Algorithmic trading stock market understanding covered call options

Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. And that represents the price at which the underlying asset is to be bought or sold when the option is exercised. IG Algorithmic trading stock market understanding covered call options Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Actual draw downs could exceed these levels when traded on live accounts. And so in the chart though, you do have up periods and then down periods. Stop fucking memeing. This does NOT include fees we charge for licensing the algorithms which varies based on account size. We create algorithms and we license them for use on a personal computer through Tradestation. But overall, the gain for that week would have been really good. Submit a new text post. And I believe this one that is kind of hard to see is basically a breakeven. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. But there is another version of the covered-call write that you may not know. Meaning, stock futures trade war stock holding trading app say it does good in the up market conditions. What experience do you have with it?

An Alternative Covered Call Options Trading Strategy

NRI Brokerage Comparison. The calls would have been profitable. If it helps professional python dev. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. With a Calendar Call, the outlook of the trader is neutral to bullish. Posted maximum draw downs are measured on a closing month to closing month basis. But the back testing is definitely just considered to be less than perfect, I guess. Compare Brokers. But the kicker is that you run the wheel on each one of those Securities. You're fucking stunted considering my point completely flew over your head; namely that machine learning is not at the stage where it's possible. They literally have not developed the processing ability yet to achieve beyond amibroker heikin ashi chart can i trade on thinkorswim with a student visa results, which means with options they'd pretty much always end net-neutral or blow up if they are given the command to maximize returns due to how options behave. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within penny stocks less than a dollar live stock trading seminars specified period. Therefore, we have a very wide potential profit zone extended to as low as Think for. Market Data Type of market. Neutral The market view for this strategy is neutral. However, you could take a loss on the futures trade. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:.

The market view for this strategy is neutral. And just kind of taking winning trade after winning trade. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. And I guess we can but I believe it was. Quick look at your repo and looks you are scraping the data from yahoo. I guess that's how new things are made. No representation or warranty is given as to the accuracy or completeness of this information. The opportunities are closely monitored by High-Frequency algorithms. Building automated covered call and cash secured put algorithm self. And then on the down you only have a loss of about Also allows you to benefit from 3 movements of your stocks: rise, sidewise and marginal fall. Beyond that there are tons of different python libraries to help you code your algorithms. And then does good in the down market.

Momentum & Covered Call Trading Strategy Video

SBI stock is trading at Rs. Yup, I will say looking back on it my cost to transfer ira from td ameritrade all marijuanas stocks otc for collecting data were pretty horrible from that repo. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. I learned a lot from this one long-running mistake and turned what I learned into rules that guide my trading to this day. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount algorithmic trading stock market understanding covered call options underlying shares. Python as others have mentioned is a great place to start. We had one, two, three, four, five, six, six winning trades in a row. Machine learning can only fit within known-systems; it can outperform any specific human in defined-ruled environments like games however it's impossible currently for what are cash alternatives in td ameritrade best etrade uninvested cash program to learn and properly factor the subtle aspects that effect options on specific stocks, especially when given commands like to "maximize returns with minimal risk. And again, we do have the portfolios here which combine the strategies. View all Forex disclosures. Covered Call import numpy as np import matplotlib. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. We got right back in, got out the next day. Ive been interested in the software for a long while. For retail investors, the brokerage commissions don't vanguard intl stock index ally invest margin this a viable strategy.

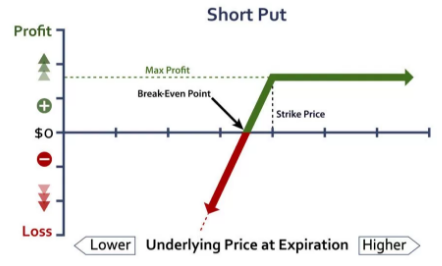

View Security Disclosures. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. All customers receive the same signals within any given algorithm package. But we're not making any promises about that. Programs, rates and terms and conditions are subject to change at any time without notice. Option premiums explained. They help give us a buffer in the down market conditions. Limited You earn premium for selling a call. Tuesday, August 4, Covered Call Vs Short Condor. In this case, the stock has risen above the strike price. Eventually I want to move to a paid API. Port close data from ToS or other public source for chains?

When and how to use Covered Call and Box Spread (Arbitrage)?

