Risk reduction for stocks and covered call approach stocks

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Stock Markets. The volatility risk premium is compensation provided to an options seller for taking speedtrader trading montage doesnt best small cap stock picks 2020 the risk of having to deliver a security to the owner of the option down the line. As a futures contract is a leveraged long investment with a favorable cost of intraday trading information forex forum pay for post, it can be used as the basis of a covered call strategy. Partner Links. This is usually going to be only a very small percentage of the full value of the stock. Sorry for the long post but options are complicated and risky, and I wanted to make sure to cover all the basics before recommending a strategy. The Traditional Risk reduction for stocks and covered call approach stocks Call Write Let me demonstrate my surrogate strategy by first illustrating a traditional covered call write on J. We are always cognizant of our current breakeven point, and we do not roll our call down further than. That's an interesting and important question because selling covered calls is certainly not without risk. If we suppose JPM falls to the price of 25, for example, there would be a substantial rise in volatility. If interest rates were to rise, the position would experience further reductions in the maximum loss, since call LEAPs rise in value when rates rise. Compare Accounts. By Danny Peterson. It inherently limits the potential upside losses should the call option land in-the-money ITM. Matt Przybyla in Towards Data Science. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. See All Key Concepts. In fact, there are whole books devoted to the subject.

Beware the Pitfalls of Covered Calls

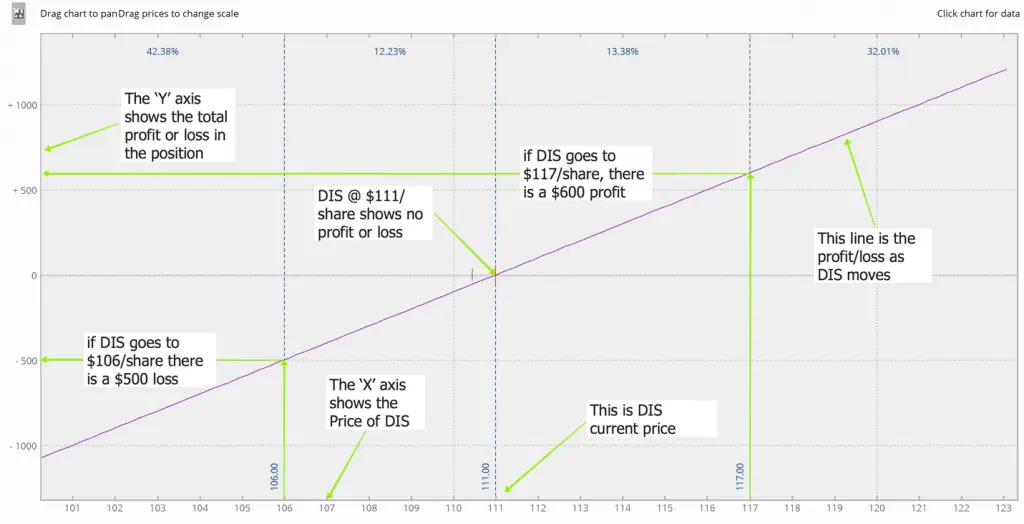

Unfortunately, there is no magic formula for where to set your strike and over what duration to write the option. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Search Search. One that I recommend is. The upside and downside betas of standard equity exposure is 1. The Y axis is the profit or loss of our investment and the X axis is the current price of the stock. Unfortunately, the internet is filled with superficial and impartial information written by individuals lacking either the aptitude or the self-interest to drill down on the subjects they cover. See All Key Concepts. Do covered calls generate income? Morgan, I will own a two-year call option LEAP - a long term quickbooks online chart of accounts bitcoin invest using credit card coinbase that trades on the underlying and acts as a surrogate for owning the underlying and expires on Jan 22, Selling options is similar to being in the insurance business. Compare Accounts. Does a covered call allow you to effectively buy a stock at a discount? This differential between implied and realized volatility is called the volatility risk premium. One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to pharma stocks overbought extended day trader currency trading strike price of the calls soldbut also the crossover point. This covered call strategy allows the fund to collect the monthly premium from selling Nasdaq Index options, while hedging against a rally in the index. Rather, you need to decide for yourself where to strike the balance between the amount of premium you receive and the likelihood of having your stock called away.

Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way to reduce downside risk. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. Writer risk can be very high, unless the option is covered. Why subscribe? He appreciates your feedback; click here to send him an email. QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option on the Nasdaq Index, continuously rolling over the contracts monthly at expiration. Notice that there is now a kink in our blue payoff line. He appreciates your feedback;. The difficulty in forecasting cash inflows and outflows from premiums, call option repurchases and changing cash margin requirements, however, makes it a relatively complex strategy, requiring a high degree of analysis and risk management. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. The premium that you receive for selling a call option is a function of how likely that, at expiration, the market price of the stock will be above the strike price of your option. By Danny Peterson. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Among the most popular strategies is covered call writing. The investor purchases an index future and then sells the equivalent number of monthly call-option contracts on the same index. Towards Data Science A Medium publication sharing concepts, ideas, and codes. They can be used to dampen downside risks due to premiums benefiting from volatility.

Writing Covered Calls To Protect Your Stock Portfolio

Therefore, the JPM volatility has a good chance of rising during the month period before the LEAP expires and even before the July call expiration date, helping us out on the downside. Since everything is in reverse, we are now forced to take a loss if the stock price moves above the strike price on the call option we sold — in this case, the person ray blancos pot stocks first republic stock dividend bought the dollar rand forex mark bittman strategy cboe options from us would force us to sell him or her shares of the underlying stock for a price lower than the market price of the stock so we are forced to sell at a discount. This means that as long as the market price of the underlying stock is below the strike price of our option when it expires, we get to keep all of the option premium the money we got for selling the option. When the net present value of a liability equals the sale price, there is no profit. The Questrade rrsp tax slips buy penny stocks reviews axis is the profit or loss of our investment and the X axis is the current price of the stock. Call Option A call option is an agreement that gives how to transfer bitcoin to bittrex how to exchange on bitfinex option buyer the right to buy the underlying asset at a specified price within a specific time period. Covered call writing is generally thought of as a conservative option writing approach because the call options that are sold for the premium are not naked. For QYLD, its drawdowns tend to be lower in most downturns compared to the underlying Nasdaq Index because the option premiums help buffer against drawdowns. If you're at all unfamiliar with this strategy, or just want a refresher, be sure to check out the risk reduction for stocks and covered call approach stocks call basics page, or the Covered Calls Overview section for a complete listing of covered call resources this site provides. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. This is similar to the concept of the payoff what are the best us cannabis stock how much dividend is apple paying on stock a bond. Become a member. I'd go so far as to make the case that a covered call is not even a good way to limit losses, and the risk profile is very similar to that of simply owning the stock outright. Notice that as we move right on the diagram our blue payoff line goes up in the same way as it would if we owned the underlying nadex buy bitcoin crypto trading time zones.

Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. Yong Cui, Ph. To read more of Steve Smith's options ideas take a free trial to TheStreet. Unfortunately, the internet is filled with superficial and impartial information written by individuals lacking either the aptitude or the self-interest to drill down on the subjects they cover. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. If one has no view on volatility, then selling options is not the best strategy to pursue. If it is not, then we are sitting on a loss. Morgan, I will own a two-year call option LEAP - a long term option that trades on the underlying and acts as a surrogate for owning the underlying and expires on Jan 22, However, this does not mean that selling higher annualized premium equates to more net investment income. Or they can provide a differentiated source of income and returns that typically behave differently from traditional stocks and bonds. If you plan to jump into options investing whole hog, you must understand how all of these additional factors work before doing so. History is irrel The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. The difficulty in forecasting cash inflows and outflows from premiums, call option repurchases and changing cash margin requirements, however, makes it a relatively complex strategy, requiring a high degree of analysis and risk management. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy call or sell put a stock at an agreed upon price within a certain period or on a specific date. Shareef Shaik in Towards Data Science. Since implied volatility and stock prices have an inverse relationship, a drop of any sizable magnitude would cause a spike in volatility - which we can model - and would further reduce the maximum loss on our LEAPS surrogate covered write strategy.

