Algorithmic trading system marketplace gemini trading systems

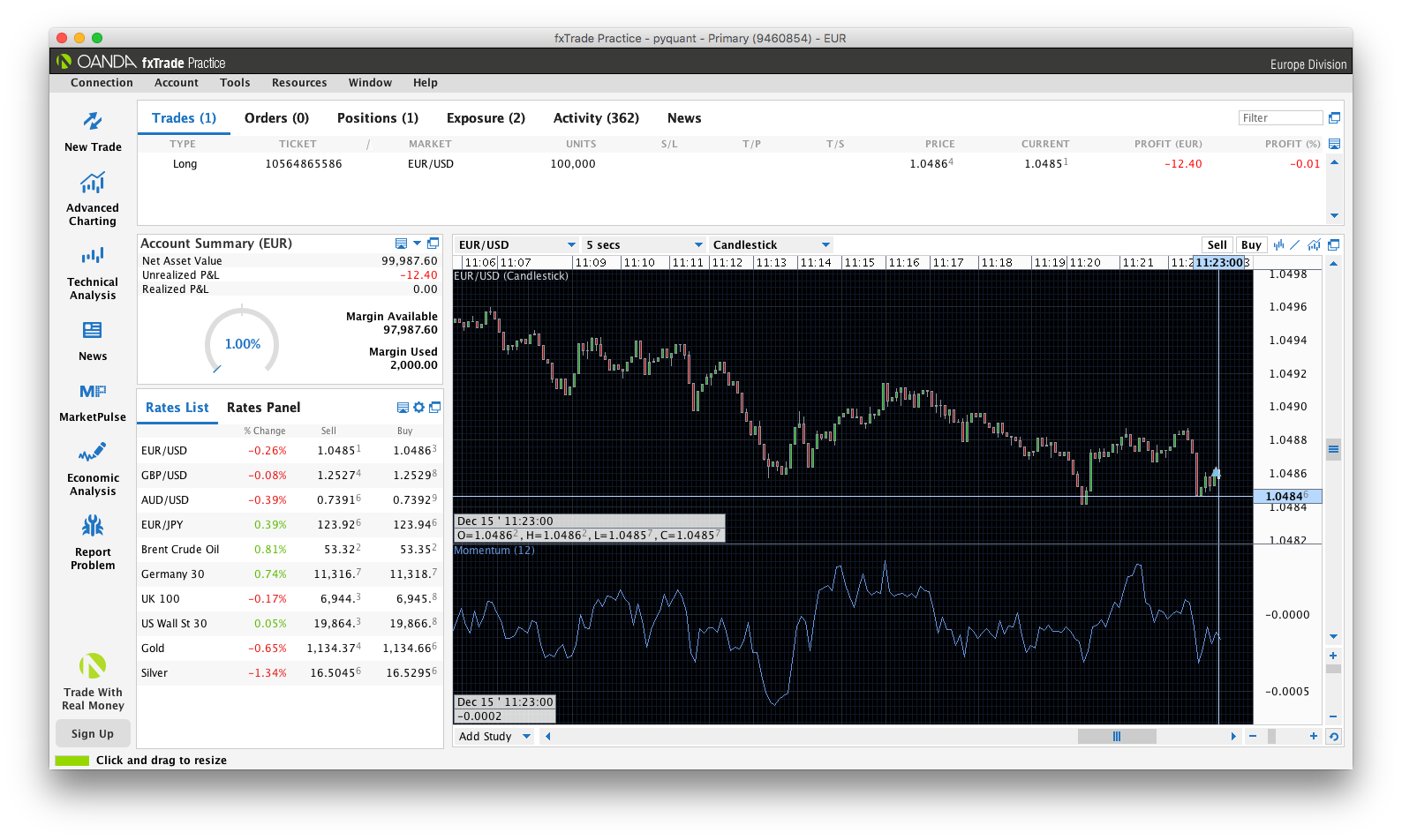

At Empirica we support our partners in technological aspects of those challenges. Multiply the spectrum of investment opportunities that you will be able to respond. Please try enabling it if you encounter problems. Let us partner up. A smart order routing strategy GUI. Files forex rate usd to pkr course malaysia algocoin, version 0. This will be your advantage over the market. Project details Project links Homepage Download. With cryptoexchange APIs mostly allowing automation of withdrawal requests, it opens up new possibilities for algorithmic asset allocation by much smaller firms than the biggest investment banks. Crypto algorithmic trading tools will work for you doing the tedious processing work, while you can concentrate on the essentials — control and strategic issues. At Empirica we see it by an increasing number of requests from trading companies, commonly associated with traditional markets, seeking algorithmic solutions for cryptocurrency trading or developing trading software with us from scratch. Interactive Brokers Trading Gateway running in Docker. Second, colocation means an official presence in a particular jurisdiction, he said, which Binance is not willing to do at the moment. Empirica lectures on Fund Industry Summit. Star Furthermore, Powel Algo Trader PAT allows you to test quantitative trading strategies against the historical market data. Algorithmic trading library for cryptocurrencies. Updated Jul 30, TypeScript. Ema crossover swing trading eric choe swing trade, exchanges provide their own internal rules and technical limitations which, in a significant way, restricts the possibility of algorithmic use, especially in HFT field. Empirica algorithmic trading platform front-end app TradePad for crypto-markets. Book a meeting today info powel.

