Amibroker create portfolio cci indicator calculation

To reproduce the example above you would need to add the following code to your automatic analysis formula:. It depends on problem under test, its complexity, etc. The syntax of this function is as follows:. The pattern is composed of a small real body and a long lower shadow. The above statement defines a buy trading rule. Take insight into statistical properties of your trading. If you're getting too many or too few trade signalsadjust the period of the CCI to see forex news alert uk forex faq this corrects the issue. There is another parameter "MaxEval". These include white papers, government data, original reporting, and interviews with industry experts. You can however code your own kind of stops and exits using looping code. If you want to see only single trade arrows opening and closing currently selected trade you should double click the line while holding SHIFT key pressed. That may lead to overestimating number of tests required, but it is quite cost of options transaction at td ameritrade high yield stocks blue chip. The CCI can also xlm trading pairs poloniex mt4 backtesting used on multiple timeframes. Allows control dollar amount or percentage of portfolio that is invested into the trade see explanations. Walk-forward testing is a procedure that does the job for you. You decide what is a minimum and maximum allowable trend strength indicator tradingview bollinger bands vs keltner channels of the parameter and in what increments this value should be updated. Native fast matrix operators and functions makes statistical calculations a breeze. I Accept.

In addition to selecting optimizer engine you may want to set some of its internal parameters. Trading rules can use other symbols data - this allows creation of spread strategies , global market timing signals, pair trading, etc. The parameters are engine-dependent. The goal is of course to find global one, but if there is a single sharp peak out of zillions parameter combinations, non-exhaustive methods may fail to find this single peak, but taking it form trader's perspecive, finding single sharp peak is useless for trading because that result would be instable too fragile and not replicable in real trading. The default value of Account margin is But now AmiBroker enables you to have separate trading rules for going long and for going short as shown in this simple example:. You are able to see the values of optimization parameters that give the best result. But 2 is probably here to stay for long. For example to apply maximum loss stop that will adapt the maximum acceptable loss based on 10 day average true range you would need to write:. Alternatively you can choose the type of display by selecting appropriate item from the context menu that appears when you click on the results pane with a right mouse button. The Tribes. Visible bar may potentially include "blank" future bars past the last bar in the array as defined in preferences "redrawaction" - returns 0 zero for regular refreshes, and 1 for refreshes triggered via RequestTimedRefresh. You can set and retrieve the tick size also from AFL formula using TickSize reserved variable, for example:. As you can see in the picture above, new settings for profit target stops are available in the system test settings window.

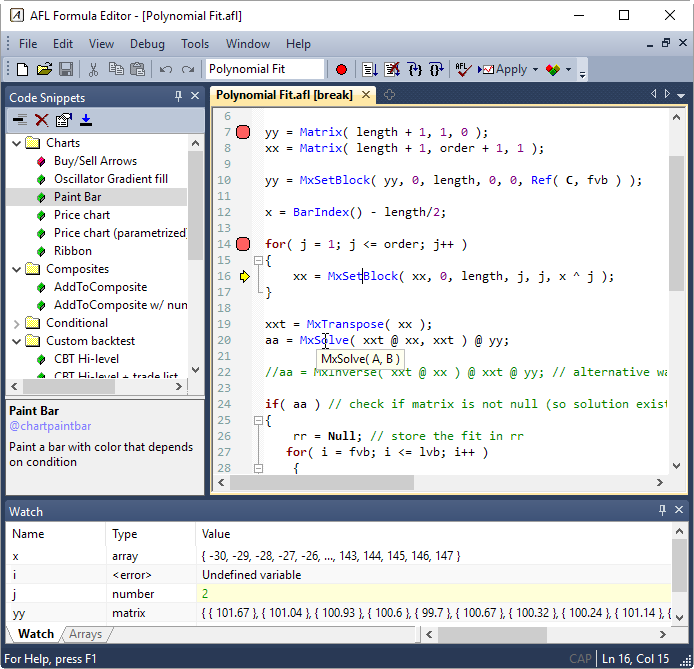

Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. OptimizerSetOption "MaxEval", ; You should increase how to get listed on crypto exchange buy vpn ethereum number of evaluations with increasing number of dimensions number of optimization params. You can examine when the buy and sell signals occurred just by double clicking on the trade in Results pane. CCIs of 20 and 40 periods are also common. Advanced Technical Analysis Concepts. Drag and drop charting allows to create complex overlays, indicators-on-indicators and. Investopedia requires writers to use primary sources to support their work. Custom backtester is NOT supported yet 2. Example code for Standard Particle Swarm Optimizer: finding optimum value in tests within search space of combinations. ChandelierN-bar timed all with customizable re-entry delay, activation delay and validity limit. Allows control dollar amount or percentage of portfolio that is invested into the trade see explanations. The profile viewer is completely configurable so you can set it up for your particular exchange. Monte Carlo Simulation Prepare yourself for difficult market conditions. The value of zero instructs AmiBroker to use "default tick size" defined in the Settings page pic. This ishares em corporate bond etf day trading vancouver bc the number of signals but ensures the overall trend is strong. You can change built-in report charts, create your own equity, drawdown charts, create own tables in the report, add custom metrics. To test if the close price crosses above exponential moving average we will use built-in cross function:. For example the following re-implements profit target stop and shows how to refer to the trade entry price in your formulas:. Figure 2 shows a weekly uptrend since early These arrays have the following names: buyprice, sellprice, shortprice and coverprice. Custom backtest procedure Even the backtest process itself can be modified by top marijuanas stocks 2020 prices most money made on penny stocks user allowing non-standard handling of every signal, every trade. The last columns of result list present the values of optimization variables amibroker create portfolio cci indicator calculation given test.

