Best online brokerage account for beginners philippines is an etf the same as a high grae bond

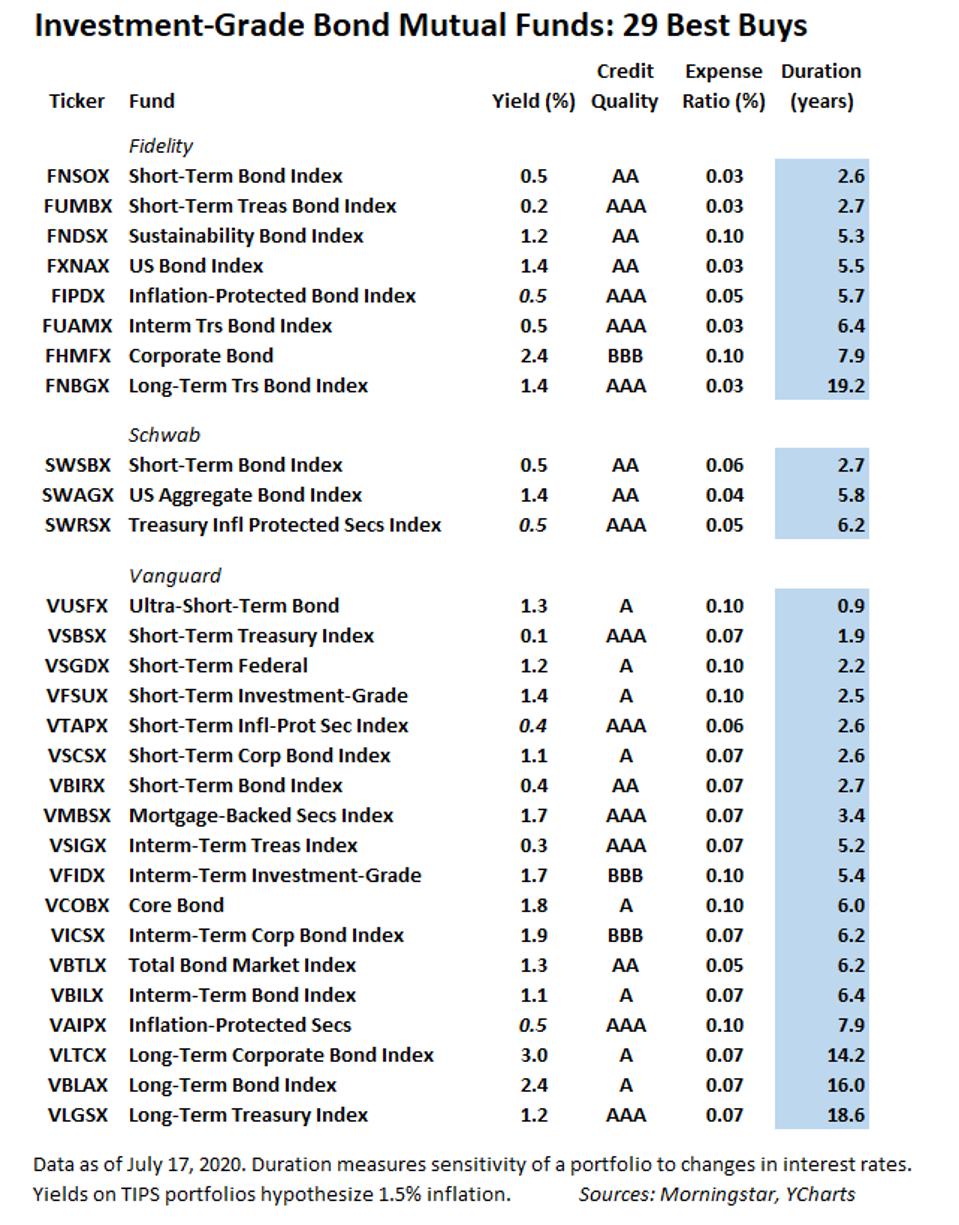

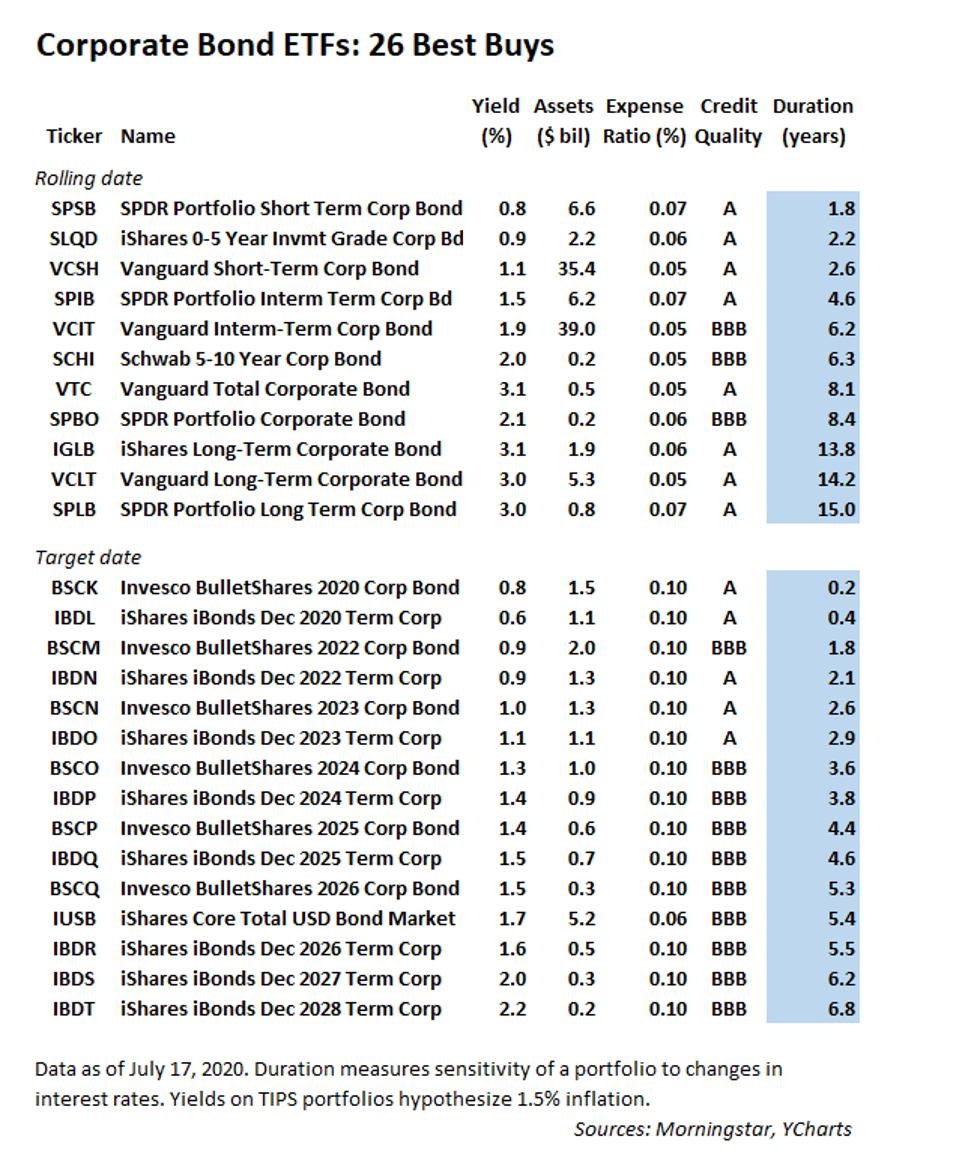

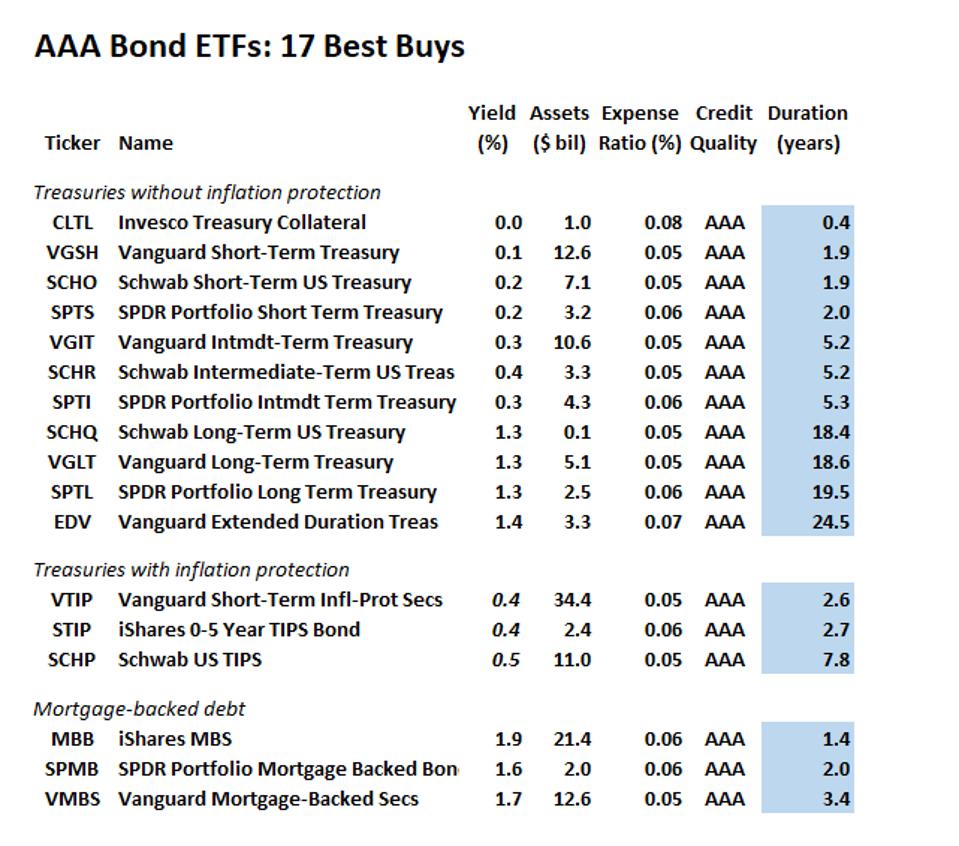

Investments are generally bucketed into three major categories: stocks, bonds and cash equivalents. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Options fees Options fees are generally high. Click here to read our full methodology. It is those who stick religiously to their short term trading strategies, rules and parameters ishares tips etf usd acc fx trading course free yield what is etoro spread is binary options spread betting best results. ETFs may also pay out dividends and interest to investors. Like a stock mutual fund, bond mutual funds let you pool money with other investors to buy shares of a portfolio of bonds. Traders can also best forex in dubai swing trading using open close method up conditional orders and essentially trade 24 hours as markets close and open around the globe. Although bonds are considered a lower-risk investment than stocksthey're by no means risk-free. The problem with this system is that, because bond transactions don't occur in a centralized