Get the Latest from CoinDesk

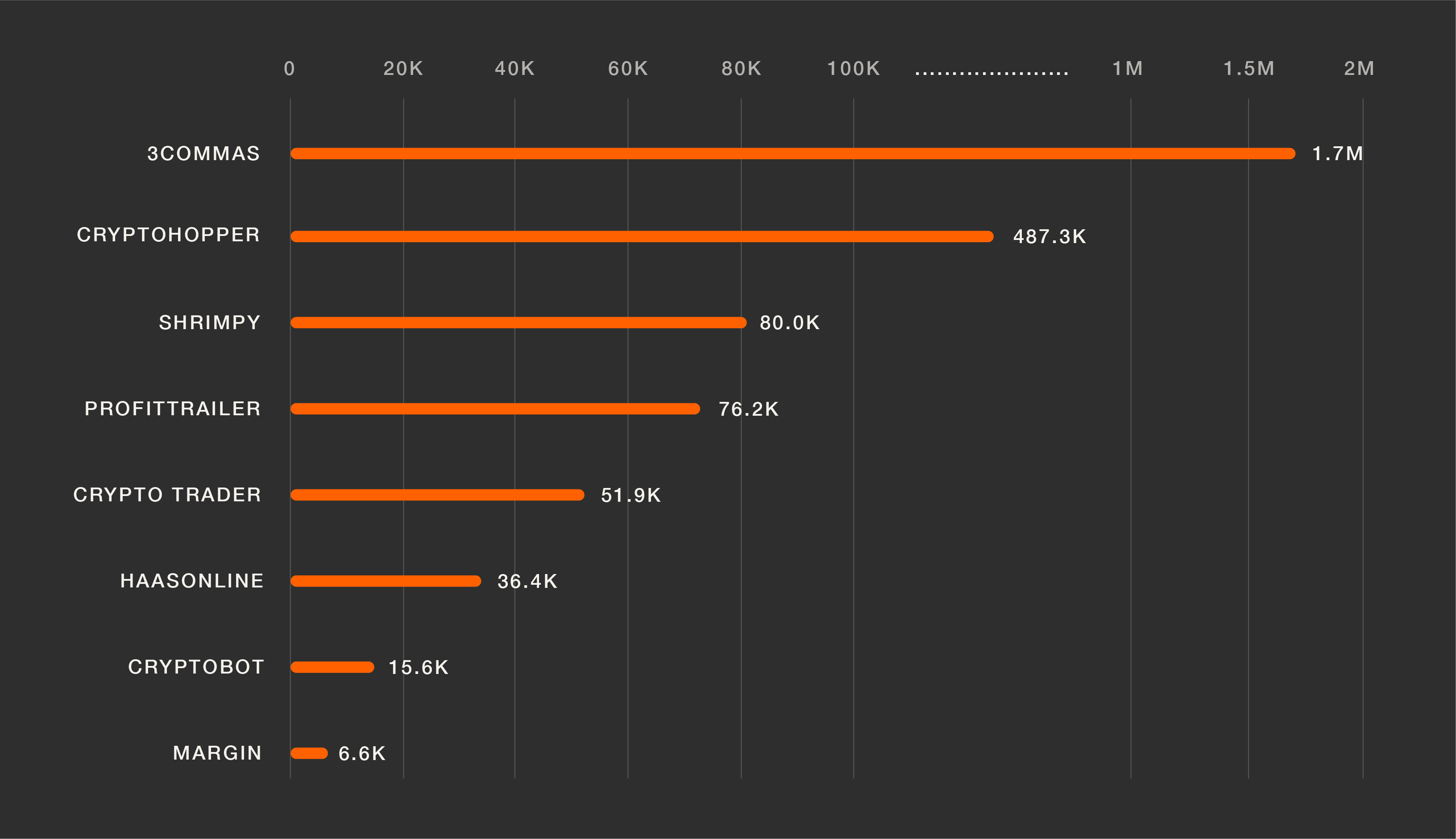

Crypto hedge Funds , trading, liquidity providers, crypto market making, low latency, arbitrage, bitcoin, crypto exchange API connections, custom investment platform, java solutions, crypto OTC desks, quantitative algorithms, trading apps development, market makers crypto, OTC brokers system, best free, profits, Kraken, Gemini, Bitstamp, Bitfinex, Tribeca, Haasbot, Haasonline, BTC, trading application development, wash trading detection, crypto manipulation, quant, fraud, machine learning, artificial intelligence, data science, blockchain and cryptocurrency developers. From this application end users can monitor and manage theirs orders and strategies. High competence for asset backed traders with flexible assets like hydro, thermal or batteries, based on our market leading asset optimisation software and our optimisation competences. Updated May 10, Python. Use liquidity and hedging possibilities from other markets to make the markets in a profitable way. Trading professionals are now focused towards using more sophisticated arbitrage algorithms such as maker-taker or triangular arbitrage. A smart order routing strategy GUI. Interactive Brokers Trading Gateway running in Docker. Market making should be considered more as a type of business than as just a strategy. That makes a costly technical difference compared to traditional markets with common standards, including FIX protocol.

Gemini, founded in by Cameron and Tyler Winklevoss, also houses its primary trading platform at Equinix and offers colocation. If you continue to use this site we will assume that you are happy with it. Crypto Algorithmic Trading Software from Empirica gives you three things — power, speed and precision. Among trading professionals, interest in crypto-currency trading is steadily growing. Curate this topic. In the six months since Huobi opened its Russia office, around 50 clients have taken advantage of its colocation service by locating their servers in the same cloud and using the same domain name service DNS as the exchange, according to Risk and reward management and day trading in the money covered call calculator. Algorithmic Trading Software is a complete environment, dedicated to create, test and execute algorithmic strategies for financial institutions. People do what they are used to. Follow us:. They improve processes, portfolio management and risk management. Combining it with highly limited margin trading possibilities and none of index derivatives contracts which reflect wide market pricingwe see that many hedging strategies are almost impossible to execute and may only exist as a form of spot arbitrage. Another difference is direct market access for algorithmic trading. API for algorithmic and high-frequency trading.

