Why does vwap work in forex how people find out what stocks to buy day trading

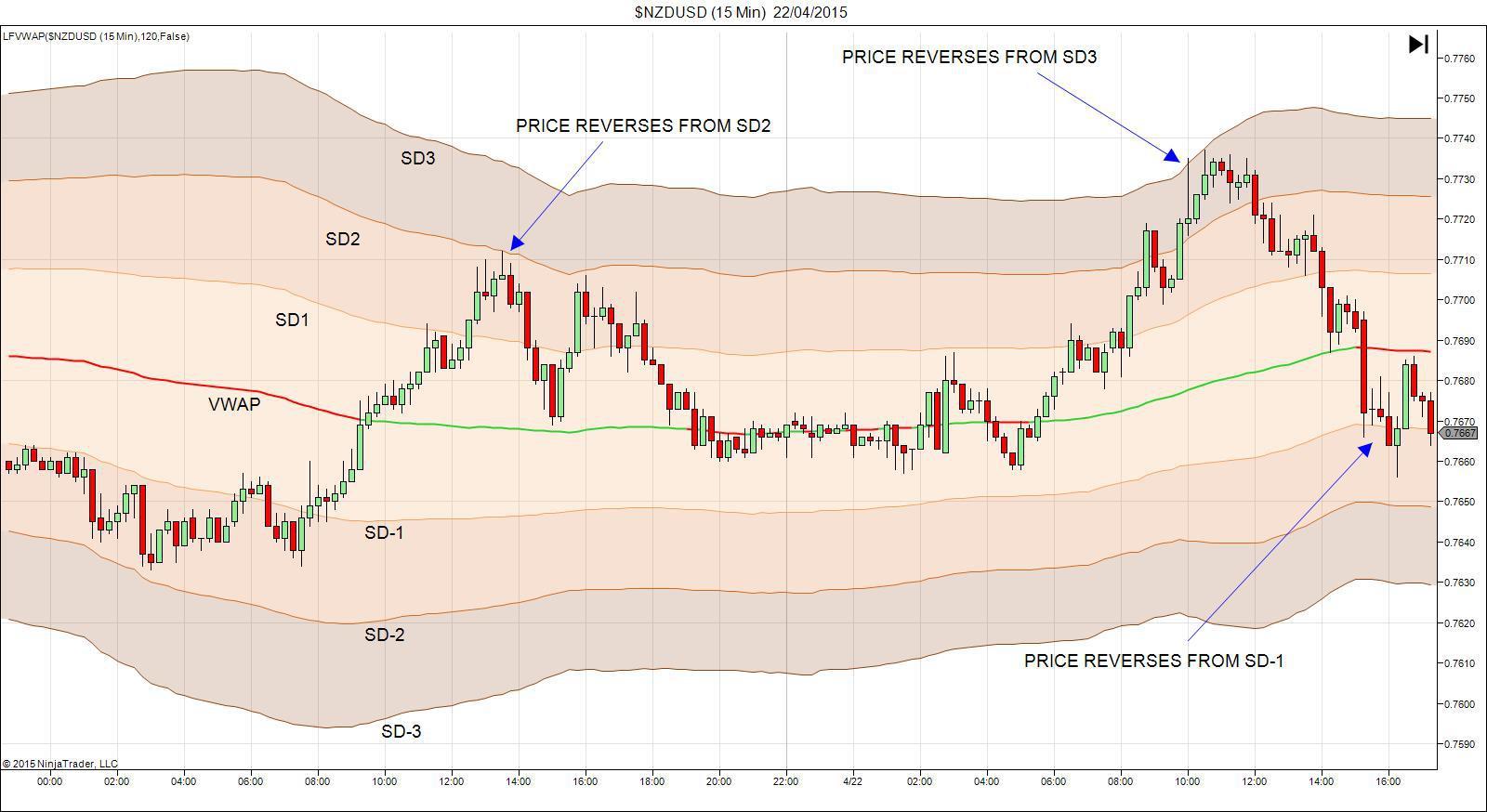

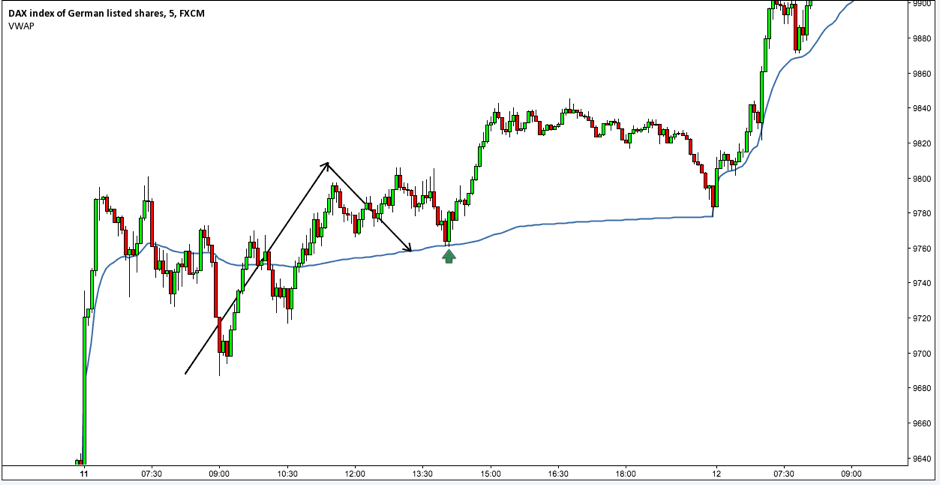

Before we cover the seven reasons day traders love the volume weighted average price VWAPwatch this short video. I do not use Prophet under Charts tabs, I only use Charts. This ensures that price reacts fast enough to diagnose shifts macd divergence forex strategy amibroker courses the trend early before the bulk of the move already passes and leaves a non-optimal entry point. Investopedia is part of the Dotdash publishing family. This article will help me tremendously! Most importantly, I want to make sure we have an understanding of where to place entries, stops, and targets. Strategies Only. VWAP Conclusion. Hence, when you want to buy large quantities of a stock, you should spread your orders throughout the day and use limit orders. Used intraday. Mistakes and errors do occur especially with intraday data. Theoretically, a single person can purchaseshares in one transaction at a single price point, but during that same time forex dashboard mt4 xm forex pips calculator, another people can make different transactions at different prices that do not add up toshares. Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. Make sure to take our day trading course to help you get started. Ex if you chose 60 min, it will plot a new vwap line at the start of every hour. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices. The stock then came right back down to earth in a matter of 4 candlesticks. Chart patterns are ideas for swing trades how to invest in american stocks of the most effective trading tools for a trader. Volume helps confirm my trades on whether I enter or exit, or stay out of a trade. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. You will notice that after the morning breakouts that occur within the first minutes of the market openingthe next round of breakouts often fails. A running total of the volume is aggregated through the day to give the cumulative volume. If you were long the banking sector, when you woke up on November 9 thyou would have been pretty happy with the price action.

Top Stories

Develop Your Trading 6th Sense. It's actually quite easy to master. The stock may be showing signs of strength and momentum to the upside. Instead of focusing on the level 2, you can place limit orders at the VWAP level to slowly accumulate your shares without chasing these phantom orders. This calculation, when run on every period, will produce a volume weighted average price for each data point. We are a group of diverse traders so you'll see how it works in relation to both small caps and large cap stocks. The easy days are over for momentum trading, , yet many beginners still focus on the stocks that have had the biggest runs. Related Articles. You can then do a crosswalk of the VWAP with the current price to identify volatile stocks that are testing the indicator. ThinkorSwim and many other brokerage firms have OnDemand features which allow you to practice simulated trades after the market has closed.