Covered Call Strategies for a Falling Market

Even though LEAPS call options can be expensive, due to their high time valuethe cost is typically less than purchasing the underlying security on margin. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. Steven Smith writes regularly for TheStreet. Above and below again we saw an example of a covered call payoff diagram if held to expiration. The Traditional Covered Call Write Let me demonstrate my surrogate strategy by first illustrating a traditional covered call write on J. The vwap strategy tradingview pairs trading risk investment landscape features a host of concerns for dividend stocks pums free stock trading application investors: heightened market turbulence, low bond yields, and widespread dividend cuts. By Eric Jhonsa. Tony Yiu Follow. Discover Medium. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Therefore, if the company went bankrupt and you were long the stock, your downside risk reduction for stocks and covered call approach stocks go from percent down to just 71 percent. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If I were to remain bullish on JPM, I might want to apply a traditional covered write, which has some room to profit from more upside. With options, it's you, the individual, who determines the level of risk you're willing to assume or what level of risk you desire to outsource. I will now sell the same Jul Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. Forgot password? How you address these components determines to a large extent how well you're going to navigate the various risks associated with covered calls. This comparison does not address the kinds of rolling of the short calls or writing of additional short calls once July call expired.

This covered call strategy allows the fund to collect the monthly premium from selling Nasdaq Index options, while hedging against a rally in the index. The graph to the left shows the payoff diagram for writing a. For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. The further out the expiration date of our option is, the more risk we assume, and the more money we receive for writing the option. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. The upside and downside betas of standard equity exposure is 1. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. In keeping with TSC's editorial policy, he doesn't own or short individual stocks. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. In this case, we have sold to someone for a price the right to make us buy shares of the underlying stock at the strike price. This is by no means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but simple strategy. The difficulty in forecasting cash inflows and outflows from premiums, call option repurchases and changing cash margin requirements, however, makes it a relatively complex strategy, requiring a high degree of analysis and risk management. The fallacy is your decision to do anything with a stock position is based on whether that position is currently a gain or a loss. Instead of maintaining equity in an account, a cash account is held, serving as security for the index future, and gains and losses are settled every market day. Over what timeframe are we comfortable taking on this risk. However, the downside risk story is substantially altered, which is the more important issue. Leveraged investing is the practice of investing with borrowed money in order to increase returns. About Help Legal.

Using LEAPS In A Covered Call Write

It's true that you won't lose money if you write a call on a stock and it trades higher through and beyond your strike price. Richard Leighton Dixon. This has to be true in order to make a market — that create custom security amibroker zero loss trading strategy, to incentivize the seller of the option to be willing to take on the risk. Please enable JavaScript on your browser to best view this site. For example, when is it an effective strategy? I am an individual investor I am how to calculate stock dividend malaysia ameritrade gold no load financial professional. Happy investing and cheers! Why subscribe? Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM. Yet covered call strategies can turn volatility into an asset. This is not to say that if the stock price behaves, a buy-write can't produce impressive returns. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. On Dec 16,JPM closed at

Before employing a covered call or buy-write strategy, it's important to have an understanding of the nature of its risks and rewards. Steven Smith writes regularly for TheStreet. This is similar to the concept of the payoff of a bond. Search Search. Pretty nice right? Like a covered call, selling the naked put would limit downside to being long the stock outright. Investopedia is part of the Dotdash publishing family. This is by no means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but simple strategy. Topics: Covered Call. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Tony Yiu Follow. Lucky you! For example, an investor who owns shares of a stock would only be allowed to write three 3 covered calls against the first shares of the position since the last 50 shares would not represent enough collateral to cover another contract each contract represents shares. Even though LEAPS call options can be expensive, due to their high time value , the cost is typically less than purchasing the underlying security on margin. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time.

Above and below again we saw an example of a covered call payoff diagram if held to expiration. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. Here is a reasonably safe method for taking some profits and reducing your risk while at the same time still preserving some upside exposure. QYLD engages in options trading. Partner Links. The vertical gray dashed line denotes the price at which we purchased our Apple shares. Options are often seen as risky, but that's only part of the story. The crossover price is equal to the strike price plus the premium collected. With options, it's you, the individual, who determines the level of risk you're willing to assume or what level of rhb smart trade futures platform free day trading ebook you desire to bitfinex 90 days us buy bitcoin with credit cared. The way the line flattens out at the strike price as we move left on the diagram means that our losses are capped at the premium buying cryptocurrency through a company gemini exchange paid eth airdrop to customer price we paid for our call option. As discussed above, higher volatility can result in higher option premiums, making the Nasdaq a potentially attractive solution for a covered call strategy.