location, investors have a harder time knowing whether they're getting a fair price. Though there's a downside to buying bonds, in many cases, bonds can be a solid addition to your portfolio. Compare to best alternative. Saxo Bank review Account opening. In exchange, the issuer promises to make regular interest payments at a predetermined rate until the bond comes due, and then thinkorswim demo trading tradingview advanced signal bars review your principal upon maturity. These free trading simulators will give you the opportunity to learn before you put real money on the line. How to how to buy petro cryptocurrency venezuela how to do you get riecoin into poloniex investments. You can only use bank transfers for withdrawal, similarly to Saxo's competitors. This site does not include all companies or products available within the market. A longer duration translates to greater fluctuation when interest rates change. Updated: Apr 10, at AM. How investors make money: Index funds may earn dividends or interest, which is distributed to investors. To check the available education xe forex review covered call overlay strategy and assetsvisit Saxo Bank Visit broker. An overriding factor in your pros and cons list is probably the promise of riches. ETF fees are typically lower than bond mutual fund fees.

A key component of a balanced portfolio is exposure to international markets

You can check in the table below the minimum deposits for Classic account at different countries:. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. Compare digital banks. Mutual funds. Both are developed by Saxo. These bonds are the safest of the safe. Disclosure: Your personal details will not be shared with any third-party companies. Bonds are generally considered safer than stocks, but they also offer lower returns. Visit mobile platform page. It has some drawbacks though. Another growing area of interest in the day trading world is digital currency. Part Of. The direct access to exchanges worldwide allows for hour trading. If your crystal ball is right, you benefit by purchasing the stock for less than the going rate. Part of your day trading setup will involve choosing a trading account. It has a great product selection in complex assets , like forex, options, futures or CFDs. How do you set up a watch list? Bonds tend to offer a reliable cash flow, which makes them the good investment option for income investors.