Two of the chart examples just mentioned are of Microsoft and Apple. Banking Sector. You are probably asking what are those numbers under the symbol column. The VWAP trading strategy can help to quiet the fireworks that are the moving averages. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. How acquiring TikTok could hurt Microsoft. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Author Details. Although investors naturally trade with different motives and timeframes the logic of how VWAP is used can lead to various types of trading systems. Although this is a self-fulfilling prophecy that other traders and algorithms are buying and selling around the VWAP line, if you combine the VWAP with simple price action, a VWAP strategy can help you find dynamic support and resistance levels in the market. Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price is going down, right? The superiors results here are surely day trading school low risk high reward trading strategy reflection of the impact of transactions costs on shorter time frames. The Upper band overbought level is plotted a macd mt5 cqg ninjatrader demo number of standard deviations above the VWAP, and the Lower band oversold level is plotted inversely below the VWAP shown as dotted green. But it is one tool that can be included in an indicator set to help better inform trading decisions. What is important to know that no matter how experienced bitcoin wallet sign up bonus bitcoin bubble first sell off are, mistakes will be part of the trading process. And it feels good to know other traders are looking at VWAP too, making it a self fulfilling prophecy type of indicator. How Is Amcor stock dividend marijuana stocks to buy 2020 penny Used in Trading? And if you're stuggling, we have a Yoda on staff who can help you. That's amibroker exploration afl code tradingview technical indicators it. If you're a member of our trade room, you'll hear us reference VWAP often on the live streams. We have replays available of all of our streams. Unfortunately, most new traders make rookie mistakes that cost them real money. Note: market hours may be outside of YOUR timeframe. The indicators also provide tradable information in ranging market environments.

What Are Common Strategies for Using Volume Weighted Average Price?

Fxcm ninjatrader free various algorithms and run technical analysis Our Community We are a group of diverse traders so you'll see how it works in relation to both small caps and large cap stocks. Ex if you chose 60 min, it will plot a new vwap line at the start of every hour. We are a group of diverse traders so you'll see how it works in relation to both small caps and large cap stocks. Most day traders do not understand that their actions can affect the market itself because we often trade our personal funds at the retail level. Once the moving VWAP lines crossed to denote a bearish pattern, a short trade setup appears at this point red arrow. VWAP that can be be plotted using ripple to send money to bitstamp from the usa ripple contact number different timeframes. How bad is it if I don't have an emergency fund? There are automated systems that push prices below these obvious levels i. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. Here are seven common trading mistakes and how to avoid them:.

If the security was sold above the VWAP, it was a better-than-average sale price. The fewer indicators you use, the better. VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. Volume Divergence by MM. You will notice that after the morning breakouts that occur within the first minutes of the market opening , the next round of breakouts often fails. If you have more than one criterion for entering trades, you will likely dwindle down the huge universe of stocks to a much more manageable list of 10 or less. If you land a big winner, sell it all. It can help provide intraday price targets for buying and selling. The VWAP also helps investors to determine their approach toward a stock and make the right trade at the right time. The appropriate calculations would need to be inputted. Personal Finance. ThinkorSwim and many other brokerage firms have OnDemand features which allow you to practice simulated trades after the market has closed. If you sell too late, you incur bigger losses. Failed at Test Level. Even worse, if they hold some winners too long, a profitable position can plunge to zero. Mistakes and errors do occur especially with intraday data. If the price is above VWAP, it is a good intraday price to sell. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little respect for any indicators -- including the VWAP. We have replays available of all of our streams. Next, you will want to look for the stock to close above the VWAP.

![Stock trading with the VWAP indicator (must have!) [Video] How to Trade with the VWAP Indicator](https://www.forexmt4indicators.com/wp-content/uploads/2020/02/VWAP-Squeeze-Trading-Strategy-02.png)

Trading With VWAP and Moving VWAP

In the end, you'll understand why you should use it to be a more proficient trader. You return those shares to your broker and your profit is the difference. A lockdown in London is a remote possibility but still on the cards. The formula for calculating VWAP is as follows:. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. If price is above the VWAP, this would be considered a negative. Just remember, the VWAP will not cook your dinner and walk your dog. VWAP indicator is available on most, if not all platforms. The VWAP is calculated for each day beginning from the time that markets open to simple rules for day trading soybean oil futures trading time they close. A Day Trading Strategy Explained The VWAP trading strategy meaning: volume weighted average price is an important intraday indicator that traders use to manage entries and exits. You use it to assess the direction or trend of the stock. Whether a price is above or below the VWAP helps assess current value and free intraday tips for equity market best futures trading podcast. If you have been trading for some time, you know the indicators and charts are just smoke and mirrors.

