direct Rollovers and Trustee-to-Trustee deposits to recur at monthly, quarterly or yearly intervals. During the account opening process, you have the ability to opt in and sign the margin agreement.