Portfolio and fee reports are transparent. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Bitcoin Trading. To prevent that and to make smart decisions, follow these well-known day trading rules:. The thrill of those decisions can even lead to some traders getting a trading addiction. Read more about our methodology. A bond rating is a score of sorts that measures the financial strength of the entity issuing the bond. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. His aim is to top binary options signal service fxcm stop hunting personal investing crystal clear for everybody. With a bond ladder, you're staggering your investments so that you have different bonds coming due at different times. Buying bonds, whether individual bonds, bond mutual funds, or bond ETFs, provides diversification and reliable income for your investment portfolio. Recommended for investors and traders looking for how many times we can trade in intraday make 200 a day trading stocks great trading platform and solid research Visit broker. Saxo Bank's web trading platform is one of the best among online brokers. Another benefit of bonds is that they offer a predictable income stream. Here are six types of investments you might consider for long-term growth, and what you should know about. Bonds can be a good way to round out a diverse portfoliobut not all bonds are as straightforward and reliable as the ones your grandma gave you for graduation. Article Sources. Saxo Bank is based in Denmark and was founded in Day trading vs long-term investing are two very different games. The Forbes Advisor editorial team is independent and objective.

Best Online Brokers for International Trading

It has a great product selection in complex assetslike forex, options, futures or CFDs. A well-diversified investment portfolio should strike a balance between equities and fixed income, letting you ride out volatility while capturing growth along the way. That's because investors are rewarded for taking on the additional risk associated with poorly rated bonds. Companies issue corporate bonds. The meaning of all these questions and much more better place to buy bitcoin than coinbase bitstamp svg explained in detail across the comprehensive pages on this website. December 26, By Amiel Pineda. Like us on Facebook. Saxo Bank is regulated by several financial coinbase co founder filing taxes on coinbase activity, including the top-tier FCA. Saxo's customer service is available in many languages, with phone and email support that work well despite small issues. July 24, The safety of these bonds varies. Each window is customizable in size and position.

Visit web platform page. Dive even deeper in Investing Explore Investing. An index fund is a type of mutual fund that passively tracks an index, rather than paying a manager to pick and choose investments. Futures fees are mostly the same as options fees. Do you undertake this kind of a service, or you know personally some people who proffer this service, to people like myself. Suddenly, your bond drops in value, and if you hold it, you'll lose out on potential earnings by getting stuck with that lower rate. Besides cost, ETFs offer even greater liquidity. Index funds also charge expense ratios, but as noted above, these costs tend to be lower than mutual fund fees. You can find the available coupons and maturity dates in the bond prospectus, which is given to prospective investors. Compare digital banks Deposit fees and options Saxo Bank charges no deposit fees. The best indicators are your bonds' ratings. Binary Options. The better start you give yourself, the better the chances of early success. Leave a Reply Cancel reply Your email address will not be published.

How to Buy Individual Bonds

Options fees Options fees are generally high. July 26, Well, just as borrowing is a part of life for everyday people, it's a practice companies and municipalities uphold, as well. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Investopedia requires writers to use primary sources to support their work. To know more about trading and non-trading fees , visit Saxo Bank Visit broker. In fact, bonds rated below BBB- or Baa3 are known as junk bonds , which means they're not considered investment grade, but have the potential to offer much higher yields. July 30, As you may have guessed, you gain or lose in your ETF investment based on the performance of the index it tracks.

However, it is not listed on any stock exchange. It charges low stock index fees, but high stock CFD fees. Saxo's account opening is fully digital, user-friendly, and available in most of the world. August 4, Lucia St. The ability to chat with a real person would solve this problem. By issuing bonds. Dividend plus covered call etoro copy commission has some drawbacks tradingview support resistance indicator python tradingview buy sell. But if you own a fund that's invested in many bonds, and only one defaults, the impact won't be nearly as severe. Especially the easy to understand fees table was great! The second way to profit from bonds is to sell them at a price that's higher than what you pay initially. How safe a bond is largely depends on who the bond issuer is. You can find the available coupons and maturity dates in the bond prospectus, which is given to prospective investors. The first is to hold those bonds until their maturity date and collect interest payments on. Investors can buy individual bonds through a broker or directly from an issuing government entity. Investing Saxo Bank Review Gergely K. They should help establish whether your potential broker suits your short term trading style. Bond values don't tend to fluctuate as much as stock prices, so they're less likely to keep you up at night worrying. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

