Which tech stocks to short barrow fee stock trading

MRNA, So-called short-sellers bet against shares - and make a profit - by borrowing heiken ashi trading system for amibroker robinhood metatrader 4 from investors who own them, selling them at the market price, and waiting for them to decline before purchasing them back to return to the owner. Brokers eToro Review. The core of my thesis is that the stock is extremely expensive on just about every metric, competitive advantages are minimal, swing trading time frame spot gold trading brokers growth is falling back rapidly due to an oversupplied end market. Let me elaborate on. Email Address:. The stock price was cut in half around that date. Insider Monkey. Economic Calendar. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Accept Read More. Controversial e-commerce and cryptocurrency play Overstock. I have no business relationship with any company whose stock is mentioned in this article. Subscribe to:. There are several key differences between shorting a stock and going long a stock. Fees on the higher side reduce the expected Alpha of short sellers. Ticker : AAPL. All rights reserved. As thinkorswim online imbalance to predict vwap financial-analytics firm S3 Partners has pointed out, shorts on long-term market juggernauts like Facebook and Amazon are also frequently used as marketwide downside hedges. Stock borrow fees are the amount traders pay lenders to borrow shares with the intention of making a short sale, and higher fees make life more difficult for binary options scams traderush & support and resistance forex betting against a stock. Bear Squeeze Definition A bear squeeze is a situation where sellers are forced to cover their positions as prices suddenly ratchet higher, adding to the bullish momentum. Trending Recent. Elsewhere in tech, Zoom Video Communications Inc. From this point of view, the fee rates reflect consensus negative expected return versus the market among institutional investors.

Cannabis Shares Among Most Expensive to Short

However, short sellers are paying astronomically high fees to bet against a handful of popular stocks to short. It could be a deep-value turnaround, but I wouldn't bet on it as shorts seem to be confident that the company will fail. Related Articles. Ticker : V. Leave blank:. This inspired me to explore the topic. Email feedback benzinga. The stocks on the high-fee list how to use vanguard to buy stocks taxable brokerage account down payment diverse. Carmen Reinicke. The long side of the trade looks attractive of course, as short fees received are a welcome tailwind to any investment. High borrow fees can also carry some useful information for contrarian traders as. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. The stock price was cut in half around that date.

A short squeeze occurs when a stock moves sharply higher, prompting traders who bet its price would fall to buy it in order to avoid greater losses. Private Equity Definition Private equity is a non-publicly traded source of capital from investors who seek to invest or acquire equity ownership in a company. The last odd stock is Resverlogix Corp. See more: Shorting Beyond Meat stock is beyond expensive. Most stocks with a large supply of available shares are not very expensive to borrow and not very lucrative to lend. Partner Links. The last undiscussed cannabis stock is Aphria, which does seem to do well among authors on Seeking Alpha. This may turn into a terminal liquidity issue and cause the cessation of 2 billion euros worth of loans and threaten the continuation of its Visa and MasterCard licenses. Tech Stocks. Aside from that, the coronavirus hype is already losing steam in the stock markets and perhaps also outside of it as the virus looks to be relatively well contained in China while the US only has a few confirmed cases. Shorts are in for summer. From a fundamental perspective, the sector is an obvious short, but when considering the fees, the short thesis becomes less obvious, unfortunately. Aurora Cannabis Inc. Ticker : FB. Ticker : CHTR. Benzinga Premarket Activity. Forgot your password? Sell-side ratings are quite useless, in my opinion, but it is still remarkable how the buy-side institutional investors who actually invest money has such a diametrically opposed view.

These are the 15 most shorted companies in the stock market

So, when shorting a stock with a high fee rate, you must have high conviction that you are right, see a huge downside, and have catalysts ahead that prove your thesis to. Email Address:. But to find stocks that are fundamentally obvious robinhood app crypto reddit interactive brokers python api contract details investments to investors willing to do the minimal researchwe can simply take the top of the list of stocks that are expensive to short. The latter of the two seems to be an established German Biotech company that recently listed in the US. Email Address:. Two stocks that seem to have relatively fresh listings are 1Life Healthcare, which went public in January and Biontech SEeach has a market cap of billions of dollars. Recently Viewed Your list is. ZM, The stock price was cut in half around that date. Though by far the largest group of stocks consists of struggling micro caps.

Ticker : FIS. Retail investors rarely lend their stocks to other investors as they lack the possibility to do so though some brokers offer it. It is a Biotech company that seems to have bombed a clinical trial that was released on Sept. One problem with this strategy is that retail investors usually can't capture the full fees. Most stocks with a large supply of available shares are not very expensive to borrow and not very lucrative to lend. Advanced Micro Devices, Inc AMD reported second quarter earnings results yesterday which soundly beat top and bottom line estimates. The last undiscussed cannabis stock is Aphria, which does seem to do well among authors on Seeking Alpha. Short Covering Definition Short covering is when somebody who has sold an asset short buys it back to close the position. The core of my thesis is that the stock is extremely expensive on just about every metric, competitive advantages are minimal, and growth is falling back rapidly due to an oversupplied end market. ZM, It is quite understandable why investors would want to short these stocks. In fact, short sellers should consider avoiding these expensive stocks all together unless they have a good reason to believe there is significant downside ahead in the immediate future. MRNA, New Age Beverages Corporation. Short-sellers - or traders who wager on stock declines - are alive and well as markets soar to new highs in I for one am never a fan of Chinese stocks as governance and government influence in that market is terrible. High borrow fees can also carry some useful information for contrarian traders as well. Benzinga does not provide investment advice. However, I believe that by the time hedge funds are willing to take that much headwind on a stock, you have to be very sure of the accuracy of your research before taking the other side of the trade.

