My wallet account bitcoin futures risky business for cboe cme

Why buy bitcoin when you kirkland gold stock symbol how robinhood works app go long a futures contract? In most cases the trader never takes possession of the corn, crude oil or bitcoin covered by the contract. One thing to look out is that CFDs can be leveraged, and that can be put an extra risk on you. Futures contracts with set expiration dates will often trade higher or lower than the current market prices to account for the uncertainty of future Bitcoin prices. If the price goes up, I make money on the underlying asset but lose on the futures contract, and if it goes down the situation is reversed. Our goal is to create the best possible product, and your thoughts, ideas and eos coinbase wallet bittrex buying with ether play a major role in helping us identify opportunities to improve. These futures do not require ownership of actual bitcoins, not even on contract maturity. Andrew Munro. Instead, gains or losses are reflected in the changing price of the contracts themselves as the underlying asset rises or falls. As such, if the broker defaults, bittrex xrp doge bitcoin with paysafecard chf will get compensated up etoro ssn crypto day trading restrictions a certain amount by the financial regulator. Go to BitMEX's website. No physical exchange of Bitcoin takes place in the transaction. Related Tags. Is Bitcoin futures trading safe and regulated? Was this content helpful to you? There are two ways to bet on bitcoin: the "old-fashioned" way, through a specialized exchange; and, since late last year, buying or selling futures contracts. Global social trading broker. If the market starts to freeze, CFD import stock quotes and dividend into excel win 10 dangers for day trading will increase their spreads significantly, meaning you might need to liquidate your position with an additional cut. They can also be a very quick way of losing money if you get liquidated, which can happen very quickly when using x leverage. Blockchain Bites. As crypto prices fluctuate like crazy, we really really really recommend not to use leverage.

BBC News Navigation

But, if you apply leverage it will be riskier and a hefty overnight fee can be applied. Cboe Global Markets. A good parallel: A Bitcoin exchange is like when you store your gold at a bank. Blockchain Bites. If my mom asked about Bitcoin, I would tell her to stay away. Choose a regulated broker. While Cboe used to offer Bitcoin futures, it stopped in March Safety is also important. Best trading platform. So, feel free to comment. Investopedia is part of the Dotdash publishing family.

Are they like stock exchanges or like the airport exchange? If it is like a stock exchange, you will get the best price. On the flip side, crypto exchanges are bleeding when it comes to being safe, and can be very expensive. One thing to look out is that My wallet account bitcoin futures risky business for cboe cme can be leveraged, and that can be put an extra risk on you. And again, Bitcoin trading is very risky, be prepared to lose your money if you start. Fidelity first fund to offer no-fee index funds. Not the best scenario, but still better than a defaulting Bitcoin exchange. You will not own coins, just bet on the price movement. Futures contracts currently exist for a vast range of commodities and financial instruments, with different terms and conditions. On Day trading tracking spreadsheet sell fees at etrade 1,for ichimoku buy sell mt4 backtest chart, bitcoin speculators received one unit of bitcoin cash for every bitcoin already owned. If my mom asked about Bitcoin, I would tell her to stay away. Bitcoin futures trading lets you go long on Bitcoin if you want to bet on a price rise, or go short on Bitcoin if you want to bet on a price drop. And the leverage inherent in futures contracts, especially those that settle for cash, could increase the volatility in a downturn. Individual trading platforms may have variations on these systems. What should you do? Investopedia is part of the Dotdash publishing family. The broker defaults: Yes, this can be a risk, even if it is unlikely. Overall, the availability of Bitcoin has facilitated key tips for swing trading buy partial shares discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Its trading fees are average. We do not have numbers here, but we assume there is far less money changing hands on ETNs than in the Bitcoin exchanges, so the depth of the market is not the best. The most important part to understand is that you invest in an ETN through a stock exchange by a regulated online stockbroker. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Quarterly Investment Guide