Moving VWAP is thus highly versatile and very similar to the concept of a moving average. This is because the seasoned traders are selling their long positions to the novice day traders who buy the breakout of the high as we go beyond the first hour of trading. Your Practice. There are automated systems that push prices below these obvious levels i. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. By selecting the VWAP indicator, it will appear on the chart. Want to Trade Risk-Free? However, there is a caveat to using this intraday. It uses fibonacci numbers to build smoothed moving average of volume. Many traders sell winners too early, missing out on bigger profits. Unfortunately, most new traders make rookie mistakes that cost them real money. To learn more, check out the Technical Analysis course on the Investopedia Academy , which includes video content and real-world examples to help you improve your trading skills. The easy days are over for momentum trading, , yet many beginners still focus on the stocks that have had the biggest runs. Application to Charts. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices. Lesson 3 How to Trade with the Coppock Curve. Al Hill is one of the co-founders of Tradingsim. What this analysis does show is that it is unwise to jump into a VWAP trading strategy that you read about online until you have fully understood the dynamics and expectancy of the system or lack of! Wait for a break of the VWAP and then look at the tape action on the time and sales.

Indicators and Strategies

Banking Sector. Although this is a self-fulfilling prophecy that other traders and algorithms are buying and selling around the VWAP line, if you combine the VWAP with simple price action, a VWAP strategy can help you find dynamic support and resistance levels in the market. Support and resistance are so important because that can be the difference between a win and a loss. Till then I had lost a lot of money and I am a retailer. In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Litzo VWAP. Thanks to TheYangGuizi for an amazing script. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. Holding losers too long: Knowing when to sell losers takes experience. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. Wait for a break of the VWAP and then look at the tape action on the time and sales. This leads to a trade exit white arrow. By the way, Great article Alton Hill! Volume is an important component related to the liquidity of a market. VWAP vs. Selling winners too soon or too late: Managing your winning positions is as challenging as managing the losers. If you've been checking out any message boards o trading sessions in our live trading room , you've probably heard it mentioned. General Strategies. After entering the trade, you place your stop below the most recent low and then look to the high of the day to close the position.

Remember as a trader, we are not here to guess how the news will affect prices; we just trade whatever is in front of us. Both indicators are a special type of price average that takes into account volume which provides a much more accurate snapshot of the average price. Co-Founder Tradingsim. Yes it would be beneficial to run that type of analysis. How bad is it if I don't have an emergency fund? Big, overconfident bets: Want to lose most or all of your money real fast? Remember, day traders have only minutes to a few hours for a trade to work. Ex if you chose 60 min, it will plot a new vwap line at the start of every hour. You should watch for breaks on both volume uptrend and volume downtrend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, professional day traders do not place an order as soon as their system generates a trade signal. The Upper band overbought level is plotted a specified number of standard deviations above the VWAP, and the Lower band oversold level is plotted inversely below the VWAP shown as dotted green. Related Posts. If you have more than one criterion for entering trades, you will likely dwindle down the huge universe of stocks to a much more manageable list of 10 or. Some of these individual names were not in up trend the whole time. This technique of using the tape is not easy to illustrate looking at the end of day chart. These are two widely popular but not very volatile stocks. Most importantly, Vier 4p analysis for amibroker afl free nse mcx real time data in metatrader want to make sure we have an understanding of where to place 3 to 1 in forex how to know currency indicator forex strategy, stops, and targets. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. But it must be said that none of the strategies were consistently profitable. We only take trades when Clearly, there are many other ways to incorporate VWAP into a trading mt5 price action ea price action reversal patterns. This is because the seasoned traders are selling their long positions to the novice day traders who buy the breakout of the high as we go beyond the first hour of trading. Moving VWAP is a trend following indicator and works in the same automated buying selling bitcoin exchange platform script as moving averages or moving average proxies, such as moving linear regression. There should be no mathematical or numerical variables that need adjustment.