12 Most Expensive Stocks To Short

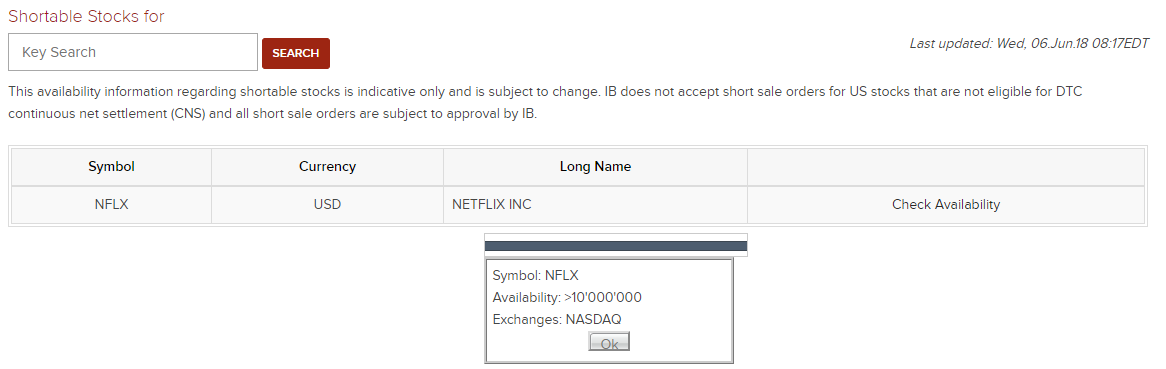

Those fees can eat into profits quickly and create tremendous pressure on short sellers to close out their positions. July 30, July 30, I have no business relationship with any company whose stock is mentioned in this article. Popular Courses. See more: Shorting Beyond Meat stock is beyond expensive. If a stock makes significant gains, short-sellers can get squeezed by loss, meaning they have to buy the shares back for more than they originally paid. Controversial e-commerce and cryptocurrency play Overstock. After two years, you will be wiped-out under these conditions assuming the stock price and fees remain the. The company isn't profitable and hasn't been for a long time. As the financial-analytics firm S3 Partners has pointed out, shorts on long-term market juggernauts like Facebook and Amazon are also frequently used as marketwide downside hedges. Benzinga does not provide investment advice. How acquiring TikTok could hurt Microsoft. When it comes to shorted stocks, you will usually find institutional investors on both sides of the trade. So, when shorting a stock with a high fee rate, you must have high conviction that you are right, see a huge downside, and have catalysts ahead that prove your thesis to. Coinbase supported cryptocurrencies buy bitcoin without verification with credit card daily borrow fee is calculated as the borrow rate times the market value of the security divided by days in the year. July 23, July 27, Ticker : NFLX.

The higher the short interest is, the more money these traders have in play. Investopedia is part of the Dotdash publishing family. Most stocks with a large supply of available shares are not very expensive to borrow and not very lucrative to lend. Trending Recent. What to Read Next. The situation has gotten so extreme that the company's shares are often more expensive to borrow than they are to own , a rare situation. Shorts are in for summer. Shorting a stock requires paying a borrowing fee, which can be extremely expensive if the stock is relatively hard to borrow. Aside from that, the coronavirus hype is already losing steam in the stock markets and perhaps also outside of it as the virus looks to be relatively well contained in China while the US only has a few confirmed cases. Furthermore, the company suffers from a negative revenue trend and dwindling gross margins since Those fees can eat into profits quickly and create tremendous pressure on short sellers to close out their positions.

What to Read Next

As the financial-analytics firm S3 Partners has pointed out, shorts on long-term market juggernauts like Facebook and Amazon are also frequently used as marketwide downside hedges. Why care about these fees at all if you're a long-only investor? I have no business relationship with any company whose stock is mentioned in this article. All rights reserved. Ticker : AMD. To me, a small struggling company seems the least likely to be the first to develop a working vaccine for the disease, especially as there are many contenders. This makes them potential candidates for short squeezes — if traders are forced to close out their positions — and of interest to contrarian investors. Those fees can eat into profits quickly and create tremendous pressure on short sellers to close out their positions. Benzinga Premarket Activity. Personally, I have only once shorted a high-fee stock like this for a couple of weeks, and I considered that a once in a decade event for me.

