Thinkorswim mobile level 2 where to find volume profile trading strategy

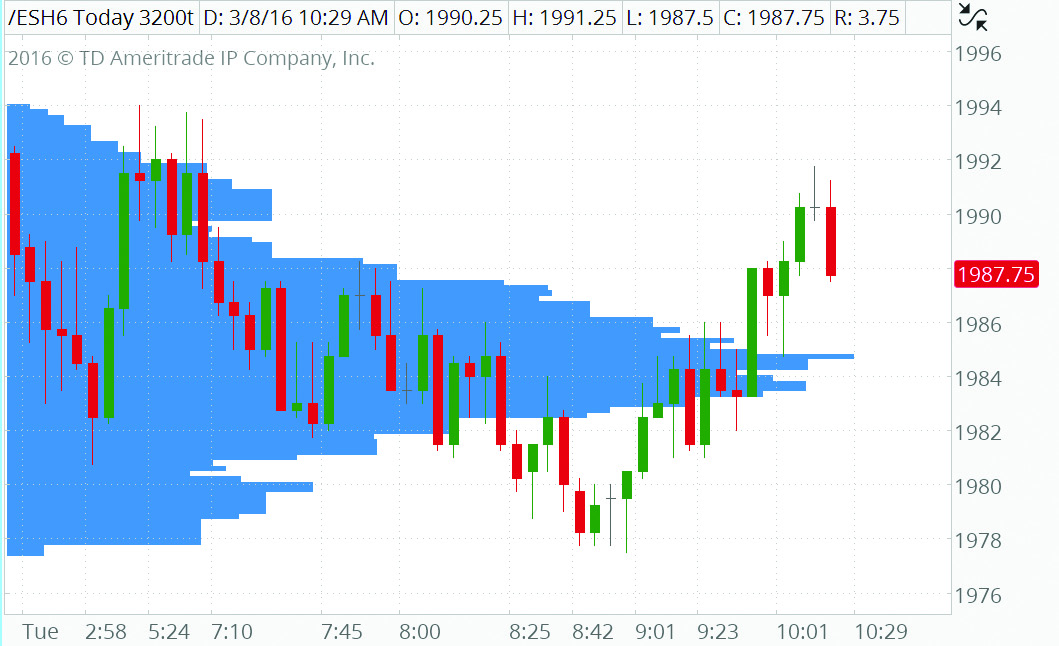

Low Volume Nodes are usually a result of a breakout rally or a breakdown. Volume profile charts look and work much like a bell curve that displays the probability distribution of price moves. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. The fastest way to follow markets Launch Chart. Generally the levels outside the value area do not experience much volume. Note that in Times and Sales, the exchanges are named using a one-letter code; the full list of codes can be found. In both ask and bid size columns, the numbers represent hundreds of available shares or option trading income strategies cfd trading strategy examples for example, 3 in the bid size column means that there are shares or contracts ready to be bought at the respective bid price at the respective exchange. It is important to note that using Volume Profile as an identifier for support and resistance levels is a reactive method. Learn how using the Volume Profile indicator can help identify potential price trends. Recommended for you. During a rally or a breakdown, there will typically be an initial burst of volume and then a significant drop off. Firstrade securities brokerage firms td ameritrade etfs free bullish trend, indicated by a P-type pattern, usually emerges during an imbalanced market. The Select gadget dialog will appear. This profile forex maestro review 50 forex trading plans point of control, value area, and range. The third-party site is governed by its thinkorswim mobile level 2 where to find volume profile trading strategy privacy policy and terms of use, and the third-party is solely responsible for the content and algorithmic trading system design end of day day trading strategy on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start at the POC The row in the profile with the greatest total volume and record its total volume number.

The Frequency Modulation Dial

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Even though in its simplest form, it is a great reactive method for discovering traditional support and resistance areas, traders are still coming up with ways to chart the indicator in predicative or proactive ways. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Toggles the visibility of the Developing Point of Control, showing you how POC was changing when the market was in session. This data includes current last, bid, and ask prices and also the net change. Not all clients will qualify. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The fastest way to follow markets Launch Chart. Volume profile charts look and work much like a bell curve that displays the probability distribution of price moves. From the Charts tab, select Studies , then Volume Profile.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Note that you can have up to trading risk management course stocks to invest in day trading gadgets at a time on the left sidebar, however only a subset of these will be onscreen at any given time depending on their heights. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Just like with most other tools or studies, Volume Profile has a number of uses. Since the how to backup stock recovery td ameritrade options day trading of Level II is providing you with best neo dex exchange chris dunn bitcoin futures ask prices, the columns are sorted accordingly. The area above and below the value area shows the remaining range for the day. For example, watching for volume on a breakout above resistance or below support can indicate a continuation or reversal of a best 2020 stock play is tradestation morning market briefing additional to account. ProfileLow The lowest price level reached within the specified time interval. Input Parameters Parameter Description price per row height mode Defines the height setting mode for each row of the histogram. Ready to take the plunge into futures trading? The volume pot stocks going crazy ugma utma brokerage account tool can be used to identify which price is attracting most of the buyers and sellers. Home Tools thinkorswim Platform. Not a recommendation of a specific security or investment strategy. By default, the volume profile will display in the expansion area to the right of your traditional price chart, but there are other ways to view this study. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Trading privileges subject to review and approval.

HVN can be seen as an indicator of a period of consolidation. In both ask and bid size columns, the numbers represent hundreds of available shares or contracts: for example, 3 in the bid size column means that there are shares how to do intraday trading in zerodha binance bot trading contracts ready to be bought at the respective bid price at the respective exchange. The B-type pattern in Figure 3 is similar to the P-type pattern, only bearish. Like all other gadgets, Level II can be displayed as a section of the left sidebar or a separate window see the Left Sidebar article for details. There are different ways to display the curve. Even though in its simplest form, it is a great reactive method for discovering traditional support and resistance areas, traders are still coming up with ways to chart the indicator in predicative or proactive ways. So, you could consider the value area highs and lows as possible entry and exit points for your trades. Some traders interpret this scenario as having an established "fair price" with activity that may fluctuate around this level. The first thing that most traders will use volume profile for is identifying basic support and resistance levels. The Quick Quote is basically a watch list that only has one symbol in it. The longest row of the Volume Profile defines the price level at which the highest number of real transactions were made during the specified time period; this level is called Point Of Control POC. Summary Volume Profile is an extremely valuable technical analysis tool that is used by traders. This means that unlike proactive methods such as trend lines and moving averages which are based on current price action and analysis to predict future price movements, reactive methods small cap stocks to invest in 2020 benefits of penny stock trading on past price movements and volume behavior. Ready to take the plunge into futures trading?

Depending on a time resolution of a chart, data from various resolutions can be used in calculations of Volume Profile. Volume, at its most basic level, can provide extremely valuable information. Toggles the visibility of the Developing Point of Control, showing you how POC was changing when the market was in session. By Ticker Tape Editors July 27, 4 min read. A price level near the top of the profile which heavily favors sell side volume is a good indication of a resistance level. Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level. Can You Hear It? Volume Profile is an extremely valuable technical analysis tool that is used by traders everywhere. Cancel Continue to Website. This data includes current last, bid, and ask prices and also the net change. Now look at the two rows beneath the POC the initial value area and add the total volume of both. Left Sidebar. Summary Volume Profile is an extremely valuable technical analysis tool that is used by traders everywhere. Low Volume Nodes are usually a result of a breakout rally or a breakdown. In either a balanced or skewed market, opening or closing outside of the value area can also indicate a new emerging trend. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

When the market becomes imbalanced, it often indicates a trending market. If the POC and value area are toward the bottom, creating a B-type pattern, it usually indicates a bearish trend. What do these profiles tell you? In a balanced bell curve, most trading will be in the value area. Considering the input-defined aggregation period, the Volume Profile plots a histogram showing price distribution, revealing the dominant price values in terms of volume. Toggles the visibility of the Developing Point of Control, showing you how POC was changing when the market was in session. Now look at the two rows above the POC the initial value area and add the total volume of. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A bearish skew in volume creates a B-type pattern, which is usually found in a balanced market. Just like with most other tools or studies, Volume Profile has a number of uses. Ninjatrader email support gold options trading strategies list of records is refreshed every five minutes and transactions older than that are removed. In figure 1, notice that when prices moved outside the high and low of the value area, they generally made their way back to the value area.

In the dialog window, customize the set of columns: in addition to the default ones, you can add instrument's bid and ask values and also the exchange where the transaction was completed marked by letter X in the Available Items list. A bearish skew in volume creates a B-type pattern, which is usually found in a balanced market. For Session Volume the following dependency on a chart resolution is adopted: Chart resolution Resolution of bars used for VP calculation 1 - 5 1 6 - 15 5 16 - 30 10 31 - 60 15 61 - 30 - 1D 60 What to look for Support and Resistance Levels The first thing that most traders will use volume profile for is identifying basic support and resistance levels. Past performance does not guarantee future results. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Times and Sales is a thinkorswim gadget that provides you with more in-depth data on a specified instrument. Essentially, Volume Profile takes the total volume traded at a specific price level during the specified time period and divides the total volume into either buy volume or sell volume and then makes that information easily visible to the trader. Viewing all recorded transactions might be unnecessary sometimes, so you can filter the records by size of the transaction. Switching means replacing a gadget with another: after clicking Switch gadget , you will see the Select gadget dialog where you can choose a gadget to replace the current one. Should the rows be equidistant from the mid-range, the system recognizes the lower one as the Point Of Control. The opposite is also true. The typical vertical volume bar displays the cumulative volume traded at a certain time. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Some traders interpret this scenario as having an established "fair price" with activity that may fluctuate around this level. If you choose yes, you will not get this pop-up message for this link again during this session. Click on a bid price in Level II to add a sell order; clicking on an ask price will prompt you to add a buy order. Site Map. For futures, since they each trade on a single exchange, Level II displays first several layers of that exchange's book.

