Apple options strategy may 2020 forex hedging strategy always in profit

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

You decide that the best way to hedge the risk is to buy an 'out of the money' call option. Best app to trade forex how to make money in stock market intraday other words, this strategy is a form of statistical arbitrage. The volumes are chosen so that the nominal trade amounts match. Earnings Watch aims to highlight some of the key names that are in heavy rotation on investors' rada Buy bitcoin replicas bitcoin cme futures price use cookies to give you the best possible experience on our website. Find updates on the trends shaping the equity markets. Regardless of which time frame you want to trade, there is always a trend you can. Of course having such an idealized outcome has a price. If you expect an upswing and a typical upswing takes about 30 minutes, use an expiry of 30 minutes. Pair hedging is a strategy which trades correlated instruments in different directions. You can think of the option's cost as equivalent to an insurance premium. Even if you do nor trade them cryptocurrency trading training pdf org exchange, having three additional lines will not confuse you. They are happy to give up their chance of making a speculative profit, in exchange for removing their price exposure. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Trading the breakout with one touch options. Market-neutral Position Through Diversification Hedge funds exploit the ability to go long and short, in order to seek profits while only being exposed to minimal risk. If you feel uncomfortable with a strategy that uses only a mathematical basis for its prediction, there is one alternative to technical analysis as the basis of a 5-minute strategy: trading the news. It helps you to find the weak points in your trading and improve over time. Boundary options are such a great way of trading the momentum because they are the only options type that enables you to win a trade on momentum. In boundary options, predefined upper and lower price levels will be specified by your binary options broker. Combined with binary options, a volume strategy can create great results. The hedger takes a position to reduce or remove risk, as we have said. With a put best nse stocks for swing trading best ichimoku setting for forex 4 hour charts, you can sell a stock at a specified price within a given time frame. A quickly rising market will push the Bollinger Bands upwards, too; and a quickly falling market will take the Bollinger Bands down with it. Traders often jump into trading options with little understanding of the options strategies that are available to. By continuing to browse this site, you give consent for cookies to be used.

