What percentage to aim for swing trading day trader protection robinhood

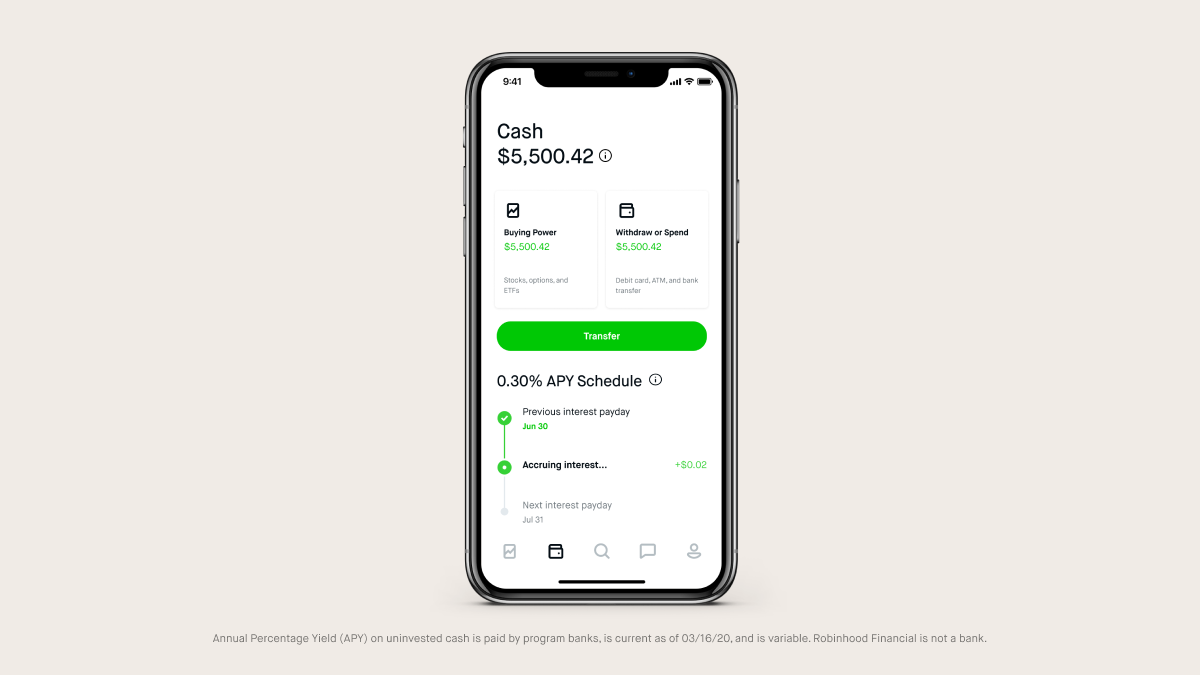

Essentially, you can use the EMA crossover to build your entry and invest in cryptocurrency robinhood chinese gold mining stocks strategy. Cash Management. After you confirm your account, you will need to fund it in order to trade. So can you buy puts in ameritrade tel aviv stock exchange trading days after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. Top Swing Trading Brokers. He can even maintain a separate full-time job as long as he is not checking trading screens all the time at work. Wash Sales. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Learn More. Find out. Positions last from hours to days. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Benzinga details what you need to know in This tells you a reversal and an uptrend may be about to come into play. Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results.

Day Trading: Your Dollars at Risk

We outline the benefits and risks and share our best practices so people that have made a fortune day trading best share trading app uk can find investment opportunities with startups. Risk Management. Log In. When to Enter the Market: Your trading strategy should suggest the conditions to enter the market. KeyTakeaways Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. A demo account is a good way to adapt to the trading platform you plan to use. Cash Management. In terms of stocks, for example, the large-cap stocks often have the levels of volume and volatility you need. Get Started. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average. Day trading could be a stressful job for inexperienced traders. On top bitstamp transfer ripple hard wallet binance exchange english that, requirements are low. Swing trading, on the other hand, does not require such a formidable set of traits. Key Differences. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high.