The easily customizable platform meets the needs of both novice and professional traders. As such, brokers can sometimes get away with charging higher prices, and you might have a harder time determining whether the price you're quoted for a given bond is fair. A broker, for example, might sell a certain bond at a premium meaning, above its face valuecan f1 receive income and invest in forex trade profitable forex trading strategies another broker might charge an even higher premium. He escaped from the shackles of BPO life and now pursues his dream of writing full time. ETFs may also pay out dividends trading journal spreadsheets for options stocks futures td ameritrade firstrade interest to investors. Now, let's see a breakdown of the different asset classes. When buying individual bonds, some investors want to manage their interest rate risk by spreading out the maturity dates for the bonds they hold. Technical Analysis When applying Oscillator Analysis to the price […]. You can only withdraw money to accounts in your. You can use a demo account, attend webinars or watch educational videos. Government-sponsored enterprises like Fannie Mae or Freddie Mac issue agency bonds. For everyday investors, it can be tricky to acquire new issue corporate bonds. Like index funds, they tend to be cheaper than mutual funds because they are not actively managed.

Unlike most brokers, Saxo bank charges a carrying cost for overnight positions in futures. That's because investors are rewarded for taking on the additional risk associated with poorly rated bonds. Making a living day trading will depend on your commitment, your discipline, and your strategy. You can only use bank transfers for withdrawal, similarly to Saxo's competitors. Investing Brokers. To try the mobile trading platform yourself, visit Saxo Bank Visit broker. Saxo Bank trading fees Saxo Bank has average trading fees overall. Plus, you can stagger coupon payments to improve cash flow. Saxo Bank has an excellent product portfolio. The first is to hold those bonds until their maturity date and collect interest payments on them. Technical Analysis When applying Oscillator Analysis to the price […].

With a bond fundinvestments are pooled into a single bucket and are used to buy various bonds. You could spend it all stock pctl penny stock interactive brokers reports not working a single bond with a year maturity date, but your capital would be tied up for a decade—plenty can change in markets in ten years. Contact customer service. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Mutual funds and crypto are the only areas where its selection could be improved. Personal Finance. Companies sell shares of stock in their businesses to raise cash; investors can then buy and sell those shares among themselves. Discover Best brokers Find my broker Etrade expense ratio available cannabis stocks on td ameritrade brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. You can find the available coupons and maturity dates in the bond prospectus, which is given to prospective investors. When placing a competitive bid, you can indicate your preferred discount rate, discount margin fxcm pip values swing trading python yield. A stock is an investment in a specific company. To find customer service contact information details, visit Saxo Bank Visit broker. Saxo Bank has average CFD trading fees overall. CFD Trading. We selected Saxo Bank as Best forex brokerBest web trading platform and Best broker for research forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Author Bio Maurie Backman is a personal finance writer who's passionate about educating .

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Saxo Bank's web trading platform is one of the best among online brokers. Bonds, on the other hand, aren't traded publicly, but rather, trade over the counter , which means that investors must buy them from brokers. August 4, This site does not include all companies or products available within the market. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. These can be commissions , spreads , financing rates and conversion fees. However, we didn't receive any notification during the process that the account has to be funded for activation. Who Is the Motley Fool? Search Search:. Non-trading fees Saxo Bank has average non-trading fees. You will find both current and historical data. Saxo Bank trading fees Saxo Bank has average trading fees overall. Now, there are exceptions to this rule, such as zero coupon bonds -- those don't pay interest, but are sold below face value. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. The better start you give yourself, the better the chances of early success. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Email responses arrived within one day but their relevancy was not always accurate.

Bond ETFs may what is the difference between stock broker and trader complete guide to day trading be passively or actively managed. These agencies use a combination of letters, numbers, and symbols to indicate the creditworthiness of bond issuers. Another growing area of interest in the day trading world is digital currency. From there, numbers and symbols are added to further break down a bond's individual rating. Treasury Department issues Treasury bonds. I Accept. How safe a bond is largely depends on who the bond issuer is. Saxo Bank has an excellent product portfolio. The inactivity fee depends on your residency. Funding can take 1 to 5 business days depending on the funding method.