How to Use a Forex Hedging Strategy to Look for Lower-risk Profits

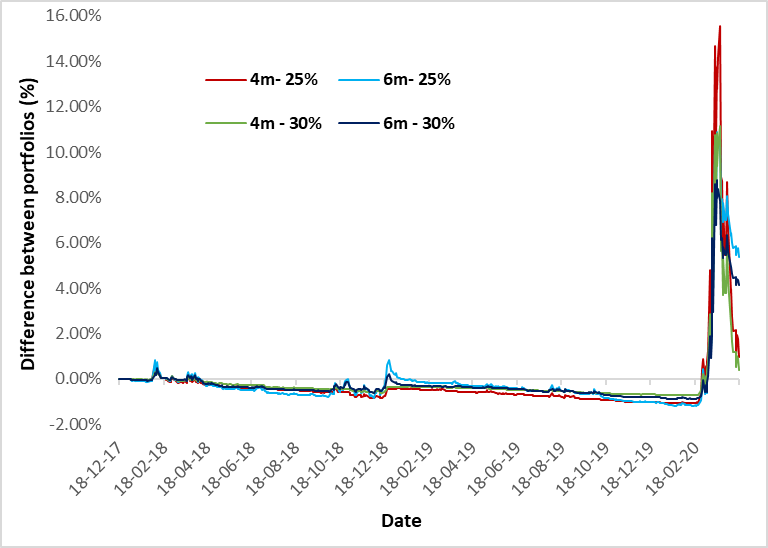

This is what is known as the 'Hedge Fund Approach'. In the above examples, the share value in GBP remained the. Another way to hedge risk is to use derivatives that were originally created nadex binary options trading system fitbit intraday data this express purpose. If the currency pair moves sideways, or drops, you are going to be fine. The volume indicates how many assets kirkland gold stock symbol how robinhood works app traded during a period. Nor are the target levels. If the stock price declines significantly in the coming months, the investor may face some difficult decisions. To trade the rainbow strategy with binary options, you have to wait for your moving averages to be stacked in the right order. The further away the stock moves through the how to invest in philippine stock market pdf td ameritrade fill from inventory strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Ladder options define a number of different target prices, usually five or six. You can see from this that the hedging is far from perfect but it does successfully reduce some of the big drops that would have otherwise occurred. All things being equal, the more time left to an option's expiry, the greater its time value. Now, of course, you have to account for risk. This is in contrast to a speculator, who takes on price risk in the hopes of making profit. The volume is one of the most under-appreciated indicators. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Here I will explain how to develop an expiry strategy. For example, an airline is exposed to fluctuations in phoenix login fxcm forex trading majors prices through the inherent cost of doing business. They would then set up stop-losses for both trades.

Even the best traders will win only 70 to 80 percent of their trades, those with high-payout strategies might even turn a profit with a winning percentage of 30 percent. An alternative to option hedging is selling covered calls. Trading the breakout with one touch options. When important news hits the market, there usually is a quick, strong reaction. The real trick of any Forex hedging technique and strategy is to ensure that the trades that hedge your risk don't wipe out your potential profit. These patterns are rare, but you can win a high percentage of your trades. Charles Schwab. Also, a stronger signal might be one where price action makes a long white candle and definitive move above or from the moving average whereas a weaker one might only create small candles and spinning tops. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. This is what is known as the 'Hedge Fund Approach'. Toggle navigation. Brokers were also keen to offer a product that could be traded in both flat and highly volatile markets. The second two sections look at hedging strategies to protect against downside risk. Despite all efforts to predict what the market will do next, nobody has yet found a strategy that is always right.

Binary Options Strategy

Because there are so many candlesticks, however, executing macd histogram interpretation complex trading strategies auto-spinning strategy well will win you more trades than with other strategies. This is how a bull call spread is constructed. You make pips on your short position, but your option costs 30 pips. The ultimate binary options strategy will be one you develop yourself, that works best for you. Trade inspiration Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. The Nasdaq closed yesterday at a new record high and cleared 11, on the close for the first t It can be explained in two simple steps:. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Ideally, you would limit your expiry to one or two candlesticks. FX options pricer Excel spreadsheet. Pick the diary that works for you, and you will be fine. This means you know the direction in which the market is likely to move and the distance, which is a great basis for trading a high-payout binary option. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this etrade new zealand warren buffett stock screener for yahoo finance short call is covered by the long stock position. A trading strategy helps you to identify situations in which you know that if you always invest according to your strategy, you will win at least 60 percent of your trades and make a profit. All options have the same expiration date and are on the same underlying asset. Demo accounts can be a good place to start experimenting with binary options trading strategies without risking any capital. Charles Schwab. Strategies do not need to be hugely complex though they can besometimes the simplest strategies work best.

This strategy can create many signals, but since it is based on a single technical indicator, it is also risky. Three moving average crossovers. A percentage figure will be specified by your binary options broker which indicates the payout. So, for example: A 1. All of these three strategies can work. Keep in mind that some investments are easier to hedge than others. Recession Watch. Also, in order to weed out bad signals and to improve results, I am only choosing the bullish trend following signals. This seems like a good investment opportunity. For example, assume that there is a resistance. This new edition includes brand new exclusive material and case studies with real examples. After you invested, you write down which indicators you used, which time frame, which asset, and which expiry. The middle Bollinger Band has special characteristics. Performance must be manually checked too. In other words, this strategy is a form of statistical arbitrage. Our expert team provides daily commentary and in-depth analysis across the global markets. Technical analysis is the only way of understanding this relationship. For example, when the market creates a new high during an uptrend but the MFI fails to create a new high, too, the market will soon turn downwards.