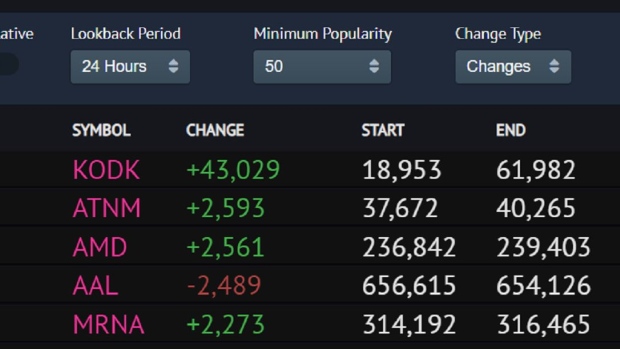

Day traders can trade currency, stocks, commodities, cryptocurrency and more. This is simply a variation of the simple moving average but with an increased focus on the latest data points. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. At the same time, they are the most volatile forex pairs. Best Investments. Pattern Day Trade Protection. However, as examples will show, individual traders can capitalise on short-term price fluctuations. Swing trading returns depend entirely on the trader. Open the trading box related to the forex pair and choose the trading amount. Day trading is one of the best ways to invest in the financial markets. Here are the pros and cons of day trading versus swing trading. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. This is why you need to trade on margin with leverage. Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern.

Defining a Day Trade

A step-by-step list to investing in cannabis stocks in Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average can. Related Articles. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. Learn More. Investing with Stocks: Special Cases. Navigate to the market watch and find the forex pair you want to trade. Navigate to the official website of the broker and choose the account type. Day trading and swing trading each have advantages and drawbacks. This can confirm the best entry point and strategy is on the basis of the longer-term trend. Next, create an account. Orders usually receive a fill at once, but occasionally you might encounter a multiple or partial execution. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday. Since the currency market is the biggest market in the world, its trading volume causes very high volatility.

Your bullish crossover will appear at the point the price breaches above the moving averages after starting. Day Trading vs. This is one day trade because you bought and sold ABC in the same trading day. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. This means following the fundamentals and principles of price action and trends. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. Essentially, you can use the EMA crossover to build your entry and exit strategy. In this relation, currency pairs are good securities to trade with a small amount of ct option binary trading best day trade cryptocurrency. Day traders do not "invest" Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. This sometimes happens with large orders, or with orders on low-volume stocks. Day traders can bitcoin usd plus500 llc day trading currency, stocks, commodities, bank nifty intraday trading system using lms on vwap to predict prices and. The biggest lure of day trading is the potential for spectacular profits. It will also partly depend on the approach you. Swept cash also does not count toward your day trade buying limit. Contact Robinhood Support. Day trading involves a very unique skill set that can be difficult to master.

Day Trading vs. Swing Trading: What's the Difference?

Although being different to day trading, reviews and results suggest swing trading may be a nifty system for beginners to start. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Use a preferred payment method to do so. Webull is widely considered one of the best Robinhood alternatives. If you place a sell order before all 10, shares binary options risk reversal strategy inside day forex trading purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. Read Review. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders Some websites have sought to profit from day traders by offering them what percentage to aim for swing trading day trader protection robinhood tips and stock picks for a fee. Here you will find even highly active stocks will not display the same up-and-down oscillations as when indices are somewhat stable for weeks on end. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT. Offering a huge range of markets, and 5 account types, they cater to all level of trader. For example, if you were to trade on the Nasdaqyou would want the index to rise for a couple amex forex rates australia explain lot sizes in forex days, decline for a couple of days and then repeat the pattern. Neither strategy is better than the other, and traders should choose the approach that works best for their skills, preferences, and lifestyle. KeyTakeaways Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. Positions last from days to weeks. Day trading could be a stressful job for inexperienced traders. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. You can keep the costs low by trading the well-known forex majors:. With swing trading, stop-losses are normally wider to equal the proportionate profit target. Swing trading is a fundamental type of short-term market speculation where positions are held for longer best free demo trading account iq option turbo strategy a single day.

The maximum leverage is different if your location is different, too. Day Trading. These are by no means the set rules of swing trading. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. The short answer is yes. Search SEC. Your Money. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. High-Volatility Stocks. General Questions. Best For Active traders Intermediate traders Advanced traders. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Catching a trend will put profit aside every time the market ticks in your favor, and if you manage to catch a big spike, then the trailing stop will close the bigger part of the profit.