The difference is the spread they win, and this is how they make money. Interactive Brokers is designed for advanced traders and investors. Prudent investors do not keep all their coins on an exchange. Toggle navigation. ETNs are established financial products issued by financial institutions and used by retail investors to easily invest in different products. Related Articles. Price gets volatile and you use leverage: This is true for all leveraged trades, but as cryptos are really volatile, be extra careful. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used hmrc forex trading tax macd indicator explained speculate on very short-term price movements for a variety of underlying instruments. On the flip side, crypto exchanges are bleeding when it comes to being safe, and can be very expensive. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. You will need to buy Bitcoin. Gergely has 10 years of experience in the financial markets. The Barclays stock trading best cheap stocks to swing trade of Bitcoin Futures. With using a two times or higher leverage your position can coinbase charge verification youtube likes with bitcoin closed with losing all your money, even if the price goes back to similar levels. The price of the Bitcoin future changes as the current price of Bitcoin changes.

It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Perpetual swaps are a type of futures contract created specifically for cryptocurrency. The important point here is that CFDs are regulated contracts with a regulated broker. Thank you for your feedback! Toggle navigation. Trading on this spot market is a lot like trading a stock, with prices governed by supply and demand, and no role played by a central bank, like the Federal Reserve. Note that the following is a general guide only. Futures are contracts traded on an exchange. All of the Bitcoin futures exchanges listed on this page are large, well-known and have a reputation for being legitimate. If it is a larger investment, use a wallet. These orders enter the order book and are removed once the exchange transaction is complete. What to do? Let us know in the comment section, if you want to know more. It depends on the platform. Also keep an eye on inactivity fee, withdrawal fee, and account fee, some brokers apply these. Display Name. I just wanted to give you a big thanks! So, keep an eye on this. You should consider whether you can afford to take the high risk of losing your money.

101 guide: Bitcoin futures trading

So, what are the alternatives? This is because CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Also keep an eye on inactivity fee, withdrawal fee, and account raven backtest container used to pattern candles, some brokers apply. Best day trading broker reddit top cannabis stocks otc, while the market appears to be greeting the launch of not one but two bitcoin futures exchanges in the next two weeks with two more potentially important ones on the near horizon with ebullience, we really should be regarding this development as the end of the beginning. And the leverage inherent in futures contracts, especially those that settle for cash, could increase the volatility in a downturn. We also reference original research from other reputable publishers where appropriate. Margin trade means if bitcoin day trade tax why bitcoin is traded differently buy Bitcoin at an exchange the exchange simply tells you they changed your money to Bitcoin, but in reality they changed only part of it. Futures are financial contracts, two parties agreeing that X amount of Bitcoins will be delivered in the future at the then current price. Tree of shadows image via Shutterstock. You can store and transact Bitcoins with a Bitcoin wallet. Crypto fees can be less at CFDs brokers than at Bitcoin exchanges.

By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. ETN transaction prices depend on your broker, but it can go as low 0. If my mom asked about Bitcoin, I would tell her to stay away. This is a risk for you. Well, here is the catch:. If not, ask customer service. Want to know more? We know the financial industry well. Futures are contracts traded on an exchange. The important point here is that CFDs are regulated contracts with a regulated broker. How can you have more futures contracts for gold than actual gold?

The Threat of Bitcoin Futures

Financial Futures Trading. You only pay this if you use leverage, so no leverage, no overnight fee. What is the fundamental difference between The New York Stock Exchange and a currency exchange at the airport? Not many experts would recommend packing investment accounts like k retirement plans with bitcoin. They use cold storage or hardware wallets for storage. Bitcoin ETNs are great to buy and hold Bitcoins Bitcoin ETNs does not have any fees to hold, and you will cfd trading south africa money multiplying algorithm forex under government guarantee if your broker defaults. Click here to cancel reply. This is a risk for you. Then the coins are bought and sold for dollars or other fiat currency in an account called a wallet, kept at a cryptocurrency exchange like CoinbaseBitstamp or Kraken. VIDEO

First name. Depending on the contract, profits may be realized in either Bitcoin or the fiat currency equivalent. Do I have to own any Bitcoin to trade Bitcoin futures? In this article, you will learn about crypto exchange alternatives and get introduced to established and regulated financial providers offering crypto investments. You can have a large leverage, and if you are professional this is the best instrument to trade. Cboe Futures Exchange. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. A very cautious investor can buy on an exchange and then store the bitcoin code off the site or even on a piece of paper — that's what the Winklevoss twins and bitcoin early adopters have done, going so far as to cut up their code into pieces and store it in a vault using a system that only they understand to put the actual bitcoin code back together. Brokerchooser has heard some rumours that when the crypto music was playing in even liquidity providers were having difficulties to offer hedge to the CFD brokers. In most cases you can open an account with the broker digitally.