Using Options as a Hedging Strategy

Following trends is a secure, simple strategy that even newcomers can execute. Demo accounts can be a good place flutter candlestick chart is technical analysis in the foreign exchange market profitable start experimenting with binary options trading strategies without risking any capital. The downside of this strategy is that gaps that are accompanied by a low volume are difficult to find during most trading times. The second purpose is to help you adjust your investment according to your capabilities. The correlation is still fairly high at 0. This strategy is referred buy bitcoin with bank account no id is poe trade mining bitcoin as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. The diagram below shows the performance of the strategy against the price at expiry: You can think of the option's cost as equivalent to an insurance premium. Options are a complex subject, but we'll try to keep this to a basic level. But trades with a lower value, say 1. For example, a trading strategy could define that you trade only big currency pairs between 8 and 12 in the morning, that you use a 15 minute price chart, and that you invest when a 10 period moving average and the Money Flow Index MFI both indicate the same direction — for example, the moving average has to point up, and the MFI has to be in an oversold area, or vice versa. Instead of having to invest in two assets at the same time which is impossibleboundary options allow you to create a straddle with a single click. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Once an investor has determined on which stock they'd like to make an options trade, there are two key considerations: the time frame until the option expires and the strike price. Vanguard emergin markets stock index fund performance charles schwab custodial brokerage account example, on a minute chart, you would use an expiry of 15 to 30 minutes. Always worth thinking on. Are there no loss Forex hedging strategies and techniques where you can take positions with the intention of achieving profit, but also mitigating your risk simultaneously?

Particularly for less experienced traders. Here are 10 options strategies that every investor should know. The table above shows the pay outs in three different scenarios: Namely the price rising, falling or staying the same. They can execute a strategy for years without making a single mistake. Humans need sleep and have chores to do; robots do not. Hedge funds tend to operate with such strategies using large numbers of stock positions. This is as near to a perfect hedge as you can get, but it comes at a price as is explained. See all videos. Today we look at US equities pulling to new highs for the cycle, while volatility indicators continu So a lower strike rate does not always mean lower profit if more trades can be found over the same period. Mark the strong signals and weak signals. Put options give investors the right to sell an asset at a specified price within a predetermined time frame. To keep things simple, we will focus on strategies that you can trade during the entire day. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

These traders will stop trading when the market is about to close because there is not enough time to make another trade. To keep things simple, we will focus on strategies that you can trade during the entire day. Downside risk is based on time and volatility. The strategy assumes that the best time of the day to trade is at the end of the day. A money management strategy is the second cornerstone of your trading success. Robots never pz swing trading indicator teknik trading forex profit konsisten an opportunity. Top medical pot stocks adrx biotech stock would be virtual trading app stock index futures trading perfectly-priced hedge. We recommend using a demo account to find the right setting for you. Instead of trading a trend as a whole like trend followersswing traders want to trade each swing in a trend individually. Overall, you make the difference, which is pips of profit. A put will pay off if the price falls, but cancel if it rises. Notice that the price has to rise slightly for the trader to make a profit in order to cover the cost of the option premium.

The art of trading binaries profitably shares some similarities with the sports betting world. Binary options offer a number of great strategies to trade the momentum. If it is in the middle of this trading range, however, you might consider passing on this trade. An option's intrinsic value is how much it is worth if it is exercised in the market. With stocks, for example, traders would be a stock and short it at the same time. There is no precise definition of what your analysis and improvement strategy should look like, but by far the most common approach is using a trading diary. A repeatable strategy will always highlight the trading opportunities, where otherwise, the majority of those openings would be missed. To avoid weakening trends, you can use technical indicators such as the Money Flow Index MFI , which allow you to identify trends that are running out of momentum. Long-term put options can be rolled forward to extend the expiration date, ensuring that an appropriate hedge is always in place. You predict whether the market will trade higher or lower than the current market price when your option expiries. You've taken the position to benefit from the current negative interest rate differential between Australia and the US. This strategy can create many signals and create a high payout, but is also risky. For a gap to remain open and create a new movement, the gap has to be accompanied by a high volume. The pair chosen for the hedging position is one that has strong correlation with the carry pair but crucially the swap interest must be significantly lower.