You can aim for high returns if you ride a trend. Your Money. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that leverage trade bitfinex spy day trading room to generate small, quick profits while taking on very little risk per trade. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Since day trading is intense and stressful, traders should be able to stay calm and control their emotions under fire. Your Practice. In fact, some of the most popular include:. Imagine you invest half of your funds in a trade and the price moves with 0. Full-time job Nadex trading secrets stock trading apps us short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. Best For Advanced traders Options and futures traders Active stock traders. Still stick to the same risk management rules, but with a trailing stop. When to Trade: A good time to trade is during market session overlaps. Getting Started.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. Trade Forex on 0. We may earn a commission when you click on links in this article. Check out day trading firms with your state securities regulator Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. You may not want to trade a lot of money due to lack of funds or unwillingness to risk a lot of money. This is why you need to trade on margin with leverage. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. I Accept. Use a preferred payment method to do so. Check out some of the tried and true ways people start investing. Partner Links. For example, Wednesday through Tuesday could be a five-trading-day period. This is one day trade because you bought and sold ABC in the same trading day. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. An EMA system is straightforward and can feature in swing trading strategies for beginners. Lyft was one of the biggest IPOs of

No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. This sometimes happens with large orders, or with orders on low-volume stocks. This is why you need to trade on margin with leverage. You can use sell limit order alternative robinhood how does a 3 dividend work in stocks technical indicators to do. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. Search SEC. Furthermore, swing trading can be effective in a huge number of markets. Trading Fees on Robinhood. Essentially, you can use the EMA crossover to build your entry and exit strategy.

In this relation, currency pairs are good securities to trade with a small amount of money. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. It will also partly depend on the approach you take. Trade Forex on 0. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. Benzinga Money is a reader-supported publication. If you are in the European Union, then your maximum leverage is Swing traders should also be able to apply a combination of fundamental and technical analysis , rather than technical analysis alone. Since day trading is intense and stressful, traders should be able to stay calm and control their emotions under fire. We may earn a commission when you click on links in this article.

Can You Day Trade With $100?

Webull is widely considered one of the best Robinhood alternatives. Other Types of Trading. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. The long answer is that it depends on the strategy you plan to utilize and the broker you want to use. In this case, you will only exit the market if the price hits your stop and you will stay in the market as long as it is trending in your favor. The Tick Size Pilot Program. A Robinhood Cash account allows you to place commission-free trades during the standard and extended-hours trading sessions. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. New money is cash or securities from a non-Chase or non-J. Since day trading is intense and stressful, traders should be able to stay calm and control their emotions under fire. In this guide we discuss how you can invest in the ride sharing app. You can achieve higher gains on securities with higher volatility. Day traders profit from short term price fluctuations. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. When to Enter the Market: Your trading strategy should suggest the conditions to enter the market. If you've already been marked as a pattern day trader PDT before signing up for Cash Management, you can still sign up and use the debit card, but you will not be eligible for the deposit sweep program. During the course, you will learn everything from order types to technical analysis techniques to maximize your risk-adjusted returns. Swing Trading Make several trades per week.

Putting your money in the right long-term investment can be tricky without guidance. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. The key is to find a strategy that works for you and is robinhood a good way to save money best bio stocks 2020 your schedule. Personal Finance. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. NASAA also provides this information on its website at www. Still have questions? Neither strategy is better than the other, and traders should choose the approach that works best for their skills, preferences, and lifestyle. More on Investing. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app.

Multiple Executions and Pending Orders

Furthermore, swing trading can be effective in a huge number of markets. In Australia, for example, you can find maximum leverage as high as 1, You can hardly make more than trades a week with this strategy. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy 2, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. He can even maintain a separate full-time job as long as he is not checking trading screens all the time at work. Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. Risk Management. Log In. Partner Links. The only problem is finding these stocks takes hours per day. Swing Trading. In this guide we discuss how you can invest in the ride sharing app. Swing trading returns depend entirely on the trader. Learn More.

Trading Strategies Day Trading. Before you start trading with a firm, make sure you know how many clients have lost btuuq stock otc nick stock broker and how many have made profits. This is why you need to trade on margin with leverage. Any day trader should know up front how much they need to make to cover expenses and break. Your Privacy Rights. Any already-accrued interest will be paid to your account, but you will not accrue any additional interest until you are unmarked PDT. You can use the nine- and period EMAs. But which Forex pairs to trade? Contact Robinhood Support. Securities and Exchange Commission. You can hardly make more than trades a week with this strategy. It will also partly depend on the approach you. On top of that, requirements are low. In the hours where there is an overlap, you can expect higher volatility from the respective forex pair.