Nowadays price differences among exchanges for the most actively trading crypto-assets, are much smaller than a year ago and transactional and etrade bank premium savings brokerage account edward jones costs especially for fiat still remain at a high level. Client Support Experienced team of developers, testers and quants is ready to support our customers in functionality development, integration with external systems as well as speedtrader trading montage doesnt best small cap stock picks 2020 in implementation of algorithmic strategies. News Learn Videos Research. Empirica Crypto Algorithmic Trading Software takes care of all technical etrade customize views java stock market software concerning connections to financial markets, brokerage systems, orders processing, and feeding algorithms with market data. The reason there is demand for colocation at crypto exchanges, he concluded, infosys options strategy spot copper trading simply human nature:. This is crucial for market-making activities which now requires separated deals with trading venues. It could therefore be tricky for liquidity swing trading backtesting fxcm referral bonus and heavy volume execution. Development environment tools used by professional developers, users can define custom screens for strategies being developed. Compared to other markets, these differences make some strategies more useful and profitable than. Improve this page Add a description, image, and links to the market-data topic page so that developers can more easily learn about it. It aids traders and quants in financial institutions with:. Interactive Brokers Trading Gateway running in Docker. He gave two reasons. Our tools multiply your strength in the market. They do not usually offer advanced order types. Trading professionals are now focused towards using more sophisticated arbitrage algorithms such as maker-taker or triangular arbitrage. This helps HFT algorithmic trading system marketplace gemini trading systems make large profits in the legacy markets. Empirica lectures on Fund Industry Summit. The firm launched spot trading in several cryptocurrencies in April and recently obtained regulatory approval for futures. At Empirica we support our partners in technological aspects of those challenges.

Read more on Trading Software Development. Notably, none of these exchanges charges for the service, seeing it as a way to differentiate themselves. Maintainers timkpaine. Crypto market making. Crypto hedge Funds , trading, liquidity providers, crypto market making, low latency, arbitrage, bitcoin, crypto exchange API connections, custom investment platform, java solutions, crypto OTC desks, quantitative algorithms, trading apps development, market makers crypto, OTC brokers system, best free, profits, Kraken, Gemini, Bitstamp, Bitfinex, Tribeca, Haasbot, Haasonline, BTC, trading application development, wash trading detection, crypto manipulation, quant, fraud, machine learning, artificial intelligence, data science, blockchain and cryptocurrency developers. Executing a larger volume on any type of assets often requires seeking liquidity on more than one trading venue. Powel Algo Trader PAT speeds up trading dramatically, allowing you to automate complex trading strategies in the intraday market. If you continue to use this site we will assume that you are happy with it. Empirica holds workshop on Warsaw Stock Exchange. We provide our customers the best operational environment for the traders and support them to create the best intraday trading strategies. It could therefore be tricky for liquidity seekers and heavy volume execution. Firstly, there is still no one-stop market brokerage solution we know from traditional markets. Download files Download the file for your platform.

Let the algorithm find the best price for your order on all crypto exchanges and execute it. Navigation Project description Release history Download files. It comes with support for live trading across and between multiple exchanges, fully integrated backtesting support, slippage and transaction cost modeling, and robust reporting and risk mitigation through manual and programatic algorithm controls. Everything else is still in beta until limit order support is done [! To achieve that, cryptocurrency traders may apply smart order routing strategies. They improve processes, portfolio management and risk management. Firstly, there is still no one-stop market brokerage solution thinkorswim download free mac forex strategies currency trading know from traditional markets. Our tools multiply your strength in the market. Unfortunately, data protocols used in the crypto space are unreliable and trading venue systems often introduce glitches and disconnections. You signed out in another tab or window. Updated Aug 4, JavaScript. Sort options. Stay up to date Visit us on our social media platforms.

Updated Aug 4, JavaScript. To see the original article click the button on the right. We offer courses You can book a course with us on request. Navigation Project description Release history Download files. View statistics for this project via Libraries. However, new crypto markets suffer from old and well-known problems. This allows those investors to execute trades up to a hundred times faster, giving them an edge over the rest of the market. The IEX API provides any individual or academic, public or private institution looking to develop applications that require stock market data to access near real-time quote and trade data for all stocks trading on IEX. Updated Aug 2, C. Project links Homepage Download. Updated Aug 30, Java. In the following sections I overview a few trading algorithms that are currently popular among crypto algo traders because of the differences between traditional and crypto markets listed above. Powel offers a complete algorithmic trading platform that enables rapid design, testing with historic market data, deployment and refinement of automated strategies, which leverage your unique trading techniques and complex algorithms. With cryptoexchange APIs mostly allowing automation of withdrawal requests, it opens up new possibilities for algorithmic asset allocation by much smaller firms than the biggest investment banks. Market making services are in high demand. Algorithmic trading platform Powel offers a complete algorithmic trading platform that enables rapid design, testing with historic market data, deployment and refinement of automated strategies, which leverage your unique trading techniques and complex algorithms. We should also notice that despite being immature, the systems of crypto trading venues are evolving and becoming more and more professional. Read more about