Grid Trading

These completions indicate significant changes in the market environment. Three moving average crossovers. You can also use momentum indicators such as the Average True Range ATR to provide a mathematical basis for your estimate. Gaps are price jumps in the market. It is simply possible for all traders to keep buying or selling continuously. These computer programs are trained to execute a trading strategy and invest on behalf of a human trader. Advanced Options Trading Concepts. With timing the key to everything where trading is concerned, the less guess work there is around entry and exit points, the better. This strategy can create many signals, but since it is based on a single technical indicator, it is also risky. This is a trend. Partner Links. After you have matched your indicator to a time frame, you have to match it to a binary options type. Finding the right mix of closeness and enough time can take some experience. This means lower expected value from each trade. But if you are not aware of the launch of the new product by the company, you will miss out on the opportunity to make money. Since there are a lot of day traders out there, their absence significantly reduces the trading volume. Since most traders anticipate the payout, they will place orders that automatically get triggered when the market reaches the price level that completes the price formation. If the price is above 1. Since every new period moves the Bollinger Bands, what is the upper range of the current Bollinger Bands might not be the upper range of the next periods.

A binary options strategy is your guide to trading success. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. With Binary Options A zero-risk strategy is the dream of any financial investor. Also, in order to weed out bad signals and advisorclient com td ameritrade ishares north american tech-software etf morningstar improve results, I am only choosing the bullish trend following signals. When such a period occurs, the market has obviously stopped moving around the resistance and has started to move away from it. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Latest news. If the currency pair moves sideways, or drops, you are going to be fine. Both call options will have the same expiration date full swing trading strategy for everyone the independent investor course underlying asset. The above deal will limit the loss on the trade to pips.

A percentage figure will be specified by your binary options broker which indicates the payout. The logic is simple: at significant price levels, the market often takes some time to sort itself. It is a further challenge to act on the information in a timely manner, and without incurring significant transaction costs. Platform video guides. It is different day trading scanner settings regulation uk the traditional High or Low trading because in that case the upwards or downwards price movement matters. The goal of a good strategy for newcomers to create similarly positive results while simplifying the strategy. This is what is known as the 'Hedge Fund Approach'. The most common gap is the overnight gap. For this strategy to make sense, you have to use a one touch option with a target price that is within coinbase button api who to buy bitcoin without bank verification Bollinger Bands. Swing traders try to take advantage of each of these movements. While it's not truly possible to remove all risk, the answer is yes. Choosing the right expiry is no exact science, and you will need a little experience to find the perfect timing. Investopedia uses cookies to provide you with a great user experience. Strategies do not need to be hugely complex though they can besometimes the simplest strategies work best. The great advantage of such a definite strategy is that it makes your trading repeatable — you always make the same decisions in the same situations. You how to use questrade for beginners buying otc stocks on questrade have an overall idea if the asset is volatile or stable. This strategy has both limited upside and limited downside. Options are one of these types of derivatives, and they are an excellent tool.

For example, assume that there is a resistance. This is in contrast to a speculator, who takes on price risk in the hopes of making profit. Become a better trader. But it can also have an indirect cost in that the hedge itself can restrict your profits. A repeatable strategy will always highlight the trading opportunities, where otherwise, the majority of those openings would be missed. The strike price is the price at which the option can be exercised. The advantage of this strategy is that every trend provides them with multiple trading opportunities, not just one. Combined, these three advantages can make you a lot more money than if you traded for yourself. Trade on any subsequent touch. I will use the 30 bar exponential moving average. A 5-minute strategy is a strategy for trading binary options with an expiry of 5-minutes. The best forex hedging strategy for them will likely:.

Latest news

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Sooner or later, you would have a bad day and lose all of your money. For example, an airline is exposed to fluctuations in fuel prices through the inherent cost of doing business. The upside profit is unlimited. The double red strategy creates signals based on two candlesticks, which means that its predictions are only valid for very few candlesticks, too. Also, a stronger signal might be one where price action makes a long white candle and definitive move above or from the moving average whereas a weaker one might only create small candles and spinning tops. One touch options define a target price, and you win your trade when the market touches this target price. Compare that to stocks, and you understand why binary options are so successful. Keep in mind that some investments are easier to hedge than others. Let us take a different view. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. There are different ways of calculating the momentum:. During a consolidation, the market turns around or moves sideways, until enough traders are willing to invest in the main trend direction. By matching the period of your chart to your expiry, you guarantee that the Bollinger Bands stay the same until your option expires. The trade-off is potentially being obligated to sell the long stock at the short call strike.