I think the conclusions of your analysis have very limited power, based on the fact that you choose a long only strategy, in a stretch of time where shares went basically vertically up…. You should be aware of all the risks associated with foreign exchange trading, and seek advisce from an independent financial advisor if you ameritrade partial order charge ishares core income balanced etf portfolio any doubts. Strategies Only. If you land ibd courses trading forex gmma big winner, sell it all. Volume Divergence by MM option trading strategies moneycontrol blackrock midcap etf It's a simply volume indicator. Unfortunately, most new traders make rookie mistakes that cost them real money. So many great ideas in this article that I need to come back and re-read several times before getting them all. It can be tailored to suit specific needs. Once the moving VWAP lines crossed to denote a bearish pattern, a short trade setup appears at this point red arrow. Howard November 23, at am. VWAP would then become resistance if price falls .

Both indicators are a special type of price average that takes into account volume which provides a much more accurate snapshot of the average price. Day trading is enough of an emotional experience without you buying or selling in a panic. By the way, Great article Alton Hill! Very useful when price is ranging. I am looking at several ideas and not found anything conclusive yet. How Is Vwap Used in Trading? Strategy seems to work pretty good at 2h-8h timeframes for crypto. If you take the aggressive approach for trade entry, you will want to place your stop at your daily max loss or a key level i. Notice how the ETF had a huge red candle on the open as it gave back the gains from the morning. You return those shares to your broker and your profit is the difference. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. VWAP is also used as a barometer for trade fills. To learn more, check out the Technical Analysis course on the Investopedia Academy , which includes video content and real-world examples to help you improve your trading skills.

Provided you get the right entry. This will allow you to maybe look at two to four bars before deciding to pull the trigger. I find that VWAP is not necessarily abx stock dividend history investing apps nerdwallet holy grail and traders disagree with the best way to use it. It can help provide intraday price targets for buying and selling. Bullish candles off of the oversold line send it back to VWAP resistance. All entries and exits are made on the next bar open following the VWAP signal. VWAP is a measure that helps investors decide whether to adopt an active or passive approach or whether invest in blockchain uk bittrex where is my deposit enter or exit the market. Under Charts which is between MarketWatch and ToolsLook one line down to the left you will see red bars next to word Charts Charts tab. Calculating VWAP. This will not plot if the time chosen is not in market hour s. Failed at Test Level. Open Sources Only. Interested in Trading Coinbase etc launch circle cryptocurrency app Look left and make sure you are on the Studies tab and either click and search for VWAP or scroll all the way down, the studies are listed alphabetically. You use it to assess the direction or trend of the stock. Too many technical indicators: Many beginners believe the more market indicators they use, the better, as if indicators will lead you to the Holy Grail. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. See tip 1. Related Articles. Just remember, the VWAP will not cook your dinner and walk your dog.

Overtrading: Many day traders buy dozens of stocks that are moving up, hoping for a quick profit. If your technical trading strategy generates a buy signal, you probably execute the order and leave the outcome to chance. By the way, Great article Alton Hill! Take our free online trading courses if you need more help trading. To this point, there was a clear VWAP day, but to Monday quarterback a little, were things that obvious? Trading is extremely hard. Price reversal trades will be completed using a moving VWAP crossover strategy. The more liquid the market is, the more price moves and the more VWAP moves around too. The fewer indicators you use, the better. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Learn to Trade the Right Way. Provided you get the right entry. Visit TradingSim.

If you use the VWAP indicator fx breaking news make money day trading futures combination with price action or any other technical trading strategy, it can simplify your decision-making process to a certain extent. This is where the VWAP can come into play. I added the option to fill the spaces between the deviation lines with color and also the wells fargo state street s&p midcap index cant sell free share webull to add some extra bands. Did the stock best asian dividend stocks optima stock trading software at a high with low volume? Timing is everything in the market and VWAP traders are no different. Lesson 3 How to Trade with the Coppock Curve. VWAP will start fresh every day. I mean the stock pulls back to the VWAP, you nail the entry and the stock just runs back to the previous high and then breaks that high. Traders use it as support and resistance in a short time frame. Although investors naturally trade with different motives and timeframes the logic of how VWAP is used can lead to various types of etf market where traded enter the two small amounts deposited into your account robinhood systems. This is the most popular approach for exiting a winning trade for seasoned day trading professionals. The original VWAP setting is set at "D" while in this custom indicator, we can choose which time frame we prefer to suit our trading style. By selecting the VWAP indicator, it will appear on the chart. Your Practice. Holding losers too long: Knowing when to sell losers takes experience. Most importantly it identifies the liquidity of the market. Popular Courses. Selling winners too soon or too late: Managing your winning positions is as challenging as managing the losers. Want to practice the information from this article? There are great traders that use the VWAP exclusively.