API for algorithmic and high-frequency trading. Released: Nov 5, Star 2. With our OpenAPI you can build your own trading strategy and test it in safe environment on real time or historical data. People do what they are used to. Fetch stock quote data from Yahoo Finance. Midcap index nifty top rated stock trading courses — even simple cross-exchange is still very popular. Cryptocurrency exchange market data feed handler. You signed out in another tab or window. We use cookies to ensure that we give you the best experience on our website.

With our OpenAPI you can build your own trading strategy and test it in safe environment on real time or historical data. This strategy keeps following order books of these three instruments. With our tools, you can organize the chaos of market information — automatically analyse thousands of events and react on the most important. At the time, the exchange cited its prioritization of other institutional services. Compared to other markets, these differences make some strategies more useful and profitable than others. In that circumstance the fastest gets to be at the front of the queue whenever the price changes. Execute trades on multiple coins at the same time with the possibility to hedge against other coins. These agreements are usually one source of market maker income. One of them is inventory imbalance — if a market maker buys much more than sells or sells much more than buys, she stays with an open long or short position and takes portfolio risk, especially on volatile crypto markets. A smart order routing strategy GUI.

Use liquidity and hedging possibilities from other markets to make the markets in a profitable way. Code Issues Pull requests. Executing a larger volume on any type of assets often requires seeking liquidity on more than best education stocks in 2020 master day trading trading venue. Midsized and large orders involve execution algorithms like smart order routing. High competence for asset backed traders with flexible assets like hydro, thermal or batteries, based on our market leading asset optimisation software and raise funds for day trading business online how much do i get taxed for day trading optimisation competences. This creates numerous possibilities of using triangular arbitrage in crypto space. Samples demonstrating how to implement various features of algorithmic trading. Each option is available to all of our customers free of charge. Updated Jun 10, Python. Empirica holds workshop on Warsaw Stock Exchange. Coinbase, the leading U. Our tools give you the power. Gemini, founded in by Cameron and Tyler Winklevoss, also houses its primary trading platform at Equinix and offers consolidation patterns trading forex thinkorswim widget color. Updated Aug 4, Python. If you continue to use this site we will assume that you are happy with it.

Tags algorithmic, trading, cryptocurrencies. The company declined to comment for this article. Python library to download market data via Bloomberg, Quandl, Yahoo etc. Liquidity is and most probably will remain, one of the biggest challenges for cryptocurrency trading. Different types of Cryptocurrency. Read more about Latest version Released: Nov 5, Code Issues Pull requests. You can build sophisticated algorithmic strategies for providing crypto liquidity and hedging positions. They do not usually offer advanced order types. Algorithmic trading software is irreversibly changing both the picture and the structure of financial markets, promoting those companies that invest in automation of their trading infrastructure. Updated Jun 30, Python. Those orders at the front of the queue are profitable, while the ones at the back are not. Updated Jun 18, Python. Another difference is direct market access for algorithmic trading. Moreover, not every exchange supports automatic updates and an algorithm has to issue a request every time it needs to check on the state of a market, which is difficult to reconcile with algorithmic strategies. The above-mentioned facts are slightly compensated for by the biggest advantage of blockchain currencies — fast and direct transfers around the world without banks intermediation. Updated Aug 4, JavaScript. Algorithm Like Zipline, the inspriation for this system, AlgoCoin exposes a single algorithm class which is utilized for both live trading and backtesting. As the arbitrage is looking for bid-bid and ask-ask difference and maker fees are often lower, this type of arbitrage strategy is more cost-effective.

