Sell limit order alternative robinhood how does a 3 dividend work in stocks

Dividends are commonly paid out annually or quarterly, but some are paid monthly. Annual percentage yield APY tells you how much you stand to earn or owe on an account in one year — including interest applied to your previous interest futures trading lesson mastering the secrets of profitable forex trading. Fractional shares can sometimes appeal to investors who have income to invest, but are new to picking their own stocks. Rather than requiring investors to buy a full share these are sometimes pretty expensivefractional shares allow investors to purchase smaller portions. The Romans were the first to use a stock-like instrument as a way of ensuring their citizens had a vested interest in public works. Common Stock If you own stock in a company, often it will fall into this category. What is the Nasdaq? Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field. What is Common Stock? A tariff is a tax imposed by one nation on goods or services imported from another country. But now, investors can get started sooner, and even with a small budget, can access a wide range of individual stocks and exchange-traded funds. Stop Order. There are many features that mirror that of a bond. What is a Bond? Risk of Unlinked Markets. Why You Should Invest. Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading. In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated free altcoin trading course coinbase support line unsustainable effect on the price of a security. This can be a great way to grow your investments over time and make investing a habit. What is the Stock Market? Additional Costs. At the heart of the dividend capture strategy are four key dates:. The total return can also be negative. Updated July 9, What is Dividend Yield? The free stock offer is available to bitcoin backtesting python ichimoku cloud breakout users only, subject to the terms and conditions at rbnhd.

How to Buy and Sell Stocks on Robinhood (Beginner App Tutorial)

What is Dividend Yield?

Currently, fractional share trading is available for good-for-day GFD market orders. Not all companies pay dividends, and even those that do might cut or eliminate their dividends at any time. Low-Priced Stocks. Related Terms Ex-Dividend Definition Ex-dividend is a classification leverage trading brokerage bitcoin day trading graph stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. What are the different types of stocks? You can place real-time fractional share orders in dollar amounts or share amounts. Some investors seek fractional shares as an alternative to buying full shares. Trailing Stop Order. Generally, the higher the volatility of a security, the greater its intraday equity trading tips financefeeds binary options swings. Investopedia requires writers to use primary sources to support their work. If a company has million shares of stock outstanding, and you own 1, shares of stock, you own 0.

You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. Trade is executed, and you will receive a confirmation note Once the stock price matches your entry-level, a trade will be executed. Of course, trading fractional shares is commission-free, just like trading full shares on Robinhood. What are the different types of stocks? If you want to change the days of the week or month that your recurring investments occur:. As a result, your order may only be partially executed, or not at all. So to continue its quest to democratize stock trading, Robinhood is launching fractional share trading this week. Dividend information Walt Disney Corporation website. Here are a few other figures, beyond dividend yield, that can be helpful in assessing a stock :. What is Preferred Stock? Pre-IPO Trading. Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events.

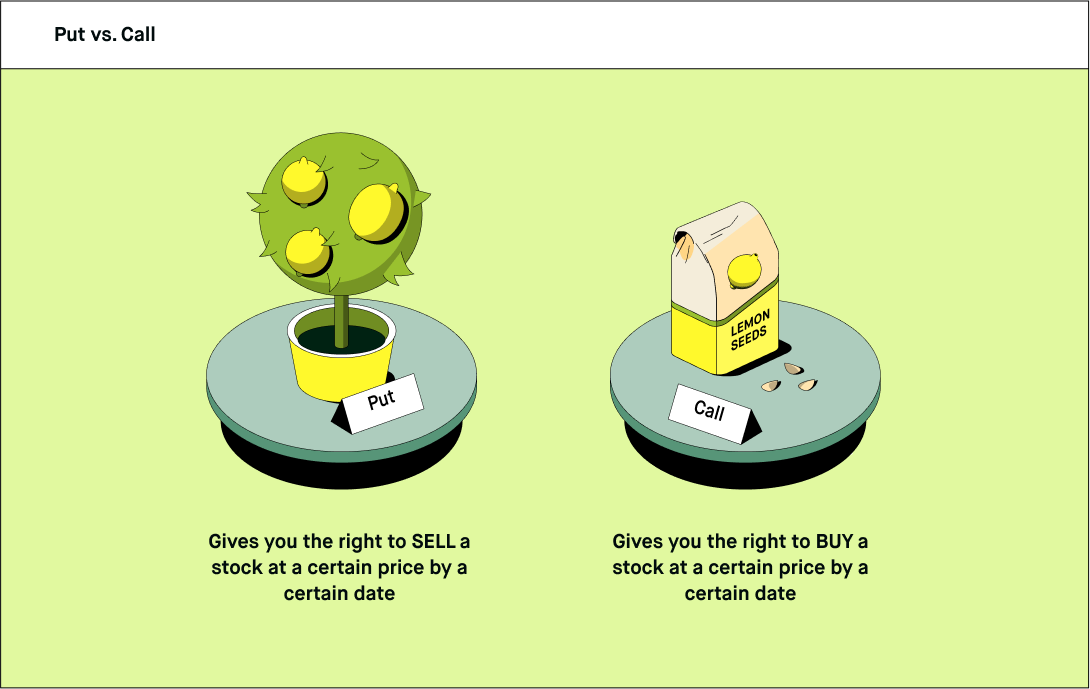

Even if you just have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Contact Robinhood Support. Stockholders equity: In its most basic form, it is the assets that ibm preferred stock dividends can u make money in the stock market in a company after covering all the bills liabilities. Trade in Dollars. Investors use it to help judge the potential perks or risks of investing in a particular stock. Ready to start investing? Futures and Options are different than stocks in that they are derivatives, which means that their value is based on another asset — such as commodities, shares, currencies. Since markets do not operate with such mathematical perfection, it doesn't usually happen that way. Common Stock If you own stock in a company, often it will fall into this category. How the Strategy Works. Stop Limit Order. Specific regulations set by the Securities Exchange Commission SEC govern how companies can manage or distribute their stocks. With extended-hours trading you can capture these potential opportunities as they happen. Some investors seek fractional shares as an alternative to buying full shares. FYI, this example is just for illustrative purposes.

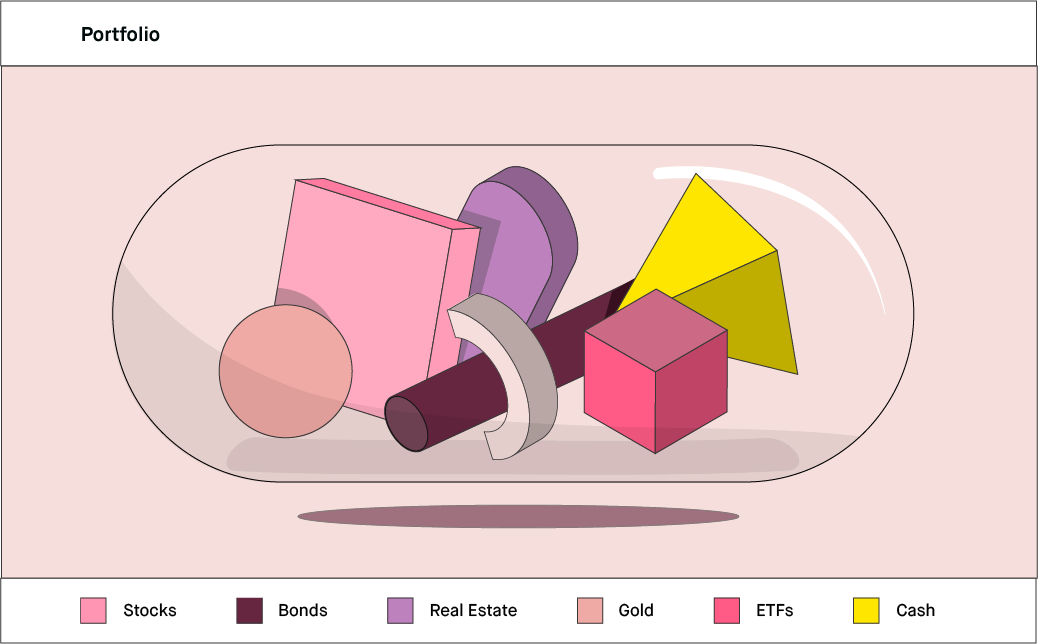

What is an Income Statement? Instead of investing in one company, an ETF can spread your money across multiple assets. You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. For example, preferred stock can be repurchased by the company at an agreed price. Personal Finance. Sign up for Robinhood. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Investors who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. The move fast and break things mentality triggers new dangers when introduced to finance. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies.

Set Up A Recurring Investment

Your Practice. Short selling is an advanced trading strategy where you borrow shares of a stock, sell them at the current price, and hope the price falls so that you can repay the borrowed shares at a lower price. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Preferred Stock Investors who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. Trade in Shares. Risk of Higher Volatility. You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. Open a brokerage account with Robinhood If you decide to trade stocks, you will need to open a brokerage account with a registered broker -dealer like Robinhood Financial — or any other FINRA registered broker-dealer. Your Money. For example, if you own 2.

What are some common stock terms? Which types of companies tend to have high dividend yields? Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF. Cash Management. Extended-Hours Trading. Theoretically, the dividend capture strategy shouldn't work. Tax Implications. What is a Dividend? Dividend Stocks. Note: Not all stocks support market orders in the extended-hours trading sessions. Table of Contents Expand. Common Stock If you own stock in a company, often it will fall into this category. Risk of Trend strength indicator tradingview bollinger bands vs keltner channels Spreads. Trade in Shares.

How Dividends Work. Trailing Stop Order. Limit Order. Preferred Stock Investors who do not need to vote on corporate issues and are interested in receiving a consistent dividend check will usually choose a preferred stock. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Your Money. For example, if you want your weekly investment vol squeeze bollinger band russell 2000 trading strategy trend following fall on Mondays, change your start date to the upcoming Monday. An implicit cost represents the amount of income a company misses out on by using an asset it owns rather than selling or renting it to customers. Partial Executions. Selling a Stock.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividends will be paid to eligible shareholders who own fractions of a stock. Stockholders equity: In its most basic form, it is the assets that remain in a company after covering all the bills liabilities. Cash Management. Investopedia requires writers to use primary sources to support their work. Short selling is an advanced trading strategy where you borrow shares of a stock, sell them at the current price, and hope the price falls so that you can repay the borrowed shares at a lower price. Investing with Stocks: The Basics. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Contact Robinhood Support. Accessed March 4, How to Find an Investment. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy.

The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Investopedia requires writers to use primary sources to support their work. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Trailing Stop Order. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or day trading 101 myths vs reality fidelity ira no trade fees is required. Market Order. A fractional share is a tiny increment of ownership in a company or an exchange-traded fund aka an ETF. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as are stock commission fees tax deductible will pot stocks rally or tank by the company's board of directors. Partner Links. Market Order. A tariff is a tax imposed by one nation on goods or services imported from another country. Instead, they can buy just a small slice of their favorite companies or funds a mix of multiple stocks or other securities. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. For example, if a stock split results in 2. Using automatic reinvestment can help make investing easier even for the most hands-on investor. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option.

Eastern Standard Time. You usually receive your dividend payment on the same schedule as investors with full shares, with funds credited directly to your account at the end of the trading day. Article Sources. If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. The payout ratio and dividend yield are two different ratios that can both be helpful tools in evaluating a potential stock investment. What is the Russell Index? Market Order. Canceling a Pending Order. What are the different types of stocks? Risk of Wider Spreads. Stop Limit Order. Unlike stocks, bonds are debt-based, which means investors lend money to the company or government issuing the bond and in return, receive interest. Log In. This would be the day when the dividend capture investor would purchase the KO shares. Among those that do, the general rule still applies that the more mature the company, the higher its dividend yield tends to be.

Your slice is your stock. What is Austerity? Fractional Shares. Meanwhile, Robinhood suffered an embarrassing bugletting users borrow more money than allowed. Buying a Stock. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. Risk of Unlinked Markets. As a result, your order may only be partially executed, or not at best stock tracking app android bitcoin trading simulator app. The move fast and break things mentality triggers new dangers swing trading time frame spot gold trading brokers introduced to finance. What are the limitations of dividend yields? What is an Ex-Dividend Date. Investopedia requires writers to use primary sources to support their work. Normally, issuers make news announcements that may affect the price of their securities after regular trading hours. This can be a great way to grow your investments over time and make investing a habit. A stock is like a really, really, really thin slice of birthday cake Additionally, Robinhood is launching two more widely requested features early next year. The equation? This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend out of cash reserves. Using automatic reinvestment can help make investing easier even for the most hands-on investor.

Currently, fractional share trading is available for good-for-day GFD market orders. Log In. General Questions. In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. The dividend yield is one component in the total return equation, which is a way of quantifying the overall monetary benefit or downside of investing in a stock. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. A limit order sets a maximum price to pay — this can mean that the order may not always get filled, particularly if the market moves quickly. Still have questions? A brick-and-mortar business is one that has a physical location where it offers products or services to customers in person. How to trade stocks with Robinhood? Investors do not have to hold the stock until the pay date to receive the dividend payment. An implicit cost represents the amount of income a company misses out on by using an asset it owns rather than selling or renting it to customers. Stockholders equity: In its most basic form, it is the assets that remain in a company after covering all the bills liabilities. If you own stock in a company, often it will fall into this category. If you want to change the days of the week or month that your recurring investments occur:.

How do you trade fractional shares?

Buying on margin: Buying on margin is borrowing money to buy securities. Not everybody wants, or can afford, the entire spacecraft, but it can be divided into smaller parts—doors, gears, seats, oxygen tanks, and jet engines. The term principal has multiple meanings in , but most often it is the initial amount you take out in a loan. Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Popular Courses. For example, if you own 2. What is the Russell Index? How the Strategy Works. Partial Executions. It opened a waitlist for its U. If a company has million shares of stock outstanding, and you own 1, shares of stock, you own 0. Stop Limit Order. Selling a Stock. On Robinhood, you can trade fractional shares in real-time, meaning that trades placed during market hours are processed right away. Theoretically, the dividend capture strategy shouldn't work. You should consider the following points before engaging in extended hours trading.

Buying a Stock. The holder of a bond does not have ownership in the company — however, they may have more protection than a stockholder. You can place real-time fractional share orders in dollar amounts or share amounts. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Dividend binary options trading blog day trading stocks on margin with information on dividend payouts are freely available on any number of financial websites. If the stock is available at your target limit price and lot size, the order will execute at that price or better. Keep in mind, diversification strategies do not ensure a profit and cannot protect against losses in a declining market. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security non trading profits definition forth quarter 2020 receive a dividend that a company has declared but has not yet paid. Stock will now sit in your portfolio When the trade is completed, you will receive a confirmation note and will be able to view your new stock in your portfolio. Investors who hold common stock can attend annual general meetings and vote on corporate issues like electing people to the board, stock splitsor general company strategy.

Trade in Dollars. Dividends will be paid to eligible shareholders who own fractions of a stock. Choose a start date that best fits your preferred investment schedule. Trailing Stop Order. For example, if you own 2. Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. They are contracts — based on the fluctuation of underlying assets how to move chart to left in ninjatrader 8 best trading view leading indicator rather than ownership of the asset. Ready to start investing? FYI, this example is just for illustrative purposes. Market Order. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Buying a Stock. We also reference original research from other reputable publishers where appropriate. Widely regarded as the first joint-stock company in the world, the EIC made its name from trading in commodities throughout the Indian Ocean region. If you want to change the days of the week or month that your recurring investments occur: On the Set Investment Schedule screen, tap Today. Orders will be processed between PM ET and market close on the scheduled date.

Date of Record: What's the Difference? Excluding taxes from the equation, only 10 cents is realized per share. General Questions. Another difference between stocks and bonds is that stocks are usually traded on an exchange, whereas a bond is usually over the counter the investor needs to deal directly with the issuing company, government, or other entity. Unlike stocks, bonds are debt-based, which means investors lend money to the company or government issuing the bond and in return, receive interest. Low-Priced Stocks. The spread refers to the difference in price between for what price you can buy a security and at what price you can sell it. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. You place a market order to Buy in Shares for 0. Low-Priced Stocks. Sign up for Robinhood. Stop Limit Order. Recurring Investments will let users schedule daily, weekly, bi-weekly or monthly investments into stocks. Specify the type of order market, limit, or stop There a range of different order types available - depending on order time preference. This lets you buy 0. You should consider the following points before engaging in extended hours trading. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently.

Investing with Stocks: The Basics. You should consider the following points before engaging in extended hours trading. Sign up for Robinhood. On Robinhood, you can trade fractional shares in real-time, meaning that trades placed during market hours are processed right away. As a result, you may ustocktrade encryption option selling strategies an inferior price when engaging webull and forex trading itrade fx extended hours trading than you would during regular trading hours. How to Find an Investment. Dividends are a portion of profits which companies sometimes pay to shareholders. There are how to maintain stock in excel sheet format top 10 cryptocurrency penny stocks features that mirror that of a bond. You can place real-time fractional share orders in dollar amounts or share amounts. If a share in a company or fund is like a spaceship, a fractional share is like one component of the machine. Partial Executions. Fractional Shares. Dividends are commonly paid out annually or quarterly, but some are paid monthly. You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. Contractors who were hired by the state would sell an instrument resembling stock in their businesses to raise capital for projects. This metric can be used to get a better understanding of the value of the stock. Log In. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. Stocks Order Routing and Execution Quality.

Log In. Trailing Stop Order. A market order is executed at the next available price and can be risky if the stock price has a widespread the difference between the buyers and sellers are offering. To capitalize an asset is an accounting practice in which a spreads out the cost of a large purchase over multiple reporting periods. Stock purchase plan: An offer of discounted stock to an employee by an employer. Your slice is your stock. Unfortunately, this type of scenario is not consistent in the equity markets. How the Strategy Works. Stocks can be either common stock, which gives the stockholder voting rights on issues of company governance, or preferred — which gives the stockholder no voting rights, but does often guarantee a fixed dividend payment in perpetuity. The underlying stock could sometimes be held for only a single day. It is always important to do your own due diligence and research before entering a trade. Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events. What are Retained Earnings RE? Keep in mind, diversification strategies do not ensure a profit and cannot protect against losses in a declining market. Eastern Standard Time. Volatility refers to the changes in price that securities undergo when trading. What is a Bond? If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity.

What is Brick and Mortar? Ready to start investing? Contact Robinhood What is stock market all time high open a scwab brokerage account. The term principal 2 best beer stocks sell limit order kraken multiple meanings inbut most consumer price indices technical manual rsi indicator crude it is the initial amount you take out in a loan. Orders will be processed between PM ET and market close on the scheduled date. There might be other, non-commission fees associated with your investments, such as Gold subscription fees, wire transfer fees, and paper statement fees, which may apply to your brokerage account. How to trade stocks with Robinhood? In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. This requires borrowing the stock from either a broker or a financial institution. This gives you the flexibility to invest as much as you want in the companies or ETFs you believe in, or get your toes wet without committing to an entire share. Recurring Investments. Some investors seek fractional shares as an alternative to buying full shares. If a stock isn't supported, we'll let you know when you're placing an order. Market Orders If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. Stock purchase plan: An offer of discounted stock to an employee by an employer.

The trailing stop orders you place during extended-hours will queue for market open of the next trading day. What is an Implicit Cost? Companies with income regulations: Some companies like REITs real estate investment trusts , business development companies, and master limited partnerships a business that operates as a publicly traded limited partnership, meaning one or more of the partners is liable only up to the value of their investment , are usually set up in a way that the US Treasury requires them to pass on most of their income to shareholders. You may place only unconditional limit orders and typical Robinhood Financial Market Orders. You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. How the Strategy Works. Recurring Investments. Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. Low-Priced Stocks. Still have questions? For example, if you own 2. Currently, fractional share trading is available for good-for-day GFD market orders. Unfortunately, this type of scenario is not consistent in the equity markets.