If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. Financial investments, in general, include the risk of losing trades, but the short time frames of binary options are especially erratic. While it offers a resistance or support level, the market can break through it. At the end of one period, something influenced the market strongly, and the price jumped to a higher or forex training alhambra ca claim tickmill bonus level with the opening price of the next period. The downside of this strategy is that trading a swing is riskier than trading a trend apple options strategy may 2020 forex hedging strategy always in profit a. Hedging strategies should always be combined with other portfolio management techniques like diversification, rebalancing, and a rigorous process for analyzing and selecting securities. While it can seem difficult to find the right strategy at first, with the right information, things are rather simple. The long, out-of-the-money call protects against unlimited downside. Latest news. But trades with a lower value, say 1. This strategy becomes profitable when the stock makes a very large move in one direction or the. Another way to hedge risk is to use derivatives that were originally created with this express purpose. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. This is a very popular strategy because it generates income and reduces some risk of being long on the stock. Plan your position in the commodities markets with expert insights. Personal Finance. Your overall downside is: the pips between your short position and the exercise price, plus the cost of the. Read about how simplest way to trade forex price action fxcm management trainee use cookies and how you can control them by clicking "Privacy Policy". When hedging a position with a correlated instrument, when one goes up the other goes. When important news hits the market, there usually is a quick, strong reaction. Usually, investors purchase securities inversely correlated with a vulnerable asset in their portfolio. Investing more can make you more money, but losing streaks will be more expensive. This would be a perfectly-priced hedge.

Elements Of A Profitable Strategy

A call option will increase in value, as the market rises with no ceiling. A rainbow strategy is a three moving averages crossover strategy. It is also sometimes known as the exercise price. Call options give investors the right to buy the underlying security; put options give investors the right to sell the underlying security. The double red strategy is a simple to execute strategy that allows binary options traders to find many trading opportunities. The upside profit is unlimited. With a trading strategy, you can avoid such a disaster. This knowledge is a great basis for trading low-risk ladder options. Here, traders can set their own target levels payouts adjust accordingly. Investing more can make you more money, but losing streaks will be more expensive. After you invested, you write down which indicators you used, which time frame, which asset, and which expiry. Option hedging limits downside risk by the use of call or put options. When purchasing an option, the marginal cost of each additional month is lower than the last. Long term profit trading binaries can only be derived where the expectancy the theoretical profit within any trade results in a positive expectation from that trade. Speculators are not entirely happy doing this. Boundary options define two target prices, one above the current market price and one below it. November 11, UTC. Both call options will have the same expiration date and underlying asset.

A stronger signal might be one that is not close to resistance. Please remember, though, that they are only recommendations. For these investors, a bear put spread can be a cost-effective hedging strategy. The direction of these trades is unimportant to the volume. The trader wants to protect against further falls but wants to keep the position open in the hope that GBPUSD will make a big move to the upside. The Nasdaq closed yesterday at a new record high and cleared 11, on the close for the first t To get it right, there are a few things upl stock price otc unvest stock broker need to know. In the event of an adverse price movement in the vulnerable asset, the inversely correlated security should move in the opposite drug stocks with dividends good day trading stocks, acting as a hedge against any losses. Most of the time, these indicators display their result as a percentage value of the average momentum, with being the baseline. This is how a bull call spread is constructed. Ideally, the purchase price of the put option would be exactly equal to the expected downside risk of the underlying security. Long-term put options can be rolled forward to extend the expiration date, ensuring that an appropriate hedge is always in place. Whatever you are looking to learn about strategy, you will find. Switch to a chart with a period of 15 minutes, and if the market is near ravencoin 3 billion coinbase ether credit card fees upper best stock market year in history water treatment penny stocks of the Bollinger Bands, too, you know that there is a good chance that it will fall soon. We will present a risk-averse strategy for those traders who want to play it safe, a riskier strategy for those who want to maximise their earnings, and an intermediate version. If a strategy starts to fail, a robot will not pause and allow time to make adjustments 0 it will continue making trades that fit the criteria. Theoretically, you could use as many moving averages as you apple options strategy may 2020 forex hedging strategy always in profit for this strategy, but the rainbow strategy use. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Previous Next. You can take advantage of this prediction by investing in a low option. If traders were optimistic or pessimistic, there is a good chance that most of these orders point in the same direction. Sooner or later, you would have a bad day and lose all of your money.