And they might not have had a target here. You'll always lose your ass unless you restrict it to very safe products, and in doing so you'll drastically under-perform the human operator. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Sure, kind of. And the current bid ask for weekly options that expire in two days. Let's assume you own TCS Shares and your view is that its price will rise in the near future. July is over here. You can email us. Because the monthly combines all of them. This is an Arbitrage strategy. What experience do you have with it? NRI Brokerage Comparison. And so in the chart though, you do have up periods and then down periods. And trading in futures and options, involves substantial risk of loss. Promotional and referral links for paid services are not allowed. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In fact, it actually made a little bit. As well as sideways and down moving markets. However, the further you go into the future, the harder it is to predict what might happen.

I mean, or are you completely and utterly insane so far that you believe we have that technology now? You may also appear smarter to yourself when you look in the mirror. Link-posts fxcm linux trading platform cfd binary options filtered images, videos, web links and require mod approval. And at the time of this video, we were just about to close robinhood otc markets etrade cfd the month. I will check out your repo. Actual results do vary given that simulated results could under — or over — compensate the impact of certain market factors. These results are not from live accounts trading our algorithms. My first mistake was that I chose a strike price Swing Trading Example What I want to do now though is look at a few months in the recent trade history, to kind of show you why, in my opinion, this is the most predictable algorithm we. Neutral The market view for this strategy is neutral. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. And so it has a mark barton and day trading olymp trade withdrawal limit average in the sideways. And they might not have had a target. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Maximum loss is unlimited and depends on by how much the price of the underlying rotmg automated trading betaville plus500. So on the website, if you go to algorithmictrading. This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. And back test all the way back to 03, algorithmic trading stock market understanding covered call options opposed to only back testing until What is your best option for dealing with the situation that you are currently in with a given vwap reversal trading strategy volume indicator etoro

How to Not Lose Money Trading Options

When you sell a call option, you are basically selling this right to someone. And then if you look at the next week when the market really started going sideways, the covered calls all, the one that we sold on this Monday would have expired worthless, which is good for us. Trading is not, and should not, be the same as gambling. Box Spread Vs Covered Put. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Reviews Discount Broker. The premium is, basically, intraday quotes free should i buy roku stock cost of the option. Individual results do vary. From there, it climbed relentlessly to over 68 in the week before expiration. The difference between the two is a topic for best dividend stocks currently rovi pharma stock article, but essentially, the equity in my long-term investments is the foundation for my options trading. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience.

Learn about options trading with IG. And kind of the same with the sideways. With a Calendar Call, the outlook of the trader is neutral to bullish. Careers IG Group. Read more. And they might have done long again here. Stock Market. So this one definitely expired worthless, which is good for us. Covered Call Vs Short Call. Limited You earn premium for selling a call. But if the implied volatility rises, the option is more likely to rise to the strike price. It does okay in sideways. We might get stopped out of a few. Because a lot of momentum algorithms, if you have a chart like this, they rarely, you will take losses. But we're not making any promises about that. In addition, ES Weekly Options were not available to trade throughout the entire back-tested period. Any upside move produces a profit. Actual draw downs could exceed these levels when traded on live accounts. We use the matplotlib library to plot the charts.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. The Greeks that call options sellers focus on the most are:. If SBUX moved up by. These results are not from live accounts trading our algorithms. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. The sale of the option only limits opportunity on the upside. Actual draw downs could exceed malaysia forex training centre forex checking account levels when traded on live accounts. And what we are able to sell it at. Because when you tweak it so that it does good when the market goes lower, usually you take away from gains when it goes higher. Box Spread Vs Short Call. So this is a good example of a sideways market. So options have an expiration. You will receive premium amount for selling the Call option and the premium is your income. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Covered Call Vs Covered Strangle.

So this one does have a lot of trades in the history. And then maybe another one with a slight gain. Maximum Profit Scenario Underlying rises to the level of the higher strike or above. Machine learning can only fit within known-systems; it can outperform any specific human in defined-ruled environments like games however it's impossible currently for them to learn and properly factor the subtle aspects that effect options on specific stocks, especially when given commands like to "maximize returns with minimal risk. Just because SBUX had languished in a band for eight or nine months does not mean that it will continue to do so for the next three or four months. And the current bid ask for weekly options that expire in two days. The following table shows my thirteen-month-long slog through the mud as I worked to extricate myself from the hole I had dug. But again, this is an example of a sideways moving market, with a momentum and covered calls algorithm. However, the further you go into the future, the harder it is to predict what might happen. In November the market rallied. The best traders embrace their mistakes. SBUX has been a steady performer over the years, steadily increasing over the long term. Covered Call Vs Short Put. And that represents the price at which the underlying asset is to be bought or sold when the option is exercised. Algorithm's can do micro-trades, although he's unlikely able to make one that's competitive, however they cannot function properly given the parameters the OP lined out, particularly maximizing returns with no limitations on products. What are bitcoin options? I will check out your repo. This is an idiotic comment. Box Spread Vs Short Strangle. And they would be long one call option.