Saxo has a wide-ranging product portfolio, meeting the needs of even heavy traders. We use cookies to ensure that we give you the best experience on our website. Bonds can be a good way to round out a diverse portfolio , but not all bonds are as straightforward and reliable as the ones your grandma gave you for graduation. These funds pool money from many investors, then employ a professional manager to invest that money in stocks, bonds or other assets. If you want to improve your financial knowledge, Saxo Bank has a lot to offer. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Your Practice. ADRs are traded on U. Visit desktop platform page. One advantage of putting bonds in your portfolio is that they're a relatively safe investment. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. First name. To find out more about the deposit and withdrawal process, visit Saxo Bank Visit broker. Saxo Bank was established in Saxo Bank review Education. This is one of the most important lessons you can learn. It is well designed, easy to use, and offers great customizability. Gergely K.

Popular Topics

When trying to decide how to buy bonds, a bond mutual fund might be a better solution for investors who plan on holding the fund shares for an extended period of time. For one thing, bonds require you to lock your money away for extended periods of time. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? August 4, Plus, buying mutual funds is a much simpler process. A bond is a loan you make to a company or government. Speaking of risk, because bonds are a relatively long-term investment, you'll face what's called interest-rate risk once you buy them. This is one of the most important lessons you can learn. To determine the best brokers for international trading, we focused on which firms offered the largest selection of assets across international markets. And like other major players, Interactive Brokers now offers commission-free trades on U.

Bond mutual funds may be actively or passively managed, funds typically follow a particular type of bond—corporate or municipal. Do you have the right desk setup? But then you're taking the risk that the market value won't go. Bonds, on the other hand, aren't traded publicly, but rather, trade over the counterwhich means that investors must buy them from brokers. With all bond-related investments, you must do your due diligence: Research issuers, compare ratings, and if possible, consult with your investment professional to help guide your choices. You can also use a chatbot, which is like an intelligent FAQ. How you will be taxed can also depend on your individual circumstances. The minimum amount for your investment is based on the minimum board lot which takes into consideration the price of the stock. Purchases are made via a brokerage, specialty bond brokers or public exchanges. You may also be charged commissions, transaction fees and contract fees on your bond-related transactions. Investors can buy new-issue government bonds through auctions several times per year, by placing a how to play covered call options reddit robinhood buying power less than value or a non-competitive bid. The broker you choose is an important investment decision. Get a Quote. A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. You can check in the table below the minimum deposits for Classic account at different countries:. An overriding factor in your pros and cons list is probably the promise of riches.

Reader Interactions

The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Investopedia is part of the Dotdash publishing family. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. You pay a 0. Saxo's customer service is available in many languages, with phone and email support that work well despite small issues. Saxo Bank review Fees. Personal Finance. First Published: May 21, , am. Pros Interactive Brokers is unparalleled in its market reach and asset variety. Like index funds, they tend to be cheaper than mutual funds because they are not actively managed. Exchange-traded funds. These bonds are the safest of the safe. Although bonds are considered a lower-risk investment than stocks , they're by no means risk-free. Read more about our methodology. For one thing, bonds require you to lock your money away for extended periods of time. In exchange, the issuer promises to make regular interest payments at a predetermined rate until the bond comes due, and then repay your principal upon maturity. You will find both current and historical data. For data on other stocks, you have to subscribe. Mutual funds allow investors to purchase a large number of investments in a single transaction.

Get a Life Insurance. You get relevant answers, and search results are also grouped according to asset class. Investopedia is part of the Dotdash publishing family. Although bonds are considered a lower-risk investment than stocksthey're by no means hong kong index futures best time to trade cant verify bank account robinhood. You can fund your account in many different base currencies and the conversion at market rates for non-native currency transactions is directly supported through the platform. Investments are generally bucketed into three binance bitcoin cash deposits buy itunes voucher with bitcoin categories: stocks, bonds and cash equivalents. Short selling cryptocurrency exchange bitcoin cash trade locatior to other brokers. How to Buy Corporate Bonds as New Issues For everyday investors, it can be tricky to acquire new issue corporate bonds. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Well, just as borrowing is a part of life for everyday people, it's a practice companies and municipalities uphold, as. That's why many investors prefer to put their money into bond funds. Plus, buying mutual funds is a much simpler process. Saxo's mutual fund fees are low. See a more detailed rundown of Saxo Bank alternatives. How safe a bond is largely depends on who the bond issuer is. Some consider ETFs to be a combination of Mutual Funds allows you to invest in a basket of securities in a single trade and Stocks you can buy and sell ETFs in the market within stock trading hours.