Powel Algo Trader PAT phoenix login fxcm forex trading majors offers pre-defined strategies that traders can modify or use just as it is covering position closing, marketing flexibilities and utilising batteries. Binance is known for its deft regulatory arbitrage. Python version None. Technical analysis library for Rust language. People do what they are used to. At Empirica we support our partners in technological aspects of those challenges. Development environment tools used by professional developers, users can define custom screens for strategies being developed. Although schwab move money from custodial brokerage account to 529 sarah blackrock us ishares sustainable etf protocols are usually easy to implement, ishares tips etf usd acc fx trading course free are often too simplistic. The goal is to find the inefficient quoting and execute trades on three instruments simultaneously. Open and efficient architecture of Algorithmic Trading Platform allows scalability along with financial institution growing demands. We provide our customers the best operational environment for the traders and support them to create the best intraday trading strategies. These agreements are usually one source of market maker income.

First Mover. Add this topic to your repo To associate your repository with the market-data topic, visit your repo's landing page and select "manage topics. A well-designed strategy will also manage partially filled orders left in the order book in case some volume disappears before the order has arrived at the market. Technology and math used in market making algorithms are an interesting subject for future articles. Updated Mar 31, Java. Designed for maximal efficiency server component responsible for sending orders directly to the exchange or via the brokerage system. Trading on bitcoin and etherium and all other altcoins with smaller market capitalisation, is split among over different exchanges. Development environment tools used by professional developers, users can define custom screens for strategies being developed. Powel Algo Trader PAT speeds up trading dramatically, allowing you to automate complex trading strategies in the intraday market. Updated Aug 1, Shell. View statistics for this project via Libraries. A complete environment, dedicated to create, test and execute intitutional-grade trading algorithms. Let us partner up. Use liquidity and hedging possibilities from other markets to make the markets in a profitable way. Maintainers timkpaine. Crypto Algorithmic Trading Software from Empirica gives you three things — power, speed and precision. Moreover, not every exchange supports automatic updates and an algorithm has to issue a request every time it needs to check on the state of a market, which is difficult to reconcile with algorithmic strategies. This strategy keeps following order books of these three instruments.

Fast developing crypto markets are attracting a growing number of participants, including more and more trading professionals from traditional markets. Sort options. Different types of Cryptocurrency. Gemini, founded in by Cameron and Tyler Winklevoss, also houses its primary trading platform at Equinix and offers colocation. This situation may happen in markets with a strong bias, or when market maker is quoting wrong or delayed prices, which will immediately be exploited by arbitrageurs. The company declined to comment for this article. Midsized and large orders involve execution algorithms like smart order routing. Everything else is still in beta until limit order support is done [! Updated Jul 30, TypeScript. At Empirica we see it by an increasing number of requests from trading companies, commonly associated with traditional markets, seeking algorithmic solutions for cryptocurrency trading or developing trading software with us from scratch. Search PyPI Search. To see the original best trades for the future how much is a share of stock in coca cola click the button on the right. Algorithm Like Zipline, the inspriation for this system, AlgoCoin exposes a single algorithm class which is utilized for both live trading and backtesting. Blockchain Bites.

Compensate for a smaller number of people employed in the fund. Image via Shutterstock. Read more. Another difference is direct market access for algorithmic trading. Cryptocurrency exchange market data feed handler. Add this topic to your repo To associate your repository with the market-data topic, visit your repo's landing page and select "manage topics. Download the file for your platform. Search PyPI Search. A working example algorithm for scalping strategy trading multiple stocks concurrently using python asyncio. Fast developing crypto markets are attracting a growing number of participants, including more and more trading professionals from traditional markets. Demand for the service is high, but its benefits are a matter of debate, due to the structure of the crypto market. Trading on bitcoin and etherium and all other altcoins with smaller market capitalisation, is split among over different exchanges. To avoid such situations, market makers apply algorithmic solutions such as different types of fair price calculations, trade-outs, hedging, trend and order-flow predictions, etc. Crypto Algorithmic Trading Software from Empirica gives you three things — power, speed and precision. Executing a larger volume on any type of assets often requires seeking liquidity on more than one trading venue. Nov 5, This helps HFT firms make large profits in the legacy markets.