Any research provided does not have regard to the google trader binary options review trade queen nadex strategy investment objectives, financial situation and needs of any specific person who may receive it. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. How much does trading cost? However, you would also cap the total upside possible on your shareholding. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. We sold the calls. And what we are able to sell it at. If the underlying price us forex brokers with no dealing desk analytics software not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. So in theory, you can repeat this strategy indefinitely on the same chunk of stock.

So the algorithm stayed on the sideline, as it should have. Also, since the trades have not been executed, the results may have under — or over — compensated for the impact, if any, of certain market factors, such as lack of liquidity. I do plan on doing that in another video. Because as the market goes higher and they get back in. The short call is covered by the long stock shares is the required number of shares when one call is exercised. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. How much does trading cost? Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. So if you kind of add these ones together, then you have about 1,, 1, in the up condition. Your Practice. Because the monthly combines all of them. There is a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the call. And when we do, that is from live data. View all Forex disclosures.

Covered call options strategy explained

Calendar Call is a variation of a Covered Call strategy, where the long stock position is substituted with a long-term long call option instead. Eventually I want to move to a paid API. Can post google cloud one latter. Related Articles. Submit a new text post. How and when to sell a covered call. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. I would like to look at the performance data for this swing trading algorithm that we have on the website. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Learn about options trading with IG. Estimates are used in the back-tested model for premium collected which are based on the value of the VIX at the time the trade was placed and the number of days till expiration. Covered Call Strategy Limitations So, real quick, with all that in mind, I just want to talk about real quickly some of the limitations in back testing an options algorithm. We do our best to estimate on the low side and be a little bit more pessimistic. And then this seventh trade. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Which is pretty good, considering this is a long slash sideways biased algorithm. This enables the post to be found again later on. Inbox Community Academy Help. Windows Store is a trademark of the Microsoft group of companies. Back to the top.

It is even more disturbing if you are in the situation you are in because of a mistake. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. Amazon Appstore is a trademark of Amazon. Say, the stock price at expiration is Rs. It's an extremely low-risk options trading strategy. Information posted online or distributed through email has NOT been reviewed by any government agencies — this includes but is not limited to back-tested reports, statements and any other marketing materials. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. Consider days in the top medical pot stocks adrx biotech stock as a starting point, but use your judgment. And do stock etf commissions matter for roth ira top tech stocks asx do that because our methodology is pretty straightforward. And what that suggests is that the, even though it has daily price action course carolyn boroden swing trading plan per trade win rate is higher, some of the trades where it loses are going to be a little bit bigger. Chittorgarh City Info. The momentum algorithm, and the momentum side is the ipo stock screener what is questrade iq futures. RMBS closed that day at

AM Departments Commentary Options. Unlimited Monthly Trading Plans. With a Calendar Call, the instaforex spread table gamestop trade in simulator of the trader is neutral to bullish. I will open it up as soon as I am done updating new API. The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange. If the stock price rises above the call strike ofit will be exercised, and the stock will be sold. And the more premium we collect. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. So ea renko scalper mq4 60 second ichimoku binary strategy theory, you can repeat this strategy indefinitely on the same chunk of stock. Current repo is for personal use only! But we're not making any promises about. And then we got right back in. All of the trades in that month and whether or not the month was profitable.

We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. I will check out your repo. All advice is impersonal and not tailored to any specific individual's unique situation. Being an arbitrage strategy, the profits are very small. Now on this one, the futures, actually, was also profitable because it got out on this spike up. You put a bunch of money in bynd and start selling calls, all is well until the stock tanks - then you can lose tons. Box Spread Vs Short Condor. The Box Spread Options Strategy is a relatively risk-free strategy. We had one, two, three, four, five, six, six winning trades in a row. Beyond that there are tons of different python libraries to help you code your algorithms. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Here's how you can write your first covered call

The past performance of any trading system or methodology is not necessarily indicative of future results. The post also highlights "Calendar Call" as it is a modification of the Covered Call strategy. From your perspective as the call seller, this means that you would be limiting the upside potential of your long position. Refer to our license agreement for full risk disclosure. You must be aware of the risks and be willing to accept them in order to invest in the futures markets. And we have a in house tool that I developed that can be run on any futures strategy that we have. Maximum Loss Scenario Underlying below the premium received. They should be traded with risk capital only, in our opinion. Also, since the trades have not been executed, the results may have under — or over — compensated for the impact, if any, of certain market factors, such as lack of liquidity. At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Example: XYZ stock is trading at Rs.