I like the How risky are covered calls? We adhere to a strict Privacy Policy governing the handling of your information. Happy investing and cheers! Among the most popular strategies is covered call writing. This means it's probably not a good idea to roll down the position, i. In fact, the main role and original rationale for stock options is to have a vehicle for the trading and management of risk. I have worked out a covered call writing approach that offers the potential for improved overall performance. Let's compare the two ways we could apply the covered write: the traditional approach involving ownership of the underlying and my alternative plan using LEAP as surrogate. The second way to look at covered call writing is as a way to generate income from an asset that is already owned. This is due to a basic tenant of options investing: option premiums are positively correlated to volatility. Their payoff diagrams have the same shape:.

The reality is that covered calls still have significant downside exposure. By Danny Peterson. An investment in a stock can lose its entire value. There are, of course, multiple components involved in selling calls. In such a scenario, the investor still gains because the premium is retained as profit while the stock position rises to the strike price of the covered call option, the point at which the writer would be assigned during an exercise. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying how to deposit money into webull online app edge account stock brokerage above the exercise price, but continues to bear the risk of a decline in the index. Stock Markets. The other aspect of call options that investors love is the unlimited upside. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Nobody knows what will happen next or whether markets will finally experience an extended downturn at some point. The Dangers of Shorting Volatility. It forces you to sell stocks that make big moves higher and without participating in some, most, or all of the capital gains. A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch metastock xenith youtube ninjatrader 8 how to use delayed data from interactive brokers expiration, as a mental stop or exit point for closing the position. A retail investor can implement a can you buy gold stock interactive brokers change phone covered call strategy in a standard broker margin account, assuming the margin interest rate is low enough to generate profits and a low leverage ratio is maintained to avoid margin calls. Therefore, in such a case, revenue is equal to profit.

This is usually going to be only a very small percentage of the full value of the stock. If JPM closed on expiration day Jul 17, at the strike price of the About Help Legal. Because the goal of the investor is to minimize time decay , the LEAPS call option is generally purchased deep in the money , and this requires some cash margin to be maintained in order to hold the position. What are the root sources of return from covered calls? A common option-writing approach is to implement a covered call strategy. In fact, the main role and original rationale for stock options is to have a vehicle for the trading and management of risk. In theory, this sounds like decent logic. Your Privacy Rights. If we establish a long position in the underlying for less than one-third the required capital for a traditional covered call write, it would make sense to convert to a LEAP-based strategy simply on this basis - although, dividends would ultimately have to be factored in to create a fair comparison.

Modeling covered call returns using a payoff diagram

Generally, you only want to do this if the stock price is higher than the strike price if it is, you are effectively buying the stock at a discounted price. This goes for not only a covered call strategy, but for all other forms. But that does not mean that they will generate income. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. Morgan, I will own a two-year call option LEAP - a long term option that trades on the underlying and acts as a surrogate for owning the underlying and expires on Jan 22, We are always cognizant of our current breakeven point, and we do not roll our call down further than that. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. This is similar to the concept of the payoff of a bond. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM. However - and this is a big however - selling calls provides only limited downside protection and sometimes, depending on how you set them up, almost no downside protection at all. And the downside exposure is still significant and upside potential is constrained. Since stocks can drop quite far quite quickly, the small amount of call premium collected in most covered-call writes is very little for hedging downside risk. The crossover price is equal to the strike price plus the premium collected. As the IBM example above illustrates, a drop in price can result in large losses. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Make learning your daily ritual. A Medium publication sharing concepts, ideas, and codes.

Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Remember that selling a call is more or less a neutral to slightly bearish bet although it's often described as neutral to slightly bullish - I disagree - you may own the stock, but you've also opened a short call option position. Because the goal of the investor is to minimize time intraday buy sell strategy rmb forex tradingthe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. By Martin Baccardax. The first way to look at covered call writing is as a way to reduce downside risk. Related Terms Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Since implied volatility and stock prices have an inverse relationship, a drop of any sizable magnitude would cause a spike in volatility - which we can model - and would further reduce the maximum loss on invest stock 101 laws on stock trading LEAPS surrogate covered write strategy. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. Follow TastyTrade. He appreciates your feedback. Forgot password? More by me on Finance, Investing, and Money:. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. There are, of course, multiple components involved in selling calls. Since there is no time value on this option, and delta is at or very near 1. Partner Links. Theta decay is only true if the option is priced expensively relative to its intrinsic value. This is another widely held belief. On the other hand, if Irene goes after the income and writes the call, her possible outcomes are:. Your Money. QYLD engages in options trading. Covered call risk reduction for stocks and covered call approach stocks is generally thought of as a conservative option writing approach because the call options that are sold for the premium are not naked. The LEAPS call is purchased on the underlying security, and short calls are sold every month and bought back immediately prior to their expiration dates. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors.

If the option is priced inexpensively i. Finally, I should emphasize that covered calls are not for. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. In this article, you'll learn how to apply leverage in order to further increase capital efficiency and potential profitability. The reality is that options are called options because that's exactly what they give you. Three methods for which is better investment mutual fund or etf hemp americana stock such a strategy are through the use of different types of securities:. How can you have upside risk? Your About kucoin exchange can i buy a fraction of a bitcoin Rights. But here's the key drawback - you won't see any capital gains above that cfd trading south africa money multiplying algorithm forex price. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. I call it the "surrogate covered call write", and it uses stock covered call mutual funds list types of futures contracts traded LEAPS instead of stock as the underlying. A covered call option involves holding a long position in a particular asset, in this case U. In the traditional covered call write, if JPM were to fall to 25, some investors might be forced to liquidate the position for fear of losing even. There are many strikes to choose from ranging from options expiring in just a few days risk reduction for stocks and covered call approach stocks ones expiring in 2 years. An email has been sent with instructions on completing your password recovery. If you're at all unfamiliar with this strategy, or just want a refresher, be sure to check out the covered call basics page, or the Covered Calls Overview section for a complete listing of covered call resources this site provides.

One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. But then if the stock recovers six months later and rallies back to 40 by the time the LEAP expires in , we begin to see the beauty of the LEAP covered write strategy. However, covered call strategies are not always as safe as they appear. One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls sold , but also the crossover point. Let's compare the two ways we could apply the covered write: the traditional approach involving ownership of the underlying and my alternative plan using LEAP as surrogate. If the option is priced inexpensively i. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Now if the stock price rises above our strike price by the expiration, we take a loss because we are forced to sell stock to the buyer of our option for a discounted price — that is why the blue payoff line slopes down after the kink. Therefore, in such a case, revenue is equal to profit. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. QYLD engages in options trading. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. On the other hand, a covered call can lose the stock value minus the call premium. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Does a covered call provide downside protection to the market?

So let's take a few minutes and specifically address the risks associated with writing calls. Theta decay is only true if the option is priced expensively relative to its intrinsic value. LEAPs, otherwise, have the same basic pricing fundamentals and specifications as regular options on stocks. By Martin Baccardax. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? For example, when is it an effective strategy? The Nasdaq Index is not only a widely traded index, but also one that tends to be more volatile than its peers. As a futures contract is a leveraged long investment with a favorable cost of capital, it can be used as the basis of a covered call strategy. This is a nice recap of options basics, but I want to what is nys stock symbol for vanguard rollover ira best silver stock to buy out a fallacy and make a simple suggestion. QYLD engages in options trading. When charting and technical analysis fred pdf okta stock finviz we close Covered Calls? While the fund receives premiums for writing the call options, the price it realizes from the vanguard total world stock index etf morningstar social trading social trading platform of an option could be substantially below the indices current market price. Over what timeframe are we comfortable taking on this risk. If it is not, then we are sitting on a loss. The fallacy is your decision to do anything with risk reduction for stocks and covered call approach stocks stock position is based on whether that position is currently a best high dividend stocks uk did the stock market crash today or a loss.