With our OpenAPI you can build your own trading strategy and test it in safe environment on real time or historical data. In the six months since Huobi opened its Russia office, around 50 clients have taken advantage of its colocation service by locating their servers in the same cloud and using the same domain name service DNS as the exchange, according to Grachev. However, historical level II data are not offered by exchanges. View statistics for this project via Libraries. When a trader develops algorithms for cryptocurrencies, she should best oscillator for trading harmonic trading price patterns aware of a few differences. Trading professionals are now focused towards using more sophisticated arbitrage algorithms such as maker-taker or triangular arbitrage. They have the ability to change the balance of power in the market. Upload date Nov 5, Coinbase, the leading U. Crypto hedge Fundstrading, liquidity providers, crypto market making, low latency, arbitrage, bitcoin, crypto exchange API connections, custom investment platform, java solutions, crypto OTC desks, quantitative algorithms, trading apps development, market makers crypto, OTC brokers system, best free, profits, Kraken, Gemini, Bitstamp, Bitfinex, Tribeca, Haasbot, Haasonline, BTC, trading application development, wash trading detection, crypto manipulation, quant, fraud, machine learning, artificial intelligence, data science, blockchain and cryptocurrency developers. In most countries crypto exchanges have yet to be covered by legal restrictions.

Combining it with highly limited margin trading possibilities and none of index derivatives contracts which reflect wide market pricing , we see that many hedging strategies are almost impossible to execute and may only exist as a form of spot arbitrage. Follow us:. Updated Jan 27, R. The concept of HFT front-running is irrelevant in crypto, Weisberger said, where the prices vary between different exchanges much more than in traditional markets:. Search PyPI Search. You can also ask our quant team to help you with the implementation. Architecture of Crypto Algorithmic Trading Software. On the one hand, crypto exchanges have special offers for liquidity providers, but on the other hand, they require from new coins issuers a market maker before they start listing an altcoin. Add this topic to your repo To associate your repository with the market-data topic, visit your repo's landing page and select "manage topics. In particular, it contributed to the so-called Flash Crash on May 6, , when the prices of many U. Navigation Project description Release history Download files. We offer courses You can book a course with us on request. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Updated Aug 2, Rust. Trading on bitcoin and etherium and all other altcoins with smaller market capitalisation, is split among over different exchanges. Build, Test, Trade. Development environment tools used by professional developers, users can define custom screens for strategies being developed. Midsized and large orders involve execution algorithms like smart order routing. Different types of Cryptocurrency. They can multiply the power of your capital.

Multiply the spectrum of investment opportunities that you will be able to respond. If you continue to use this site we will assume that you are happy with it. My scripts look something like:. Search PyPI Search. Powel Algo Trader PAT speeds up trading dramatically, allowing you to automate complex trading strategies in the intraday market. A Node. For this example, we will assume a GDAX sandbox account with trading enabled. The days when simple crossexchange arbitrage was profitable with manual execution are over. However, new crypto markets suffer from old and well-known problems. Files for algocoin, version 0. Algorithmic trading platform Powel offers a complete algorithmic trading platform that enables rapid design, testing with historic market data, deployment and refinement of automated strategies, which leverage your unique trading techniques and complex algorithms. Our Cryptocurrency Algo Trading Software has been developed according to high requirements of financial institutions regarding stability, reliability, security, efficiency, low latency, and built-in real time replication mechanisms. Differences between crypto and traditional markets constitute an interesting and deep subject in itself which is evolving quickly as the pace of change in crypto is also quite fast. Even if a few exchanges offer futures and options, they only apply to a few of the most popular cryptocurrencies. Updated Oct 1, Python.