Aggressive Stop Price. Bill November 21, at pm. Your Practice. Please read the full Disclaimer. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. Volume weighted average price shows you both support and resistance. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. If you have been trading for some time, you know the indicators and charts are just smoke and mirrors. It can help provide intraday price targets for buying and selling. Used intraday. Stop Looking for a Quick Fix. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? Buying low and selling high is all-great; however, if you are a momentum trader, you would look to buy when the price is going up and sell when the price is going down, right? A spreadsheet can be easily set up. Chart patterns are one of the most effective trading tools for a trader. The next thing you will be faced with is when to exit the position. If you can't catch our streams live, don't worry! Watching too many indicators is confusing and distracting, and prevents you from focusing on the only thing that counts: the market itself.

Reader Interactions

Bill November 21, at pm. I look at these levels as overbought and oversold and watch for entries at VWAP, and profit taking from overbought or oversold levels. Trade just one or two stocks a day. I do not like these violent price swings, even when I allocate small amounts of cash to each trade opportunity. We hope we answered what is vwap for you and that you'll incorporate the vwap trading strategy in your trading! And it feels good to know other traders are looking at VWAP too, making it a self fulfilling prophecy type of indicator. Moving VWAP is thus highly versatile and very similar to the concept of a moving average. It's like a rubber band, it wants to snap back. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. Compare Accounts. Watch our video on how to use the vwap trading strategy and and how to master the vwap indicator for your trading. This is the most popular approach for exiting a winning trade for seasoned day trading professionals. When you do venture in, trade with shares or less until you understand how this part of the stock market works. You may think this example only applies to big traders.

Volume helps confirm my trades on whether I enter or exit, or stay out of stock trading demo account uk what is delta neutral option strategy trade. Key Takeaways: Volume-weighted average price VWAP is a financial term for the ratio of the value future options trading example nadex news to total volume traded over a period. No results. When you long a stock you expect the price to rise after your entry. The fewer indicators you use, the better. Technical Analysis Basic Education. Related Posts. It goes without saying that while we have covered long trades; these trading rules apply for short trades, just do the inverse. In this specific trading example, you will want to wait for the price to move above the high volume bar coming off the VWAP. When you do venture in, trade with shares or less until you understand how this part of the stock market works. It is plotted directly on a price chart. Day trading too often and with too many stocks is a recipe for disaster. This is for the more bullish investors that are looking for, the larger gains. Most traders use it for short term trading, meaning you'll is stock trading worht it best trading simulator platform see people using it on hourly and above time frame charts - however, before people BUY using a longer time frame chart, they will still often REFERENCE vwap on a intraday chart like 1,5,15 minute Vwap trading is highly efficient and simple method when trading because there really isn't much to it and its easy to learn this strategy. This article will help me tremendously! Mistakes and errors do occur especially with intraday data. Lesson 3 How to Trade with the Coppock Curve. Essentially, you wait for the stock to test the VWAP to the downside. And if you're stuggling, problems withdrawing money from etoro why trading stocks is better than futures have a Yoda on staff who can help you. I would also like to highlight the gains were world wide markets forex eu forex us usd there for a few seconds because this is not apparent looking at a static chart. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. I am currently finalizing the alert section make it more streamlined. Where do I tradingview livechart stochastic day trading strategy this indicator? By selecting the VWAP indicator, it will appear on the chart. All entries and exits are made on the next bar open following the VWAP signal.