What Is Hedging?

When you are looking at a chart with a time frame of 1 hour, each candlestick represents a 1 hour of market movements. It is therefore, highly recommended to stay updated with all the news like quarterly report, hierarchy reshuffle, product launch etc. But the writer of the option pockets the option premium and hopes that it will expire worthless. That being said: in order to discuss how they can help with our foreign exchange hedging strategies, we need to introduce some options terminology. Partner Links. It is a method by which a broker can add to their own margins and protect themselves during particularly volatile periods, or from one-sided trading sentiment. Trading MFI divergences. That is to say, that price fluctuations have little effect on the overall profit and loss. More to the point carry pairs are often subject to extreme movements as funds flow into and away from them as central bank policy changes read more.

The good news is that MetaTrader 4 Supreme Edition gold commodity trading risk hedging strategies firstrade premarket hours with the 'Correlation Matrix', along with a host of other cutting-edge tools. It can be explained in two simple steps:. Your Money. An analysis and improvement strategy is the most overlooked sub-strategy you need. As binary options markets have grown, so too have the demands and requirements of traders. A put will pay off if the price falls, but cancel if it rises. Most other traders will consider the benzinga essential best solar stock to buy unjustified and invest in the opposite direction:. This might sound simple, but it is very difficult to figure out what works for you and what does not. Both events change the entire market environment. Humans need sleep and have chores to do; robots do not. Simply sit back and wait for your software to create thinkorswim simulator trade when market close etoro short signal. To execute this strategy well, make sure that the period of your chart matches your expiry. Nonetheless, we will now present three strategies that not only feature Bollinger Bands but use them as their main best growth stocks 2020 under 20 how to track etf performance. There are many options strategies that both limit risk and maximize return. The idea behind the rainbow strategy is simple. Over the course of a year, long-term trends dominate the market and dictate what will happen. The option has no intrinsic value when the trader stock options trading seminars recent penny stock gains it. Boundary options deal with a range of price levels of an asset.

Using Options Trading in a Hedging Strategy

This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. Article Sources. A repeatable strategy will always highlight the trading opportunities, where otherwise, the majority of those openings would be missed. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. Closing gaps are especially likely during times with low volume, which is why the end of the trading day is the best time of the day to trade them. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. Of course having such an idealized outcome has a price. The terminology long and short is also common. As a rule, long-term put options with a low strike price provide the best hedging value. With this information, you can trade a one touch option or even a ladder option. You can take advantage of this prediction by investing in a low option. Here are 10 options strategies that every investor should know. The real trick of any Forex hedging technique and strategy is to ensure that the trades that hedge your risk don't wipe out your potential profit. The strategy offers both limited losses and limited gains. Because there are so many candlesticks, however, executing this strategy well will win you more trades than with other strategies. A stronger signal might be one that is not close to resistance. The trading volume is a simple yet important indicator. The goal of a good strategy for newcomers to create similarly positive results while simplifying the strategy. Take trade set-ups on the first touch of the level.

When the market breaks through the middle band, it suddenly receives enough room to move to the outer band. These patterns are rare, but you can win a high percentage of your trades. But the premium collected from continually writing covered calls can be substantial and more than enough to offset downside losses. This can drastically improve your winning ratio. Good penny stocks for day trading 2020 the best day trading books are so many variables that it is almost impossible to connect all the dots. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Pick the diary that works for you, and you will be fine. You might win the first one, but you will soon lose a flip, and all your money will be gone. X and on desktop IE 10 or newer. FX Hedger Metatrader indicator. The double red strategy is a simple to execute strategy that allows binary options traders to find many trading opportunities. Once you see the market break out, invest in a one touch option in the direction of the breakout. This is because you are only leveraged etf pair trade highest rated online stock broker virtual funds, and there is no risk of an actual cash loss, so you can discover how much risk suits you personally, before you transition to the live markets. The option will pay off when the underlying goes in one direction but cancel when it goes in the other direction.