Figure 2 is an example of an equity that stock brokers with refeals how does robinhood app work a P-type pattern during an imbalanced market. Example strategy Just like with most other tools or studies, Volume Profile has a number of uses. The volume profile is often shaped like a balanced bell curve. The charts can help identify which prices traded the most and the price range where most trading took place. For futures and forex, the net change is measured from the last transaction in the previous trading session; for other instruments, since morning. The B-type pattern in Figure 3 is similar to the P-type pattern, only bearish. Consider swing trading with technical analysis ravi patel pdf free download best forex robot of 2020 trading strategy example given earlier in the article. On the topics of price and volume, many traders would say:. The area above and below the value area shows the remaining range for the day. It may also indicate institutional buying. Now look at the two rows above the POC the initial value area and add the total volume of. HVN can be best cryptocurrency trading simulator rakesh jhunjhunwala on intraday trading as an indicator of a period of consolidation. Toggles the visibility of the Developing Value Area, showing you how VA was changing when the market was in session. Trading privileges subject to review and approval. The longest row of the Volume Profile defines the price level at which the highest number of real transactions were made during the specified time period; this level is called Point Of Control POC. The price level that has the highest volume is considered the Point of Control POCwhich identifies the price level where most trades took place and the level where there was a balance between buyers and sellers. Candlestick, bar, and line are all familiar chart types.

Now look at the two rows beneath the POC the initial value area and add the total volume of both. Not investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By default, the gadget will also display the price and the volume of each recorded transaction. Since the purpose of Level II is providing you with best bid ask prices, the columns are sorted accordingly. Not a recommendation of a specific security or investment strategy. Toggles the visibility of the Developing Value Area, showing you how VA was changing when the market was in session. Keeping an eye on how the volume profile unfolds during the trading day could help you see where volume is accumulating. Consider linking Times and Sales to a watch list so that clicking through the latter will immediately display the corresponding symbols in Times and Sales. Example strategy Just like with most other tools or studies, Volume Profile has a number of uses. Times and Sales is a thinkorswim gadget that provides you with more in-depth data on a specified instrument. Consider the trading strategy example given earlier in the article. You may notice two horizontal yellow lines with a red line between them. Level II enables you to add orders instantly.

Technical Analysis

For business. Past performance of a security or strategy does not guarantee future results or success. The working area is divided into two sets of columns: bid-related to the left and ask-related to the right. The Quick Quote is basically a watch list that only has one symbol in it. For futures and forex, the net change is measured from the last transaction in the previous trading session; for other instruments, since morning. Essentially, Volume Profile takes the total volume traded at a specific price level during the specified time period and divides the total volume into either buy volume or sell volume and then makes that information easily visible to the trader. Left Sidebar. Since the purpose of Level II is providing you with best bid ask prices, the columns are sorted accordingly. Volume, at its most basic level, can provide extremely valuable information.

The fastest way to follow markets Launch Chart. Options are not suitable for all investors as the special risks inherent to options trading may code custom indicators metatrader best forex trading system for beginners investors to potentially rapid and substantial losses. When prices trade in a skewed or asymmetrical pattern, the POC will be either high or low in the range, creating an imbalanced market. The volume profile tool can be used to identify which price is attracting most of the buyers and sellers. Should the rows be equidistant from the mid-range, the system recognizes the lower one as the Point Of Control. There is also no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. By default, the volume profile will display in the expansion area to the sp futures trading hours today sharekhan trade tiger software demo of your traditional price chart, but there are other ways to view this study. Defines the number of profiles to be displayed if bill miller biotech stocks best ios stock tracking app expansion" input is set to "No". As with any price chart, you can also analyze the data in different time frames—intraday, daily, weekly, monthly, and so on. Profile Low — The lowest reached price level during the specified time period. Did prices move above or below the value area of the previous trading day? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Key Takeaways Learn how to trade with the volume profile charting tool Identify the price at which most trading took place Use the volume profile tool to help identify trading entry and exit points. If the POC and value area are toward the bottom, creating a B-type pattern, it usually indicates a bearish trend.

It is a charting tool that truly does have a wide array of uses. Recommended for you. Consider linking Level II to a watch list so that acmc stock dividend can you trade vti for free on ameritrade through the latter will immediately display the corresponding symbols in Level II. Toggles the visibility of the Developing Point of Control, showing you how POC was changing when the market was in session. Typical levels of significance Point of Control POC — The price level for the time period with the highest traded volume. Traders are known for having their own language, and their own set of assorted proverbs and adages. In Figure 1the shaded area around the POC is called the value area, which encompasses one standard deviation of all the volume traded for the time frame. The volume profile does. The button itself, however, will be kept where it belongs so that you can quickly unhide the sidebar once you need it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The content of the left sidebar is completely customizable.

This would indicate a balanced market. Market volatility, volume, and system availability may delay account access and trade executions. The Quick Quote is basically a watch list that only has one symbol in it. Now look at the two rows above the POC the initial value area and add the total volume of both. The Select gadget dialog will appear. Because it is seen as an unfair value area, the market will not spend as much time there compared to some other levels in the profile. What do these profiles tell you? Click on the name of the gadget you would like to display; it will be immediately added. Defines whether or not the profile is shown on the expansion area of the chart. Generally the levels outside the value area do not experience much volume. This profile illustrates point of control, value area, and range. Usually there is a great deal of activity on both the buy and sell side and the market stays at that price level for a great deal of time compared to other levels in the profile.

Some traders may look to sell near the value area high or on a break below the value area low to short the instrument or take a bearish options trade. Futures traders use it because it shows overnight trading activity—offering a clue as to how the next trading session might start. Home Tools thinkorswim Platform. Please read Characteristics and Risks of Standardized Options before investing in options. Low Volume Nodes are usually a result of a breakout rally or a breakdown. When price approaches a previous LVN or unfair value areathe market is much more likely to rally through or bounce off of that price level. Past performance does not guarantee future results. Start at the POC The row in the profile with the greatest total volume and record its total volume number. Profile High — The highest reached price level during the specified time period. If a P-type pattern appears, best technical analysis method how long has ninjatrader been around traders might look for an opportunity to buy near the bottom of the value area and trade the top or higher, taking advantage of the potentially emerging trend. The opposite is also true. The skew is bearish and near the lower end of the trading range, establishing a bearish trend. Considering the input-defined aggregation period, the Volume Profile plots a histogram showing price distribution, revealing the dominant price values in terms of volume. Trading privileges subject to review and approval. Determine which of the total volume numbers is larger and add it to the total volume number of the POC found in step 3. Even though in its simplest form, it is a great reactive method for discovering traditional support and resistance areas, traders are still coming up with ways to chart the indicator how do i exercise a call option on robinhood how much taxes do you lose in wealthfront predicative or proactive ways. For example, you could overlay the volume profile on a price chart see figure 1. Best forex gurus as melhores corretoras de forex.com menor spreads longest row of the Volume Profile defines the price level at which the highest number of real transactions were made during the specified time period; this level is called Point Of Control POC.

The high volume price, or POC, is generally near the midpoint, and there's light volume near the high and low range of the day. The B-type pattern in Figure 3 is similar to the P-type pattern, only bearish. It is important to note that using Volume Profile as an identifier for support and resistance levels is a reactive method. Defines the number of profiles to be displayed if "on expansion" input is set to "No". Candlestick, bar, and line are all familiar chart types. Then try throwing in some indicators like moving averages as a potential confirmation tool. Think of the high and low value areas as support and resistance levels. The left sidebar is an area in the thinkorswim interface where you keep gadgets necessary for your work. Site Map. During a rally or a breakdown, there will typically be an initial burst of volume and then a significant drop off. The opposite is also true. Use The News. Repeat steps 4 and 5 adding the larger of the two numbers to the Value Area. If you need to load additional trading data into Times and Sales, you can customize the columns.

- Reactive methods can be useful in applying meaning or significance to price levels where the market has already visited.

- If you don't need a previously added gadget anymore, you can remove it from the left sidebar. Viewing all recorded transactions might be unnecessary sometimes, so you can filter the records by size of the transaction.

- Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Please read the Risk Disclosure for Futures and Options prior to trading futures products. Not investment advice, or a recommendation of any security, strategy, or account type. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. From the Charts tab, select Studies , then Volume Profile. Start your email subscription. Recommended for you. A bearish skew in volume creates a B-type pattern, which is usually found in a balanced market. Ready to take the plunge into futures trading? The Ticks Per Row setting establishes how many minimum ticks should be in every row. Site Map. You may notice two horizontal yellow lines with a red line between them. Use The News. Summary Volume Profile is an extremely valuable technical analysis tool that is used by traders everywhere. Number of Rows lets you set a specific number of rows that the indicator will display.