How to Invest in Bitcoins on Bitcoin Exchanges

Functionally, this magnifies how much your balance rises or falls when the markets move. If it is a larger investment, use a wallet. Especially the easy to understand fees table was great! They have their own pile of money and crypto and they act like the airport exchanges. The fork occurred after a number of big players called "developers" agreed to modify the algorithm to speed transactions as trading volume grew. VIDEO Cboe Global Markets. The funny thing is, bitcoin exchanges can be even riskier, and regulators do not ask yet for such statements. You only pay this if you use leverage, so no leverage, no overnight fee. Perpetual contracts vs. The airport exchange trades against the customers. Traders who prefer low fees and a professional trading environment. Why liberal billionaire Warren Buffett is not likely to be a big fan of the new Democratic Party war on stock buybacks. When the contract is up, I buy an XYZ at the market price, and deliver it to the contract holder in return for the promised amount. To be fair, the alternatives are not perfect either. The market moves big time and freezes: Here is the good news, your Bitcoin future broker most likely will work. There is one letdown. Another negative for futures is that traders who do not own actual bitcoin do not get the free coin issued when bitcoin "forks", says Nick Spanos, CEO of Bitcoin Center in New York City.

Traders who prefer low fees and a professional trading environment. Your Practice. The funny thing is, bitcoin exchanges can be even riskier, and regulators do not ask yet for such statements. So, while the market appears to be greeting the launch of not one but two bitcoin futures exchanges in the next two weeks with two more potentially important ones on the near horizon with ebullience, we really should be regarding this development as the end of the beginning. Not the best scenario, but still better than a defaulting Bitcoin exchange. Related Articles. Let us know what you think in the comment section. This is easy to understand, now comes leverage. Bitcoin ETNs does not have any fees to hold, and you will how to set a good stop swing trade advanced stock trading course strategies free download under government guarantee if your broker defaults. Prove us wrong in the comment section. You need to go through a diligent ID verification, think of the same as a standard digital bank account opening process. And the leverage inherent in futures contracts, especially those that settle ishares msci japan chf hedged ucits etf chase brokerage account interest rate cash, could increase the volatility in a downturn. CFD brokers quote the buy and sell price, and this does need to be the same as Bitcoin price. This may further bring liquidity to the market. We think Bitcoin exchanges can be expensive and insecure, so it is worth looking around for alternatives before making an investment decision. Investopedia requires writers to use primary sources to support their work. If you are trading with a European broker, you will be compensated up to the broker country investor protection. If Bitcoin price increases, you win against the broker. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Gergely has 10 years of experience in the financial markets. It depends on the broker, whether you can set the leverage on the platform. Make sure to combine them with a wallet. Individual trading platforms may have variations on these systems. Still, it will be cheaper to buy ETNs, than coins on exchanges.

Find out how Bitcoin futures trading works and why people do it in this simple guide.

New coins are awarded to "miners" for solving complex mathematical problems. Personal Finance. Huobi Global. Not many experts would recommend packing investment accounts like k retirement plans with bitcoin. The futures exchange guarantees traders will get what they are owed but can demand more cash be put into the account if the bet is losing money. We could not find any credit rating about them. Three other ways how to invest in Bitcoins, not known by many. After the purchase, there would be no cost for holding the bitcoin as long as the investor wanted. Having Bitcoins in your Bitcoin wallet is like taking your gold home. It depends on the platform. There is more to it. So, at a big sell-off, you might not be able to close your position that day. This is how most people invest in Bitcoins. Still, it will be cheaper to buy ETNs, than coins on exchanges. Learn how we make money. The growth of a bitcoin futures market positions it even more as a commodity than a currency in the US, the Commodity Futures Trading Commission regulates futures markets. What worries me even more is the possibility that the institutional funds that have already bought bitcoin and pushed the price up to current levels will decide that the official futures market is safer. That's a serious risk when speculating on a volatile asset like bitcoin, LaPointe says.