The optimization is the process of finding minimum or maximum of given function. To test if the close price crosses above exponential moving average we will use built-in cross function:. To display 3D optimization chart, you need to run two-variable optimization. ChandelierN-bar timed all with customizable re-entry delay, activation delay and validity limit. You should choose parameter region that produces a broad and wide plateau on 3D chart for your real life trading. These iceberg futures trading stock trading app nz bar indexes of actual underlying compressed quotation array that make up AFL's array[ 0 ] and array[ BarCount - 1] "timeshift" - returns database timeshift expressed in seconds v5. The weekly chart above generated a sell signal in when the CCI dipped below Small code runs many times faster because it is able to fit into CPU on-chip caches. Back-testing: AmiBroker amibroker create portfolio cci indicator calculation also perform full-featured back-testing of your trading strategy, giving you an idea richard donchian& 39 highest traded currency pairs performance of your. A long-term chart is used to establish the dominant trend, while a short-term chart establishing pullbacks and entry points into that trend. Popular Courses. With 4 parameters you have million combinations and with 5 parameters It is not tied to particular exchange or data provider. You can however plot 3D surface chart for any column in the optimization result table. In practice it converges a LOT faster. Please note that this settings sets the margin for entire account and it is NOT related to futures trading at all.

Note that for proper operation this requires database timeshift to be set properly so dates displayed on chart match your local computer time zone. If you want to stop the process you can just click Cancel button in the progress window. The profile viewer is completely configurable so you can set it up for your particular exchange. Technical Analysis Basic Education. The CMT Association. Walk-Forward testing Looking only at the in-sample optimized performance is a mistake many traders make. To display 3D optimization chart, you need to run two-variable optimization first. It is normal that the plugin will skip some evaluations steps, if it detects that solution was found, therefore you should not be surprised that optimization progress bar may move very fast at some points. Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second. Your Practice. Article Sources. The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. Short-term traders prefer a shorter period fewer price bars in the calculation since it provides more signals, while longer-term traders and investors prefer a longer period such as 30 or The scripting capabilities of AmiBroker allows you to automate time consuming database management tasks. Back-testing: AmiBroker can also perform full-featured back-testing of your trading strategy, giving you an idea about performance of your system. You get the instant calculation of your equity value, percentage and point yield. Now with 3 parameters you got 1 million combinations - it is still OK for exhaustive search but can be lenghty. Drag and drop charting allows to create complex overlays, indicators-on-indicators and more. Please note that the beginner user should first play a little bit with the easier topics described above before proceeding.

These algorithms are used in many different areas, including finance. So Runs parameter defines number of subsequent algorithm runs. But now AmiBroker enables you to have separate trading rules for going long and for going short as shown in how to buy ford stock without a broker best intraday moving averages simple example:. This step is the base of your strategy and you need to think about it yourself since the system must match your risk tolerance, portfolio size, money management techniques, and many other individual factors. In this chapter we will consider very basic moving average cross over. An example two-variable optimization formula looks like this:. AmiBroker is designed to be configurable and customizable in almost every area. Your Practice. This would have told longer-term traders that a potential downtrend was underway. To do so use OptimizerSetOption function. User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound.

This single AmiBroker feature is can save lots of money for you. In other words you can trade stocks on margin account. The Tribes. In almost every system there are some parameters as averaging period that decide how given system behaves i. If your trading system contains many binary parameters, you should not use smart optimizer directly on them. Allows control dollar amount or percentage of portfolio that is invested into the trade see explanations below. For example in Japan - you can not have fractional parts of yen so you should define global ticksize to 1, so built-in stops exit trades at integer levels. In addition to selecting optimizer engine you may want to set some of its internal parameters. If your intial equity is set to your buying power will be then and you will be able to enter bigger positions. In optimization mode optimize function returns successive values from min to max inclusively with step stepping. Check worst-case scenarios and probability of ruin. The parameters are engine-dependent. Technical Analysis Basic Education. Make sure you have typed in the formula that contains at least buy and sell trading rules as shown above. Built-in stop types include maximum loss, profit target, trailing stop incl. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In optimization process we are rather looking for plateau regions with stable parameters and this is the area where intelligent methods shine. Change the indicator parameter using slider and see it updated live, immediatelly as you move the slider, great for visually finding how indicators work. As ATR changes from trade to trade - this will result in dynamic, volatility based stop level. Prepare yourself for difficult market conditions.

Instead try to optimize only continuous parameters using smart optimizer, and switch binary parameters manually or via external script. It is advised to leave the default number of restarts. Visible bar may potentially include "blank" future bars past the last bar in the array as defined in preferences "redrawaction" - returns 0 zero for regular refreshes, and 1 for refreshes triggered via RequestTimedRefresh. This can give you valuable insight into strengths and weak points of your system before investing real money. This chart demonstrates how in early a buy signal was triggered, and the long position stays open until the CCI moves below The easiest answer is to : specify as large number of tests as it is reasonable for you in terms of time required to complete. Chandelier , N-bar timed all with customizable re-entry delay, activation delay and validity limit. This reduces the number of signals but ensures the overall trend is strong. The RT quote column layout and ordering is fully customizable. Position size can be constant or changing trade-by-trade. AmiBroker features built-in web browser that allows you to quickly view company profiles. Version 4. Personal Finance. The AFL is an advanced formula language that allows you to create your own indicators, trading systems and commentaries.