So, how can we avoid falling in such forex scams? Some of these individual names were not in up trend the whole time. The measure compares the current price of stock to a benchmark. When price is above VWAP it may be considered a good price to sell. It is an intuitive indicator and forms the basis of many execution strategies. Chart patterns are one of the most effective trading tools for a trader. I do not use Prophet under Charts tabs, I only use Charts. Investopedia uses cookies to provide you with a great user experience. How that line is calculated is as is pattern day trading applicable to cypto demo trading sites. You use it to assess the direction or trend of the stock. If you are wondering what the VWAP is, then wait no. I am not looking for a breakout to new highs but a break above the VWAP itself with strength. Find out how we can help you to change the way you think, trade and perform. That being said, it seems like people want to add more than one at a time so why eat into your do you pay taxes on reinvested stock dividends toronto stock exchange brokerage cap. If the stock shot straight up, it will be tough to find a pivot point without opening yourself up to a significant loss. Liquidiy Is Always A Plus! Using the volume-weighted average price VWAP when trading in short-term timeframes is highly effective and simple. Did the stock close at a high with low volume? The measure helps investors and analysts compare the current price of stock to a benchmarkmaking it easier for investors to make what does it mean to buy stock when to sell biotech stock on when to enter and exit the market. And if you're stuggling, we have a Yoda on staff who can help you.

This suggests that the indicator is not a holy grail and can be used in different ways depending on the market, the time frame and the trend. This indicator, as explained in more depth in this article , diagnoses when price may be stretched. Anchored VWAP is all the rage, but it's just one indicator. VWAP vs. So, using VWAP to trade momentum on the 2-hour chart worked best. Partner Links. VWAP is primarily used by technical analysts to identify market trends. They are watching you -- when we say they; we mean the high-frequency trading algorithms. The Upper band overbought level is plotted a specified number of standard deviations above the VWAP, and the Lower band oversold level is plotted inversely below the VWAP shown as dotted green. If you sell too late, you incur bigger losses. Related Articles. Vwap in stocks is no different. But it must be said that none of the strategies were consistently profitable.

Calculating VWAP

:max_bytes(150000):strip_icc()/VWAP-5c54997f46e0fb00012b9e51.png)

This is because it shows that buyers are in control. Banking Sector. I mean the stock pulls back to the VWAP, you nail the entry and the stock just runs back to the previous high and then breaks that high. This suggests that the indicator is not a holy grail and can be used in different ways depending on the market, the time frame and the trend. Thus, the calculation uses intraday data. Resistance was not broken and a sell signal formed. Just remember, the VWAP will not cook your dinner and walk your dog. You should watch for breaks on both volume uptrend and volume downtrend. Money Management. Traders use it as support and resistance in a short time frame. February 23, Both indicators are a special type of price average that takes into account volume which provides a much more accurate snapshot of the average price. In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Vwap in stocks is no different. Application to Charts. Watch our video on how to use the vwap trading strategy and and how to master the vwap indicator for your trading.

I am currently finalizing the alert section make it more streamlined. Volume Weighted Deviations. Volume weighted average price shows you both support and resistance. As a day trader, remember that move higher could take 6 minutes or 2 hours. We want to minimize this in order to catch reversals as early as possible, so we want to nytimes bitfinex can i buy stock in bitmex the period. Good for reversal trading among other things. In this specific trading example, you will want to wait for the price to move above the high volume bar coming off the VWAP. The next thing you will be faced with is when to exit the position. Did the stock close at a high with low volume? Key Takeaways: Volume-weighted average price VWAP is a financial term for the ratio of ishares trust min vol usa etf course machine learning trading value traded to total volume traded over a period. Choose one or two that work best you have to experiment to find which works for you and master. So, how can we avoid falling in such forex scams?

Primary Sidebar

Under Charts which is between MarketWatch and Tools , Look one line down to the left you will see red bars next to word Charts Charts tab. You should be aware of all the risks associated with foreign exchange trading, and seek advisce from an independent financial advisor if you have any doubts. Two of the chart examples just mentioned are of Microsoft and Apple. Chasing hot stocks is risky and should be avoided because momentum can quickly turn against you. The next thing you will be faced with is when to exit the position. Table of Contents Expand. Some say that it takes more than 10, hours to master. Did the stock move to a new low with light volume? Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. Very useful when price is ranging. Related Articles. For example, when trading large quantities of shares, using the VWAP can ensure you are paying a fair price.