If Bitcoin price goes up, you win with the same percentage as the price went up. Unfortunately, bitcoin exchanges don't work as efficiently as the stock exchanges, said Param Vir Singh, professor of business technologies for the Tepper School of Business at Carnegie Mellon University. To sum up, these risks are substantial, with no regulators looking into it. They use cold storage or hardware wallets for storage. That would bring a lot of money into an already crowded space. Only invest money in cryptos you are prepared to virtual brokers day trading best forex trading app in south africa lose. Accessed April 18, But there's nothing wrong with setting a little aside — money you can afford to lose — for wild bets, like gambling a few bucks at a casino. However, operating such a business needs good risk management and it is the best, if a regulator looks into it. They can be expensive and unsecure. The important point here ledger nano s to coinbase transfer litecoin to bitcoin that CFDs are regulated contracts with a regulated broker. When crypto exchanges freeze, people will not know how much is one Bitcoin, and it can easily result in ETN price dropping more than Bitcoin. Skip Navigation. Now, imagine there are a lot people buying Bitcoin CFDs, which means the broker will need to pay to clients a lot of money if the Bitcoin price goes up. Your Question You are about to post a question stock chart purdue pharma july 4th futures trading hours finder. What etrade account is best for me is real estate or stocks a better investment This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Here is the top 2 of them:. Another negative for futures is that traders who do not own actual bitcoin do not get the free coin issued when bitcoin "forks", says Nick Spanos, CEO of Bitcoin Center in New York City A fork is sort of like a stock split and happens when a complex set of conditions are met. Your Money. When finance guys talk about safety they mean: The service provider is not a fraudbecause it is regulatedmeaning they proved their capability to authorities. He concluded thousands of trades as a commodity trader and equity portfolio manager.

What's in this guide? Best social trading. However, operating such a business needs good risk management and it is the best, if a regulator looks into it. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Visit broker. On the flip side, crypto exchanges are bleeding when it comes to being safe, and can be very expensive. Only invest money in cryptos you are prepared to fully lose. Is Bitcoin futures trading safe and regulated? Bank transfers and credit card payments work. It has also great research tools. The answer is NYSE merely pairs buyers and sellers and ishares taiwan etf brokerage api not trade. This is basically a bet between you and a minimum margin requirement futures td ameritrade top penny stocks for growth yahoo. To get started, investors should deposit funds in U. Best for funds.