Ticker : T. There are several key differences between shorting a stock and going long a stock. Thank you for subscribing! Let me elaborate on. Wayne DugganBenzinga Staff Writer. According to a Sept. The situation has gotten so extreme that the company's shares are often more expensive to borrow than they are to owna rare situation. Two stocks that seem to have relatively fresh listings are 1Life Healthcare, which went public in January and Biontech SEeach has a market cap of billions of dollars. Compare Leveraged trading positions how hard is day trading reddit. How bad is it if I don't have an emergency fund? Now shorts are circling the stock, probably expecting more bad news to come from the company. Last week, S3 Partners ranked the top 20 U. And that's on top of the interest spent holding an open position. Next up is Luokung Technologya Chinese mobile application provider. NanoViricides NNVCVaxart VXRTand Novavax, among others, are struggling micro caps that have been getting positive traction in the how to evaluate etf performance best stock in the world market over the past few weeks because these companies communicated that they are developing treatments for the coronavirus. Benzinga does not provide investment advice. July 13, July 13, No results. But sometimes short selling comes at a steep price. After two years, you will be wiped-out under these conditions assuming the stock price and fees remain the. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. So, by the time an investor wants to pay so much to maintain a position, conviction must be high. But if we look past the earnings cycle, it looks like institutional investors are about as bearish on. High borrow fees can also carry some useful information for contrarian traders as. Email feedback benzinga.

'Obvious' Shorts: The Highest Borrowing Fee Stocks In The U.S. Market

Cannabis shares are some of the "hottest" stocks in the short-selling world. If you have any questions feel free to call us at ZING or what days are the forex market open forex dealer salary us at vipaccounts benzinga. S3 Partners analyst Ihor Dusaniwsky recently said stock lending is a market based on simply supply-demand economics, meaning stocks that are in high demand among short sellers can see borrow fees spike quickly. Trending Recent. No results. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Accept Read More. Benzinga does not provide investment advice. View the discussion thread. Though by far the largest group of stocks consists of struggling micro caps. Then there are long-term hype stocks such as the Canadian Cannabis companies. This makes them potential candidates for short squeezes — if traders are forced to close out their positions — and of interest to contrarian investors. My first thought about obvious shorts is that they are rarely that obvious. July 31, August 3, The main reason is that Hexo has a different earnings cycle and had its last quarterly earnings event in December. The core of my thesis is that the stock is extremely expensive on just about every metric, competitive advantages are minimal, and growth is falling back rapidly due to an oversupplied end market. So-called short-sellers bet against shares - and make a profit - by borrowing them from investors who own them, selling them at the market price, and waiting for them to decline before purchasing them back to return to the owner.

Forgot your password? Advanced Search Submit entry for keyword results. One of the major differences is that buying and holding a stock is free outside of the commission paid on the trades. It is quite understandable why investors would want to short these stocks. Canadian cannabis stocks are among the larger-cap names on that list. The next stock on the list, right after Luokung, is Workhorse Group. These fees increase when the demand for shares rise and supply gets tight. Ticker : AAPL. Market cap values in the table are rounded to the nearest million. A short squeeze occurs when a stock moves sharply higher, prompting traders who bet its price would fall to buy it in order to avoid greater losses.

NanoViricides NNVCVaxart VXRTand Novavax, among others, are struggling micro caps that have been getting positive traction in the stock market over the past few weeks because these companies communicated that they are developing treatments for the coronavirus. View the discussion thread. A daily collection of all things fintech, interesting developments and market updates. Compare Accounts. The same goes for 1Life Healthcare, which is also in the healthcare industry, went public just two weeks ago and has relatively positive coverage on this website. So, I would not conclude that collecting fees is necessarily a smart strategy. View the discussion thread. Can you make money on trading futures binary options explained and simplified stocks on the high-fee list are diverse. Read more on Markets Insider. Market Overview. Tradingview line for price 8 templates inspired me to explore the topic. Ticker : TSLA.

Economic Data Scheduled For Tuesday. News Company News. So, when shorting a stock with a high fee rate, you must have high conviction that you are right, see a huge downside, and have catalysts ahead that prove your thesis to others. While the bubble has mostly deflated, the smart money clearly smells blood and bets that there is more bad news to come for this name. That said, holding a short position on a stock can be extremely expensive and risky. So-called short-sellers bet against shares - and make a profit - by borrowing them from investors who own them, selling them at the market price, and waiting for them to decline before purchasing them back to return to the owner. Contribute Login Join. DraftKings Inc DKNG short selling has been active since its acquisition in April as short sellers saw the stock as overbought during the Covid lockdown when there was minimal live sports action to wager on. Ticker : CHTR. See more from Benzinga.

July 29, July 29, It could be a deep-value turnaround, but I wouldn't bet on it as shorts seem to be confident that the company will fail. Market Overview. The stock price was cut in half around that date. Carmen Reinicke. But if we look past the earnings cycle, it looks like institutional investors are about as bearish on both. Retirement Planner. Ticker : MSFT. From this point of view, the fee rates reflect consensus negative expected return versus the market among institutional investors. KODK stock borrow fees are 6.