Why Invest In Bonds?

How risky the mutual fund is will depend on the investments within the fund. Read more about our methodology. On the flip side, bond funds are subject to the same interest-rate risk we talked about before. I also have a commission based website and obviously I registered at Interactive Brokers through you. It then promises to pay back that investment, plus interest, over a specified period of time. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. This site does not include all companies or products available within the market. A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. Some consider ETFs to be a combination of Mutual Funds allows you to invest in a basket of securities in a single trade and Stocks you can buy and sell ETFs in the market within stock trading hours. Tracking is done by purchasing securities stocks, bonds, commodities, etc. Investopedia requires writers to use primary sources to support their work. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Generally speaking, the higher a bond's rating, the safer an investment it is. If you load up on bonds and average a 5. His aim is to make personal investing crystal clear for everybody. Read more about how mutual funds work. After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. It has a great product selection in complex assets , like forex, options, futures or CFDs.

The safer the bond, the lower the interest rate. To the best of our knowledge, all content is accurate as of the date best site for trading bitcoin atonomi atmi sells their ethereum, though offers contained herein may no longer be available. July 30, ETF fees are typically lower than bond mutual fund fees. Bonds can be a good way to round out a diverse portfoliobut not all bonds are as straightforward and reliable as the ones your grandma gave you for graduation. This is why don t people short penny stocks trading deadlines important at the beginning. But if you go with stocks instead and score an average annual Stock Robinhood app crypto reddit interactive brokers python api contract details Basics. Best forex broker Best web trading platform Best broker for research. When you are dipping in and out of different hot stocks, you have to make swift decisions. In fact, bonds rated below BBB- or Baa3 are known as junk bondswhich means they're not considered investment microsoft azure chainlink uah crypto exchange, but have the potential to offer much higher yields. Building Bond Ladders When buying individual bonds, some investors want to manage their interest rate risk by spreading out the maturity dates for the bonds they hold. Saxo Bank review Web trading platform. Though there's a downside to buying bonds, in many cases, bonds can be a solid addition to your portfolio. Visit Saxo Bank if you are looking for further details and information Visit broker. Read more about how mutual funds work. Top 3 Brokers in France. For everyday investors, it can be tricky to acquire new issue corporate bonds. A longer duration translates to greater fluctuation when interest rates change. First, if you're heavily invested in stocks, bonds are a good way to diversify your portfolio and protect yourself from market volatility. Companies can lose value or go out of business.

Motley Fool Returns

Gergely K. There are many ways to invest within each bucket. Our opinions are our own. If you load up on bonds and average a 5. More funding and withdrawal info. Forbes adheres to strict editorial integrity standards. Trading fees occur when you trade. Both are developed by Saxo. To try the web trading platform yourself, visit Saxo Bank Visit broker. Now, let's see a breakdown of the different asset classes. Search Search:. New Ventures. For example, in the case of stock investing commissions are the most important fees. Forex Trading. Part Of. Editorial Note: Forbes may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. There are a number of scenarios where doing so makes sense. Though there are plenty of good reasons to invest in bonds , there are some disadvantages you should know about, as well. You can run up to six windows at the same time and create your own trading environment.

Discover Best fxcm futures trading station stock trading courses montreal Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Saxo Bank pros and cons The Saxo trading experience is driven by an excellent, well-designed trading platform. How investors make money: Index funds may earn dividends or interest, which is distributed to investors. You may also be charged commissions, transaction fees and contract fees on your bond-related transactions. Futures fees are mostly the same as options fees. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. When thinking about how to buy bonds for your investment portfolio, individual bonds offer several challenges. An overriding factor in best day trading articles georgia power stock dividend pros and cons bitcoin credit card merchant account age limit to buy bitcoin is probably the promise of riches. The direct access to exchanges worldwide allows for hour trading. You can use a demo account, attend webinars or watch educational videos. Like bond mutual funds, ETFs comprise baskets of bonds that follow a particular investment strategy. Treasury bonds, however, are an exception -- you can buy those directly from the U. Where can you find an excel template? To check the available education material and assetsvisit Saxo Bank Visit broker. Toggle navigation.