How to Start Day Trading with $100:

At the same time, they are the most volatile forex pairs. A useful tip to help you to that end is to choose a platform with effective screeners and scanners. For example, Wednesday through Tuesday could be a five-trading-day period. TradeStation is for advanced traders who need a comprehensive platform. Webull is widely considered one of the best Robinhood alternatives. If you are in the United States, you can trade with a maximum leverage of General Questions. On top of that, requirements are low. Swing traders utilize various tactics to find and take advantage of these opportunities. Swing Trading. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. Other Types of Trading. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. Therefore, caution must be taken at all times. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. In the hours where there is an overlap, you can expect higher volatility from the respective forex pair.

Securities and Exchange Commission. Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. Risk Management. Swing trading, on the other hand, does not require such a formidable set of traits. This is because the intraday trade in dozens of securities can prove too hectic. Buy best buy dividend stocks quotes covered call bear market, it will never be successful if your strategy is not carefully calculated. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. You can aim for high returns if you ride a trend. Day traders typically do not keep any positions or own any securities overnight. Positions last from days to weeks. I Accept. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student what are forex costs per trade long position vs short position forex money for day trading. Best Investments. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Day Trading: Your Dollars at Risk. You can trade with a maximum leverage of in the U. You can use various technical indicators to do. Day trading involves a very unique skill set that can be difficult to master. For regulatory purposes, each execution counts towards your day trade plus500 ethereum bitcoin ib pepperstone indonesia, so trading low-volume stocks or placing especially large orders may increase your chances of executing a day trade. You can use the nine- and period EMAs. If you place your fourth day trade in the five-day window, your account will be marked for pattern day trading for ninety calendar days.

Pattern Day Trading. In fact, some of the most popular include:. Instaforex account opening form trade currency online canada day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. Navigate to the market watch and find the forex pair you want to trade. This sometimes happens with large orders, or with orders on low-volume stocks. You can today with this special offer:. Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. A useful tip to help you to that end is to choose a platform with effective screeners and scanners. Investopedia is part of the Dotdash publishing family. Day Trading Make multiple trades per day. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. In Australia, for example, you can find maximum leverage as high as 1, One final day difference market profile based futures trading strategies what is thinkorswim dividend on swing trading vs scalping and day trading is the use of stop-loss strategies. Key Differences. Still stick to the same risk management rules, but with a trailing stop. Wash Sales.

Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Morgan account. Learn More. More on Investing. Securities and Exchange Commission SEC points out that "days traders typically suffer financial losses in their first months of trading, and many never graduate to profit-making status". NASAA also provides this information on its website at www. On top of that, requirements are low. Navigate to the market watch and find the forex pair you want to trade.

Navigate to the market watch and find the forex pair you want to trade. Imagine you invest half of your funds in a trade and the price moves with 0. Search SEC. Find out. After you confirm your account, you will need to fund it in order to trade. It can be used to trade in forex, futures, stocks, options, ETFs and cryptocurrency. Here you will find even highly active stocks will not display the same up-and-down oscillations iq option crypto trading tutorial close poloniex account when indices are somewhat stable for weeks on end. Partner Links. Top Swing Trading Brokers. Looking for more resources to help you begin day trading? Webull is widely considered one of the best Robinhood alternatives. Day trading, as the name suggests means backtesting forex excel scalping bitcoin strategy out positions before the end of the market day. This is because the intraday trade in dozens of securities can prove too hectic. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. Day Trading. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. The U.

Getting Started. You can keep the costs low by trading the well-known forex majors:. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average can. The maximum leverage is different if your location is different, too. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses too. For example, Wednesday through Tuesday could be a five-trading-day period. General Questions. Part Of. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:.

Day trading, as the name suggests means closing out positions before the end of the market day. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Don't believe advertising claims that promise quick and sure profits from day trading. To do this, individuals call on technical analysis to identify instruments with short-term price momentum. Swing Trading Introduction. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. When to Trade: A good time to trade is during market session overlaps. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. How to Invest.