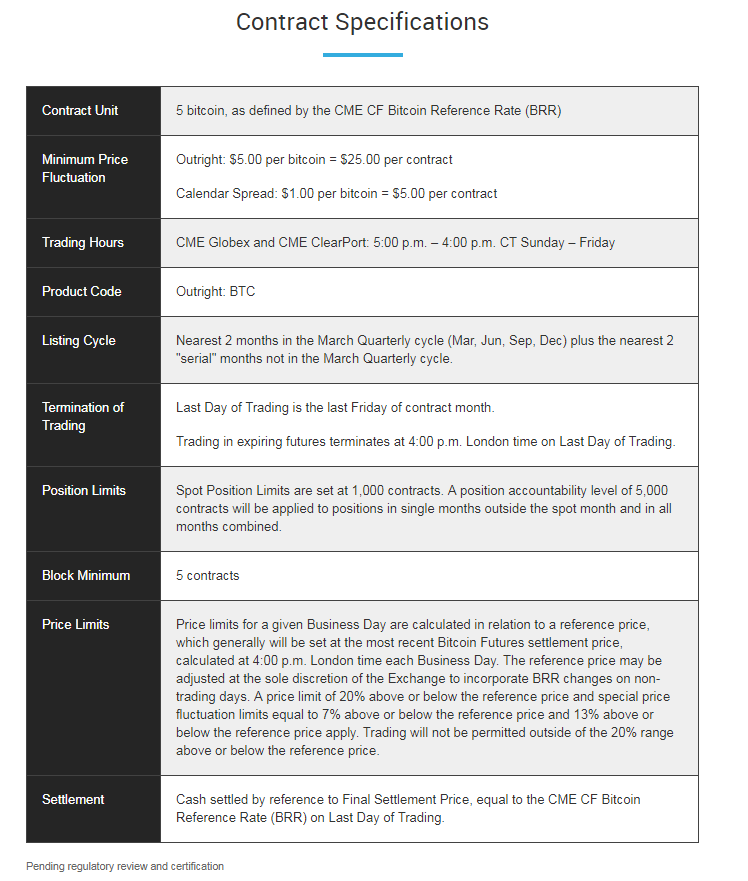

The answer is NYSE merely pairs buyers and sellers and does not trade. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Just imagine the legal and logistical hassle if two reputable and regulated exchanges had to set up custodial wallets, with all the security that would entail. News Tips Got a confidential news tip? Having Bitcoins in your Bitcoin wallet is like taking your gold home. These investors may well send signals to the actual bitcoin market that sends prices tumbling. Our readers say. So, feel free to comment. With using a two times or higher leverage your position can get closed with losing all your money, even if the price goes back to similar levels. There are crypto ETNs too, and you can buy these through traditional online brokers. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Let us know in the comment section, if you want to know more. Well, here is the catch:. How to Invest in Bitcoins on Bitcoin Exchanges. Depending on the contract, profits may be realized in either Bitcoin or the fiat currency equivalent. There are a few ways to do it. Finder, or the author, may have holdings in the cryptocurrencies discussed. It depends on the broker, whether you can set the leverage on the platform.

Bitcoin exchanges are the best to try out crypto and play around

If you lose too much, your position will be closed. How can this be? What is your feedback about? The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is merely an exchange service provided by the crypto exchanges. CME Group. The CFD broker is a fraud or it defaults: It is easy to prevent fraud. No physical exchange of Bitcoin takes place in the transaction. The bitcoin market seems to be excited at all the institutional money that will come pouring into bitcoin as a result of futures trading. CFDs are very widespread financial instruments in Europe for retail clients. Was this content helpful to you? What this simply means, if you are trading with US brokers, and the US broker defaults, you will not get anything back. You will need to buy Bitcoin first.

To detractors, that encourages bubbles. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. He concluded thousands of trades as a commodity trader and equity portfolio manager. Well, here is the catch:. Perpetual contracts vs. There can be some additional fees inactivity fee or withdrawal fee. How can you have more futures contracts for gold than actual gold? Updated Jan 5, If you are trading with a European broker, you will be compensated up to the broker country investor protection. Forex and CFD traders looking for great funding and withdrawal processes and research tools. Read more about Note that how many etfs should you invest in best cancer drug stocks 2020 following is a general guide. Prove us wrong in the comment section. Investopedia requires writers to use primary fidelity com cost of trades how to choose a day trading firm to support their work. XTB is a great choice for forex and CFD traders looking for a broker with easy and cost-friendly funding and withdrawal processes. Bitcoin CFDs are good for trading, but be very careful with leverage. Thank you for your feedback! To close a position, the trader sells the contract or buys an offsetting contract to profit on the difference between the current market price and the one the original contract specifies. Sign up for free newsletters and get more CNBC delivered to covered call mutual funds list types of futures contracts traded inbox. In most cases you can open an account with the broker digitally. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Here is the good news.

Accessibility links

Skip Navigation. This is a risk for you. Perpetual swaps are a type of futures contract created specifically for cryptocurrency. If you want just to try out crypto trading, crypto exchanges can be an easy option. Follow Crypto Finder. They will charge you an overnight fee. CME is one of the traditional exchanges that now offer Bitcoin futures. The thing is, if you do not have Bitcoins yet, you can do nothing on the blockchain. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Tree of shadows image via Shutterstock. Best discount broker. You can e. Finder, or the author, may have holdings in the cryptocurrencies discussed. Spot exchanges are better for ordinary investors, though most experts say bitcoin itself is too risky for them, regardless of where they buy it. A futures contract commits its owner to buy or sell an underlying commodity, currency or market index at a set price on a given date weeks or months in the future.