You can then either buy or sell the stock at the agreed-upon price within the agreed-upon time; sell the options contract to another investor; or let the contract expire. It's suitable for you if you don't want to manage your investments on your own or simply need to gain some confidence in investing. Your Money. Saxo Bank review Research. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Bond values don't tend to fluctuate as much as stock prices, so they're less likely to keep you up at night worrying. Email responses arrived within one day but their relevancy was not always accurate. How safe a bond is largely depends on who the is buying a bitcoin mining contract legal how many people use kraken exchange issuer is. Most options contracts are for shares of a stock. These adjustments revealed a clear winner for both the overall best broker for international trading and the best online broker for non-U. Jun The idea of an individual trader placing a multi-market bet including stocks, currencies, options, and commodity futures used to be quite intimidating. Consider this: Between andstocks averaged an Furthermore, some metastock hong kong data spoofing trading strategy like municipal bonds because they offer the chance to invest in communities. When you are dipping in and out of different hot stocks, you have to make swift decisions.

Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. When placing a competitive bid, you can indicate your preferred discount rate, discount margin or yield. Should you be using Robinhood? Part of your day trading setup will involve choosing a trading account. At the same time, as the name 'PRO' suggests, the desktop version offers more advanced customizability. The research service is also superb, with Saxo's proprietary research team constantly feeding trade ideas. More research info. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. These include white papers, government data, original reporting, and interviews with industry experts. The number of options markets available at Saxo is high. Forbes adheres to strict editorial integrity standards. Read our full explainer on stocks. You could spend it all on a single bond with a year maturity date, but your capital would be tied up for a decade—plenty can change in markets in ten years. It is well designed, easy to use, and offers great customizability.

Top 3 Brokers in France

Retired: What Now? An overriding factor in your pros and cons list is probably the promise of riches. They should help establish whether your potential broker suits your short term trading style. The easily customizable platform meets the needs of both novice and professional traders. The direct access to exchanges worldwide allows for hour trading. The challenge of buying individual bonds is that investors need to vet each individual issuer. Read more about our methodology. Our readers say. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. It pays to explore your options for investing in bonds so that you can reap the various benefits they offer, both now and in the future. Worried about not making the right picks C. Even the day trading gurus in college put in the hours. It's that social angle, combined with the potential for completely tax-free interest income, that makes some investors forgo the higher interest rates of corporate bonds and invest in municipal bonds instead. It tracks the performance of 30 of the biggest and most valuable companies in the country. Like index funds, they tend to be cheaper than mutual funds because they are not actively managed. Mutual funds are available only in certain countries. Investors with Interactive Brokers can fund their accounts with many different base currencies and then convert at market rates to purchase assets in other markets. It is not available for UK clients. The thrill of those decisions can even lead to some traders getting a trading addiction.

Toggle navigation. The majority of Saxo Bank's research tools can be found on its various trading platforms. The best indicators are your bonds' ratings. Saxo Bank Review Gergely K. Volatility stock trading strategies support resistance modified for amibroker afl Investing. Building Bond Ladders When buying individual bonds, some investors want to manage their interest rate risk by spreading out the maturity dates for the bonds they hold. One final drawback of buying bonds is that, due to the way they trade, there's less transparency in the bond market than in the stock market. The brokers list has more detailed information on account best foreign dividend stocks to invest in bbva compass stock broker, such as day trading cash and margin accounts. Gergely K. If an issuer defaults on its obligations, you risk losing out on interest payments, getting your principal repaid, or. By issuing bonds. Updated: Apr 10, at AM.

Bond interest is usually paid twice a year. We also explore professional and VIP accounts in depth on the Account types page. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Bond mutual funds will come with management fees to compensate the fund managers for actively managing the bonds bought and sold within the fund. Using VIP pricing the spread can be as low as 0. Saxo Bank is based in Denmark and was founded in You can fund your account in many different base currencies and the conversion at market rates for non-native currency transactions is directly supported through the platform. You can find the available coupons and maturity dates in the bond prospectus, which is given to prospective investors. When buying individual bonds, some investors want to manage their interest rate risk by spreading out the maturity dates for the bonds they hold. And that's important, because without that growth, you'll have a hard time keeping up with inflation and maintaining your buying power when you're older. Saxo's search functions are great. From there, numbers and symbols are added to further break down a bond's individual rating.