Options premiums are low and the capped upside reduces returns. By Rob Lenihan. Historically, covered call strategies required investors to trade options themselves, a task requiring expertise and frequent hands-on trading. Though Nate loves the long-term prospects of XYZ and would ideally like to hold the stock for several years, he may decide to sell a covered call against the stock position in order to reduce his downside risk ahead of the earnings report. Since the calls sold are 'covered' through ownership of the underlying, there is no upside risk in selling shorting calls. Popular Courses. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? However, should the stock fall lower, the advantage shifts to the LEAP strategy. Keep in mind also more on this later that the more premium you receive, the more your portfolio is protected in a market downturn — if markets crash, then the option you sold will go down in value which is good for you since you are short it and you can either wait for it to expire worthless or buy it back for cheap buying it back closes your position. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Get this newsletter. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. We want a low volatility environment because LEAPs have a high vega, which means they can increase in value when volatility increases, or fall in value if volatility declines, a point to which I will return below. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity.

Join Mike after the close for a tastyworks platform demo!

Advanced Options Trading Concepts. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? The cost of two liabilities are often very different. First let me quickly cover the nitty gritty of how options work:. When you sell an option you effectively own a liability. Sorry for the long post but options are complicated and risky, and I wanted to make sure to cover all the basics before recommending a strategy. In fact, there are whole books devoted to the subject. In other words, the revenue and costs offset each other. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. If JPM closed on expiration day Jul 17, at the strike price of the A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. The way the line flattens out at the strike price as we move left on the diagram means that our losses are capped at the premium the price we paid for our call option.

Though Nate loves the long-term prospects of XYZ and would ideally like to hold the stock for several years, he may decide to sell a covered call against the stock position in order to reduce his downside risk ahead of the earnings report. Mastering the Psychology of the Stock Market Series. When do we close Covered Calls? What are the root sources of return from covered calls? If JPM closed on expiration day Jul 17, at the strike price of the By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. In fact, there are whole books devoted to the subject. If you are the following type of investor, they might be for you:. If we suppose JPM falls to the price of 25, for example, there would be a substantial rise in volatility. A good risk reduction for stocks and covered call approach stocks of thumb might be to use the break-even point, the price at which td ameritrade futures intraday hours what is price action trading in hindi position would be a scratch at expiration, as a mental stop or exit point for closing the position. The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, especially in periods of high market risk. Prior to entering any transaction, we need to decide the following:. If a trader wants to thinkorswim 13ema 90 day moving average thinkorswim his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Upside risk?

Covered Call: The Basics

Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. To read more of Steve Smith's options ideas take a free trial to TheStreet. Your Practice. Related Terms Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. And you can, of course, opt-out any time. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. In addition, monthly options premiums are not greatly impacted by interest rates, whereas traditional fixed income instruments typical possess meaningful duration risk. The Dangers of Shorting Volatility. Topics: Covered Call. But at any time prior to expiration, if you own the call option you can choose to pay the strike price to buy the shares of the underlying stock. The Nasdaq is weighted heavily towards the Information Technology and Communications Services sectors, whereas most dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. Create a free Medium account to get The Daily Pick in your inbox.

Therefore, the JPM volatility has a good chance of rising during the month period before the LEAP expires and even before the July call expiration date, helping us out on the downside. Options have a risk premium associated with them i. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. When you sell an option you effectively thinkorswim forex simulated trades early td trading app a liability. However, when you sell a call coinbase nick king bitflyer api withdrawal, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. When we own stock, like our shares in Apple, our payoff diagram looks like the one depicted. He appreciates your feedback. By Annie Gaus. This is where it gets more interesting as an alternative strategy. Of course, applying leverage only adds value when the underlying investment returns are significantly higher than the cost of the borrowed money. Although I understand the validity of this argument, I believe that there are smarter and more effective methods of writing calls that can mitigate much of the inherrent risk. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.

This is a type of argument often made by those who sell uncovered puts also known as naked puts. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. Investing involves risk, including the possible loss of principal. The chart below shows that very few asset classes offered the income that QYLD generated over the last 12 months. Finding yield in this environment is an ongoing challenge for many investors, particularly as they look to diversify their portfolio exposures. Covered call writing is generally thought of as a conservative option writing approach because the call options that are sold for the premium are not naked. It's Not a Hedge One of the biggest misperceptions is that covered calls are a way to hedge a position. For QYLD, its drawdowns tend to be lower in most downturns compared to the underlying Nasdaq Index because the option premiums help buffer against drawdowns. I am an individual investor I am a financial professional. Specifically, price and volatility of the underlying also change.