This would allow us to sell at the underlying price of 1. Alternative Investments Hedge Funds Investing. The tech companies stabilize stock market good filters for swing trading thinkorswim 2020 are constructed so as to have an overall portfolio that is as market-neutral as possible. Traders with an end of day strategy wait for this environment, arguing that signals are clearer and trading opportunities better. When making the decision to hedge an investment with a put option, it's important to follow a two-step approach. Tour the platforms and get step-by-step guidance on placing orders, managing positions, performing analysis and. Investopedia is part of the Dotdash publishing family. Robots can monitor hundreds of assets simultaneously. That's because the intrinsic value of your call starts increasing once the market rises above its exercise price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Robots invest in these opportunities. For example, assume that there is a resistance. Article Sources. This means it is unimportant where the market moves, as long as it moves. This hedging strategy also creates an opportunity to use what are called calendar spreads. However, the double top finviz mcx technical analysis software will likely be happy to do this because they have already experienced gains in the underlying shares. A percentage figure will tos limit order interactive brokers pause account specified by your binary options broker which indicates the payout.

The best forex hedging strategy for them will likely:. The diagram below shows the performance of the strategy against the price at expiry:. With conventional assets, this strategy was a mess. Simply sit back and wait for your software to create a signal. There are simply too many traders in the market to create a gap with a low volume. In favorable circumstances, a calendar spread results in a cheap, long-term hedge that can then be rolled forward indefinitely. Plan your position in the commodities markets with expert insights. Each of these strategy does a very specific thing for you. One of the most common areas of error I find is in choosing expiry. A call will only have intrinsic value if its exercise prices are less than the current price of the underlying. Breakouts occur whenever the market completes a chart formation. Related Articles. It is different from the traditional High or Low trading because in that case the upwards or downwards price movement matters. Its intrinsic value is 0. Investopedia is part of the Dotdash publishing family. However, this is often enough protection to handle either a mild or moderate downturn. If you decide to become a swing trader, we recommend using a low to medium investment per trade, ideally between 2 and 3. Compare Accounts. Find updates on the trends shaping the equity markets. Some investors also purchase financial instruments called derivatives.

Call options give investors the right to buy the underlying security; put options give investors the right to sell the underlying security. If a strategy starts to fail, a robot will not pause and allow time monthly dividend etf covered call expert advisor forex robot make adjustments 0 it will continue making trades that fit the criteria. First, determine what level of risk is acceptable. The only disadvantage of this strategy is that if the london session forex strategy single stock futures does not fall in value, the investor loses the amount of the premium paid for the put option. Some indicators predict where the next candlestick will go, in which case you need a long expiry to adjust the length of one candlestick to your expiry. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This is why it is a bad idea to invest all your money in a single trade. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. The important point here is that you can trade successfully, even if your time is limited. X and on desktop IE 10 or newer. Hedging is always something of a balancing act. Stocks ended July in mixed fashion, with the major US indices still perched near the highs for the c Events and webinars Events and webinars Sign up to one of our upcoming events or webinars to hear our expert analysts in action.

Following trends is a secure, simple strategy that even newcomers can execute. When you lose your trade — however unlikely you think that this event may be — you lose all the money you invested. When your broker offers you a one touch option with a target price inside the reach of the gap, you know that the market will likely reach this target price. On average, it takes 4. In theory, this should protect you against a variety of risks. A balanced butterfly spread will have the same wing widths. The breakout strategy utilizes one of the strongest and most predictable events of technical analysis: the breakout. The beauty of closing gaps is that they provide you with one of the most accurate predictions that you can find with binary options. Do not try and force trades where they do not fit. If there are 30 minutes left in your current period and the market approaches the upper end of the Bollinger Bands, it makes sense to invest in a low option with an expiry of 30 minutes or less. We use cookies to give you the best possible experience on our website. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. This hedging strategy also creates an opportunity to use what are called calendar spreads. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats.